The global adhesive and sealant market, driven by rising demand across automotive, construction, and industrial maintenance sectors, is projected to grow at a CAGR of 5.4% from 2023 to 2030, according to Grand View Research. With increasing need for durable, cost-effective solutions in metal repair applications, metal repair glue has emerged as a critical category within this space. As industries prioritize rapid, on-site fixes with minimal downtime, manufacturers specializing in high-strength, temperature-resistant, and corrosion-proof adhesives are gaining significant market traction. This growing demand is further supported by advancements in epoxy and hybrid polymer technologies, which are enhancing bonding performance on diverse metal substrates. In this evolving landscape, nine key manufacturers have positioned themselves at the forefront through innovation, rigorous testing, and broad product portfolios tailored to industrial and consumer applications alike.

Top 9 Metal Repair Glue Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Devcon Industrial Epoxy Adhesive

Domain Est. 2017

Website: itwperformancepolymers.com

Key Highlights: Devcon® is the best metal epoxy manufacturer & coating solutions provider. You can use the epoxy adhesives as metal bonding filler, epoxy plastic filler, ……

#2 Royal Adhesives & Sealants

Domain Est. 1994

Website: hbfuller.com

Key Highlights: A leading manufacturer of high performance adhesives, sealants, encapsulants, and polymer costings – across a variety of markets and around the globe….

#3 Permabond Adhesive

Domain Est. 1996

Website: permabond.com

Key Highlights: Permabond manufactures many types of industrial adhesive products to suit the varied needs of a number of different industries….

#4 Henkel Adhesives:

Domain Est. 2000

Website: next.henkel-adhesives.com

Key Highlights: Henkel Adhesive Technologies is the world’s number one producer in adhesives, sealants, and functional coatings….

#5 Bonding to Different Metal Substrates

Domain Est. 1988

Website: 3m.com

Key Highlights: These are some of the best adhesives and tapes to use for bonding metals. It is important to choose the strength and durability of the adhesive….

#6 J

Domain Est. 1995

Website: jbweld.com

Key Highlights: Discover the world’s strongest bond with J-B Weld products. Sort by and find the perfect solution for your job. Need help? We’ve got you covered….

#7 Sika

Domain Est. 1995

Website: usa.sika.com

Key Highlights: Sika provides structural adhesives for bonding metal to metal, like steel, aluminum and mixed materials in automotive and other industries….

#8 Loctite Metal Glue

Domain Est. 1999

Website: loctiteproducts.com

Key Highlights: Strong, durable adhesive bonds metal to most common materials · Clear-drying, no-drip gel for clean and precise application · Works on aluminum, steel, wood, ……

#9 PDR Glue

Domain Est. 1999

Website: metalmedic.com

Key Highlights: $11 delivery 30-day returnsThe best PDR kit offers numerous benefits, including strength and movement to repair dents. Quality tool choices allow you to repair defects easier and f…

Expert Sourcing Insights for Metal Repair Glue

H2: Analysis of 2026 Market Trends for Metal Repair Glue

The global metal repair glue market is projected to experience steady growth by 2026, driven by increasing demand across industrial, automotive, construction, and DIY sectors. Several key trends are shaping the market landscape:

-

Rising Industrial Maintenance Needs

As industries prioritize cost-effective maintenance solutions, metal repair glue is gaining traction as a fast, reliable alternative to welding or mechanical fastening. The push for minimizing downtime in manufacturing and heavy equipment operations is accelerating adoption, especially in emerging economies with expanding industrial bases. -

