The global mobile robotics market is experiencing robust expansion, driven by increasing automation across logistics, manufacturing, healthcare, and retail sectors. According to Mordor Intelligence, the mobile robots market was valued at USD 6.97 billion in 2023 and is projected to reach USD 21.13 billion by 2029, growing at a CAGR of approximately 20.3% during the forecast period. Similarly, Grand View Research reports a CAGR of 22.3% from 2023 to 2030, citing rising demand for warehouse automation, labor cost reduction, and advancements in AI and computer vision as key growth accelerators. As industries prioritize operational efficiency and supply chain resilience, mobile robots have emerged as critical enablers of smart automation. In this rapidly evolving landscape, a select group of manufacturers are leading innovation, scalability, and deployment at global scale—shaping the future of autonomous mobility in dynamic environments.

Top 10 Mobile Robots Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 About MiR

Domain Est. 2012

Website: mobile-industrial-robots.com

Key Highlights: A leading manufacturer of AMRs. We are committed to optimizing user experience by developing user-friendly, flexible, and safe robots….

#2 Global Leading AGV/AMR Robot Company|VisionNav Robotics

Domain Est. 2016

Website: visionnav.com

Key Highlights: Headquartered in Atlanta, VisionNav® Robotics is a global leader in autonomous industrial vehicles (AMRs/AGVs) and logistics automation solutions….

#3 Mobile Robots (AMRs)

Domain Est. 1990

Website: abb.com

Key Highlights: Autonomous Mobile Robots (AMRs) are cutting-edge transport robots specifically designed to move loads autonomously in a diverse range of industries, ……

#4 Mobile Robotics

Domain Est. 1995

Website: oceaneering.com

Key Highlights: We deliver standardized mobile robots with infrastructure-free navigation ensuring the lowest total cost of ownership per vehicle….

#5 OMRON Robotics

Domain Est. 1997

Website: robotics.omron.com

Key Highlights: Solve manufacturing inefficiencies with OMRON Robotics’ cutting-edge robots — engineered to maximize productivity, quality, and safety….

#6 Robotic arm, mobile robot, autonomous robots, ROS robot

Domain Est. 2008

Website: generationrobots.com

Key Highlights: A robotics project? Or need to buy robotic hardware? With 17 years of experience in robotics, Generation Robots is a major robots distributor and designer….

#7 AMR & AGV: Autonomous Mobile Robots

Domain Est. 2015

Website: agilox.net

Key Highlights: AGILOX develops the world’s easiest AMR Solutions (AMR | AGVs). ✓ Find out more about our Autonomous Mobile Robots (AMRs) on our homepage!…

#8 Enabled Robotics

Domain Est. 2016

Website: enabled-robotics.com

Key Highlights: We deliver Mobile Cobots to global market leaders in the industries of aerospace, automotive, semiconductors and pharmaceuticals. We are Enabled Robotics….

#9 Autonomous Mobile Robots Company – AMR

Founded: 2002

Website: robotnik.eu

Key Highlights: Robotnik designs, manufactures and markets mobile robots and mobile manipulators. Our company was founded in 2002 and we are currently a reference company in ……

#10 About the Mobile Robot Directory

Domain Est. 2006

Website: mobile-robots.com

Key Highlights: We’ve created this site as a service to users and prospective buyers of mobile robotic systems for intralogistics and material handling in production and ……

Expert Sourcing Insights for Mobile Robots

2026 Market Trends for Mobile Robots

The mobile robotics market is poised for transformative growth and evolution by 2026, driven by technological advancements, shifting labor dynamics, and expanding application demands across diverse sectors. Key trends shaping the landscape include:

