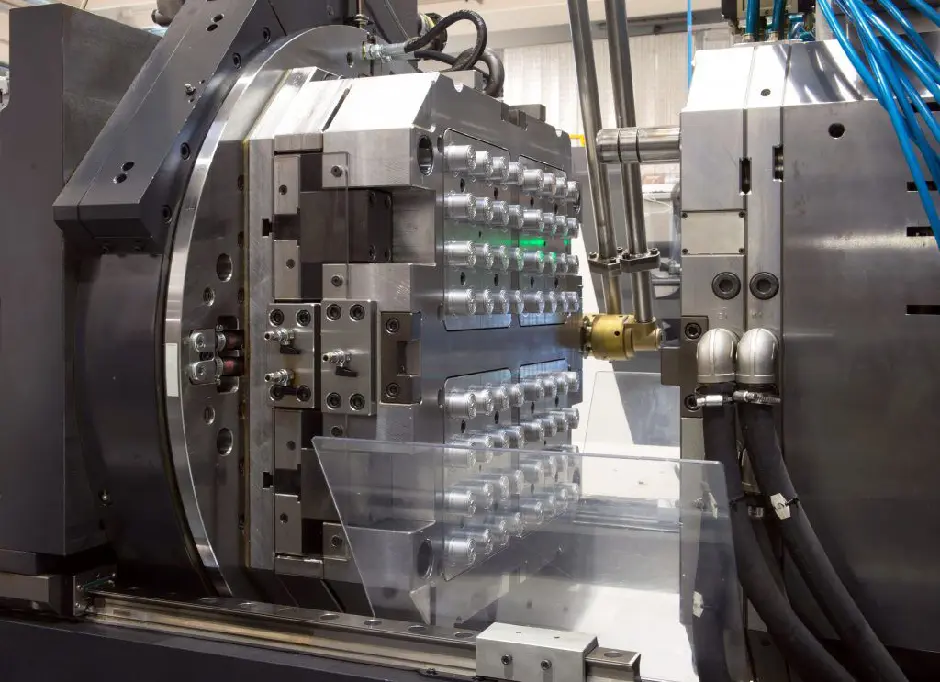

The global plastic mold manufacturing industry has experienced robust growth, driven by rising demand across automotive, consumer electronics, medical devices, and packaging sectors. According to a 2023 report by Grand View Research, the global plastic molds market size was valued at USD 89.6 billion and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by advancements in injection molding technologies, increasing adoption of lightweight components in automotive manufacturing, and the surge in customized consumer products. Additionally, Mordor Intelligence projects that the mold manufacturing market will benefit from expanding industrial automation and the proliferation of high-precision molding in emerging economies. As competition intensifies, innovation in mold design, material efficiency, and production speed have become critical differentiators among top manufacturers. In this evolving landscape, the following ten companies have emerged as leaders, combining scale, technological expertise, and global reach to dominate the plastic mold manufacturing sector.

Top 10 Mold Plastic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Technimark

Domain Est. 1996

Website: technimark.com

Key Highlights: Your global manufacturing partner specializing in precision injection molding, complex assembly, and contract manufacturing….

#2 Dutchland Plastics

Domain Est. 1999

Website: dutchland.com

Key Highlights: Dutchland Plastics is a rotational molding plastic products manufacturer offering engineering, mold maintenance, finishing services, assembly and logistics….

#3 Universal Plastics: Thermoforming

Domain Est. 1996

Website: universalplastics.com

Key Highlights: Universal Plastics offers many injection molding services, including structural foam and gas assist to offer the proper process, engineering support, global ……

#4 PCS Company

Domain Est. 1997

Website: pcs-company.com

Key Highlights: PCS Company is a team of industry experts providing solutions and innovative products for the plastic injection molding, mold making, and die casting industries ……

#5 Innovative Molding Solutions –

Domain Est. 1997

Website: currierplastics.com

Key Highlights: Currier provides custom injection molding, custom blow molding, tooling, and design engineering for industries including: healthcare, packaging, and more!…

#6 American Plastic Molding

Domain Est. 1998

Website: apmc.com

Key Highlights: APM is an innovative engineering and manufacturing organization, focused on “product realization.” Our manufacturing core competencies in assembly and ……

