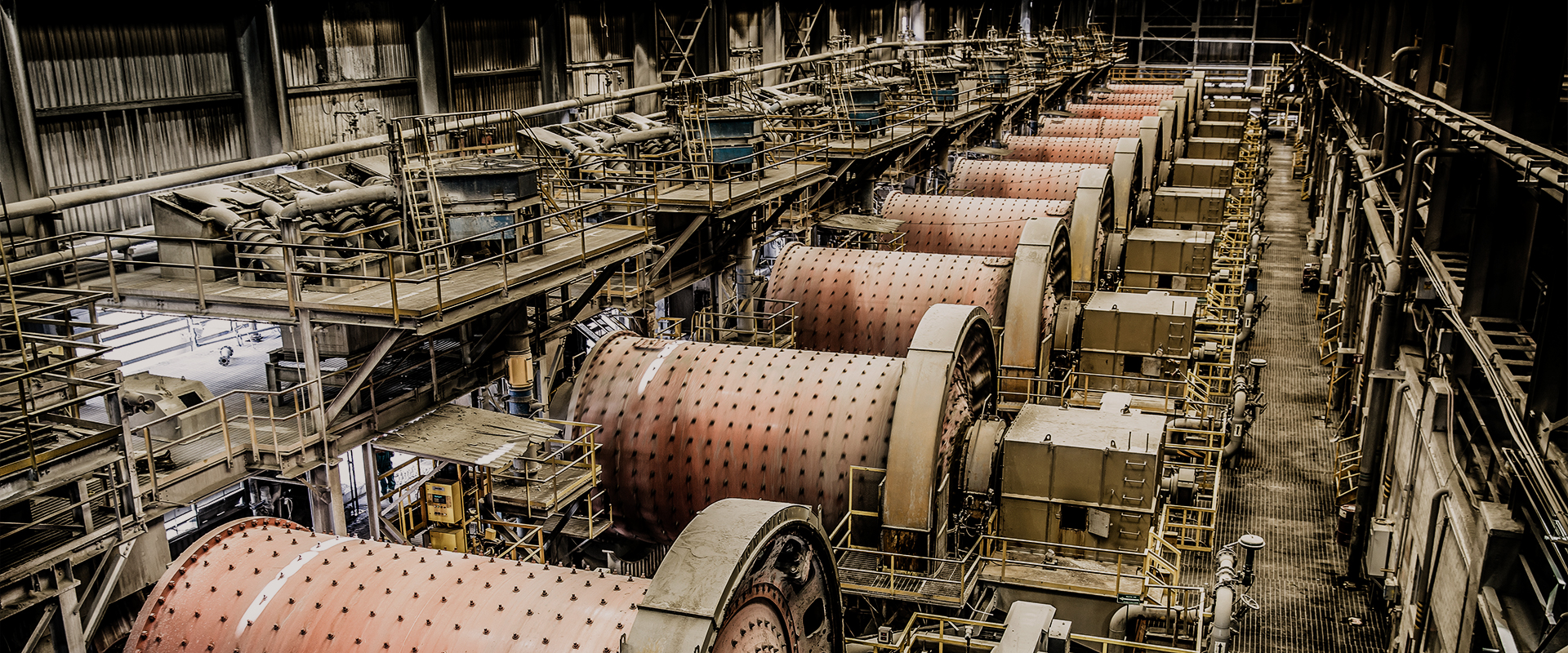

The global mining supplies market is experiencing robust expansion, driven by rising mineral demand across industries such as construction, energy, and technology. According to Grand View Research, the global mining equipment market was valued at USD 93.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by increasing underground mining activities, automation adoption, and investments in mineral exploration, especially in emerging economies. Additionally, Mordor Intelligence forecasts a CAGR of over 6% for the mining equipment market through 2029, citing technological advancements and the push for improved operational efficiency and safety. In this evolving landscape, leading mining supplies manufacturers are scaling innovation, offering advanced machinery, wear-resistant components, and digital monitoring systems to meet industry demands. Here’s a data-driven look at the top 10 mining supplies manufacturers shaping the future of the sector.

Top 10 Mining Supplies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial & Mining Explosives Manufacturing

Domain Est. 1997

Website: dynonobel.com

Key Highlights: Dyno Nobel is a global leader in commercial explosives. Learn about our products, practical innovations and career opportunities….

#2 United Central Industrial Supply

Domain Est. 2000

Website: unitedcentral.net

Key Highlights: We are the largest distributor of mining supplies in North America and specialize in helping mine operators lower costs. Contact us today!…

#3 Mine Supply Company

Domain Est. 2001 | Founded: 1966

Website: minesupplyco.com

Key Highlights: Founded in 1966 in Saskatoon, Saskatchewan, Mine Supply Company serves mining and industrial operations throughout North America….

