The global metal grating market is experiencing robust growth, driven by rising infrastructure development, increasing demand from industrial and commercial sectors, and stringent safety regulations. According to Grand View Research, the global metal grating market size was valued at USD 5.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts steady market expansion, supported by growing construction activities in emerging economies and increased adoption in oil & gas, wastewater treatment, and architectural applications. As demand escalates, manufacturers are focusing on innovation, durability, and compliance with international standards to maintain a competitive edge. In this evolving landscape, the following ten companies have emerged as leading metal grating manufacturers, recognized for their product quality, global reach, and technological advancements.

Top 10 Metal Grating Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

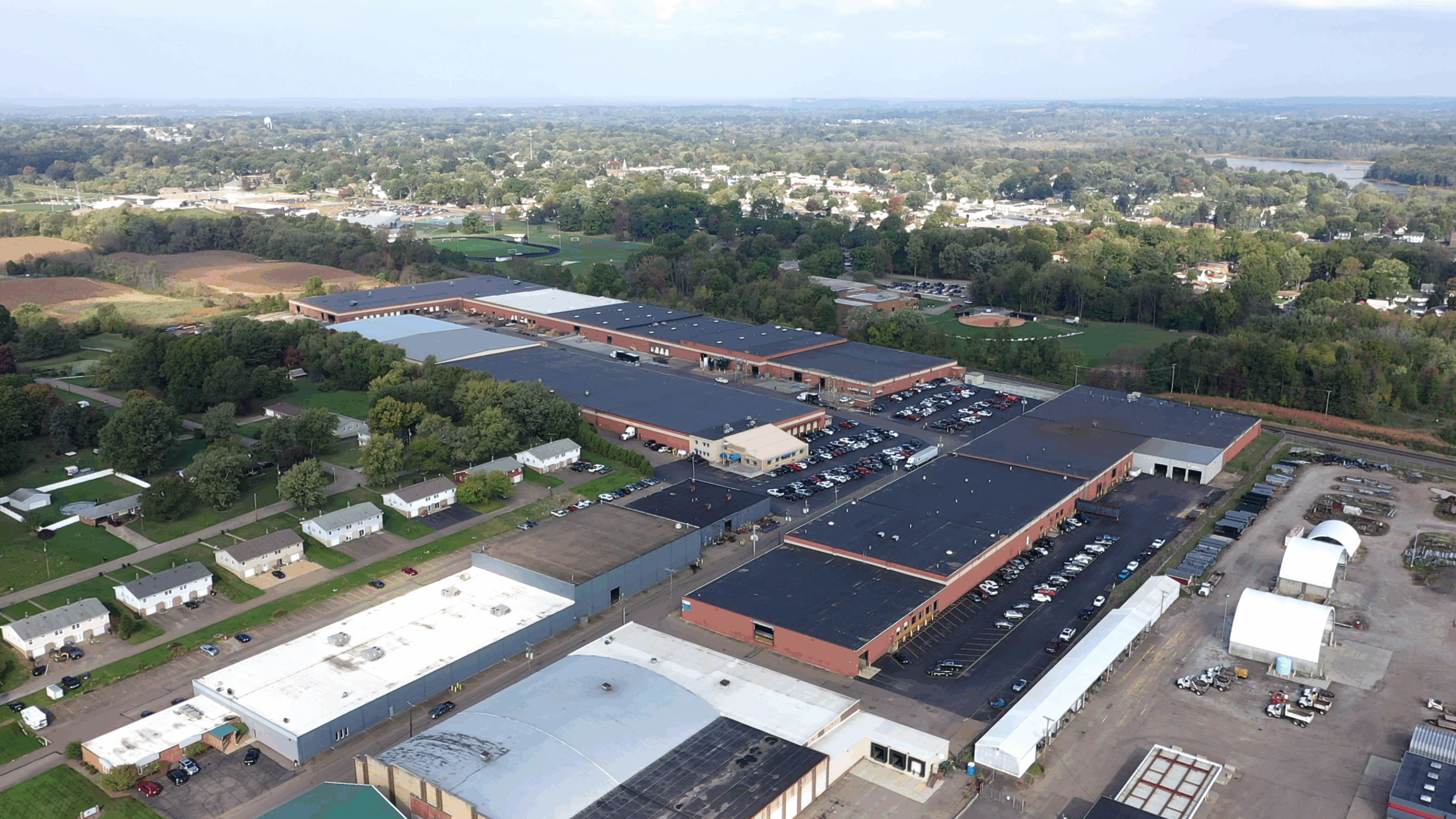

#1 Ohio Gratings

Domain Est. 1996

Website: ohiogratings.com

Key Highlights: Ohio Gratings, Inc. is a premier metal bar grating supplier, specializing in industrial and commercial grating design, manufacturing, and custom fabrication ……

