The global abrasive materials market, driven by rising demand across automotive, aerospace, and metal fabrication industries, is projected to grow at a CAGR of 4.8% from 2023 to 2028, according to Mordor Intelligence. With metal sanding and surface preparation remaining a critical step in industrial manufacturing and maintenance workflows, the demand for high-performance metal sand paper has intensified. This growth is further fueled by technological advancements in coated abrasives and the expanding need for precision finishing in emerging markets. As competition among manufacturers heats up, identifying the top players—those offering durability, innovation, and consistent quality—has become essential for both industrial buyers and procurement professionals. Based on market presence, product range, and technological innovation, here are the top 10 metal sand paper manufacturers shaping the industry’s future.

Top 10 Metal Sand Paper Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Apex Abrasives – Sandpaper

Website: apex-abrasives.com

Key Highlights: Apex Abrasives is a leading manufacturer of silicon carbide sandpaper & sanding products and supplies. We make sandpaper in every grit and size for ……

#2 Abrasive manufacturer Starcke in Melle » Sandpaper manufacturer

Website: starcke.de

Key Highlights: Welcome to Starcke GmbH & Co. KG, the renowned manufacturer of abrasives in Melle ✓ Production with the highest quality standards ✓ Find out more!…

#3 3M Sandpaper Sheets & Rolls for Metalworking

Domain Est. 1988

Website: 3m.com

Key Highlights: Individual sheets or lengths of paper-backed, flat-stock straight-edge abrasives used in sanding, grinding, deburring, and finishing applications….

#4 Abrasives

Domain Est. 1995

Website: rustoleum.com

Key Highlights: No matter what needs sanding, Gator offers abrasives for the job. Find sandpaper, cutting and grinding tools, and abrasives for floors, drywall, vehicles and ……