#7 SyBridge Technologies

Domain Est. 2003

Website: sybridge.com

Key Highlights: Precision molds powering the world’s leading plastic products. With over 50 years of mold-making experience, we’re true experts in our craft. SyBridge builds ……

#8 Plastic Injection Molding

Domain Est. 2004

Website: precisionmoldedplastics.com

Key Highlights: Precision is a vertically integrated, plastic injection molding company that builds custom molds and tooling, manufactures parts and products, and performs a ……

#9 Plastic Molding Manufacturing

Domain Est. 2008

Website: plasticmoldingmfg.com

Key Highlights: Plastic Molding Manufacturing is a U.S.-based custom plastic injection molding company, providing full-service, single-source solutions for custom molded ……

#10 Springboard Manufacturing

Domain Est. 2019

Website: springboardmfg.com

Key Highlights: We offer state-of-the-art medical injection molding and assembly services for numerous types of medical device applications in a wide range of sizes….

Expert Sourcing Insights for Mold Plastic

H2 2026 Market Trends for Molded Plastics

As we approach the second half of 2026, the global molded plastics market is navigating a complex landscape shaped by sustainability mandates, technological innovation, economic fluctuations, and shifting end-user demands. Key trends expected to dominate H2 2026 include:

-

Accelerated Shift Towards Sustainable Materials & Circularity:

- Bioplastics & Bio-based Polymers: Adoption of PLA, PHA, and bio-PET will surge, driven by stringent regulations (e.g., EU Green Deal, California SB 54) and corporate ESG commitments. Expect significant R&D focus on improving performance (heat resistance, durability) and cost-competitiveness of high-performance bioplastics.

- Chemical Recycling Integration: Mechanical recycling limits are pushing investment into chemical recycling (pyrolysis, depolymerization) to handle mixed/contaminated waste. Major polymer producers and chemical companies will scale up commercial plants, aiming to supply “recycled content” feedstocks (e.g., rNaphtha, rPP, rPE) for high-quality molded parts, particularly in automotive and electronics.

- Design for Recycling (DfR): OEMs and molders will prioritize mono-material designs, easy disassembly, and compatibility with existing recycling streams. Digital product passports tracking materials will become more common.

- Regulatory Pressure: Extended Producer Responsibility (EPR) schemes and plastic taxes will intensify, forcing brands to pay for end-of-life management and favor recycled content, directly impacting material selection and molding processes.

-

Advanced Materials & Processing Innovation:

- High-Performance & Engineered Plastics Growth: Demand for lightweighting in electric vehicles (EVs), aerospace, and consumer electronics will drive use of PEEK, PEI, PPS, and long-fiber reinforced composites. Focus on materials offering higher temperature resistance, strength-to-weight ratios, and electrical properties.

- Multi-Material & Overmolding: Increased use of in-mold labeling (IML), in-mold assembly (IMA), and overmolding (e.g., soft-touch TPEs on rigid substrates) for functional integration, aesthetics, and reduced assembly steps, particularly in automotive interiors and consumer goods.

- AI & Digitalization in Molding: Wider adoption of AI-powered process optimization for predictive maintenance, real-time quality control (computer vision), and energy efficiency. Digital twins for mold design and process simulation will become standard practice, reducing time-to-market.

- Additive Manufacturing (AM) for Molds: Use of metal AM (e.g., DMLS) for conformal cooling channels in molds will become more mainstream, significantly improving cycle times, part quality (reduced warpage), and enabling complex geometries.

-

Supply Chain Resilience & Regionalization:

- Nearshoring/Reshoring: Geopolitical tensions and supply chain disruptions will continue pushing companies to regionalize production. Expect growth in molded plastics capacity in North America (driven by IRA incentives) and parts of Southeast Asia (diversification from China), though China remains dominant.

- Vertical Integration: Larger players may acquire or invest in resin production (especially bio-based or recycled) or downstream assembly to secure supply and capture more value.

- Inventory Optimization: Companies will maintain strategic inventories of critical resins and components, balancing just-in-time efficiency with resilience.

-

End-Market Dynamics:

- Automotive (EV Focus): Continued strong demand for lightweight, durable plastic components in EVs (battery housings, interior trims, under-hood parts, charging infrastructure). Emphasis on safety (flame retardancy) and recyclability.

- Packaging (Sustainability-Driven): Growth in molded rigid packaging (e.g., trays, clamshells) made from recycled content or compostable materials, especially for food and healthcare. Pressure on single-use flexible films remains high.

