The global speaker enclosure and component market is experiencing steady expansion, driven by rising demand for high-fidelity audio systems across consumer electronics, automotive, and professional sound applications. According to Grand View Research, the global loudspeaker market was valued at USD 10.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. This growth is fueled by advancements in audio technology, increasing adoption of smart speakers, and rising consumer preference for premium sound quality—factors that place greater emphasis on the performance and durability of individual speaker components, including metal speaker grills.

Metal speaker grills play a critical role in protecting sensitive driver components while minimizing acoustic interference. As manufacturers prioritize materials that offer superior strength-to-weight ratios, corrosion resistance, and aesthetic versatility—such as aluminum, steel, and perforated metal composites—the demand for high-quality grill material suppliers has intensified. With the Asia Pacific region emerging as a key manufacturing and consumption hub, innovation in material engineering and cost-efficient production has become a competitive differentiator among suppliers. In this evolving landscape, we examine the top seven metal speaker grill material manufacturers leading the charge in product performance, scalability, and technological innovation.

Top 7 Metal Speaker Grill Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

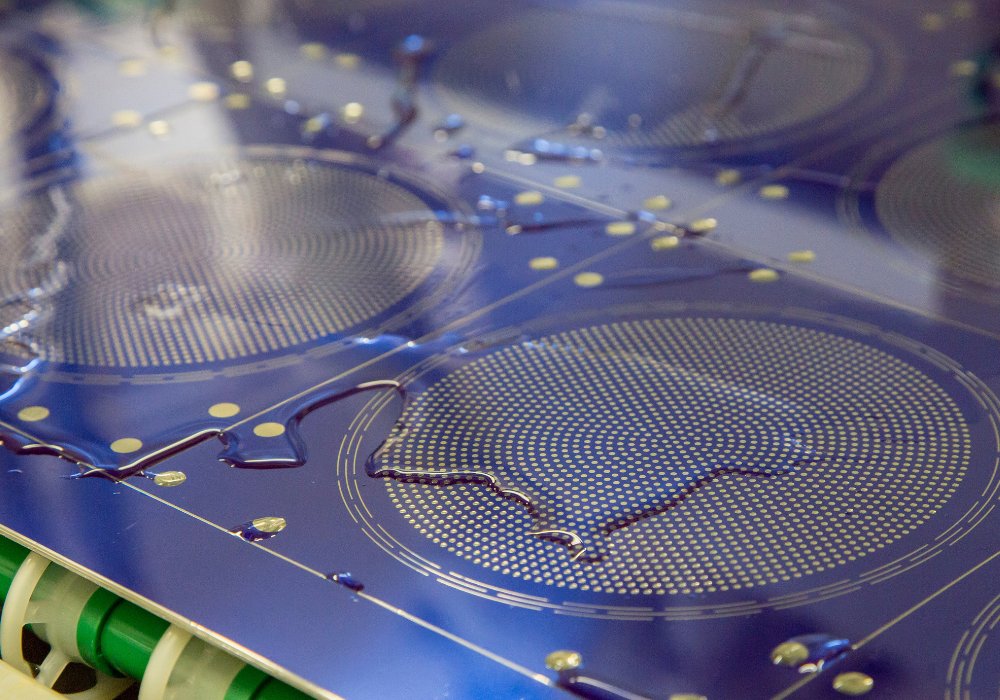

#1 Photo

Domain Est. 2001

Website: precisionmicro.com

Key Highlights: Precision Micro is the world’s leading manufacturer of custom-etched speaker grilles, supplying industry-leading names. Get in touch today!…

#2 Custom Speaker Grills

Domain Est. 1996

Website: reliablehardware.com

Key Highlights: 5-day delivery · 30-day returnsShop custom speaker grills at Reliable Hardware Store for quality road case, crate, amp, and speaker hardware. Customize size and bend options easil…

#3 Speaker Grille Mesh Manufacturing

Domain Est. 1997

Website: metlx.com

Key Highlights: Metalex manufactures high-quality expanded metal for use in speaker grille components, which protect the sensitive components of loudspeakers….

