The global merchandise manufacturing industry is experiencing steady expansion, driven by rising demand from corporate branding, sports, entertainment, and e-commerce sectors. According to a 2023 report by Mordor Intelligence, the global promotional products market—core to merchandise manufacturing—was valued at USD 37.8 billion in 2022 and is projected to grow at a CAGR of 4.8% through 2028. This growth is further supported by increasing consumer engagement with branded merchandise, particularly in the digital retail space. Meanwhile, Grand View Research highlights that the custom apparel market alone is expected to reach USD 22.3 billion by 2030, expanding at a CAGR of 8.1%, fueled by personalization trends and on-demand production models. As businesses continue to leverage merchandise for marketing and customer loyalty, identifying reliable, scalable, and innovative manufacturers has become critical. In this evolving landscape, the following nine merchandise manufacturers stand out for their production capabilities, technological integration, sustainability initiatives, and global reach—positioning them at the forefront of the industry.

Top 9 Merchandise Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OrderMyGear

Domain Est. 2008

Website: ordermygear.com

Key Highlights: OrderMyGear (OMG) provides technology for promotional product distributors, apparel decorators, team dealers, and suppliers to sell branded merchandise….

#2 Nadel

Domain Est. 1995

Website: nadel.com

Key Highlights: Made with Nadel. Our tight-knit global team of experts deeply understands all aspects of branded merchandise creation—from ideation to delivery. See Portfolio….

#3 Top ranking supplier print and promotional products North America

Domain Est. 1995

Website: proforma.com

Key Highlights: Proforma is the leader in the printing, promotional products and packaging industries with a creative edge to add impact and value to your programs….

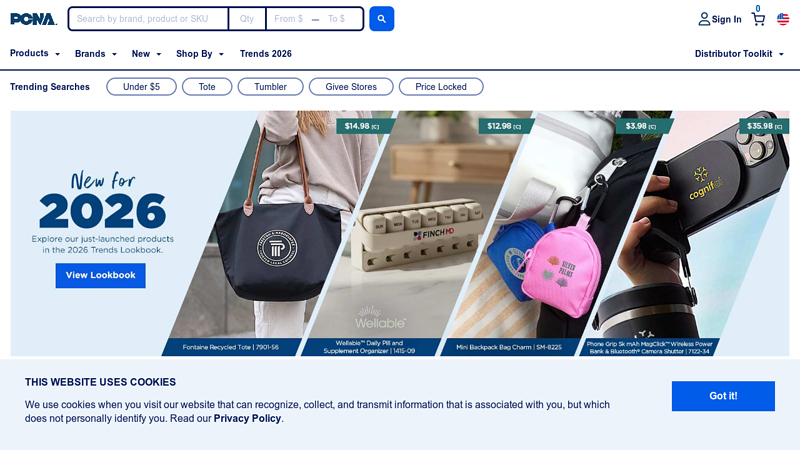

#4 PCNA

Domain Est. 1996

Website: pcna.com

Key Highlights: PCNA is the leading source for custom and promotional products to decorate and imprint company logos to Inspire Pride….

#5 SanMar

Domain Est. 1996

Website: sanmar.com

Key Highlights: Top Picks for You ; Shop Brooks Brothers ; Shop Richardson ; Shop OGIO ……

#6 Promotional Product Supplier & Custom Swag Company

Domain Est. 1997 | Founded: 1994

Website: stran.com

Key Highlights: Elevate Your Brand with Custom Promotional Products & Swag. Since 1994, Stran has been helping brands build connections through custom merchandise….

#7 Promotional Products

Domain Est. 1998

Website: 4imprint.com

Key Highlights: Promotional products by 4imprint. Find the perfect custom printed gifts for business branding, saying thanks, or awarding excellence!…

#8 Vantage Apparel

Domain Est. 1999 | Founded: 1977

Website: vantageapparel.com

Key Highlights: Since 1977, Vantage Apparel has set the standard for premium branded apparel, offering unmatched expertise in custom decoration and promotional clothing….

#9 Monday Merch

Domain Est. 2021

Website: mondaymerch.com

Key Highlights: Monday Merch, trusted by 4000+ global customers, simplifies company merchandise with full-service design, production, warehousing, and shipping….