#2 Bar Grating Manufacturer & Supplier

Domain Est. 2003 | Founded: 1976

Website: indianagratingsinc.com

Key Highlights: Indiana Gratings Inc. Supplying Steel, Aluminum, Stainless Steel and Fiberglass Gratings to the United States Since 1976…

#3 Miner Grating Systems

Domain Est. 2019

Website: minergrating.com

Key Highlights: Miner Grating is North America’s leading manufacturer and fabricator of bar grating, diamond safety grating, and round hole safety grating products….

#4 IKG

Domain Est. 1995

Website: ikg.com

Key Highlights: America’s first and leading steel grating manufacturer. ……

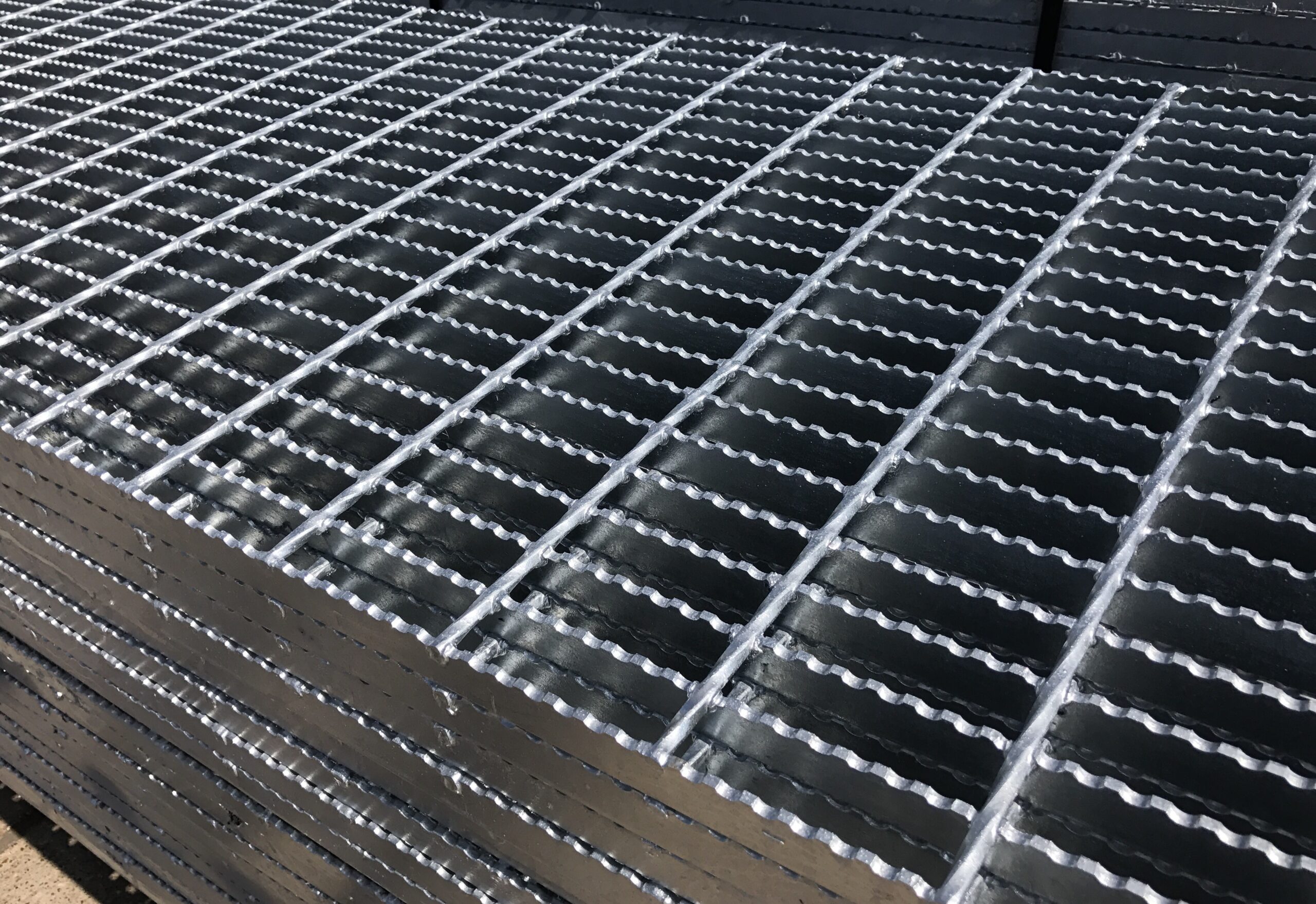

#5 Nucor Steel Grating

Domain Est. 1997

Website: nucor.com

Key Highlights: Vulcraft Grating is a leading North American producer of bar grating products. Our grating products are manufactured at modern plants using specially designed ……

#6 Vulcraft Grating

Domain Est. 1997

Website: vulcraft.com

Key Highlights: Steel bar grating from Vulcraft-standard, heavy-duty, and stair treads. Custom fabrication, fast delivery, and expert support for all your grating needs….

#7 Grating Pacific

Domain Est. 1997

Website: gratingpacific.com

Key Highlights: Grating Pacific is the Western States’ leading fabricator and supplier of metal bar grating, aluminum, and fiberglass grating, woven and welded wire mesh ……

#8 Steel and Metal Grating

Domain Est. 1997

Website: metalsusa.com

Key Highlights: Metals USA stocks a variety of bar grating sizes in carbon steel and aluminum, including galvanized, painted, and serrated options….

#9 Neenah Foundry

Domain Est. 2000

Website: neenahfoundry.com

Key Highlights: Neenah Foundry has been a consistent leader in delivering durable and highly engineered, structural, and sustainable casting solutions for customers….

#10 Metal Grating

Domain Est. 2011

Website: kloecknermetals.com

Key Highlights: Kloeckner offers an extensive range of metal grating products such as 19W4 serrated bar grating, 19W4 non-serrated bar grating, and expanded metal grating….

Expert Sourcing Insights for Metal Grating

H2: Emerging Market Trends in Metal Grating for 2026

As the global industrial and construction sectors evolve, the metal grating market is poised for significant transformation by 2026. Driven by technological innovation, sustainability mandates, and shifting infrastructure demands, several key trends are expected to shape the landscape.

