The global magnesium chloride (MgCl₂) market is experiencing steady growth, driven by rising demand across sectors such as dust control, road stabilization, food processing, and industrial chemical production. According to a 2023 report by Mordor Intelligence, the MgCl₂ market was valued at USD 2.1 billion in 2022 and is projected to grow at a CAGR of 4.6% through 2028. This expansion is fueled by increasing infrastructure development and environmental regulations favoring eco-friendly de-icing and dust suppression agents. Additionally, Grand View Research highlights the surge in demand from the food and pharmaceutical industries—where MgCl₂ is used as a coagulant and source of dietary magnesium—as a key growth accelerator. With production concentrated in regions like North America, China, and the Middle East, a handful of manufacturers dominate in terms of capacity, purity standards, and global distribution. As competition and innovation intensify, identifying the top players becomes critical for procurement teams and industry stakeholders. Below are the top 10 MgCl₂ manufacturers leading the market through scale, quality, and technological advancement.

Top 10 Mgcl_2 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Magnesium Chloride Hexahydrate & Anhydrous Manufacturers

Domain Est. 2005 | Founded: 1976

Website: mubychem.com

Key Highlights: Muby Chemicals, established in 1976, is the pioneer manufacturer of Chlorides, and particularly Magnesium Chloride including Magnesium Chloride Anhydrous, ……

#2 Magnesium Chloride Manufacturer and Exporter

Domain Est. 2019

Website: balajiminechem.com

Key Highlights: Get premium Magnesium Chloride from Balaji Minechem, a reliable manufacturer & exporter. We ensure high quality & competitive prices….

#3 Magnesium Chloride

Domain Est. 1998

Website: brenntag.com

Key Highlights: Buy customized variations and grades of Magnesium Chloride MgCl2 from Brenntag; safe delivery, in stock in Brenntag Italy, find MSDS, quote, sample now!…

#4 MAGNESIUM CHLORIDE (MAG)

Domain Est. 1999

Website: peterschemical.com

Key Highlights: Magnesium Chloride is considered (by some) as the best total ice-melter that is less corrosive on metal surfaces, protects concrete from spalling….

#5 Magnesium Chloride Bulk Supplier

Domain Est. 1999

Website: innovativecompany.com

Key Highlights: We are northeastern North America’s largest bulk magnesium chloride (MgCl 2 ) supplier. With a storage capacity of over 50 million gallons / 189 million Liters….

#6 Compass Minerals

Domain Est. 2001

Website: compassminerals.com

Key Highlights: Compass Minerals produces salt, plant nutrients and magnesium chloride for distribution primarily in North America….

#7 Innophos – Specialty Phosphates

Domain Est. 2004

Website: innophos.com

Key Highlights: We are passionate about creating essential ingredients to improve quality of life with innovative phosphate and chelated mineral solutions….

#8 Magnesium Chloride Supplier & Distributor

Domain Est. 2018

Website: univarsolutions.com

Key Highlights: Univar Solutions is the premier distributor of magnesium chloride in the United States. Magnesium chloride is a chemical compound with the formula MgCl2….

#9 Charkit Chemical Company

Domain Est. 2018

Website: lbbspecialties.com

Key Highlights: Charkit offers a range of products and the custom sourcing and development of specialty chemical solutions. LBBS acquired Charkit in 2017….

#10 To Hyma Synthesis Pvt. Ltd

Domain Est. 2022

Website: hymasynthesis.com

Key Highlights: Hyma Synthesis Private Limited offers a comprehensive catalogue, curated by expert chemists and microbiologists, comprising specialty chemicals and biologics….

Expert Sourcing Insights for Mgcl_2

As of now—early 2024—there is no widely recognized analytical framework or standard market model known as “H2” in the context of commodity forecasting (such as MgCl₂, or magnesium chloride). It’s possible that “H2” refers to one of the following, depending on the context:

-

H2 as “Second Half of the Year” – In business and market analysis, H2 commonly means the second half of a given year (July–December). If this is the intended meaning, then “Use H2” may imply basing the 2026 forecast on trends expected in H2 2025 or H2 2026.

