The global mini bike and pocket bike market is experiencing steady growth, driven by rising demand for recreational vehicles, increasing disposable incomes, and a growing interest in motorsports among younger consumers. According to a report by Mordor Intelligence, the global off-road motorcycle market—under which mini and pocket bikes largely fall—is projected to grow at a CAGR of over 5.8% from 2024 to 2029. Additionally, Grand View Research valued the global motorcycle market at over USD 97 billion in 2023, with ancillary segments like mini bikes contributing significantly due to their popularity in urban commuting, stunt riding, and youth-oriented entertainment. As demand surges, so does the need for reliable and high-performance parts, fueling expansion among component manufacturers. This growing ecosystem has led to the emergence of specialized suppliers focusing on critical parts such as engines, frames, suspension systems, and performance upgrades. Below is a data-driven overview of the top 9 mini bike and pocket bike parts manufacturers shaping the industry’s supply chain landscape.

Top 9 Mini Bike Pocket Bike Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Factory Minibikes

Domain Est. 2009

Website: factoryminibikes.com

Key Highlights: We specialize in high-quality pit bike parts, billet engine kits, suspension components, and custom accessories — all backed by expert support and fast U.S. ……

#2 go kart & mini bike parts

Domain Est. 2003

Website: gokartsusa.com

Key Highlights: Parts for most USA Made Go Karts and Mini Bikes including Yerf-Dog, Taco, Rupp, Manco, Kenbar, Azusa, Bonanza, Kartco, and most other American Manufacturers….

#3 Pocket Bike Part for your Pocket Bike at MiniPocketRockets

Domain Est. 2004

Website: minipocketrockets.com

Key Highlights: Original part from the manufacturer of our high quality pocket bikes. Replace your broken or chipped flywheel with this quality part. Shipping is free….

#4 Pocket Bike Parts

Domain Est. 2006

#5 Mini Bikes Store I Quads

Domain Est. 2018

Website: minibikes.store

Key Highlights: Welcome to European Largest Shop of Two & Four Wheel Outdoor Toys & Performance Vehicles for Children. We Deliver our Products to 32 European Countries….

#6 MotoTec Gas Powered Pocket Bike

Domain Est. 2019

Website: mototecusa.com

Key Highlights: 4-day delivery · 10-day returnsMotoTec Pocket/Mini Bike V2 Front Wheel Assembly 90mm. $29.99. Out of Stock. Add To Cart….

#7 Pocket Bike Parts

Domain Est. 2020

Website: gokartsusa.biz

Key Highlights: Free delivery over $1,179 14-day returns…

#8 Rpc Mini Bikes

Domain Est. 2022

Website: rpcminibikes.com

Key Highlights: Our shop offers a wide range of custom and stock mini bike parts that will help you take your ride to the next level. Browse through our selection and find the ……

#9 FRP

Domain Est. 2024

Website: frpmoto.com

Key Highlights: Offering various power sports, including mini bikes, mini quad, kids dirt bikes, kids pocket bikes, and etc, for riders to experience the joy of off-road ……

Expert Sourcing Insights for Mini Bike Pocket Bike Parts

H2: 2026 Market Trends for Mini Bike and Pocket Bike Parts

The mini bike and pocket bike parts market is poised for notable transformation by 2026, driven by a combination of technological innovation, evolving consumer preferences, and expanding global demand. As urban mobility solutions continue to diversify and recreational vehicle interest grows, the niche segment of mini and pocket motorcycles is experiencing renewed attention. This analysis explores key market trends shaping the industry’s trajectory through 2026.

