The global metal polishing services market is experiencing steady expansion, driven by growing demand for high-precision surface finishing across industries such as automotive, aerospace, medical devices, and consumer electronics. According to a 2023 report by Mordor Intelligence, the metal surface treatment market—including polishing, grinding, and buffing—was valued at approximately USD 19.8 billion and is projected to grow at a CAGR of 5.2% from 2023 to 2028. This growth is fueled by rising industrial automation, stricter quality standards, and increased investment in high-performance materials requiring refined surface finishes. Additionally, Grand View Research highlights the expanding application of metal polishing in the renewable energy and semiconductor sectors, further accelerating market demand. As competition intensifies, manufacturers are focusing on advanced technologies like robotic polishing, eco-friendly abrasives, and process automation to enhance precision and throughput. In this dynamic landscape, the following ten companies have emerged as leading metal polishing service providers, recognized for their technical expertise, scalability, and innovation in delivering consistent, high-quality finishes across diverse metal substrates.

Top 10 Metal Polishing Service Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cape Cod Polish Company, Inc.

Domain Est. 1997

#2 Metal and Surface Finishing

Domain Est. 1999

Website: remchem.com

Key Highlights: REM provides complete technology solutions to meet your metal surface finishing needs via our range of chemically accelerated surface finishing/polishing ……

#3 Commercial Metal Polishing: Electropolishing Services

Domain Est. 2001

Website: commercialmetalpolishing.com

Key Highlights: Commercial Metal Polishing in Pennsylvania has handled commercial & industrial polishing and electropolishing projects throughout northeast coast….

#4 Custom Metal Cutting Specialists

Domain Est. 1996

Website: metalcutting.com

Key Highlights: We have 50 years of experience with custom metal cutting, grinding and lapping, metal polishing, and precision machining of metal parts….

#5 Pioneer Metal Finishing

Domain Est. 1997

Website: pioneermetal.com

Key Highlights: Pioneer Metal Finisher processes for gold plating, chrome plating and more! Request a quote, find your finish, or explore quality finishing services….

#6 Williams Metalfinishing

Domain Est. 1997

Website: polishers.com

Key Highlights: Williams Metalfinishing specializes in high quality metal polishing & vapor degreasing services. Capabilities: Sheet / Plate Metal Polishing Services….

#7 Polished Metals

Domain Est. 1998

Website: polishedmetals.com

Key Highlights: A top metal finishing company, Polished Metals is the gold standard in service and quality, offering a wide variety of polishing options….

#8 Electropolishing Service for Stainless Steel & Other Metals

Domain Est. 1998

Website: ableelectropolishing.com

Key Highlights: Precision electropolishing and passivation for deburring, preventing corrosion for stainless steel, Nitinol, titanium, other metals: get a free sample….

