The global material handling equipment market is experiencing robust growth, driven by rising automation in manufacturing, warehousing, and logistics sectors. According to a report by Mordor Intelligence, the market was valued at USD 228.5 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029. This expansion is fueled by increased demand for efficient supply chain solutions, labor cost optimization, and the rapid growth of e-commerce fulfillment centers. Additionally, advancements in robotics, IoT integration, and AI-powered inventory management systems are reshaping the material handling landscape. As operations prioritize speed, accuracy, and scalability, leading manufacturers are innovating to meet evolving industry needs. Against this backdrop, we present the top seven material handling manufacturers shaping the future of intralogistics and industrial automation.

Top 7 Material Handling Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Crown Equipment Corporation

Domain Est. 1998

Website: crown.com

Key Highlights: Crown Equipment Corporation is a global manufacturer of material handling equipment, lift trucks and technology, with a network of more than 500 forklift ……

#2 Toyota Forklifts

Domain Est. 1996

Website: toyotaforklift.com

Key Highlights: Toyota’s full line of material handling products are proudly built in the United States and includes forklifts, reach trucks, order pickers, pallet jacks, ……

#3 TMHNA

Domain Est. 2006

Website: tmhna.com

Key Highlights: Toyota Material Handling, the industry leader in forklift sales, is composed of two main group companies: Toyota Material Handling USA, Inc. and The Raymond ……

#4 MHI

Domain Est. 1995

Website: mhi.org

Key Highlights: We are the leading trade association dedicated to advancing and innovating the material handling and supply chain industry. JOIN TODAY!…

#5 Material Handling Resources

Domain Est. 1999

Website: mhrweb.com

Key Highlights: Material Handling Resources (MHR) is one of the country’s top material-handling distributors. For over 27 years, MHR has supported material handling needs ……

#6 Alta Equipment Group

Domain Est. 2001

Website: altg.com

Key Highlights: Alta is your source for new and used material handling and construction equipment for sale with 57 locations in Florida, Illinois, Michigan, New England, ……

#7 Linde Material Handling

Domain Est. 2008

Website: linde-mh.us

Key Highlights: Welcome to Linde Material Handling. Outfit your operation with innovative solutions for material handling, warehouse automation, fleet management, and more….

Expert Sourcing Insights for Material Handling

H2: 2026 Market Trends in Material Handling

The material handling industry is undergoing a transformative shift by 2026, driven by technological advancements, evolving supply chain demands, and sustainability imperatives. As global logistics networks become more complex and customer expectations rise, companies are investing heavily in automation, digitalization, and resilient infrastructure. Below are key trends shaping the material handling landscape in 2026:

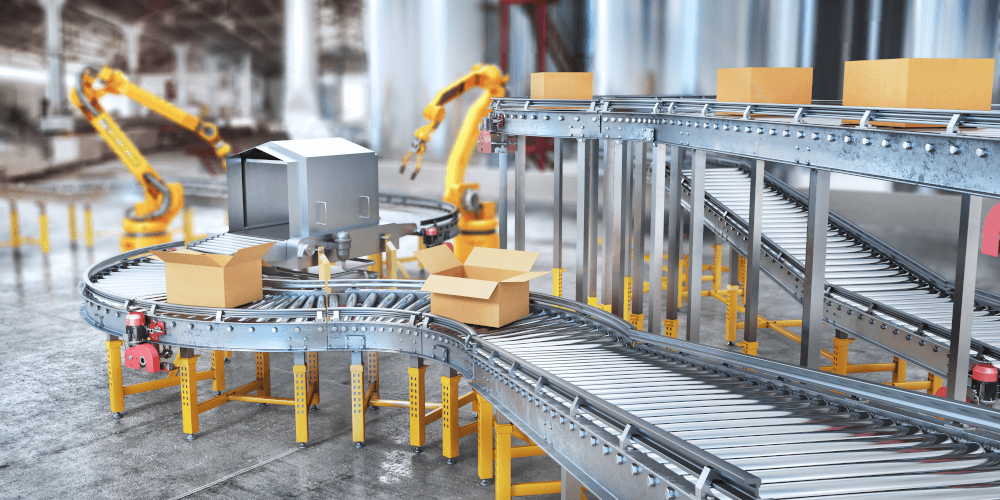

1. Accelerated Adoption of Automation and Robotics

By 2026, automation has become central to material handling operations. Autonomous Mobile Robots (AMRs), robotic palletizers, and automated storage and retrieval systems (AS/RS) are widely deployed across warehouses, distribution centers, and manufacturing facilities. The need for labor optimization amid workforce shortages has accelerated investment in collaborative robots (cobots) that work alongside human operators, increasing efficiency and reducing error rates.

