The global vibration isolation systems market is experiencing robust growth, driven by increasing demand for precision equipment in industries such as semiconductor manufacturing, life sciences, aerospace, and photonics. According to a report by Mordor Intelligence, the vibration isolation systems market was valued at USD 1.25 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2029. Similarly, Grand View Research estimates that the broader precision motion control and isolation market—encompassing mechanical, active, and passive platforms—will surpass USD 15 billion by 2030, fueled by advancements in nanotechnology and rising R&D investments. As manufacturing tolerances tighten and sensitivity to environmental disturbances increases, mechanical vibration isolation platforms have become critical for ensuring measurement accuracy, process repeatability, and equipment longevity. Against this backdrop, several manufacturers have emerged as leaders, offering innovative solutions that combine passive damping mechanisms with advanced materials and structural design. This list highlights the top nine mechanical vibration isolation platform manufacturers shaping the industry through performance, scalability, and technological differentiation.

Top 9 Mechanical Vibration Isolation Platforms Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

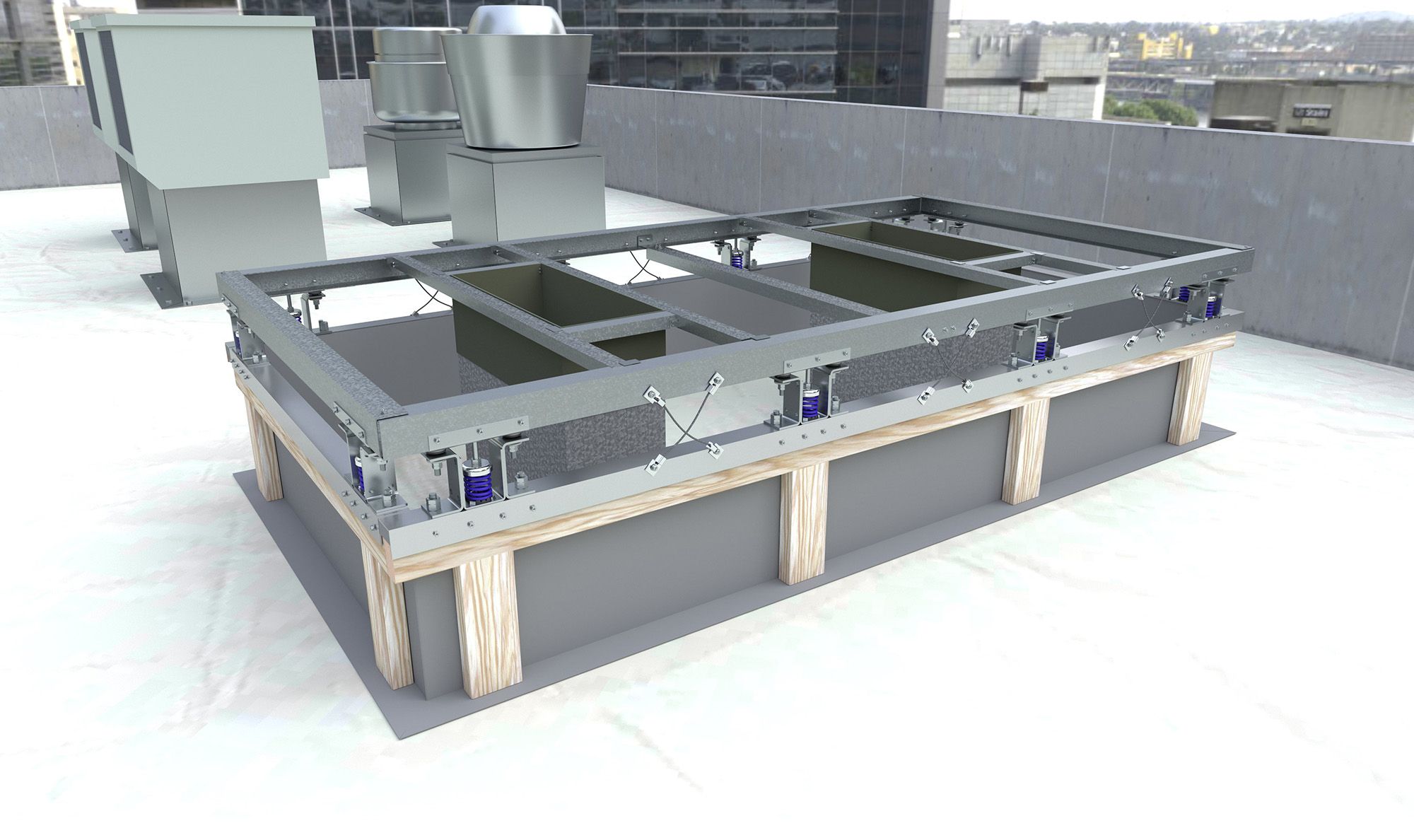

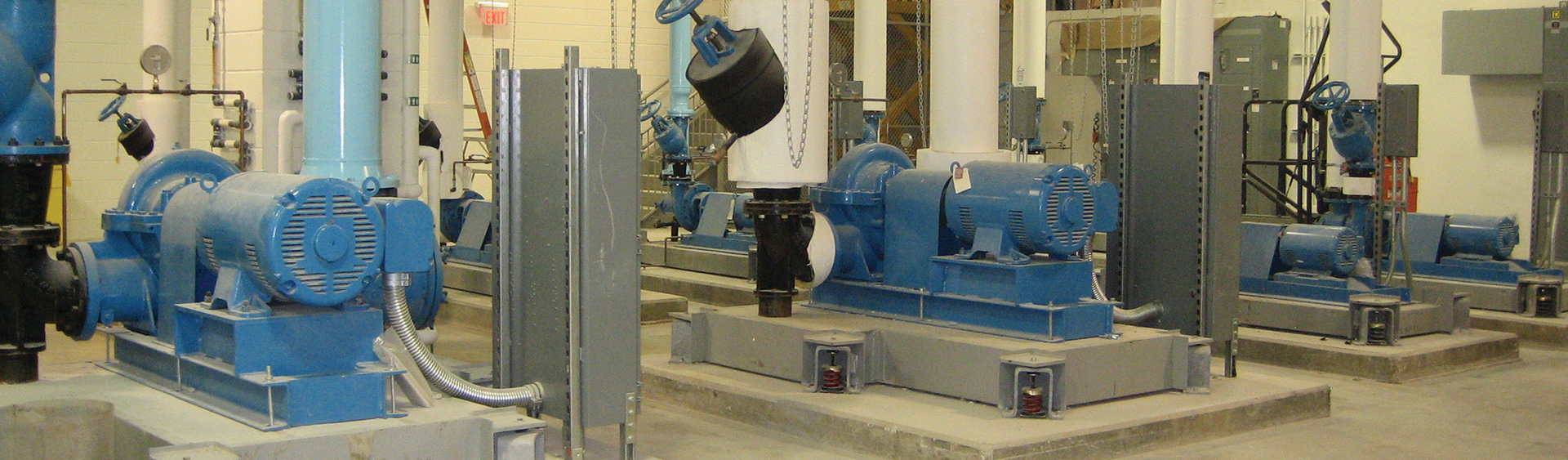

#1 Kinetics Noise Control

Domain Est. 1996

Website: kineticsnoise.com

Key Highlights: Kinetics Noise Control produces the industry’s largest selection of products and solutions that control airborne noise, isolate structure-borne vibration, ……

#2 Minus K Technology

Domain Est. 1996

Website: minusk.com

Key Highlights: Minus K’s passive mechanical vibration isolators outperform air and active systems without the need for air or electricity….

#3 Vibration Isolators Technology

Domain Est. 1996

Website: group.stabilus.com

Key Highlights: Reliable protection against damaging vibrations in construction, production, and energy generation – whether off the shelf or customized….

