The global mattress market is undergoing rapid expansion, driven by increasing consumer awareness of sleep health, rising disposable incomes, and growing e-commerce penetration. According to a 2023 report by Grand View Research, the global mattress market size was valued at USD 43.8 billion and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Similarly, Mordor Intelligence projects steady growth, citing urbanization and a surge in home furnishing demand—especially in emerging economies—as key market drivers. This growth has spurred innovation and competition among manufacturers, giving rise to a diverse range of products from innerspring and memory foam to hybrid and smart mattresses. In this evolving landscape, identifying the top players becomes essential for consumers and industry stakeholders alike. Below, we highlight the top 10 mattress manufacturers shaping the industry through scalability, technology integration, and consistent product performance.

Top 10 Mattresses Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

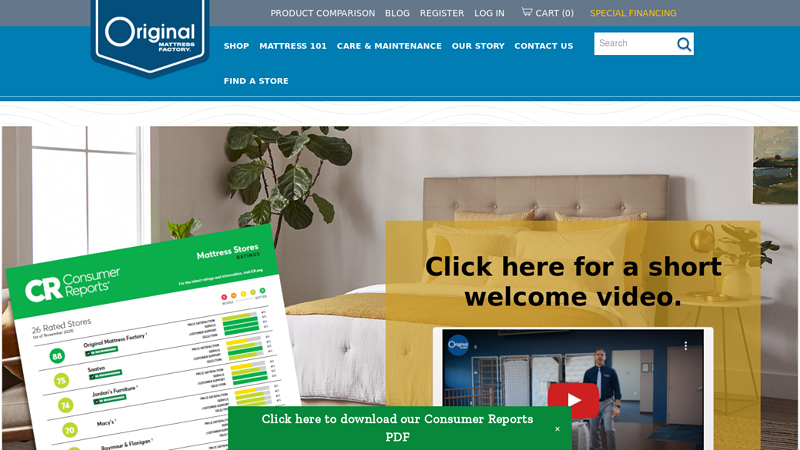

#1 The Original Mattress Factory

Domain Est. 1997

Website: originalmattress.com

Key Highlights: Manufacturer of the best mattresses and box springs for the Eastern US. Providing the best comfort and durability you can find in a mattress….

#2 Shovlin Mattress Factory

Domain Est. 2013

Website: shovlinmattress.com

Key Highlights: We are a family-owned NJ mattress manufacturer offering premium bedding at a lower price and superior quality than the name brand competition….

#3 Tempur Sealy International

Domain Est. 2013

Website: tempursealy.com

Key Highlights: Tempur Sealy International is more than a mattress company. As a leading designer, manufacturer, distributor, and retailer of bedding items worldwide….

#4 Symbol Mattress

Domain Est. 1997

Website: symbolmattress.com

Key Highlights: Manufactures mattresses, box springs, sofa beds and upholstered furniture for wholesalers in the US….

#5 Mattress Company Online

Domain Est. 1997

Website: simmons.com

Key Highlights: Shopping to buy a mattress online for better sleep shouldn’t be hard or break the bank either! All Simmons mattresses are cost-effective & ship to your door ……

#6 Diamond Mattress

Domain Est. 2000

Website: diamondmattress.com

Key Highlights: Discover better sleep with our expertly crafted mattresses—trusted for over 80 years. Shop memory foam, hybrid, and natural latex mattresses made with ……

#7 Certified Non Toxic Mattress

Domain Est. 2005

Website: myessentia.com

Key Highlights: Free delivery · 120-day returnsExperience GOLS & GOTS certified non toxic mattresses. Essentia’s organic mattresses provide superior comfort & deep sleep with patented organic lat…

#8 Helix

Domain Est. 2014

Website: helixsleep.com

Key Highlights: Free delivery · Free 100-day returnsShop Helix Sleep mattresses. Outrageous comfort designed for every body. Take our 30-second sleep quiz to find out which mattress is right for …

#9 Custom Mattress Makers

Domain Est. 2018

Website: custommattressmakers.com

Key Highlights: We specialize in custom mattresses for RVs, campers, vans, trailers, European beds, and more. Every mattress is handcrafted in the USA, backed by our 100 ……

#10 Mattresses Online

Domain Est. 1997

Website: serta.com

Key Highlights: Made in the U.S.A. All Serta mattresses are made in the U.S.A with global components, leveraging over 90 years of manufacturing expertise….