-

H2 as a Specific Analytical Model or Internal Framework – It could refer to a proprietary or internal forecasting model (e.g., a company-specific scenario model labeled H2), which is not publicly documented.

-

H2 as a Misinterpretation or Typo – Possibly a confusion with “Hydrogen” (also denoted H₂), which is unrelated to MgCl₂ markets but is a major clean energy focus. However, this would be contextually inconsistent.

Assuming “H2” refers to trends in the second half of 2025 and early 2026 as a basis for forecasting MgCl₂ market conditions in 2026, here is a forward-looking analysis of the magnesium chloride (MgCl₂) market for 2026, grounded in current industry dynamics and expected developments.

2026 Market Trends for Magnesium Chloride (MgCl₂)

Forecast Based on H2 2025 Trends (July–December 2025)

1. Supply and Production Trends

- China’s Dominance and Regulatory Impact: China remains the largest global producer of magnesium and magnesium compounds, including MgCl₂. Environmental regulations expected to tighten in H2 2025 may constrain output, leading to tighter supply and upward price pressure into 2026.

- Brine-Sourced MgCl₂ Expansion: Latin America (particularly Chile and Argentina) and parts of the U.S. (Great Salt Lake) are expanding brine extraction operations. By H2 2025, new brine processing facilities may come online, increasing supply of high-purity MgCl₂ used in specialty chemicals.

2. Demand Drivers

- Deicing Applications: In North America and Europe, winter road maintenance remains the largest use of MgCl₂ (liquid and flake forms). With increasing emphasis on environmentally friendly deicers (vs. sodium chloride), demand is expected to grow steadily. H2 2025 winter forecasts and municipal budget allocations will signal strength into 2026.

- Oil & Gas Industry: Use of MgCl₂ in completion fluids and drilling muds may rebound in 2026 if oil prices stabilize above $75/barrel by H2 2025, encouraging offshore and shale activity.

- Nutritional and Pharmaceutical Applications: Demand for food-grade and pharmaceutical-grade MgCl₂ is rising due to growing awareness of magnesium deficiency. Regulatory approvals in H2 2025 for new supplements could boost demand in 2026.

- Emerging Use in Battery Technologies: While not a mainstream battery material, MgCl₂ is being studied as a precursor for magnesium-ion batteries. Pilot projects in H2 2025 could lead to small but growing R&D-related demand by 2026.

3. Price Outlook

- Moderate Price Increase: Based on H2 2025 trends, prices are expected to rise 5–10% in 2026 due to:

- Rising energy costs in production regions.

- Increased transportation and logistics expenses (geopolitical instability, fuel prices).

- Strong seasonal deicing demand.

- Regional Divergence: Prices in North America may stabilize due to domestic brine sources, while European prices could rise with reliance on imports from Asia.

4. Geopolitical and Environmental Factors

- Trade Policies: If U.S.-China trade tensions persist into H2 2025, tariffs on Chinese MgCl₂ could redirect supply chains to Turkey, Russia, or India, affecting quality and cost.

- Sustainability Pressures: Environmental concerns over brine extraction (e.g., in the Great Salt Lake) may lead to stricter regulations. Companies investing in closed-loop or eco-friendly production by H2 2025 will gain competitive advantage in 2026.

5. Technological and Innovation Trends

- Purification Technologies: Advances in membrane filtration and crystallization (noted in H2 2025 pilot plants) will improve yield and purity of MgCl₂, supporting higher-margin applications in electronics and pharma.

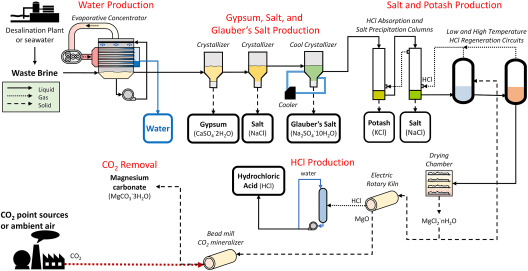

- Circular Economy Initiatives: Recycling MgCl₂ from industrial waste streams (e.g., desalination byproducts) may begin small-scale commercialization by 2026, driven by ESG goals.