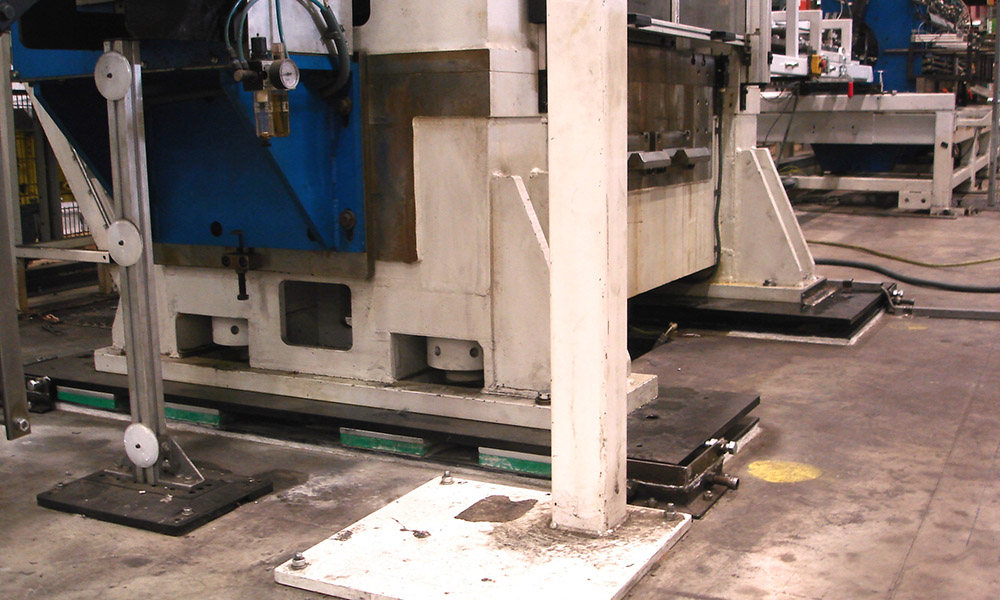

#4 Vibrasystems

Domain Est. 1998

Website: vibrasystems.com

Key Highlights: Manufacturer of vibration isolation pads, vibration dampener solutions, and rubber products. We provide solutions for noise and vibration reduction and ……

#5 VISCMA

Domain Est. 2000

Website: viscma.com

Key Highlights: BUILD A SAFER TOMORROW. Providing professionals confidence in safe design, selection, and specification of vibration isolation….

#6 Table Top Mechanical Vibration Isolation Platforms

Domain Est. 1994

Website: newport.com

Key Highlights: Free delivery 30-day returnsNewport mechanical table-top isolation platforms deliver proven passive vibration control for microscopes and benchtop instruments, ensuring stable, ……

#7 Enidine

Domain Est. 1995

Website: enidine.com

Key Highlights: Enidine is your trusted source for highly engineered shock absorbers and vibration isolation products. Visit us today to learn more about our energy ……

#8 Vibration Isolation Equipment

Domain Est. 1997 | Founded: 1968

Website: kineticsystems.com

Key Highlights: Kinetic Systems has been manufacturing vibration isolation equipment and providing vibration management solutions in the USA since 1968. Contact us today!…

#9 Passive Vibration Isolation System

Domain Est. 2000

Website: holmarc.com

Key Highlights: Passive air isolators are employed in this series of table supports for isolating the tabletop from vertical and horizontal disturbances….

