The global methyl oleate market is experiencing steady growth, driven by rising demand in personal care, lubricants, agrochemicals, and biodiesel applications. According to Grand View Research, the global fatty acid esters market—of which methyl oleate is a key derivative—is projected to expand at a CAGR of 5.8% from 2023 to 2030, fueled by increasing adoption of bio-based chemicals and sustainable feedstocks. Similarly, Mordor Intelligence forecasts sustained market momentum, citing expanding industrial applications and regulatory support for renewable chemicals in North America and Europe. As demand for high-purity, sustainably sourced methyl oleate rises, a select group of manufacturers have emerged as leaders in production capacity, product innovation, and global reach. The following list highlights the top eight methyl oleate manufacturers shaping this evolving landscape.

Top 8 Methyl Oleate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Methyl Oleate

Domain Est. 2010

Website: dongnamlab.com

Key Highlights: Methyl Oleate. Pharmaceutical Secondary Standard; Certified Reference Material. Manufacture: Merck; Trademark: Supelco. Manufacturer: Merck….

#2 Methyl oleate

Domain Est. 2011

Website: chemfaces.com

Key Highlights: Description: Methyl oleate could used as a primary carbon source and as an alternative inducer for the production of an extracellular lipase, Lip2, in Y….

#3 Methyl oleate

Domain Est. 1996

Website: biosynth.com

Key Highlights: In stockMethyl oleate is a fatty acid with a hydroxyl group at the methyl end. It is used as a catalyst in the reaction of phosphorus pentoxide and fatty acids….

#4 Methyl Oleate Supplier & Distributor USA

Domain Est. 1998

Website: rierdenchemical.com

Key Highlights: Methyl Oleate is used in detergents, emulsifiers, wetting agents, stabilizers, textile treatments, plasticizers for duplicating inks, rubbers and waxes….

#5 Methyl Oleate Supplier

Domain Est. 2004

Website: silverfernchemical.com

Key Highlights: Methyl Oleate 112-62-9 is in stock, get a quote today. Silver Fern is your reliable supplier of Methyl Oleate….

#6 METHYL OLEATE

Domain Est. 2005

Website: wilmar-international.com

Key Highlights: Wilmarin methyl esters are derived from vegetable oils via transesterification process. Depending on customer requirements, they are available as broad cuts ……

#7 Methyl oleate

Domain Est. 2010

Website: interfat.com

Key Highlights: It is a non-branched mono saturated fatty acid ester obtained from methanol and oleic acid, from palm oil or olive oil. Clear liquid with a melting point of ……

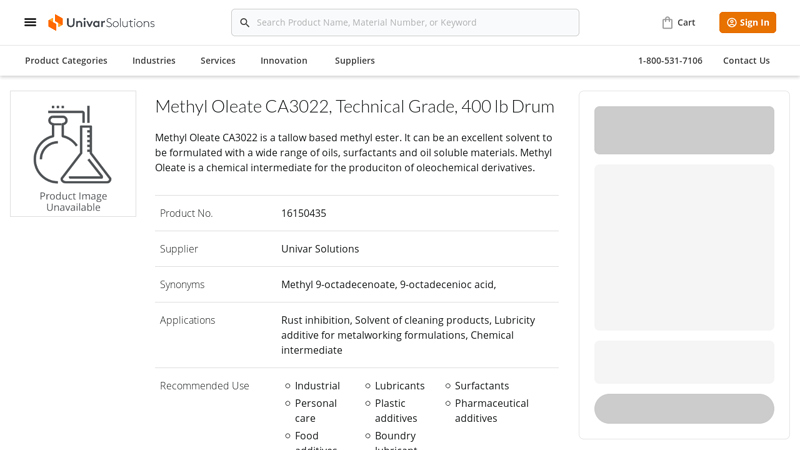

#8 Methyl Oleate Ca3022

Domain Est. 2018

Website: univarsolutions.com

Key Highlights: 3–7 day delivery 14-day returnsMethyl Oleate CA3022 is a tallow based methyl ester. It can be an excellent solvent to be formulated with a wide range of oils, surfactants and oil s…

Expert Sourcing Insights for Methyl Oleate

H2: Market Trends and Outlook for Methyl Oleate in 2026

As the global chemical and bio-based product markets evolve toward sustainability, methyl oleate — a fatty acid methyl ester derived primarily from oleic acid in vegetable oils such as high-oleic sunflower, canola, or tallow — is expected to experience significant shifts by 2026. Driven by regulatory support, green chemistry initiatives, and increasing demand for bio-based alternatives, the methyl oleate market is poised for growth, particularly in specialty chemicals, biofuels, and oleochemical applications.