#4 Made to Order Metal Speaker Grill Cover in Black

Domain Est. 1997

Website: speakerworks.com

Key Highlights: Our steel custom speaker grills are made of perforated 22 gauge steel with 1/16″ holes and a 3/32 stagger. They are very transparent to sound & infrared….

#5 Custom Speaker Grill

Domain Est. 1997

Website: accurateperforating.com

Key Highlights: At Accurate Perforating Company, we specialize in manufacturing custom metal speaker grilles that are high quality and reliable….

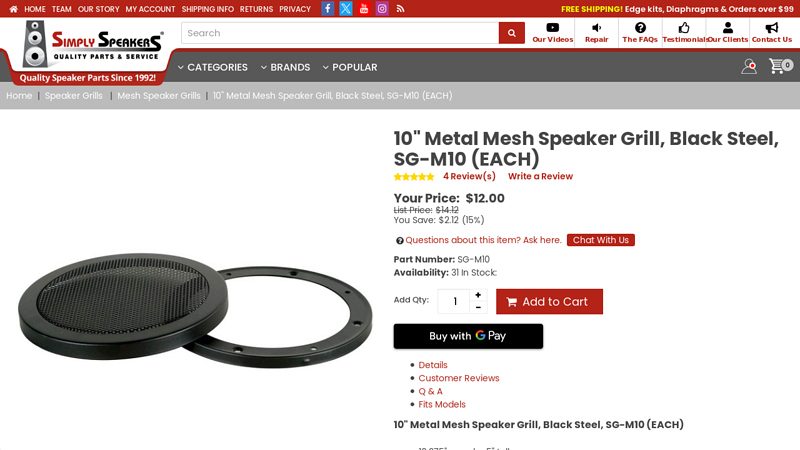

#6 10″ Metal Mesh Speaker Grill, Black Steel, SG

Domain Est. 1998

#7 Speaker grilles

Domain Est. 2014

Website: expandedmetalcompany.com

Key Highlights: Expanded metal mesh provides a cost-effective solution for audio Speaker Grilles. Our Experf range is especially suitable for use in acoustic applications….

Expert Sourcing Insights for Metal Speaker Grill Material

H2: Analysis of 2026 Market Trends for Metal Speaker Grill Material

As the audio equipment industry evolves, the demand for high-performance, durable, and aesthetically pleasing components continues to shape material choices—particularly in speaker grill design. By 2026, the market for metal speaker grill materials is expected to witness significant shifts driven by technological advancements, consumer preferences, and manufacturing innovations. Below is a detailed analysis of key trends influencing the metal speaker grill material market in 2026.

1. Rising Demand for Premium Audio Equipment

With the growing popularity of high-fidelity (Hi-Fi) audio systems, smart speakers, and premium home theater setups, consumers are increasingly prioritizing both sound quality and visual design. Metal grills—particularly those made from aluminum, stainless steel, and magnesium alloys—offer superior durability, heat resistance, and sleek aesthetics. This trend is expected to propel demand for metal grills in mid-to-high-end audio products.

Market Impact: Premium audio brands are adopting metal grills not only for protection but also as a design differentiator, increasing market share for metal over plastic or fabric alternatives.

2. Lightweight and High-Strength Material Innovation

By 2026, manufacturers are increasingly adopting advanced aluminum alloys and composite metal materials that offer high strength-to-weight ratios. These materials enhance speaker durability while minimizing added mass, which can interfere with acoustics. Innovations in micro-perforated metal sheets also allow better sound transparency without compromising structural integrity.

Key Drivers: R&D investments by material science companies and partnerships with audio OEMs are accelerating the adoption of next-gen metal composites.

