The wholesale distribution and manufacturing sector in Mexico has experienced robust growth over the past decade, driven by the country’s strategic geographic location, strong manufacturing base, and integration into global supply chains through trade agreements like USMCA. According to Mordor Intelligence, the Mexico wholesale trade market was valued at approximately USD 350 billion in 2022 and is projected to grow at a CAGR of over 6.5% from 2023 to 2028. This expansion is further supported by increasing domestic consumption, rising industrial output, and growing cross-border trade with the United States and Canada. Additionally, Grand View Research reports that Mexico’s manufacturing sector, particularly in electronics, automotive, and consumer goods, is expanding steadily, reinforcing the nation’s role as a key hub for production and distribution in North America. As demand for efficient supply chain solutions grows, identifying leading wholesale distributors and manufacturers in Mexico becomes essential for businesses seeking reliable sourcing partners, cost-effective logistics, and access to high-quality, competitively priced goods.

Top 10 Mexico Wholesale Distributors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Specialty Foods Distribution Inc.

Domain Est. 2005

Website: specfoodinc.com

Key Highlights: Specialty Foods Distribution Inc. is a Mexican food products distributor based in Joplin, Missouri serving restaurants in the Midwest….

#2 Mexican Wholesale Suppliers

Domain Est. 1997

#3 Mexico BSP Distributors and Importers

Domain Est. 2000

Website: trade.gov

Key Highlights: Mexican Firm specialized in supporting American and Foreign Companies in Mexico, with more than a decade of successful stories in the market….

#4 Import/Export

Domain Est. 2004

Website: multimexican.com

Key Highlights: Interested in a Hispanic product we don’t carry? · We create relationships with vendors, import and distribute to your location. · WHOLESALE DISTRIBUTION….

#5 Mexmax Inc

Domain Est. 2005

Website: mexmax.com

Key Highlights: MexMax is a family-owned and operated business that offers a nationwide online platform for both uncommon and authentic Hispanic and Latin household products….

#6 US Foods de México

Domain Est. 2006

Website: usfoodsdemexico.com

Key Highlights: US Foods de México is the leading supplier of food products and kitchen equipment to hotels and restaurants in Los Cabos & Puerto Vallarta….

#7 MegaMex Foodservice

Domain Est. 2009

Website: megamexfoodservice.com

Key Highlights: See our vast portfolio of brands including WHOLLY® AVOCADO, WHOLLY GUACAMOLE®, LA VICTORIA®, HERDEZ®, EMBASA®, DON MIGUEL® and TRES COCINAS™….

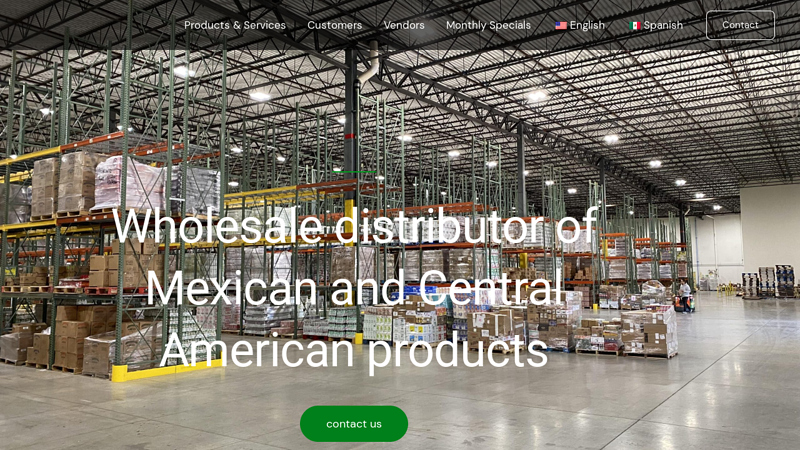

#8 Wholesale Distributor of Mexican & Central American Products

Domain Est. 2012

Website: encantoproducts.com

Key Highlights: Wholesale distributor of Mexican and Central American products. Over 3,000 different products and coverage of over 12 states in the Midwest. About · Productos ……

#9 Crevel

Domain Est. 2019

Website: creveleurope.com

Key Highlights: Crevel serves over 400 loyal customers as the leading distributor of authentic Mexican and American products for foodservice and retail businesses….