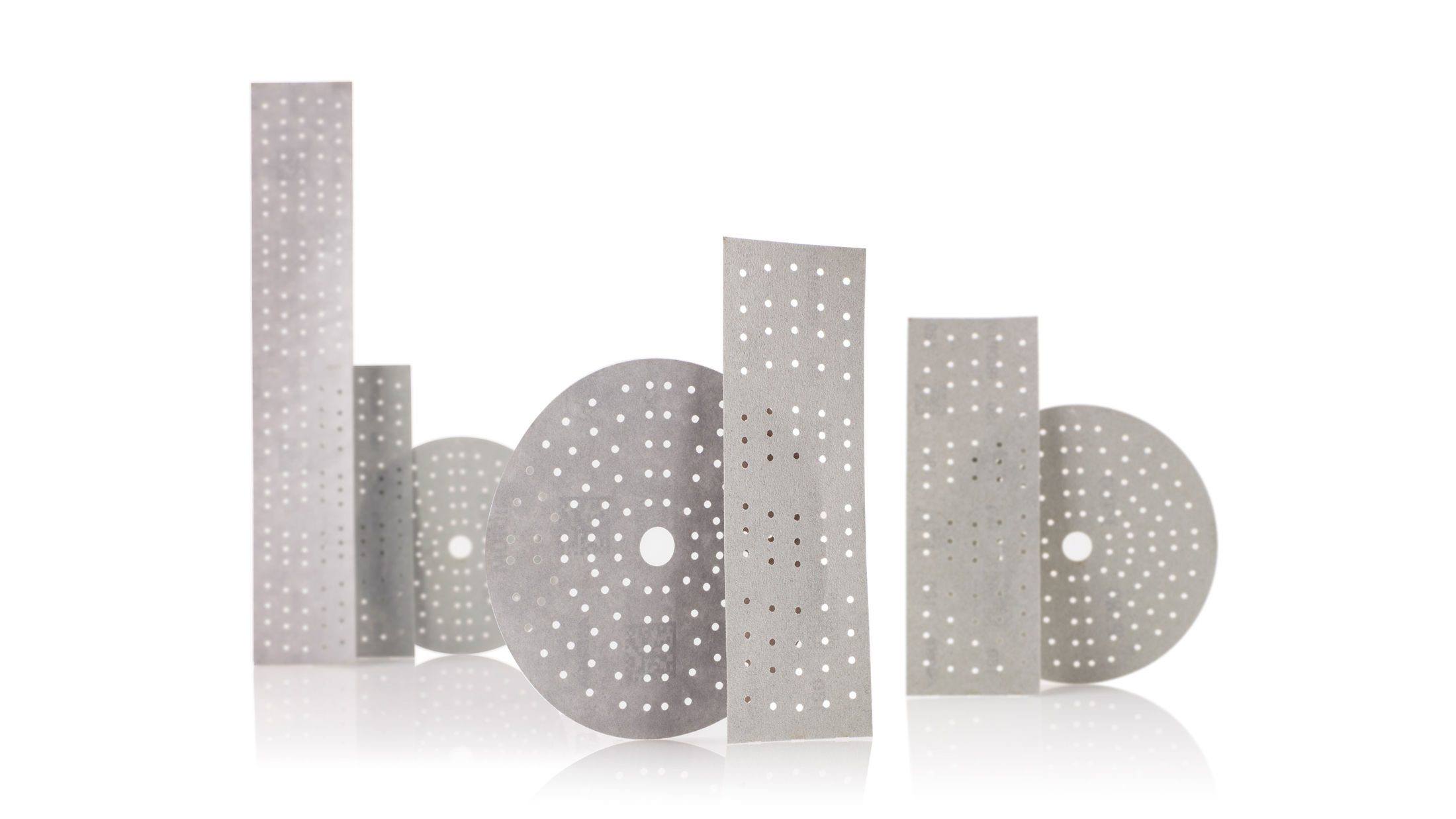

#5 Sanding Sheets for Metalworking

Domain Est. 1996

Website: sandpaper.com

Key Highlights: Consistent coating and meticulous quality control allow Uneeda to offer the highest quality waterproof sandpaper for metallic surfaces. Find you sheets now!…

#6 Iridium – Abrasives for Professional Sanding

Domain Est. 1997

Website: mirka.com

Key Highlights: Iridium is a family of premium abrasives and polishing compounds designed to deliver professional results. Whether your business is in repairs or manufacturing; ……

#7

Domain Est. 1998

Website: nortonabrasives.com

Key Highlights: An industry leader in abrasives for 130 years and counting. Get to know Norton. Browse our products, watch our videos, leverage our expertise articles, and ……

#8 Abrasive Paper Sheets Archives

Domain Est. 1998

Website: unitedabrasives.com

Key Highlights: Stearate Aluminum Oxide (3S) 9″ x 11″ Paper Sheet · Extremely long lasting · Open coat structure prevents loading · Use dry only · C-weight paper backing – medium ……

#9 sia Abrasives Industries AG

Domain Est. 2005

Website: siaabrasives.com

Key Highlights: Bonded and flexible abrasives, foam and fleece abrasive solutions and sandpaper for automotive, wood and metal applications….

#10 Sunmight USA

Domain Est. 2006

Website: sunmightusa.com

Key Highlights: Products. Ceramic Film · Film · Gold · Sun Foam · Sun Net · Flexible Film · Waterproof · Scuff Products · Flex Sanding Sponge; Sanding Systems · Application….

Expert Sourcing Insights for Metal Sand Paper

H2: Market Trends in Metal Sand Paper for 2026

The global metal sand paper market is poised for significant transformation by 2026, driven by technological advancements, evolving industrial demands, and sustainability initiatives. This analysis explores key trends expected to shape the market landscape in the coming years.

-

Growing Demand from Automotive and Aerospace Industries

The automotive and aerospace sectors are major consumers of metal sand paper due to their reliance on precision surface finishing. As electric vehicle (EV) production expands and aerospace manufacturers adopt lightweight alloys, demand for high-performance abrasive solutions is increasing. By 2026, metal sand paper with enhanced durability and precision will be critical for smoothing composites, aluminum, and high-strength steel components. -

Shift Toward High-Performance and Specialty Abrasives

Manufacturers are focusing on developing sand papers with advanced abrasive grains such as ceramic alumina and zirconia. These materials offer longer lifespan, higher cutting efficiency, and better heat resistance—qualities essential for industrial automation and robotic sanding systems. Customized solutions tailored for specific metals (e.g., stainless steel, titanium) are expected to gain traction. -

Rise of Automation and Robotics in Surface Preparation

With increased adoption of robotic sanding in manufacturing, metal sand paper formulations are being optimized for consistent performance under automated conditions. Products designed for robotic compatibility—featuring uniform backing materials, anti-clogging coatings, and precise grit consistency—are projected to dominate the industrial segment by 2026. -

Sustainability and Eco-Friendly Production

Environmental regulations are pushing manufacturers to reduce volatile organic compounds (VOCs) and adopt recyclable backings and biodegradable resins. Brands investing in green manufacturing processes and eco-conscious packaging are likely to gain competitive advantage. Additionally, reusable or long-life sanding products are becoming more popular to reduce waste. -

Expansion in Emerging Markets

Rapid industrialization in Asia-Pacific (particularly China, India, and Southeast Asia), coupled with infrastructure development in Latin America and Africa, is driving demand for metal sand paper. Local production hubs and partnerships with global suppliers are expected to boost market penetration in these regions. -

Digital Integration and Smart Supply Chains

By 2026, digital platforms will play a larger role in distribution, with B2B e-commerce channels expanding access to industrial abrasives. Predictive analytics and inventory management tools will help suppliers meet just-in-time manufacturing needs, improving efficiency across the supply chain.