2. Growth of Smart Warehousing and IoT Integration

Internet of Things (IoT) sensors and real-time data analytics are enabling smart warehouse ecosystems. In 2026, connected material handling equipment—such as smart conveyors, forklifts with telematics, and intelligent sortation systems—provides end-to-end visibility and predictive maintenance capabilities. This integration improves asset utilization, reduces downtime, and enhances operational agility.

3. Expansion of AI and Machine Learning Applications

Artificial intelligence is playing a pivotal role in optimizing material flow, inventory management, and demand forecasting. AI-powered warehouse management systems (WMS) and transportation management systems (TMS) dynamically adjust workflows based on real-time conditions. In 2026, machine learning algorithms are increasingly used to optimize pick paths, reduce congestion, and improve throughput in high-volume fulfillment centers.

4. Emphasis on Sustainability and Energy Efficiency

Environmental regulations and corporate ESG goals are driving the adoption of energy-efficient material handling solutions. Electric forklifts, regenerative braking systems, and solar-powered warehouses are becoming standard. Equipment manufacturers are focusing on lightweight, recyclable materials and modular designs to reduce environmental impact throughout the product lifecycle.

5. Resilience and Flexibility in Supply Chains

Post-pandemic disruptions have underscored the need for adaptable material handling systems. In 2026, companies prioritize modular and scalable solutions that can quickly respond to fluctuating demand. Flexible automation, multi-modal handling systems, and decentralized fulfillment models support rapid reconfiguration of logistics operations.

6. Rising Demand in E-Commerce and Last-Mile Logistics

The continued growth of e-commerce is fueling demand for faster, more accurate material handling solutions. Automated parcel sortation, goods-to-person systems, and micro-fulfillment centers located in urban areas are key trends. These systems reduce delivery times and support the scalability required by omni-channel retail.

7. Workforce Transformation and Training Technologies

As automation grows, the role of human workers is shifting toward supervision, maintenance, and data analysis. Augmented reality (AR) and virtual reality (VR) are increasingly used for training operators on new systems, improving safety, and reducing onboarding time. Upskilling initiatives are now a strategic priority for logistics and manufacturing firms.

8. Regional Market Dynamics and Investment Trends

North America and Europe lead in automation adoption, while Asia-Pacific—particularly China, India, and Southeast Asia—experiences rapid growth due to expanding manufacturing and logistics infrastructure. Government initiatives promoting smart factories and digital supply chains are catalyzing investment in advanced material handling technologies across emerging markets.

In summary, the 2026 material handling market is defined by intelligent automation, data-driven operations, and sustainable innovation. Companies that embrace these trends are better positioned to achieve operational excellence, respond to market volatility, and meet the evolving demands of global commerce.

Common Pitfalls in Sourcing Material Handling Equipment (Quality and Intellectual Property)

Sourcing material handling equipment—such as conveyors, automated guided vehicles (AGVs), robotic arms, and warehouse management systems—requires careful evaluation beyond just cost and delivery timelines. Two critical areas where organizations often encounter significant risks are quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational disruptions, legal disputes, and long-term financial losses.

Quality-Related Pitfalls

Inadequate Supplier Qualification and Audits

Failing to conduct thorough due diligence on potential suppliers can result in sourcing equipment that does not meet performance or durability standards. Many organizations rely solely on product brochures or third-party references without visiting manufacturing facilities or reviewing quality management certifications (e.g., ISO 9001). Without on-site audits, hidden production flaws or inconsistent manufacturing processes may go undetected until after delivery.