Expert Sourcing Insights for Merchandise

H2 2026 Market Trends in the Merchandise Industry

As we approach the midpoint of 2026, the merchandise landscape continues to evolve rapidly, shaped by shifting consumer behaviors, technological advancements, and sustainability imperatives. Here’s a breakdown of key trends defining the market in H2 2026:

1. Hyper-Personalization and AI-Driven Customization

Businesses are leveraging advanced AI and machine learning to deliver deeply personalized merchandise. Platforms now offer real-time design suggestions based on user preferences, purchase history, and social media activity. AI-powered tools enable dynamic customization—such as auto-generating unique apparel designs or personalized gift items—driving higher engagement and conversion. Mass customization is no longer a niche; it’s becoming the standard expectation, especially among Gen Z and Millennial consumers.

2. Sustainability as a Core Value, Not a Feature

Eco-conscious merchandising has moved beyond basic “green” claims. In H2 2026, consumers demand transparency and verifiable sustainability credentials. Brands are responding with circular economy models—offering repair, resale, and recycling programs for merchandise. Biodegradable packaging, carbon-neutral shipping, and traceable supply chains are table stakes. Merchandise made from lab-grown materials, recycled ocean plastics, or agricultural waste (e.g., mushroom leather, pineapple fiber) is gaining mainstream appeal.

3. Experiential and Limited-Edition Drops

Merchandise is increasingly tied to experiences rather than just products. Limited-edition collaborations, NFT-linked physical items, and event-exclusive drops continue to thrive. Brands are using AR/VR previews and gamified launch events to build anticipation. The “drop culture” mentality persists, but with a focus on community value—offering loyal customers early access or co-creation opportunities—fostering deeper brand connections.

4. Rise of Creator and Micro-Brand Merchandising

Independent creators, influencers, and niche communities are driving significant merchandise sales through direct-to-consumer (DTC) platforms. Platforms like Shopify, Printful, and Teespring have evolved to offer integrated fulfillment, global distribution, and even AI design tools tailored for small creators. Fans are more willing to buy merch from trusted individuals than traditional brands, especially when it supports causes or reflects shared values.

5. Integration of Smart and Connected Products

The Internet of Things (IoT) is making its way into merchandise. In H2 2026, smart apparel with embedded sensors (e.g., temperature-regulating jackets, fitness-tracking shirts) and NFC-enabled tags for authentication and digital content access are becoming more common. These “phygital” products bridge physical goods with digital experiences—unlocking exclusive content, loyalty rewards, or metaverse avatars.

6. Localization and Cultural Relevance

Global brands are shifting toward hyper-localized merchandise strategies. Instead of one-size-fits-all campaigns, companies are tailoring designs, colors, and messaging to regional cultures and events. This trend is fueled by data analytics and local influencer partnerships, ensuring merchandise resonates authentically and avoids cultural missteps.

7. Supply Chain Resilience and On-Demand Manufacturing

Geopolitical instability and climate disruptions have pushed brands to adopt agile, nearshored, and on-demand production. 3D printing, digital textile printing, and localized fulfillment centers reduce lead times and overproduction. This shift supports sustainability goals and enables rapid response to trending designs or sudden demand spikes.

Conclusion

H2 2026 marks a maturation point for the merchandise industry, where personalization, sustainability, and digital integration are not just competitive advantages but essential components of success. Brands that leverage data ethically, prioritize environmental stewardship, and foster authentic community engagement are leading the way. The future of merchandise lies not in mass production, but in meaningful, adaptive, and experience-rich consumer connections.

Common Pitfalls Sourcing Merchandise: Quality and Intellectual Property Issues

Sourcing merchandise can be a cost-effective way to expand product offerings, but it comes with significant risks—especially concerning quality control and intellectual property (IP) rights. Overlooking these pitfalls can lead to customer dissatisfaction, legal disputes, financial losses, and reputational damage.

Quality Control Challenges

One of the most frequent issues when sourcing merchandise, particularly from overseas suppliers, is inconsistent or substandard product quality. Without proper oversight, businesses may receive items that differ significantly from samples in materials, craftsmanship, or durability. Poor quality not only leads to product returns and negative reviews but can also compromise brand reputation. Relying solely on supplier promises or initial prototypes without ongoing inspections during and after production increases the risk of receiving defective goods.

Intellectual Property Infringement

Sourcing products—especially unbranded or generic items—can inadvertently lead to intellectual property violations. Suppliers may produce counterfeit goods, use protected designs, logos, or patented features without authorization, or replicate products too closely to established brands. Even if a business is unaware of the infringement, it can still be held legally liable for distributing such merchandise. Conducting thorough due diligence on suppliers and verifying the legitimacy of product designs is essential to avoid costly lawsuits, customs seizures, or forced product recalls.