Expert Sourcing Insights for Mattresses

2026 Market Trends for Mattresses

The mattress industry is poised for continued evolution in 2026, shaped by shifting consumer priorities, technological innovation, and broader economic forces. Key trends indicate a market increasingly focused on personalization, sustainability, health integration, and omnichannel experiences.

Rising Demand for Personalized and Adaptive Sleep Solutions

Consumers are moving beyond one-size-fits-all mattresses, seeking products tailored to their specific sleep needs. By 2026, advancements in smart mattress technology—including AI-driven sleep tracking, adjustable firmness zones, and responsive materials like phase-change cooling gels and adaptive foams—will become more mainstream. Brands are leveraging data from sleep trackers and customer profiles to offer customized recommendations, both online and in-store. This hyper-personalization caters to diverse preferences across age groups, body types, and sleep positions.

Sustainability and Eco-Conscious Materials Gain Prominence

Environmental concerns are reshaping material sourcing and manufacturing practices. By 2026, mattresses made from organic cotton, natural latex, recycled foams, and biodegradable components will see increased demand. Transparency in supply chains and third-party certifications (e.g., GOTS, CertiPUR-US, GREENGUARD) will serve as key differentiators. Consumers are also favoring brands that offer take-back programs and modular designs that extend product lifecycles, reducing landfill waste.

Integration of Health and Wellness Features

The convergence of sleep and wellness is accelerating. Mattresses in 2026 will increasingly incorporate health-monitoring features such as heart rate and respiration tracking, snore detection, and temperature regulation. These innovations position mattresses not just as furniture, but as proactive tools for improving overall health. Partnerships between mattress companies and healthcare providers or wellness platforms may emerge, offering integrated sleep health solutions.

Growth of the Premium and Hybrid Segments

The premium mattress segment is expected to outpace the broader market, driven by higher consumer willingness to invest in quality sleep. Hybrid models—combining innerspring, memory foam, and latex—dominate this segment due to their balanced support and comfort. Brands emphasizing durability, advanced materials, and long-term value will capture market share, especially among affluent consumers and aging populations seeking orthopedic support.

Omnichannel Retail and Enhanced In-Store Experiences

While direct-to-consumer (DTC) brands popularized bed-in-a-box models, traditional retailers are adapting by blending digital and physical channels. In 2026, successful brands will offer seamless omnichannel experiences: online configurators, home trial programs, augmented reality (AR) tools for visualization, and enhanced in-store testing zones with sleep consultants. Retail spaces will transform into experiential showrooms, emphasizing education and personalized service to build trust.

Economic Pressures and Value-Conscious Shopping

Despite premium growth, inflationary pressures and economic uncertainty will influence purchasing behavior. Consumers may delay replacements or seek value-oriented options, boosting demand for mid-tier mattresses and refurbished or gently used models. Financing options (e.g., buy-now-pay-later) will remain critical for conversion, especially in the premium segment.

Consolidation and Competitive Differentiation

The market is likely to see continued consolidation, with larger players acquiring niche innovators to expand product portfolios. To stand out, brands will emphasize unique value propositions—whether through proprietary technologies, sustainability leadership, or wellness integration—rather than competing solely on price.

In summary, the 2026 mattress market will be defined by innovation, sustainability, and personalization. Brands that successfully blend advanced technology with eco-friendly practices and consumer-centric experiences will lead the industry in delivering better sleep for a health-conscious, digitally engaged population.

Common Pitfalls When Sourcing Mattresses: Quality and Intellectual Property (IP) Concerns

Sourcing mattresses, especially from overseas manufacturers, can present significant challenges related to product quality and intellectual property protection. Being aware of these common pitfalls helps mitigate risks and ensures a successful procurement process.

