The global monobasic calcium phosphate market is experiencing steady expansion, driven by rising demand in food & beverage, pharmaceuticals, and animal feed industries. According to Grand View Research, the global calcium phosphate market size was valued at USD 3.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with monobasic variants playing a critical role due to their superior solubility and bioavailability. This growth is further fueled by increasing fortification of food products and the expanding use of excipients in pharmaceutical formulations. As regulatory standards tighten and demand for high-purity, consistent-quality ingredients rises, a select group of manufacturers have emerged as leaders in producing monobasic calcium phosphate. These companies are distinguished by their advanced production technologies, global supply chain reach, and compliance with food and pharmaceutical grade standards. Here’s a data-driven look at the top seven manufacturers shaping this evolving landscape.

Top 7 Monobasic Calcium Phosphate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Calcium Phosphate Mono Basic

Domain Est. 2002

Website: cdhfinechemical.com

Key Highlights: CDH is an ISO certified Calcium Phosphate Mono Basic manufacturer in India, Calcium Phosphate Mono Basic (CAS-10031-30-8) supplier & exporter in India….

#2 Calcium Phosphate Monobasic Monocalcium …

Domain Est. 2005 | Founded: 1976

Website: mubychem.com

Key Highlights: Supplier, Manufacturer, Exporter of Calcium Phosphate Monobasic or Monocalcium Phosphate Muby Chemicals of Mubychem Group, established in 1976, is the original ……

#3 Mono Acid Calcium Phosphate

Domain Est. 2017 | Founded: 1982

Website: vijen.in

Key Highlights: Vijay Enterprises, a trusted name since 1982, is a leading Mono Acid Calcium Phosphate (MACP) manufacturer, supplier and export. Renowned for its manufacturing ……

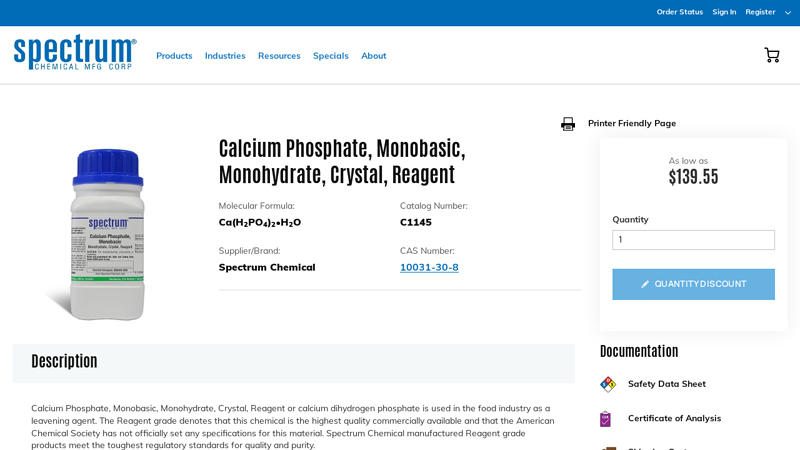

#4 Calcium

Domain Est. 1995

Website: spectrumchemical.com

Key Highlights: 15-day returnsCalcium Phosphate, Monobasic, Monohydrate, Crystal, Reagent or calcium dihydrogen phosphate is used in the food industry as a leavening agent….

#5 Calcium Phosphate Monobasic

Domain Est. 1995

Website: thomassci.com

Key Highlights: In stock 1–2 day deliveryCalcium Phosphate Monobasic is mainly used in fertilizers, as acidulant in baking powders and in wheat flours, mineral supplement for foods and feeds, ……