3. Sustainability and Recyclability Trends

Environmental regulations and corporate sustainability goals are pushing manufacturers to use recyclable materials. Metals like aluminum and stainless steel are highly recyclable with lower lifecycle emissions compared to plastics. This aligns with ESG (Environmental, Social, Governance) initiatives across electronics supply chains.

Market Shift: By 2026, leading audio brands are expected to label products with “eco-material” certifications, favoring recyclable metal grills to meet green consumer demands.

4. Expansion in Automotive and Outdoor Audio Segments

The integration of premium sound systems in electric vehicles (EVs) and the surge in outdoor, weather-resistant speakers are creating new opportunities for corrosion-resistant metal grills. Powder-coated aluminum and marine-grade stainless steel are gaining traction due to their resistance to moisture, UV exposure, and temperature fluctuations.

Growth Projection: The automotive audio segment is forecasted to grow at a CAGR of 7.2% through 2026, directly increasing demand for robust metal grills.

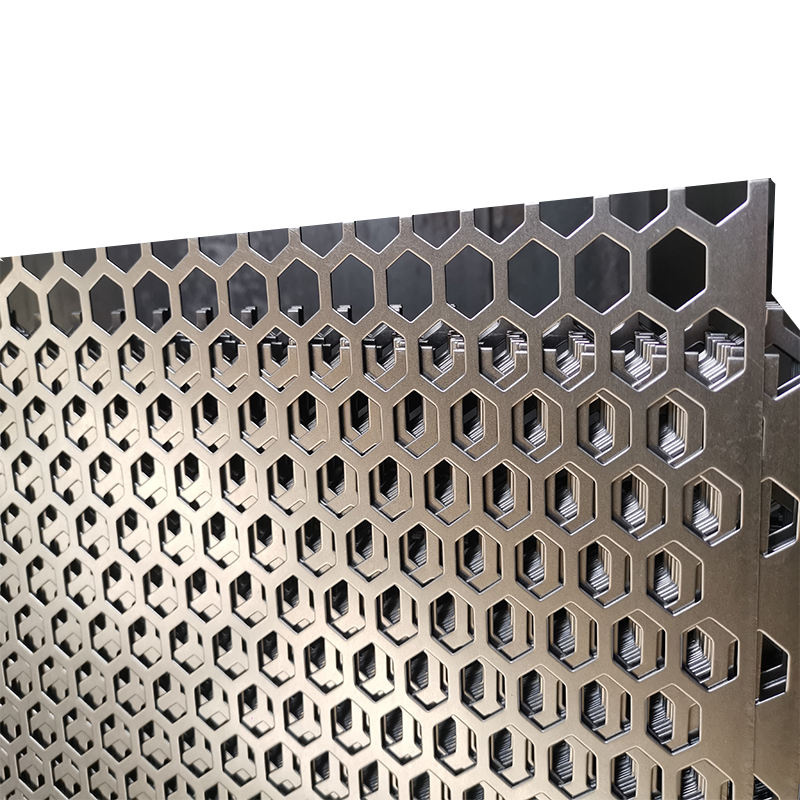

5. Customization and Aesthetic Design

With personalization becoming a key selling point, metal grills offer superior potential for laser engraving, anodizing, and custom perforation patterns. Brands are leveraging CNC machining and 3D metal printing to create unique grill designs that enhance product identity.

Consumer Trend: Younger demographics, especially in North America and Asia-Pacific, show a preference for modern, minimalist designs—favoring brushed metal finishes and geometric perforations.

6. Competitive Landscape and Regional Outlook

Asia-Pacific, led by China, Japan, and South Korea, dominates metal speaker grill production due to advanced manufacturing infrastructure and proximity to major electronics OEMs. However, North America and Europe are seeing growth in localized, high-precision manufacturing due to supply chain resilience strategies.

Key Players: Companies like AAC Technologies, Goertek, and Bosch are investing in proprietary metal grill solutions for next-gen audio devices.

