The global meta-cresol market is experiencing steady growth, driven by rising demand across key industries such as pharmaceuticals, agrochemicals, and specialty chemicals. According to Grand View Research, the global cresol market—encompassing ortho-, meta-, and para-cresol isomers—was valued at USD 1.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. Meta-cresol, in particular, plays a critical role as an intermediate in the synthesis of antioxidants, vitamins (such as Vitamin E), and disinfectants, underpinning its increasing industrial relevance. Regional production is concentrated in Asia-Pacific, where expanding chemical manufacturing capabilities in China and India are bolstering supply chains. As demand intensifies, a select group of manufacturers has emerged as key players in ensuring high-purity meta-cresol supply. Based on production capacity, geographic reach, and market influence, the following nine companies represent the leading forces shaping the meta-cresol landscape today.

Top 9 Metacresol Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 meta

Domain Est. 2005

Website: mubychem.com

Key Highlights: meta-Cresol or 3-Methylphenol or Metacresol is an organic compound with the formula CH3C6H4(OH). It is a colorless, viscous liquid that is used as an ……

#2 Meta Cresol

Domain Est. 2012

Website: vdhchemtech.com

Key Highlights: We are sole manufacturer of Meta Cresol in India. We have specialized team in order to manufacture, supply and export high quality Meta Cresol….

#3 Biovencer

Domain Est. 2013

Website: biovencer.com

Key Highlights: Biovencer Healthcare is the most trusted manufacturer of Pharmaceutical Lozenges like Dichlorobenzyl Alcohol & Amyl Metacresol Lozneges….

#4 Metacresol (USP)

Domain Est. 2014

Website: pharmacompass.com

Key Highlights: PharmaCompass offers a list of M-Cresol API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, ……

#5 M

Domain Est. 2024

Website: jeiferpharm.com

Key Highlights: Buy M-Cresol BP EP USP Pharma Grade from trusted China chemical supplier &distributor. Factory direct price, quality guarantee, fast delivery for your ……

#6 METACRESOL USP/PH.EUR

Domain Est. 1998

Website: safic-alcan.com

Key Highlights: It is used as preservative in solid and semi-solid dosage forms. Benefits: Complies with USP and Ph Eur specifications….

#7 m

Domain Est. 2004

Website: lanxess.com

Key Highlights: m-Cresol Product Information: Molecular Formula C7 H8 O, Molar weight 108.1, CAS (CAS Number) 108-39-4, Product Applications Manufacturing of herbicides….

#8 Meta‑Cresol Pharmaceutical Grade

Domain Est. 2023

Website: actylislab.com

Key Highlights: Rating 4/4.5 (17) We supply and export high quality Meta-cresol which is manufactured and packed under GMP environment along with regulatory documentation….

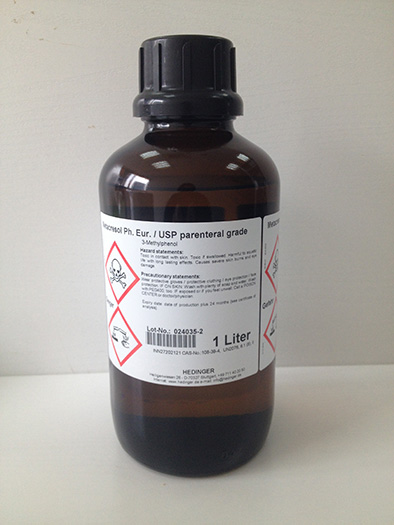

#9 Metacresol Ph. Eur. /USP parenteral grade

Website: hedinger.de

Key Highlights: Metacresol (m-Cresol) is manufactured by LANXESS based on IPEC PQC GMP Guidelines. There are special procedures in place at the manufacturing site to achieve ……

Expert Sourcing Insights for Metacresol

H2 2026 Market Trends Analysis for m-Cresol (Meta-cresol)

The global m-cresol (meta-cresol) market is poised for moderate growth and strategic shifts in the second half of 2026 (H2 2026), driven by evolving demand from key downstream industries, ongoing supply constraints, and regulatory pressures. m-Cresol, an aromatic organic compound primarily used in the production of vitamin E, agrochemicals, and specialty chemicals, is experiencing a period of recalibration amid macroeconomic and technological developments.

1. Demand-Side Trends

a. Vitamin E Industry Expansion

– The largest consumer of m-cresol remains the synthesis of isophytol, a critical intermediate in the production of synthetic vitamin E (tocopherols and tocotrienols).

– H2 2026 sees sustained demand from the nutraceutical and animal feed sectors, particularly in emerging markets in Asia-Pacific (China, India, and Southeast Asia), where health consciousness and livestock production are rising.

