The global mesh wiring market is experiencing robust growth, driven by rising demand for energy-efficient building solutions, smart infrastructure development, and advancements in industrial automation. According to a 2023 report by Mordor Intelligence, the global structured cabling market—which includes mesh wiring solutions—is projected to grow at a CAGR of over 7.5% from 2023 to 2028. Similarly, Grand View Research valued the global industrial wiring and cable market at USD 208.5 billion in 2022, with an expected CAGR of 5.8% through 2030, citing increased adoption in manufacturing, power, and telecommunications sectors. As connectivity demands evolve, mesh wiring has emerged as a critical component for resilient, scalable network infrastructures in data centers, smart buildings, and industrial IoT ecosystems. This growing reliance on high-performance cabling systems has elevated the role of specialized manufacturers capable of delivering durable, high-throughput solutions. In this context, we spotlight the top 10 mesh wiring manufacturers shaping the industry through innovation, global reach, and compliance with evolving technical standards.

Top 10 Mesh Wiring Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 W.S. Tyler

Domain Est. 1996

Website: wstyler.com

Key Highlights: WS Tyler strives to revolutionize the manufacturing of woven wire mesh with a focus on seamless integration for customers….

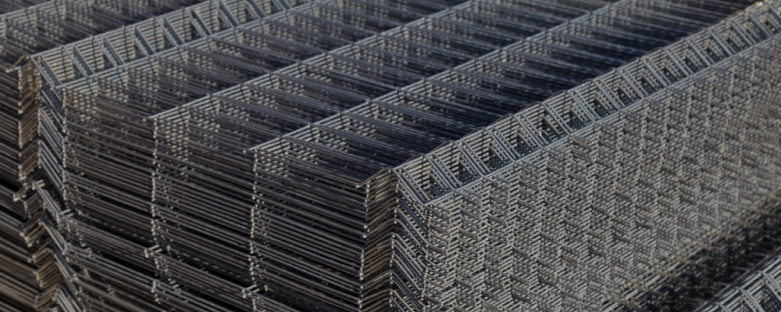

#2 Insteel Industries Inc.

Domain Est. 1996

Website: insteel.com

Key Highlights: We manufacture and market prestressed concrete strand and welded wire reinforcement, including engineered structural mesh, concrete pipe reinforcement and ……

#3 Gerard Daniel

Domain Est. 2000

Website: gerarddaniel.com

Key Highlights: We offer a comprehensive range of wire cloth and mesh products, including micronic, square and twilled weaves. EXPLORE WIRE MESH. Filtration Products ……

#4 GKDMETALFABRICS

Domain Est. 2000

Website: gkdmetalfabrics.com

Key Highlights: GKD Metal Fabrics is the leading supplier of custom-woven architectural wire mesh and designs for various architectural applications. Contact us today….

#5 Wire Mesh Manufacturers

Domain Est. 2001

Website: wire-cloth.net

Key Highlights: Instantly discover the leading wire mesh manufacturers and suppliers in the USA producing ISO certified products made from premium materials for unbeatable ……

#6 Delta Wire

Domain Est. 1999

Website: deltawire.com

Key Highlights: Delta Wire & Mfg. offers a variety of welded wire mesh sizes, configurations and gauges to suit almost any need. Made from bright drawn mild steel….

#7 Wire Mesh & Wire Cloth Since 1854

Domain Est. 2007

Website: darbywiremesh.com

Key Highlights: Trusted by customers since 1854, Darby has been the name in the wire mesh & wire cloth industry for supplying mesh for use in numerous applications….

#8 WMC

Domain Est. 2009

Website: wmc-us.com

Key Highlights: We are committed to building infrastructures which last a lifetime, by manufacturing the highest quality of wire products….

#9 SQC Wire Mesh

Domain Est. 2010 | Founded: 2010

Website: sqcwiremesh.com

Key Highlights: Established in 2010, SQC Wire Mesh is a trusted wire mesh stockist and solution provider with strategic offices and warehouses in Singapore and Malaysia….

#10 Wire Mesh Technical Information by IWM

Domain Est. 2015

Website: iwmesh.com

Key Highlights: IWM is in continuous production of plain weave wire mesh constructed of aluminum, low carbon steel, stainless steel, commercial bronze and copper alloys….

Expert Sourcing Insights for Mesh Wiring

H2: Projected Market Trends for Mesh Wiring in 2026

By 2026, the global market for mesh wiring—commonly used in smart home automation, industrial IoT (Internet of Things), and advanced telecommunications infrastructure—is expected to experience significant growth driven by technological innovation, increasing demand for seamless connectivity, and rising adoption of decentralized network architectures. Mesh wiring, which enables devices to communicate through interconnected nodes rather than relying on a centralized hub, is poised to play a critical role in next-generation network deployments.

