The global demand for mono fluoro phosphate (MFP), a key ingredient in dental care products for its proven efficacy in preventing tooth decay, is experiencing steady growth. According to a 2023 report by Mordor Intelligence, the global oral care market—of which MFP is a critical component—is projected to grow at a CAGR of 5.8% from 2023 to 2028, driven by rising consumer awareness of dental hygiene and increasing demand for preventative care solutions. This expanding market has intensified the need for high-purity, reliable MFP supply, positioning leading chemical manufacturers at the forefront of innovation and production scale. As regulatory standards tighten and formulation requirements evolve, particularly in fluoride-containing toothpastes, a select group of manufacturers have emerged as dominant players, combining technical expertise, regulatory compliance, and global distribution networks. Based on market presence, production capacity, and technological advancement, the following eight companies represent the top manufacturers of mono fluoro phosphate worldwide.

Top 8 Mono Fluoro Phosphate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sodium monofluorophosphate USP Grade Manufacturers, with SDS

Domain Est. 2005 | Founded: 1976

Website: mubychem.com

Key Highlights: Supplier, Manufacturer, Exporter of Sodium monofluorophosphate USP Grade, Muby Chemicals of Mubychem Group, established in 1976, is the original manufacturers ……

#2 Sodium Monofluorophosphate API Manufacturers

Domain Est. 2014

Website: pharmacompass.com

Key Highlights: Sodium Monofluorophosphate Manufacturers | Traders | Suppliers · BK Giulini GmbH · Elementis Pharma · Forest Laboratories · Nutriplant · Srikem Laboratories Pvt ……

#3 Sodium Monofluorophosphate Manufacturer and Suppliers

Domain Est. 2019

Website: scimplify.com

Key Highlights: Source high-quality Sodium Monofluorophosphate CAS Number: 10163-15-2 from Scimplify, a trusted manufacturer and distributor….

#4 CAS Number 10163-15-2

Domain Est. 1995

Website: spectrumchemical.com

Key Highlights: Spectrum Chemical manufactures and distributes fine chemicals with quality you can count on including those with CAS number 10163-15-2….

#5 Sodium Monofluorophosphate

Domain Est. 1996

Website: parchem.com

Key Highlights: Parchem supplies Sodium Monofluorophosphate and a range of specialty chemicals worldwide….

#6 Sodium Monofluorophosphate Supplier & Distributor

Domain Est. 1998

Website: dastech.com

Key Highlights: Dastech International is an USA supplier and distributor of Sodium Monofluorophosphate, providing supply chain, logistics and warehousing worldwide….

#7 Sodium Monofluorophosphate

Domain Est. 1998

Website: in-cosmetics.com

Key Highlights: Preventing dental caries is the key function of sodium monofluorophosphate. It slowly releases fluoride ions, which bind with hydroxyapatite in tooth enamel ……

#8 Sodium mono floro phosphate

Domain Est. 2024

Website: kokanagroup.com

Key Highlights: Sodium monofluorophosphate, often abbreviated as SMFP, is a chemical compound commonly used in oral care products for its role in dental health….

Expert Sourcing Insights for Mono Fluoro Phosphate

H2: Projected Market Trends for Mono Fluoro Phosphate in 2026

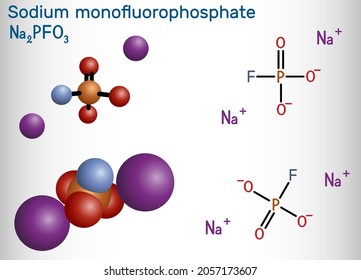

By 2026, the global market for Mono Fluoro Phosphate (MFP), particularly sodium monofluorophosphate (Na₂PO₃F), is expected to experience steady growth driven by its widespread applications in oral care, industrial processes, and emerging uses in advanced materials. Key trends shaping the MFP market include rising demand for fluoridated dental products, expansion in personal care formulations, regulatory developments, and regional market dynamics.