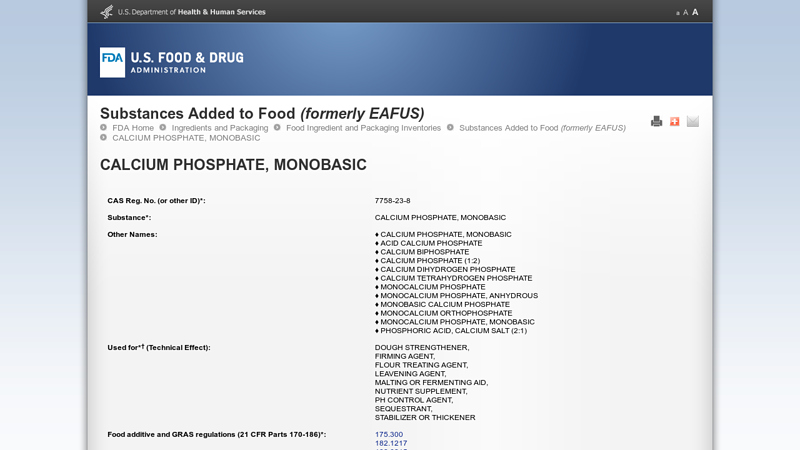

#6 calcium phosphate, monobasic

Domain Est. 2000

Website: hfpappexternal.fda.gov

Key Highlights: CAS Reg. No. (or other ID)*:, 7758-23-8. Substance*:, CALCIUM PHOSPHATE, MONOBASIC. Other Names: ♢ CALCIUM PHOSPHATE, MONOBASIC ♢ ACID CALCIUM PHOSPHATE…

#7 CALCIUM PHOSPHATE,MONOBASIC

Website: yoneyama-chem.co.jp

Key Highlights: CALCIUM PHOSPHATE,MONOBASIC. Appearance:White crystalline powder Odor:None pH:3.4. Chemical stability:Stable under normal condition….

Expert Sourcing Insights for Monobasic Calcium Phosphate

H2: Market Trends for Monobasic Calcium Phosphate in 2026

The global market for monobasic calcium phosphate (MCP) is projected to experience steady growth by 2026, driven by increasing demand across key industries such as animal nutrition, food and beverage, and pharmaceuticals. Several macroeconomic, regulatory, and technological factors are shaping the trajectory of this market.

-

Rising Demand in Animal Feed

Monobasic calcium phosphate remains a critical source of bioavailable phosphorus and calcium in livestock and poultry feed formulations. As global meat consumption continues to rise—particularly in emerging economies—there is growing pressure on feed producers to enhance animal growth rates and bone development efficiently. By 2026, MCP is expected to maintain dominance in mineral feed supplements due to its high solubility and digestibility compared to alternative phosphates. Regulatory shifts promoting phosphate efficiency and minimizing environmental runoff (e.g., in the EU and North America) are also encouraging the use of highly bioavailable forms like MCP, further boosting market demand. -

Expansion in Food and Beverage Applications

In the food industry, MCP is widely used as a leavening agent in baked goods, a nutritional fortificant, and a stabilizer. The clean-label movement and increased consumer focus on fortified foods are expected to drive the use of MCP in functional foods and dietary supplements. By 2026, food-grade MCP demand is anticipated to grow, particularly in regions with rising health consciousness, such as Asia-Pacific and Latin America. Innovations in plant-based and gluten-free baking—where precise leavening control is critical—will further stimulate the need for reliable acidulants like MCP. -

Pharmaceutical and Nutraceutical Growth

The nutraceutical sector is increasingly incorporating MCP into calcium supplements due to its superior absorption profile. With an aging global population and rising prevalence of osteoporosis, demand for effective calcium delivery systems is rising. Pharmaceutical manufacturers are also exploring MCP in tablet formulations for its compressibility and stability. By 2026, advancements in delivery mechanisms and personalized nutrition are expected to broaden MCP’s application scope in healthcare products. -

Regional Market Dynamics

Asia-Pacific is forecasted to be the fastest-growing region for MCP, led by strong agricultural output in countries like China, India, and Vietnam. Europe remains a mature but stable market, with growth driven by sustainable feed practices and stringent safety standards. In North America, innovation in feed additives and functional foods supports moderate growth. Meanwhile, Latin America and Africa present untapped potential, with expanding livestock industries and improving feed formulation practices. -

Sustainability and Supply Chain Considerations

Environmental concerns over phosphate mining and water eutrophication are prompting manufacturers to explore more sustainable production methods. By 2026, companies investing in closed-loop processes, waste reduction, and recycled phosphate sources are likely to gain competitive advantage. Regulatory frameworks, such as the EU’s Green Deal and REACH regulations, may influence sourcing and production standards, pushing the industry toward greener alternatives. -