#4 FLS

Domain Est. 1993

Website: fls.com

Key Highlights: We empower miners to optimise production and meet global mineral demands responsibly….

#5 Mining

Domain Est. 1996

Website: liebherr.com

Key Highlights: Liebherr understands that mining is a challenging industry. We produce custom excavators and haul trucks that are reliable, economical, and cost efficient….

#6 Mining Equipment

Domain Est. 2005

Website: miningequipmentltd.com

Key Highlights: Mining Equipment specializes in rail mounted equipment. We have a very large inventory of diesel, battery and trolley locomotives in stock….

#7 Mining

Domain Est. 2015

Website: home.sandvik

Key Highlights: Mining is a global leading supplier in equipment and tools, parts, service and technical solutions for the mining and infrastructure industries….

#8 Mining Machinery and Processing Equipment

Domain Est. 2016

Website: global.weir

Key Highlights: We offer a diverse portfolio of mining processing equipment that covers the entire flowsheet, from extraction to mineral processing and beneficiation….

#9 Epiroc USA – Mining Equipment

Domain Est. 2017

Website: epiroc.com

Key Highlights: We provide innovative mining equipment, consumables and services for drilling and rock excavation. Whether the application is surface and underground mining ……

#10 Mining Equipment, Parts & Services

Website: mining.sandvik

Key Highlights: Our range of rock tools, ground support products and parts and components ensure your equipment operates at peak performance whilst maximising project safety ……

Expert Sourcing Insights for Mining Supplies

H2 2026 Market Trends for Mining Supplies

The global mining supplies market in H2 2026 is poised for continued transformation, driven by technological innovation, sustainability imperatives, and evolving commodity demands. Here’s a detailed analysis of the key trends shaping the sector:

1. Accelerated Digitalization and Automation

- Autonomous Systems Expansion: Adoption of autonomous haul trucks, drills, and loaders will surge, particularly in large-scale open-pit operations in Australia, Canada, and South America. OEMs like Caterpillar, Komatsu, and Sandvik are expected to dominate the supply of integrated automation solutions.

- AI-Driven Predictive Maintenance: Mining companies will increasingly deploy AI-powered analytics for predictive maintenance of critical equipment, reducing downtime and extending equipment life. Suppliers offering smart sensors and IIoT-enabled components will see strong demand.

- Digital Twin Implementation: More mines will implement digital twin technology to simulate and optimize operations, driving demand for connected, data-rich mining supplies and software integration platforms.

2. Sustainability and Decarbonization

- Electrification of Equipment: Battery-electric vehicles (BEVs) and trolley-assist systems will gain traction, especially in underground mining. Suppliers of electric mining trucks, loaders, and charging infrastructure (e.g., Epiroc, Volvo CE) will experience robust growth.

- Green Procurement Policies: Mining firms under ESG pressure will prioritize suppliers with verifiable low-carbon footprints. Mining supply contracts will increasingly include sustainability clauses, favoring vendors using recycled materials and renewable energy in production.

- Water and Energy Efficiency: Demand will rise for water-saving technologies (e.g., dry stack tailings filters) and energy-efficient grinding and processing equipment, particularly in water-scarce regions like Chile and South Africa.

3. Supply Chain Resilience and Localization

- Nearshoring and Regional Hubs: Geopolitical tensions and past disruptions have prompted miners to diversify supply chains. Suppliers establishing regional manufacturing or distribution centers (e.g., in Southeast Asia, Eastern Europe, or Latin America) will gain competitive advantage.

- Inventory Rebalancing: After post-pandemic volatility, companies are shifting from just-in-time to strategic stockpiling of critical spares and consumables (e.g., drill bits, explosives, conveyor belts), supporting steady demand in H2 2026.

4. Commodity-Specific Demand Shifts

- Battery Metals Boom: Strong demand for lithium, cobalt, nickel, and copper—driven by EV and renewable energy expansion—will sustain investment in associated mining. Suppliers of specialized extraction and processing equipment (e.g., solvent extraction units, high-pressure grinding rolls) will benefit.

- Coal Supply Rationalization: While thermal coal mining declines in the West, metallurgical coal for steel remains in demand. Suppliers may pivot focus to wear-resistant components and efficient longwall systems for remaining coal operations.

5. Regulatory and Safety Advancements

- Stricter Safety Standards: Global emphasis on mine safety will drive demand for advanced monitoring systems (e.g., gas detection, ground movement sensors) and explosion-proof equipment.