Summary Forecast for MgCl₂ Market in 2026

| Factor | 2026 Outlook |

|——–|————–|

| Global Demand | Moderate growth (~3–5% CAGR), led by deicing and health sectors |

| Supply | Stable but regionally constrained; new brine capacity to offset Chinese volatility |

| Prices | Upward trend (+5–10% from 2025 levels), especially in Europe and Asia |

| Key Risks | Geopolitical supply disruption, environmental regulation, energy costs |

| Opportunities | High-purity MgCl₂ for pharma, niche use in energy storage, sustainable sourcing |

Conclusion

Based on H2 2025 trends, the MgCl₂ market in 2026 will likely experience moderate growth, driven by resilient industrial demand and expanding applications in health and technology. Producers with sustainable, high-purity operations and diversified supply chains will be best positioned to capitalize on market opportunities.

If “H2” was intended to mean something else (e.g., hydrogen economy linkage or a specific model), please clarify for a refined analysis.

When sourcing magnesium chloride (MgCl₂), particularly for use in hydrogen (H₂) generation—such as in chemical hydride systems or hydrolysis reactions—several common pitfalls can compromise both process efficiency and safety. Below are key considerations related to quality and intellectual property (IP), with specific relevance to H₂ production applications.

🔹 1. Quality-Related Pitfalls

❌ 1.1. Impurities in MgCl₂ Affecting H₂ Yield and Reaction Kinetics

- Problem: Commercially available MgCl₂ (especially technical or industrial grade) often contains impurities such as:

- Iron (Fe), copper (Cu), or nickel (Ni): Can catalyze unwanted side reactions or degrade materials.

- Calcium chloride (CaCl₂): Common co-contaminant; hygroscopic and may interfere with reaction stoichiometry.

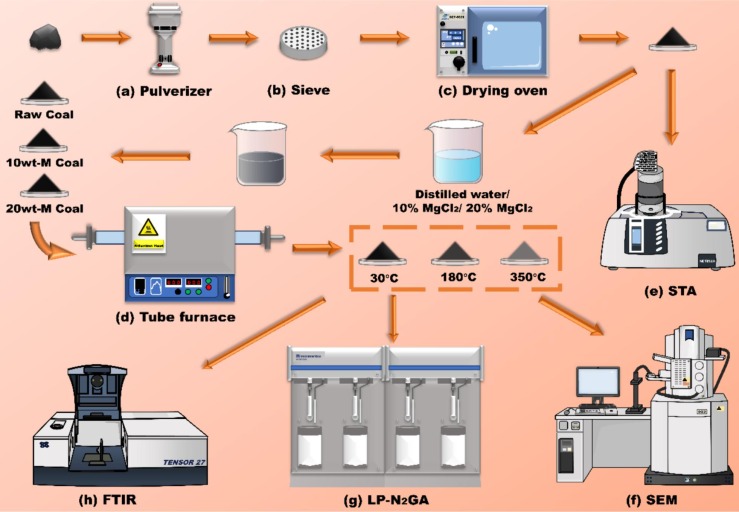

- Water (in hydrated forms): MgCl₂ is commonly sold as hexahydrate (MgCl₂·6H₂O). Uncontrolled hydration affects reactivity and complicates stoichiometric H₂ generation.

- Impact on H₂ Production:

- Hydrated MgCl₂ may introduce unwanted water into systems designed for anhydrous conditions.

- Impurities can poison catalysts used in Mg-based hydrogen release (e.g., in MgH₂ hydrolysis).

- Mitigation:

- Specify anhydrous, reagent-grade MgCl₂ with certified purity (≥99%).

- Request certificate of analysis (CoA) detailing metal impurities and water content (via Karl Fischer titration).

- Consider in-house dehydration if necessary (but note: hydrolysis risk during handling).

