The global marine propulsion and outboard parts market has seen steady expansion, driven by rising recreational boating activities and increased investments in marine infrastructure. According to Mordor Intelligence, the outboard motors market is projected to grow at a CAGR of over 5.8% from 2024 to 2029, with major contributions from leading manufacturers like Mercury Marine. This growth is supported by technological advancements in fuel efficiency, emissions reduction, and digital integration in marine engines. As demand for reliable and high-performance marine components rises, Mercury Marine and its network of key parts manufacturers play a pivotal role in shaping industry standards. In this context, identifying the top suppliers behind Mercury’s robust ecosystem is essential for distributors, OEMs, and service providers aiming to align with market leaders in marine innovation and quality.

Top 6 Mercury Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

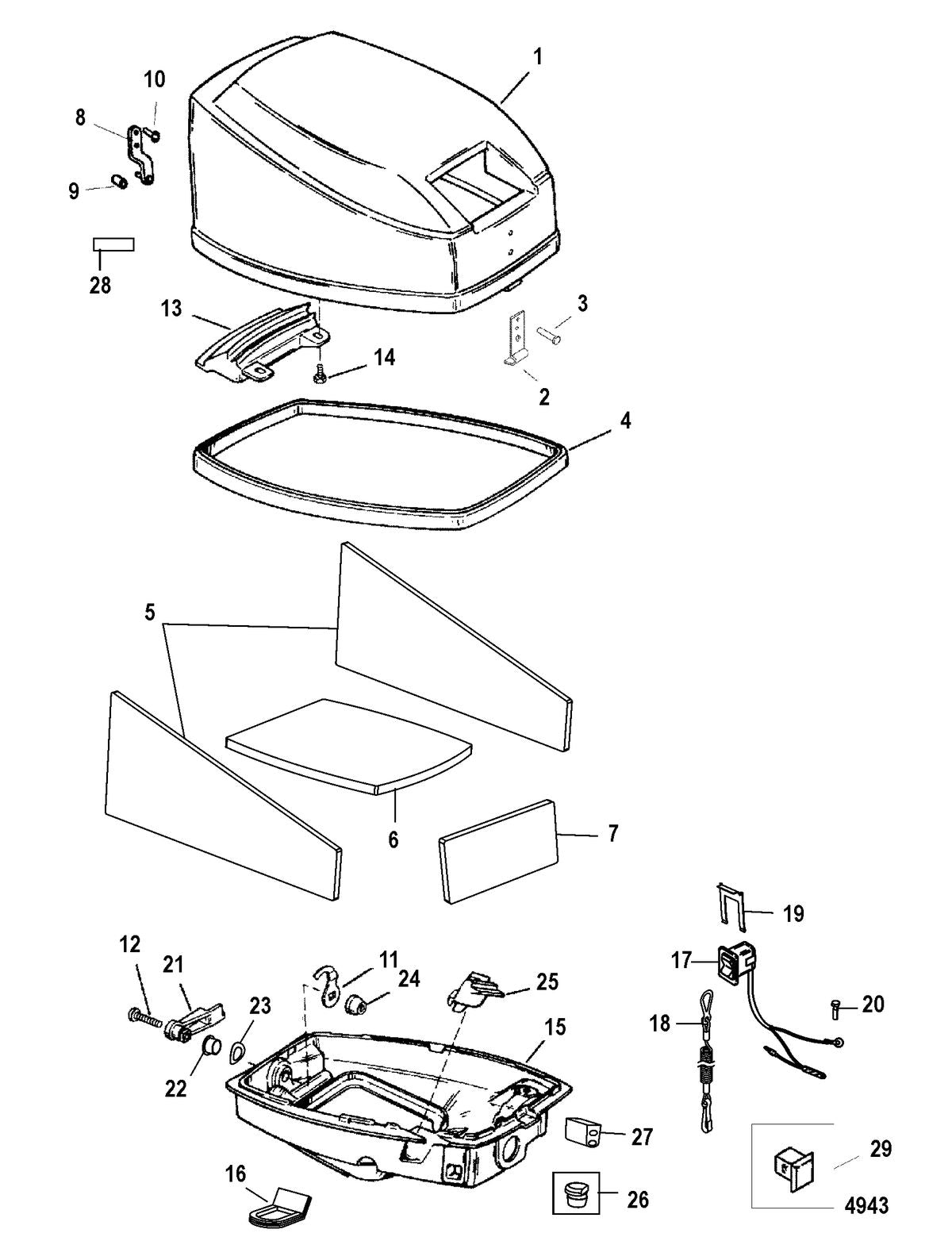

#1 Mercury Marine Parts Lookup Drawings

Domain Est. 1998

Website: mercruiserparts.com

Key Highlights: Use our Mercury online parts catalog to find genuine Mercury Marine, Mercury Outboard, Mercruiser, Quicksilver and Mercury Racing OEM factory parts….

