The global metal lathes market is witnessing robust growth, driven by increasing demand for precision machining across industries such as automotive, aerospace, and general manufacturing. According to a report by Mordor Intelligence, the global CNC machine tool market—which includes metal lathes—is projected to grow at a CAGR of over 7.5% from 2023 to 2028, fueled by automation trends and advancements in smart manufacturing technologies. Similarly, Grand View Research estimates that the global lathe machine market size was valued at USD 28.6 billion in 2022 and is expected to expand at a CAGR of 5.8% from 2023 to 2030. This steady growth reflects the critical role metal lathes play in modern production environments. As manufacturers seek higher accuracy, efficiency, and integration with Industry 4.0 systems, the competitive landscape is led by innovators who combine engineering excellence with digital capabilities. Below are the top 10 metal lathe manufacturers shaping the future of precision machining.

Top 10 Metal Lathes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sherline

Domain Est. 1995

Website: sherline.com

Key Highlights: Sherline Products are suppliers of precision mini-benchtop lathes, milling machines, CNC machine accessories for industrial and home use….

#2 Lathes

Domain Est. 1996

Website: clausing-industrial.com

Key Highlights: Clausing has provided the metalworking industry with high-quality manual and CNC lathes for decades. With swings from 6 inches to over 100 inches….

#3 South Bend Lathe Co.

Domain Est. 2000

Website: southbendlathe.com

Key Highlights: South Bend Lathe Works became the largest manufacturer of precision metalworking lathes in the world with customers in more than 88 countries….

#4 EMCO lathes & milling machines manufacturer, CNC training …

Domain Est. 2007

Website: emco-world.com

Key Highlights: EMCO has been a leading manufacturer of lathes and milling machines for over 75 years and offers a wide range of development opportunities….

#5 World

Domain Est. 2008

Website: sunmaster-cnc.com

Key Highlights: As one of Taiwan’s reliable lathe machine manufacturers and suppliers, we specialize in the design and manufacturing of metalworking machinery….