#10 Best Mexican Foods

Domain Est. 2003 | Founded: 1968

Website: bestmexicanfoods.com

Key Highlights: Since 1968, Best Mexican Foods has supplied restaurants with the highest quality wholesale Mexican food products that are as flavorful and delicious as they are ……

Expert Sourcing Insights for Mexico Wholesale Distributors

H2 2026 Market Trends for Mexico Wholesale Distributors

As Mexico’s economy continues to evolve through 2026, wholesale distributors are navigating a dynamic landscape shaped by economic shifts, technological advancements, and changing consumer demands. Here’s an analysis of key trends expected to influence the sector in the second half of 2026:

1. Strengthening Nearshoring Momentum

By H2 2026, nearshoring will be a dominant force reshaping supply chains. With U.S. and Canadian companies relocating manufacturing to Mexico to reduce geopolitical risks and logistical costs, wholesale distributors are experiencing increased demand for industrial goods, packaging materials, and MRO (Maintenance, Repair, and Operations) supplies. Distributors located near manufacturing hubs such as Monterrey, Querétaro, and Guadalajara are well-positioned to benefit from just-in-time delivery needs and integrated logistics services.

2. Digital Transformation Acceleration

Wholesale distributors are increasingly investing in digital platforms to remain competitive. E-commerce adoption among B2B buyers in Mexico has surged, and by H2 2026, a majority of mid-to-large distributors will offer online ordering, real-time inventory tracking, and automated invoicing. Integration with ERP and CRM systems enables better demand forecasting and customer relationship management. Smaller distributors are partnering with fintechs and SaaS providers to access affordable digital tools.

3. Supply Chain Resilience as a Priority

Following past disruptions from global events and logistical bottlenecks, distributors are focusing on supply chain diversification and inventory optimization. In H2 2026, we see a rise in multi-sourcing strategies, regional warehousing, and investments in predictive analytics to mitigate risks. Distributors are also enhancing last-mile capabilities to serve both urban centers and underserved rural markets.

4. Sustainability and Regulatory Compliance

Environmental regulations and corporate sustainability goals are influencing procurement decisions. By 2026, wholesale distributors are adapting by offering eco-friendly packaging, energy-efficient products, and compliance with NOM (Norma Oficial Mexicana) standards. Some are also exploring carbon footprint tracking and green logistics options, such as electric delivery fleets, especially in major cities like Mexico City and Toluca.

5. Growing Demand in Key Sectors

Certain sectors are driving wholesale growth:

– Food & Beverage: Rising urbanization and middle-class consumption are increasing demand for perishable and specialty food distribution. Cold chain infrastructure investments are critical.

– Healthcare: Post-pandemic healthcare expansion and government initiatives fuel demand for medical supplies and pharmaceutical distribution.

– Construction & Home Improvement: Ongoing infrastructure projects and housing demand boost sales of building materials and hardware.

6. Consolidation and Competitive Pressures

The wholesale sector is undergoing consolidation, with larger players acquiring regional distributors to expand reach and achieve economies of scale. This trend pressures smaller distributors to either specialize, form cooperatives, or enhance service differentiation. Price competition remains intense, especially in commoditized product lines.

7. Labor and Talent Challenges

Despite economic growth, the sector faces labor shortages, particularly in logistics and skilled technical roles. In H2 2026, distributors are investing in training programs, automation (e.g., warehouse robotics), and improved working conditions to retain talent and boost productivity.

Conclusion

By H2 2026, Mexico’s wholesale distribution sector is becoming more strategic, tech-driven, and resilient. Distributors who embrace digitalization, align with nearshoring trends, and prioritize sustainability and supply chain agility will be best positioned for growth. Success will depend on the ability to adapt quickly to evolving market demands and leverage Mexico’s growing role in North American supply chains.

Common Pitfalls When Sourcing Mexico Wholesale Distributors (Quality, IP)

Sourcing wholesale distributors in Mexico can offer significant advantages, including proximity, cost savings, and access to a growing market. However, businesses often encounter critical pitfalls related to product quality and intellectual property protection. Being aware of these risks is essential to building a successful and sustainable supply chain.

