The global modular drawer cabinets market is experiencing robust growth, driven by rising demand for space-efficient and customizable storage solutions across residential, commercial, and industrial sectors. According to Grand View Research, the global modular furniture market was valued at USD 68.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. This surge is fueled by urbanization, increasing home improvement expenditures, and a growing preference for adaptable interior designs—trends particularly evident in North America, Europe, and parts of Asia-Pacific. Mordor Intelligence further projects that the Asia-Pacific region will witness the fastest growth due to rapid urban development and increasing disposable incomes. As demand intensifies, a cohort of manufacturers has emerged as leaders in innovation, quality, and scalability. Here’s a data-informed look at the top 10 modular drawer cabinets manufacturers shaping the future of functional storage.

Top 10 Modular Drawer Cabinets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 IHL Modular Drawer Cabinets

Domain Est. 1999

Website: greenemfg.com

Key Highlights: The IHL Series 1350 eye-level height modular drawer cabinets are made from durable welded 16 and 14 gauge steel, ideal for industrial settings, educational ……

#2 Industrial Modular Cabinets

Domain Est. 2000

Website: lyonworkspace.com

Key Highlights: Lyon is the leading manufacturer of industrial modular cabinets in the USA. Lyon modular cabinets come with drawers, in mobile units, or as part of workbenches….

#3 Modular Drawer Cabinets

Domain Est. 1997

Website: southwestsolutions.com

Key Highlights: Modular drawer cabinets that save space and speed access to tools. Design, install, and service by SSG. Get Revit files or a consultation….

#4 Strong Hold

Domain Est. 1998

Website: strong-hold.com

Key Highlights: MODULAR DRAWER STORAGE CABINETS: BUILT TO OUTLAST EVERYTHING. Browse MDS Cabinets. In the end, all that will be left are cockroaches and Strong Hold cabinets….

#5 Vidmar® Cabinet Types

Domain Est. 2009

Website: storage.stanleyblackanddecker.com

Key Highlights: Maximize every inch with modular industrial storage cabinets from Vidmar®—engineered for high-density organization, durability, and workspace efficiency ……

#6 Modular Drawer Cabinet Solutions

Domain Est. 1996

Website: borroughs.com

Key Highlights: Cabinets attach side-to-side, back-to-back, are designed to be stacked up to five units high, and are adjustable for each application….

#7 Custom Modular Drawer Cabinets

Domain Est. 1996

Website: equipto.com

Key Highlights: Our Modular Drawer Cabinets are designed with flexibility in mind. Choose from a vast offering of preconfigured cabinets or customize your cabinets on the fly….

#8 Buy LISTA Modular Cabinets Online

Domain Est. 1999

Website: listacabinets.com

Key Highlights: Free delivery 14-day returnsYou will find compact modular drawer cabinets ranging from 4 to 16 drawers, with different drawer heights, and as many customizable ……

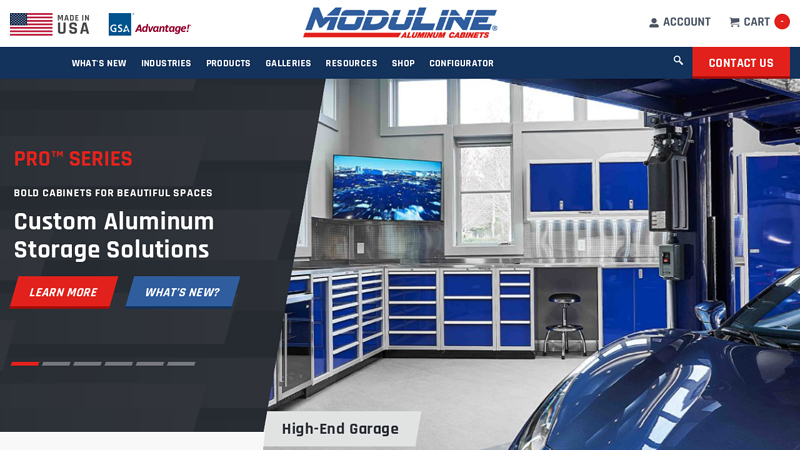

#9 Moduline® Aluminum Cabinets

Domain Est. 2000

Website: modulinecabinets.com

Key Highlights: Moduline Cabinets makes the most sought-after, high-end aluminum cabinet systems on the market today. With rugged, good looks and superior build quality….