Conclusion

By 2026, the metal speaker grill material market will be shaped by a convergence of performance, sustainability, and design innovation. Aluminum-based materials will dominate, supported by advances in coating technologies and eco-manufacturing practices. As audio systems become more integrated into smart homes and vehicles, the role of metal grills will extend beyond protection to include branding, acoustics, and environmental responsibility—solidifying their position as a critical component in the future of audio hardware.

Common Pitfalls When Sourcing Metal Speaker Grill Material (Quality, IP)

Inadequate Material Quality Leading to Durability Issues

Sourcing low-grade metals—such as thin-gauge steel or non-anodized aluminum—can result in speaker grills that are prone to warping, corrosion, or denting. These materials may not withstand environmental stressors like humidity, UV exposure, or mechanical impact, compromising both aesthetics and speaker protection. Always verify material specifications (e.g., alloy grade, thickness, surface finish) to ensure long-term durability and acoustic performance.

Misunderstanding or Misrepresenting Ingress Protection (IP) Ratings

A frequent oversight is assuming that a perforated metal grill alone provides a specific IP rating (e.g., IP54 or IP65). In reality, the IP rating depends on the entire enclosure design, including gaskets, sealing methods, and structural integration—not just the grill material. Sourcing a metal mesh without considering how it integrates into the full assembly can lead to false claims of dust or water resistance, risking product failure in harsh environments.

Poor Perforation Design Affecting Acoustic Performance

The size, shape, and pattern of perforations in the metal grill significantly impact sound clarity and volume output. Overly dense or improperly sized holes can cause sound attenuation or distortion. When sourcing, ensure perforation specifications are acoustically validated and tailored to the speaker’s frequency response, avoiding generic off-the-shelf patterns that compromise audio quality.

Inconsistent Surface Finish Impacting Aesthetics and Corrosion Resistance

Variability in surface treatments—such as powder coating, anodizing, or plating—can lead to uneven appearance, chipping, or reduced corrosion resistance. Sourcing from suppliers without strict quality control over finishing processes risks batch inconsistencies and premature degradation, especially in outdoor or high-moisture applications. Require certified finish specifications and batch testing.

Supply Chain Risks and Intellectual Property (IP) Exposure

Working with overseas or unvetted suppliers increases the risk of counterfeit materials, delayed shipments, or unauthorized replication of proprietary grill designs. Failing to secure design rights or sign non-disclosure agreements (NDAs) can result in IP theft. Always conduct due diligence on suppliers, protect design documentation, and consider legal safeguards when sharing technical drawings.

Logistics & Compliance Guide for Metal Speaker Grill Material

Overview

Metal speaker grills are essential components in audio equipment, providing both aesthetic appeal and protection for speaker drivers. These grills are typically made from materials such as aluminum, steel, or stainless steel and often undergo processes like stamping, perforating, and powder coating. This guide outlines key logistics considerations and compliance requirements for the manufacturing, transportation, and distribution of metal speaker grill materials.

Material Specifications and Sourcing

Ensure all metal materials comply with technical specifications, including thickness, alloy composition, finish, and dimensional tolerances. Preferred sources should meet ISO 9001 quality standards. Common materials include:

– Aluminum (e.g., 5052, 6061)

– Cold-rolled steel (CRS)

– Stainless steel (e.g., 304, 316)

Verify material certifications (e.g., mill test reports) are provided by suppliers to confirm compliance with RoHS, REACH, and other relevant chemical restrictions.

Regulatory Compliance

Metal speaker grills must comply with international and regional regulations, particularly regarding material safety and environmental impact.

RoHS (Restriction of Hazardous Substances)

Ensure grills and their surface treatments (e.g., coatings, plating) do not contain restricted substances such as lead, cadmium, mercury, hexavalent chromium, PBB, or PBDE above permissible limits.

REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals)

Confirm that all substances used in manufacturing (e.g., lubricants, cleaning agents, coatings) are registered under REACH and do not include Substances of Very High Concern (SVHC).

