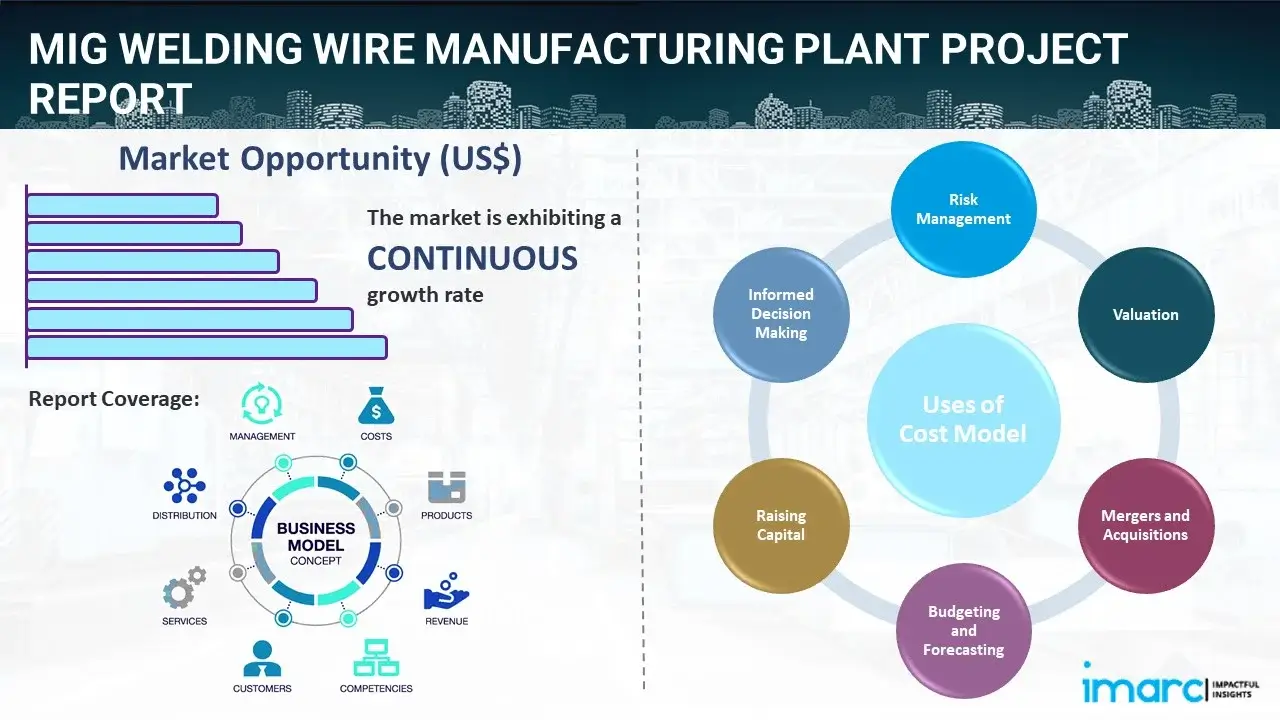

The global MIG welding wire market is experiencing steady expansion, driven by increasing demand across automotive, construction, and heavy manufacturing sectors. According to Mordor Intelligence, the market was valued at approximately USD 4.2 billion in 2023 and is projected to grow at a CAGR of over 4.8% from 2024 to 2029. This growth is fueled by the rising adoption of automation in welding processes and the need for high-strength, consistent filler materials in industrial applications. As one of the most widely used consumables in gas metal arc welding (GMAW), MIG welding wire plays a critical role in ensuring weld quality, productivity, and cost-efficiency. With growing infrastructure development and advancements in material science, manufacturers are focusing on innovation in alloy compositions and wire coatings to enhance performance. In this evolving landscape, a select group of global suppliers have emerged as leaders in material quality, R&D investment, and production scale. Based on market presence, product breadth, and technological capabilities, the following eight companies stand out as the top MIG welding wire material manufacturers worldwide.

Top 8 Mig Welding Wire Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Haynes International

Domain Est. 1995

Website: haynesintl.com

Key Highlights: We are proud to be a member of the Acerinox group. Haynes International is a leading developer, manufacturer, and distributor of HASTELLOY® and HAYNES® high- ……

#2 Specialty MIG Wire

Domain Est. 1999

Website: usaweld.com

Key Highlights: Free delivery over $100 30-day returnsSpecialty MIG Wire. Made in the U.S.A.! ER4043 Aluminum MIG Welding Wire – 8″ Spool. On sale from $84.95. Sale. View · ER5356 Aluminum MIG Wel…

#3 MIG Wires and TIG Rods

Domain Est. 1996

Website: lincolnelectric.com

Key Highlights: MIG Wires and TIG Rods. Filler metals made from the highest quality steel to maximize consistency, feedability and arc performance….