Inconsistent Product Quality Standards

One of the most frequent challenges is variability in product quality. While many Mexican manufacturers and distributors meet international standards, others may lack rigorous quality control processes. Differences in raw materials, production methods, and oversight can result in inconsistent batches, defective goods, or products that don’t meet your specifications. Relying solely on distributor-provided samples or certifications without independent verification increases the risk of receiving subpar products at scale.

Lack of Transparent Supply Chain Oversight

Many wholesale distributors in Mexico act as intermediaries rather than direct manufacturers, which can obscure visibility into the actual source of goods. This lack of transparency makes it difficult to assess working conditions, manufacturing practices, and compliance with safety or environmental regulations. Without clear supply chain mapping, brands risk reputational damage or regulatory non-compliance due to issues stemming from unvetted subcontractors.

Intellectual Property Infringement Risks

Mexico’s intellectual property (IP) enforcement can be inconsistent, particularly at the state and local levels. Distributors or their suppliers may inadvertently—or deliberately—produce counterfeit goods, replicate patented designs, or use unauthorized branding. Even with registered trademarks or patents in Mexico, enforcement often requires proactive legal action, which can be time-consuming and costly. The risk is heightened when distributors operate across multiple jurisdictions with varying levels of IP oversight.

Inadequate Legal Protections in Contracts

Many sourcing agreements with Mexican distributors lack robust clauses protecting quality expectations and IP rights. Vague or incomplete contracts may omit clear quality benchmarks, inspection rights, liability for IP violations, or recourse mechanisms. Without enforceable agreements governed by mutually recognized legal frameworks, resolving disputes becomes significantly more difficult, especially when navigating cross-border litigation.

Counterfeit and Gray Market Goods

Some distributors may supply gray market or counterfeit products to meet price demands, particularly in industries like electronics, apparel, and automotive parts. These goods may appear authentic but lack warranties, safety certifications, or performance reliability. Unwittingly introducing such products into your supply chain can damage brand integrity, lead to customer dissatisfaction, and expose your business to legal liability.

Limited After-Sales Support and Accountability

When quality issues arise or IP violations are discovered, some Mexican distributors may lack the infrastructure or willingness to provide timely support. Limited accountability, poor communication, or reluctance to take responsibility can delay resolution and disrupt operations. Establishing clear service level agreements (SLAs) and performance metrics upfront is crucial to ensuring responsiveness and reliability.

Failure to Conduct On-Site Due Diligence

Remote assessments and paper-based evaluations are often insufficient. Without on-site audits, businesses may miss red flags such as outdated equipment, poor labor practices, or inadequate quality management systems. Physical inspections and third-party audits are vital to verifying a distributor’s capabilities and compliance with your standards.

By recognizing these common pitfalls—particularly those related to quality control and intellectual property—businesses can implement stronger vetting processes, negotiate better contracts, and build more resilient partnerships with Mexican wholesale distributors.

Logistics & Compliance Guide for Mexico Wholesale Distributors

Navigating the logistics and regulatory landscape in Mexico is crucial for wholesale distributors aiming to operate efficiently and avoid costly delays or penalties. This guide outlines key considerations for managing supply chains, customs procedures, transportation, and legal compliance in the Mexican market.

Understanding Mexican Import Regulations

All goods entering Mexico are subject to customs regulations administered by the Tax Administration Service (Servicio de Administración Tributaria, SAT). Wholesale distributors must work with a licensed customs broker (agente aduanal) to handle import declarations (Pedimento). Key documentation includes commercial invoices, packing lists, bill of lading or airway bill, and certificates of origin—especially important for goods qualifying under USMCA (United States-Mexico-Canada Agreement) to benefit from reduced or eliminated tariffs.

Customs Clearance and Duties

The customs clearance process in Mexico typically involves cargo inspection, duty assessment, and tax collection. Import duties vary based on the Harmonized System (HS) code of the product, with rates ranging from 0% to 20% or higher for sensitive goods. Value Added Tax (IVA) at 16% is applied to most imports, and an additional 8% IVA may apply in border regions. Anti-dumping duties or special taxes (e.g., on sugary drinks or electronics) may also be applicable. Accurate classification and valuation are critical to avoid delays or audits.