– Growth in fortified foods and dietary supplements continues to support vitamin E demand, thereby driving m-cresol consumption.

b. Agrochemical Applications

– m-Cresol is a precursor in the manufacture of certain herbicides and fungicides.

– With the global push for higher agricultural yields amid climate volatility, agrochemical demand in regions like Latin America and Africa supports steady m-cresol usage.

– However, increasing regulatory scrutiny on pesticide use in Europe and North America may constrain growth in these regions.

c. Specialty Chemicals and Emerging Uses

– Growing applications in antioxidants, polymer stabilizers, and pharmaceutical intermediates are contributing to diversified demand.

– Research into new derivatives and fine chemicals using m-cresol is gaining momentum, particularly in R&D-intensive markets like Japan and South Korea.

2. Supply-Side Dynamics

a. Production Concentration and Capacity Constraints

– China remains the dominant producer of m-cresol, accounting for over 60% of global supply. Production is largely integrated with coal tar refining and xylene-based processes.

– Environmental regulations in China continue to impact operating rates, with periodic shutdowns affecting supply stability.

– Limited new capacity expansions are expected in H2 2026 due to high capital costs and regulatory hurdles.

b. Feedstock Volatility

– m-Cresol production is sensitive to fluctuations in benzene and toluene/xylene prices.

– In H2 2026, crude oil price stability (projected due to balanced global supply) supports predictable feedstock costs, though geopolitical risks in the Middle East remain a watchpoint.

c. Import-Export Flows

– North America and Europe remain net importers of m-cresol, relying on Asian suppliers.

– Trade patterns are influenced by logistics costs and regional inventory levels; H2 2026 sees improved shipping availability post-pandemic, reducing lead times.

3. Pricing Trends

- m-Cresol prices in H2 2026 are expected to remain firm, averaging $3,200–$3,600 per metric ton, depending on region and volume.

- Price support is attributed to tight supply-demand balance and increasing raw material costs.

- Contract pricing is preferred by major buyers to hedge against volatility, while spot market activity remains limited.

4. Regulatory and Sustainability Pressures

- Environmental, social, and governance (ESG) factors are reshaping the chemical industry.

- m-Cresol production faces scrutiny due to its derivation from fossil fuels and potential environmental impact.

- Companies are investing in greener synthesis routes, including bio-based cresols, though commercial-scale adoption remains in early stages.

5. Regional Outlook

- Asia-Pacific: Strongest growth region; China and India drive both production and consumption.

- North America: Steady demand from vitamin E and specialty chemical sectors; reliance on imports continues.

- Europe: Slower growth due to stringent regulations and mature markets; focus on sustainable alternatives.

- Rest of World: Incremental growth in Latin America and the Middle East, linked to agrochemical and industrial applications.

6. Outlook and Strategic Implications

- The m-cresol market in H2 2026 reflects a tight but stable environment with moderate growth (~3–4% year-on-year).

- Key players are focusing on vertical integration, supply chain resilience, and R&D for alternative feedstocks.

- Long-term sustainability challenges may accelerate innovation in bio-based m-cresol or substitute intermediates.

Conclusion

In H2 2026, the m-cresol market is characterized by resilient demand from vitamin E and agrochemical sectors, constrained supply amid environmental regulations, and stable pricing. Market participants must navigate geopolitical risks, sustainability mandates, and regional disparities to maintain competitiveness. Strategic investments in green chemistry and supply diversification will likely define leadership in the evolving m-cresol landscape.

Common Pitfalls in Sourcing Meta-Cresol: Quality and Intellectual Property Concerns

Sourcing meta-cresol (m-cresol), an important chemical intermediate used in pharmaceuticals, agrochemicals, and fragrances, presents several challenges related to quality consistency and intellectual property (IP) risks. Being aware of these pitfalls is essential for ensuring supply chain reliability, product performance, and legal compliance.

Quality-Related Pitfalls

Inconsistent Purity and Isomeric Composition

Meta-cresol is one of three cresol isomers (ortho-, meta-, para-), and its value often depends on high isomeric purity. A common pitfall is receiving material with variable or unspecified isomer content due to inadequate separation during production. Impurities such as other cresol isomers, phenol, or xylenols can affect downstream processes, especially in pharmaceutical synthesis where strict purity standards apply.

Variability in Raw Material Sources and Production Methods

Meta-cresol can be derived from coal tar, petroleum-based feedstocks, or via synthetic routes like the sulfonation of toluene. Sourcing from suppliers using coal tar may introduce trace contaminants (e.g., heavy metals, PAHs), while synthetic methods require tight process control. Lack of transparency in the manufacturing process can lead to batch-to-batch inconsistencies.