One of the primary drivers of this trend is the escalating demand for reliable and scalable home and industrial automation systems. As consumers and enterprises alike seek robust, self-healing networks that minimize dead zones and ensure continuous connectivity, mesh-based solutions offer a compelling advantage over traditional star-topology networks. The proliferation of smart devices—including security systems, lighting, HVAC controls, and voice assistants—continues to fuel investment in mesh wiring infrastructure.

Additionally, advancements in wireless protocols such as Wi-Fi 6E, Matter, and Thread are accelerating the integration of mesh networks into mainstream applications. These protocols enhance interoperability, reduce latency, and improve energy efficiency, making mesh wiring more attractive for both consumer electronics and industrial monitoring systems. By 2026, it is anticipated that a majority of new smart home installations will incorporate mesh-ready wiring or be built on mesh-compatible platforms.

The industrial sector is also embracing mesh wiring for asset tracking, predictive maintenance, and real-time data monitoring. In manufacturing and logistics, wireless mesh networks supported by robust wired backbones offer resilience in challenging environments. This trend is being reinforced by the rollout of private 5G networks and edge computing, where mesh topologies enhance data routing efficiency and redundancy.

Geographically, North America and Western Europe are leading adoption due to high smart home penetration and government support for digital infrastructure. However, rapid urbanization and smart city initiatives in Asia-Pacific—particularly in China, India, and South Korea—are expected to become major growth engines for the mesh wiring market by 2026.

In terms of materials and design, there is a growing shift toward using low-voltage, high-efficiency cabling such as Cat6a and fiber-optic hybrids that support high-bandwidth mesh backhauls. Sustainability considerations are also influencing product development, with increased demand for recyclable materials and energy-efficient network components.

In summary, by 2026, the mesh wiring market will be shaped by the convergence of smart technologies, evolving communication standards, and the need for resilient, scalable networks. Stakeholders across construction, technology, and telecom sectors must adapt to these trends by investing in compatible infrastructure and supporting ecosystem integration to remain competitive.

Common Pitfalls Sourcing Mesh Wiring (Quality, IP)

Sourcing mesh wiring—especially for critical applications such as industrial automation, data centers, or infrastructure—requires careful evaluation to avoid costly mistakes. Two of the most frequent pitfalls involve quality inconsistencies and misinterpretation or misrepresentation of Ingress Protection (IP) ratings.

Quality Inconsistencies

One of the biggest risks when sourcing mesh wiring is variability in material and construction quality. Many suppliers, particularly in cost-driven markets, may use subpar materials to reduce prices. For example, some mesh shields may be made from low-grade or thinly coated copper, reducing conductivity and electromagnetic interference (EMI) protection. Poor braiding density (measured in percent coverage) can also compromise shielding effectiveness. Additionally, inconsistencies in jacket materials—such as using non-halogen-free or low-temperature-resistant compounds—can lead to premature degradation in harsh environments. Buyers often overlook these details until field failures occur, leading to system downtime and safety hazards.

Misunderstanding or Misrepresenting IP Ratings

Another major pitfall is the incorrect interpretation or false claims regarding Ingress Protection (IP) ratings. Mesh wiring assemblies—especially connectors and termination points—must maintain the specified IP rating (e.g., IP67, IP68) throughout their service life. However, many suppliers advertise cable ratings without accounting for how the mesh shield and overall assembly affect sealing. For instance, a cable may be rated IP68, but if the termination method compromises the enclosure seal, the actual protection is lost. Furthermore, some vendors may apply IP ratings to individual components rather than the fully assembled system, leading to non-compliance in real-world installations. Always verify that the entire assembly, including joints and connectors, meets the required IP standard under relevant testing conditions.

Logistics & Compliance Guide for Mesh Wiring

Overview

This guide outlines the key logistics and compliance considerations for the procurement, transportation, installation, and maintenance of Mesh Wiring systems. Mesh Wiring—commonly used in structured cabling for networking, telecommunications, and building automation—must adhere to industry standards, safety regulations, and logistical best practices to ensure performance, safety, and regulatory compliance.

Regulatory Standards and Certifications

Mesh Wiring products and installations must comply with regional and international standards to ensure safety, electromagnetic compatibility (EMC), and performance. Key standards include:

- ISO/IEC 11801: International standard for generic cabling in commercial buildings.

- ANSI/TIA-568.2-D: U.S. standard for balanced twisted-pair telecommunications cabling.

- EN 50173: European equivalent of ISO/IEC 11801.

- RoHS (Restriction of Hazardous Substances): Ensures wiring materials do not contain restricted substances such as lead, mercury, and cadmium.

- REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals): Applies to material content within wiring components in the EU.

- CE Marking: Required for products sold within the European Economic Area (EEA), indicating conformity with health, safety, and environmental protection standards.

- UL Certification (Underwriters Laboratories): Required for electrical safety compliance in North America.

Ensure all mesh wiring components (cables, connectors, patch panels) carry appropriate certifications before procurement or installation.

