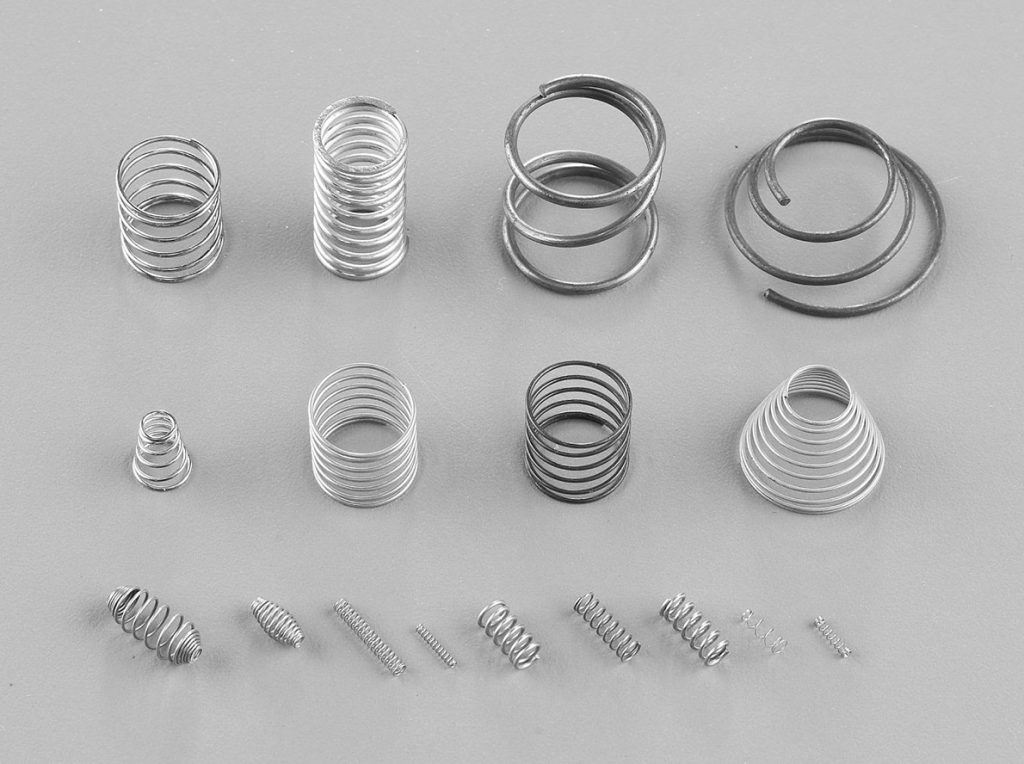

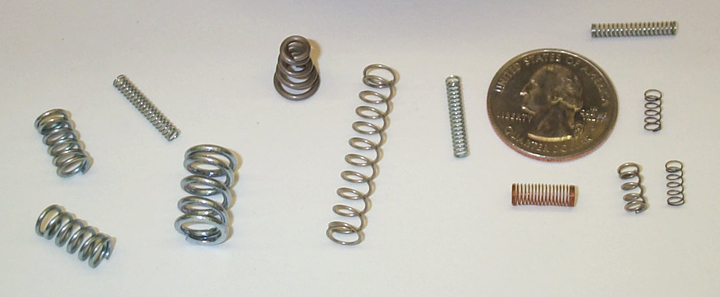

The global miniature springs market is experiencing steady growth, driven by increasing demand across industries such as medical devices, electronics, automotive sensors, and aerospace. According to Grand View Research, the global springs market was valued at USD 5.7 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030, with miniature springs capturing a growing segment due to miniaturization trends in precision equipment. Similarly, Mordor Intelligence forecasts rising adoption of micro-springs in wearable technology and minimally invasive medical devices, bolstering regional and niche manufacturing capabilities. As demand for high-precision, compact spring components intensifies, a select group of manufacturers has emerged at the forefront of innovation, quality, and scalability. Here are the top 9 miniature springs manufacturers leading this specialized domain.

Top 9 Miniature Springs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Micro Springs Manufacturer

Domain Est. 1997

Website: newcombspring.com

Key Highlights: We can make almost any type of spring in a micro size while maintaining strict compliance to specifications for your application. Learn about micro springs….