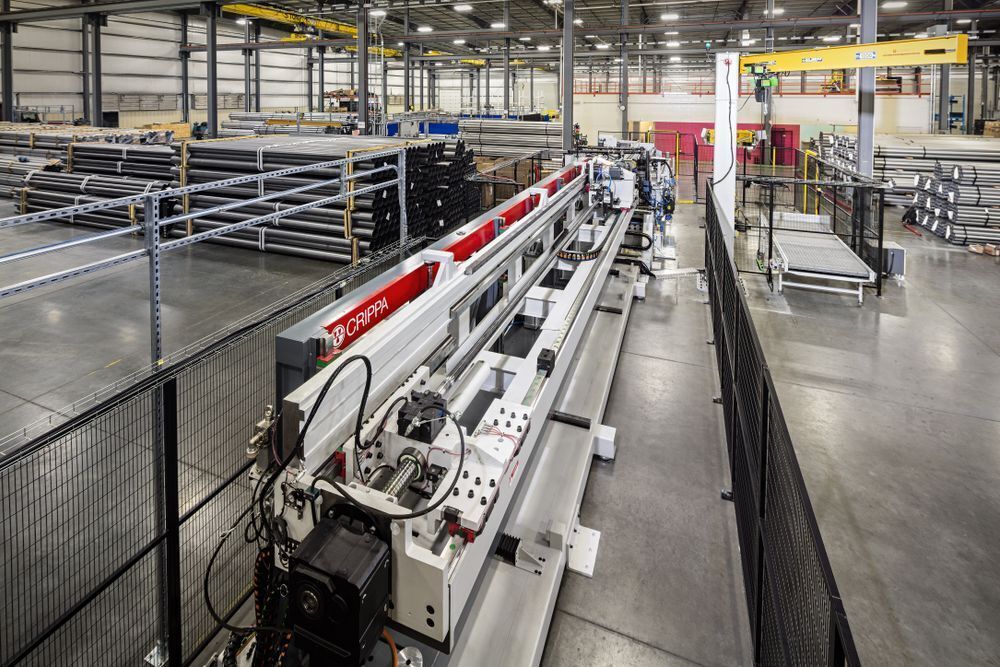

#9 Lincoln Industries

Domain Est. 2002

Website: lincolnindustries.com

Key Highlights: Lincoln Industries is the largest and most diverse privately-held metal finishing company in North America. We develop technical solutions that move our ……

#10 Diamond Brite Metals: Metal Polishing NJ&TX

Domain Est. 2012

Website: diamondbritemetals.com

Key Highlights: In addition to metal polishing, DBM provides other value-added services such as cutting, welding, and bollard fabrication….

Expert Sourcing Insights for Metal Polishing Service

2026 Market Trends for Metal Polishing Services

Growing Demand in Industrial and Manufacturing Sectors

The metal polishing service industry is projected to experience steady growth by 2026, driven by increasing demand from key industrial sectors such as automotive, aerospace, construction, and consumer goods. As manufacturers place greater emphasis on product aesthetics, durability, and corrosion resistance, the need for high-quality metal finishing processes like polishing is expanding. In particular, electric vehicle (EV) production and advanced aerospace components are driving demand for precision-polished metal parts, where surface integrity directly impacts performance and safety.

Advancements in Automation and Smart Polishing Technologies

A major trend shaping the 2026 landscape is the integration of automation and robotics in metal polishing. Automated polishing systems equipped with AI-driven feedback mechanisms and computer numerical control (CNC) are becoming more prevalent, improving consistency, reducing labor costs, and minimizing human error. These smart systems are especially beneficial for high-volume production environments, enabling faster turnaround times and adherence to tight tolerances. The adoption of Industry 4.0 technologies is expected to redefine competitiveness in the metal polishing sector.

Rising Emphasis on Sustainability and Eco-Friendly Practices

Environmental regulations and sustainability concerns are influencing operational practices in the metal polishing industry. By 2026, more service providers are anticipated to adopt eco-friendly polishing compounds, closed-loop water recycling systems, and energy-efficient equipment to reduce their environmental footprint. Regulatory pressures in North America and the European Union are pushing companies toward cleaner production methods, with certifications such as ISO 14001 becoming increasingly important for maintaining market access and client trust.

Expansion in Emerging Markets

The Asia-Pacific region, particularly countries like India, Vietnam, and Indonesia, is expected to witness significant growth in metal polishing services due to rapid industrialization and infrastructure development. These regions are attracting foreign investment in manufacturing, leading to increased demand for surface finishing solutions. Local service providers are upgrading their capabilities to meet international standards, creating new opportunities for collaboration and technology transfer.

Customization and High-Precision Services

Clients across industries are demanding more customized and high-precision polishing solutions tailored to specific applications. This trend is especially evident in medical device manufacturing and luxury goods, where mirror finishes and micro-surface treatments are essential. By 2026, metal polishing firms that offer specialized services—such as electropolishing, vibratory finishing, or nano-polishing—will likely gain a competitive edge in niche markets.

Workforce Development and Skills Gap Challenges

Despite technological advancements, the industry continues to face a shortage of skilled technicians capable of operating advanced polishing systems and understanding metallurgical requirements. By 2026, successful companies will likely invest in workforce training programs and partnerships with technical schools to bridge the skills gap. Upskilling will be crucial to maintaining quality standards and adapting to evolving customer expectations.

In conclusion, the 2026 metal polishing service market will be defined by technological innovation, sustainability, and globalization. Companies that embrace automation, environmental responsibility, and specialized service offerings will be best positioned to capitalize on emerging opportunities and maintain long-term growth.