- Traceability and Compliance: Blockchain-enabled supply tracking will gain adoption to ensure ethical sourcing of minerals and compliance with regulations like the EU Conflict Minerals Regulation.

6. Price and Cost Pressures

- Input Cost Volatility: Fluctuations in steel, rubber, and rare earth prices will impact margins for suppliers. Companies with vertical integration or long-term hedging agreements will outperform.

- Value Engineering: Miners will demand more cost-effective, durable supplies. Suppliers offering modular designs, remanufactured parts, and performance-based pricing models will gain market share.

Conclusion

H2 2026 will be a pivotal period for mining supplies, marked by a convergence of digital innovation, environmental responsibility, and strategic supply chain adaptation. Leading suppliers will differentiate through integrated technology offerings, sustainable practices, and regional agility. Companies that align with miners’ goals of efficiency, safety, and decarbonization will capture the most significant growth opportunities in this dynamic landscape.

Common Pitfalls When Sourcing Mining Supplies: Quality and Intellectual Property (IP)

Sourcing mining supplies presents unique challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these areas can lead to costly operational failures, safety hazards, and legal disputes. Below are the most common pitfalls to avoid.

Poor Quality Control and Substandard Materials

One of the most frequent issues in mining supply procurement is receiving products that do not meet required technical or safety standards. Suppliers—especially those in low-cost regions—may use inferior materials or cut corners in manufacturing to reduce costs. These substandard supplies, such as worn-out drill bits, faulty conveyor belts, or under-spec pumps, can lead to unplanned downtime, increased maintenance costs, and even safety incidents in high-risk mining environments.

Lack of rigorous quality assurance processes, inconsistent certifications (e.g., ISO, MSHA, or ATEX), and insufficient on-site inspections can compound this risk. Without third-party testing or clear quality benchmarks in contracts, buyers may have limited recourse when defective products are delivered.

Inadequate Verification of Supplier Credentials

Many organizations fail to conduct thorough due diligence on potential suppliers. This includes not verifying a supplier’s track record, manufacturing capabilities, compliance history, or financial stability. Unverified suppliers may lack the capacity to deliver consistent quality or meet delivery timelines, especially under the demanding conditions of mining operations.

Additionally, some suppliers may misrepresent their affiliation with reputable manufacturers or falsely claim certifications. This not only affects supply chain reliability but may also void equipment warranties or insurance coverage.

Intellectual Property Infringement Risks

Sourcing mining equipment or components—particularly wear parts, proprietary tools, or aftermarket accessories—can expose buyers to intellectual property (IP) risks. Some suppliers produce and sell “compatible” or “generic” versions of branded components that closely resemble patented or trademarked designs. While marketed as cost-effective alternatives, these products may infringe on existing IP rights, exposing the buyer to legal liability.

Mining companies may unknowingly purchase counterfeit or reverse-engineered parts, which not only violates IP laws but also increases the risk of equipment failure due to poor tolerances or untested designs. In some jurisdictions, customs authorities may seize shipments suspected of IP infringement, causing delays and reputational damage.

Lack of IP Clauses in Contracts

Procurement agreements often overlook specific IP clauses, leaving buyers vulnerable. Without clear contractual terms defining ownership of custom-designed parts, specifications, or modifications, disputes can arise over who controls the design and whether the supplier can resell similar products to competitors. This is particularly critical when working with OEMs or engineering firms on bespoke mining solutions.

Additionally, failure to require suppliers to warrant that their products do not infringe third-party IP can leave the buyer responsible for litigation costs and damages.

Dependency on Single or Unreliable Supply Sources

Over-reliance on a single supplier—especially for critical components—can amplify quality and IP risks. If that supplier delivers poor-quality goods or becomes involved in an IP dispute, operations may be disrupted with no immediate alternative. Diversifying the supplier base and qualifying multiple vendors can mitigate these risks, but this requires proactive supply chain management and ongoing quality monitoring.

Conclusion

To avoid these pitfalls, mining companies should implement robust supplier qualification processes, enforce strict quality control protocols, conduct IP due diligence, and include protective clauses in procurement contracts. Partnering with reputable suppliers, leveraging independent inspections, and consulting legal experts on IP matters are essential steps to ensure reliable, compliant, and safe sourcing of mining supplies.

Logistics & Compliance Guide for Mining Supplies

Introduction

The logistics and compliance landscape for mining supplies is complex, shaped by the remote locations of mining operations, stringent safety regulations, and global supply chain dependencies. This guide outlines key considerations and best practices to ensure efficient, cost-effective, and legally compliant movement of mining equipment, consumables, and spare parts.