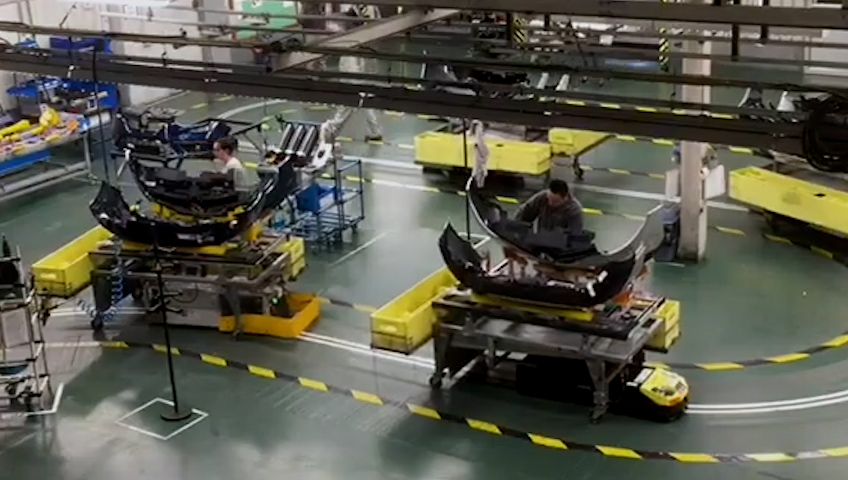

Accelerated Adoption in Logistics and Warehousing

The e-commerce boom and supply chain resilience demands will continue to fuel massive deployment of Autonomous Mobile Robots (AMRs) in warehouses and distribution centers. By 2026, AMRs will move beyond simple goods-to-person tasks to perform complex order picking, palletizing, and yard management. Integration with Warehouse Management Systems (WMS) and orchestration platforms will become standard, enabling fleets of hundreds of robots to operate seamlessly. Expect increased consolidation among robotics providers and deeper partnerships with logistics giants.

Expansion into New Verticals

Beyond logistics, mobile robots will penetrate new industries. In healthcare, disinfection, delivery, and patient transport robots will become commonplace in hospitals. In retail, inventory-scanning robots and automated floor cleaners will optimize operations. The construction sector will adopt robots for site surveying, material transport, and progress monitoring. Agriculture will see wider use of autonomous tractors and harvesting robots, driven by labor shortages and the need for precision farming.

Advancements in AI and Autonomy

Robot intelligence will leap forward by 2026, with widespread adoption of advanced AI for real-time decision-making, dynamic path planning, and adaptive navigation in unstructured environments. Machine learning will enable robots to learn from experience, improving task performance over time. Multi-modal sensor fusion (LiDAR, vision, radar) combined with edge computing will enhance perception and safety, allowing robots to operate reliably alongside humans in complex settings.

Emphasis on Interoperability and Open Standards

Fragmentation in proprietary systems will drive demand for open platforms and standardized communication protocols (e.g., ROS 2, VDA 5050). Customers will prioritize solutions that allow integration across different robot brands and backend systems. Cloud-based fleet management and analytics platforms will become essential for monitoring performance, predictive maintenance, and optimizing workflows across large-scale deployments.

Focus on Sustainability and ROI

As sustainability becomes a boardroom priority, mobile robots will be marketed not just for labor savings but also for energy efficiency and reduced carbon footprints in operations. Demonstrable ROI through increased throughput, reduced errors, and lower operational costs will be critical for adoption. As technology matures, pricing will stabilize, making robotics accessible to small and medium-sized enterprises (SMEs).

Workforce Transformation and Human-Robot Collaboration

Rather than replacing workers, mobile robots will increasingly augment human capabilities. The focus will shift to collaborative workflows where robots handle repetitive or strenuous tasks, freeing personnel for higher-value activities. This will necessitate workforce retraining and new operational models emphasizing safety, change management, and human-robot interaction design.

In conclusion, by 2026, mobile robots will transition from niche automation tools to integral components of intelligent operational ecosystems, driven by smarter software, broader applications, and a growing imperative for efficiency and resilience across global industries.

Common Pitfalls When Sourcing Mobile Robots: Quality and Intellectual Property Risks

Sourcing mobile robots—whether for warehouse automation, logistics, healthcare, or industrial applications—can significantly enhance operational efficiency. However, organizations often encounter critical pitfalls related to quality assurance and intellectual property (IP) protection. Overlooking these areas can result in costly delays, performance shortfalls, legal disputes, or compromised competitive advantage.

Inadequate Quality Assurance and Testing Standards

One of the most frequent pitfalls in sourcing mobile robots is assuming that all vendors adhere to consistent quality standards. Many suppliers, especially newer or lower-cost manufacturers, may lack rigorous testing protocols, leading to robots that perform poorly in real-world environments.

- Insufficient Environmental Testing: Robots may function well in controlled lab settings but fail in dynamic, real-world conditions such as uneven floors, variable lighting, or temperature extremes.

