The global MEMS pressure transducer market is experiencing robust growth, driven by rising demand across automotive, industrial, healthcare, and aerospace sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 7.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2029. This expansion is fueled by the increasing adoption of miniaturized, high-precision sensors in applications such as tire pressure monitoring systems (TPMS), respiratory devices, and industrial automation. Complementing this outlook, Grand View Research reports that advancements in MEMS fabrication technologies and integration with IoT platforms are further accelerating market penetration. As competition intensifies, a select group of manufacturers are leading innovation, reliability, and global market share—shaping the future of pressure sensing technology. Here are the top 10 MEMS pressure transducer manufacturers driving this transformation.

Top 10 Mems Pressure Transducer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MEMS Pressure Sensors for Industrial Applications

Domain Est. 2013

Website: amphenol-sensors.com

Key Highlights: NovaSensor is a leader in the design and fabrication of MEMS Pressure Sensors and the inventor of SenStable® Processing Technology, providing excellent ……

#2 MEMS Pressure Sensors

Domain Est. 1993

Website: st.com

Key Highlights: ST’s tiny silicon pressure sensors use innovative MEMS technology to ensure extremely high-pressure resolution in ultra-compact and thin packages….

#3 Sensor Technology

Domain Est. 1997

Website: millar.com

Key Highlights: Millar’s microelectromechanical systems (MEMS) pressure sensors set the standard for precision in medical devices, trusted for over 55 years in human and ……

#4 MEMS

Domain Est. 1997

Website: nxp.com

Key Highlights: These MEMS-based pressure sensors provide robust solutions for the appliance, medical, consumer, industrial and automotive markets….

#5 MEMSIC Semiconductor Co., Ltd.

Domain Est. 1999

Website: memsic.com

Key Highlights: MEMSIC Semiconductor is a world-leading IC product company, mainly engaged in MEMS (Micro-Electro-Mechanical System)sensor R&D, manufacturing and sales, ……

#6 Merit Sensor

Domain Est. 2004

Website: meritsensor.com

Key Highlights: We design and manufacture MEMS Piezoresistive pressure sensors for accurate and reliable pressure measurement. Designed and manufactured in the USA….

#7

Domain Est. 1996

Website: invensense.tdk.com

Key Highlights: TDK InvenSense provides world-leading MEMS sensors and magnetic sensor solutions for consumer and automotive applications that require precision and low ……

#8 MEMSCAP

Domain Est. 1998

Website: memscap.com

Key Highlights: MEMSCAP designs, manufactures and markets ultra-high precision and stability pressure sensors for the Avionics and Medical market segments….

#9 Merit Sensor

Domain Est. 1999

Website: rhopointcomponents.com

Key Highlights: 5–7 day deliveryWe design and manufacture piezoresistive pressure sensors (a type of MEMS) … For our official website, please visit www.meritsensors.com….

#10 Pressure Sensors

Domain Est. 2001

Website: sensata.com

Key Highlights: Low pressure (inches of water to 100psi / 2mbar to 6 bar). MEMS solutions including TPMS offer extremely low power consumption and wireless connectivity….

Expert Sourcing Insights for Mems Pressure Transducer

H2: Market Trends for MEMS Pressure Transducers in 2026

By 2026, the global market for MEMS (Micro-Electro-Mechanical Systems) pressure transducers is poised for significant growth and transformation, driven by technological advancements, expanding industrial applications, and rising demand across key sectors. Several pivotal trends are shaping the market landscape:

1. Surge in Automotive and EV Adoption

The automotive industry remains a dominant driver of MEMS pressure transducer demand. With the accelerating shift toward electric vehicles (EVs) and advanced driver assistance systems (ADAS), pressure sensors are increasingly deployed for battery thermal management, cabin pressure control, and brake systems. By 2026, stringent emissions regulations and fuel efficiency standards in regions like Europe and North America will further boost demand for precision pressure monitoring, reinforcing the role of MEMS transducers in engine management and tire pressure monitoring systems (TPMS).