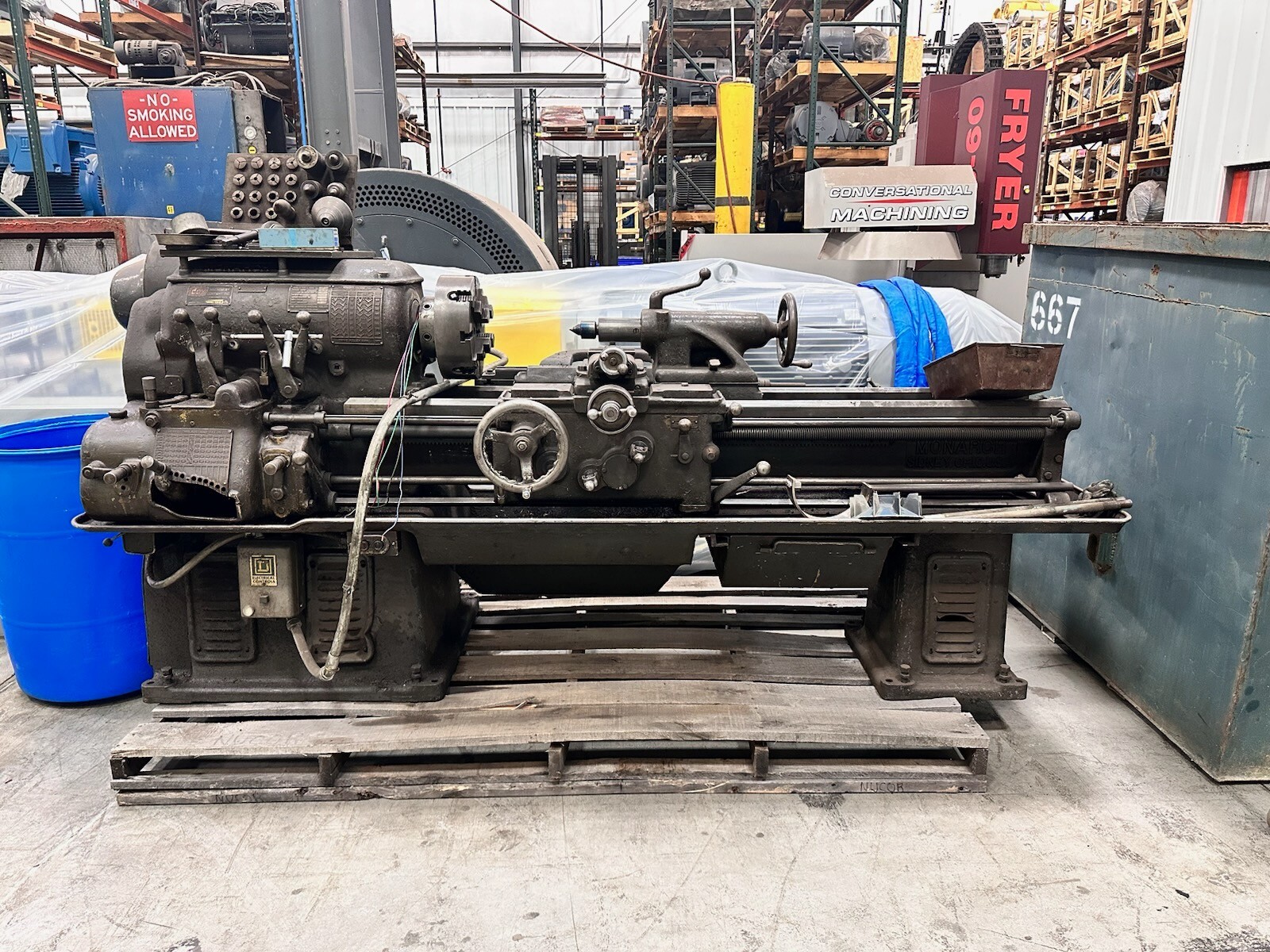

#6 Summit Machine Tool

Domain Est. 1996

Website: summitmt.com

Key Highlights: Summit Machine Tool – metal lathes (manual & CNC lathes), metalworking machinery, machine tools and more. Get A Quote Today!…

#7 MONARCH Lathes

Domain Est. 1998 | Founded: 1909

Website: monarchlathe.com

Key Highlights: Monarch Lathes has been supplying the world with high quality, manual metal cutting equipment since 1909. Headquartered in Sidney, Ohio….

#8 TAIG Tools

Domain Est. 1999

Website: taigtools.com

Key Highlights: At TAIG Tools we manufacture precision desktop Milling Machines, Lathes (otherwise known as Micro Mills and Micro Lathes) and a complete line of accessories….

#9 Tormach Lathes

Website: tormach.com

Key Highlights: Free delivery over $250 · 60-day returnsThe Tormach 8L CNC Lathe overperforms its price tag, and makes an excellent choice for education, prototyping, and light production runs….

#10 WEILER

Website: weiler.de

Key Highlights: Whether for industry, craftsmanship or training: WEILER stands for highest quality in metalworking for lathes for over 80 years – Made in Germany. More than ……

Expert Sourcing Insights for Metal Lathes

H2: 2026 Market Trends for Metal Lathes

The global metal lathe market is poised for significant transformation by 2026, driven by technological innovation, evolving industrial demands, and the increasing adoption of automation and smart manufacturing. As industries shift toward precision, efficiency, and sustainability, metal lathes—especially CNC (Computer Numerical Control) variants—are undergoing rapid advancements to meet these requirements. Below are the key market trends expected to shape the metal lathe industry in 2026:

-

Growth in CNC Lathe Adoption

CNC metal lathes are expected to dominate the market by 2026 due to their superior precision, repeatability, and ability to handle complex geometries. Industries such as aerospace, automotive, and medical device manufacturing are investing heavily in CNC technology to improve production efficiency and product quality. The integration of AI and machine learning into CNC systems enables predictive maintenance and real-time optimization, further enhancing operational performance. -

Integration of IoT and Industry 4.0

The rise of smart factories under Industry 4.0 is accelerating the integration of Internet of Things (IoT) in metal lathes. By 2026, a growing number of metal lathes will feature IoT connectivity, enabling remote monitoring, data analytics, and seamless communication with other manufacturing systems. This connectivity improves uptime, reduces downtime, and supports data-driven decision-making across the production floor. -

Increased Demand from Emerging Economies

Countries in Asia-Pacific (particularly India, Vietnam, and Indonesia), Latin America, and Africa are expanding their manufacturing sectors, leading to higher demand for affordable and reliable metal lathes. Government initiatives promoting “Make in India,” “Digital India,” and similar industrialization programs are expected to drive investments in machine tools, including metal lathes. -

Focus on Energy Efficiency and Sustainability

Environmental regulations and rising energy costs are pushing manufacturers to adopt energy-efficient machine tools. By 2026, metal lathe producers are expected to prioritize eco-friendly designs, reduced power consumption, and recyclable components. Green manufacturing practices will increasingly influence purchasing decisions in both developed and developing markets. -