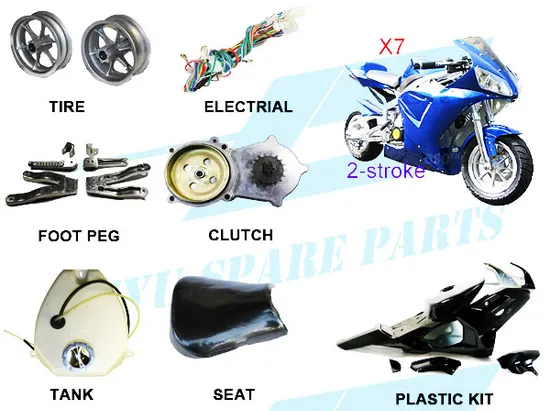

Rising Demand for Customization and Aftermarket Upgrades

A significant trend influencing the mini bike and pocket bike parts market is the increasing consumer demand for customization. Enthusiasts, particularly younger riders and hobbyists, are seeking performance-enhancing and aesthetically distinct components such as upgraded engines (49cc to 110cc), high-performance suspension systems, LED lighting kits, and custom body kits. The aftermarket parts segment is expected to grow at a CAGR of over 7% from 2023 to 2026, fueled by online marketplaces, DIY culture, and social media communities showcasing custom builds.

Expansion of E-Commerce and Global Distribution

E-commerce platforms like Amazon, eBay, and specialized retailers such as MiniBikeParts.com and Alibaba are playing a pivotal role in expanding access to pocket bike components worldwide. By 2026, digital sales are projected to account for more than 60% of total parts revenue. This shift is enabling faster delivery, broader product availability, and competitive pricing, particularly benefiting hobbyists in regions like North America, Europe, and parts of Southeast Asia.

Advancements in Electric Mini Bikes and Component Innovation

A major technological shift is the rise of electric-powered mini and pocket bikes. Anticipating stricter emissions regulations and growing environmental awareness, manufacturers are developing compact electric motors, lightweight lithium-ion batteries, and efficient power management systems. This transition is driving demand for compatible parts such as motor controllers, battery enclosures, and regenerative braking systems. By 2026, electric variants are expected to represent nearly 25% of new mini bike sales, creating new opportunities in the parts ecosystem.

Youth and Recreational Market Growth

The core demographic for mini and pocket bikes remains youth and recreational riders aged 12–25. With rising disposable income and a strong interest in motorsports and outdoor activities, this segment is a primary growth driver. Parents and guardians are investing in high-quality, durable parts to ensure safety and longevity. Additionally, mini motocross and competitive riding events are gaining popularity, spurring demand for racing-specific components such as performance tires, reinforced frames, and exhaust systems.

Regulatory and Safety Standards Influence

As mini bikes become more powerful and prevalent, regulatory scrutiny is increasing. Countries such as the U.S., Germany, and Australia are introducing or tightening rules around engine displacement, speed limits, and required safety features (e.g., reflectors, speed governors). These regulations are pushing manufacturers to produce compliant parts, including speed limiters, certified lighting, and DOT-approved tires. By 2026, compliance-ready parts are projected to dominate the market, especially in regions with established safety enforcement.

Supply Chain Optimization and Localized Manufacturing

Ongoing supply chain challenges have prompted companies to diversify sourcing and invest in localized production. While China remains the largest supplier of mini bike components, countries like India, Vietnam, and Mexico are emerging as alternative manufacturing hubs. This shift is expected to reduce lead times and improve resilience. Additionally, 3D printing and on-demand manufacturing are gaining traction for low-volume, custom parts, particularly in developed markets.

Sustainability and Circular Economy Practices

Environmental concerns are beginning to influence product design and material selection. By 2026, there will be greater emphasis on recyclable materials, longer-lasting components, and remanufactured or refurbished parts. Some brands are introducing take-back programs and modular designs to support easier repairs and reduce electronic waste—particularly relevant for electric mini bike systems.

Conclusion

The 2026 market for mini bike and pocket bike parts is set for dynamic growth, characterized by innovation, digitalization, and a shift toward sustainability. As consumer demand evolves and technology advances, stakeholders—from manufacturers to retailers—must adapt to capitalize on emerging opportunities in customization, electrification, and global e-commerce expansion.

Common Pitfalls When Sourcing Mini Bike and Pocket Bike Parts

Quality Inconsistencies

One of the most frequent challenges when sourcing mini bike and pocket bike parts is inconsistent quality. Many suppliers, particularly from regions with less stringent manufacturing standards, offer components made from subpar materials. This can lead to premature wear, safety hazards, and poor performance. Critical parts such as engines, brakes, and suspension systems may not meet durability expectations, resulting in frequent replacements and customer dissatisfaction.

