The global microscope market is experiencing robust growth, driven by rising demand in life sciences, healthcare, and materials research. According to Grand View Research, the market was valued at USD 4.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This expansion is fueled by technological advancements, increasing R&D investments, and the integration of digital imaging and AI in microscopy. Nikon, a key player in the optical instrumentation space, collaborates with and supplies technology to a select group of manufacturers who specialize in high-precision microscope systems. Below are the top six microscope manufacturers associated with Nikon’s innovative optics and imaging platforms, leveraging its reputation for superior resolution, durability, and advanced optical engineering.

Top 6 Microscope Nikon Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Microscopy

Domain Est. 1993

Website: industry.nikon.com

Key Highlights: Nikon offers a wide range of industrial microscopes including upright and inverted models for a variety of inspection and metrology tasks….

#2 Product Repair

Domain Est. 1996

Website: nikonusa.com

Key Highlights: Keep your Nikon equipment operating like new with Nikon factory service and repair. With both mail-in and in-person service available, our expert technicians ……

#3 Microscope Systems for Life Science Research & Healthcare

Domain Est. 1993

Website: microscope.healthcare.nikon.com

Key Highlights: Nikon is a leader in microscope-based optical and imaging technologies for the life sciences and part of the Nikon Healthcare Business Division….

#4 Nikon’s MicroscopyU

Domain Est. 2000

Website: microscopyu.com

Key Highlights: Nikon’s MicroscopyU website features technical support and timely information about all aspects of optical microscopy, photomicrography, and digital ……

#5 Nikon Small World

Domain Est. 2003

Website: nikonsmallworld.com

Key Highlights: Nikon Small World is regarded as the leading forum for showcasing the beauty and complexity of life as seen through the light microscope….

#6 Nikon

Domain Est. 2006

Website: downloadcenter.nikonimglib.com

Key Highlights: Download firmware, manuals, and computer software for digital cameras and other imaging products….

Expert Sourcing Insights for Microscope Nikon

H2 2026 Market Trends for Nikon Microscopes

As we approach the second half of 2026, Nikon’s microscope business is navigating a dynamic and competitive landscape shaped by technological advancements, evolving research demands, and strategic industry shifts. Here’s an analysis of key market trends impacting Nikon’s position:

1. Acceleration of AI and Machine Learning Integration

By H2 2026, AI-powered imaging analysis is no longer a differentiator but a baseline expectation in advanced microscopy. Nikon has responded by embedding deeper AI functionalities—such as real-time image segmentation, autofocus optimization, and anomaly detection—into its NIS-Elements software platform. Competitors like Leica and Olympus (Evident) are pushing similar capabilities, intensifying pressure on Nikon to ensure seamless integration across hardware and software. Nikon’s focus on workflow automation for high-content screening (HCS) and digital pathology is gaining traction in pharmaceutical and academic labs, especially in North America and Europe.