H2: Growth in Sustainable and Corrosion-Resistant Materials

Environmental regulations and lifecycle cost considerations are accelerating demand for metal gratings made from stainless steel, aluminum, and fiber-reinforced polymer (FRP) composites. These materials offer superior corrosion resistance—especially critical in marine, wastewater, and chemical processing environments—reducing maintenance and replacement costs. By 2026, eco-friendly manufacturing processes and recyclability will be key differentiators, with manufacturers increasingly adopting low-carbon production techniques and circular economy models.

H2: Expansion in Renewable Energy Infrastructure

The global push toward clean energy is a major catalyst for metal grating demand. Solar farms, wind turbine platforms, and hydrogen production facilities require durable, non-slip flooring and access structures. Offshore wind projects, in particular, are driving demand for lightweight aluminum and stainless steel gratings that withstand harsh saltwater conditions. As governments meet renewable targets by 2026, this sector will represent one of the fastest-growing end-use markets for metal grating.

H2: Advancements in Smart and Modular Grating Systems

Digital integration is beginning to influence metal grating design. By 2026, smart gratings embedded with sensors for structural health monitoring—such as load detection, vibration analysis, and corrosion tracking—are expected to gain traction in critical infrastructure like bridges and industrial plants. Additionally, modular and prefabricated grating systems will become more popular, enabling faster installation, reduced labor costs, and greater design flexibility in construction and retrofitting projects.

H2: Regional Market Shifts and Urbanization

Asia-Pacific, led by China, India, and Southeast Asia, will remain the dominant market due to rapid urbanization, industrial expansion, and infrastructure investment under initiatives like Belt and Road. Meanwhile, North America and Europe will see steady growth driven by aging infrastructure rehabilitation and stringent safety standards. Emerging markets in Africa and Latin America will also increase adoption as industrialization accelerates.