2. Healthcare Sector Expansion

The medical device industry is emerging as a high-growth segment for MEMS pressure transducers. Applications in wearable health monitors, ventilators, infusion pumps, and respiratory devices have expanded post-pandemic. As patient-centric and home-based care models gain traction, compact, low-power, and highly accurate MEMS sensors are becoming essential. By 2026, integration with IoT-enabled healthcare platforms will drive demand for smart, wireless pressure sensing solutions.

3. Industrial Automation and Industry 4.0 Integration

Manufacturing and process industries are increasingly adopting smart factory technologies. MEMS pressure transducers are critical components in predictive maintenance systems, pneumatic controls, and fluid monitoring. Their miniaturization, reliability, and compatibility with digital communication protocols make them ideal for real-time data acquisition in industrial IoT (IIoT) ecosystems. By 2026, the push for operational efficiency and reduced downtime will amplify adoption in automation and condition monitoring applications.

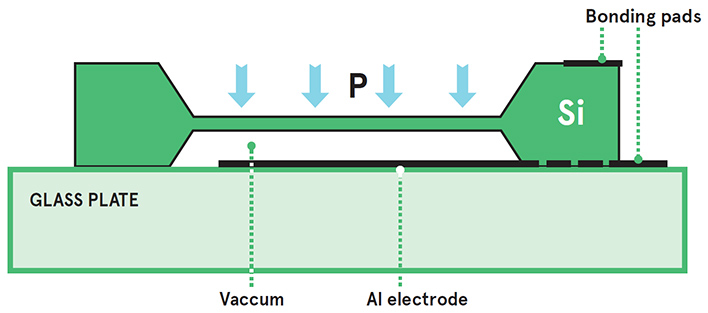

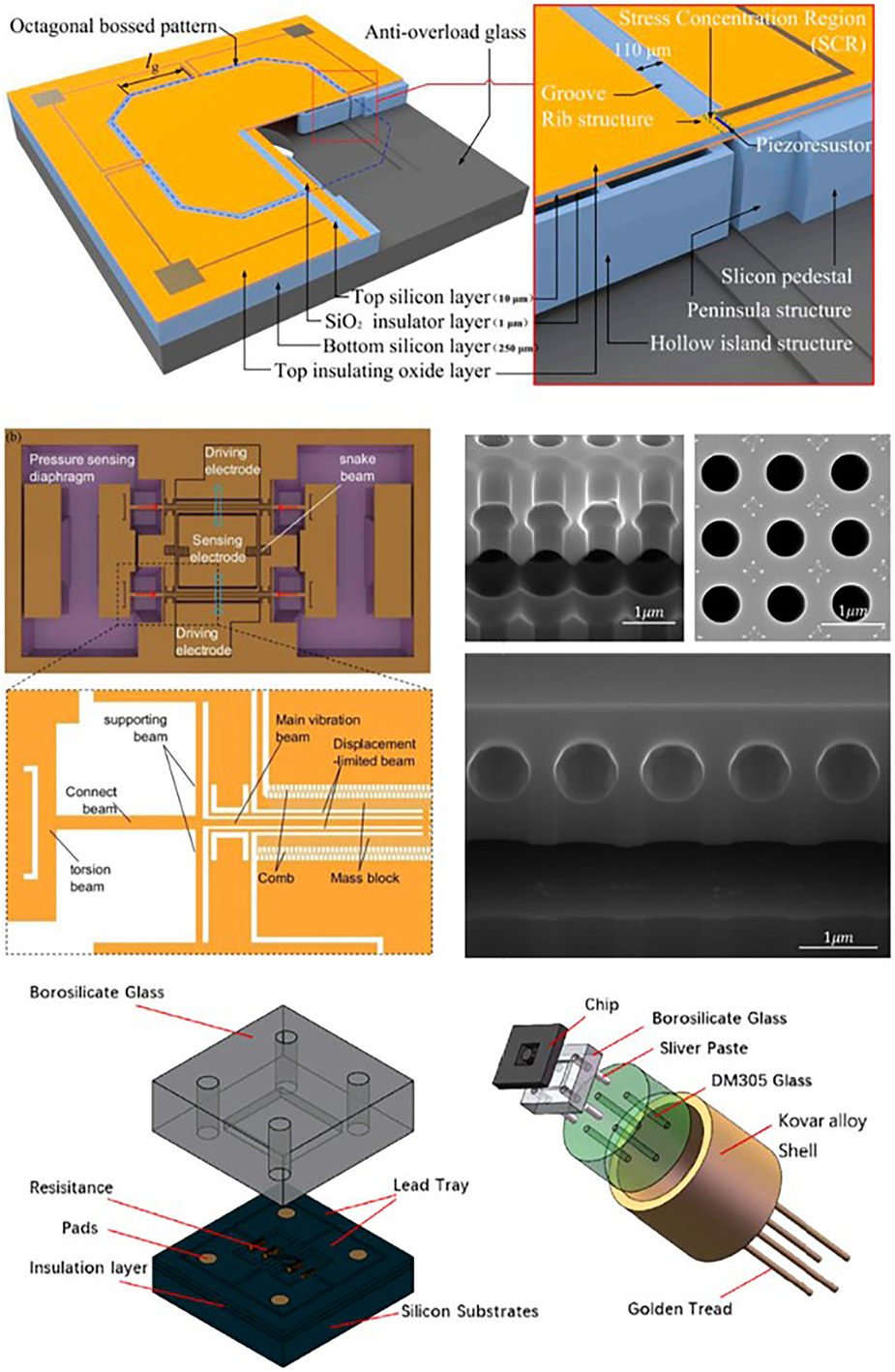

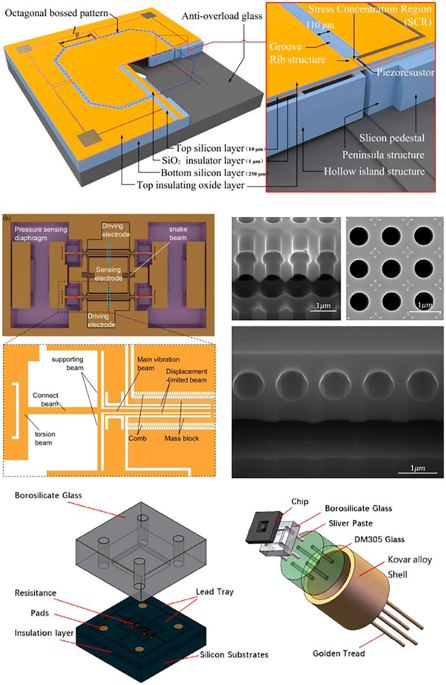

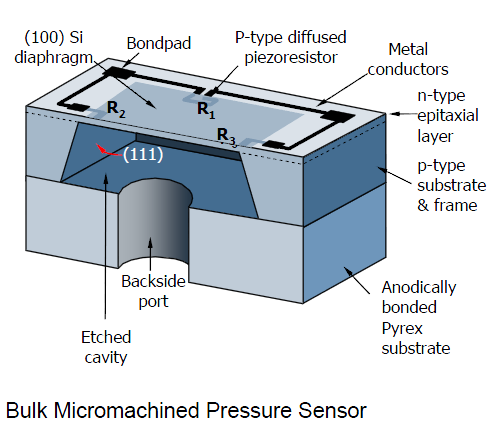

4. Advancements in Sensor Technology and Materials

Ongoing R&D in piezoresistive and capacitive MEMS technologies is enhancing sensitivity, temperature stability, and long-term reliability. Innovations in packaging—such as wafer-level packaging and hermetic sealing—are improving performance in harsh environments. Additionally, the integration of AI-driven calibration and self-diagnostic features is expected to become standard by 2026, enabling smarter and more autonomous sensor systems.