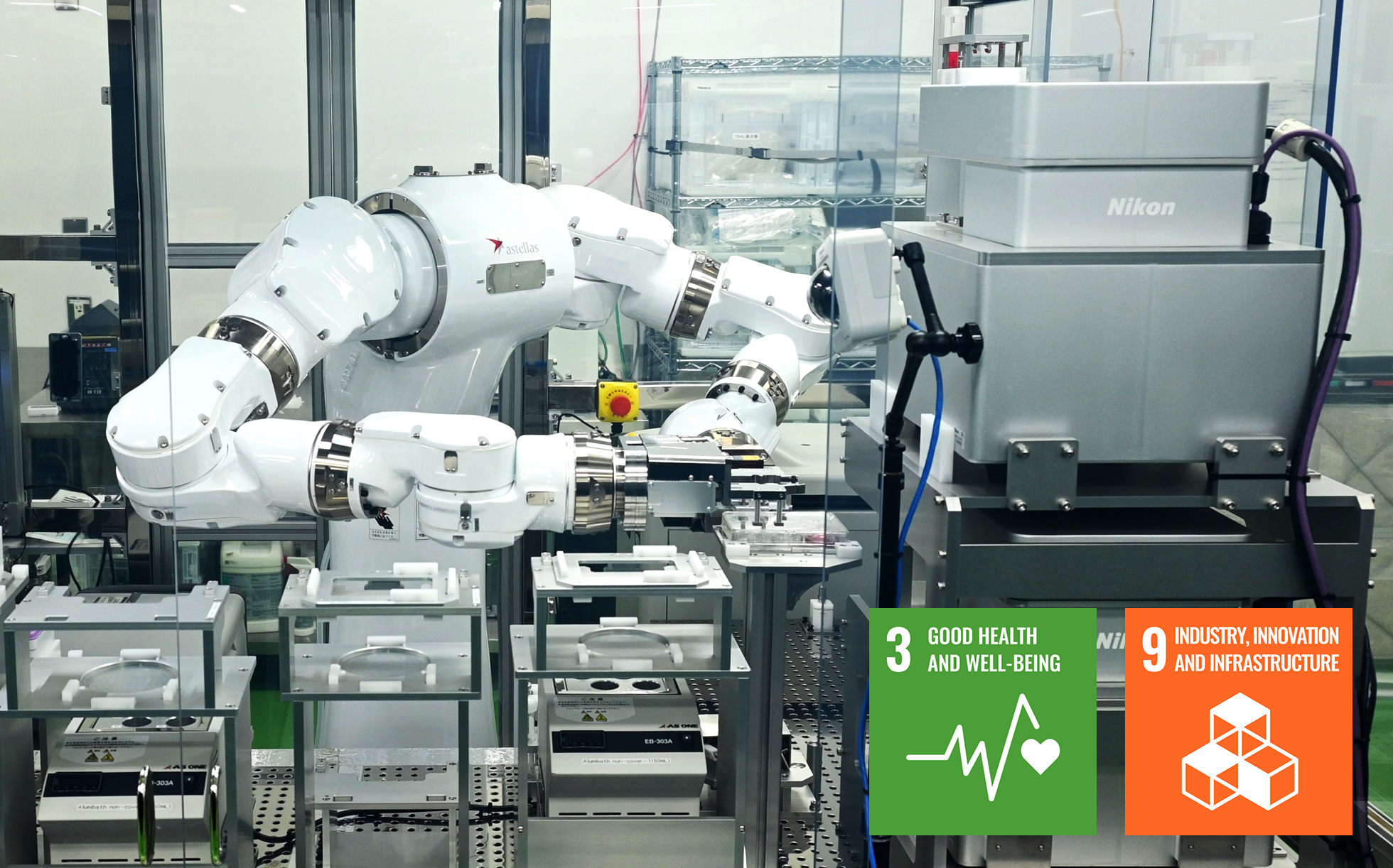

2. Growth in Life Sciences and Biopharma Applications

The sustained investment in life sciences research—particularly in areas like immunotherapy, neuroscience, and single-cell analysis—is driving demand for confocal and super-resolution microscopes. Nikon’s A1R MP+ and N-SIM systems remain competitive, but demand is shifting toward multimodal platforms that combine fluorescence, live-cell imaging, and correlative light-electron microscopy (CLEM). Nikon’s collaboration with research institutions to develop customized solutions for 3D organoid and tissue-clearing imaging is positioning it strongly in this niche.

3. Expansion of Industrial and Semiconductor Microscopy

In the industrial sector, Nikon continues to leverage its core strength in precision optics for semiconductor inspection and quality control. With global chip demand rising, Nikon’s upright and inverted industrial microscopes (e.g., Eclipse series) are benefiting from increased adoption in Asian manufacturing hubs, particularly in Japan, South Korea, and Taiwan. However, competition from specialized metrology firms and Chinese OEMs is intensifying on price, pushing Nikon to emphasize reliability, longevity, and integration with automated production lines.

4. Demand for Modular and Customizable Systems

Research labs increasingly favor modular microscope platforms that can evolve with project needs. Nikon’s modular Eclipse Ti3 and Ni-E platforms are seeing strong adoption due to their flexibility in adding automation, multiple detectors, and environmental control. In H2 2026, Nikon is enhancing its customization services, offering bundled solutions with third-party accessories and software APIs, enabling seamless integration into larger lab ecosystems.