#4 Alcotec

Domain Est. 1996

Website: esab.com

Key Highlights: AlcoTec products include: Aluminum TIG (GTAW) welding wire; Aluminum MIG (GMAW) welding wire; Brazing wire; Metallizing wire; Tie Wire….

#5 Welding Wire for MIG TIG & SAW Welding

Domain Est. 1998

Website: centralwire.com

Key Highlights: Discover our specialized Welding Wire suitable for MIG, TIG, & SAW welds. Designed for superior strength and adaptability….

#6 MIG Welding Wire

Domain Est. 2004

Website: nsarc.com

Key Highlights: We offer MIG welding wire in different materials such as carbon steel, stainless steel, and aluminum alloys. Aluminum · Carbon Steel · Flux- ……

#7 Harris Products Group

Domain Est. 2006

Website: harrisproductsgroup.com

Key Highlights: Welding Alloys and Welding Fluxes. Harris offers a full array of welding filler metals in both wire and rod including mild steel, stainless, aluminum and cast ……

#8 The company

Website: mig-weld.eu

Key Highlights: MIG WELD offers a wide range of aluminium wires and rods ideally suited to provide high quality products for the joining of aluminium sheets or parts….

Expert Sourcing Insights for Mig Welding Wire Material

H2: 2026 Market Trends for MIG Welding Wire Material

The global MIG (Metal Inert Gas) welding wire market is poised for significant transformation by 2026, driven by industrial automation, advancements in material science, and shifting regional manufacturing dynamics. Key trends shaping the MIG welding wire material landscape include rising demand for high-performance alloys, sustainability initiatives, and the expansion of end-use industries such as automotive, construction, and renewable energy.

-

Growth in High-Strength and Specialty Alloys

By 2026, demand for advanced MIG welding wires made from high-strength low-alloy (HSLA) steels, stainless steels, and nickel-based alloys is expected to rise. These materials offer superior weld integrity, corrosion resistance, and performance under extreme conditions, making them ideal for aerospace, offshore, and energy applications. Technological improvements in wire composition and coating are enhancing arc stability and spatter reduction, further boosting adoption. -

Increased Automation and Robotic Welding

The proliferation of automated and robotic welding systems in manufacturing, especially in the automotive and heavy equipment sectors, is driving demand for consistent, high-quality MIG wires. Precision-engineered wires with uniform diameter and surface treatment are essential for reliable performance in automated environments. This trend is pushing manufacturers to invest in tighter quality control and standardized production processes. -

Sustainability and Circular Economy Initiatives

Environmental regulations and corporate sustainability goals are influencing material choices in welding. By 2026, there will be a growing preference for recyclable and low-emission MIG wires. Manufacturers are exploring eco-friendly copper coatings and reducing hexavalent chromium in wire treatments. Additionally, closed-loop recycling of scrap welding wire is expected to become more prevalent in production facilities. -

Regional Shifts in Production and Demand

Asia-Pacific, particularly China and India, will remain the largest consumers of MIG welding wire due to rapid infrastructure development and industrialization. However, North America and Europe are witnessing a resurgence in domestic manufacturing, supported by reshoring initiatives and investments in clean energy infrastructure, which will boost regional demand. Latin America and the Middle East are emerging as growth markets due to expanding oil & gas and construction sectors. -

Raw Material Price Volatility and Supply Chain Resilience

Fluctuations in the prices of key raw materials such as iron ore, nickel, and copper may impact MIG wire production costs. By 2026, suppliers are expected to adopt more resilient supply chains, including regional sourcing and long-term contracts, to mitigate risks. Digital supply chain tools and predictive analytics will play a larger role in inventory and procurement planning. -

Innovation in Coated and Cored Wires

While solid MIG wires dominate the market, there is increasing interest in metal-cored and flux-cored wires for specific applications. These alternatives offer higher deposition rates and better performance on contaminated or painted surfaces. By 2026, hybrid wire solutions combining the benefits of solid and cored wires may gain traction, especially in high-productivity environments.

