The global metal heat treatment market is experiencing robust growth, driven by increasing demand from automotive, aerospace, energy, and industrial manufacturing sectors. According to a report by Mordor Intelligence, the market was valued at USD 115.6 billion in 2023 and is projected to grow at a CAGR of over 7.2% from 2024 to 2030. This expansion is fueled by advancements in material science, stringent performance requirements in critical components, and a rising emphasis on enhancing metal durability and resistance. As industries prioritize precision engineering and operational longevity, heat-treated metals have become indispensable in high-stress applications. With Asia-Pacific emerging as a key growth region due to rapid industrialization and infrastructure development, manufacturers are scaling technological capabilities and geographic reach. In this competitive and evolving landscape, identifying the top metal heat treatment manufacturers is essential for supply chain optimization and strategic sourcing decisions.

Top 10 Metal Heat Treatment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Surface Combustion

Domain Est. 1997

Website: surfacecombustion.com

Key Highlights: Surface® Combustion is the leading manufacturer of industrial heat treating furnaces for over 100 years, delivering furnaces that last….

#2 DELTA H

Domain Est. 1998

Website: delta-h.com

Key Highlights: DELTA H designs and manufactures industrial furnaces and ovens for aerospace, defense, and manufacturing. Explore our USA-made thermal processing solutions….

#3 Paulo

Domain Est. 1999

Website: paulo.com

Key Highlights: Paulo is the nation’s largest privately-held commercial thermal processing company advancing manufacturers in aerospace, automotive, and beyond….

#4 Heatmasters

Domain Est. 1999

Website: heatmasters.net

Key Highlights: Heatmasters is an international industrial service and equipment provider specializing in heat treatment, NDT inspection, surface treatment, and other services….

#5 The leading provider of heat treatment and specialist thermal …

Domain Est. 1997

Website: bodycote.com

Key Highlights: Bodycote is the world’s largest service provider of heat treatment and specialist metallurgical technologies. Our technologies are vital to the safe and ……

#6 Stack Metallurgical Group

Domain Est. 1997

Website: stackmet.com

Key Highlights: We specialize in a comprehensive range of metal processing services including heat treating and aluminum anodizing services for a range of industries ……

#7 Specialty Steel Treating: Heat Treating Services

Domain Est. 2000

Website: sst.net

Key Highlights: We provide a variety of services including: case hardening, tempering steel, carburizing, quenching heat treatment, vacuum heat treatments and more….

#8 Advanced Heat Treat Corp

Domain Est. 2007

Website: ahtcorp.com

Key Highlights: Welcome to Advanced Heat Treat Corp. (AHT), a recognized leader in providing commercial heat treat services and metallurgical solutions….

#9 Phoenix Heat Treating

Domain Est. 2007

Website: phoenix-heat-treating.com

Key Highlights: Providing high quality service around the nation for over 100 years. Whether it be heat treating, metal finishing or a specialized service, we’ve got you…

#10 Metal Treatments

Domain Est. 2022

Website: aalberts-ht.us

Key Highlights: Specializing in high-quality metal treatments, Aalberts surface technologies brings strength, durability, and precision to every project we undertake….

Expert Sourcing Insights for Metal Heat Treatment

H2: 2026 Market Trends for Metal Heat Treatment

The global metal heat treatment market in 2026 is poised for steady growth, driven by intense technological innovation, strategic shifts toward sustainability, and evolving demands across key industrial sectors. Key trends shaping the landscape include:

1. Accelerated Adoption of Advanced Technologies:

Automation, digitalization, and Industry 4.0 integration are no longer optional. By 2026, predictive maintenance powered by IoT sensors, real-time monitoring of furnace atmospheres, and AI-driven process optimization will become standard in competitive heat treatment facilities. Digital twins will enable simulation of heat treatment cycles, reducing trial-and-error, improving quality consistency, and shortening time-to-market for new components—particularly critical in aerospace and medical device manufacturing.

2. Strategic Shift Toward Sustainability and Energy Efficiency:

Environmental regulations and corporate ESG goals are pushing the industry toward greener practices. In 2026, we expect increased investment in energy-efficient furnace technologies (e.g., regenerative burners, improved insulation), electrification of processes using renewable power sources, and wider adoption of low-emission quenching media. Carbon footprint tracking throughout the heat treatment lifecycle will become a competitive differentiator, especially in Europe and North America.

3. Growth Driven by High-Performance Sectors:

Demand will be strongest in industries requiring extreme material properties. The aerospace and defense sectors will continue to drive innovation in vacuum and atmosphere-controlled heat treatments for superalloys and titanium. In the automotive sector, while electric vehicles (EVs) reduce demand for some traditional components, they create new opportunities—such as heat treatment for high-strength EV drivetrain parts, battery enclosures, and lightweight structural components made from advanced high-strength steels (AHSS).