#2 Custom Micro Springs Manufacturer

Domain Est. 1999

Website: springcompany.com

Key Highlights: Proud custom micro springs manufacturer supporting the miniaturization of products across industries since 1850….

#3 Small Springs

Domain Est. 2000

Website: springsfast.com

Key Highlights: Need a source for small springs? As an experienced spring manufacturer with comprehensive manufacturing capabilities, W.B. Jones can handle the design, ……

#4 Micro Springs for Mini Applications

Domain Est. 1996

Website: leespring.com

Key Highlights: Micro Springs for Mini Applications Lee Spring offers micro springs in stock and ready to ship, plus custom made miniature springs to your specifications….

#5 Micro & Miniature Springs

Domain Est. 1996

Website: centuryspring.com

Key Highlights: Explore micro and miniature compression springs for tight spaces and precision loads. Stock and custom options available for critical applications….

#6 Micro Springs

Domain Est. 1996

Website: acxesspring.com

Key Highlights: We manufacture precision micro springs from 0.006 to 0.020 wire diameter. We guarantee the quality of our micro springs because we have spent years perfecting ……

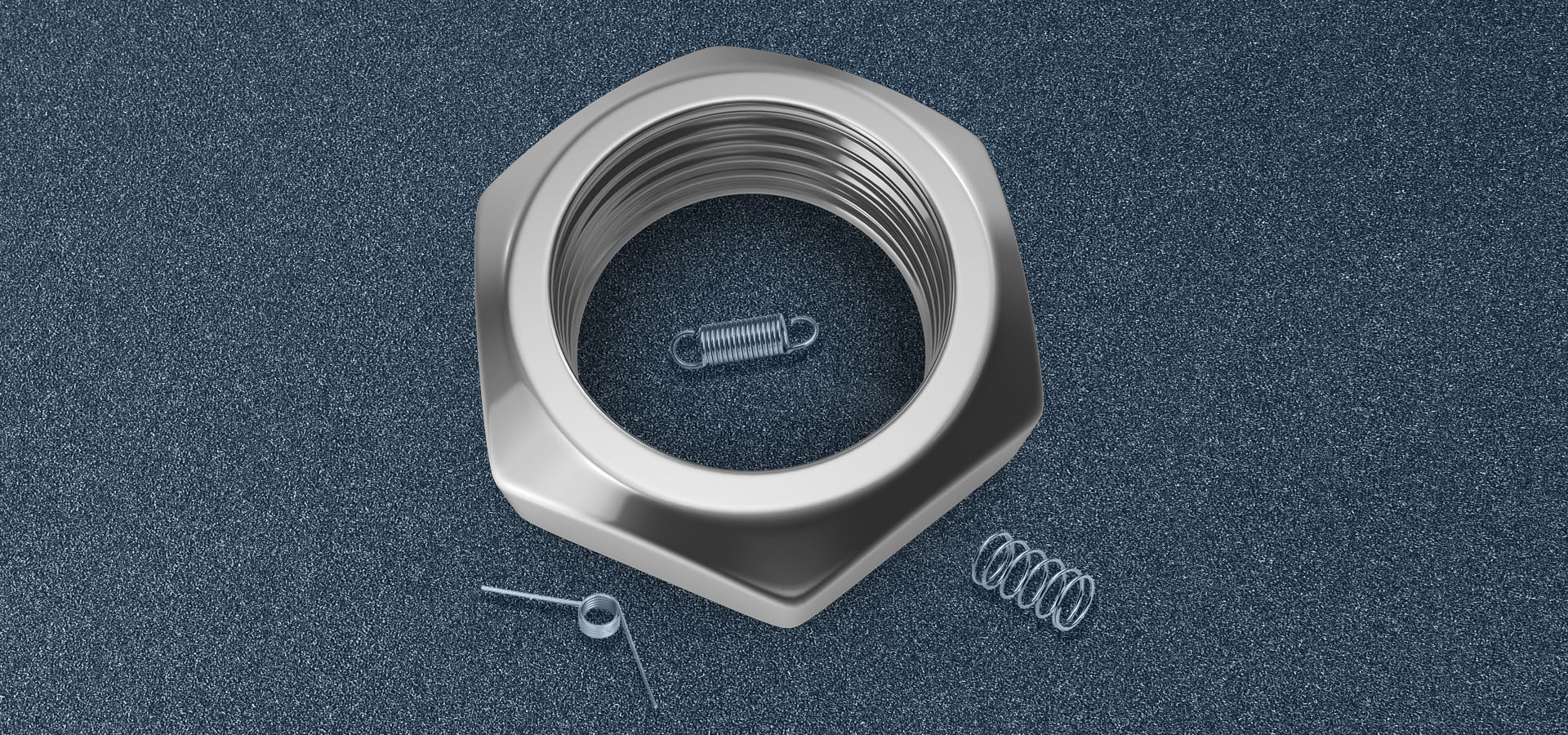

#7 Micro springs

Domain Est. 1997

Website: kern-liebers.com

Key Highlights: We develop and manufacture micro springs from 0.03 mm wire diameter and 0.18 mm spring diameter according to your specific requirements….

#8 Miniature Springs

Domain Est. 1999

Website: drtempleman.com

Key Highlights: Custom & stock miniature springs manufactured from round wire. Compression springs, extension springs, & torsion springs. Wire diameters down to 0.004in ……

#9 Dayon Spring

Domain Est. 2005

Website: dayonspring.com

Key Highlights: Dayon Spring manufactures micro and miniature springs and miniature wire forms. Engineering and technical support for your miniature spring designs….

Expert Sourcing Insights for Miniature Springs

H2: 2026 Market Trends for Miniature Springs

As we approach 2026, the global miniature springs market is poised for significant transformation, driven by technological advancements, evolving industry demands, and shifts in manufacturing practices. These precision components—typically defined as springs under 10 mm in size—are critical in a wide range of high-performance applications, including medical devices, consumer electronics, aerospace systems, and automotive sensors. This analysis explores key trends shaping the miniature springs market in 2026 under the H2 economic and industrial outlook.

Rising Demand in Medical Technology