Lack of Standardization

Mini and pocket bikes often lack industry-wide standardization in parts sizing and specifications. This can make it difficult to find compatible replacements or upgrades. Buyers may unknowingly purchase parts that appear similar but do not fit or function correctly, leading to delays and increased costs.

Intellectual Property (IP) and Counterfeit Components

Sourcing parts from unverified suppliers increases the risk of dealing with counterfeit or IP-infringing components. Many generic parts mimic branded designs (e.g., replica Chinese engines modeled after Honda or Tomos), which can expose buyers to legal risks, especially in markets with strong IP enforcement. Using counterfeit parts may also void warranties and affect performance and safety.

Misleading Product Descriptions and Specifications

Online marketplaces and third-party suppliers sometimes provide inaccurate or exaggerated product details. A part advertised as “high-performance” or “aluminum alloy” might actually be made from cheaper materials like plastic or low-grade metal. This misrepresentation can lead to incorrect purchasing decisions and operational failures.

Supply Chain and Logistics Issues

Reliance on overseas suppliers—especially for cost-sensitive buyers—can result in long lead times, customs delays, and communication barriers. These logistical challenges can disrupt inventory management and affect timely delivery to customers or repair shops.

Limited After-Sales Support and Warranty

Many low-cost suppliers do not offer reliable customer service, technical support, or warranty coverage. If a part fails, resolving the issue can be difficult or impossible, particularly when dealing with sellers in different countries or on anonymous e-commerce platforms.

Conclusion

To avoid these pitfalls, buyers should vet suppliers carefully, prioritize quality certifications, verify IP compliance, and request samples before bulk ordering. Establishing relationships with reputable manufacturers or distributors can significantly reduce risks associated with sourcing mini bike and pocket bike parts.

Logistics & Compliance Guide for Mini Bike Pocket Bike Parts

Product Classification and HS Codes

Proper classification of mini bike and pocket bike parts is essential for international shipping and customs clearance. Most components fall under Harmonized System (HS) codes within Chapter 87 (Vehicles, Their Parts and Accessories). Common classifications include:

- Frames and Forks: HS 8714.19 – Parts and accessories for cycles (including motorized cycles)

- Engines (2-stroke or 4-stroke): HS 8407.00 – Spark-ignition internal combustion piston engines

- Wheels and Tires: HS 8714.91 – Wheels and rims for bicycles or motorcycles

- Electrical Components (lights, wiring, switches): HS 8539 or HS 8543 – Electrical lighting or electrical apparatus

- Braking Systems: HS 8714.20 – Brake parts for motorcycles or cycles

- Complete Pocket Bikes (if shipped assembled): HS 8711.90 – Motorcycles and cycles fitted with auxiliary engines

Note: HS code assignments vary by country. Always confirm with local customs authorities or a licensed customs broker.

Import Regulations and Restrictions

Import requirements for mini bike parts vary significantly by destination country. Key considerations include:

- Emissions Standards: Engines may need to comply with EPA (USA), CARB (California), or Euro 5/6 regulations. Non-compliant engines may be denied entry.

- Safety Certifications: Electrical components or lighting may require E-mark (Europe), DOT (USA), or other region-specific safety marks.

- Age Restrictions: Some countries restrict the sale or use of pocket bikes to minors, affecting import eligibility.

- Banned Items: Certain high-performance engines or parts that could be used for modifying street-legal vehicles may be restricted.

Always verify local transportation or consumer protection laws before shipping.

Packaging and Shipping Requirements

Proper packaging ensures parts arrive undamaged and meets carrier standards:

- Use sturdy corrugated boxes with internal dividers or foam inserts for fragile components (e.g., carburetors, lights).

- Protect sharp edges with corner guards or bubble wrap to prevent punctures.