-

Growing Demand in Oral Care Products

The primary application of MFP remains in toothpaste and mouthwash formulations as a key anti-cavity agent. With increasing global awareness of dental hygiene and preventive healthcare, especially in emerging economies, demand for fluoridated toothpastes is expected to rise. MFP is favored over sodium fluoride in certain formulations due to its higher compatibility with other ingredients, such as abrasives and detergents, reducing formulation challenges. This advantage is anticipated to sustain its market share in the oral care sector. -

Expansion in Asia-Pacific Markets

The Asia-Pacific region, particularly China, India, and Southeast Asian countries, is projected to be the fastest-growing market for MFP in 2026. Rising disposable incomes, urbanization, and government initiatives promoting oral health are contributing to increased consumption of dental care products. Domestic production of MFP in China is also expected to grow, reducing reliance on imports and enhancing regional supply chain resilience. -

Regulatory and Health Safety Considerations

Regulatory scrutiny around fluoride use is likely to remain a key factor influencing market dynamics. While MFP is generally considered safe at approved concentrations, ongoing evaluations by health authorities (e.g., FDA, EFSA) regarding systemic fluoride exposure may impact formulation standards. However, no major regulatory restrictions are expected by 2026, and MFP’s established safety profile should support continued use. -

Technological Advancements and Product Innovation

Innovations in delivery systems, such as nano-encapsulation of MFP for enhanced fluoride release and reduced sensitivity, are expected to enter commercial stages by 2026. These advancements may open new applications in specialty dental products, including toothpastes for sensitive teeth or children’s formulations with improved taste and safety. -

Sustainability and Supply Chain Developments

Environmental concerns related to phosphate mining and fluorine sourcing may prompt manufacturers to adopt greener production methods. Companies are likely to invest in closed-loop processes and alternative raw material sourcing to meet sustainability goals, which could influence production costs and pricing strategies. -

Competition with Alternative Fluoride Compounds

MFP will continue to compete with other fluoride sources such as sodium fluoride and stannous fluoride. While sodium fluoride remains dominant in some markets, MFP’s stability in certain formulations ensures a strong niche presence. Market competition may drive price adjustments and encourage strategic partnerships between chemical suppliers and oral care brands.

In summary, the Mono Fluoro Phosphate market in 2026 is anticipated to grow moderately, supported by steady demand in oral care, regional market expansion, and incremental innovation. Key stakeholders should monitor regulatory trends, sustainability pressures, and formulation technologies to maintain competitiveness in this evolving landscape.

H2: Common Pitfalls in Sourcing Mono Fluoro Phosphate (MFP) – Quality and Intellectual Property Concerns

Sourcing Mono Fluoro Phosphate (MFP), commonly used in dental care products such as toothpaste for its anti-caries properties, presents several key challenges, particularly in ensuring product quality and navigating intellectual property (IP) landscapes. Below are the primary pitfalls to avoid:

- Inconsistent Product Quality and Purity

- Impurity Risks: MFP sourced from unreliable suppliers may contain hazardous impurities such as heavy metals (e.g., lead, arsenic) or excess fluoride, which can compromise product safety and regulatory compliance.

- Batch-to-Batch Variability: Inadequate manufacturing controls can lead to inconsistent particle size, moisture content, or chemical composition, affecting formulation stability and efficacy in end products.

-

Lack of Certifications: Suppliers may lack ISO, GMP, or FDA-registered facility certifications, increasing the risk of non-compliant materials.

-

Insufficient Regulatory Compliance Documentation

-

MFP must meet stringent regulatory standards (e.g., USP, Ph. Eur., or FDA monographs). A common pitfall is sourcing from suppliers unable to provide full documentation of compliance, CoA (Certificate of Analysis), or DMF (Drug Master File) support, especially for pharmaceutical or OTC dental applications.

-

Intellectual Property (IP) Infringement Risks

- Patented Formulations and Processes: Certain methods of manufacturing or stabilizing MFP, especially in combination with other ingredients (e.g., in anti-sensitivity toothpastes), are protected by patents. Sourcing or using MFP in formulations without due diligence may lead to IP infringement claims.