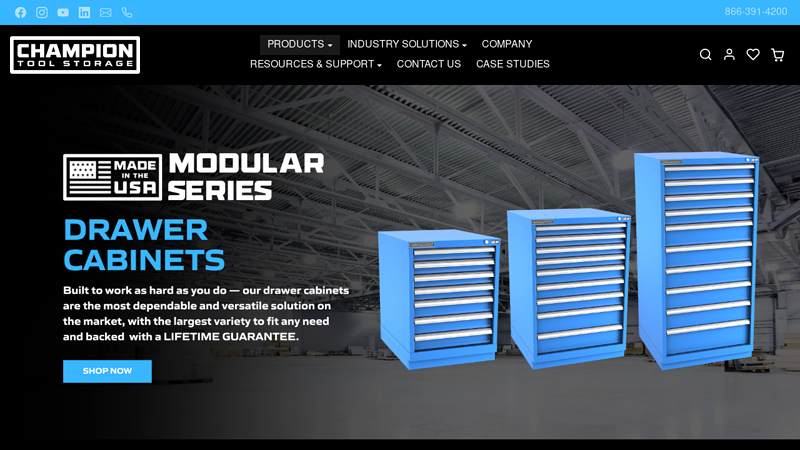

#10 Modular Drawer Cabinets Landing Page

Domain Est. 2001

Website: championbuilt.com

Key Highlights: Easy-to-order Modular Drawer Cabinets in our most popular sizes and configurations. Available in a range of heights, widths, drawers, and color options….

Expert Sourcing Insights for Modular Drawer Cabinets

2026 Market Trends for Modular Drawer Cabinets

The modular drawer cabinet market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and sustainability imperatives. As urbanization continues and living spaces become more compact, demand for versatile, space-saving, and customizable storage solutions is on the rise. This analysis explores key market trends shaping the modular drawer cabinet industry in 2026.

Rising Demand for Customization and Flexibility

One of the most prominent trends in 2026 is the increasing consumer demand for personalized and adaptable storage. Homeowners and businesses alike are prioritizing modular drawer cabinets that can be reconfigured to suit changing needs. Whether used in kitchens, home offices, retail environments, or healthcare facilities, the ability to adjust drawer sizes, add dividers, or reorganize layout enhances functionality. Manufacturers are responding with configurable systems, online design tools, and modular rails that allow users to modify cabinet interiors without professional assistance.

Integration of Smart Technology

Smart storage solutions are gaining traction, with modular drawer cabinets incorporating IoT-enabled features. By 2026, expect to see increased integration of soft-close mechanisms, touchless opening systems, interior LED lighting with motion sensors, and even inventory tracking via RFID tags—especially in commercial and medical settings. These innovations enhance user experience and efficiency, particularly in high-use environments like laboratories and retail backrooms.

Sustainable Materials and Eco-Friendly Manufacturing

Sustainability is a major driver in the 2026 market landscape. Consumers and regulators are demanding greener alternatives, pushing manufacturers to adopt recycled materials, low-VOC finishes, and energy-efficient production methods. Bamboo, reclaimed wood, and recyclable aluminum are becoming more prevalent in modular cabinet construction. Additionally, modular design supports sustainability by extending product lifespan—damaged components can be replaced rather than discarding the entire unit.

Growth in E-Commerce and Direct-to-Consumer Models

The rise of online furniture retail is accelerating the adoption of modular drawer cabinets. Their flat-pack, easy-to-ship design aligns perfectly with e-commerce logistics. In 2026, brands are leveraging augmented reality (AR) apps that allow customers to visualize cabinets in their space before purchase. Direct-to-consumer (DTC) models reduce costs and improve margins, enabling faster innovation and customer feedback loops.