Inadequate or Missing Certifications and Analytical Data

Procuring meta-cresol without proper Certificates of Analysis (CoA), compliance with pharmacopeial standards (e.g., USP, Ph. Eur.), or material safety data sheets (MSDS) increases risk. Suppliers may provide incomplete or falsified documentation, especially in less-regulated markets, leading to quality non-conformances or regulatory rejection.

Poor Packaging and Stability Issues

Meta-cresol is sensitive to oxidation and moisture. Poor packaging (e.g., non-inert containers, improper sealing) can result in degradation during storage or transit, affecting color, acidity, and efficacy. Suppliers may overlook stability data or shelf-life specifications, leading to performance issues upon use.

Intellectual Property (IP) Pitfalls

Unlicensed or Infringing Production Methods

Some manufacturing processes for meta-cresol—particularly advanced catalytic or biotechnological routes—may be protected by patents. Sourcing from suppliers using patented technologies without proper licensing exposes buyers to indirect IP infringement risks, especially if the end product is commercialized in regulated markets.

Lack of Freedom-to-Operate (FTO) Assessment

Companies integrating meta-cresol into proprietary formulations or processes may unknowingly violate existing patents covering specific uses, purification methods, or formulations. Failing to conduct a thorough FTO analysis before sourcing can result in legal disputes, injunctions, or costly redesigns.

Ambiguous IP Ownership in Custom Syntheses

When working with contract manufacturers for custom-purified or derivatized meta-cresol, unclear contractual terms about IP ownership can lead to disputes. Suppliers may claim rights over process improvements or novel derivatives, jeopardizing the buyer’s control over their product pipeline.

Counterfeit or Misrepresented Material

In some regions, counterfeit or mislabeled chemicals are a concern. Suppliers may falsely claim high purity or specific origin to meet demand. This not only compromises quality but may also involve IP misrepresentation, such as falsely claiming compliance with patented purification processes.

Mitigation Strategies

- Conduct thorough supplier audits and request full analytical data and process documentation.

- Specify required purity, isomeric content, and regulatory compliance in purchase agreements.

- Perform independent quality testing upon receipt.

- Engage legal and IP experts to review supplier practices and assess FTO for intended applications.

- Use contracts that clearly define IP rights, especially in custom manufacturing arrangements.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure a secure, compliant, and high-performing supply of meta-cresol.

Logistics & Compliance Guide for m-Cresol (Meta-Cresol)

Chemical Identification and Properties

m-Cresol (meta-cresol or 3-methylphenol) is an aromatic organic compound with the chemical formula C₇H₈O. It is one of the three isomers of cresol and appears as a colorless to pale yellow liquid with a characteristic phenolic odor. It is moderately soluble in water and highly soluble in organic solvents. m-Cresol is used in the production of antioxidants, disinfectants, agrochemicals, and resins.

CAS Number: 108-39-4

UN Number: 2079

Classification: Flammable liquid, Category 3; Acute toxicity, Oral, Category 3; Skin corrosion/irritation, Category 1B; Serious eye damage/eye irritation, Category 1; Specific target organ toxicity (single exposure), Category 3 (respiratory tract irritation); Hazardous to the aquatic environment, Category Acute 1.

Storage Requirements

- Storage Conditions: Store in a cool, dry, well-ventilated area away from direct sunlight, heat sources, and ignition sources.

- Container Type: Use corrosion-resistant containers made of stainless steel, glass, or approved plastics (e.g., HDPE). Ensure containers are tightly sealed to prevent vapor release.

- Segregation: Store away from strong oxidizers, acids, bases, and foodstuffs. Do not store near incompatible materials such as ammonia, isocyanates, or peroxides.

- Temperature Control: Maintain storage temperatures below 40°C (104°F). Avoid freezing, as solidification may compromise container integrity.

- Secondary Containment: Use spill pallets or dikes to contain potential leaks.

Handling Procedures

- Personal Protective Equipment (PPE):

- Chemical-resistant gloves (e.g., nitrile or neoprene)

- Safety goggles or face shield

- Lab coat or chemical-resistant clothing

- Respiratory protection (NIOSH-approved respirator with organic vapor cartridge) if vapor concentrations exceed permissible exposure limits

- Engineering Controls: Use local exhaust ventilation or fume hoods when handling open containers or during transfer operations.

- Hygiene Practices: Wash hands thoroughly after handling. Avoid contact with skin, eyes, and clothing. Do not eat, drink, or smoke in handling areas.