- Geographic IP Variability: Patent protections vary by region (e.g., US vs. EU), and suppliers in less-regulated markets may offer MFP produced via patented processes without licensing, exposing buyers to legal risk.

-

Supplier Transparency: Some suppliers may not disclose whether their production process or final product circumvents existing patents, increasing downstream liability.

-

Supply Chain Opacity and Traceability

-

MFP may be sourced through intermediaries or multi-tier supply chains with limited visibility into raw material origins or production methods. This lack of traceability makes it difficult to assess both quality and IP risks.

-

Cost-Driven Sourcing Leading to Compromised Standards

- Selecting suppliers based solely on price can lead to substandard MFP that fails long-term stability testing or regulatory audits. The lowest-cost option may not account for total cost of ownership, including rework, recalls, or legal exposure.

Best Practices to Mitigate Risks

– Conduct thorough supplier audits and request full quality documentation.

– Perform independent testing of incoming MFP batches.

– Engage legal and IP experts to review formulations and sourcing routes for freedom-to-operate.

– Prioritize suppliers with proven regulatory compliance and transparent manufacturing processes.

By proactively addressing these quality and IP-related pitfalls, companies can ensure safe, compliant, and legally secure sourcing of Mono Fluoro Phosphate.

Logistics & Compliance Guide for Mono Fluoro Phosphate (MFP)

Hazard Class: 6.1 (Toxic Substances) – UN 2811

Proper Shipping Name: TOXIC SOLID, INORGANIC, N.O.S. (Mono Fluoro Phosphate)

UN Number: 2811

Packing Group: II (Medium Hazard)

CAS Number: 7783-44-6 (for Sodium Mono Fluoro Phosphate, typical form)

1. Chemical Overview

- Chemical Name: Mono Fluoro Phosphate (MFP), commonly as Sodium Mono Fluoro Phosphate (Na₂PO₃F)

- Appearance: White crystalline powder

- Uses: Dental care (toothpaste), dietary supplements, water fluoridation (rare)

- Toxicity: Harmful if swallowed, inhaled, or absorbed through skin. Releases fluoride and phosphate ions; chronic overexposure may lead to fluorosis.

2. Hazard Classification (GHS / CLP)

Hazard Class: Acute Toxicity (Oral, Dermal, Inhalation), Specific Target Organ Toxicity (Repeated Exposure)

Hazard Statements (H-Statements)

– H302: Harmful if swallowed

– H312: Harmful in contact with skin

– H332: Harmful if inhaled

– H372: Causes damage to bones, teeth through prolonged or repeated exposure

Precautionary Statements (P-Statements)

– P261: Avoid breathing dust/fume

– P270: Do not eat, drink, or smoke when using this product

– P280: Wear protective gloves/eye protection/face protection

– P301+P312: IF SWALLOWED: Call a POISON CENTER or doctor/physician if you feel unwell

– P501: Dispose of contents/container in accordance with local regulations

3. Transportation (Dangerous Goods Regulations)

In accordance with UN Recommendations on the Transport of Dangerous Goods (TDG), IMDG Code (sea), IATA DGR (air), and ADR (road in Europe).

- UN Number: 2811

- Proper Shipping Name: TOXIC SOLID, INORGANIC, N.O.S. (Mono Fluoro Phosphate)

- Class: 6.1 (Toxic Substances)

- Packing Group: II

- Labels Required:

- Class 6.1 (Skull and Crossbones)

- May require supplementary label for environmental hazard if applicable (check concentration)

- Packaging:

- Must meet performance standards (e.g., UN-certified packaging)

- Inner packaging: Sealed plastic bags or containers

- Outer packaging: Rigid fiberboard drum, plastic drum, or jerrican with cushioning

- Must prevent dust release

- Segregation Requirements:

- Keep away from foodstuffs, acids, and strong oxidizers

- Do not transport with Class 5.1 (oxidizers) or Class 8 (corrosives) unless properly isolated

4. Storage & Handling

- Storage Conditions:

- Store in a cool, dry, well-ventilated area

- Keep in tightly closed, labeled containers

- Avoid moisture (hygroscopic)

- Segregate from food, feed, and incompatible materials (acids, bases)