Supply Chain Overview

Mining supply chains typically involve sourcing raw materials and components from global suppliers, transporting them across international borders, and delivering to often remote or off-grid mine sites. Key supply categories include drilling equipment, explosives, conveyor systems, lubricants, wear parts, and personal protective equipment (PPE). Understanding the lifecycle—from procurement to final delivery—is essential for risk mitigation.

Transportation Modes and Challenges

Selecting the right transport mode is critical based on location, urgency, and cargo type.

– Road Transport: Most common for regional or last-mile delivery. Challenges include poor infrastructure in remote areas, oversized load permits, and driver availability.

– Rail: Efficient for bulk or heavy cargo over long distances. Requires coordination with rail operators and adherence to loading standards.

– Sea Freight: Used for international shipments of large machinery. Subject to customs delays, port congestion, and weather disruptions.

– Air Freight: Reserved for urgent spare parts or high-value items. High cost but essential for minimizing downtime.

Regulatory Compliance

Mining operations are tightly regulated to ensure safety, environmental protection, and transparency.

– Customs and Import Regulations: Accurate classification (HS codes), valuation, and documentation (commercial invoice, packing list, certificates of origin) are required. Tariff exemptions may apply for certain mining equipment under trade agreements.

– Dangerous Goods Handling: Explosives, chemicals, and flammable materials must comply with ADR (Europe), IMDG (sea), or IATA (air) regulations. Proper labeling, packaging, and training are mandatory.

– Environmental Regulations: Compliance with local and international standards (e.g., EPA, REACH) for emissions, waste, and hazardous material disposal.

– Local Content Requirements: Some countries mandate a percentage of locally sourced goods or services—monitor procurement strategies accordingly.

Permits and Documentation

Timely acquisition of permits is critical to avoid delays.

– Import/Export Licenses: Required for restricted items like explosives or dual-use technologies.

– Transit Permits: For oversized or overweight cargo crossing jurisdictions.

– Certificates of Conformity (CoC): Proof that equipment meets safety and quality standards (e.g., ISO, CE, CSA).

– Bill of Lading, Air Waybill, and Customs Declarations: Must be accurate and consistent across all documents.

Warehousing and Inventory Management

Efficient storage reduces downtime and supports just-in-time delivery.

– On-Site vs. Regional Warehousing: Balance between proximity to mine sites and economies of scale.

– Inventory Tracking Systems: Use RFID or barcoding to monitor stock levels and expiration dates (e.g., for reagents or lubricants).

– Security and Climate Control: Essential for high-value or sensitive items (e.g., electronic controls, explosives).

Risk Management and Contingency Planning

Mining supply chains face numerous risks, including geopolitical instability, natural disasters, and supplier failure.

– Supplier Diversification: Avoid over-reliance on single sources.

– Insurance Coverage: Include cargo, liability, and business interruption insurance.

– Emergency Response Plans: Establish protocols for supply disruptions, including alternative routing and backup suppliers.

Sustainability and ESG Considerations

Environmental, Social, and Governance (ESG) factors are increasingly important.

– Carbon Footprint Reduction: Optimize transport routes, use fuel-efficient vehicles, and consider rail over road where possible.

– Ethical Sourcing: Ensure raw materials (e.g., cobalt, rare earths) are sourced responsibly, adhering to OECD guidelines.

– Waste Management: Implement recycling programs for packaging and used equipment.

Technology and Digitalization

Leverage digital tools to enhance visibility and efficiency.

– Transport Management Systems (TMS): Track shipments in real time and optimize routing.

– Blockchain for Traceability: Enhance transparency in supply chain transactions.

– Predictive Maintenance Analytics: Forecast spare part needs based on equipment usage.

Conclusion

Successful logistics and compliance for mining supplies require a proactive, integrated approach. By understanding regulatory requirements, optimizing transportation, and investing in technology and risk mitigation, mining companies can ensure reliable supply chain performance while maintaining legal and environmental standards. Regular audits and stakeholder collaboration further strengthen operational resilience.

In conclusion, sourcing mining supplies effectively is a critical factor in ensuring operational efficiency, safety, and cost-effectiveness within the mining industry. A well-structured procurement strategy should prioritize reliable suppliers, quality assurance, compliance with industry standards, and timely delivery to minimize downtime. Additionally, leveraging technology, building strong supplier relationships, and considering sustainability and local sourcing options can further enhance supply chain resilience. By adopting a strategic and proactive approach to sourcing, mining operations can optimize performance, reduce risks, and support long-term success in a competitive and demanding sector.