Transportation Regulations

m-Cresol is regulated as a hazardous material under international and national transportation regulations:

IMDG Code (Maritime):

– UN 2079, Cresol, liquid, 6.1 (8), PG II

– Proper Shipping Name: CRECOL, LIQUID

– Labels: Toxic, Corrosive, Flammable

– Special Provisions: May require ventilation and temperature control depending on volume and duration

IATA DGR (Air):

– UN 2079, Class 6.1 (Toxic), PG II

– Max net quantity per package: 5 L for passenger aircraft; 60 L for cargo aircraft

– Packaging must meet performance standards (e.g., 4G, 1H2)

– Required documentation: Shipper’s Declaration for Dangerous Goods

ADR/RID (Road/Rail – Europe):

– UN 2079, Class 6.1 + Class 8 (Toxic and Corrosive), PG II

– Tunnel Code: C/E

– Driver training: ADR certification required

– Vehicle must display orange placards with hazard numbers 66 (6.1 + 8)

49 CFR (US DOT – Highway/Rail):

– Hazard Class: 6.1 (Poisonous Materials) with subsidiary hazard Class 8 (Corrosive)

– PG II – Packing Group II

– Placarding: “POISON” and “CORROSIVE” if transported in large quantities (≥1,001 lbs aggregate gross weight)

– Required shipping papers with proper hazard class, UN number, and emergency contact information

Emergency Response

- Spill Response:

- Evacuate non-essential personnel.

- Contain spill with inert absorbent material (e.g., vermiculite, sand).

- Collect contaminated material in labeled, sealable containers for proper disposal.

- Ventilate area and avoid ignition sources.

- Do not flush into drains or waterways.

- Fire Hazards:

- Flash Point: ~90°C (194°F), Closed Cup

- Extinguishing Media: Alcohol-resistant foam, dry chemical, or carbon dioxide. Do not use water jet.

- Firefighters should wear full protective gear and self-contained breathing apparatus (SCBA).

- Exposure First Aid:

- Inhalation: Move to fresh air; seek medical attention if respiratory irritation occurs.

- Skin Contact: Remove contaminated clothing; wash with soap and water for 15 minutes. Seek medical help.

- Eye Contact: Rinse immediately with copious amounts of water for at least 15 minutes; consult an ophthalmologist.

- Ingestion: Rinse mouth; do NOT induce vomiting. Seek immediate medical assistance.

Regulatory Compliance and Documentation

- Safety Data Sheet (SDS): Maintain up-to-date SDS (GHS-compliant) accessible to all personnel.

- Labeling: All containers must display GHS-compliant labels with:

- Product identifier

- Signal word: “Danger”

- Hazard pictograms (Skull & Crossbones, Corrosion, Flame, Health Hazard)

- Hazard statements (e.g., H301, H314, H331, H373)

- Precautionary statements

- Reporting Requirements:

- Report spills exceeding reportable quantities (RQ) to relevant environmental agencies (e.g., US EPA, ECHA).

- Include m-Cresol in facility chemical inventories (e.g., Tier II, REACH).

- Training: Ensure all handlers and transporters are trained under OSHA HAZCOM, DOT HMR, or equivalent regulations.

Environmental and Disposal Considerations

- Environmental Hazards: m-Cresol is toxic to aquatic life with long-lasting effects. Prevent release into soil, water, or sewer systems.

- Waste Disposal:

- Dispose of waste m-Cresol and contaminated materials as hazardous waste.

- Follow local, state, and federal regulations (e.g., RCRA in the US).

- Use licensed hazardous waste disposal contractors.

- Incineration in approved facilities with gas scrubbing is recommended.

Additional Notes

- Regularly inspect storage areas, containers, and transportation vehicles for leaks or corrosion.

- Implement a chemical management system to track inventory, expiration, and usage.

- Stay updated on regulatory changes from agencies such as OSHA, EPA, DOT, ECHA, and IMO.

This guide is intended for general informational purposes. Always consult the latest Safety Data Sheet and applicable regulatory authorities for site-specific compliance.

Conclusion for Sourcing m-Cresol

In conclusion, sourcing m-cresol requires a strategic approach that balances quality, reliability, cost-effectiveness, and regulatory compliance. As a key chemical intermediate used in pharmaceuticals, agrochemicals, dyes, and antioxidants, ensuring a consistent supply of high-purity m-cresol is critical for downstream applications. A thorough evaluation of potential suppliers should include assessments of production capacity, adherence to international quality standards (such as ISO, REACH, or FDA guidelines), and robust supply chain logistics.

Asia, particularly China and India, remains a dominant supplier due to established chemical manufacturing infrastructure and competitive pricing. However, diversifying sources may mitigate supply chain risks related to geopolitical factors, trade restrictions, or transportation disruptions. Additionally, engaging with suppliers offering sustainable and environmentally responsible production methods can support corporate social responsibility goals and align with increasingly stringent environmental regulations.

Ultimately, building long-term partnerships with reputable suppliers, conducting regular audits, and maintaining clear communication will ensure a resilient m-cresol sourcing strategy. Continuous market monitoring and flexibility to adapt to price fluctuations or changes in regulatory landscapes will further enhance supply security and operational efficiency.