-

Regulatory and Sustainability Drivers

By 2026, tightening environmental regulations across North America, Europe, and parts of Asia-Pacific will continue to promote the use of bio-based and biodegradable chemicals. Methyl oleate benefits from its renewable origin and low toxicity, aligning with the EU’s Green Deal, REACH compliance, and U.S. EPA’s Safer Choice Program. These frameworks favor non-petroleum-derived intermediates, boosting methyl oleate adoption in lubricants, plasticizers, and surfactants. -

Expansion in Bio-Based Lubricants and Plasticizers

The industrial sector is increasingly shifting from phthalate-based plasticizers and mineral oil-based lubricants to bio-based alternatives. Methyl oleate serves as a key precursor for biolubricants and eco-friendly plasticizers due to its excellent lubricity, low volatility, and biodegradability. By 2026, demand from the automotive, manufacturing, and packaging industries is expected to rise, particularly in regions with strong green manufacturing policies. -

Growth in Renewable Diesel and Biodiesel Co-Product Utilization

Methyl oleate is often produced as a co-product or byproduct in biodiesel (FAME) production from high-oleic feedstocks. With global renewable diesel and biodiesel capacity expanding — especially in the U.S., Brazil, and Southeast Asia — the availability of methyl oleate is expected to increase. Producers are investing in downstream refining to isolate and purify methyl oleate for higher-value applications, enhancing profitability from biorefineries. -

Innovation in Specialty Chemical Applications

By 2026, R&D efforts will further unlock methyl oleate’s potential in high-value sectors: - Surfactants and Emulsifiers: Used in agrochemicals, personal care, and household cleaners, methyl oleate-based esters offer improved performance and environmental profiles.

- Polymer Additives: As a building block for bio-based polyols and acrylates, it supports sustainable polymer development.

-

Agricultural Adjuvants: Its use in pesticide formulations improves spray efficiency and reduces environmental impact.

-

Feedstock Availability and Price Volatility

Methyl oleate supply will depend heavily on the availability and pricing of high-oleic vegetable oils. While advances in oilseed crop breeding (e.g., high-oleic soybean) are improving yields, climate change and land-use competition may create price fluctuations. However, increased use of waste oils and non-food biomass could mitigate these risks and support a more stable supply chain. -

Regional Market Dynamics

- Europe: Leading in green chemistry adoption, Europe will remain a key market for high-purity methyl oleate, especially in cosmetics and pharmaceuticals.

- North America: Strong growth driven by renewable fuel mandates and bio-based product innovation.

-

Asia-Pacific: Rising industrialization and government support for bio-based chemicals in China and India will expand demand, though competition with lower-cost petrochemicals remains a challenge.

-

Competitive Landscape and Investment

Major oleochemical producers (e.g., KLK Oleo, IOI Corporation, Oleon) are expected to expand methyl oleate production capacity or form strategic partnerships to capture emerging opportunities. Investment in purification technologies and catalytic conversion processes will enhance product quality and open new markets.

Conclusion

By 2026, the methyl oleate market is projected to grow at a compound annual growth rate (CAGR) of 5–7%, driven by sustainability trends, regulatory support, and technological advancements. Its role as a versatile, renewable chemical intermediate will solidify its position in the green transition of the chemical industry. However, stakeholders must navigate feedstock volatility and invest in innovation to maintain competitiveness in this evolving landscape.

H2: Common Pitfalls in Sourcing Methyl Oleate – Quality and Intellectual Property Concerns

Sourcing methyl oleate, a fatty acid methyl ester derived from oleic acid, is critical for industries ranging from biofuels and lubricants to cosmetics and pharmaceuticals. However, procurement can be fraught with challenges, particularly regarding product quality and intellectual property (IP) risks. Below are the key pitfalls to avoid:

1. Quality-Related Pitfalls

a. Inconsistent Purity Levels

Methyl oleate purity can vary significantly between suppliers, especially if derived from different feedstocks (e.g., high-oleic sunflower oil vs. tallow). Impurities such as residual free fatty acids, glycerides, or other methyl esters (e.g., methyl palmitate, methyl stearate) can affect downstream performance.

Pitfall: Assuming all methyl oleate is equivalent without verifying certificate of analysis (CoA) specifications (e.g., GC purity >90%, low peroxide value).

Best Practice: Require detailed CoAs and validate with third-party testing for critical applications.

b. Oxidative Stability Issues

Methyl oleate contains a cis double bond, making it prone to oxidation. Poor storage or handling can lead to rancidity, color darkening, and formation of aldehydes or acids.

Pitfall: Overlooking storage conditions (e.g., nitrogen blanketing, antioxidants like BHT) and shelf life.