Quality-Related Pitfalls

Inconsistent Material Standards

Suppliers may use substandard or misrepresented materials (e.g., low-density foam, inferior springs, or non-certified fabrics) to cut costs. Without strict specifications and third-party testing, this can lead to poor durability, comfort, and safety issues such as off-gassing or fire hazards.

Lack of Certification Compliance

Many mattresses require certifications like CertiPUR-US (for foam), OEKO-TEX (for textiles), or flammability standards (e.g., TB 117 in California). Sourcing from manufacturers unfamiliar with or unwilling to comply with these regulations can result in non-compliant products that cannot be legally sold in target markets.

Poor Craftsmanship and Construction

Inconsistent stitching, misaligned layers, or improper assembly can compromise mattress integrity. These defects often stem from inadequate quality control processes at the factory, leading to high return rates and reputational damage.

Inadequate Testing and Prototyping

Skipping prototype reviews or durability testing (e.g., compression, edge support, roll-off tests) increases the risk of launching a product that fails under real-world use. Relying solely on supplier claims without independent verification is a common oversight.

Supply Chain Variability

Raw material fluctuations—such as changes in foam density or fabric sourcing—can alter the final product’s feel and performance. Without contracts that lock in material specifications, buyers may receive inconsistent batches over time.

Intellectual Property (IP) Risks

Design and Patent Infringement

Mattress designs, including unique coil systems, layering configurations, or cooling technologies, may be protected by patents. Sourcing a look-alike product without due diligence can lead to costly legal disputes, product seizures, or forced recalls.

Counterfeit or Clone Products

Some suppliers openly offer replicas of popular branded mattresses. While attractive due to lower prices, these products expose buyers to IP litigation and damage brand credibility if discovered by consumers or rights holders.

Lack of IP Ownership Clauses

Without clear contractual terms, custom-designed mattresses or proprietary technologies developed with a manufacturer may not belong to the buyer. This can prevent brand exclusivity and allow the supplier to sell the same design to competitors.

Reverse Engineering Risks

Sharing detailed technical specifications with manufacturers—especially in regions with weak IP enforcement—increases the risk of design theft. Suppliers may replicate and sell the design independently or to others, undermining market differentiation.

Weak Contractual Protections

Many sourcing agreements fail to include robust IP clauses, confidentiality agreements, or restrictions on production volume and resale. This leaves buyers vulnerable to unauthorized production, gray market sales, or brand dilution.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough factory audits and request material certifications.

– Require independent lab testing for compliance and performance.

– Secure IP assignments in writing and file patents or design rights in relevant markets.

– Use non-disclosure agreements (NDAs) and work with legally vetted contracts.

– Partner with reputable sourcing agents or legal experts familiar with international IP law.

By proactively addressing both quality and IP concerns, businesses can protect their brand, ensure customer satisfaction, and maintain a competitive edge in the mattress market.

Logistics & Compliance Guide for Mattresses

Moving mattresses across borders or within supply chains requires careful attention to logistics, safety, and regulatory compliance. This guide outlines key considerations for manufacturers, distributors, retailers, and logistics providers involved in mattress transportation and sales.

Product Classification and Harmonized System (HS) Codes

Mattresses are typically classified under the Harmonized System (HS) for international trade. The most common HS codes include:

– 9404.21: Mattresses, stuffed with straw, hair, or other natural filling

– 9404.29: Other mattresses (e.g., foam, spring, latex)

– 9404.60: Mattress supports (e.g., box springs)

Accurate classification is essential for determining import/export duties, taxes, and regulatory requirements in different jurisdictions.

Packaging and Labeling Requirements

Proper packaging protects mattresses during transit and ensures compliance with safety and labeling laws.

- Plastic Encasement: Most mattresses must be sealed in plastic to maintain hygiene and prevent contamination. Use puncture-resistant, breathable plastic where possible.

- Warning Labels: Include mandatory safety labels such as:

- “Do Not Remove Under Penalty of Law” (U.S. FTC requirement)

- Fire safety compliance labels (e.g., TB 117-2013 in California, 16 CFR Part 1633 federally in the U.S.)

- Country of origin

- Care instructions

- Tamper-Evident Seals: Required in many regions to indicate the mattress is new and unused.