#2 Mercury Marine

Domain Est. 1995

Website: mercurymarine.com

Key Highlights: Mercury Marine is the world’s leading manufacturer of recreational marine propulsion engines. Get sales, service and parts info, and find a local dealer ……

#3 Mercury

Domain Est. 1995

Website: boats.net

Key Highlights: Get brand new OEM Mercury outboard parts at the best price online, guaranteed. All parts are top quality and a perfect fit for smooth performance and longer ……

#4 Genuine Mercury Parts and Accessories at FordPartsGiant

Domain Est. 2009

Website: fordpartsgiant.com

Key Highlights: Shop genuine Mercury parts online from FordPartsGiant.com with wholesale prices. We have a comprehensive OEM parts catalog covering all models for Mercury….

#5 Mercury Marine EPC

Domain Est. 1996

#6

Domain Est. 1998

Website: mercuryracing.com

Key Highlights: Mercury Racing builds the best marine & automotive propulsion systems, accessories, and parts on the market. Learn the value of raw performance and power….

Expert Sourcing Insights for Mercury Parts

H2: Market Trends for Mercury Parts in 2026

As the automotive and marine industries evolve toward electrification, digitalization, and sustainability, Mercury Parts—a key player in marine propulsion and aftermarket components—is expected to experience significant shifts in market dynamics by 2026. The H2 (second half) of 2026 will be particularly telling, as macroeconomic stabilization, technological adoption, and consumer behavior trends converge. Below is an analysis of the anticipated market trends for Mercury Parts during this period.

-

Increased Demand for Hybrid and Electric Propulsion Components

By H2 2026, Mercury Marine’s investment in its Next-Gen electric and hybrid outboard technologies (such as the Avator electric drive platform) is expected to yield stronger market penetration. Growing environmental regulations, especially in Europe and North America, will drive demand for low-emission marine solutions. Mercury Parts will see rising sales in components related to electric motors, battery integration systems, and digital control modules. -

Expansion of Digital Service Ecosystems

Mercury’s integration of digital platforms like Mercury SmartCraft and VesselView will continue to mature. By H2 2026, aftermarket parts will increasingly include connectivity modules, sensor arrays, and software-driven diagnostics. Consumers and service providers will demand interoperable, over-the-air (OTA) upgradable components, positioning Mercury Parts as not just mechanical suppliers but digital solution enablers. -

Growth in Recreational Boating Aftermarket

Despite economic fluctuations, the global recreational boating market is projected to rebound in H2 2026, supported by pent-up demand and aging fleets requiring upgrades. Mercury Parts will benefit from replacement cycles for outboard engines, propellers, lower units, and rigging components. The used boat market will also stimulate demand for genuine OEM replacement parts due to reliability concerns with third-party alternatives. -

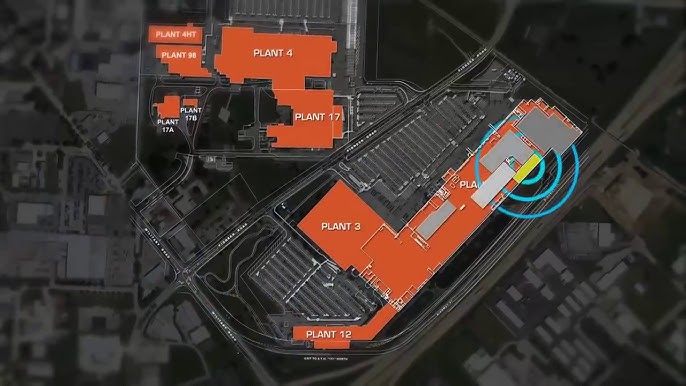

Supply Chain Resilience and Localization

By 2026, Mercury (under parent company Brunswick Corporation) will likely have further localized production and parts distribution networks to mitigate global supply chain risks. H2 will see improved inventory availability and reduced lead times for critical parts, enhancing customer satisfaction and dealer network efficiency—particularly in North America, Europe, and emerging markets like Australia and Southeast Asia. -

Focus on Sustainability and Circular Economy

Environmental, Social, and Governance (ESG) pressures will push Mercury to expand its remanufactured and recycled parts programs. In H2 2026, expect a broader rollout of certified refurbished components, such as remanufactured gear cases and powerheads, appealing to cost-conscious and eco-aware consumers. This aligns with Brunswick’s broader sustainability goals and could open new revenue streams. -

Competition from Emerging Technologies and Brands

While Mercury maintains leadership in outboard innovation, competition from new entrants in the electric marine space (e.g., Torqeedo, ePropulsion, and traditional automakers eyeing marine EVs) may pressure margins. Mercury Parts will need to emphasize brand loyalty, superior service networks, and integrated ecosystems to retain market share, especially in premium and commercial segments. -

Commercial and Government Sector Opportunities

Government contracts for patrol, research, and coastal surveillance vessels will fuel demand for durable, high-performance Mercury engines and parts. H2 2026 may see increased procurement cycles in North America and allied nations, supporting aftermarket service and spare parts volume.