One of the most influential drivers of the miniature springs market is the rapid expansion of minimally invasive medical devices. With an aging global population and increased healthcare investments, especially in North America and Asia-Pacific, demand for implantable devices, surgical robotics, and drug delivery systems is surging. Miniature springs are essential in devices such as insulin pumps, pacemakers, and endoscopic tools due to their reliability, precision, and ability to function in confined spaces. By 2026, the medical sector is expected to account for over 35% of miniature spring consumption, with a compound annual growth rate (CAGR) of approximately 7.2% in this segment.

Growth in Consumer Electronics and Wearables

The proliferation of compact, high-functionality consumer electronics continues to fuel demand for miniaturized components. Smartwatches, hearing aids, foldable smartphones, and augmented reality (AR) devices all rely on miniature springs for mechanisms such as connectors, switches, and vibration modules. As consumers demand sleeker and more durable designs, manufacturers are pushing the limits of component miniaturization. By 2026, the consumer electronics sector will represent a major revenue stream for miniature spring producers, particularly those capable of delivering high-volume, consistent quality at scale.

Advancements in Materials and Manufacturing

Material innovation is a cornerstone of the 2026 miniature springs market. Traditional materials like stainless steel and phosphor bronze remain prevalent, but emerging alloys such as nickel-titanium (Nitinol) and beryllium copper are gaining traction due to their superior fatigue resistance, elasticity, and biocompatibility. Additionally, additive manufacturing (3D printing) and micro-stamping technologies are enabling more complex spring geometries and faster prototyping. These advancements are reducing lead times and enabling customization for niche applications, especially in aerospace and defense.

Automation and Precision Engineering

Industry 4.0 trends are reshaping production processes across the miniature springs sector. Automated coil winding machines, computer-aided design (CAD) integration, and in-line quality control systems are improving precision and yield rates. By 2026, leading manufacturers are expected to adopt AI-driven predictive maintenance and digital twin technologies to optimize production efficiency and reduce material waste. This shift supports the growing demand for springs with tolerances within microns—critical for high-reliability applications.

