The global HVAC market is experiencing steady expansion, driven by increasing demand for energy-efficient climate control solutions across residential, commercial, and industrial sectors. According to Mordor Intelligence, the HVAC market was valued at USD 145.48 billion in 2023 and is projected to reach USD 211.37 billion by 2029, growing at a CAGR of 6.37% over the forecast period. A key contributor to this growth is the rising adoption of high-performance sealing and insulation materials, such as mastic, which play a critical role in minimizing air leakage and improving system efficiency. As energy regulations tighten and building standards evolve, demand for reliable mastic HVAC products has surged, positioning leading manufacturers at the forefront of innovation and quality. This growing emphasis on system performance and sustainability has elevated the importance of selecting top-tier mastic manufacturers capable of delivering durable, code-compliant solutions. Below are the top 8 mastic HVAC manufacturers shaping the industry through product excellence, technological advancement, and market reach.

Top 8 Mastic Hvac Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

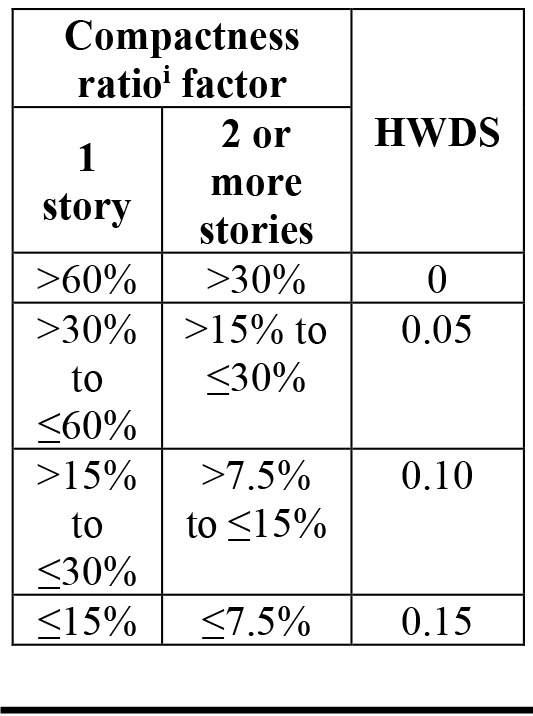

#1 WAC 51-11R-40320: –

Domain Est. 1997

Website: app.leg.wa.gov

Key Highlights: Metallic ducts located outside the conditioned space must have both transverse and longitudinal joints sealed with mastic. … manufacturer’s air handler ……

#2 MasTec

Domain Est. 1996

Website: mastec.com

Key Highlights: MasTec is one of the nation’s top power plant and renewable energy construction companies, specializing in building and engineering of natural gas power plants….

#3 Master Flow® Duct Mastic/Sealant

Domain Est. 1996

Website: gaf.com

Key Highlights: Master Flow® Duct Mastic is a water-based adhesive that creates a tight seal on duct seams and joints and helps eliminate air leakage….

#4 Duct Sealants & Mastic

Domain Est. 1997

Website: herculesindustries.com

Key Highlights: Duct Sealants and Mastic are specifically designed for sealing all types of joints in internal duct work systems . The water based formulations make these Duct ……

#5 RCD Corporation Air Duct Sealants Mastics Adhesives Insulation …

Domain Est. 1999

Website: rcdmastics.com

Key Highlights: RCD Corporation Mastics are air duct sealants that save energy by sealing leaking air conditioning, heating, and HVAC air ducts in forced air heating and ……

#6 CADS Fiber

Domain Est. 2002

#7 Carlisle HVAC

Domain Est. 2010

Website: carlislehvac.com

Key Highlights: Carlisle HVAC Brands produces industry-leading solutions that equip HVAC systems to perform at peak efficiency every day, all day, even in tough conditions….