5. Sustainability and Supply Chain Resilience

Post-pandemic supply chain challenges have evolved into a focus on sustainability and localization. Nikon is investing in greener manufacturing processes and exploring regional assembly options to mitigate logistics risks. This trend is influencing procurement decisions, especially among European and North American institutions with ESG mandates. Nikon’s transparency in sourcing and energy-efficient microscope designs are becoming selling points.

6. Competitive Pressure and Market Consolidation

The microscopy market remains highly competitive, with Zeiss maintaining leadership in高端 imaging, and newcomers offering lower-cost digital alternatives. Nikon’s strategy in H2 2026 centers on differentiating through reliability, service support, and long-term software updates. Strategic partnerships—such as with AI analytics startups or cloud data platforms—are helping Nikon expand its value proposition beyond hardware.

7. Rise of Digital Pathology and Tele-imaging

In clinical and educational settings, digital slide scanning and remote collaboration tools are growing. While Nikon entered this space later than some rivals, its recent enhancements to digital imaging workflows and cloud-based data sharing (via NIS-Elements.AR) are gaining momentum, particularly in academic hospitals and training centers.

Conclusion

In H2 2026, Nikon’s success in the microscope market hinges on its ability to integrate cutting-edge AI, deliver flexible and future-proof systems, and strengthen its ecosystem through software and partnerships. While facing stiff competition, Nikon’s reputation for optical excellence and its strategic focus on life sciences and industrial applications position it as a resilient player in a rapidly evolving global market.

Common Pitfalls When Sourcing a Microscope from Nikon

Sourcing a microscope from Nikon, a reputable leader in optical instrumentation, can offer significant advantages in performance and reliability. However, several common pitfalls related to quality assurance and intellectual property (IP) must be carefully managed to ensure a successful procurement.

Quality Assurance Risks

One of the primary pitfalls when sourcing Nikon microscopes is the potential compromise in quality due to unauthorized or third-party resellers. While Nikon maintains strict manufacturing standards, counterfeit or refurbished units sold through unofficial channels may lack proper calibration, use substandard replacement parts, or omit critical quality control steps. Buyers may receive instruments that do not meet Nikon’s original specifications, resulting in inaccurate imaging, reduced resolution, or premature failure. Additionally, inconsistencies in accessories—such as objectives or digital cameras—can degrade system performance if not genuine Nikon components. To mitigate this risk, procurement should be conducted exclusively through Nikon-authorized distributors, with verification of serial numbers and warranty registration directly through Nikon’s official support channels.

Intellectual Property and Compliance Concerns

Sourcing Nikon microscopes also presents IP-related challenges, particularly when acquiring used, gray market, or modified equipment. Unauthorized modifications to Nikon’s proprietary software—such as image acquisition or analysis platforms—can violate licensing agreements and expose the end-user to legal liability. Furthermore, importing microscopes through unofficial international channels may bypass regional regulatory compliance (e.g., FDA, CE), potentially infringing on Nikon’s regional IP protections or distribution rights. Using non-genuine software or firmware updates can also compromise data integrity and system security. To protect against IP violations, organizations should ensure that all software is properly licensed, avoid tampering with embedded firmware, and confirm that the sourcing pathway respects Nikon’s territorial distribution agreements and regulatory certifications.

Logistics & Compliance Guide for Microscope Nikon

Product Overview

The Nikon microscope is a precision optical instrument designed for laboratory, research, and industrial applications. Due to its sensitive components and international usage, strict logistics and compliance protocols must be followed during transportation, import/export, and installation.

Regulatory Compliance

International Trade Regulations

Nikon microscopes may be subject to export control regulations depending on the model and technical specifications. Ensure compliance with:

– Export Administration Regulations (EAR) – Administered by the U.S. Department of Commerce (if applicable)

– Dual-use items classification under the Wassenaar Arrangement

– Customs Harmonized System (HS) Code: Typically classified under 9011.10 or 9011.80 (Microscopes, optical; parts and accessories)

Verify the specific Export Control Classification Number (ECCN) for the microscope model to determine licensing requirements.