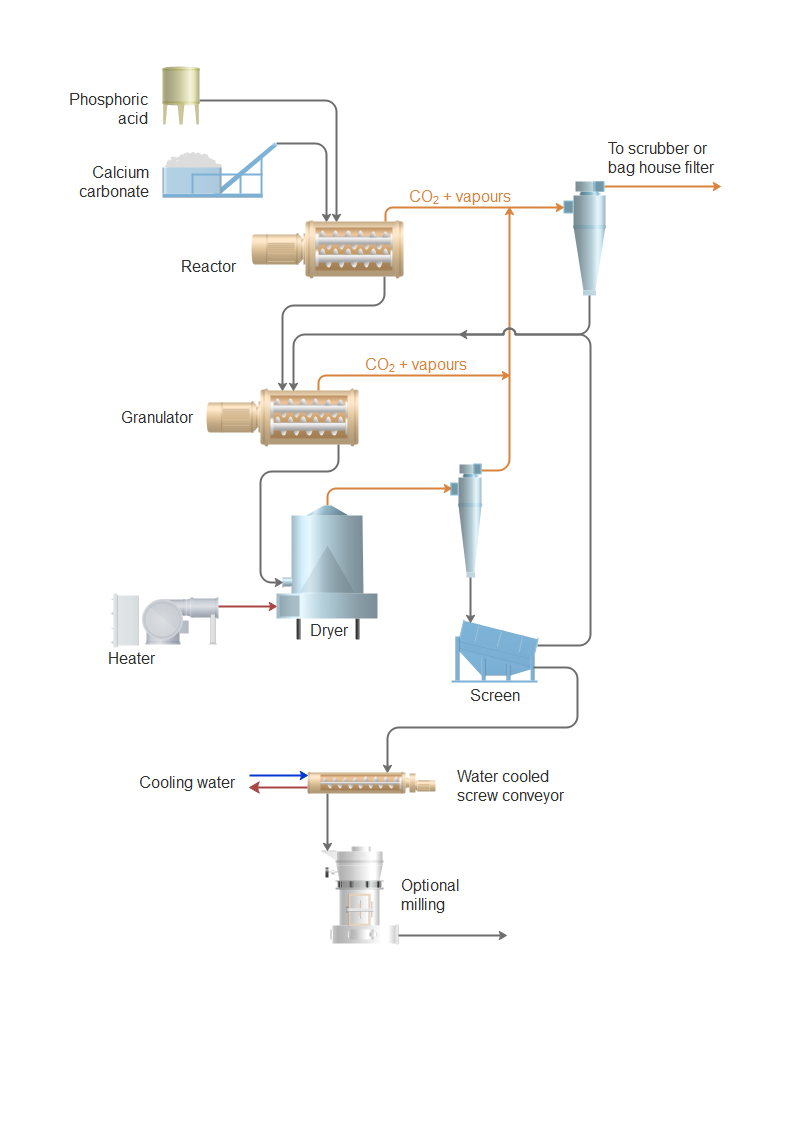

Price Volatility and Raw Material Challenges

Fluctuations in phosphoric acid and calcium carbonate prices—key raw materials for MCP—could impact market stability. Geopolitical tensions affecting phosphate rock supply (e.g., from Morocco and China) may lead to periodic price spikes. However, by 2026, diversification of supply chains and regional production scaling are expected to mitigate some of these risks.

Conclusion

By 2026, the monobasic calcium phosphate market is poised for moderate but consistent growth, underpinned by its irreplaceable role in animal nutrition and expanding applications in food and health sectors. Success will depend on manufacturers’ ability to adapt to sustainability demands, innovate in formulation technologies, and navigate global supply chain complexities. Companies that align with regulatory trends and consumer preferences for clean, efficient, and eco-friendly ingredients will be best positioned to capture market share.

Common Pitfalls in Sourcing Monobasic Calcium Phosphate (Quality, Intellectual Property)

Sourcing monobasic calcium phosphate (MCP), particularly for use in food, pharmaceuticals, or nutraceuticals, involves several critical considerations related to quality and intellectual property (IP). Below are common pitfalls under these two categories:

1. Quality-Related Pitfalls

1.1 Inconsistent Purity and Grade Specifications

– Pitfall: Suppliers may offer MCP labeled as “food grade” or “pharmaceutical grade” without adhering to internationally recognized standards (e.g., USP, FCC, Ph. Eur.).

– Impact: Variability in purity affects formulation stability, bioavailability, and regulatory compliance.

– Mitigation: Require certificates of analysis (CoA) and verify conformance to pharmacopoeial standards. Conduct third-party testing if necessary.

1.2 Contaminant Risks (Heavy Metals, Microbial Load)

– Pitfall: MCP derived from lower-grade raw materials or inadequate processing may contain unacceptable levels of arsenic, lead, or microbial contaminants.

– Impact: Regulatory rejection, safety issues, and potential product recalls.

– Mitigation: Ensure suppliers follow GMP and conduct regular contaminant screening. Include strict limits in supply agreements.

1.3 Hydration State Variability (Anhydrous vs. Monohydrate)

– Pitfall: Confusion or mislabeling between anhydrous and monohydrate forms affects solubility and dosing accuracy.