In summary, the MIG welding wire material market in 2026 will be characterized by technological innovation, regional diversification, and sustainability-driven development. Stakeholders who invest in advanced materials, automation compatibility, and environmentally responsible practices are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing MIG Welding Wire (Quality & IP)

Sourcing MIG welding wire involves critical considerations beyond price and availability. Overlooking quality control and intellectual property (IP) aspects can lead to significant operational, financial, and legal risks. Here are the most common pitfalls to avoid:

Poor Quality Control and Inconsistent Performance

One of the biggest risks in sourcing MIG wire—especially from unfamiliar or low-cost suppliers—is inconsistent quality. Substandard wire can lead to frequent welding defects, increased rework, and downtime.

- Inconsistent Chemistry and Diameter Tolerance: Low-quality wire often fails to meet AWS (American Welding Society) or ISO specifications for chemical composition (e.g., C, Mn, Si levels) and diameter tolerance. This inconsistency results in unstable arcs, excessive spatter, poor bead appearance, and weak welds.

- Contamination and Oxidation: Improper handling or inadequate packaging can expose wire to moisture and air, leading to surface oxidation or oil contamination. This compromises arc stability and increases porosity in the weld.

- Inadequate Packaging and Spooling: Poorly wound spools cause feeding issues (birdnesting), while non-hermetic packaging allows moisture absorption, especially in solid wires like ER70S-6. This directly impacts weld integrity and requires costly pre-baking or wire brushing.

- Lack of Traceability and Certification: Reputable suppliers provide Material Test Reports (MTRs) or Certificates of Conformance (CoC) traceable to specific heat lots. Sourcing without proper documentation makes quality verification impossible and poses risks for projects requiring compliance (e.g., pressure vessels, structural steel).

Intellectual Property and Brand Infringement Risks

Sourcing from unauthorized or counterfeit suppliers poses serious intellectual property (IP) concerns, particularly when dealing with branded consumables.

- Counterfeit or “Look-Alike” Products: Some suppliers offer wire that mimics the packaging and labeling of well-known brands (e.g., Lincoln Electric, Miller, ESAB) but is manufactured without authorization. These products often fail to meet performance standards and may infringe on trademarks and patents.

- Unauthorized Distribution Channels: Purchasing from resellers not approved by the original manufacturer can result in off-spec or expired products. These channels may bypass quality assurance and warranty support.

- Patented Wire Technologies: Certain wire formulations (e.g., specific deoxidizer blends for improved performance in contaminated steels) or coating technologies may be patented. Using counterfeit versions could expose the end-user to IP liability, especially in regulated industries.

- Voided Warranties and Lack of Technical Support: Using non-genuine or counterfeit wire may void equipment warranties and deny access to the manufacturer’s technical support and troubleshooting assistance when welding issues arise.

Mitigation Strategies

To avoid these pitfalls, implement a structured sourcing strategy:

- Source from Authorized Distributors or Directly from OEMs: Prioritize suppliers with official distribution agreements.

- Demand Full Documentation: Require MTRs/CoCs with every shipment and verify lot traceability.

- Conduct Incoming Inspections: Perform visual checks, measure diameter, and test weld samples for consistency and mechanical properties.

- Audit Suppliers: Evaluate supplier facilities and quality management systems (e.g., ISO 9001 certification).

- Verify Brand Authenticity: Check packaging details, security labels, and contact the manufacturer to confirm legitimacy if in doubt.

- Maintain Records: Keep detailed records of suppliers, batches, and certifications for compliance and traceability.

By focusing on quality assurance and respecting intellectual property rights, companies can ensure reliable welding performance, reduce operational risks, and avoid legal complications.

Logistics & Compliance Guide for MIG Welding Wire Material

This guide outlines the essential logistics and compliance considerations for the safe and legal handling, storage, transportation, and documentation of Metal Inert Gas (MIG) welding wire, a consumable used in arc welding processes.

Regulatory Classification and Documentation

MIG welding wire is generally classified as a non-hazardous solid material under most international transport regulations. However, accurate classification and proper documentation are critical.

– UN Number & Hazard Class: Typically not assigned a UN number as it is non-hazardous. Confirm with the manufacturer’s Safety Data Sheet (SDS).

– Safety Data Sheet (SDS): Must be available for each wire type (e.g., ER70S-6, ER308LSi). The SDS provides handling, storage, and emergency response information, even if the product is non-hazardous.

– Commercial Invoice & Packing List: Required for international shipments. Include material grade, diameter, spool weight, and country of origin.

– Certificate of Conformance (CoC): Often required by industrial buyers to verify material meets ASTM, AWS, or other standards.