Rise of Hybrid and Multi-Tasking Lathes

To reduce production time and floor space, manufacturers are shifting toward hybrid lathes that combine turning with milling, drilling, or grinding capabilities. These multi-tasking machines allow complete part processing in a single setup, improving throughput and accuracy. Their adoption is expected to grow significantly by 2026, particularly in high-mix, low-volume production environments. -

Impact of Advanced Materials

The growing use of advanced materials—such as titanium alloys, composites, and high-strength steels—in aerospace, defense, and energy sectors is influencing lathe design. These materials require lathes with higher rigidity, specialized tooling, and enhanced cooling systems. Machine manufacturers are responding with lathes engineered to handle demanding material applications. -

Aftermarket Services and Digital Support

As metal lathes become more sophisticated, the demand for aftermarket services—including maintenance, upgrades, training, and remote diagnostics—is expected to grow. By 2026, leading manufacturers will offer comprehensive digital service platforms that provide real-time support, software updates, and performance analytics to maximize machine lifespan and productivity. -

Supply Chain Resilience and Localization

Ongoing global supply chain disruptions have prompted companies to reconsider sourcing strategies. Many manufacturers are shifting toward localized production and regional supply chains, boosting domestic demand for metal lathes. This trend is expected to encourage regional manufacturing hubs and strengthen local machine tool industries.

Conclusion:

By 2026, the metal lathe market will be characterized by digitalization, automation, and sustainability. CNC and smart lathes will lead market growth, supported by Industry 4.0 integration and rising industrialization in emerging economies. Manufacturers who invest in innovation, energy efficiency, and customer-centric digital services will be best positioned to capture market share in this evolving landscape.

Common Pitfalls When Sourcing Metal Lathes (Quality and Intellectual Property)

Sourcing metal lathes, especially from international or unfamiliar suppliers, involves significant risks related to both quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to costly downtime, safety hazards, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inadequate Verification of Manufacturing Standards

Many suppliers, particularly in low-cost regions, may claim compliance with international standards (e.g., ISO, CE, DIN) without proper certification. Buyers often accept documentation at face value without independent verification, leading to receipt of machines that fail to meet required precision, safety, or durability benchmarks.

Poor Build Quality and Substandard Components

Some manufacturers use inferior materials (e.g., low-grade cast iron, subpar bearings, or outdated electrical systems) to reduce costs. This compromises machine rigidity, accuracy, and longevity. Without on-site inspections or third-party audits, these issues may only become evident after installation and operation.

Lack of Rigorous Testing and Calibration

Reputable suppliers conduct factory acceptance tests (FAT), including precision checks (e.g., runout, alignment, taper), vibration analysis, and load testing. Suppliers cutting corners may skip these steps, resulting in machines requiring extensive rework or adjustment before productive use.

Insufficient After-Sales Support and Spare Parts Availability

Even a well-built machine can become a liability if the supplier fails to provide timely technical support, training, or access to genuine spare parts. Sourcing from vendors without established local service networks can lead to prolonged machine downtime and increased operational costs.

Intellectual Property (IP) Risks

Procurement of Counterfeit or Clone Machines

Some suppliers market machines as being from well-known brands but are actually unauthorized replicas. These clones often infringe on original designs, patents, or trademarks. Purchasing such equipment exposes the buyer to potential legal action, especially in regions with strict IP enforcement (e.g., EU, USA).

Lack of IP Due Diligence in Supplier Vetting

Buyers may fail to investigate whether the supplier holds legitimate rights to the design, software, or branding of the lathe. This is particularly critical when sourcing CNC lathes, where control systems and software may be pirated or reverse-engineered, violating copyright laws.

Exposure to Legal and Customs Seizures

Importing machines with infringing IP can result in customs detentions, fines, or confiscation. In some jurisdictions, the end user—not just the manufacturer—can be held liable for contributory infringement, especially if due diligence was not exercised.

Hidden Software and Licensing Violations

CNC controls often use proprietary software requiring valid licenses. Unauthorized duplication or use of unlicensed software (e.g., Siemens, Fanuc, or Mitsubishi controls) not only violates IP but may also void warranties and compromise machine performance and cybersecurity.

Mitigation Strategies

- Conduct third-party factory audits and performance testing before purchase.

- Require valid certifications and verify them through independent bodies.

- Perform IP due diligence, including trademark and patent searches.

- Include contractual clauses that guarantee IP ownership, indemnify against infringement claims, and ensure software licensing compliance.

- Source from reputable distributors or original equipment manufacturers (OEMs) with transparent supply chains.

Avoiding these pitfalls requires proactive due diligence, technical assessments, and legal safeguards to ensure both machine reliability and legal compliance.