In conclusion, the 2026 metal sand paper market will be defined by innovation, automation, and sustainability. Companies that invest in advanced materials, environmentally responsible practices, and digital transformation will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Metal Sand Paper (Quality, IP)

Sourcing metal sand paper—especially for precision or industrial applications—comes with several critical challenges related to quality consistency and intellectual property (IP) risks. Avoiding these pitfalls is essential to ensure performance, compliance, and supply chain integrity.

Poor Quality Control and Inconsistent Performance

One of the most frequent issues in sourcing metal sand paper is inconsistent quality, particularly when dealing with overseas or low-cost suppliers. Substandard materials, such as low-grade abrasive grains or weak bonding agents, can lead to reduced cutting efficiency, premature wear, or uneven surface finishes. Additionally, variations in grit size, coating density, or backing material durability can compromise product reliability. Without rigorous quality assurance processes and third-party testing, buyers risk receiving non-conforming batches that affect downstream manufacturing processes.

Lack of Traceability and Material Certification

Many suppliers, especially in unregulated markets, fail to provide proper documentation such as material test reports (MTRs), ISO certifications, or compliance with industry standards (e.g., FEPA, ANSI). This lack of traceability makes it difficult to verify the composition and performance claims of the sand paper. For applications in aerospace, medical devices, or automotive sectors, such documentation is not just beneficial—it’s mandatory. Sourcing without proper certification exposes companies to quality failures and regulatory non-compliance.

Intellectual Property Infringement and Counterfeit Products

Metal sand paper technologies—particularly those involving proprietary coating methods, nano-abrasives, or specialized backings—may be protected under patents or trade secrets. Sourcing from suppliers who replicate branded products (e.g., knock-offs of 3M, Norton, or Klingspor) poses serious IP risks. Using counterfeit or reverse-engineered products can lead to legal liability, especially if the end application involves patented manufacturing processes. Moreover, these products often underperform due to the absence of exact formulations and process controls.

Insufficient Supplier Vetting and Audit Failures

Companies often overlook the importance of on-site audits or fail to conduct due diligence on potential suppliers. Without verifying manufacturing capabilities, R&D investment, and compliance systems, buyers may unknowingly partner with subcontractors or brokers who lack control over production. This increases exposure to quality deviations and IP vulnerabilities, particularly if the supplier outsources production to unapproved facilities.

Inadequate Contractual Protections

Procurement agreements that lack clear clauses on quality specifications, IP ownership, confidentiality, and liability can leave buyers exposed. Without enforceable terms, recourse in the event of defective products or IP disputes is limited. Ensuring contracts include warranties, audit rights, and indemnification for IP violations is critical when sourcing technically advanced consumables like metal sand paper.

Avoiding these pitfalls requires a strategic sourcing approach that emphasizes supplier qualification, rigorous testing, legal safeguards, and ongoing performance monitoring.

Logistics & Compliance Guide for Metal Sand Paper

Overview

Metal sand paper, also known as abrasive paper or sanding discs used in metalworking applications, is a common industrial consumable. While it may seem low-risk, proper logistics and compliance management are essential due to potential hazards related to dust, packaging, transportation, and environmental regulations. This guide outlines key considerations for the safe and compliant handling, storage, transport, and disposal of metal sand paper.

Classification and Hazard Identification

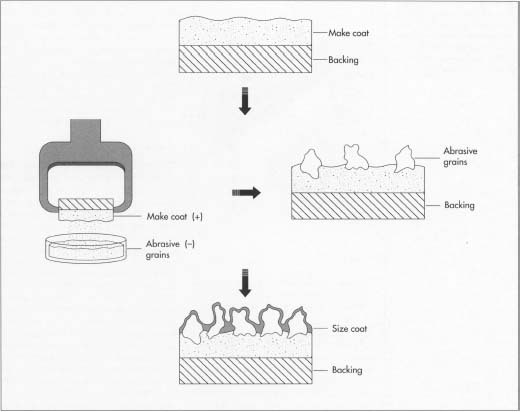

Metal sand paper typically consists of a backing material (e.g., paper or cloth) coated with abrasive minerals such as aluminum oxide, silicon carbide, or zirconia. While not classified as hazardous under most international transport regulations (e.g., UN Model Regulations), certain aspects may trigger compliance requirements:

– Dust Emissions: When used or damaged, sand paper can generate fine particulate matter. Inhalation of mineral dust (especially crystalline silica in some formulations) poses health risks.

– Coatings and Additives: Some products may contain stearates, resins, or other chemical binders subject to safety data sheet (SDS) reporting.