4. Regional Market Dynamics and Reshoring:

Geopolitical factors and supply chain resilience concerns are leading to industrial reshoring and nearshoring, particularly in North America and Europe. This trend supports regional heat treatment service providers and encourages investment in localized, high-capacity facilities. Meanwhile, Asia-Pacific—led by China, India, and Southeast Asia—will remain the largest market volume-wise, fueled by infrastructure expansion, manufacturing growth, and rising automotive production.

5. Consolidation and Service Differentiation:

The market will see continued consolidation among service providers as companies seek scale, technological capability, and broader geographic reach. Success will depend on specialization—offering certified, traceable treatments for regulated industries (e.g., NADCAP for aerospace), value-added services like metallurgical consulting, and rapid turnaround times enabled by digital workflow integration.

In summary, the 2026 metal heat treatment market will be defined by smarter, cleaner, and more specialized operations. Companies that leverage digital tools, prioritize sustainability, and align with high-growth, high-performance industries will be best positioned to capitalize on emerging opportunities.

Common Pitfalls in Sourcing Metal Heat Treatment: Quality and Intellectual Property (IP) Risks

Outsourcing metal heat treatment is a common practice, but it introduces significant risks related to product quality and the protection of sensitive intellectual property. Failing to manage these pitfalls can lead to costly failures, safety issues, and competitive disadvantage.

Quality-Related Pitfalls

- Inadequate Process Control & Monitoring: Relying on suppliers who lack robust process control systems (e.g., inconsistent furnace temperatures, improper soak times, uncalibrated equipment) results in non-uniform or out-of-specification material properties (hardness, strength, microstructure). This can lead to premature part failure in service.

- Poor Traceability and Documentation: Suppliers failing to maintain accurate, detailed records (lot traceability, process parameters, test results, certifications like material test reports – MTRs) make it impossible to verify quality, conduct root cause analysis if failures occur, or meet regulatory requirements (e.g., aerospace, medical).

- Insufficient or Inaccurate Testing: Over-reliance on supplier-provided test reports without independent verification, or using incorrect/non-standardized testing methods (e.g., wrong hardness scale, improper sample preparation), provides a false sense of security and masks underlying quality issues.

- Lack of Supplier Qualification and Audits: Sourcing from unqualified or uninspected heat treaters increases risk. Failing to conduct initial qualification audits and periodic surveillance audits allows process drift and non-compliance to go undetected.

- Non-Compliance with Specifications and Standards: Suppliers not adhering strictly to the customer’s detailed specifications (e.g., AMS, ASTM, customer-specific) or relevant industry standards (e.g., NADCAP for aerospace) produce parts that may not meet the required performance criteria.

- Inadequate Handling and Post-Treatment: Poor practices in quenching, tempering, cleaning, or handling after heat treatment (e.g., causing distortion, quench cracking, or surface contamination) can ruin otherwise properly treated parts.

Intellectual Property (IP) Protection Pitfalls

- Unprotected Process Specifications: Sharing detailed heat treatment recipes (specific temperature profiles, times, atmospheres, quenchants) without proper legal safeguards (e.g., robust Non-Disclosure Agreements – NDAs) exposes proprietary processes that are key to achieving unique material performance, allowing competitors to potentially reverse-engineer or misuse the information.

- Lack of Clear Ownership of Developed IP: Ambiguity in contracts regarding who owns IP developed during the heat treatment process (e.g., optimized parameters for a specific alloy, novel fixturing solutions) can lead to disputes. Assumptions that the customer owns all IP can be legally challenged.

- Insufficient Access Controls: Allowing the supplier broad access to sensitive design data, material composition details, or end-product application information beyond what is strictly necessary for the heat treatment task increases the risk of information leakage or misuse.

- Inadequate Cybersecurity Measures: Storing or transmitting sensitive process data, part geometries, or material specs electronically through suppliers with weak cybersecurity protocols creates vulnerabilities for data breaches.

- Subcontracting Without Oversight: Suppliers subcontracting the work to unvetted third parties (sub-tier heat treaters) without the customer’s knowledge or approval bypasses the original qualification and IP protection measures, creating significant quality and security blind spots.

- Insufficient IP Clauses in Contracts: Relying on vague or weak contractual language regarding confidentiality, data usage, reverse engineering prohibitions, and audit rights for IP compliance leaves the customer with limited recourse if IP is compromised.