Conclusion

H2 2026 will be a pivotal period for Mercury Parts, marked by accelerated technological transformation and shifting consumer expectations. Success will depend on Mercury’s ability to balance innovation with reliability, expand digital integration, and strengthen its global service infrastructure. With strategic focus on electrification, sustainability, and customer-centric solutions, Mercury Parts is well-positioned to lead in the evolving marine aftermarket landscape.

Common Pitfalls in Sourcing Mercury Parts: Quality and Intellectual Property Risks

Sourcing Mercury parts—whether referring to components from Mercury Marine, Mercury Systems, or another entity using the “Mercury” brand—can present significant challenges, particularly concerning part quality and intellectual property (IP) protection. Falling into common pitfalls can lead to operational failures, legal liabilities, and reputational damage. Below are key risks to avoid:

Quality Assurance Failures

One of the most critical risks when sourcing Mercury parts is compromising on quality. Counterfeit, substandard, or non-OEM (Original Equipment Manufacturer) parts may appear cost-effective initially but often lead to system failures, safety hazards, and increased long-term costs.

- Counterfeit Components: Unauthorized suppliers may offer fake Mercury parts that mimic genuine products but fail to meet performance or durability standards. These can be especially dangerous in marine or aerospace applications where reliability is crucial.

- Lack of Certification: Genuine Mercury parts typically come with certifications (e.g., ISO, AS9100 for Mercury Systems). Sourcing from vendors without proper traceability or documentation increases the risk of receiving non-compliant parts.

- Inconsistent Performance: Non-OEM parts may not undergo the same rigorous testing as authentic components, leading to premature wear, incompatibility, or system downtime.

Intellectual Property (IP) Infringement

Sourcing Mercury parts from unauthorized channels can expose organizations to serious IP violations, particularly when dealing with proprietary technology, software, or design elements.

- Unauthorized Replication: Some suppliers may reverse-engineer or illegally reproduce Mercury parts, violating patents, trademarks, or copyrights. Purchasing such parts—even unknowingly—can implicate your organization in IP infringement.

- Software and Firmware Risks: Mercury Systems, for example, often integrates proprietary software into its hardware. Unauthorized parts may include pirated or modified firmware, leading to cybersecurity vulnerabilities and legal exposure.

- Trademark Misuse: Using or distributing parts that bear the Mercury logo or branding without authorization constitutes trademark infringement, potentially resulting in cease-and-desist orders, fines, or litigation.

Mitigation Strategies

To avoid these pitfalls:

– Source exclusively through authorized distributors or directly from Mercury.

– Verify certifications, part numbers, and batch traceability.

– Conduct supplier audits and due diligence.

– Consult legal counsel when uncertain about IP compliance.

By proactively addressing quality and IP concerns, organizations can ensure reliable performance and maintain compliance when sourcing Mercury parts.

Logistics & Compliance Guide for Mercury Parts

This guide provides essential information for the proper handling, transportation, storage, and regulatory compliance associated with Mercury-containing components (“Mercury Parts”) used in industrial, automotive, or electronic applications. Strict adherence to these guidelines is necessary to ensure safety, environmental protection, and compliance with international, federal, and local regulations.

Regulatory Compliance Overview

Mercury is a regulated hazardous substance under multiple frameworks including the U.S. Environmental Protection Agency (EPA) regulations, the European Union’s Restriction of Hazardous Substances (RoHS) Directive, the Minamata Convention on Mercury, and various state and local environmental laws. All Mercury Parts must be managed in accordance with:

- EPA 40 CFR Parts 260–266: Governing hazardous waste handling, storage, and disposal.

- DOT 49 CFR: Regulating the safe transport of hazardous materials, including mercury and mercury-containing devices.

- OSHA 29 CFR 1910.1000: Setting permissible exposure limits (PELs) for mercury vapor in the workplace.

- RoHS Directive (2011/65/EU): Restricting the use of mercury in electrical and electronic equipment, with limited exemptions.

- Minamata Convention: A global treaty aiming to reduce mercury emissions and phase out mercury use in products and processes.