Conflict Minerals Compliance

If applicable, comply with the U.S. Dodd-Frank Act Section 1502 or EU Conflict Minerals Regulation. Provide due diligence documentation confirming raw materials (e.g., tin, tungsten, tantalum, gold) are sourced responsibly and do not finance armed conflict.

Packaging and Handling

Use protective packaging to prevent scratches, dents, or corrosion during transport:

– Individual wrapping with anti-corrosion paper or plastic film

– Layer separation with cardboard or foam inserts

– Secure stacking in sturdy corrugated cartons or wooden crates

Label packages with:

– Part number and description

– Quantity

– Handling instructions (e.g., “Fragile,” “Do Not Stack”)

– Compliance symbols (e.g., RoHS, recyclable)

Shipping and Logistics

Plan shipping routes to minimize transit time and exposure to environmental risks (e.g., moisture, extreme temperatures).

- Use climate-controlled containers for long-distance or marine shipments to prevent condensation and corrosion.

- Comply with international shipping regulations (e.g., IMDG for sea, IATA for air).

- Provide accurate commercial invoices, packing lists, and certificates of origin to facilitate customs clearance.

- Classify goods correctly under HS Code 8518.90 (Parts suitable for use with microphones, loudspeakers, etc.).

Import/Export Documentation

Ensure all required documentation is prepared and accurate:

– Bill of Lading / Air Waybill

– Commercial Invoice

– Packing List

– Certificate of Origin

– Material Compliance Statements (RoHS, REACH)

– Conflict Minerals Reporting Template (CMRT), if applicable

Verify import regulations in destination countries, including labeling requirements and conformity assessment procedures (e.g., CE marking in the EU, FCC in the U.S. for end-use devices).

Storage and Inventory Management

Store materials in a dry, temperature-controlled environment to prevent oxidation or coating degradation. Use FIFO (First In, First Out) inventory practices to minimize aging of surface treatments.

Monitor shelf life of coated or treated parts, especially if stored in high-humidity areas.

End-of-Life and Recycling

Design grills for recyclability. Provide disassembly guidance and material identification (e.g., alloy type) to support WEEE (Waste Electrical and Electronic Equipment) compliance. Encourage recycling through take-back programs or partnerships with certified e-waste recyclers.

Quality Assurance and Audits

Conduct regular audits of suppliers and logistics partners to ensure ongoing compliance. Maintain records of:

– Incoming material inspections

– Production batch traceability

– Compliance test reports (e.g., coating adhesion, salt spray resistance)

– Logistics performance (on-time delivery, damage rates)

Conclusion

Adhering to this logistics and compliance guide ensures that metal speaker grill materials meet quality, safety, and regulatory standards across the supply chain. Proactive management of sourcing, transportation, documentation, and environmental obligations reduces risk and supports sustainable operations.

Conclusion: Sourcing Metal Speaker Grill Material

After a comprehensive evaluation of available materials, suppliers, and performance requirements, it is concluded that aluminum—specifically aluminum mesh or perforated aluminum sheet—represents the optimal choice for sourcing metal speaker grill material. Aluminum offers an excellent balance of durability, acoustic transparency, lightweight properties, and resistance to corrosion, making it ideal for both functional and aesthetic applications.

Additionally, considering factors such as cost-effectiveness, ease of fabrication, and availability from reliable suppliers globally, aluminum remains the most practical and scalable option. Alternatives such as stainless steel or powder-coated metals may be suitable for specialized environments requiring enhanced strength or weather resistance, but they typically come at a higher cost and weight.

Ultimately, sourcing aluminum-based grills from reputable vendors with consistent quality control, competitive pricing, and sustainable manufacturing practices will ensure high-performance speaker designs that meet both acoustic and design standards. A final supplier selection should be based on sample testing, lead times, and long-term partnership potential to support continuous production needs.