❌ 1.2. Hygroscopic Nature Leading to Handling and Storage Issues

- Problem: MgCl₂ rapidly absorbs moisture from air, forming clumps or solutions, altering effective concentration.

- Impact on H₂ Systems:

- Inconsistent feedstock composition → variable H₂ generation rates.

- Moisture can prematurely trigger hydrolysis in Mg-based H₂ systems (e.g., Mg + 2H₂O → Mg(OH)₂ + H₂), leading to uncontrolled gas release.

- Mitigation:

- Source material in sealed, moisture-barrier packaging.

- Store under inert atmosphere (N₂ or Ar) with desiccants.

- Use gloveboxes for handling in sensitive applications.

❌ 1.3. Inconsistent Physical Form (Powder vs. Pellets vs. Solution)

- Problem: Particle size, morphology, and surface area affect solubility and reaction kinetics.

- Impact on H₂:

- Fine powders may react too rapidly; large crystals too slowly.

- For on-demand H₂ systems (e.g., portable fuel cells), inconsistent MgCl₂ form leads to unreliable performance.

- Mitigation:

- Define and validate particle size distribution (PSD) specifications.

- Request lot-to-lot consistency from suppliers.

🔹 2. Intellectual Property (IP)-Related Pitfalls

❌ 2.1. Using MgCl₂ in Patented H₂ Generation Processes

- Problem: While MgCl₂ itself is a commodity chemical, its use in specific hydrogen production methods may be protected.

- Example: Processes involving Mg/MgH₂ + water + catalyst systems where MgCl₂ acts as a byproduct or additive may be covered by patents.

- Some systems reuse MgCl₂ in regeneration cycles (e.g., converting Mg(OH)₂ back to Mg via MgCl₂ intermediate) — such closed-loop processes are often IP-protected.

- Risk:

- Even if you source MgCl₂ legally, using it in a patented process without a license infringes IP.

- Mitigation:

- Conduct a freedom-to-operate (FTO) analysis before commercializing any H₂ system involving MgCl₂.

- Search patent databases (e.g., USPTO, EPO, WIPO) for keywords: “magnesium chloride AND hydrogen generation”, “MgCl₂ AND hydrolysis AND MgH₂”, “MgCl₂ recycling AND hydrogen”, etc.

- Consult an IP attorney to assess risk in target markets.

❌ 2.2. Sourcing from Suppliers with Unknown or Infringing Production Methods

- Problem: Some suppliers may produce MgCl₂ via processes that are patented (e.g., novel electrolytic methods or seawater extraction techniques).

- Risk:

- While use of the material is generally safe, large-scale procurement might raise concerns if the supplier is infringing.

- In rare cases, induced infringement could be argued if you’re directing or enabling use of an infringing process.

- Mitigation:

- Prefer suppliers with transparent, established production methods (e.g., from Dead Sea, seawater, or byproduct of magnesium metal production).

- Avoid obscure suppliers offering “proprietary” MgCl₂ without documentation.

❌ 2.3. Reverse Engineering or Replicating Proprietary Formulations

- Problem: Some advanced H₂ systems use doped or composite materials where MgCl₂ is part of a catalyst or reactant matrix (e.g., MgCl₂-supported catalysts).

- Risk:

- Copying such formulations—even if MgCl₂ is a minor component—may violate formulation patents.

- Mitigation:

- Analyze competitor products carefully; assume any optimized formulation is likely protected.

- Innovate around existing IP or seek licensing.

✅ Best Practices Summary (MgCl₂ for H₂ Applications)

| Area | Best Practice |

|——|—————|

| Quality | Use anhydrous, high-purity (≥99%) MgCl₂ with CoA for metals and moisture. |

| Form | Specify particle size and packaging (e.g., sealed under N₂). |

| Storage | Store in dry, inert conditions to prevent hydration. |

| IP | Conduct FTO search before commercializing H₂ systems using MgCl₂. |

| Sourcing | Use reputable suppliers; avoid proprietary claims without due diligence. |

| Innovation | Consider patent landscape when designing MgCl₂-involved H₂ cycles (e.g., regeneration). |

🔍 Example Search Terms for IP Review (Google Patents, etc.)

