The global lawn mower market is experiencing steady growth, driven by rising residential landscaping trends, increasing environmental awareness, and demand for low-maintenance outdoor equipment. According to Grand View Research, the global lawn mower market size was valued at USD 33.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A notable segment within this expansion is mechanical push lawn mowers—eco-friendly, cost-effective, and ideal for small to medium-sized lawns. With no emissions, minimal maintenance, and quiet operation, these walk-behind mowers are seeing renewed interest amid increasing consumer preference for sustainable landscaping solutions. In response, a core group of manufacturers has emerged as leaders in innovation, durability, and performance, shaping the future of manual lawn care. Below, we spotlight the top 9 mechanical push lawn mower manufacturers leading this niche segment, based on product quality, market presence, and consumer trust.

Top 9 Mechanical Push Lawn Mower Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lawn & Garden Equipment

Domain Est. 1990

Website: deere.com

Key Highlights: John Deere offers a complete line of lawn and garden equipment to meet all of your maintenance needs. Explore lawn mowers, compact utility tractors, ……

#2 Ariens

Domain Est. 1995

Website: ariens.com

Key Highlights: Starting with four employees in 1933, we now employ over 1500 people to design, fabricate and assemble our zero turn lawn mowers and snow blowers in ……

#3 Bobcat Company

Domain Est. 1997

Website: bobcat.com

Key Highlights: For more than 60 years, Bobcat Company has built compact equipment that helps you work more efficiently and effectively. You rely on the performance, ……

#4 CRAFTSMAN®

Domain Est. 1998

Website: craftsman.com

Key Highlights: Official website for CRAFTSMAN®. Explore power tools, outdoor equipment, hand tools, storage products and more….

#5 Jacobsen

Domain Est. 1998 | Founded: 1921

Website: jacobsen.com

Key Highlights: Jacobsen has been a pioneer in the turf maintenance industry since 1921, renowned for innovative and high-quality mowers and turf equipment. Learn. More · Golf ……

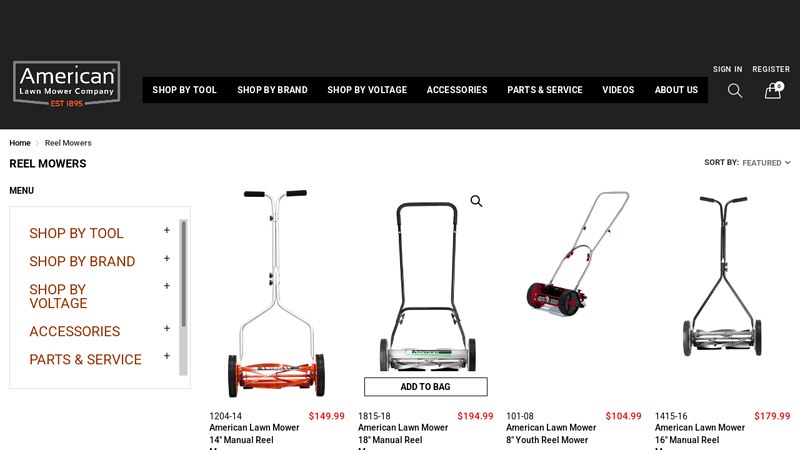

#6 Reel Mowers

Domain Est. 2000

#7 Homepage

Domain Est. 2011

Website: meangreenproducts.com

Key Highlights: Mean Green invented the world’s first commercial grade, electric, zero-turn mower that could mow all day. Today, Mean Green offers a full range of ……

#8 McLane Made in USA Since 1946

Domain Est. 2018 | Founded: 1946

Website: mclaneedgers.com

Key Highlights: McLane builds premium lawn mowers and edgers in the USA since 1946. Trusted for precision, durability, and pro-grade cutting performance….

#9 Allett Canada

Domain Est. 2020

Website: allett.ca

Key Highlights: Allett Canada delivers professional-grade cylinder and reel mowers engineered for perfect stripes and flawless finishes. Explore precision machines ……

Expert Sourcing Insights for Mechanical Push Lawn Mower

H2: 2026 Market Trends for Mechanical Push Lawn Mowers

The mechanical push lawn mower market is poised for subtle but significant shifts by 2026, influenced by growing environmental awareness, evolving consumer preferences, and advancements in lawn care technology. While electric and robotic mowers are gaining traction, mechanical push mowers—manual, non-powered units—continue to hold a niche yet resilient position in the global lawn care equipment landscape. Below are key trends expected to shape the mechanical push lawn mower market in 2026:

-

Resurgence in Eco-Conscious Consumerism

With increasing emphasis on sustainability and carbon footprint reduction, mechanical push mowers are experiencing renewed interest. As zero-emission tools requiring no fuel or electricity, they align perfectly with eco-friendly lifestyles. Urban and suburban homeowners seeking low-impact yard maintenance are increasingly opting for these manual alternatives, particularly in environmentally progressive regions like Western Europe and North America. -