#8 Design Polymerics

Domain Est. 2018

Website: meridianadhesives.com

Key Highlights: Design Polymerics is a trusted innovator in sustainable building products for HVAC systems, providing advanced sealants, adhesives, and insulation mastics that ……

Expert Sourcing Insights for Mastic Hvac

H2: 2026 Market Trends Forecast for Mastic HVAC

As the HVAC (Heating, Ventilation, and Air Conditioning) industry evolves through technological innovation, regulatory changes, and shifting consumer demands, Mastic HVAC—known for its duct sealants, coatings, and energy efficiency solutions—is poised to experience significant market transformation by 2026. The following analysis outlines key trends expected to influence Mastic HVAC’s market position and growth trajectory in the coming years.

1. Rising Demand for Energy Efficiency and Building Performance Standards

The global push toward net-zero carbon emissions and energy-efficient buildings will drive increased adoption of high-performance duct sealing solutions. By 2026, stricter energy codes such as the International Energy Conservation Code (IECC) and green building certifications like LEED and BREEAM will mandate tighter duct systems. Mastic HVAC products, particularly duct sealants and mastics that prevent air leakage, will become essential in commercial and residential construction to meet compliance requirements and reduce HVAC energy losses.

2. Growth in Green Building and Sustainable Construction

Sustainable construction is projected to account for over 50% of new building projects globally by 2026. Mastic HVAC’s environmentally friendly, low-VOC (volatile organic compound) sealant formulations align with this trend. Demand will grow for eco-conscious materials that contribute to healthier indoor air quality and reduce environmental impact. Companies offering sustainable, third-party certified products will gain a competitive edge, positioning Mastic HVAC favorably if they continue investing in greener formulations and recyclable packaging.

3. Expansion of the Retrofit and Renovation Market

With aging infrastructure in North America and Europe, the HVAC retrofit market is expected to expand significantly. Many existing buildings have inefficient duct systems that contribute to energy waste. Mastic-based sealants are ideal for retrofitting due to their durability and ease of application. By 2026, government incentives and energy efficiency programs (such as ENERGY STAR and local utility rebates) will further accelerate demand for duct sealing in retrofits, boosting Mastic HVAC sales in the remodeling sector.

4. Advancements in Smart HVAC and Building Automation Integration

While mastic itself is not a smart technology, the broader adoption of smart HVAC systems will indirectly affect mastic demand. As buildings incorporate advanced sensors and building automation systems (BAS), performance metrics like air leakage rates will be monitored in real time. Poorly sealed ducts will be flagged quickly, creating a feedback loop that emphasizes the importance of proper sealing during installation and maintenance. This will increase awareness and demand for reliable mastic products as part of comprehensive system integrity.

5. Consolidation and Competition in the Building Materials Sector

The building materials market is seeing increased consolidation, with larger players acquiring specialty brands. By 2026, Mastic HVAC may face intensified competition from both established manufacturers and new entrants offering alternative sealing technologies (e.g., aerosol-based duct sealants). To maintain market share, Mastic HVAC will need to differentiate through product performance, technical support, contractor education, and digital tools for estimating and application guidance.

6. Supply Chain Resilience and Raw Material Volatility

Ongoing fluctuations in petrochemical prices—key inputs for acrylic and rubber-based mastics—will continue to affect production costs. By 2026, companies with diversified supply chains and investments in alternative raw materials or bio-based formulations will have a strategic advantage. Mastic HVAC must focus on supply chain transparency and resilience to mitigate disruptions and maintain pricing competitiveness.

7. Geographical Market Shifts

While North America remains a core market, growth in Asia-Pacific and the Middle East—driven by urbanization and rising cooling demands—will create new opportunities. Mastic HVAC may benefit from exporting to regions with expanding commercial construction and increasing HVAC penetration, especially in countries adopting international energy standards.

Conclusion

By 2026, Mastic HVAC is expected to operate in a market defined by sustainability, regulatory enforcement, and technological integration. Success will depend on the company’s ability to innovate eco-friendly products, support the growing retrofit economy, and align with global energy efficiency goals. With strategic positioning, Mastic HVAC can capitalize on these trends to strengthen its role as a critical enabler of high-performance HVAC systems worldwide.

Common Pitfalls When Sourcing Mastic HVAC: Quality and IP Concerns

Sourcing mastic for HVAC (Heating, Ventilation, and Air Conditioning) systems involves more than just selecting a cost-effective sealant. Poor choices can compromise system efficiency, longevity, and compliance. Two major areas where buyers often encounter issues are product quality and intellectual property (IP) concerns. Understanding these pitfalls helps ensure reliable performance and legal compliance.