– Static Electricity: Dry abrasive materials can generate static, posing a low-level fire risk in specific environments.

Regulatory Compliance Requirements

Safety Data Sheets (SDS)

Under the Globally Harmonized System (GHS), manufacturers and suppliers must provide an SDS for metal sand paper if it contains hazardous components above threshold levels. Even if classified as non-hazardous, providing an SDS is considered best practice and may be required by customers or import regulations in certain jurisdictions (e.g., EU REACH, OSHA HazCom 2012 in the U.S.).

REACH and RoHS Compliance (EU)

- REACH (EC 1907/2006): Confirm that no Substances of Very High Concern (SVHC) are present above 0.1% w/w in the product.

- RoHS (2011/65/EU): While primarily targeting electronic equipment, ensure no restricted heavy metals (e.g., lead, cadmium) are used in coatings or backing materials.

Country-Specific Import Regulations

- United States: Comply with OSHA 29 CFR 1910.1200 (Hazard Communication Standard). No special import license required for non-hazardous sand paper.

- European Union: Declare compliance with CLP Regulation (EC No 1272/2008) and maintain EU REACH registration if importing in large volumes.

- Canada: Follow WHMIS 2015 requirements; SDS must be in English and French.

- China: May require CCC certification or filing under new chemical substance regulations if additives are used.

Packaging and Labeling

Packaging Requirements

- Use moisture-resistant packaging to prevent degradation of adhesive and backing.

- Palletize cartons securely with stretch wrap to avoid shifting during transit.

- Include desiccants if shipping to humid environments.

- Inner liners (e.g., polyethylene bags) help control dust and protect from contamination.

Labeling Requirements

- Product name, grit size, abrasive type, and dimensions.

- Manufacturer/supplier name and contact information.

- Lot or batch number for traceability.

- GHS-compliant pictograms and hazard statements (if applicable).

- Storage instructions (e.g., “Store in a cool, dry place”).

- “Keep Dry” and “Protect from Moisture” warnings.

Transportation Guidelines

Domestic and International Shipping

- Non-Hazardous Classification: Most metal sand paper is shipped as a general commodity under IATA, IMDG, or ADR regulations.

- Air Freight: No restrictions under IATA DGR if non-combustible and non-reactive.

- Sea Freight: Standard container shipping; ensure ventilation to avoid moisture buildup.

- Overland (Road/Rail): Secure loads per regional regulations (e.g., EUMOS 40509 in EU for pallet stability).

Temperature and Humidity Control

- Avoid extreme temperatures (>40°C or <0°C) to prevent adhesive failure.

- Maintain relative humidity below 65% to prevent backing material degradation.

Storage Best Practices

- Store in original packaging off the floor on pallets.

- Keep in a dry, well-ventilated area with stable temperature (15–25°C recommended).

- Rotate stock using FIFO (First In, First Out) method.

- Separate from chemicals, flammable materials, and food-grade products.

Occupational Health and Safety (OHS)

- Provide SDS to end-users and train workers on safe handling.

- Recommend use of PPE (e.g., dust masks, gloves) during handling and sanding.

- Implement dust control measures (e.g., local exhaust ventilation) in work areas.

Environmental and Disposal Considerations

- Used sand paper may be contaminated with metal particles and classified as industrial waste.

- Dispose of according to local regulations; do not incinerate if coated with halogenated resins.

- Recycle backing materials where facilities exist (limited recycling options currently available).

- Comply with EPA (U.S.), EA (UK), or equivalent regional waste directives.

Recordkeeping and Documentation

- Maintain records of SDS, compliance declarations (REACH, RoHS), and shipping documents for minimum of 5–7 years.

- Track batch numbers and distribution for product traceability and recall preparedness.

Conclusion

While metal sand paper is generally a low-risk product, adherence to logistics and compliance standards ensures safety, regulatory alignment, and customer satisfaction. Proactive management of SDS, labeling, packaging, and disposal not only mitigates risk but also supports sustainable and responsible supply chain operations. Regular audits and updates to compliance documentation are recommended as regulations evolve.

In conclusion, sourcing metal sandpaper requires careful consideration of several key factors including grit type and size, backing material durability, abrasive composition, and the specific application requirements. Whether for industrial manufacturing, metal fabrication, or precision finishing, selecting the right sandpaper impacts both the quality of the finish and operational efficiency. It is essential to evaluate suppliers based on product consistency, cost-effectiveness, availability, and compliance with industry standards. Establishing relationships with reputable suppliers, possibly through bulk purchasing or long-term agreements, can ensure a reliable supply chain. Additionally, considering sustainable and eco-friendly options may support environmental goals without compromising performance. Overall, a strategic approach to sourcing metal sandpaper enhances productivity, reduces waste, and contributes to superior end results in metalworking applications.