Mitigation: To avoid these pitfalls, implement rigorous supplier qualification, enforce strict quality documentation requirements (including audits), perform independent verification testing, define clear and comprehensive IP protection clauses in contracts (robust NDAs, clear ownership definitions), limit data sharing to the minimum necessary, and maintain control over the supply chain (including subcontracting).

Logistics & Compliance Guide for Metal Heat Treatment

Overview of Metal Heat Treatment Processes

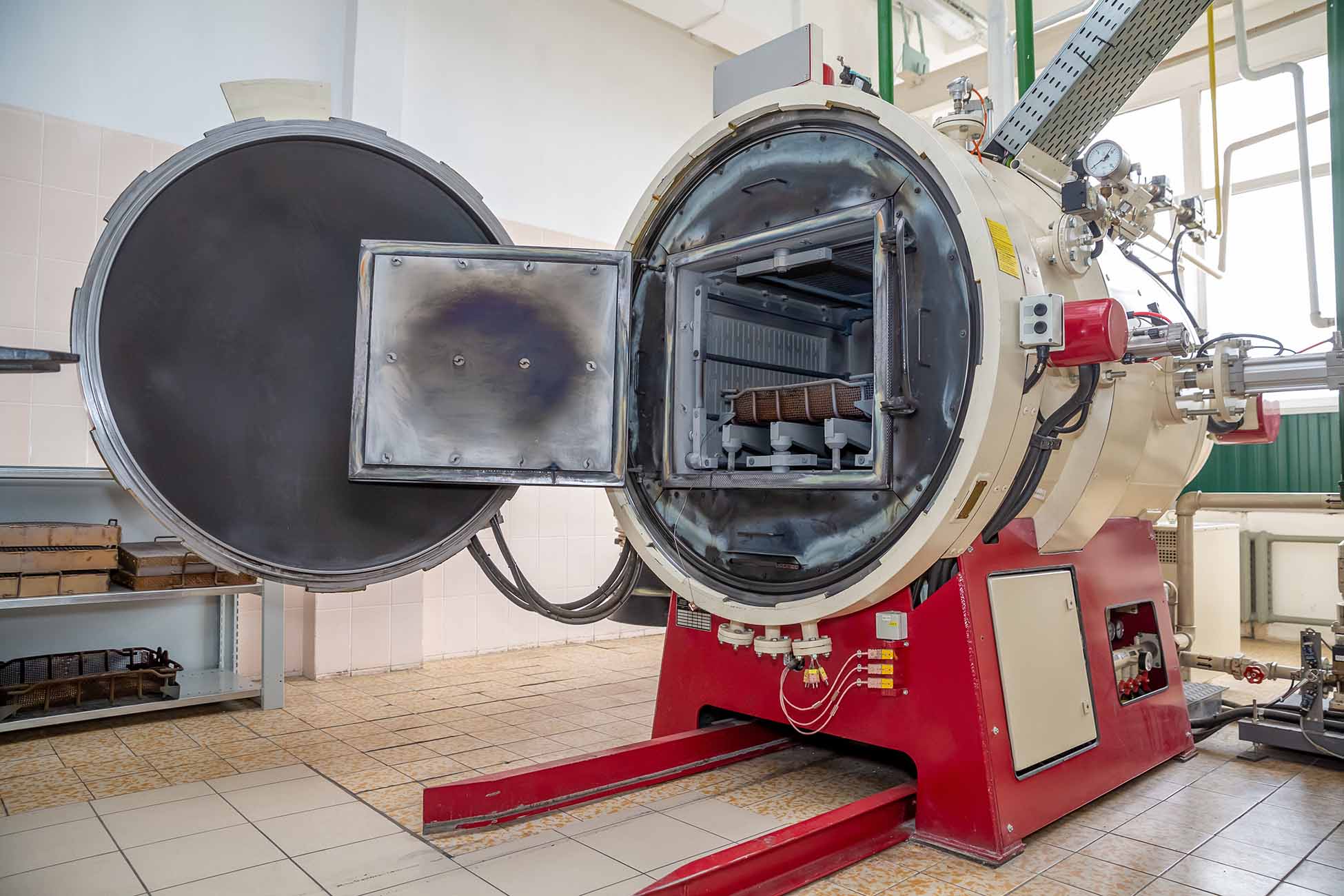

Metal heat treatment involves controlled heating and cooling of metals to alter their physical and mechanical properties without changing their shape. Common processes include annealing, quenching, tempering, normalizing, and case hardening. These operations enhance properties such as hardness, strength, ductility, and wear resistance. Due to the high temperatures and potential safety hazards involved, strict logistics and compliance protocols are essential.