- Lack of Long-Term Reliability Data: Some vendors cannot provide comprehensive Mean Time Between Failures (MTBF) or durability testing results, making it difficult to assess long-term operational costs.

- Inconsistent Software Updates and Support: Poorly maintained firmware or infrequent software patches can lead to security vulnerabilities and performance degradation over time.

To mitigate this, buyers should require proof of third-party testing, demand access to field performance data, and include service-level agreements (SLAs) that define uptime, response times, and maintenance responsibilities.

Unverified Component Sourcing and Supply Chain Transparency

The quality of a mobile robot heavily depends on its constituent components—motors, sensors, batteries, and control systems. Sourcing from vendors who lack supply chain transparency risks receiving robots built with substandard or counterfeit parts.

- Use of Low-Grade Sensors or Batteries: Inferior sensors lead to navigation errors, while low-quality batteries reduce runtime and lifespan.

- Lack of Traceability: Without clear documentation of component origins, diagnosing failures or ensuring compliance with safety standards (e.g., UL, CE) becomes challenging.

Procurement teams should require detailed bills of materials (BOMs), conduct factory audits, and insist on compliance with international quality standards such as ISO 9001.

Intellectual Property Infringement Risks

Mobile robots often incorporate advanced software, navigation algorithms, and mechanical designs protected by patents, copyrights, or trade secrets. Sourcing from vendors without proper IP due diligence can expose the buyer to legal liability.

- Use of Unlicensed Software or Algorithms: Some vendors may integrate open-source or third-party code without proper licensing, potentially violating intellectual property rights.

- Ambiguous IP Ownership in Custom Solutions: When co-developing robots or modifying existing platforms, contracts may fail to clearly assign ownership of new IP, leading to disputes.

- Risk of Infringing Patented Technologies: Vendors may unknowingly—or deliberately—use patented navigation or control methods, exposing the end-user to infringement claims.

To protect against IP risks, buyers must conduct IP audits, require vendors to provide IP indemnification clauses in contracts, and ensure all software components are properly licensed.

Hidden Dependencies and Vendor Lock-In

Many mobile robot platforms rely on proprietary software ecosystems, cloud services, or unique hardware interfaces. Without careful evaluation, organizations can become locked into a single vendor, limiting flexibility and increasing long-term costs.

- Proprietary Communication Protocols: Prevent integration with existing systems or other automation tools.

- Limited API Access or Documentation: Hinders customization, troubleshooting, and in-house development.

- Restricted Right to Repair: Some vendors enforce policies that prevent third-party maintenance, increasing downtime and service costs.

Procurement strategies should prioritize open standards (e.g., ROS, MQTT), demand full API access, and negotiate rights to repair and modify equipment.

Conclusion

Sourcing mobile robots involves more than comparing specs and price tags. Organizations must proactively address quality control gaps and intellectual property vulnerabilities to avoid operational disruptions and legal exposure. Conducting thorough vendor assessments, demanding transparency, and embedding strong contractual protections are essential steps in securing reliable, legally sound robotic solutions.

Logistics & Compliance Guide for Mobile Robots

Integrating mobile robots into logistics operations enhances efficiency, safety, and scalability. However, successful deployment requires strict adherence to logistical planning and regulatory compliance. This guide outlines key considerations to ensure safe, legal, and effective use of mobile robots in industrial and commercial environments.

Regulatory Compliance

Mobile robots must comply with national and international safety and operational standards. Key regulations include:

- ISO 3691-4:2020 – Safety requirements for driverless industrial trucks and their systems. This standard covers risk assessment, safety functions, and operational controls.

- ANSI/ITSDF B56.5 – U.S. safety standard for autonomous industrial vehicles, aligning with ISO 3691-4.

- CE Marking (EU) – Required for robots deployed in Europe, ensuring conformity with health, safety, and environmental protection standards under the Machinery Directive (2006/42/EC) and EMC Directive.

- OSHA Guidelines (USA) – While no specific robot standard exists, OSHA enforces general duty clauses requiring employers to provide a safe workplace, including hazard mitigation around automated systems.

Ensure all robots undergo third-party safety certification and maintain documentation for audits.