- Label all packages clearly with SKU numbers, component descriptions, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

- Use waterproof packaging for outdoor storage or sea freight to prevent moisture damage.

- Include a detailed packing slip inside and outside the box for customs and recipient verification.

For international shipments, consider using UN-certified packaging for engines containing residual fuel or lubricants.

Documentation for International Shipments

Accurate documentation is critical for customs clearance:

- Commercial Invoice: Must include seller/buyer details, itemized list of parts, HS codes, quantities, unit/total values, currency, and Incoterms (e.g., FOB, DDP).

- Packing List: Details weight, dimensions, and number of packages.

- Certificate of Origin: Required in some countries for tariff preference or trade agreements.

- Bill of Lading (BOL) or Air Waybill (AWB): Issued by the carrier for freight tracking.

- Compliance Certificates: Include EPA, CARB, or CE documentation if applicable.

Maintain copies of all documents for at least five years for audit purposes.

Environmental and Hazardous Materials Compliance

Some parts may be subject to environmental regulations:

- Engines with residual fuel or oil: Considered hazardous waste in many jurisdictions. Clean thoroughly before shipping.

- Batteries (if included): Lithium-ion or lead-acid batteries require UN 38.3 testing and special labeling under IATA/IMDG regulations.

- Painted or coated parts: May be subject to REACH (EU) or TSCA (USA) regulations for restricted chemicals.

Properly declare any hazardous materials and use certified hazardous goods shippers when required.

Labeling and Product Marking

Ensure all parts meet destination market labeling requirements:

- Permanent markings: Include manufacturer name, model number, date of production, and compliance marks (e.g., CE, FCC).

- User instructions and warnings: Provide multilingual safety labels if selling in multiple regions.

- Age and use warnings: Required in many countries (e.g., “Not for use on public roads,” “For off-road use only”).

Non-compliant labeling can result in seizure or fines.

Incoterms and Liability

Choose clear Incoterms to define responsibilities:

- EXW (Ex Works): Buyer arranges and pays for shipping; assumes risk once goods leave seller’s facility.

- FOB (Free on Board): Seller delivers goods to a port; risk transfers upon loading.

- DDP (Delivered Duty Paid): Seller handles all logistics and pays import duties; highest responsibility.

Select terms based on your capacity to manage international compliance and customer expectations.

Returns and Warranty Logistics

Establish a clear returns policy for defective or non-compliant parts:

- Warranty claims: Require photo documentation and part numbers before processing.

- Return shipping: Use trackable, insured services; clarify who pays return costs (based on fault).

- Repair or replacement: Offer local service centers in key markets to reduce return shipping.

Keep a log of compliance-related returns to identify recurring product or documentation issues.

Recordkeeping and Audits

Maintain organized records to support compliance:

- Store copies of invoices, shipping documents, and compliance certificates digitally.

- Track import/export licenses, if required.

- Conduct annual internal audits to verify adherence to regulations.

Proper records reduce risks during customs inspections or regulatory audits.

Final Recommendations

- Partner with experienced freight forwarders familiar with automotive or recreational vehicle parts.

- Stay updated on regulatory changes via government trade portals (e.g., U.S. Census ACE, EU TAXUD).

- Consult legal or compliance experts when entering new markets.

Following this guide ensures smooth logistics operations and minimizes compliance risks for mini bike and pocket bike parts.

In conclusion, sourcing mini bike or pocket bike parts requires careful consideration of quality, compatibility, reliability, and cost. With the growing popularity of these compact motorcycles, there is a wide range of suppliers available—from local dealers and specialty stores to online marketplaces and international manufacturers. However, it is essential to verify the authenticity and durability of parts, especially since many pocket bikes use non-standardized components. Establishing relationships with reputable vendors, reading customer reviews, and comparing pricing and warranties can help ensure a smooth and cost-effective procurement process. Additionally, considering factors such as shipping times, return policies, and technical support enhances the overall experience. Ultimately, a strategic and informed approach to sourcing parts will ensure optimal performance, longevity, and safety of your mini bike while minimizing downtime and maintenance costs.