Growing Demand in Urban and Small-Scale Landscaping

Mechanical push mowers are ideal for small to medium-sized lawns, making them well-suited for urban gardens, townhouses, and compact residential lots. As urbanization continues and lot sizes shrink in many developed markets, demand for compact, affordable, and low-maintenance mowing solutions is expected to rise. This trend is particularly evident in densely populated areas where noise regulations and space constraints favor manual mowers. -

Health and Wellness Appeal

The physical activity involved in pushing a non-motorized mower is increasingly marketed as a health benefit. By 2026, manufacturers and retailers are likely to emphasize the dual advantage of lawn maintenance and light exercise, appealing to fitness-conscious consumers. This wellness angle enhances the product’s value proposition beyond mere utility. -

Price Sensitivity and Cost-Effectiveness

In times of economic uncertainty or inflation, mechanical mowers remain attractive due to their low upfront cost and minimal maintenance. With no batteries, motors, or complex parts, they offer long-term savings. This affordability ensures steady demand in price-sensitive markets and among budget-conscious consumers, particularly in developing economies and rural areas. -

Competition from Electric and Smart Mowers

Despite their advantages, mechanical mowers face stiff competition from cordless electric and robotic mowers, which offer greater convenience and are becoming more affordable. However, mechanical mowers maintain a competitive edge in reliability, simplicity, and independence from charging infrastructure—factors that will sustain their market presence, especially among older demographics and off-grid users. -

Innovation in Design and Materials

By 2026, expect incremental innovations aimed at improving user experience, such as lighter-weight composites, ergonomic handles, and improved blade efficiency. While not technologically advanced, enhancements in build quality and usability will help modernize the product and attract younger, design-conscious buyers. -

Regional Market Variations

North America and Europe will remain primary markets due to strong environmental regulations and consumer preference for sustainable products. In contrast, developing regions may see slower adoption due to lower lawn ownership rates and preference for multipurpose, powered tools. However, niche adoption in eco-communities and organic farms could emerge. -

Retail and Distribution Shifts

E-commerce platforms and specialty garden retailers are expected to play a larger role in distributing mechanical mowers. Online content highlighting sustainability and cost savings will drive awareness and conversion, especially when paired with video demonstrations and user testimonials.

In conclusion, while mechanical push lawn mowers represent a mature and modestly sized segment of the outdoor power equipment market, they are far from obsolete. By 2026, their enduring appeal will be rooted in sustainability, affordability, and simplicity—qualities that ensure continued relevance in an increasingly automated world.

Common Pitfalls Sourcing Mechanical Push Lawn Mowers (Quality, IP)

Sourcing mechanical push lawn mowers, especially from overseas manufacturers, involves several potential pitfalls related to product quality and intellectual property (IP) rights. Being aware of these risks is crucial for protecting your brand, ensuring customer satisfaction, and avoiding legal complications.

Poor Build Quality and Durability

One of the most frequent issues when sourcing mechanical push mowers is inconsistent or subpar build quality. Components such as the steel deck, blade assembly, cutting mechanism, and handlebars may be made from inferior materials or with imprecise manufacturing tolerances. Thin-gauge steel decks can dent easily, blades may dull quickly or be poorly balanced, and plastic parts may crack under stress. Over time, this leads to premature wear, safety hazards, and negative customer reviews—damaging your brand reputation.

Inadequate Quality Control Processes

Many suppliers, particularly smaller or less experienced manufacturers, lack rigorous quality control (QC) protocols. Without proper in-line and final inspections, defective units can pass through undetected. Common issues include misaligned wheels, loose bolts, improper blade sharpening, and inconsistent cutting height adjustments. Relying solely on a supplier’s word without third-party inspections or sample testing increases the risk of receiving a shipment that fails to meet specifications.

Non-Compliance with Safety and Regulatory Standards

Mechanical push mowers must comply with regional safety standards such as ANSI B71.3-2012 in the U.S. or EN 836 in Europe. Sourcing mowers from manufacturers unfamiliar with these regulations can result in products that lack essential safety features—like blade brake systems, proper shielding, or stability tests. Importing non-compliant units may lead to customs delays, product recalls, or legal liability in case of user injury.

Intellectual Property Infringement Risks

Sourcing push mowers carries significant IP risks, particularly when suppliers offer “copycat” versions of well-known brands. These knockoffs may replicate patented designs, such as unique deck shapes, height adjustment mechanisms, or handle folding systems. Purchasing such products—even unknowingly—can expose your business to lawsuits for contributory infringement. Additionally, using branded logos or design elements without authorization may violate trademark laws.

Lack of Design Originality and Patent Clearance

Even if a mower isn’t a direct copy, it may still infringe on existing utility or design patents. Many mechanical mower innovations—like gear-driven reel systems or ergonomic handle designs—are protected. Failing to conduct a freedom-to-operate (FTO) analysis before sourcing can result in costly legal disputes or blocked shipments by customs authorities enforcing IP rights.

Misrepresentation of Materials and Specifications

Suppliers may exaggerate material thickness, blade hardness (e.g., claiming high-carbon steel when using mild steel), or cutting width. For example, a claimed 18-inch cutting width might measure only 17 inches due to deck overlap. These discrepancies affect performance and can mislead consumers, leading to returns and reputational damage.