Common Pitfalls When Sourcing Metal Polishing Services (Quality & Intellectual Property)

Sourcing metal polishing services can significantly impact the final appearance, performance, and value of your metal components. However, overlooking key risks in quality control and intellectual property (IP) protection can lead to costly setbacks. Here are common pitfalls to avoid:

Inadequate Quality Standards and Specifications

Many suppliers fail to adhere to consistent quality benchmarks due to vague or missing specifications. Without clearly defined surface finish requirements (e.g., Ra values, grit levels, mirror vs. satin finishes), results can vary drastically between batches. Always provide detailed technical drawings and finish standards, and verify the supplier’s quality control processes before production.

Lack of Process Validation and Consistency

Polishing methods (mechanical, electrochemical, vibratory, etc.) must be appropriate for the metal type and part geometry. Suppliers may use inconsistent techniques or poorly maintained equipment, leading to defects like warping, micro-scratches, or uneven finishes. Audit the supplier’s capabilities and request process validation samples before scaling.

Poor Material and Surface Contamination Control

Improper handling or cross-contamination from previous jobs (e.g., using the same buffing wheels for stainless steel and aluminum) can compromise surface integrity and cause corrosion or discoloration. Ensure the supplier has strict material segregation and cleaning protocols, especially for high-purity or medical-grade applications.

Inadequate Inspection and Reporting

Some providers lack robust inspection methods—relying on visual checks instead of profilometers or digital microscopy. This leads to undetected defects. Require detailed inspection reports with measurable data and photos, and conduct your own incoming quality checks, especially for critical components.

Intellectual Property Exposure

Sharing detailed CAD models, technical drawings, or proprietary designs with polishing vendors without legal safeguards risks IP theft or unauthorized replication. Always execute a comprehensive Non-Disclosure Agreement (NDA) and limit design data access to only what’s necessary for the polishing process.

Unsecured Tooling and Fixtures

Custom jigs or polishing tools developed for your parts may be retained or reused by the supplier for competitors unless ownership is explicitly defined. Ensure contracts state that all tooling created for your project is your property and cannot be used for other clients.

Failure to Define IP Ownership in Process Development

If a supplier develops a unique polishing technique or parameter set specifically for your product, ownership may become contested. Clearly specify in contracts that any process innovations developed for your project are either your exclusive property or require licensing agreements.

Insufficient Documentation and Traceability

Without batch tracking, process logs, or material certifications, it’s difficult to trace quality issues or prove compliance in regulated industries (e.g., aerospace, medical). Demand full documentation and ensure the supplier maintains traceability from raw material to finished product.

By proactively addressing these quality and IP-related pitfalls, businesses can ensure reliable, secure, and high-standard metal polishing outcomes.

Logistics & Compliance Guide for Metal Polishing Service

Overview

This guide outlines the essential logistics and compliance considerations for operating or utilizing a metal polishing service. Adhering to these standards ensures operational efficiency, regulatory compliance, worker safety, and environmental protection.

Facility Requirements

The physical location of the metal polishing service must meet specific criteria to support safe and compliant operations. Facilities should include dedicated areas for polishing, material storage, waste handling, and equipment maintenance. Adequate ventilation, fire suppression systems, and proper lighting are mandatory. Floors must be non-slip and chemical-resistant, with clearly marked zones for hazardous operations.

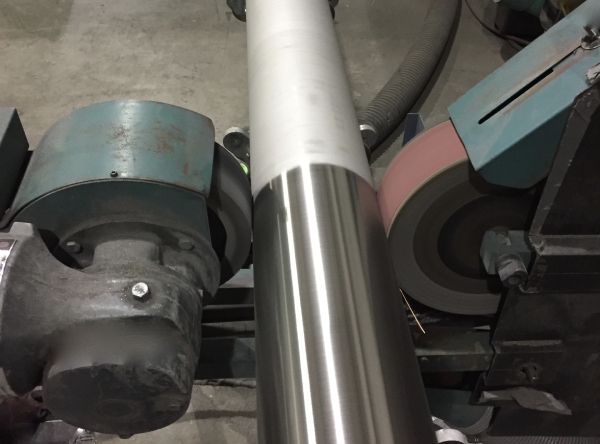

Equipment and Tooling Standards

All polishing equipment—including belt sanders, buffing wheels, grinders, and automated polishing machines—must comply with OSHA and ANSI safety standards. Machines must be regularly maintained and equipped with appropriate guards, emergency stop mechanisms, and dust extraction systems. Only manufacturer-approved consumables (e.g., polishing compounds, abrasives) should be used, and all tools must be inspected before each shift.