Regional Market Shifts

Asia-Pacific, particularly China, Japan, and South Korea, remains the dominant manufacturing hub for miniature springs due to established electronics supply chains and a robust medical device industry. However, geopolitical factors and supply chain diversification efforts are encouraging localized production in North America and Europe. The U.S. and Germany are investing in high-precision manufacturing capabilities, aiming to reduce dependency on overseas suppliers. This reshoring trend is expected to boost regional miniature spring markets, especially in defense and automotive sectors.

Sustainability and Regulatory Pressures

Environmental regulations and sustainability goals are influencing material sourcing and production methods. By 2026, compliance with RoHS, REACH, and ISO 14001 standards will be non-negotiable for market access in Europe and North America. Manufacturers are increasingly adopting eco-friendly coatings, recycling scrap materials, and reducing energy consumption in production. These efforts not only ensure regulatory compliance but also enhance brand reputation among environmentally conscious clients.

Conclusion

Under the H2 2026 economic outlook—characterized by moderate global growth, technological acceleration, and supply chain resilience—the miniature springs market is on a trajectory of steady expansion. Key growth vectors include medical innovation, consumer electronics miniaturization, advanced materials, and automation. Companies that invest in R&D, sustainability, and precision engineering will be best positioned to capitalize on emerging opportunities in this dynamic and high-value niche market.

Common Pitfalls in Sourcing Miniature Springs: Quality and Intellectual Property Concerns

Sourcing miniature springs—often used in medical devices, aerospace, electronics, and precision instruments—introduces unique challenges. While cost and lead time are typical considerations, quality inconsistencies and intellectual property (IP) risks can significantly impact product performance, regulatory compliance, and competitive advantage. Below are key pitfalls to watch for.

Quality-Related Pitfalls

Inadequate Material Verification

Miniature springs often require high-grade alloys (e.g., stainless steel, Elgiloy, or MP35N) to meet performance demands. Suppliers may substitute lower-grade materials to cut costs, leading to premature failure. Without proper certifications (e.g., material test reports or MTRs), buyers risk receiving substandard components.

Insufficient Dimensional Accuracy and Tolerances

Due to their small size, even micron-level deviations can render a spring unusable. Inconsistent manufacturing processes or lack of precision tooling at the supplier level can result in non-compliant parts. Ensure suppliers employ advanced metrology (e.g., optical comparators, CMMs) and adhere to tight tolerances specified in your design.

Poor Process Control and Traceability

Repeatability is critical in high-volume miniature spring production. Suppliers without robust quality management systems (e.g., ISO 13485 for medical applications) may lack batch traceability, process validation, and statistical process control (SPC), increasing the risk of field failures and recall complications.

Inadequate Testing and Validation

Miniature springs are often subjected to rigorous fatigue, load-life, and environmental testing. Some suppliers skip or underperform these tests, especially under cost pressure. Verify that the supplier conducts application-specific testing—including life cycle and stress-relief validation—and provides documented results.

Intellectual Property-Related Pitfalls

Unprotected Design Specifications

Sharing detailed spring designs (e.g., CAD models, load-deflection curves) without proper legal safeguards exposes your IP. Suppliers may reverse-engineer or replicate the design for other clients, especially in regions with weak IP enforcement.

Lack of Formal IP Agreements

Failing to establish clear contractual terms regarding ownership, confidentiality, and usage rights in a Non-Disclosure Agreement (NDA) or Development Agreement increases the risk of IP theft. Ensure legal documentation explicitly states that all designs, tooling, and process innovations remain your sole property.

Supplier Overlap and Competing Customers

Some spring manufacturers serve multiple clients in the same industry. Without exclusivity clauses, your proprietary design could end up in a competitor’s product. Conduct due diligence on the supplier’s client base and request assurances of non-compete or exclusivity where feasible.

Tooling and Process Ownership Ambiguity

Custom tooling developed for your miniature spring may be co-owned or retained by the supplier. This can limit your ability to switch vendors or scale production. Clarify ownership of molds, fixtures, and process know-how upfront to prevent future supply chain dependency.

Avoiding these pitfalls requires thorough supplier vetting, rigorous quality audits, and proactive IP protection strategies. Partnering with reputable, certified manufacturers and establishing strong legal frameworks are essential steps in securing reliable, high-performance miniature springs without compromising innovation or compliance.