Site Assessment and Infrastructure Readiness

Before deployment, conduct a thorough site evaluation:

- Floor Conditions: Assess flatness, slope, and surface materials to ensure robot traction and navigation accuracy.

- Traffic Flow: Map pedestrian and vehicle traffic patterns to define robot pathways and avoid congestion.

- Environmental Factors: Evaluate lighting, temperature, humidity, and potential exposure to dust or chemicals that may affect sensors or performance.

- Network Connectivity: Confirm reliable Wi-Fi or industrial communication networks (e.g., 5G, private LTE) for real-time data exchange and fleet management.

Fleet Management and Integration

Mobile robots should integrate seamlessly with existing logistics systems:

- WMS/TMS Integration: Connect robots to Warehouse Management Systems (WMS) or Transportation Management Systems (TMS) for task assignment and inventory tracking.

- Fleet Coordination Software: Use centralized control platforms to manage routing, charging, and task prioritization across multiple robots.

- Interoperability: Ensure robots support standard communication protocols (e.g., MQTT, REST APIs, OPC UA) for compatibility with diverse equipment.

Safety Protocols and Risk Mitigation

Implement robust safety measures to protect personnel and assets:

- Collision Avoidance: Equip robots with LiDAR, 3D cameras, and ultrasonic sensors to detect and avoid obstacles.

- Emergency Stop (E-Stop): Install accessible E-stop buttons on robots and in operational zones.

- Speed Limitation: Adjust robot speed based on environment (e.g., lower speeds in high-traffic areas).

- Zoning and Signage: Clearly mark robot-only lanes and use visual/audio alerts at intersections or blind spots.

- Human-Robot Interaction Training: Train staff on safe behaviors around robots, including emergency procedures.

Maintenance and Operational Compliance

Regular maintenance ensures long-term reliability and compliance:

- Scheduled Inspections: Follow manufacturer-recommended maintenance intervals for batteries, sensors, wheels, and software updates.

- Logkeeping: Maintain records of maintenance, incidents, and software versions for audit and traceability.

- Software Updates: Apply security patches and firmware updates promptly to address vulnerabilities and improve performance.

Data Security and Privacy

Mobile robots generate and transmit sensitive operational data:

- Encryption: Use end-to-end encryption for data in transit and at rest.

- Access Controls: Implement role-based access to robot control systems and data dashboards.

- Cybersecurity Standards: Comply with frameworks such as NIST or ISO/IEC 27001 to protect against cyber threats.

Environmental and Sustainability Considerations

Optimize robot operations to support sustainability goals:

- Energy Efficiency: Use robots with high-efficiency motors and regenerative braking.

- Battery Management: Follow proper charging, disposal, and recycling protocols for lithium-ion batteries.

- Lifecycle Planning: Design for repairability, reuse, and recyclability to minimize environmental impact.

Documentation and Training

Complete deployment requires thorough documentation and workforce readiness:

- User Manuals and SOPs: Provide clear operating procedures, emergency response guidelines, and troubleshooting steps.

- Operator Training: Certify personnel on robot operation, safety, and incident reporting.

- Compliance Manuals: Maintain an up-to-date compliance file including risk assessments, certifications, and regulatory correspondence.

By adhering to this guide, organizations can ensure that mobile robot deployments are safe, compliant, and aligned with operational excellence in modern logistics environments.

Conclusion for Sourcing Mobile Robots:

Sourcing mobile robots is a strategic decision that can significantly enhance operational efficiency, flexibility, and scalability across various industries such as manufacturing, logistics, warehousing, and healthcare. As automation demands grow, selecting the right mobile robot solution involves careful evaluation of factors including navigation technology, payload capacity, integration capabilities, scalability, total cost of ownership, and vendor support.

Organizations must align their specific operational needs with the technical capabilities and reliability of potential robotic systems. A successful sourcing strategy should emphasize not only initial functionality but also long-term adaptability, maintainability, and compatibility with existing workflows and IT infrastructure. Engaging with experienced suppliers, conducting thorough pilot testing, and considering future expansion needs will help ensure a strong return on investment.

Ultimately, sourcing mobile robots is not just about acquiring hardware—it’s about partnering with technology providers to drive digital transformation, improve productivity, and remain competitive in an increasingly automated world. With the right approach, mobile robotics can deliver sustainable value and lay the foundation for a smarter, more responsive operation.