The global light gauge steel framing market, which includes 2×4 metal studs, is experiencing steady growth driven by rising demand for sustainable, fire-resistant, and dimensionally stable construction materials. According to Grand View Research, the market was valued at USD 32.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by increased adoption in residential and commercial construction, particularly in North America and Europe, where builders are shifting away from traditional wood framing toward steel for its durability and precision. As demand for high-quality, code-compliant metal stud systems rises, a select group of manufacturers have emerged as leaders in innovation, scale, and product reliability. Based on production capacity, market presence, and technical specifications, the following are the top 10 manufacturers of 2×4 metal studs shaping the future of modern construction.

Top 10 Metal Stud 2X4 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SCAFCO Steel Stud Company

Domain Est. 1997

Website: scafco.com

Key Highlights: SCAFCO Steel Stud Company is a manufacturer of a complete line of steel framing products and accessories with direct access to our engineering department….

#2 Current Metal Stud Pricing

Domain Est. 2021

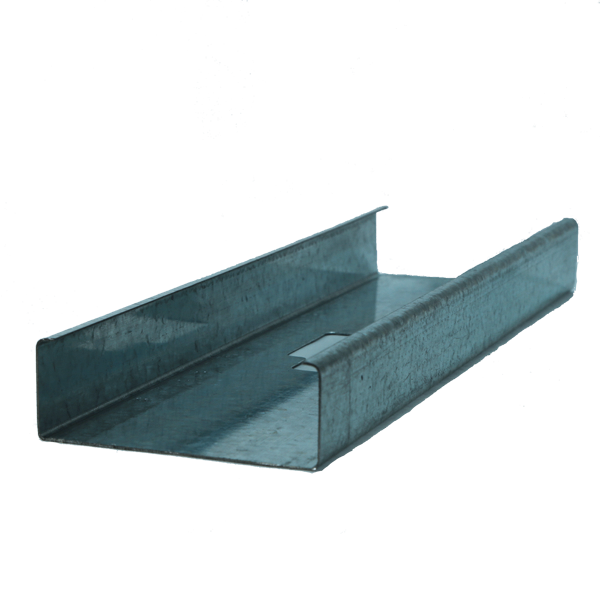

#3 Steel Framing Products

Domain Est. 1996

Website: cemcosteel.com

Key Highlights: All of these c-studs and tracks are manufactured from the highest quality G40 hot-dipped galvanized steel ranging in thicknesses from 15 mils up to 33 mils….

#4 Steeler Construction Supply: Metal Stud Framing

Domain Est. 1998

Website: steeler.com

Key Highlights: Your one-stop shop for steel studs, gypsum board, drywall screws, and all-things drywall construction….

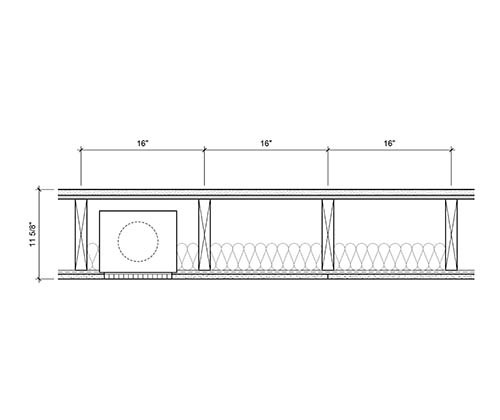

#5 U305

Domain Est. 1998

Website: nationalgypsum.com

Key Highlights: Framing: 2×4 wood studs 16″ o.c.; Insulation: 3-1/2″ glass-fiber insulation; Side 1: 5/8″ Fire-Shield Gypsum Board; Side 2: 5/8″ Fire-Shield Gypsum Board on ……

#6 Metal Framing, Studs, & Tracks

Domain Est. 1999

Website: lwsupply.com

Key Highlights: We carry a wide selection of metal framing, studs, and tracks to support all types of projects. Our branches stock a wide range of studs and tracks in several ……

#7 Super Stud Building Products

Domain Est. 2002

Website: buysuperstud.com

Key Highlights: Super Stud provides technical engineering and design services for comprehensive project support including shop drawings under PE seal….

#8 Structural Stud: Exterior Structural Framing

Domain Est. 2006

#9 OEG Structural Stud

Domain Est. 2006

Website: oegusa.com

Key Highlights: OEG Structural Studs are general purpose framing component used in a variety of applications including load bearing interior and exterior walls….

#10 Structural Studs

Domain Est. 2011

Website: clarkdietrich.com

Key Highlights: A metal stud is ductile and therefore can perform at a wide range of deflections. Wall facing materials tend to be more brittle (Brick, Stucco or EIFS), and ……

Expert Sourcing Insights for Metal Stud 2X4

H2: Market Trends for 2X4 Metal Studs in 2026

As the construction industry evolves in response to sustainability mandates, material efficiency demands, and technological advancements, the market for 2X4 metal studs is poised for significant transformation by 2026. Key trends shaping the sector include growing adoption in light-gauge steel framing, increased focus on resilient and fire-resistant construction, and the influence of green building standards. Below is an analysis of the primary market dynamics expected to impact the 2X4 metal stud segment in 2026.