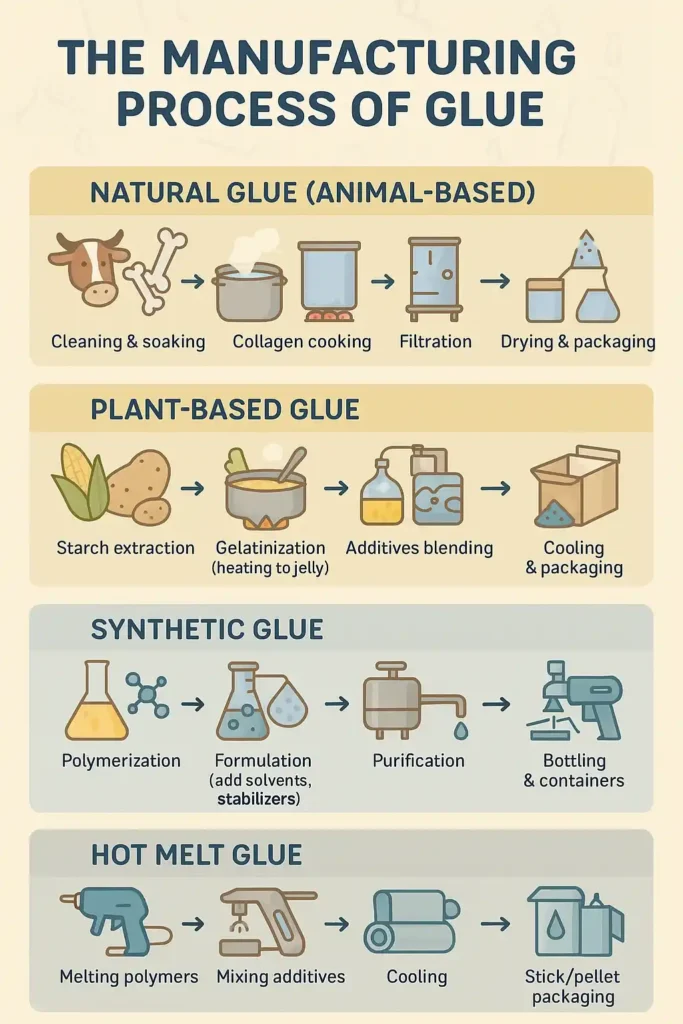

Advancements in Adhesive Technology

Ongoing innovations in epoxy and polymer-based formulations are enhancing the performance of metal repair glues. By 2026, products with improved heat resistance, faster curing times, and stronger bonding capabilities are expected to dominate the market. Hybrid adhesives combining epoxy with nanomaterials or rubber additives are emerging to meet demanding industrial applications. -

Growth in the Automotive and Transportation Sector

The automotive industry is increasingly using metal repair adhesives for both manufacturing and after-market repairs. With the rise of lightweight vehicle designs and electric vehicles (EVs), traditional welding methods face limitations. Metal repair glues offer a viable solution for joining dissimilar metals and composites, contributing to the sector’s growth. -

Expansion of DIY and Consumer Markets

The do-it-yourself (DIY) trend continues to expand, fueled by online tutorials and home improvement culture. Consumers are seeking accessible, user-friendly solutions for household repairs, leading to increased retail availability of metal repair glues in hardware stores and e-commerce platforms. -

Sustainability and Environmental Regulations

Environmental concerns are pushing manufacturers to develop low-VOC (volatile organic compound) and eco-friendly adhesive formulations. By 2026, regulatory pressures in North America and Europe are expected to favor sustainable products, driving R&D investment in greener chemistries. -

Regional Market Dynamics

Asia-Pacific is anticipated to lead market growth due to rapid industrialization in countries like China, India, and Southeast Asia. Meanwhile, North America and Europe maintain strong demand, supported by advanced infrastructure and high maintenance standards. -

Competitive Landscape and Strategic Alliances

Key players such as Loctite (Henkel), Permabond, Devcon (3M), and Gorilla Glue are investing in product differentiation and global distribution. Strategic partnerships with equipment manufacturers and distributors are expected to strengthen market presence by 2026.

In conclusion, the metal repair glue market in 2026 will be characterized by technological innovation, sector diversification, and a shift toward sustainability. Companies that adapt to these trends through R&D and targeted marketing are likely to capture significant market share.

Common Pitfalls in Sourcing Metal Repair Glue (Quality & IP)

Sourcing metal repair glue involves navigating a complex landscape where performance claims can be misleading and intellectual property rights are often overlooked. Avoiding these common pitfalls is crucial for ensuring product efficacy, legal compliance, and supply chain reliability.

Overlooking Adhesive Performance Specifications

Many buyers focus solely on bond strength while neglecting other critical performance factors. Metal repair glues must resist specific environmental stresses like thermal cycling, moisture, vibration, and exposure to chemicals (oils, solvents, fuels). Selecting a glue based on generic claims without verifying compatibility with the substrate metals (e.g., aluminum, steel, copper) and operating conditions can lead to premature failure. Always request and validate technical data sheets (TDS) and material safety data sheets (MSDS), and whenever possible, conduct in-house testing under real-world conditions.

Falling for Misleading Marketing Claims

The market is saturated with adhesives touted as “industrial-strength” or “instant metal fix” without substantiation. Unverified claims about cure time, temperature resistance, or load-bearing capacity are common. Some suppliers exaggerate performance by citing ideal lab conditions that don’t reflect field use. To avoid this, source from reputable manufacturers with third-party certifications (e.g., ISO, ASTM compliance) and demand access to independent test reports.

Ignoring Intellectual Property (IP) Risks

Sourcing adhesive formulations, especially from low-cost suppliers, carries significant IP exposure. Some manufacturers reverse-engineer patented chemistries (e.g., epoxy-acrylate hybrids, modified silanes) without licensing, potentially infringing on patents held by major chemical companies. Purchasing such products—even unknowingly—can expose your business to legal liability, supply chain disruption, or product recalls. Always vet suppliers for IP compliance and request assurances (e.g., indemnification clauses) regarding the legitimacy of their formulations.

Prioritizing Cost Over Long-Term Reliability

Choosing the cheapest metal repair glue often results in higher total cost of ownership due to rework, downtime, or product failure. Low-cost adhesives may use inferior raw materials, inconsistent mixing ratios, or lack quality control, leading to batch variability. Investing in higher-quality, IP-compliant products from certified suppliers typically ensures better durability, warranty support, and technical assistance, reducing lifecycle risks.