Material Handling and Inventory Management

Incoming metal components must be labeled, logged, and stored according to material type (e.g., stainless steel, aluminum, brass) to prevent cross-contamination. Handling procedures should minimize damage and ensure traceability. Inventory systems (digital or manual) must track material batches, processing status, and final disposition. Use non-sparking tools when handling flammable metals or powders.

Waste Management and Environmental Compliance

Metal polishing generates hazardous waste such as metal sludge, used polishing compounds, and contaminated rags. These must be collected, stored, and disposed of in accordance with EPA and local environmental regulations. Facilities must have spill containment systems, Material Safety Data Sheets (MSDS/SDS) on file, and comply with RCRA (Resource Conservation and Recovery Act) standards. Recycling of metal fines and dust is encouraged and may be required by local ordinance.

Air Quality and Ventilation

Polishing operations produce fine particulate matter and fumes that can pose respiratory hazards. Facilities must have certified local exhaust ventilation (LEV) systems with HEPA filtration to capture airborne contaminants at the source. Air quality should be monitored regularly, and workers must have access to respirators when engineering controls are insufficient. Compliance with OSHA’s permissible exposure limits (PELs) for metal dust (e.g., aluminum, chromium, nickel) is required.

Worker Safety and Personal Protective Equipment (PPE)

Employees must be trained in safe operating procedures and emergency response. Mandatory PPE includes safety goggles, face shields, cut-resistant gloves, hearing protection, and flame-resistant clothing. Respiratory protection is required where air quality monitoring indicates risk. Employers must maintain OSHA 300 logs and provide annual safety training, including hazard communication (HazCom) and lockout/tagout (LOTO) procedures.

Regulatory Compliance

Metal polishing operations are subject to multiple regulatory frameworks including:

– OSHA (Occupational Safety and Health Administration) standards for general industry

– EPA regulations on hazardous waste and air emissions

– NFPA (National Fire Protection Association) standards for combustible dust

– DOT (Department of Transportation) rules for shipping hazardous materials

Facilities must maintain up-to-date permits, conduct regular audits, and be prepared for inspections.

Transportation and Shipping

Finished polished components must be packaged to prevent scratching, corrosion, or damage during transit. If transporting hazardous waste (e.g., spent polishing slurry), compliance with DOT regulations—including proper labeling, manifests, and container specifications—is mandatory. Use carriers licensed for hazardous materials when applicable.

Documentation and Recordkeeping

Maintain accurate records of:

– Equipment maintenance and inspections

– Employee training and PPE issuance

– Waste manifests and disposal receipts

– Air quality and exposure monitoring

– Safety data sheets (SDS) for all chemicals used

Records must be retained for a minimum of 30 years for exposure data and 5 years for training logs, as per OSHA requirements.

Emergency Preparedness

Facilities must have a written emergency action plan (EAP) that includes procedures for fires, chemical spills, equipment malfunctions, and medical emergencies. On-site fire extinguishers (rated for metal and electrical fires), eyewash stations, and emergency showers must be accessible and inspected monthly. Conduct quarterly emergency drills and keep incident reports on file.

Quality Assurance and Customer Compliance

Implement a quality control process to verify surface finish, dimensional accuracy, and absence of defects. Provide customers with polishing certifications, material traceability, and compliance documentation upon request. Align with industry standards such as ASTM E2786 for surface roughness or ISO 9001 for quality management systems if applicable.

In conclusion, sourcing a metal polishing service requires careful evaluation of various factors to ensure high-quality results, cost efficiency, and reliability. It is essential to assess the provider’s expertise, equipment, and experience with specific metals and finishes to match your project requirements. Additionally, considerations such as turnaround time, scalability, certifications, and compliance with industry standards play a crucial role in selecting the right partner. By conducting thorough due diligence and prioritizing transparency and communication, businesses can establish a strong, long-term relationship with a metal polishing service that enhances product quality, supports manufacturing objectives, and contributes to overall operational success.