Inconsistent After-Sales Support and Spare Parts Availability

Low-cost suppliers may not offer reliable after-sales service or a sustainable supply of replacement parts—such as blades, wheels, or height adjustment levers. This creates frustration for end users and increases your long-term support costs. Without a clear service and parts strategy, customer satisfaction plummets.

Failure to Verify Supplier Credentials

Partnering with unverified manufacturers increases exposure to all the above risks. Red flags include reluctance to provide factory audits, lack of certifications (ISO, CE, etc.), or refusal to sign IP protection agreements. Due diligence, including on-site visits or third-party audits, is essential to ensure reliability and ethical manufacturing practices.

By proactively addressing these pitfalls—through thorough vetting, independent testing, IP clearance, and robust contracts—buyers can source high-quality, compliant mechanical push mowers while minimizing legal and operational risks.

Logistics & Compliance Guide for Mechanical Push Lawn Mower

Product Classification and HS Code

Mechanical push lawn mowers are typically classified under Harmonized System (HS) Code 8433.11.00, which covers “Mowers; cylinder (reel) type.” This classification applies to non-powered, manually operated lawn mowers that use rotating blades in a cylindrical drum to cut grass. Confirm the exact HS code with local customs authorities, as variations may exist by country.

Import/Export Regulations

Ensure compliance with import and export regulations in both the country of origin and destination. Key considerations include:

– Obtain proper export documentation (commercial invoice, packing list, bill of lading/air waybill).

– Verify if export licenses are required (typically not for consumer lawn mowers, but check for destination-specific restrictions).

– Comply with destination country import duties, taxes, and customs clearance procedures.

Packaging and Labeling Requirements

- Package mowers securely to prevent damage during transit using durable cardboard boxes with internal supports.

- Label each package with: product name, model number, country of origin, weight, dimensions, handling symbols (e.g., “Fragile,” “This Side Up”), and barcode/UPC.

- Include bilingual labeling if shipping to regions requiring local language (e.g., Spanish in Latin America, French in Canada).

Safety and Compliance Standards

- United States (CPSC): Comply with Consumer Product Safety Commission guidelines. No motor means no EPA or CARB emissions requirements, but ensure compliance with general product safety rules (e.g., blade guard integrity, user instructions).

- European Union: Although mechanical mowers are not powered, general product safety (GPSD) and CE marking may still apply depending on design. Follow EN 836:2014 for safety requirements for pedestrian-controlled lawn mowers.

- Canada: Adhere to Health Canada’s Consumer Chemicals and Products Safety Act (CCPSA) and provide clear safety warnings and instructions in English and French.

Transportation and Handling

- Ground freight is typically used; avoid air transport unless expedited due to low value-to-weight ratio.

- Stack pallets no higher than 5–6 layers to prevent crushing. Use stretch wrap and corner boards for stability.

- Avoid exposure to moisture; use moisture-resistant packaging and desiccants if shipping overseas.

Documentation Requirements

- Commercial Invoice: Include full product description, HS code, value, and terms of sale (e.g., FOB, EXW).

- Packing List: Detail number of units per box, carton dimensions, and gross/net weights.

- Certificate of Origin: May be required for preferential tariff treatment under trade agreements (e.g., USMCA).

Warranty and After-Sales Support

- Provide a printed warranty (typically 1–2 years) and user manual in the local language.

- Include contact information for customer service and spare parts availability.

- Train distributors on basic troubleshooting and maintenance procedures.

Environmental and Disposal Compliance

- Inform end-users about proper disposal methods; mechanical mowers contain recyclable metal components.

- Comply with local WEEE (Waste Electrical and Electronic Equipment) directives if applicable (usually not for non-electric models, but verify).

- Avoid using hazardous coatings or paints; adhere to RoHS if applicable (typically for electrical components, but good practice for materials).

Final Recommendations

- Conduct pre-shipment inspections to verify quality and compliance.

- Work with a licensed customs broker in the destination country to ensure smooth clearance.

- Monitor regulatory changes, especially in target markets, to maintain ongoing compliance.

Conclusion: Sourcing a Mechanical Push Lawn Mower

After evaluating various factors such as cost, environmental impact, durability, performance, and long-term maintenance, sourcing a mechanical push lawn mower proves to be a sustainable, economical, and efficient choice for small to medium-sized lawns. These mowers require no fuel or electricity, emit zero pollutants, and offer quiet, low-maintenance operation, making them ideal for eco-conscious consumers and those seeking simplicity in lawn care. While they demand more physical effort compared to powered alternatives, advancements in design have significantly improved cutting performance and ease of use.

When sourcing, prioritizing reputable manufacturers known for build quality and customer support ensures longevity and reliability. Additionally, considering availability of replacement parts and local service options enhances the overall value. Ultimately, a mechanical push mower aligns well with environmentally responsible landscaping practices and offers a cost-effective, health-conscious solution for routine lawn maintenance.