Packaging and Handling Requirements

Proper packaging ensures product integrity and worker safety during handling and transport.

– Spool Packaging: Wires are wound on plastic or metal spools, typically sealed in moisture-resistant plastic film or vacuum-sealed bags to prevent oxidation.

– Palletization: Spools should be stacked securely on wooden or plastic pallets and stretch-wrapped to prevent shifting during transit. Avoid overloading pallets.

– Handling Equipment: Use forklifts or pallet jacks for movement. Avoid dropping or crushing spools, which can deform wire and cause feeding issues.

– Labeling: Each spool or outer packaging must be clearly labeled with product name, alloy type, diameter, net weight, lot number, and manufacturer information.

Storage Conditions

Appropriate storage prevents degradation and maintains welding performance.

– Environment: Store in a dry, climate-controlled warehouse. Humidity should be below 60% to prevent surface rust and contamination.

– Temperature Range: Maintain between 10°C and 30°C (50°F–86°F). Avoid extreme temperature fluctuations.

– Elevation: Keep spools on pallets or racks, at least 15 cm (6 inches) off the floor to prevent moisture absorption and damage.

– Shelf Life: Most MIG wires have a shelf life of 2–3 years if unopened and stored properly. Rotate stock using FIFO (First In, First Out) principles.

Transportation Guidelines

MIG welding wire can be shipped via road, rail, sea, or air, but certain precautions apply.

– Domestic Transport (e.g., US DOT, EU ADR): No special hazardous material placards required. Follow general freight safety standards.

– International Shipping (IMDG, IATA): Classified as “Not Restricted” or “Not Subject to Regulations” when non-hazardous. Verify with current SDS and shipping regulations.

– Containerized Shipping: Ensure containers are watertight and well-ventilated. Use desiccants if transporting through high-humidity regions.

– Temperature Control: Avoid prolonged exposure to direct sunlight or freezing conditions during transit.

Import/Export Compliance

Cross-border movement requires adherence to customs and trade regulations.

– HS Code: Typically falls under 7223.00 (Stainless steel wire) or 7217.20 (Other steel wire), depending on composition. Confirm exact code with customs broker.

– Import Duties & Tariffs: Vary by country. Check local regulations (e.g., US Harmonized Tariff Schedule, EU TARIC).

– Country of Origin Marking: Required on packaging or spools for customs clearance.

– Trade Restrictions: Monitor for sanctions or anti-dumping measures affecting steel products from specific countries.

Environmental and Safety Compliance

While generally safe, operational practices must meet workplace and environmental standards.

– Dust and Fumes: During welding—not transport—fumes are generated. Storage areas should be well-ventilated but pose minimal risk.

– Waste Disposal: Empty spools and packaging should be recycled where possible. Follow local waste management regulations.

– OSHA/Workplace Safety (US): Ensure storage areas are free of trip hazards and comply with general industry standards (29 CFR 1910).

– REACH & RoHS (EU): Confirm wire composition complies with substance restrictions, particularly for lead or other restricted metals.

Quality Assurance and Traceability

Maintain traceability from manufacturer to end-user.

– Lot Traceability: Retain lot numbers and CoCs for each shipment to support quality audits or defect investigations.

– Inspection Upon Receipt: Check for damaged packaging, moisture exposure, or visible corrosion before acceptance.

– Supplier Compliance: Source from certified suppliers who adhere to ISO 9001, AWS, or equivalent quality management systems.

Adhering to this guide ensures safe, compliant, and efficient logistics for MIG welding wire, minimizing risks and supporting quality welding operations.

Conclusion on Sourcing MIG Welding Wire Material:

Sourcing the right MIG welding wire is a critical factor in ensuring high-quality welds, operational efficiency, and cost-effectiveness in any welding application. Key considerations—including wire composition (such as ER70S-6 for mild steel), diameter, shielding gas compatibility, and coating integrity—must align with the specific requirements of the welding project and base material.

Reliable suppliers who offer consistent quality, certifications (e.g., AWS/ISO compliance), and technical support are essential to maintaining performance and safety standards. Additionally, evaluating factors such as material availability, cost-efficiency, storage, and logistics contributes to long-term supply chain stability.

Ultimately, a strategic sourcing approach that balances quality, supplier reliability, and total cost of ownership will enhance welding productivity, minimize defects, and support the success of fabrication and manufacturing operations. Continuous evaluation and supplier partnerships can further drive improvements in performance and adaptability to future material and technological advancements.