- Handling Precautions:

- Use only in controlled environments with engineering controls (e.g., local exhaust ventilation)

- Prohibit eating, drinking, or smoking in handling areas

- Use non-sparking tools if dust explosion risks are present (though MFP is not highly flammable, dust may pose minor risk)

5. Personal Protective Equipment (PPE)

- Respiratory Protection: NIOSH-approved respirator with P100 or N95 filter if dust levels exceed exposure limits

- Eye Protection: Chemical splash goggles or face shield

- Skin Protection: Impermeable gloves (nitrile or neoprene), lab coat or protective clothing

- Footwear: Closed-toe, chemical-resistant shoes

6. Exposure Limits & Monitoring

- OSHA PEL (USA): Not specifically listed; apply general fluoride limit (2.5 mg/m³ TWA for soluble fluoride compounds)

- ACGIH TLV (Canada/Europe): 2.5 mg/m³ (as F) for soluble fluoride – ceiling limit

- NIOSH REL: 2.5 mg/m³ (as F), 10-hour TWA

- Monitoring: Air sampling recommended in production or bulk handling environments

7. Spill Response & Emergency Procedures

- Spill Procedure:

- Evacuate non-essential personnel

- Wear full PPE (respirator, gloves, goggles)

- Avoid creating dust; dampen spill with water if safe

- Collect material using non-sparking tools into a sealed container

- Decontaminate area with water and mild detergent

- Disposal:

- Follow local hazardous waste regulations

- Do not dispose of in sewer or environment

- Label as “Hazardous Waste – Toxic Inorganic Compound”

8. Regulatory Compliance

- REACH (EU): Registered substance; ensure SDS is up to date and communicated in supply chain

- TSCA (USA): Listed; no significant restrictions, but reporting may be required for new uses

- GHS Compliance: SDS must be GHS-compliant (16-section format)

- Poison Control Notification: Required in some jurisdictions for toxic substances

- Customs & Import: May require prior notification or permits in certain countries (e.g., food-grade MFP may have additional scrutiny)

9. Safety Data Sheet (SDS) Requirements

Ensure the latest version of the SDS is available and includes:

– Complete hazard identification

– First-aid and firefighting measures

– Accurate transport information (UN number, class, packing group)

– Regulatory information (EPA, DOT, EU CLP)

10. Special Considerations

- Food-Grade vs. Industrial Grade: If used in toothpaste or supplements, ensure compliance with FDA, EFSA, or other food safety authorities

- Labeling: Transport packages must display:

- Proper shipping name

- UN number

- Hazard class label (6.1)

- Name and address of shipper/consignee

- “Keep Away from Food” marking if applicable

Conclusion:

Mono Fluoro Phosphate is a regulated toxic substance requiring strict adherence to safety, handling, and transportation protocols. Always consult the SDS and local regulations before shipping or using. Use H2 packaging standards (UN-certified, dust-tight, moisture-resistant) to ensure safe logistics.

Note: Always verify product-specific data with the manufacturer—impurities or formulations may alter hazard classification.

Conclusion on Sourcing Mono Fluoro Phosphate

In conclusion, sourcing mono fluoro phosphate (MFP) requires a strategic approach that balances quality, regulatory compliance, supplier reliability, and cost-efficiency. As a key ingredient in oral care products—particularly fluoride toothpaste—MFP must meet stringent purity and safety standards set by regulatory bodies such as the FDA, EFSA, and other regional authorities. Potential suppliers should be thoroughly vetted for certifications, manufacturing practices, and consistent product quality.

Given that MFP is a specialty chemical with limited global suppliers, establishing long-term partnerships with reputable manufacturers, particularly those in regions with strong chemical production infrastructures (such as China, India, or Europe), can ensure supply chain stability. Additionally, considerations around logistics, import regulations, and environmental, social, and governance (ESG) factors are increasingly important in sustainable sourcing strategies.

In summary, successful sourcing of mono fluoro phosphate hinges on due diligence, compliance assurance, and supply chain resilience to support product safety and market availability in the competitive oral care industry.