Expansion in Commercial and Industrial Applications

While residential use remains strong, modular drawer cabinets are increasingly adopted in commercial sectors. Industries such as healthcare (for medical supply organization), manufacturing (tool storage), and retail (inventory management) are investing in modular systems for improved workflow and space utilization. Ergonomic designs and security features—like lockable drawers and inventory logs—are key selling points in these markets.

Regional Market Dynamics

Growth is not uniform across regions. North America and Western Europe lead in adoption due to high disposable incomes and mature DIY markets. Meanwhile, Asia-Pacific is emerging as a high-growth region, fueled by urbanization and rising middle-class demand for modern home organization. Localized manufacturing and supply chains are helping brands meet regional preferences and reduce delivery times.

Conclusion

By 2026, the modular drawer cabinet market will be defined by customization, smart functionality, sustainability, and digital engagement. Companies that embrace modularity not only as a product feature but as a core business strategy—enabling easy upgrades, repairs, and repurposing—will gain competitive advantage. As lifestyles evolve and space constraints intensify, modular drawer cabinets will remain a cornerstone of efficient, intelligent storage solutions.

Common Pitfalls When Sourcing Modular Drawer Cabinets (Quality & IP)

Sourcing modular drawer cabinets—especially for industrial, medical, or high-precision applications—can be fraught with challenges related to quality consistency and intellectual property (IP) risks. Being aware of these pitfalls helps mitigate supply chain disruptions, legal issues, and performance failures.

Quality Inconsistencies Across Batches

One of the most frequent issues is inconsistent quality between production batches. Suppliers, particularly low-cost manufacturers, may alter materials or tolerances without notification, leading to misaligned drawers, weakened load capacity, or premature wear. This inconsistency undermines system integration and long-term reliability.

Use of Substandard Materials

To cut costs, some suppliers substitute specified materials—such as using lower-grade steel, inferior coatings, or non-compliant plastics. These substitutions compromise durability, corrosion resistance, and load-bearing performance, especially in harsh environments. Without rigorous material verification, buyers risk receiving cabinets that fail prematurely.

Poor Tolerance and Dimensional Accuracy

Modular systems rely on precise engineering to ensure interchangeability and seamless integration. Poor manufacturing tolerances result in misaligned drawer fronts, binding mechanisms, or incompatibility with mounting systems. This is especially critical when integrating with automated systems or existing infrastructure.

Inadequate Testing and Certification

Many suppliers claim compliance with industry standards (e.g., IP ratings, load testing, fire resistance) but lack proper third-party certification. Relying on self-declared specs without verified test reports exposes buyers to safety risks and non-compliance with regulatory requirements.

Lack of Traceability and Documentation

Insufficient documentation—such as material certifications, assembly instructions, or quality control records—can hinder maintenance, audits, and compliance. Without traceability, identifying the source of defects or managing recalls becomes extremely difficult.

Intellectual Property Infringement Risks

Sourcing from manufacturers with weak IP governance can expose buyers to legal liability. Some suppliers replicate patented designs, mechanisms, or branding without authorization. Purchasing such products—even unknowingly—can result in cease-and-desist orders, seizures, or litigation, especially in regulated markets.

Reverse Engineering and Design Theft

When sharing custom designs or specifications with suppliers, especially overseas, there’s a risk of design theft. Unscrupulous manufacturers may reverse engineer your cabinet design and sell it to competitors or replicate it for their own product lines, diluting your market advantage.

Inadequate IP Protection in Contracts

Purchase agreements often overlook IP clauses, failing to specify ownership of custom tooling, design modifications, or product molds. Without clear contractual terms, suppliers may claim rights to innovations developed during production, limiting your ability to switch vendors or scale production.

Supply Chain Transparency Gaps

Many suppliers subcontract parts of the manufacturing process without disclosure. This lack of transparency increases the risk of unauthorized IP use and makes it harder to ensure consistent quality and ethical sourcing practices.

Overlooking After-Sales Support and Spare Parts

Even with high initial quality, cabinets require maintenance and spare parts. Sourcing from vendors without reliable after-sales support can lead to long downtimes when components fail. Additionally, discontinued models may leave systems incompatible with future expansions.