Transport and Distribution Infrastructure

Mexico’s transportation network includes highways, railways, seaports, and airports. Major ports such as Manzanillo, Lázaro Cárdenas, and Veracruz handle significant container traffic, while land crossings like Nuevo Laredo and Tijuana are vital for cross-border trade with the U.S. Distributors should partner with certified logistics providers experienced in Mexican freight regulations. Road transport is the most common mode for distribution; ensure carriers have proper FM (Federal Motor Carrier) permits and comply with hours-of-service rules.

Warehouse and Inventory Management

Strategic warehouse locations near key ports or industrial hubs (e.g., Monterrey, Querétaro, Guadalajara) can reduce transit times. All distribution centers must comply with NOM-005-SCFI on warehouse practices and maintain proper inventory records for audit purposes. Consider leveraging IMMEX or Maquiladora programs if engaging in manufacturing or assembly, as these allow temporary import of goods duty-free under specific conditions.

Regulatory Compliance and Product Standards

Wholesale distributors must ensure products meet Mexican Official Standards (Normas Oficiales Mexicanas, NOMs), which cover safety, labeling, and technical specifications. These vary by industry—e.g., NOM-051 for food labeling, NOM-001-SCFI for general product marking. Electrical goods, medical devices, and chemicals often require pre-market approval from agencies like COFEPRIS (Federal Commission for Protection Against Sanitary Risk) or PROFEPA (Federal Attorney for Environmental Protection).

Taxation and Financial Reporting

In addition to IVA, wholesalers must comply with Income Tax (ISR) obligations. Registered distributors must issue electronic invoices (CFDI – Comprobante Fiscal Digital por Internet) through the SAT portal, which includes detailed transaction data and tax calculations. Regular tax filings and proper record-keeping are mandatory. Penalties for non-compliance can include fines, suspension of operations, or import bans.

Labor and Employment Regulations

If operating warehouses or distribution centers with local staff, distributors must adhere to Mexico’s Federal Labor Law (Ley Federal del Trabajo). This includes formal employment contracts, social security (IMSS) enrollment, profit-sharing (PTU), and workplace safety standards. Misclassification of workers or failure to meet labor requirements can lead to legal action and reputational damage.

Risk Management and Security

Cargo theft is a concern in certain regions of Mexico. Implement security protocols such as GPS tracking, secure transport, and vetted logistics partners. Consider cargo insurance and compliance with the NAFTA Cross-Border Trucking Security Guidelines or C-TPAT (Customs-Trade Partnership Against Terrorism) for enhanced supply chain security and faster customs processing.

Environmental and Sustainability Requirements

Mexico enforces environmental regulations under the General Law for Ecological Balance and Environmental Protection (LGEEPA). Distributors handling hazardous materials must comply with waste management, labeling, and transportation rules. Increasingly, sustainability practices—such as reducing packaging waste and carbon emissions—are expected by partners and consumers.

Conclusion

Success as a wholesale distributor in Mexico requires a thorough understanding of logistics networks, customs procedures, tax compliance, and regulatory standards. Partnering with experienced local agents, leveraging technology for supply chain visibility, and maintaining up-to-date compliance practices will help ensure smooth operations and long-term growth in this dynamic market.

In conclusion, sourcing from wholesale distributors in Mexico offers a strategic advantage for businesses looking to enhance supply chain efficiency, reduce costs, and access a diverse range of high-quality products. Proximity to the U.S. market, beneficial trade agreements like USMCA, and a growing logistics infrastructure make Mexico an increasingly attractive hub for wholesale distribution. By partnering with reliable distributors, companies can benefit from shorter lead times, lower transportation costs, and stronger regional market integration. However, success depends on thorough due diligence, clear communication, cultural understanding, and compliance with regulatory standards. When approached strategically, sourcing from Mexican wholesale distributors can drive growth, improve competitiveness, and support long-term business resilience in North America and beyond.