Flammability and Safety Standards

Mattresses must meet fire safety regulations to reduce combustion risks.

- United States: Comply with 16 CFR Part 1633 (Federal Mattress Flammability Standard). All mattresses sold must pass rigorous open-flame tests.

- California TB 117-2013: Additional state-level requirements; often adopted as a de facto national standard.

- European Union: Must meet EN 597-1 and EN 597-2 (cigarette and match ignition tests) and be CE-marked under the Construction Products Regulation (CPR) if applicable.

- Canada: Comply with the Mattress and Mattress Foundation Regulation under the Canada Consumer Product Safety Act (CCPSA).

- Australia/New Zealand: AS/NZS 8891:2002 – Test methods for评定 of mattress flammability.

Manufacturers must conduct third-party testing and maintain compliance documentation.

Transportation and Handling Logistics

Efficient logistics minimize damage and optimize space utilization.

- Dimensional Weight: Carriers often charge based on volume rather than actual weight due to the bulky nature of mattresses. Optimize packaging to reduce size.

- Stacking and Palletizing: Use sturdy pallets and secure strapping. Avoid stacking more than 5–6 mattresses high unless specially designed for vertical storage.

- Fleet Requirements: Use enclosed, dry trailers to protect from moisture and contaminants. Consider dedicated mattress transport vehicles with protective liners.

- Last-Mile Delivery: Coordinate white-glove delivery services where required. Train personnel in proper handling to avoid bending or puncturing.

Environmental and Recycling Regulations

Disposal and end-of-life management are increasingly regulated.

- Waste Electrical and Electronic Equipment (WEEE): Not applicable to standard mattresses, but smart/integrated tech mattresses may fall under WEEE in the EU.

- Mattress Recycling Laws: States like California, Connecticut, and Rhode Island require mattress recycling programs. Retailers may be responsible for funding or facilitating take-back.

- Extended Producer Responsibility (EPR): Emerging in the EU and other regions, requiring manufacturers to manage end-of-life disposal.

- Hazardous Materials: Avoid banned substances (e.g., certain flame retardants like PBDEs) per EPA, REACH (EU), and RoHS directives.

Import/Export Documentation

Ensure all international shipments include:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– Test reports and compliance certificates (e.g., flammability, phthalates)

– Import licenses (if required by destination country)

Verify compliance with customs authorities in both exporting and importing countries.

Consumer Protection and Warranty Compliance

- Truth in Labeling: Accurately describe materials (e.g., “memory foam” vs. “polyurethane foam”) per FTC guidelines.

- Warranty Terms: Clearly state warranty duration, coverage, and claims process. Comply with Magnuson-Moss Warranty Act (U.S.).

- Right to Repair/Return: Adhere to local consumer laws (e.g., 14-day cooling-off period in the EU for online purchases).

Best Practices Summary

- Verify regulatory requirements in every market.

- Maintain up-to-date compliance documentation.

- Use protective, compliant packaging and labeling.

- Partner with certified testing laboratories.

- Train logistics teams in safe handling procedures.

- Develop a mattress recycling or take-back strategy.

By adhering to these logistics and compliance standards, businesses can ensure safe, legal, and efficient mattress distribution worldwide.

Conclusion: Sourcing Mattress Manufacturers

Sourcing the right mattress manufacturer is a critical decision that directly impacts product quality, cost-efficiency, brand reputation, and customer satisfaction. Through careful evaluation of factors such as manufacturing capabilities, material sourcing, quality control processes, certifications, scalability, and ethical practices, businesses can identify reliable partners that align with their standards and market demands.

Whether sourcing locally or internationally, it is essential to conduct thorough due diligence, including factory audits, sample assessments, and reference checks. Building strong, transparent relationships with manufacturers fosters long-term collaboration, innovation, and adaptability in a competitive market.

In summary, successful mattress sourcing hinges on balancing cost, quality, and sustainability while choosing manufacturers who are not only capable of meeting current needs but also positioned to grow and evolve with your brand. A strategic, well-researched approach to sourcing ensures the delivery of high-quality sleep solutions that resonate with consumers and support long-term business success.