Neglecting Supply Chain Transparency

Lack of visibility into a supplier’s manufacturing and sourcing practices increases vulnerability. Hidden subcontracting, inconsistent quality control, or reliance on unverified raw material sources can compromise adhesive performance and traceability. Ensure suppliers provide clear documentation on origin, manufacturing processes, and quality assurance protocols to maintain consistency and compliance.

Logistics & Compliance Guide for Metal Repair Glue

Product Classification & Identification

Metal repair glue typically falls under hazardous materials due to flammable solvents, chemical reactivity, or health hazards. Proper identification is critical for safe handling and regulatory compliance.

- UN Number: UN 1133 (Adhesives, flammable) or UN 1866 (Other regulated liquids), depending on formulation

- Proper Shipping Name: “Adhesive, flammable, liquid” or “Chemical product, n.o.s.”

- Hazard Class: Class 3 (Flammable Liquids) or Class 8 (Corrosive Substances), if applicable

- Packing Group: II (Medium Danger) or III (Low Danger), based on flash point and toxicity

- GHS Classification: May include H225 (Highly flammable liquid and vapor), H315 (Causes skin irritation), H319 (Causes serious eye irritation), H336 (May cause drowsiness or dizziness)

Packaging & Labeling Requirements

All packaging must comply with international and national regulations (e.g., IATA, IMDG, ADR, 49 CFR).

- Use UN-certified packaging with appropriate inner containment and outer packaging

- Ensure containers are leak-proof, impact-resistant, and compatible with adhesive chemistry

- Apply GHS-compliant labels with:

- Pictograms (e.g., flame, exclamation mark)

- Signal word (“Danger” or “Warning”)

- Hazard statements (e.g., H225, H315)

- Precautionary statements (e.g., P210 – Keep away from heat/sparks/open flames)

- Include transport labels (Class 3 Flammable Liquid label) on outer packaging

Storage & Handling Procedures

Safe storage and handling prevent accidents and maintain product integrity.

- Store in a cool, dry, well-ventilated area away from direct sunlight and ignition sources

- Keep temperature below flash point (typically < 60°C / 140°F)

- Use only in areas with adequate ventilation; avoid inhalation of vapors

- Prohibit smoking, open flames, and static discharge near storage/handling zones

- Use appropriate PPE: chemical-resistant gloves, safety goggles, and respiratory protection if needed

Transportation Regulations

Compliance with transport regulations is mandatory for road, air, and sea freight.

- Air (IATA DGR): Limited to cargo aircraft if PG II or III; quantity limits apply per package

- Sea (IMDG Code): Proper stowage and segregation from oxidizers and acids

- Road (ADR in Europe, 49 CFR in USA): Driver training, vehicle placarding, and emergency response info required

- Prepare a Safety Data Sheet (SDS) in compliance with local regulations (e.g., OSHA HazCom, CLP)

Safety Data Sheet (SDS) & Documentation

An up-to-date, jurisdiction-specific SDS is required for all shipments.

- Provide SDS in the official language(s) of the destination country

- Ensure SDS includes:

- Full hazard identification

- First-aid and firefighting measures

- Accidental release procedures

- Regulatory information (e.g., TSCA, REACH, WHMIS)

- Retain shipping records and SDS for at least 3–5 years

Environmental & Disposal Compliance

Metal repair glue and packaging must be disposed of responsibly.

- Do not pour down drains or dispose of in regular trash

- Follow local hazardous waste regulations for disposal

- Empty containers may still contain residual product; treat as hazardous waste

- Recycle packaging when possible through approved chemical waste handlers

Regulatory Compliance by Region

Ensure adherence to regional requirements:

- USA: EPA, OSHA, DOT (49 CFR)

- EU: REACH, CLP Regulation, ADR

- Canada: WHMIS 2015, Transport of Dangerous Goods Act

- Asia-Pacific: Varies by country; check local chemical control laws (e.g., K-REACH, China MEA)

Emergency Response

Prepare for potential spills, fires, or exposure:

- Spill Response: Contain with absorbent materials (e.g., sand, spill pillows); avoid water runoff

- Fire: Use CO₂, dry chemical, or foam extinguishers; water may be ineffective

- Exposure: Rinse eyes/skin with water for 15+ minutes; seek medical attention if inhaled or ingested

- Provide emergency contact information on labels and SDS

Training & Recordkeeping

All personnel involved in handling, storage, or shipping must be trained.

- Conduct regular hazardous materials training (DOT, IATA, etc.)

- Maintain training logs and compliance audits

- Review SDS and procedures annually or when product formulation changes

Adherence to this guide ensures safe, legal, and efficient logistics for metal repair glue across global supply chains.

In conclusion, sourcing the right metal repair glue requires careful consideration of factors such as bonding strength, temperature and chemical resistance, curing time, ease of application, and suitability for the specific metals and environmental conditions involved. By evaluating reputable suppliers, comparing product specifications, and prioritizing quality and reliability, businesses and individuals can ensure long-lasting, durable repairs. Whether for industrial maintenance, automotive applications, or DIY projects, selecting a high-performance metal repair adhesive from a trusted source enhances efficiency, safety, and cost-effectiveness. Ultimately, investing time in proper sourcing leads to superior results and greater confidence in the integrity of the repair.