Logistics & Compliance Guide for Merchandise

Managing the logistics and compliance aspects of merchandise is critical to ensuring timely delivery, customer satisfaction, and adherence to legal and regulatory requirements. This guide outlines key considerations and best practices for handling merchandise across the supply chain.

Planning and Sourcing

- Supplier Selection: Choose reliable suppliers with strong track records in quality control, delivery timelines, and compliance with international trade laws.

- Product Specifications: Clearly define product materials, dimensions, packaging requirements, and labeling standards to avoid discrepancies.

- Ethical Sourcing: Ensure suppliers comply with labor, environmental, and human rights standards (e.g., no child labor, safe working conditions).

Import/Export Regulations

- Customs Documentation: Prepare accurate documentation, including commercial invoices, packing lists, and certificates of origin.

- Tariffs and Duties: Research applicable tariffs, duties, and taxes based on the Harmonized System (HS) codes for each product.

- Restricted/Prohibited Items: Verify that merchandise does not violate import/export restrictions in the destination country (e.g., certain textiles, electronics, or materials).

- Incoterms: Define responsibilities between buyer and seller using internationally recognized Incoterms (e.g., FOB, DDP).

Packaging and Labeling Compliance

- Country-Specific Requirements: Adhere to labeling laws in the destination market (e.g., language, size charts, care instructions, country of origin).

- Safety Warnings: Include required safety labels (e.g., choking hazards for small parts, electrical safety certifications).

- Sustainability Standards: Use recyclable or biodegradable packaging where required by local regulations (e.g., EU Packaging Directive).

- Barcodes and UCC Labels: Ensure products carry appropriate barcodes and shipping labels for retail and logistics tracking.

Transportation and Logistics

- Mode of Transport: Select the most efficient and cost-effective method (air, sea, rail, or ground) based on product type, urgency, and destination.

- Freight Forwarding: Partner with licensed freight forwarders to manage customs clearance and international shipping.

- Inventory Management: Use inventory tracking systems to monitor stock levels, prevent overstocking, and reduce lead times.

- Warehousing: Store merchandise in secure, climate-appropriate facilities with proper insurance coverage.

Regulatory Compliance

- Product Safety Standards: Ensure merchandise meets safety standards such as:

- U.S.: CPSC (Consumer Product Safety Commission) regulations

- EU: CE marking, REACH, RoHS

- UK: UKCA marking post-Brexit

- Intellectual Property: Avoid trademark or copyright infringement in designs, logos, or branded materials.

- Chemical Restrictions: Comply with regulations on restricted substances (e.g., lead, phthalates, PFAS) in textiles, plastics, and electronics.

Returns and Reverse Logistics

- Return Policy Compliance: Align return policies with local consumer protection laws (e.g., 14-day right of withdrawal in the EU).

- Eco-Compliance: Follow regulations for handling returned or defective goods, including proper disposal or recycling (e.g., WEEE for electronics).

- Cost Management: Establish processes to efficiently inspect, restock, or dispose of returned items.

Recordkeeping and Audits

- Documentation Retention: Maintain records of shipments, customs filings, compliance certifications, and supplier agreements for at least 5–7 years.

- Internal Audits: Conduct regular audits to verify compliance with logistics procedures and regulatory standards.

- Third-Party Certifications: Obtain relevant certifications (e.g., ISO 9001, FSC, GOTS) to demonstrate compliance and enhance brand credibility.

Risk Mitigation

- Insurance Coverage: Secure cargo insurance to protect against loss, damage, or theft during transit.

- Contingency Planning: Develop backup plans for supply chain disruptions (e.g., pandemics, port strikes, natural disasters).

- Compliance Training: Train staff on international trade laws, safety standards, and ethical sourcing practices.

By following this logistics and compliance guide, businesses can minimize risks, avoid penalties, and ensure smooth operations in the global merchandise market.

Conclusion:

Selecting the right merchandise supplier is a critical decision that directly impacts product quality, brand reputation, operational efficiency, and overall business success. After careful evaluation of potential suppliers based on criteria such as reliability, cost-effectiveness, production capacity, ethical practices, and communication responsiveness, it is evident that a strategic and thorough sourcing process is essential. A strong supplier partnership not only ensures consistent quality and timely delivery but also supports scalability and adaptability in a dynamic market environment. By prioritizing transparency, sustainability, and long-term collaboration, businesses can secure a competitive advantage and build a resilient supply chain. Ultimately, the chosen supplier should align with the company’s values and goals, laying a solid foundation for sustained growth and customer satisfaction.