Organizations must maintain records of mercury-containing parts, including inventory logs, safety data sheets (SDS), and training documentation.

Handling and Storage Procedures

Mercury Parts must be handled with extreme care to prevent breakage, leakage, and exposure. Follow these procedures:

- Personal Protective Equipment (PPE): Personnel must wear nitrile gloves, safety goggles, and, if vapor exposure is possible, respiratory protection with mercury vapor cartridges.

- Secondary Containment: Store Mercury Parts in sealed, labeled containers within secondary containment trays to prevent spills.

- Storage Environment: Keep parts in a cool, dry, well-ventilated area away from heat sources, direct sunlight, and incompatible materials (e.g., strong oxidizers).

- Labeling: All containers and packages must be clearly labeled: “Mercury-Containing Component – Handle with Care – Hazardous Material.”

Never handle broken or leaking Mercury Parts without proper training and spill response protocols.

Transportation Requirements

Transporting Mercury Parts is subject to strict hazardous materials regulations:

- Classification: Mercury and certain mercury-containing devices are classified as Hazard Class 8 (Corrosive) or Class 9 (Miscellaneous Hazardous Materials), depending on form and concentration.

- Packaging: Use UN-certified, leak-proof packaging with absorbent material. Inner containers must be secured to prevent movement.

- Labeling and Marking: Packages must display proper hazard labels, UN number (e.g., UN3506 for mercury in manufactured articles), and shipper/consignee information.

- Documentation: Include a hazardous materials shipping manifest and SDS with each shipment.

- Carrier Compliance: Use only carriers authorized to transport hazardous materials and ensure drivers are trained under DOT HAZMAT requirements.

International shipments must also comply with IATA (air) or IMDG (marine) regulations as applicable.

Spill Response and Emergency Procedures

In the event of a spill or breakage involving Mercury Parts:

- Evacuate and Isolate: Clear the area immediately and restrict access.

- Ventilate: Increase ventilation but avoid using fans that could aerosolize mercury.

- Notify: Alert facility safety personnel and local environmental authorities if required.

- Contain and Clean Up: Use mercury spill kits with sulfur powder, droppers, and sealed disposal containers. Never use a vacuum cleaner or broom.

- Disposal: Collect all contaminated materials as hazardous waste; dispose through licensed hazardous waste handlers.

- Reporting: Document the incident and submit reports as required by EPA, OSHA, or local agencies.

All personnel must be trained in spill response procedures annually.

Waste Disposal and Recycling

Mercury Parts are classified as hazardous waste upon disposal and must not be discarded in regular trash or drains.

- Waste Classification: Determine waste code (e.g., D009 for mercury) based on TCLP testing if applicable.

- Accumulation Limits: On-site accumulation must comply with EPA 90-day (large quantity) or 180-day (small quantity) rules.

- Recycling: Whenever possible, send Mercury Parts to certified recyclers specializing in mercury recovery.

- Manifesting: Use a hazardous waste manifest for all off-site shipments and retain copies for at least three years.

Maintain a waste disposal log with dates, quantities, and disposal vendor information.

Training and Recordkeeping

All personnel involved in handling, storing, or transporting Mercury Parts must undergo initial and annual refresher training covering:

- Hazards of mercury exposure

- Proper PPE usage

- Spill response

- Regulatory requirements

- Emergency procedures

Training records, SDS files, shipping documents, and disposal records must be maintained for a minimum of three years or as required by local law.

Conclusion

Proper logistics and compliance management of Mercury Parts is critical to protecting human health, the environment, and ensuring legal compliance. By following this guide, organizations can mitigate risks, reduce liability, and support global efforts to minimize mercury use and release. Always consult the latest regulatory updates and involve EHS professionals in your compliance planning.

Conclusion: Sourcing Mercury Factory Parts

In conclusion, sourcing parts for a mercury-based factory—whether for maintenance, repair, or decommissioning—requires a strategic, safety-driven, and compliant approach. Due to the hazardous nature of mercury and the increasingly strict environmental and occupational health regulations, it is essential to work exclusively with reputable, certified suppliers who adhere to international safety and environmental standards such as OSHA, EPA, and REACH.

Legacy equipment may present challenges in finding compatible components, making thorough documentation, reverse engineering, or collaboration with original equipment manufacturers (OEMs) crucial. Where possible, retrofitting or transitioning to mercury-free alternatives should be considered to enhance safety, reduce regulatory burden, and ensure long-term sustainability.

Ultimately, successful sourcing balances technical accuracy, regulatory compliance, worker safety, and environmental responsibility. By prioritizing these factors, industrial operators can maintain operational efficiency while minimizing risk and aligning with global trends toward safer, cleaner industrial practices.