Best Practice: Specify antioxidant content and storage protocols in purchase agreements.

c. Variable Feedstock Sourcing

Suppliers may switch feedstocks (e.g., from plant-based to animal tallow) without notice, affecting physical properties and regulatory compliance (e.g., vegan, non-GMO, or REACH requirements).

Pitfall: Lack of transparency in supply chain origins.

Best Practice: Require traceability documentation and feedstock declarations.

d. Inadequate Specification Testing

Some suppliers may provide limited or outdated analytical data. Key parameters include:

– Iodine value (measure of unsaturation)

– Acid value (indicates hydrolysis)

– Water content

– Color (Gardner or APHA scale)

Pitfall: Accepting bulk shipments without batch-specific testing.

Best Practice: Enforce incoming quality control with a defined testing protocol.

2. Intellectual Property (IP) Risks

a. Infringement of Patented Processes

Methyl oleate may be produced using proprietary methods (e.g., enzymatic esterification, specific catalyst systems, or purification techniques). Even if the molecule itself is not patentable, its production method or use in a formulation might be.

Pitfall: Sourcing from suppliers using patented processes without a license, potentially exposing the buyer to infringement claims.

Best Practice: Conduct freedom-to-operate (FTO) analysis, especially if used in high-value applications (e.g., pharmaceuticals, specialty chemicals).

b. Trade Secret Misappropriation

Some suppliers may use process know-how protected as trade secrets. If the supplier is a contract manufacturer, ensure they are not using stolen or improperly licensed technology.

Pitfall: Indirect liability from associating with unethical suppliers.

Best Practice: Include IP warranties in supply agreements and perform due diligence on supplier legitimacy.

c. Lack of IP Clarity in Custom Modifications

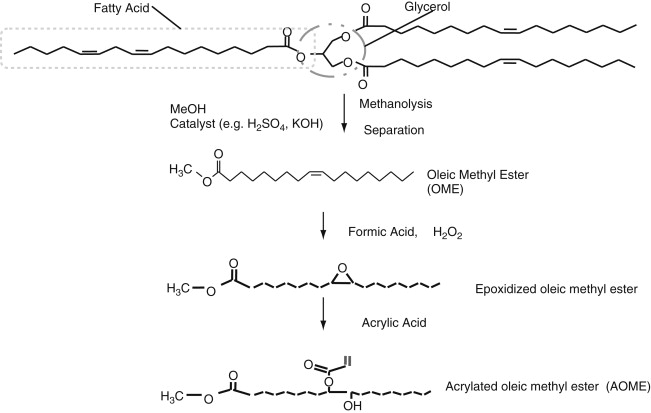

If methyl oleate is modified (e.g., epoxidized, hydrogenated), the resulting derivatives may be protected by patents. Sourcing unlicensed derivatives can lead to legal exposure.

Pitfall: Assuming that off-the-shelf modified methyl oleate is freely usable.

Best Practice: Verify IP status of derivatives and obtain usage rights where necessary.

Conclusion

To mitigate risks, buyers should:

– Require comprehensive quality documentation and conduct independent testing.

– Ensure feedstock transparency and stability controls.

– Perform IP due diligence, especially for innovative or regulated applications.

– Include robust quality and IP clauses in supplier contracts.

Proactive management of these pitfalls ensures reliable supply, product performance, and legal compliance when sourcing methyl oleate.

H2: Logistics & Compliance Guide for Methyl Oleate

1. Chemical Overview

– Chemical Name: Methyl Oleate

– CAS Number: 112-62-9

– Molecular Formula: C₁₉H₃₆O₂

– UN Number: Not regulated as a dangerous good (UN 3082 may apply if classified as environmentally hazardous, depending on formulation)

– Classification: Typically non-hazardous under GHS and DOT regulations; however, check specific formulation and concentration for impurities or additives.

– Physical State: Clear, pale yellow liquid

– Odor: Mild, oily

– Boiling Point: ~350°C

– Flash Point: ~177°C (closed cup) – classified as Combustible Liquid (not flammable per transport regulations)

2. Regulatory Classification & Compliance

GHS Classification (Globally Harmonized System):

– Not classified as hazardous under GHS in pure form:

– Not acutely toxic

– Not carcinogenic

– Not mutagenic

– Not reproductive toxicant

– Not hazardous to aquatic environment (though biodegradable, high concentrations may cause long-term adverse effects)

Transport Regulations:

– IMDG (Maritime): Not regulated as dangerous cargo when transported in pure form. May be subject to MARPOL Annex II if released in large quantities due to potential aquatic toxicity.

– IATA (Air): Not restricted as dangerous goods under IATA DGR (Packaging Instruction 902 may apply if environmentally hazardous).

– ADR (Road, Europe): Not classified as dangerous goods. Normal industrial transport rules apply.