Lack of Clear Quality Specifications and Acceptance Criteria

Ambiguous technical specifications or poorly defined performance metrics in procurement contracts can lead to disputes over whether delivered equipment meets expectations. For example, failure to define load capacity tolerances, cycle life, or mean time between failures (MTBF) may result in equipment that technically “works” but fails under real-world conditions.

Insufficient Testing and Factory Acceptance Procedures

Skipping or rushing factory acceptance tests (FATs) exposes buyers to undetected defects. Some suppliers may offer limited or symbolic testing, especially with offshore vendors under tight delivery schedules. Without witnessing critical functionality tests—such as stress testing, integration with existing systems, or safety compliance checks—buyers risk receiving substandard equipment.

Overlooking After-Sales Support and Spare Parts Availability

High-quality equipment requires reliable ongoing support. Sourcing from suppliers with weak service networks or limited spare parts inventory can lead to extended downtime. Equipment longevity depends not just on initial build quality but on the availability of maintenance expertise and genuine replacement components.

Intellectual Property-Related Pitfalls

Inadequate IP Ownership Clauses in Contracts

When customizing material handling systems, buyers often assume they own the resulting designs, software, or process improvements. However, without explicit contractual language, suppliers may retain IP rights to custom engineering, control algorithms, or integration schematics. This can restrict future modifications, reverse engineering, or third-party repairs.

Use of Proprietary Software Without Proper Licensing

Many modern material handling systems rely on embedded software for control and monitoring. Sourcing equipment without verifying software licensing terms can lead to compliance risks. Suppliers may grant only limited or non-transferable licenses, preventing deployment across multiple sites or integration with other systems.

Risk of IP Infringement by Suppliers

Suppliers may unknowingly (or deliberately) use third-party patented technologies in their designs. If the sourced equipment infringes on existing IP, the buyer could face legal liability—even if the infringement originated with the supplier. Contracts should include indemnification clauses to protect the buyer from such claims.

Failure to Protect Sensitive Operational Data

Smart material handling systems often collect and transmit operational data. If not properly secured or governed by data handling agreements, this can expose proprietary workflows, inventory patterns, or logistics strategies. Buyers must ensure suppliers comply with data protection standards and do not reuse or monetize operational data.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct comprehensive supplier audits, including quality systems and IP practices.

– Define clear technical and performance specifications in procurement contracts.

– Require detailed factory acceptance testing with documented results.

– Negotiate explicit IP ownership and licensing terms for custom solutions.

– Include indemnification clauses for IP infringement.

– Establish data governance and cybersecurity requirements for connected systems.

By proactively addressing quality and IP concerns during the sourcing process, companies can ensure reliable, compliant, and defensible material handling investments.

Logistics & Compliance Guide for Material Handling

Effective material handling is essential for ensuring operational efficiency, workplace safety, and regulatory compliance across supply chain operations. This guide outlines key logistics considerations and compliance requirements to help organizations manage the movement, storage, control, and protection of materials throughout the logistics lifecycle.

Regulatory Compliance Standards

Material handling operations must adhere to various national and international regulations to ensure safety and legal compliance. Key regulatory frameworks include:

- OSHA (Occupational Safety and Health Administration): In the U.S., OSHA sets standards for safe material handling practices, including powered industrial truck operation (29 CFR 1910.178), manual lifting guidelines, and workplace ergonomics.

- ISO Standards: ISO 9001 (Quality Management) and ISO 45001 (Occupational Health and Safety) provide international benchmarks for safe and efficient material handling systems.

- DOT (Department of Transportation): Regulates the transportation of hazardous materials, requiring proper labeling, packaging, and handling documentation (49 CFR).

- GHS (Globally Harmonized System): Mandates standardized labeling and safety data sheets (SDS) for hazardous chemicals handled in logistics facilities.

- EU Machinery Directive: Applies to material handling equipment used within the European Union, ensuring safety in design and operation.

Organizations must conduct regular audits and staff training to maintain compliance with these standards.

Equipment Safety and Certification

All material handling equipment must be properly maintained, inspected, and operated by trained personnel to reduce accident risks:

- Forklifts and Powered Industrial Trucks: Operators must be certified per OSHA requirements, with refresher training every three years or after incidents.