- Medical Devices: Rising demand for precision-molded components (e.g., drug delivery devices, diagnostics, surgical tools) using biocompatible, sterilizable, and traceable materials. Regulatory compliance (ISO 13485) is paramount.

- Consumer Electronics: Demand for thinner, lighter, and aesthetically pleasing housings and components, driving innovation in materials (e.g., glass-filled nylons, LCP) and micro-molding capabilities.

-

Economic & Raw Material Factors:

- Volatility Management: Molders will face ongoing challenges from fluctuating fossil fuel prices (impacting virgin resin costs) and the premium associated with recycled and bio-based feedstocks. Long-term contracts and hedging strategies will be crucial.

- Energy Costs & Efficiency: High energy costs (especially in Europe) will drive investment in energy-efficient molding machines (all-electric, hybrid), optimized processes, and renewable energy sourcing for manufacturing sites.

Conclusion for H2 2026:

The molded plastics market in H2 2026 will be defined by an imperative for sustainability, technological sophistication, and supply chain agility. Success will favor companies that proactively invest in circular economy solutions (recycled/bio-based materials, chemical recycling), leverage digitalization and advanced materials, adapt to regional manufacturing shifts, and cater to the specific demands of high-growth, innovation-driven sectors like EVs and medical devices. While economic headwinds and raw material volatility persist, the drive towards a more sustainable and efficient plastics value chain will be the dominant force shaping the industry’s trajectory.

Common Pitfalls in Sourcing Molded Plastic Components (Quality, Intellectual Property)

Sourcing molded plastic parts, especially from overseas or new suppliers, presents several recurring challenges that can impact product quality, timelines, and legal standing. Two of the most critical areas prone to pitfalls are quality control and intellectual property (IP) protection.

Quality-Related Pitfalls

- Inconsistent Material Quality: Suppliers may use substandard or incorrect grades of resin (e.g., lower melt flow, incorrect additives, recycled content without disclosure) to reduce costs, leading to part failure, discoloration, or dimensional instability.

- Poor Process Control: Inadequate control over injection molding parameters (temperature, pressure, cycle time, cooling) results in defects like warpage, sink marks, short shots, flash, or internal stresses, impacting part functionality and appearance.

- Insufficient Tooling Quality: Using poorly designed or manufactured molds (e.g., inadequate venting, cooling, or ejection) leads to inconsistent part quality, premature tool wear, and higher defect rates. Suppliers might cut corners on steel quality or mold complexity.

- Lack of Robust Quality Systems: Suppliers without certified quality management systems (like ISO 9001) or inconsistent inspection processes (e.g., sampling only, inadequate measurement systems) fail to catch defects, allowing non-conforming parts to ship.

- Inadequate Dimensional Accuracy & Tolerance Management: Failure to consistently meet specified tolerances due to process drift, tool wear, or poor measurement practices can cause assembly issues or functional failures in the final product.

- Inconsistent Surface Finish: Variations in mold surface treatment, release agents, or process settings can lead to unacceptable differences in gloss, texture, or appearance between batches.

Intellectual Property (IP)-Related Pitfalls

- Unauthorized Use or Reverse Engineering: Suppliers may copy mold designs, part geometries, or proprietary processes to produce identical or similar parts for competitors or sell them independently, directly infringing on your IP rights.

- Weak or Unclear Contracts: Agreements lacking explicit, enforceable clauses on IP ownership, confidentiality, non-compete, and non-disclosure leave your designs vulnerable. Jurisdiction and governing law clauses are often overlooked.

- Mold Ownership Ambiguity: Failure to clearly establish in writing that the buyer owns the molds (and associated IP) created for their parts allows the supplier to retain control, potentially holding production hostage or using the molds for others.

- Insufficient Design Protection: Not securing patents, design rights, or copyrights before sharing detailed designs increases the risk of IP theft and makes legal recourse difficult, especially in jurisdictions with weaker IP enforcement.

- Overexposure of Sensitive Information: Sharing full 3D CAD models or detailed engineering drawings without need-to-know restrictions or robust NDAs increases the risk of misuse. Sharing only necessary information (e.g., 2D drawings with critical dimensions) is safer.

- Challenges in Enforcement: Pursuing IP infringement, particularly overseas, can be costly, time-consuming, and legally complex, with uncertain outcomes, especially in regions known for IP challenges. Preventative measures are far more effective.