5. Regional Market Dynamics

Asia-Pacific, particularly China, Japan, and South Korea, will remain the largest market due to robust electronics manufacturing, automotive production, and government support for smart infrastructure. North America and Europe will see steady growth driven by innovation in aerospace, medical devices, and green technologies. Localized supply chains and reduced dependency on global logistics will also influence manufacturing strategies among key players.

6. Sustainability and Energy Efficiency Focus

With growing emphasis on environmental sustainability, MEMS pressure transducers are being optimized for low power consumption and recyclable materials. Their role in monitoring renewable energy systems—such as hydrogen fuel cells and solar thermal plants—will expand, aligning with global net-zero targets.

Conclusion

By 2026, the MEMS pressure transducer market will be characterized by increased miniaturization, smarter integration, and diversified applications. Stakeholders who invest in scalable manufacturing, multi-sensing capabilities, and cross-industry solutions will be best positioned to capitalize on emerging opportunities in this dynamic and evolving market.

Common Pitfalls When Sourcing MEMS Pressure Transducers (Quality & IP)

Sourcing MEMS pressure transducers involves navigating complex technical, quality, and intellectual property (IP) challenges. Falling into common pitfalls can lead to project delays, increased costs, and compromised product performance. Below are key areas to watch:

Quality-Related Pitfalls

Inadequate Supplier Qualification

Failing to thoroughly vet suppliers based on manufacturing capabilities, process controls, and quality certifications (e.g., ISO 13485, IATF 16949) can result in inconsistent product quality. Suppliers with poor quality management systems may deliver units with high failure rates or performance variability.

Insufficient Specification Clarity

Ambiguous or incomplete technical specifications—such as pressure range, accuracy, thermal drift, long-term stability, and package requirements—can lead to misunderstandings. This increases the risk of receiving transducers that do not meet application needs, especially under real-world operating conditions.

Neglecting Long-Term Reliability and Environmental Testing

MEMS devices are sensitive to environmental factors like temperature cycling, humidity, and mechanical stress. Sourcing without requiring or verifying test data for long-term reliability (e.g., HTOL, HALT) or environmental robustness (e.g., IP67, AEC-Q100) may result in field failures and high return rates.

Overlooking Calibration and Traceability

High-precision applications demand traceable calibration with documented standards (e.g., NIST). Suppliers that do not provide individual unit calibration data or lack metrology traceability may deliver transducers with unverified accuracy, undermining system performance.

Intellectual Property (IP)-Related Pitfalls

Unverified IP Ownership

Using transducers from suppliers with unclear or contested IP rights—especially in patented MEMS fabrication processes or sensor designs—can expose your company to legal risks, including infringement claims or supply chain disruptions if a patent dispute arises.

Lack of Freedom-to-Operate (FTO) Analysis

Proceeding without conducting an FTO assessment increases the risk of inadvertently violating third-party patents. This is particularly critical in industries like automotive or medical devices, where IP litigation is common and costly.

Inadequate Licensing Agreements

Failing to secure proper licensing for embedded IP—such as proprietary compensation algorithms or interface protocols—can restrict your ability to modify, manufacture, or sell end products. Always ensure licensing terms cover your intended use case and scale.

Insufficient Protection in Custom Designs

When co-developing custom MEMS transducers, unclear contractual terms about IP ownership, design rights, and reuse rights can lead to disputes. Ensure contracts explicitly define who owns the IP, under what conditions it can be used, and whether the supplier can offer similar designs to competitors.

Avoiding these pitfalls requires due diligence, clear technical and legal agreements, and close collaboration with trusted, transparent suppliers.

Logistics & Compliance Guide for MEMS Pressure Transducers

Product Classification & Export Controls

MEMS pressure transducers may be subject to export control regulations based on their technical specifications and end-use. Determine the appropriate export classification, such as ECCN (Export Control Classification Number) under the U.S. Commerce Control List (CCL) or equivalent in other jurisdictions (e.g., EU Dual-Use List). Devices with high accuracy, extreme pressure ranges, or intended for aerospace, military, or nuclear applications may require export licenses. Always conduct a classification review before international shipment.