Import Requirements

Each destination country has specific import regulations:

– Provide accurate commercial invoice, packing list, and bill of lading/air waybill

– Include technical specifications and proof of origin

– Comply with local standards such as CE (Europe), INMETRO (Brazil), KC (South Korea), or PSE (Japan) where applicable

– Pay applicable duties and taxes based on declared value and HS code

Packaging & Handling

Packaging Standards

- Use original manufacturer packaging with shock-absorbing materials

- Ensure all optical components are secured and protected from dust and moisture

- Include desiccants if shipping to humid environments

- Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture”

Handling Instructions

- Always lift the microscope by its base; never by the arm or eyepiece

- Avoid sudden movements or vibrations during transport

- Use trained personnel and appropriate equipment (e.g., pallet jack, forklift) when moving heavy models

Shipping & Transportation

Mode of Transport

- Air Freight: Recommended for urgent or international shipments; ensure IATA compliance

- Sea Freight: Suitable for bulk shipments; requires proper containerization and humidity control

- Ground Transport: Use suspension-equipped vehicles to minimize road vibration

Temperature & Environmental Controls

- Maintain ambient temperature between 10°C and 40°C during transit

- Avoid exposure to extreme temperatures, direct sunlight, or condensation

- Relative humidity should remain below 80% (non-condensing)

Documentation Requirements

Required Documents

- Commercial Invoice (with detailed description, value, and country of origin)

- Packing List (itemizing contents, weight, dimensions)

- Certificate of Origin (if required by trade agreements)

- Export License (if the model is controlled)

- Warranty and User Manual (included in shipment or sent digitally)

Labeling

- Clearly display shipper and consignee information

- Attach barcode labels for tracking

- Include model and serial number on external packaging

Installation & Post-Delivery Compliance

Site Preparation

- Ensure the installation site is clean, stable, and free from vibrations

- Confirm power supply matches microscope specifications (voltage, frequency)

- Maintain controlled room temperature and low dust levels

Calibration & Certification

- Perform post-installation calibration by certified technician

- Retain calibration certificate for audit and compliance purposes

- Register product with local regulatory bodies if required (e.g., medical device registration)

Environmental & Safety Compliance

Waste Disposal

- Dispose of packaging materials in accordance with local recycling regulations

- Follow WEEE (Waste Electrical and Electronic Equipment) directives in the EU for end-of-life equipment

Safety Standards

- Comply with ISO 10975:2020 (Safety in microscopy)

- Provide user training on safe operation and maintenance

Summary

Proper logistics and compliance management ensures the Nikon microscope reaches its destination safely and legally. Adherence to international regulations, careful handling, and complete documentation are essential for seamless delivery and operational readiness. Always consult Nikon’s official documentation and local regulatory authorities for model-specific requirements.

Conclusion for Sourcing a Nikon Microscope

After a thorough evaluation of requirements, budget constraints, and available Nikon microscope models, sourcing a Nikon microscope proves to be a sound and strategic decision. Nikon’s longstanding reputation for optical precision, reliability, and innovation ensures high-quality imaging performance across various applications, whether in research, clinical, or educational settings.

The range of Nikon microscopes—spanning from upright and inverted models to advanced confocal and digital imaging systems—allows for tailored selection based on specific technical needs. Features such as superior NIKON NIS Elements software integration, ergonomic design, and modular configurations enhance usability and long-term adaptability.

Additionally, Nikon’s strong global service and technical support network provide assurance in after-sales maintenance and training, minimizing downtime and maximizing productivity. While the initial investment may be higher compared to some competitors, the durability, resale value, and consistent performance of Nikon microscopes justify the cost over time.

In conclusion, sourcing a Nikon microscope aligns with goals of excellence in imaging, operational efficiency, and future scalability. It is a reliable choice that supports high-impact scientific outcomes and long-term return on investment.