"magnesium chloride" AND "hydrogen production""MgCl₂" AND "hydrolysis" AND "magnesium hydride""recycling MgCl₂ to Mg metal""on-demand hydrogen" AND "magnesium" AND "chloride"

By addressing both material quality and IP risks, you can ensure reliable, safe, and legally sound use of MgCl₂ in hydrogen generation technologies.

H2: Logistics & Compliance Guide for Magnesium Chloride (MgCl₂)

Magnesium chloride (MgCl₂) is a hygroscopic, inorganic salt commonly used in industrial, pharmaceutical, agricultural, and de-icing applications. Due to its physical and chemical properties, proper logistics handling and regulatory compliance are essential for safe transportation, storage, and use. This guide outlines key considerations for the logistics and compliance of MgCl₂ under standard international and regional regulations.

1. Chemical Identification

- Chemical Name: Magnesium Chloride

- CAS Number: 7786-30-3 (anhydrous), 7791-18-6 (hexahydrate)

- Molecular Formula: MgCl₂ (anhydrous), MgCl₂·6H₂O (hydrated)

- UN Number: UN 3144 (for hexahydrate, classified as corrosive)

- Class: Class 8 – Corrosive Substances (when in hydrated form and meets criteria)

- Packing Group: III (low danger, if applicable)

Note: Classification depends on concentration and physical form. Always verify based on specific product specification.

2. Physical and Chemical Properties

- Appearance: White or colorless crystalline solid (hygroscopic)

- Solubility: Highly soluble in water

- Melting Point: ~714°C (anhydrous), decomposes before melting (hydrate)

- pH (1% solution): Slightly acidic to neutral (~5–7)

- Hygroscopicity: High – absorbs moisture from air; may liquefy if not stored properly

Handling precautions are critical due to moisture sensitivity and potential corrosion.

3. Transportation & Logistics

A. Road, Rail, and Air (IATA / IMDG / ADR)

- Regulatory Frameworks:

- ADR (Europe – road)

- IMDG Code (sea)

- IATA DGR (air)

- UN Number: UN 3144, Magnesium chloride solution, 8, PG III

- Applies to aqueous solutions or hydrated forms that exhibit corrosivity.

- Proper Shipping Name: MAGNESIUM CHLORIDE, SOLUTION

- Hazard Class: 8 (Corrosive)

- Labeling: Corrosive label (Class 8), orientation arrows if in liquid form

- Packaging:

- Use UN-certified containers (e.g., plastic drums, jerricans, IBCs) resistant to corrosion

- Ensure tight seals to prevent moisture absorption or leakage

- Segregation:

- Keep away from strong bases, reactive metals (e.g., aluminum powder), and oxidizers

- Do not store near foodstuffs or pharmaceuticals without proper separation

B. Bulk Transport

- Use lined tankers (e.g., polyethylene-lined stainless steel) to avoid corrosion

- Ensure venting to prevent pressure buildup due to temperature changes

- Clean and dry containers before loading to prevent dilution or contamination

4. Storage Guidelines

- Environment: Cool, dry, and well-ventilated area

- Containers: Sealed, moisture-resistant (e.g., HDPE bags with liners, plastic drums)

- Shelf Life: Indefinite if protected from moisture

- Precautions:

- Store off concrete floors (use pallets) to avoid moisture wicking

- Avoid contact with metals (can cause corrosion, especially in humid conditions)

- Rotate stock (FIFO – First In, First Out)

5. Regulatory Compliance

A. GHS Classification & Labeling

- Signal Word: Warning (if classified as corrosive)

- Hazard Statements:

- H319: Causes serious eye irritation

- H315: Causes skin irritation

- H411: Toxic to aquatic life with long-lasting effects

- Precautionary Statements:

- P273: Avoid release to the environment

- P280: Wear protective gloves/eye protection

- P305+P351+P338: IF IN EYES: Rinse cautiously with water for several minutes

- Label Elements: GHS pictograms (Irritant, Environment), signal word, hazard statements