H2: Supply Chain Resilience and Localization

Ongoing geopolitical tensions and supply chain disruptions are prompting manufacturers to localize production and diversify raw material sourcing. By 2026, nearshoring and regional manufacturing hubs will become more common, reducing lead times and dependency on global trade routes. This shift will favor suppliers who can offer vertically integrated operations and just-in-time delivery capabilities.

In conclusion, the 2026 metal grating market will be defined by innovation, sustainability, and strategic adaptation to global energy and infrastructure trends. Companies that embrace advanced materials, digital integration, and regional responsiveness will be best positioned for growth.

Common Pitfalls When Sourcing Metal Grating (Quality and Intellectual Property)

Sourcing metal grating—whether for industrial platforms, walkways, drainage, or architectural applications—can present several challenges, particularly concerning quality assurance and intellectual property (IP) rights. Overlooking these aspects may lead to safety hazards, project delays, legal disputes, or increased lifecycle costs. Below are the most common pitfalls to avoid.

Poor Material Quality and Non-Compliance

One of the most frequent issues in metal grating procurement is receiving substandard materials that do not meet specified standards (e.g., ASTM, ISO, or EN). Suppliers may use inferior alloys, incorrect thicknesses, or inadequate corrosion protection (such as insufficient galvanizing), leading to premature failure, safety risks, or non-compliance with regulatory requirements.

Example: A buyer receives mild steel grating labeled as “hot-dip galvanized,” but inspection reveals thin or uneven zinc coating, resulting in rapid rusting in outdoor environments.

Inconsistent Welding and Fabrication Standards

Low-quality welding—such as incomplete fusion, inconsistent weld size, or excessive spatter—can compromise structural integrity. Poorly fabricated gratings may warp, loosen under load, or fail safety tests. This is especially problematic when sourcing from suppliers with limited quality control processes.

Tip: Always request third-party test reports or conduct on-site audits to verify welding procedures and operator certifications.

Misrepresentation of Load Capacity and Span Ratings

Some suppliers may exaggerate load-bearing capabilities or provide inaccurate span tables based on ideal conditions not reflective of real-world use. Relying on incorrect data can lead to structural failures or non-compliant installations.

Best Practice: Validate load ratings through independent engineering calculations or certified performance data aligned with recognized standards like ANSI/NAAMM MBG 531.

Intellectual Property Infringement

Using or sourcing metal grating designs protected by patents (e.g., unique bar configurations, bearing bar profiles, or connection systems) without authorization can expose buyers and suppliers to IP litigation. This is common when replicating branded products like “Bar Grating” or “Press-Locked Grating” designs.

Red Flag: Offers for “equivalent to [Brand X]” gratings at significantly lower prices may indicate unauthorized copying of patented designs.

Lack of Traceability and Documentation

Inadequate material test reports (MTRs), missing certifications, or unclear supply chain traceability hinder quality verification and regulatory compliance. In industries like oil & gas or infrastructure, full traceability is often mandatory.

Solution: Require mill test certificates, compliance declarations, and batch-specific documentation with every delivery.

Counterfeit or Grey Market Products

Purchasing through unauthorized distributors or intermediaries increases the risk of receiving counterfeit or diverted goods that mimic reputable brands but lack quality assurance. These products may fail safety inspections or void project warranties.

Prevention: Source directly from authorized manufacturers or vetted distributors with documented supply chain integrity.

Overlooking Long-Term Maintenance and Lifecycle Costs

Focusing solely on upfront price often leads to selecting lower-quality gratings that require frequent maintenance or early replacement. High initial savings can result in higher total cost of ownership.

Advice: Evaluate total lifecycle cost, including durability, corrosion resistance, and maintenance needs, rather than just purchase price.

By recognizing and addressing these pitfalls—through rigorous supplier vetting, clear specifications, third-party verification, and IP due diligence—buyers can ensure they receive safe, compliant, and legally sound metal grating solutions.

Logistics & Compliance Guide for Metal Grating

Overview

Metal grating—used in industrial flooring, walkways, platforms, and safety barriers—requires careful handling during logistics and strict adherence to compliance standards to ensure safety, durability, and regulatory conformity. This guide outlines key considerations for transporting, storing, and complying with international and regional regulations when dealing with metal grating.

Material Specifications and Classification

Metal grating is typically manufactured from carbon steel, stainless steel, aluminum, or other alloys. Its classification affects packaging, handling, and compliance requirements. Ensure all products meet relevant material standards such as ASTM A36, A1011 (steel), or ASTM B221 (aluminum) and are marked with traceability information (e.g., heat number, grade, manufacturer).