Packaging and Labeling Requirements

Proper packaging and labeling are essential for logistics efficiency and regulatory compliance:

- Durability: Cables must be wound on reels or spools and protected from moisture, crushing, and UV exposure.

- Labeling: Each package must include:

- Product name and model number

- Length and gauge (e.g., 24 AWG)

- Category rating (e.g., Cat 6A)

- Compliance markings (UL, CE, RoHS)

- Batch/lot number and manufacturing date

- Manufacturer and country of origin

- Hazard Communication: If any components contain regulated substances, appropriate GHS (Globally Harmonized System) labels must be applied.

Import/Export Compliance

When shipping mesh wiring internationally, adhere to the following:

- Harmonized System (HS) Codes: Use correct HS codes (e.g., 8544.42 for insulated copper wire) for customs declarations.

- Export Controls: Confirm no export restrictions apply—most mesh wiring is not subject to ITAR or EAR, but verify based on destination and application.

- Documentation:

- Commercial invoice

- Packing list

- Certificate of Origin

- Compliance certificates (RoHS, REACH, etc.)

- Duty and Taxation: Be aware of import duties, VAT, or GST based on destination country regulations.

Transportation and Handling

Ensure safe and efficient transportation of mesh wiring:

- Mode of Transport: Use enclosed, dry vehicles (trucks, containers) to prevent moisture and physical damage.

- Temperature Control: Avoid extreme temperatures (>60°C or <–10°C) during transit to prevent jacket degradation.

- Handling Instructions:

- Do not drop reels or apply excessive force.

- Avoid sharp bends or kinks—respect minimum bend radius (typically 4x cable diameter).

- Store vertically when possible to prevent deformation.

- Stacking: Limit stack height to prevent crushing; use dunnage between layers.

Storage Guidelines

Proper storage prevents degradation and ensures product integrity:

- Environment: Store in a dry, temperature-controlled area (10°C to 30°C recommended).

- Humidity: Maintain relative humidity below 60% to prevent oxidation.

- Shelving: Use racks to elevate reels off the floor; avoid direct contact with concrete.

- Shelf Life: Most copper-based mesh wiring has a shelf life of 10–20 years if stored properly. Inspect before use if stored long-term.

Installation Compliance

Installation must follow manufacturer specifications and local electrical codes:

- Electrical Codes: Adhere to NEC (NFPA 70) in the U.S., IEC 60364 internationally, or local equivalents.

- Separation from Power Lines: Maintain minimum separation (typically 12–24 inches) or use shielded cable when running parallel to power cables to reduce EMI.

- Grounding and Bonding: Properly ground shields and racks as per local code to ensure safety and signal integrity.

- Pulling Tension: Do not exceed maximum pulling tension (usually 25 lbs for Cat 6/6A) to avoid conductor damage.

- Fire Safety: Use plenum-rated (CMP) or riser-rated (CMR) cables where required by building codes.

Environmental and Disposal Compliance

End-of-life handling must follow environmental regulations:

- Recycling: Copper and certain jacket materials (e.g., PE, PVC) are recyclable. Partner with certified e-waste recyclers.

- Disposal: Follow local hazardous waste regulations. Do not incinerate halogenated cables (PVC) due to toxic emissions.

- WEEE Directive (EU): Applies to electrical and electronic equipment; ensure proper take-back or recycling programs are in place.

Documentation and Recordkeeping

Maintain records to support compliance audits and warranty claims:

- Product datasheets and compliance certificates

- Shipping and customs documentation

- Installation records (cable runs, test results, as-built drawings)

- Maintenance logs and testing reports (e.g., insertion loss, crosstalk)

Conclusion

Compliance and efficient logistics are critical for the successful deployment of mesh wiring systems. Adhering to technical standards, regulatory requirements, and best practices in handling and documentation ensures safety, reliability, and legal compliance across the product lifecycle. Always consult local regulations and manufacturer guidelines before procurement and installation.

Conclusion for Sourcing Mesh Wiring

In conclusion, sourcing mesh wiring requires a strategic approach that balances quality, cost, reliability, and long-term performance. After evaluating various suppliers, material specifications, and industry standards, it is evident that selecting the right mesh wiring involves more than just competitive pricing. Factors such as material durability (e.g., copper, aluminum, or alloy compositions), compliance with safety standards (e.g., UL, CE, or ISO certifications), and the supplier’s track record for on-time delivery and technical support are crucial.

Additionally, considering the specific application—whether for electrical grounding, RF shielding, aerospace, or construction—ensures that the chosen mesh wiring meets both functional and regulatory requirements. Engaging with suppliers who offer transparency in material sourcing, provide detailed product testing data, and support customization options can significantly enhance project outcomes.

Ultimately, a well-informed sourcing decision leads to improved system reliability, reduced maintenance costs, and long-term operational efficiency. Establishing strong partnerships with reputable suppliers and maintaining a focus on quality assurance will ensure that mesh wiring integrates seamlessly into the intended application, supporting safety, performance, and sustainability goals.