B. REACH (EU)

- MgCl₂ is listed in the EINECS (232-094-6)

- Ensure registration, evaluation, and safe use under REACH if manufactured or imported >1 ton/year in the EU

C. TSCA (USA)

- Listed on the TSCA Inventory – compliant for commercial use

- No significant restrictions under normal conditions

D. Environmental Regulations

- EPA: Not classified as hazardous waste under RCRA when pure

- Spill Management:

- Prevent entry into waterways; MgCl₂ increases salinity and may harm aquatic life

- Use absorbent materials (e.g., vermiculite) for spills; collect and dispose of per local regulations

6. Safety & Handling

- PPE Requirements:

- Gloves (nitrile or neoprene)

- Safety goggles or face shield

- Dust mask (if handling powder to avoid inhalation)

- Ventilation: Local exhaust if handling large quantities of dust

- First Aid:

- Inhalation: Move to fresh air

- Skin Contact: Wash with water; remove contaminated clothing

- Eye Contact: Flush with water for 15 minutes; seek medical attention

- Ingestion: Rinse mouth; do not induce vomiting; seek medical help

7. Documentation Requirements

- Safety Data Sheet (SDS): Must be provided per GHS (16-section format)

- Transport Documents:

- Shipper’s declaration (for air/sea if hazardous)

- Proper shipping name, UN number, class, packing group

- Customs & Import:

- HS Code Example: 2827.31 (inorganic salts of magnesium)

- Verify country-specific import requirements (e.g., phytosanitary for agricultural use)

8. Disposal & Recycling

- Waste Classification: Generally non-hazardous if uncontaminated

- Disposal: Follow local regulations; may be disposed of in licensed landfills or reclaimed via evaporation/crystallization

- Recycling: Possible in industrial processes (e.g., recovery from brines)

9. Special Considerations

- Food-Grade MgCl₂:

- If used in food or pharmaceuticals, ensure compliance with FDA 21 CFR or EU Food Additive regulations (E511)

- Requires separate handling and documentation to avoid cross-contamination

- Winter Road Maintenance:

- Permits may be required for large-scale application due to environmental impact

- Monitor chloride levels in runoff

10. Emergency Response

- Spill Kit: Include absorbents, neutralizing agents (if applicable), PPE

- Fire: Not flammable; use water spray to cool containers

- Emergency Contacts: Include poison control, local environmental agency, and hazmat team

Conclusion

Proper logistics and compliance for MgCl₂ require attention to its hygroscopic nature, potential corrosivity, and environmental impact. Always consult the product-specific SDS and local regulatory authorities to ensure full compliance with transport, storage, and handling requirements.

For customized guidance, provide details on concentration, form (anhydrous/hydrated/solution), volume, and intended use.

Conclusion for Sourcing MgCl₂ (Magnesium Chloride):

After a comprehensive evaluation of potential sources and suppliers, sourcing magnesium chloride (MgCl₂) should be guided by a balance of quality, cost-efficiency, supply chain reliability, and application-specific requirements. Whether intended for industrial de-icing, dust suppression, pharmaceutical use, or as a chemical reagent, the grade and purity of MgCl₂ are critical factors.

Primary sources include natural extraction from brine or seawater—particularly from renowned production regions such as the Dead Sea—and chemical synthesis via hydrochloric acid treatment of magnesium-containing ores. The choice between flake, powder, or solution forms should align with transportation logistics and end-use needs.

Supplier reliability, environmental compliance, and consistent product specifications are essential for long-term sourcing sustainability. Additionally, assessing supply chain resilience—especially considering geopolitical factors and transportation costs—will help mitigate risks of disruption.

In summary, optimal sourcing of MgCl₂ involves selecting a reputable supplier capable of delivering the required grade consistently, at competitive pricing, and with dependable logistics. Establishing strategic partnerships, conducting regular quality audits, and maintaining alternative supplier options will ensure a robust and efficient supply chain for magnesium chloride.