– Impact: Inconsistent product performance, especially in tablet formulation where disintegration is critical.

– Mitigation: Clearly specify the required form in procurement contracts and validate through analytical testing (e.g., TGA, Karl Fischer).

1.4 Poor Batch-to-Batch Consistency

– Pitfall: Variability in particle size, bulk density, or flow properties due to inconsistent manufacturing processes.

– Impact: Challenges in blending, tableting, or mixing uniformity.

– Mitigation: Establish tight specifications for physical properties and conduct supplier audits.

1.5 Lack of Supply Chain Transparency

– Pitfall: Unclear sourcing of raw materials (e.g., phosphoric acid origin, calcium source) increases risk of adulteration or sustainability concerns.

– Impact: Reputational risk, especially in regulated or ethically sensitive markets.

– Mitigation: Require full traceability documentation and favor suppliers with transparent supply chains.

2. Intellectual Property-Related Pitfalls

2.1 Infringement of Patented Manufacturing Processes

– Pitfall: Some MCP production methods, especially those yielding specific particle characteristics or high purity, may be protected by patents.

– Impact: Legal liability if sourced material is made using a patented process without authorization.

– Mitigation: Conduct IP due diligence on suppliers and require warranties of non-infringement in contracts.

2.2 Use of Proprietary Grades or Trade-Secret Formulations

– Pitfall: Suppliers may offer “specialty grades” of MCP protected as trade secrets or covered under formulation patents.

– Impact: Risk of unintentional IP violation when replicating or substituting products.

– Mitigation: Clearly define permitted uses and obtain written confirmation that the product is free to use in your application.

2.3 Licensing Requirements for Functional Claims

– Pitfall: Some high-purity or bioavailable forms of MCP may be tied to patented health claims or delivery systems.

– Impact: Marketing or labeling your product with certain claims may require a license.

– Mitigation: Review IP landscape before making functional claims and consult legal counsel.

2.4 Inadequate Protection When Developing Custom Specifications

– Pitfall: If you co-develop a custom-grade MCP with a supplier, failure to secure IP rights may result in loss of exclusivity.

– Impact: Competitors may source the same modified product.

– Mitigation: Execute clear joint development agreements that assign or license IP rights appropriately.

Conclusion

Sourcing monobasic calcium phosphate requires a balanced focus on both quality assurance and IP risk management. Thorough supplier qualification, robust specifications, and proactive legal review are essential to avoid common pitfalls that could impact product safety, efficacy, and marketability.

H2: Logistics & Compliance Guide for Monobasic Calcium Phosphate

Monobasic Calcium Phosphate (MCP), also known as calcium dihydrogen phosphate or calcium phosphate monobasic (CAS No. 7758-23-8), is widely used in food, pharmaceutical, and animal feed industries. Due to its hygroscopic nature and regulatory significance, proper logistics handling and compliance with international, national, and industry standards are essential. This guide outlines the key considerations for the safe and compliant transportation, storage, and documentation of Monobasic Calcium Phosphate.

1. Product Identification & Specifications

- Chemical Name: Monobasic Calcium Phosphate (MCP)

- CAS Number: 7758-23-8

- Formula: Ca(H₂PO₄)₂·H₂O

- Appearance: White crystalline or granular powder

- Common Grades: Food Grade, Feed Grade, Pharmaceutical Grade

- Purity: Typically 98% minimum (varies by grade)

- Solubility: Soluble in water and dilute acids; insoluble in alcohol

2. Regulatory Compliance

Ensure compliance with relevant regulatory frameworks based on application:

Food Grade (FCC, FDA, EU)

- USA: Complies with FDA 21 CFR §182.1217 (Generally Recognized as Safe – GRAS)

- EU: Approved under Regulation (EC) No 1333/2008 as a food additive (E341(i))

- Codex Alimentarius: Meets FCC (Food Chemicals Codex) specifications

Pharmaceutical Grade (USP/NF, Ph. Eur.)