Packaging and Handling

Proper packaging prevents deformation and corrosion during transit:

– Bundling: Gratings are typically bundled using steel or nylon strapping on wooden or metal skids.

– Protection: Use edge protectors and moisture-resistant wrapping (e.g., VCI paper) to prevent corrosion and surface damage.

– Labeling: Clearly label bundles with product details, weight, handling instructions (e.g., “Do Not Stack,” “This Side Up”), and safety warnings.

– Forklift Access: Design pallets/skids with proper fork entry points; avoid dragging grating to prevent warping.

Storage Requirements

Store metal grating in a dry, well-ventilated area, elevated off the ground:

– Avoid direct contact with soil or concrete to prevent moisture absorption and rust.

– Separate stainless steel from carbon steel to avoid galvanic corrosion.

– Stack no higher than recommended to prevent crushing lower layers.

Domestic and International Shipping

- Weight and Dimensions: Confirm load capacity of transport vehicles; metal grating can be heavy and bulky.

- Securement: Use tiedowns, load bars, or container braces to prevent shifting during transit.

- Documentation: Include commercial invoice, packing list, bill of lading, and material test reports (MTRs).

- Import/Export Compliance: Verify tariffs, customs codes (e.g., HS Code 7308.90 for grating structures), and country-specific restrictions.

Regulatory and Safety Compliance

Adhere to regional and international standards:

– OSHA (U.S.): Complies with 29 CFR 1910.23 for fall protection and walking-working surfaces.

– ANSI/SSSPC-ASC A12.1: Standard for safety requirements of industrial steel grating.

– EN ISO 14122 (Europe): Specifies safety of machinery and permanent means of access, including grating.

– Load Ratings: Ensure load capacity (e.g., pedestrian vs. vehicular) meets project specifications and local building codes.

Corrosion Protection and Coatings

- Galvanizing: Hot-dip galvanized (HDG) grating must comply with ASTM A123. Maintain coating integrity during handling.

- Painting/Powder Coating: Verify coating specifications (e.g., thickness, adhesion) per ASTM D4541 or ISO 2409.

- Documentation: Provide coating certification and application records for compliance audits.

Environmental and Hazardous Materials Considerations

- Metal grating is generally not classified as hazardous. However, oily residues or chromate treatments may trigger hazardous material regulations (e.g., DOT, ADR).

- Comply with REACH (EU) and RoHS directives if applicable, especially for coatings or alloy components.

Quality Assurance and Traceability

- Maintain full traceability through batch/lot numbers and certified Mill Test Reports (MTRs).

- Conduct pre-shipment inspections for dimensional accuracy, weld integrity, and surface finish per project specs (e.g., ISO 9001).

End-of-Life and Recycling Compliance

- Metal grating is highly recyclable. Follow local regulations for scrap metal disposal (e.g., EPA guidelines in the U.S., WEEE in EU).

- Provide recycling documentation upon customer request.

Conclusion

Efficient logistics and compliance for metal grating require attention to material handling, regulatory standards, and documentation. By following this guide, suppliers and contractors can ensure safe transport, regulatory conformity, and long-term product performance.

Conclusion for Sourcing Metal Grating:

Sourcing metal grating requires a strategic approach that balances quality, cost, durability, and supplier reliability. After evaluating various materials—such as carbon steel, stainless steel, aluminum, and galvanized steel—it is evident that the optimal choice depends on the specific application, environmental conditions, load requirements, and maintenance expectations. Carbon steel grating offers cost-effectiveness and strength, making it suitable for industrial applications, while stainless steel and aluminum provide superior corrosion resistance for harsh or aesthetically sensitive environments.

Establishing relationships with reputable suppliers who adhere to international standards (e.g., ASTM, ANSI, ISO) ensures consistent product quality and compliance. Additionally, considering lead times, customization capabilities, and logistical support plays a crucial role in minimizing project delays and supply chain disruptions.

In conclusion, a successful sourcing strategy for metal grating involves thorough supplier vetting, clear specification of technical requirements, and lifecycle cost analysis rather than focusing solely on upfront pricing. By prioritizing long-term performance and reliability, organizations can ensure safe, durable, and cost-efficient installations across various infrastructure, industrial, and architectural applications.