- Conveyor Systems: Must include emergency stop mechanisms, guarding, and routine maintenance logs.

- Cranes and Hoists: Require load testing, certification, and compliance with ASME B30 standards.

- Pallet Jacks and Hand Trucks: Should be inspected for structural integrity and wheel functionality before use.

- Automated Guided Vehicles (AGVs): Must comply with ANSI/ITSDF B56.5 safety standards for autonomous operation in shared workspaces.

Maintain equipment logs and inspection records for compliance verification during audits.

Ergonomic Best Practices

Improper manual handling is a leading cause of workplace injuries. Implement ergonomic strategies to mitigate risks:

- Use mechanical aids (e.g., lift tables, vacuum lifters) to reduce manual lifting.

- Train employees on proper lifting techniques (e.g., bend knees, keep back straight).

- Rotate tasks to prevent repetitive strain injuries.

- Design workstations to minimize bending, reaching, and twisting.

- Conduct job hazard analyses (JHAs) to identify and correct ergonomic risks.

Hazardous Materials Handling

Special protocols are required when handling hazardous substances:

- Classify materials according to GHS and DOT hazard categories.

- Store chemicals in approved, labeled containers with proper ventilation and spill containment.

- Provide appropriate PPE (gloves, goggles, respirators) and ensure availability of spill kits.

- Train employees on emergency response procedures, including evacuation and decontamination.

- Maintain up-to-date SDS files accessible to all personnel.

Inventory Accuracy and Traceability

Efficient logistics depend on accurate material tracking:

- Implement barcode or RFID systems for real-time inventory visibility.

- Conduct regular cycle counts and annual physical inventories.

- Use warehouse management systems (WMS) to automate tracking and reporting.

- Ensure lot and batch traceability for regulated industries (e.g., pharmaceuticals, food).

Storage and Racking Safety

Improper storage can lead to collapses, injuries, and inventory damage:

- Adhere to racking load capacities and avoid overloading.

- Secure loads using straps, shrink wrap, or dunnage.

- Maintain clear aisle markings and enforce fire code clearances.

- Inspect racking systems regularly for damage and repair or replace as needed.

- Follow ANSI MH16.1 standards for industrial steel storage racks.

Training and Documentation

A compliant material handling program requires thorough training and recordkeeping:

- Provide initial and refresher training on equipment use, safety protocols, and emergency procedures.

- Document all training sessions, inspections, and incident reports.

- Maintain logs for equipment maintenance, safety audits, and compliance certifications.

- Use digital platforms to centralize and streamline documentation access.

Sustainability and Environmental Compliance

Material handling impacts environmental performance:

- Optimize load configurations to reduce transportation emissions.

- Recycle packaging materials and use reusable containers where possible.

- Properly dispose of hazardous waste in accordance with EPA and local regulations.

- Implement energy-efficient equipment (e.g., electric forklifts, LED-lit warehouses).

By integrating these logistics and compliance practices, organizations can enhance safety, reduce costs, and ensure adherence to regulatory requirements in all material handling operations.

Conclusion: Sourcing Material Handling Supplier

In conclusion, the process of sourcing a material handling supplier is a strategic initiative that directly impacts operational efficiency, cost management, and long-term scalability. After a thorough evaluation of supplier capabilities, financial stability, product quality, service support, and industry reputation, it is evident that selecting the right partner requires a balanced approach that considers both immediate needs and future growth objectives.

The recommended supplier demonstrates a strong alignment with our operational requirements, offering reliable and innovative material handling solutions, responsive customer service, and a proven track record in the industry. Their commitment to safety, sustainability, and technological integration further reinforces their suitability as a long-term partner.

By finalizing this supplier relationship, we position the organization to enhance workflow efficiency, reduce downtime, and achieve greater logistics performance. Moving forward, establishing clear performance metrics, maintaining open communication, and periodically reviewing supplier performance will be essential to ensuring continued success and mutual growth.

Ultimately, this sourcing decision supports our broader operational goals and lays a solid foundation for improved supply chain resilience and competitiveness.