Regulatory Compliance Requirements

Environmental Regulations

Metal heat treatment facilities must comply with environmental regulations governing air emissions, wastewater discharge, and hazardous waste management. Key regulatory frameworks include:

– EPA (Environmental Protection Agency) Standards – Facilities must monitor and control emissions of volatile organic compounds (VOCs), particulate matter, and hazardous air pollutants (HAPs) from furnaces and quenching operations.

– Clean Air Act (CAA) – Requires permits for emission sources and periodic emissions testing.

– Resource Conservation and Recovery Act (RCRA) – Governs the handling, storage, transportation, and disposal of quenching oils, spent coolants, and cleaning solvents.

Occupational Health & Safety Standards

Worker safety is paramount in heat treatment operations due to high temperatures, toxic atmospheres, and heavy machinery. Compliance with OSHA (Occupational Safety and Health Administration) standards includes:

– Heat Stress Management – Monitoring work environments and providing protective gear and rest breaks.

– Hazard Communication (HazCom) – Proper labeling and safety data sheets (SDS) for all chemicals used, including quenchants and protective atmospheres (e.g., nitrogen, argon, endothermic gas).

– Lockout/Tagout (LOTO) – Ensuring equipment is de-energized during maintenance.

– Respiratory Protection – Required where fumes or inert gases are present.

International Standards and Certifications

For global operations, adherence to international standards is critical:

– ISO 9001 – Quality management systems.

– ISO 14001 – Environmental management.

– NADCAP (National Aerospace and Defense Contractors Accreditation Program) – Industry-specific accreditation for heat treatment in aerospace applications.

– IATF 16949 – Automotive quality management standard.

Logistics Management

Incoming Material Handling

- Inspect incoming metal parts for material grade, dimensions, and surface condition before processing.

- Segregate materials by alloy type and heat treatment specifications to prevent mix-ups.

- Maintain traceability using barcodes, RFID tags, or batch records.

Process Flow and Scheduling

- Implement a documented workflow from loading to cooling and post-treatment inspection.

- Use process control plans to define temperature profiles, soak times, cooling rates, and equipment settings.

- Schedule production to minimize furnace downtime and optimize energy use.

Storage and Handling of Treated Parts

- Allow adequate cooling time before handling to prevent distortion or safety risks.

- Store treated parts in dry, controlled environments to prevent corrosion.

- Use proper packaging and labeling to maintain part integrity during transport.

Transportation and Shipping Compliance

Domestic and International Shipping

- Comply with DOT (Department of Transportation) and IATA/IMDG regulations when shipping treated parts that may have residual oils or contaminants.

- Declare hazardous materials properly if quenching oils or cleaning agents remain on parts.

- Use certified carriers experienced in handling heat-treated components.

Packaging Requirements

- Use non-reactive, moisture-resistant materials to protect parts from corrosion.

- Include desiccants and vapor corrosion inhibitors (VCI) when necessary.

- Secure parts to prevent movement and damage during transit.

Recordkeeping and Documentation

- Maintain detailed process records including furnace temperature logs, load identification, soak times, and operator information.

- Keep calibration records for thermocouples, temperature controllers, and monitoring equipment.

- Document non-conformances, corrective actions, and customer-specific requirements.

- Retain records for a minimum of 5–10 years depending on industry standards (e.g., aerospace requires longer retention).

Audits and Continuous Improvement

- Conduct internal audits to verify compliance with quality, environmental, and safety standards.

- Schedule external audits for certifications such as NADCAP or ISO.

- Implement corrective and preventive actions (CAPA) based on audit findings.

- Train personnel regularly on updates to regulations, safety procedures, and process improvements.

Conclusion

Effective logistics and compliance in metal heat treatment require a systematic approach integrating regulatory adherence, operational discipline, and continuous monitoring. By following this guide, facilities can ensure product quality, worker safety, environmental protection, and customer satisfaction across diverse industrial sectors.

In conclusion, sourcing metal heat treatment services requires a strategic approach that balances quality, cost, capacity, and reliability. It is essential to evaluate potential suppliers based on their technical expertise, equipment capabilities, certifications, and adherence to industry standards such as ISO, AMS, or ASTM. Proximity, lead times, and communication efficiency also play critical roles in ensuring timely delivery and effective collaboration. Partnering with a reputable heat treatment provider not only enhances the mechanical properties and performance of metal components but also contributes to the overall reliability and longevity of the final product. Ultimately, a well-vetted sourcing decision supports operational efficiency, reduces risk, and strengthens supply chain resilience in manufacturing and engineering applications.