Expert Sourcing Insights for Mechanical Vibration Isolation Platforms

H2: 2026 Market Trends for Mechanical Vibration Isolation Platforms

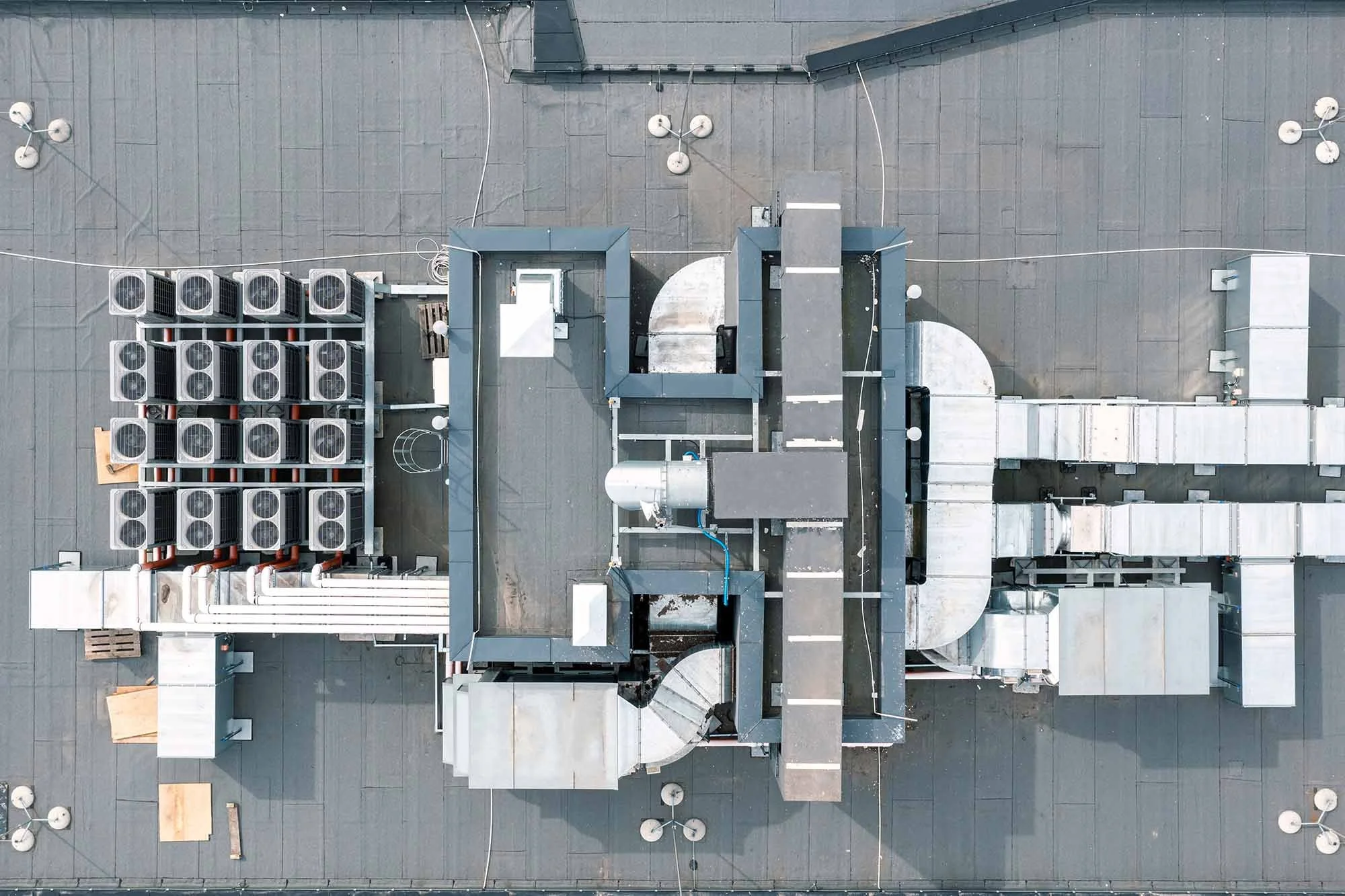

The global market for mechanical vibration isolation platforms is poised for significant transformation by 2026, driven by technological advancements, expanding industrial applications, and heightened demand for precision across key sectors. Several macro and microeconomic trends are shaping the trajectory of this market.

1. Rising Demand in High-Precision Industries

Industries such as semiconductor manufacturing, biotechnology, photonics, and nanotechnology are increasingly dependent on ultra-stable environments. With the miniaturization of components and the push for higher yields in semiconductor fabrication—especially with the proliferation of advanced nodes (e.g., 3nm and below)—even microscopic vibrations can compromise product quality. As a result, demand for high-performance mechanical vibration isolation platforms is expected to grow robustly through 2026.

2. Integration with Smart and Active Systems

While traditional passive mechanical isolation platforms remain prevalent, there is a growing shift toward hybrid and active systems that incorporate sensors, feedback loops, and real-time adjustment capabilities. By 2026, manufacturers are expected to offer more “smart” platforms with IoT connectivity, enabling remote monitoring, predictive maintenance, and adaptive damping. This convergence of mechanical engineering and digital technologies will redefine performance benchmarks.

3. Growth in Healthcare and Life Sciences

The life sciences sector, particularly in advanced imaging (e.g., electron microscopy, MRI development) and precision diagnostics, is becoming a key growth driver. Laboratories and medical research facilities are investing in vibration control to ensure data accuracy and equipment longevity. The expansion of pharmaceutical R&D post-pandemic further amplifies the need for reliable isolation solutions.

4. Expansion in Emerging Markets

Asia-Pacific—especially China, South Korea, and India—is expected to lead market growth due to rapid industrialization, government investments in high-tech manufacturing, and the establishment of new semiconductor fabs. These regions are not only increasing production capacity but also upgrading infrastructure to meet global standards, thereby boosting demand for advanced isolation platforms.