Logistics & Compliance Guide for Molded Plastic Products

Overview of Molded Plastic Logistics

Transporting molded plastic products requires careful planning due to variations in product weight, size, fragility, and material composition. Efficient logistics ensure timely delivery while minimizing damage and costs. This section covers transportation modes, packaging standards, storage conditions, and handling procedures suitable for molded plastics.

Regulatory Compliance Requirements

Molded plastic products are subject to various international, national, and regional regulations. Compliance ensures safety, environmental responsibility, and legal distribution. Key regulations include REACH and RoHS in the EU, TSCA in the U.S., and country-specific labeling and import requirements. Manufacturers and distributors must verify substance restrictions and maintain documentation for audits.

Packaging and Labeling Standards

Proper packaging protects molded plastic components during transit and prevents contamination. Use moisture-resistant, shock-absorbent materials such as corrugated cardboard, foam inserts, or reusable containers. Labels must include product identifiers, batch numbers, handling instructions (e.g., “Fragile,” “Do Not Stack”), and compliance markings (e.g., CE, UL). Recycling symbols (e.g., Resin Identification Codes #1–#7) are mandatory in many jurisdictions.

Transportation and Carrier Selection

Choose carriers experienced in handling plastic goods, whether by road, rail, sea, or air. Consider temperature sensitivity—some plastics degrade under extreme heat or cold. Use climate-controlled containers when necessary. Ensure carriers comply with safety standards (e.g., ADR for hazardous goods if applicable) and provide tracking capabilities for supply chain visibility.

Import/Export Documentation

Accurate documentation is critical for cross-border shipments. Required documents typically include commercial invoices, packing lists, certificates of origin, and bills of lading. Additional requirements may include Material Safety Data Sheets (MSDS/SDS) for certain plastic types and customs declarations referencing correct HS codes (e.g., 3926.30 for plastic tableware).

Environmental and Sustainability Compliance

Many regions enforce extended producer responsibility (EPR) for plastic products. Companies must report plastic usage, participate in recycling schemes, and reduce single-use plastics where applicable. Adhere to local waste management laws and consider using recyclable or bio-based plastics to meet environmental targets and consumer expectations.

Quality Control and Traceability

Implement quality checks pre-shipment to ensure molded products meet specifications. Maintain traceability through batch tracking systems to quickly address recalls or compliance issues. Integrate digital logs or blockchain technology for enhanced transparency across the supply chain.

Incident Management and Recalls

Prepare a response plan for logistics disruptions, product damage, or compliance failures. In case of non-compliant materials or safety concerns, initiate a recall procedure in accordance with local regulatory bodies (e.g., CPSC in the U.S., RAPEX in the EU). Communicate promptly with stakeholders and retain records for investigation and improvement.

Training and Compliance Audits

Regularly train logistics and compliance teams on updated regulations and handling procedures. Conduct internal audits to verify adherence to packaging, labeling, and transportation standards. Schedule third-party audits to validate compliance with ISO 9001, ISO 14001, or industry-specific certifications.

Conclusion and Best Practices

Successful logistics and compliance for molded plastics require proactive planning, documentation accuracy, and continuous monitoring. Adopt best practices such as supplier vetting, sustainable packaging, real-time tracking, and regulatory monitoring to ensure smooth operations and market access worldwide.

Conclusion for Sourcing Plastic Molds:

Sourcing plastic molds is a critical step in the product development and manufacturing process, directly influencing product quality, production efficiency, and overall costs. A successful sourcing strategy requires a comprehensive evaluation of mold design, material selection, supplier capabilities, and long-term support. Partnering with experienced and reliable mold manufacturers—whether domestic or overseas—ensures precision, durability, and consistency in mold performance.

Key considerations include the complexity of the part design, production volume requirements, lead times, and total cost of ownership. Investing in high-quality molds from reputable suppliers may involve higher initial costs but often leads to better part quality, reduced downtime, and lower maintenance expenses over time. Additionally, effective communication, clear specifications, and prototyping stages are essential to minimize errors and ensure alignment between design intent and final output.

In conclusion, a well-executed mold sourcing strategy balances cost, quality, and reliability, laying a solid foundation for scalable and efficient plastic part production. Continuous collaboration with suppliers and ongoing quality assessments further support long-term manufacturing success.