Logistics & Compliance Guide for Miniature Springs

Overview

Miniature springs—used in precision devices such as medical instruments, electronics, aerospace systems, and automotive sensors—require specialized handling, shipping, and regulatory compliance due to their small size, material composition, and end-use applications. This guide outlines key logistics and compliance considerations for manufacturers, distributors, and importers of miniature springs.

Material Compliance

Miniature springs are commonly made from stainless steel, music wire, phosphor bronze, or specialized alloys. Compliance with material standards is critical:

– RoHS (Restriction of Hazardous Substances): Ensure materials are free of lead, cadmium, mercury, and other restricted substances, especially for electronics and medical applications.

– REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals): Confirm that all substances used are registered and compliant in the EU market.

– Conflict Minerals (Dodd-Frank Act): Provide documentation on the sourcing of tin, tantalum, tungsten, and gold (3TG), if applicable.

– ASTM/ISO Standards: Adhere to relevant standards such as ASTM A313 (stainless steel springs) or ISO 6931 for spring manufacturing quality.

Packaging & Handling

Due to their small size and susceptibility to contamination or damage:

– Use anti-static, moisture-resistant, and ESD-safe packaging for electronic applications.

– Employ sealed containers or blister packs to prevent tangling, oxidation, or particulate contamination.

– Label packages with part numbers, batch/lot numbers, and handling instructions (e.g., “Fragile,” “Keep Dry”).

– Implement traceability systems (e.g., barcodes or RFID) for quality control and recall readiness.

Shipping & Transportation

- Domestic Shipping: Use carriers experienced in handling small, high-value components. Insure shipments accordingly.

- International Shipping: Comply with Incoterms (e.g., FOB, EXW, DDP) and ensure accurate commercial invoices, packing lists, and certificates of origin.

- Customs Compliance: Provide HS (Harmonized System) codes—typically 7320.20 (for small steel springs) or 7320.90 (other springs). Verify tariff classifications with local customs authorities.

- Export Controls: Check if springs fall under export control regulations like EAR (Export Administration Regulations), especially if used in defense, aerospace, or dual-use technologies.

Industry-Specific Requirements

- Medical Devices: If springs are used in surgical tools or implants, comply with ISO 13485 and FDA 21 CFR Part 820. Maintain full documentation for traceability and sterilization, if applicable.

- Aerospace: Follow AS9100 and NADCAP standards. Materials may require full material certification (e.g., mill test reports).

- Automotive: Align with IATF 16949 and customer-specific requirements (e.g., PPAP submissions).

Storage & Inventory Management

- Store in a climate-controlled environment to prevent corrosion or dimensional changes.

- Use FIFO (First In, First Out) inventory practices to ensure freshness and compliance with shelf-life specifications.

- Conduct regular audits for quality and compliance with internal and external standards.

Documentation & Recordkeeping

Maintain comprehensive records including:

– Material test reports (MTRs)

– Certificates of Compliance (CoC)

– Non-conformance reports (NCRs)

– Shipping and customs documentation

– Regulatory audit trails

Retention periods should align with industry requirements—typically 5–10 years for medical and aerospace sectors.

Conclusion

Effective logistics and compliance for miniature springs require attention to material regulations, secure packaging, accurate documentation, and adherence to industry-specific standards. Proactive management ensures product integrity, reduces risk, and supports global market access.

Conclusion for Sourcing Miniature Springs

Sourcing miniature springs requires a strategic approach that balances precision, material quality, supplier reliability, and cost-efficiency. These small yet critical components play a vital role in the performance and longevity of various applications across industries such as medical devices, electronics, automotive systems, and aerospace. Therefore, selecting the right supplier is essential to ensure tight tolerances, consistent quality, and compliance with industry standards.

Key considerations include the supplier’s manufacturing capabilities (especially in CNC coiling, grinding, and heat treatment), material expertise (such as stainless steel, phosphor bronze, or specialty alloys), and ability to support custom designs. Additionally, factors like lead times, scalability, and quality certifications (e.g., ISO 13485 for medical applications) significantly influence sourcing decisions.

In conclusion, successful sourcing of miniature springs hinges on partnering with experienced, technologically advanced manufacturers who demonstrate a strong track record in precision engineering and responsive customer service. By prioritizing quality and collaboration, businesses can ensure reliable supply chains and optimal performance of their end products.