Packaging & Handling Requirements

Use anti-static, shock-absorbent packaging to protect sensitive MEMS components from electrostatic discharge (ESD), vibration, and moisture. Include desiccant packs if shipping to high-humidity environments. Clearly label packages with ESD-sensitive and fragile warnings. Avoid direct contact with conductive materials and ensure devices are stored and transported within specified temperature and humidity ranges (typically -20°C to 60°C and 5–95% non-condensing RH unless otherwise specified).

Shipping & Transportation

Ship via carriers compliant with IATA, IMDG, or ADR regulations as applicable. While MEMS pressure transducers typically do not contain hazardous materials, confirm with the manufacturer. Use temperature-controlled logistics if environmental conditions exceed device specifications during transit. Maintain chain-of-custody documentation, especially for high-value or controlled shipments. Consider tracking and insurance for international deliveries.

Import Regulations & Documentation

Prepare accurate commercial invoices, packing lists, and certificates of origin. Provide technical datasheets to assist customs in classification. Import duties and VAT may apply depending on the destination country and trade agreements (e.g., USMCA, RCEP). Some countries may require product conformity assessments (e.g., CE, UKCA, CCC) before clearance. Verify local metrology or pressure equipment regulations if the transducer is integrated into regulated systems.

Regulatory Compliance

Ensure devices comply with relevant standards such as ISO 9001 (quality management), ISO 13485 (if used in medical devices), ATEX/IECEx (for hazardous environments), or IATF 16949 (automotive). Electromagnetic compatibility (EMC) must meet directives like EU EMC Directive 2014/30/EU. For transducers used in safety-critical applications, additional certifications (e.g., SIL, ASIL) may be required. Maintain compliance documentation for audits.

End-of-Life & Environmental Regulations

Dispose of or recycle MEMS pressure transducers in accordance with WEEE (Waste Electrical and Electronic Equipment) and RoHS (Restriction of Hazardous Substances) directives in applicable regions. While MEMS devices typically contain minimal hazardous substances, proper e-waste handling is mandatory. Provide take-back or recycling options where required by law, particularly in the EU and parts of Asia.

Recordkeeping & Audit Preparedness

Maintain comprehensive records of export licenses, compliance certifications, shipping documentation, and customer end-use statements for a minimum of five years (or as required by jurisdiction). Implement internal audit procedures to verify adherence to logistics and compliance protocols. Train staff regularly on updates to international trade laws and product-specific regulatory requirements.

Conclusion for Sourcing MEMS Pressure Transducers

In conclusion, sourcing MEMS (Micro-Electro-Mechanical Systems) pressure transducers requires a strategic evaluation of technical specifications, application requirements, supplier reliability, and total cost of ownership. MEMS technology offers significant advantages, including high accuracy, miniaturization, low power consumption, and excellent long-term stability, making it ideal for diverse applications in automotive, medical, industrial, and consumer electronics sectors.

Key considerations when selecting a supplier include performance parameters such as pressure range, accuracy, temperature stability, and media compatibility, as well as certifications and compliance with industry standards (e.g., ISO, AEC-Q100). Additionally, evaluating the supplier’s manufacturing capabilities, scalability, technical support, and track record in quality and reliability is critical to ensuring consistent product performance.

Establishing partnerships with reputable manufacturers—whether established global players or specialized niche suppliers—can mitigate risks related to supply chain disruptions and product defects. Furthermore, adopting a total cost approach that accounts for integration, calibration, and lifecycle support helps in making a cost-effective and sustainable sourcing decision.

Ultimately, a well-informed sourcing strategy for MEMS pressure transducers will not only meet current technical and commercial needs but also provide scalability and innovation potential for future product development.