1. Rising Demand in Residential and Multi-Family Construction

The shift toward non-combustible materials in residential construction—especially in high-density urban areas and wildfire-prone regions—is accelerating the adoption of metal studs. In 2026, the 2X4 metal stud will see increased use in multi-family housing, senior living facilities, and modular homes due to its durability, straightness, and resistance to pests and moisture. Builders are increasingly favoring cold-formed steel (CFS) framing over traditional wood, particularly as lumber price volatility persists.

2. Sustainability and Green Building Regulations

With stricter energy codes and green certification programs (e.g., LEED, Living Building Challenge), metal studs—particularly those made from recycled steel—are becoming a preferred structural component. The recyclability of steel (up to 100%) aligns with net-zero building goals. By 2026, building owners and developers are expected to prioritize materials with low embodied carbon, further boosting demand for certified, low-carbon 2X4 metal studs.

3. Technological Integration and Prefabrication

Advancements in Building Information Modeling (BIM) and off-site fabrication are streamlining the use of metal studs in construction. In 2026, precision-engineered 2X4 metal stud systems will be increasingly pre-assembled in factories for rapid on-site installation, reducing labor costs and project timelines. This trend is especially strong in Design-Build and modular construction projects, where dimensional accuracy and repeatability are critical.

4. Competitive Pricing and Supply Chain Resilience

While steel prices are subject to global market fluctuations, improved domestic production capacity in North America and recycling infrastructure are expected to stabilize input costs by 2026. Manufacturers are investing in localized distribution networks to reduce lead times and mitigate supply chain disruptions. As a result, metal studs are becoming more cost-competitive with dimensional lumber, particularly when lifecycle performance is considered.

5. Regional Growth Drivers

Markets in the Sun Belt (e.g., Texas, Florida, Arizona) are expected to lead demand due to population growth, urban development, and stringent fire codes. Internationally, emerging markets in Southeast Asia and the Middle East are adopting metal framing for high-rise construction, further expanding the global footprint of 2X4 metal stud applications.

6. Innovation in Product Design

Manufacturers are enhancing 2X4 metal studs with features such as pre-punched service holes, corrosion-resistant coatings (e.g., Galvalume®), and improved thermal break technologies to support energy-efficient wall assemblies. These innovations will enhance ease of installation and compliance with updated energy codes by 2026.

Conclusion

By 2026, the 2X4 metal stud market will be characterized by stronger demand, driven by performance advantages, regulatory support, and integration into modern construction methodologies. As the industry moves toward sustainable, resilient, and efficient building practices, metal studs are set to play a central role in shaping the future of structural framing.

Common Pitfalls When Sourcing Metal Studs 2×4 (Quality, IP)

Sourcing metal studs, particularly 2×4 dimensions, requires careful attention to material quality, structural specifications, and compliance with industry standards. Below are common pitfalls related to quality and intellectual property (IP) that buyers and contractors should avoid.

Poor Material Quality

One of the most frequent issues when sourcing metal studs is receiving substandard materials. Low-quality steel may not meet required gauge thickness (e.g., 25, 20, or 18 gauge), leading to structural weaknesses, warping, or failure under load. Some suppliers may use recycled or inconsistent steel blends that compromise durability and fire resistance.

Non-Compliance with Industry Standards

Metal studs must comply with standards such as ASTM C645 (Standard Installation Methods) and ASTM C955 (Load-Bearing Steel Framing). Sourcing studs that do not meet these specifications can lead to code violations, failed inspections, and safety hazards. Always verify that the product documentation includes compliance certifications.

Inadequate Galvanization and Corrosion Resistance

Insufficient galvanization (e.g., less than G90 coating) can result in premature rusting, especially in humid or moisture-prone environments. Buyers should ensure the studs have proper zinc coating to meet environmental demands and longevity expectations.

Misrepresentation of Product Specifications

Some suppliers may mislabel stud dimensions or strength ratings. A “2×4” metal stud refers to nominal dimensions (typically 3-5/8” wide), but deviations in actual width, flange size, or web depth affect compatibility with accessories and performance. Always request detailed technical data sheets and conduct spot checks upon delivery.

Intellectual Property (IP) Infringement

Using or sourcing metal studs that replicate patented designs (e.g., proprietary track systems, snap-in connectors, or specialized flange geometries) without authorization can lead to legal liability. Some manufacturers hold patents on unique stud profiles or assembly methods. Sourcing from unauthorized third parties who copy these designs may expose contractors or developers to IP litigation.