- Must meet compendial standards:

- USP-NF: Monobasic Calcium Phosphate Monohydrate

- Ph. Eur.: Calcium Dihydrogen Phosphate Monohydrate

Feed Grade (AAFCO, EU Directive)

- Approved under AAFCO (USA) and EU Directive 2003/100/EC for animal nutrition as a source of calcium and phosphorus

REACH & GHS Compliance (Global)

- REACH: Registered in the EU (Registration, Evaluation, Authorization, and Restriction of Chemicals)

- GHS Classification: Not classified as hazardous under GHS (no significant health or environmental hazards)

- Safety Data Sheet (SDS): Must be provided per GHS (Revision 9 or latest), including handling, storage, and emergency measures

3. Packaging & Labeling

- Primary Packaging: Sealed polyethylene-lined multi-wall paper bags (25 kg), HDPE drums (50–200 kg), or bulk FIBC bags (500–1000 kg)

- Moisture Protection: Use moisture-resistant packaging due to hygroscopic nature

- Labeling Requirements:

- Product name and chemical identity

- CAS number

- Grade (e.g., Food, Pharma, Feed)

- Net weight

- Manufacturer/distributor details

- Batch/lot number

- GHS pictograms (if applicable; typically none for MCP)

- Storage instructions (“Keep in a cool, dry place”)

4. Storage Requirements

- Conditions: Store in a dry, well-ventilated area below 25°C (77°F) and away from humidity

- Shelf Life: Typically 24 months when stored properly

- Segregation: Store separately from strong bases, oxidizers, and moisture sources

- Hygroscopic Warning: Exposure to moisture may cause caking or degradation

5. Transportation & Logistics

- Modes: Road, rail, sea, and air (as non-hazardous material)

- Classification (UN/DOT):

- UN Number: Not regulated (UN3077 may apply if impurities present)

- Hazard Class: Not classified as hazardous (non-flammable, non-toxic)

- Packing Group: Not applicable (PG III if classified under environmental hazards)

- IATA/IMDG: Can be shipped as “Not Restricted” for air and sea when meeting purity and packaging standards

- Documentation:

- Commercial Invoice

- Packing List

- Certificate of Analysis (CoA)

- Certificate of Origin

- SDS (Safety Data Sheet)

- GMP or HACCP certificates (for food/pharma)

6. Handling & Safety Precautions

- PPE Required:

- Gloves (nitrile or latex)

- Safety goggles

- Dust mask (if handling powder in poorly ventilated areas)

- Dust Control: Use local exhaust ventilation to minimize airborne dust

- Spill Management: Sweep up mechanically; avoid dry sweeping. Do not flush into drains

- First Aid:

- Inhalation: Move to fresh air

- Skin Contact: Wash with water

- Ingestion: Rinse mouth; seek medical advice if large quantities ingested

7. Environmental & Disposal Considerations

- Ecotoxicity: Low toxicity to aquatic life; avoid large-scale release into waterways

- Disposal: Dispose of in accordance with local, national, and international regulations. Can be disposed of in non-hazardous landfills if uncontaminated

8. Quality Assurance & Traceability

- Testing: Regular testing for heavy metals (Pb, As, Cd, Hg), microbial contamination (for food/pharma), and assay content

- Traceability: Maintain lot traceability from raw materials to final product

- Audits: Comply with third-party audits (e.g., BRC, ISO 22000, cGMP)

9. Import/Export Considerations

- Customs Tariff Codes (HS):

- 2835.25 (Phosphates of calcium) – common for international trade

- Import Permits: May be required in certain countries for food or pharmaceutical use

- Phytosanitary Certificate: Not typically required (non-agricultural product)

10. Key Certifications to Request

- ISO 9001 (Quality Management)

- FSSC 22000 / ISO 22000 (Food Safety)

- cGMP (Current Good Manufacturing Practice)

- HALAL / KOSHER (if applicable)

- Non-GMO Certificate

- EFfCI GMP (for pharmaceutical excipients)

Conclusion:

Monobasic Calcium Phosphate is a low-risk substance but requires strict adherence to quality and regulatory standards, especially in food, feed, and pharmaceutical applications. Proper packaging, moisture control, compliance documentation, and traceability are critical for safe and legal logistics operations globally.

Always consult local regulations and update SDS and compliance documents regularly to reflect current requirements.

In conclusion, sourcing monobasic calcium phosphate requires careful consideration of several key factors including purity, regulatory compliance, supplier reliability, cost-effectiveness, and intended application—whether for food, pharmaceuticals, or animal feed. It is essential to partner with reputable suppliers who adhere to quality standards such as FCC, USP, or food-grade specifications, depending on the use. Additionally, evaluating logistical aspects like lead times, packaging, and consistent supply chain performance ensures uninterrupted operations. Conducting thorough due diligence, including audits and sample testing, helps mitigate risks and maintain product quality. Ultimately, a strategic sourcing approach to monobasic calcium phosphate supports both operational efficiency and end-product integrity.