5. Sustainability and Energy Efficiency

Manufacturers are increasingly focusing on energy-efficient designs and sustainable materials. By 2026, regulatory pressures and corporate ESG (Environmental, Social, and Governance) goals will encourage the development of eco-friendly vibration isolation systems that reduce material waste and energy consumption during operation and production.

6. Supply Chain Resilience and Localization

Following disruptions caused by global events (e.g., pandemic, geopolitical tensions), companies are reevaluating supply chains. There is a trend toward regional manufacturing and localized sourcing of critical components, including vibration isolation platforms. This shift is prompting suppliers to establish regional production hubs, particularly in North America and Europe, to ensure faster delivery and reduce dependency on single-source suppliers.

7. Competitive Landscape and Innovation

The market is becoming increasingly competitive, with established players (e.g., Newport Corporation, Thorlabs, TMC) facing pressure from emerging manufacturers offering cost-effective alternatives. Innovation in materials—such as advanced composites and meta-materials—will play a crucial role in differentiating products by offering lighter, stiffer, and more durable platforms.

Conclusion

By 2026, the mechanical vibration isolation platform market will be characterized by higher performance standards, smarter integration, and broader industrial adoption. Driven by precision engineering demands and digital transformation, the market is projected to grow at a CAGR of approximately 5–7% globally, with the most dynamic expansion in high-tech manufacturing and research-intensive sectors. Companies that invest in R&D, sustainability, and regional scalability will be best positioned to capitalize on these evolving opportunities.

Common Pitfalls When Sourcing Mechanical Vibration Isolation Platforms

Quality-Related Pitfalls

Inadequate Material Specifications

Sourcing platforms without clearly defined material standards can lead to premature failure. Using substandard steel or elastomers compromises durability and performance, especially in harsh environments. Always specify exact material grades, hardness (for elastomeric components), and corrosion resistance to ensure long-term reliability.

Poor Manufacturing Tolerances

Vibration isolation performance is highly sensitive to dimensional accuracy. Platforms manufactured with loose tolerances may exhibit inconsistent damping characteristics or fail to interface properly with equipment. Insist on documented quality control processes and request tolerance certifications for critical dimensions.

Lack of Performance Validation Testing

Many suppliers provide theoretical performance data without real-world testing. Platforms not validated under actual load and frequency conditions may underperform in application. Require test reports such as transmissibility curves, load-deflection data, and fatigue testing under simulated operational conditions.

Insufficient Load Rating Verification

Overestimating dynamic load capacity can result in platform collapse or excessive settling. Static load ratings do not account for dynamic forces or cyclic loading. Ensure suppliers provide dynamic load ratings and consider safety factors appropriate for your application (typically 2–4x expected maximum load).

Intellectual Property (IP)-Related Pitfalls

Unlicensed or Reverse-Engineered Designs

Procuring platforms based on patented technologies without proper licensing exposes your organization to legal risks and potential product recalls. Verify that the supplier holds valid rights to the design or has appropriate IP licenses, especially for proprietary damping mechanisms or composite materials.

Ambiguous Design Ownership in Custom Solutions

When commissioning custom isolation platforms, failure to define IP ownership in contracts may result in loss of rights to the design. Clearly stipulate in procurement agreements whether your organization, the supplier, or both will own the resulting IP, including modifications and tooling.

Insufficient Documentation for Compliance and Traceability

Missing or incomplete technical documentation—including design schematics, material certifications, and test reports—can hinder regulatory compliance and future maintenance. Ensure all deliverables include full documentation packages suitable for audit trails and technical validation.

Use of Counterfeit or Non-Compliant Components

Sourcing from unauthorized distributors or low-cost suppliers may result in platforms incorporating counterfeit dampers or non-certified parts. These components often fail to meet safety or performance standards. Work only with reputable, authorized suppliers and demand component traceability down to the subassembly level.

Logistics & Compliance Guide for Mechanical Vibration Isolation Platforms

Product Classification and Regulation Overview

Mechanical vibration isolation platforms are typically categorized as industrial components or precision equipment accessories. They may fall under machinery directives, especially if integrated into larger systems. Classification under international trade systems (e.g., HS Code) often aligns with “parts and accessories for machinery” (e.g., HS 8431 or 8479, depending on application). Accurate classification is essential for customs clearance and duty assessment.