– 49 CFR (US DOT): Not regulated as hazardous material in commerce when in pure form.

Environmental Regulations:

– EPA (USA): Listed on the TSCA Inventory. No significant restrictions under CERCLA or EPCRA for reporting (unless large spills occur).

– REACH (EU): Registered substance. No SVHC (Substances of Very High Concern) status.

– Biodegradability: Readily biodegradable (OECD 301 standards).

3. Storage & Handling

Storage Conditions:

– Store in a cool, dry, well-ventilated area.

– Keep containers tightly closed to prevent oxidation.

– Avoid prolonged exposure to heat or direct sunlight.

– Compatible with stainless steel, aluminum, HDPE, and fluoropolymers. Avoid copper and brass (may catalyze oxidation).

Handling Precautions:

– Use in well-ventilated areas.

– Avoid contact with eyes and prolonged skin contact (may cause mild irritation).

– Use PPE: gloves (nitrile), safety goggles, and protective clothing if handling large volumes.

– Ground containers during transfer to prevent static discharge (though not flammable, precautionary measure).

4. Transportation Logistics

Packaging:

– Available in:

– Drums (200 L steel or HDPE)

– Intermediate Bulk Containers (IBCs, 1000 L)

– Tank trucks or ISO tanks for bulk shipments

– Ensure containers are sealed and labeled appropriately with:

– Product name

– CAS number

– Supplier information

– GHS label (if required)

Labeling Requirements:

– Not required to display hazard labels in pure form.

– May require “Environmentally Hazardous Substance” label if impurities or additives trigger classification.

– Always include Safety Data Sheet (SDS) with shipment.

Documentation:

– Commercial Invoice

– Bill of Lading

– SDS (Safety Data Sheet) – must be GHS-compliant

– Certificate of Analysis (CoA) – upon request

5. Spill & Emergency Response

Spill Procedure:

1. Contain spill with absorbent materials (e.g., vermiculite, sand, or commercial absorbents).

2. Collect spilled material and place in labeled, sealed container for disposal.

3. Clean residue with detergent and water.

4. Prevent entry into drains, waterways, or soil.

Fire Hazards:

– Flash point > 177°C – low fire risk at ambient temperatures.

– In case of fire: Use foam, CO₂, dry chemical, or water spray.

– Combustion may produce CO, CO₂, and irritant fumes.

First Aid Measures:

– Inhalation: Move to fresh air.

– Skin Contact: Wash with soap and water.

– Eye Contact: Rinse thoroughly with water for at least 15 minutes. Seek medical advice if irritation persists.

– Ingestion: Do not induce vomiting. Rinse mouth and seek medical attention.

6. Disposal & Environmental Considerations

Waste Disposal:

– Dispose of in accordance with local, state, and federal regulations.

– May be incinerated in approved facilities with emission controls.

– Recycle if possible (reprocessing into biodiesel or lubricants).

– Do not dispose of into sewers or waterways.

Environmental Impact:

– Low toxicity to mammals but may be harmful to aquatic life in high concentrations.

– High biodegradability reduces long-term environmental persistence.

7. Regulatory Documentation & Support

- Safety Data Sheet (SDS): Always provide up-to-date GHS-compliant SDS (Section 14 covers transport classification).

- Compliance Support: Consult with regulatory specialists for country-specific import/export requirements (e.g., customs, REACH, TSCA).

Summary:

Methyl Oleate is generally considered a non-hazardous chemical for transport and handling when in pure form. However, compliance with labeling, storage, and environmental protection standards is essential. Always verify the specific formulation and consult the SDS prior to shipping or processing.

Note: This guide is based on standard industry data for pure methyl oleate. Always confirm with supplier-specific documentation and regulatory authorities in your region.

Conclusion for Sourcing Methyl Oleate

In conclusion, sourcing methyl oleate requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. As a versatile bio-based ester used across industries such as cosmetics, pharmaceuticals, agrochemicals, and biodiesel, ensuring a consistent and high-purity supply is critical. Potential suppliers should be evaluated based on their production standards, regulatory compliance (e.g., REACH, FDA), and ability to provide analytical certifications (e.g., GC/MS, GC-FID).

Sourcing from reputable chemical manufacturers or specialized oleochemical producers—particularly those with integrated supply chains from renewable feedstocks—can enhance traceability and support sustainability goals. Additionally, geographic considerations, logistics, and volume requirements will influence optimal supplier selection. Long-term contracts and strong supplier relationships can mitigate price volatility and ensure supply security.

Ultimately, a well-structured sourcing strategy for methyl oleate should align with technical specifications, environmental objectives, and business scalability, ensuring both performance and compliance across downstream applications.