Lack of Traceability and Manufacturer Authenticity

Counterfeit or unbranded studs without clear manufacturer identification pose significant risks. Without traceability, it is difficult to verify warranties, ensure replacement part compatibility, or defend against liability claims. Always source from reputable suppliers with verifiable chain-of-custody documentation.

Conclusion

To avoid these pitfalls, conduct due diligence by vetting suppliers, requesting material test reports, confirming compliance with building codes, and ensuring that no intellectual property rights are violated. Investing time upfront in proper sourcing protects project integrity, safety, and legal standing.

Logistics & Compliance Guide for Metal Stud 2×4

This guide outlines the key logistics considerations and compliance requirements for handling, transporting, and using 2×4 metal studs in construction projects. Adhering to these standards ensures safety, efficiency, and regulatory compliance.

Product Specifications and Identification

Metal studs labeled as “2×4” are typically cold-formed steel (CFS) framing members designed to mimic the dimensions of traditional 2×4 wood studs. Actual dimensions usually measure approximately 1.625 inches (41 mm) in flange width and 3.5 inches (89 mm) in depth. These studs are commonly made from galvanized steel (e.g., G60 or G90 coating) to resist corrosion. Key identifiers include manufacturer markings, gauge (e.g., 20, 18, 16), and compliance labels indicating adherence to ASTM standards.

Packaging and Handling Requirements

Metal studs are generally bundled and strapped for secure transport. Bundles should be stacked flat on skids or pallets to prevent warping. Protective end caps or corner guards are recommended to avoid damage during handling. Workers must use appropriate lifting techniques or mechanical equipment (e.g., forklifts, cranes) to prevent injury and material deformation. On-site storage should be elevated, covered, and protected from moisture to prevent rust and maintain coating integrity.

Transportation and Shipping Considerations

When transporting metal studs, ensure loads are properly secured using straps or chains to prevent shifting. Loads should be evenly distributed and not exceed legal weight limits. Overhang beyond the trailer should comply with Department of Transportation (DOT) regulations and be marked with warning flags if applicable. Route planning should avoid low bridges or narrow roads that could damage long stud bundles. Temperature and humidity during transit should be monitored if condensation is a concern.

Regulatory and Building Code Compliance

Metal studs must comply with applicable building codes such as the International Building Code (IBC) and International Residential Code (IRC). They should be manufactured in accordance with ASTM C645 (Standard Specification for Installation of Steel Framing) and ASTM A1003 (Standard Specification for Steel Sheet, Carbon, Metallic- and Nonmetallic-Coated, for Cold-Formed Framing Products). Local jurisdictions may require third-party certification (e.g., ICC-ES reports) to verify structural performance and fire resistance ratings.

Fire Safety and Environmental Standards

Metal studs are inherently non-combustible and contribute positively to fire-rated wall assemblies. They must be used in configurations that meet required fire-resistance ratings (e.g., 1-hour or 2-hour walls) as tested and listed by recognized laboratories (e.g., UL, ULC). Environmentally, galvanized steel is recyclable, and manufacturers should provide Environmental Product Declarations (EPDs) and comply with regulations such as RoHS (Restriction of Hazardous Substances) where applicable.

Installation and Field Compliance

Installation must follow the manufacturer’s guidelines and engineering specifications. Proper fastening with compatible screws (e.g., Type S or Type W) and correct spacing (typically 16″ or 24″ on center) is essential. Alignment, plumb, and level must be verified during installation. Inspections may be required at framing stages to ensure compliance with design and code requirements. Modifications should not compromise structural integrity and must be approved by a structural engineer if deviating from approved designs.

Documentation and Record Keeping

Maintain records of material submittals, mill test reports, certification documents, and inspection reports. These documents verify compliance with project specifications and codes. In the event of audits or disputes, proper documentation supports traceability and accountability throughout the supply chain.

Conclusion

Proper logistics planning and adherence to compliance standards are critical for the successful use of 2×4 metal studs in construction. By following this guide, stakeholders can ensure safety, performance, and regulatory alignment from manufacturing to final installation.

Conclusion for Sourcing Metal Studs (2×4):

Sourcing 2×4 metal studs requires a strategic approach that balances cost, quality, availability, and project-specific requirements. After evaluating various suppliers, pricing models, material standards (such as ASTM C645 and gauge thickness), and delivery timelines, it is evident that selecting the right vendor plays a critical role in ensuring project efficiency and structural integrity. Local suppliers offer faster delivery and potential logistical savings, while national or online distributors may provide competitive pricing and broader product selection. Additionally, considering factors like sustainability, lead times, and compatibility with framing accessories ensures a seamless construction process. In conclusion, a well-researched sourcing strategy—aligned with project timelines, budget constraints, and quality standards—will optimize the performance and cost-effectiveness of metal stud framing systems in any construction application.