Export Controls and Dual-Use Considerations

While most vibration isolation platforms are commercial-grade and not subject to strict export controls, certain high-precision or military-spec variants may be classified as dual-use items under regulations like the U.S. Export Administration Regulations (EAR) or the EU Dual-Use Regulation. Verify whether platforms are listed on the Commerce Control List (CCL) or Annex I of the EU Dual-Use Regulation, particularly if used in aerospace, defense, or semiconductor manufacturing.

Packaging and Handling Requirements

Due to sensitivity to misalignment and structural integrity, these platforms require robust, shock-resistant packaging. Use custom crating with foam or foam-in-place materials to immobilize components during transit. Clearly label packages as “Fragile,” “This Side Up,” and “Protect from Moisture.” For large or heavy platforms, include lifting points and follow ISO 11629 standards for packaging of precision equipment.

Transportation and Freight Considerations

Ship via freight (LTL or FTL) for larger units; air freight may be used for urgent, smaller components. Avoid excessive vibration during transit—use suspension-equipped vehicles or vibration-dampened transporters when possible. Coordinate with carriers experienced in handling precision industrial equipment. Ensure temperature and humidity controls if shipping to extreme environments.

Import Compliance and Duties

Verify country-specific import regulations. Provide accurate commercial invoices, packing lists, and bills of lading. Include technical specifications to support HS code classification. Some countries may require conformity assessments or certifications (e.g., CE, UKCA, or CCC) for associated machinery, even if the platform itself is not directly regulated.

Certification and Standards Compliance

While vibration isolation platforms are not always independently certified, compliance with relevant standards strengthens market access:

– ISO 10816: Vibration criteria for machinery

– ISO 2631: Human exposure to mechanical vibration

– CE Marking: Required if integrated into machinery placed on the EU market under the Machinery Directive (2006/42/EC)

– ANSI/SIA B11.0: For integration into U.S. industrial machinery

Ensure documentation reflects conformity where applicable.

Documentation Checklist

Prepare the following for seamless logistics and compliance:

– Commercial Invoice (with HS code and value)

– Packing List (itemized weights, dimensions, materials)

– Bill of Lading or Air Waybill

– Certificate of Origin (if claiming preferential tariffs)

– Technical Datasheet (including materials, load capacity, isolation frequency)

– Export License (if dual-use or controlled)

End-Use and Destination Restrictions

Screen end-users and destinations against government restricted party lists (e.g., U.S. BIS Denied Persons List, EU Consolidated List). Avoid shipments to embargoed countries unless authorized. Confirm the platform is not being used in prohibited applications (e.g., nuclear enrichment, missile systems) without proper licensing.

Installation and On-Site Compliance

Provide installation guidelines to ensure platforms are leveled and anchored per specifications. Incorrect installation may compromise vibration isolation and void warranties. Recommend site vibration surveys pre- and post-installation to verify performance. Include safety warnings for heavy lifting and equipment interaction.

Maintenance and Regulatory Recertification

While not routinely recertified, advise users to inspect mounts, leveling feet, and isolation elements periodically. Document maintenance in alignment with quality systems (e.g., ISO 9001). Replace components according to manufacturer guidelines to maintain performance and compliance with equipment standards.

Environmental and Disposal Compliance

Platforms typically contain steel, rubber, or composite materials. Advise proper disposal per local environmental regulations (e.g., WEEE in EU for electronic components, if applicable). Encourage recycling of metal components through certified e-waste or scrap metal handlers.

Conclusion:

In conclusion, sourcing mechanical vibration isolation platforms requires a comprehensive evaluation of application-specific requirements, environmental conditions, and performance criteria. These platforms are critical in sectors such as precision manufacturing, semiconductor fabrication, optical research, and metrology, where even minute vibrations can compromise accuracy and product quality. When selecting a supplier or system, key factors such as isolation efficiency, load capacity, stability, adaptability, and ease of integration must be carefully assessed.

Both passive and active vibration isolation solutions offer distinct advantages, with passive systems providing cost-effective, reliable performance for many applications, while active systems deliver superior control in highly sensitive environments. It is essential to partner with reputable manufacturers that offer proven technology, technical support, and customization options to meet exacting standards.

Ultimately, a well-informed sourcing decision—based on thorough testing, supplier reliability, lifecycle costs, and long-term service support—ensures optimal performance, enhances process reliability, and protects valuable equipment investments. Prioritizing quality and suitability over initial cost will yield significant returns in precision, productivity, and operational consistency.