Mitigating these pitfalls requires thorough due diligence: vetting suppliers, demanding test reports, auditing production facilities, securing strong IP clauses in contracts, and maintaining design control through NDAs and proprietary documentation.

Logistics & Compliance Guide for Modular Drawer Cabinets

Product Classification & HS Code

Modular drawer cabinets are typically classified under Harmonized System (HS) code 9403.60, which covers “Other furniture and parts thereof, of wood.” However, classification may vary based on material (e.g., metal cabinets fall under 9403.20). Confirm the correct HS code based on primary material and design to ensure accurate customs declarations and tariff assessments.

Packaging & Handling Requirements

Use sturdy, corrugated cardboard with internal dividers or foam inserts to prevent movement during transit. Flat-pack configurations are recommended to reduce shipping volume and damage risk. Clearly label packages with “Fragile,” “This Side Up,” and handling instructions. Secure all components with straps or shrink wrap for palletized shipments.

Shipping & Transportation

Modular drawer cabinets are commonly shipped via LTL (Less Than Truckload) or FCL (Full Container Load) depending on order size. For international shipments, ensure compliance with ISPM 15 regulations for wooden packaging materials (e.g., pallets must be heat-treated and stamped). Optimize packaging dimensions to maximize container or truck space and reduce freight costs.

Import/Export Documentation

Essential documents include commercial invoice, packing list, bill of lading (or air waybill), and certificate of origin. The commercial invoice must detail product description, quantity, value, HS code, and country of manufacture. For exports to regulated markets (e.g., EU, USA), include compliance statements and safety certifications if applicable.

Regulatory Compliance

Ensure products meet destination market standards:

– USA: Comply with California Proposition 65 (if applicable for chemical content) and FTC labeling requirements.

– EU: Adhere to REACH (chemical safety) and CE marking if integrated with electrical components. Furniture must also meet EN 14749 for strength and durability.

– UK: Follow UKCA marking requirements post-Brexit and align with UK REACH regulations.

– Other Regions: Verify local safety, emissions (e.g., formaldehyde limits), and labeling standards.

Environmental & Safety Standards

Use low-VOC (volatile organic compounds) finishes and adhesives to meet environmental regulations such as CARB (California Air Resources Board) Phase 2 or EU Ecolabel. Provide Safety Data Sheets (SDS) for any hazardous materials used in manufacturing. Ensure packaging is recyclable and minimize plastic content to support sustainability goals.

Customs Clearance & Duties

Provide accurate valuation in accordance with WTO Valuation Agreement. Be prepared for potential duties based on the HS code and trade agreements (e.g., USMCA, RCEP). Maintain records for at least five years to support audit readiness. Utilize bonded warehouses or free trade zones where applicable to defer duty payments.

After-Sales & Warranty Compliance

Include multilingual assembly instructions and warranty information with each unit. Warranty terms must comply with consumer protection laws in the destination market (e.g., 2-year statutory warranty in the EU). Maintain a process for handling returns, repairs, and recalls in accordance with local regulations.

Recordkeeping & Audit Trail

Maintain digital records of all shipments, compliance certifications, test reports, and supplier declarations. Implement a traceability system for components to support recalls or customs audits. Regularly update compliance documentation as regulations evolve.

Contact & Support

Designate a compliance officer or logistics coordinator to manage international shipments and respond to customs inquiries. Provide customer support with clear channels for logistics tracking and compliance-related questions.

In conclusion, sourcing modular drawer cabinets offers a flexible, efficient, and cost-effective solution for optimizing storage in various environments, including workshops, healthcare facilities, industrial settings, and offices. Their customizable configurations, durability, and space-saving designs make them highly adaptable to evolving storage needs. When sourcing, it is essential to evaluate factors such as material quality, load capacity, customization options, supplier reliability, and long-term maintenance requirements. By prioritizing these considerations and partnering with reputable manufacturers or suppliers, organizations can ensure they acquire modular drawer cabinets that enhance operational efficiency, improve accessibility, and deliver lasting value. Ultimately, a strategic sourcing approach enables businesses to achieve optimal storage performance while supporting scalability and workplace organization goals.