Logistics & Compliance Guide for Metal Lathes

Overview

Metal lathes are precision machine tools used for shaping metal and other rigid materials. Due to their size, weight, and technical specifications, shipping and importing these machines require careful planning and adherence to international logistics and regulatory standards. This guide outlines key considerations for the safe and compliant transportation and handling of metal lathes.

Packaging and Handling Requirements

Metal lathes must be securely packaged to prevent damage during transit. Use the following best practices:

– Secure the lathe on a wooden pallet or skid with bracing to prevent movement.

– Cover moving parts (e.g., spindle, tailstock) with protective caps or wrap in VCI (Vapor Corrosion Inhibitor) paper.

– Remove or secure tooling, chucks, and accessories separately in labeled containers.

– Apply moisture barrier wrapping for ocean shipments to prevent rust.

– Clearly label packages with “Fragile,” “This Side Up,” and handling instructions.

Transportation Modes

Choose the appropriate transport method based on destination and urgency:

– Freight (Ocean/Sea): Most cost-effective for heavy, bulky lathes; use FCL (Full Container Load) for better protection.

– Air Freight: Faster but expensive; suitable for urgent, smaller lathes or components.

– Road/Rail (Domestic/Regional): Ideal for overland transport within continents; ensure vehicle has adequate load capacity and suspension.

Ensure carriers are experienced in handling industrial machinery and provide liftgate or forklift access at delivery points.

Export Documentation

Complete and accurate documentation is critical for international shipments:

– Commercial Invoice (with full description, value, and Harmonized System [HS] code)

– Packing List (itemizing components, weights, and dimensions)

– Bill of Lading (for sea freight) or Air Waybill (for air freight)

– Export Declaration (as required by the country of origin)

– Certificate of Origin (may be required for duty reduction under trade agreements)

HS Code Example: 8458.10 (for metal-cutting lathes) – verify with local customs authority.

Import Compliance and Duties

Each destination country has specific import regulations:

– Verify import restrictions, licensing requirements, and conformity standards (e.g., CE in the EU, UL/cUL in the U.S.).

– Calculate applicable tariffs, VAT, or GST based on declared value and HS code.

– Some countries may require pre-shipment inspection or customs valuation.

– Confirm electrical compatibility (voltage, frequency, plug type) for operational readiness upon arrival.

Safety and Regulatory Standards

Ensure the metal lathe complies with safety and technical regulations:

– CE Marking (Europe): Required under Machinery Directive 2006/42/EC.

– UL/cUL Certification (North America): For electrical safety compliance.

– OSHA/ANSI Standards (U.S.): For workplace safety and operational guidelines.

– Include user manuals, safety warnings, and technical specifications in the local language.

Insurance and Risk Management

Protect against loss or damage during transit:

– Obtain all-risk cargo insurance covering the full replacement value.

– Specify coverage for loading/unloading, storage, and inland transit.

– Retain documentation (photos, inspection reports) for claims.

Installation and Site Preparation

Coordinate with the end-user for delivery logistics:

– Verify site access (door width, floor strength, ceiling height).

– Ensure proper power supply (voltage, phase, grounding) and environmental conditions (ventilation, dust control).

– Schedule professional installation and alignment to maintain machine accuracy and warranty validity.

Environmental and Disposal Compliance

Adhere to environmental regulations:

– Properly dispose of packaging materials (wood, plastic, metal) per local waste laws.

– Handle lubricants, coolants, and metal shavings in accordance with environmental protection standards.

– Follow WEEE (Waste Electrical and Electronic Equipment) directives if disposing of old or non-functional lathes in the EU.

Summary

Successfully managing the logistics and compliance of metal lathe shipments involves meticulous planning, accurate documentation, regulatory adherence, and coordination across international borders. Partnering with experienced freight forwarders and compliance experts ensures on-time, damage-free delivery and full regulatory compliance.

In conclusion, sourcing metal lathes requires a careful evaluation of several key factors including machine specifications, accuracy, power, bed size, spindle speed, and control system (manual vs. CNC). It is essential to align the lathe’s capabilities with the intended applications—whether for prototyping, production, or maintenance—to ensure optimal performance and return on investment. Additionally, reliability of suppliers, after-sales support, warranty, and total cost of ownership play a critical role in the decision-making process. Conducting thorough market research, comparing both domestic and international vendors, and considering long-term maintenance and spare parts availability will help secure a high-quality, durable machine that meets operational needs. Ultimately, a well-sourced metal lathe enhances manufacturing precision, improves productivity, and supports the growth and efficiency of machining operations.