Quality-Related Pitfalls

-

Inconsistent Product Formulation

Not all mastics are created equal. Low-quality or counterfeit products may use substandard resins, fillers, or additives that degrade over time. This leads to cracking, shrinking, or delamination, reducing the seal’s effectiveness and increasing air leakage. -

Lack of Compliance with Industry Standards

Reputable mastic must meet standards such as UL 181, ASTM E84, or SMACNA guidelines. Sourcing from suppliers who do not provide verifiable test data or certifications can result in non-compliant installations, risking building code violations and failed inspections. -

Inadequate Adhesion and Durability

Poor-quality mastic may not adhere well to various duct materials (e.g., fiberglass, metal, flexible ducts), especially under temperature fluctuations or high humidity. This compromises long-term performance and increases maintenance costs. -

Improper Curing and Application Issues

Some mastics require specific curing times or environmental conditions. Products without clear technical documentation or inconsistent viscosity can lead to improper application, voids, or weak seals. -

Mislabeling and Brand Substitution

Counterfeit or rebranded products may mimic well-known brands but deliver inferior performance. Buyers may unknowingly receive off-spec formulations that do not match the labeled product’s claimed characteristics.

Intellectual Property (IP) Concerns

-

Use of Counterfeit or Pirated Products

Some suppliers offer HVAC mastics that falsely bear trademarks or packaging of reputable manufacturers. These counterfeit products not only violate IP rights but also pose significant performance and safety risks. -

Unauthorized Manufacturing or Repackaging

Illicit manufacturers may reverse-engineer patented formulations and sell them under generic or misleading labels. This undermines innovation and exposes end-users to untested materials that may not meet safety or performance benchmarks. -

Lack of Traceability and Documentation

Legitimate products come with batch numbers, MSDS (Material Safety Data Sheets), and technical data sheets. Sourcing from vendors who cannot provide these documents raises red flags about both quality and potential IP infringement. -

Legal Liability for End Users

Using IP-infringing materials—even unknowingly—can expose contractors and building owners to legal risks, particularly in public or commercial projects where compliance audits are common.

Best Practices to Avoid Pitfalls

- Source from Authorized Distributors: Purchase directly from manufacturers or certified suppliers to ensure authenticity and quality.

- Verify Certifications: Request and validate UL, ASTM, or SMACNA compliance documentation.

- Conduct Product Testing: Perform batch testing or field trials when sourcing from new or unfamiliar suppliers.

- Check for IP Authenticity: Confirm brand legitimacy through manufacturer verification tools or direct contact.

- Maintain Detailed Records: Keep purchase orders, product data, and application records to support compliance and warranty claims.

By addressing both quality and intellectual property concerns proactively, stakeholders can ensure durable, code-compliant HVAC systems while avoiding legal and performance risks.

Logistics & Compliance Guide for Mastic HVAC

This guide outlines key logistics and compliance considerations for Mastic HVAC operations, ensuring efficient supply chain management and adherence to regulatory standards.

Supply Chain Management

Establish reliable relationships with suppliers of HVAC components, insulation materials, sealants, and tools. Implement vendor qualification processes to ensure quality and consistency. Maintain accurate inventory records using inventory management software to prevent stockouts and overstocking, particularly for high-demand or seasonal items.

Transportation and Distribution

Utilize a mix of owned and contracted transportation to deliver materials and equipment to job sites. Ensure vehicles are properly maintained and equipped for HVAC-specific cargo, including securing systems for ductwork and fragile components. Optimize routing to minimize fuel costs and delivery times, especially for time-sensitive service calls.

Warehousing and Storage

Store materials in climate-controlled, secure facilities to protect against moisture, temperature extremes, and theft. Segregate hazardous materials (e.g., refrigerants, adhesives) in accordance with safety regulations. Implement a first-in, first-out (FIFO) system to reduce material degradation and ensure compliance with product shelf lives.

Regulatory Compliance

Adhere to federal, state, and local regulations, including EPA Section 608 for refrigerant handling, OSHA safety standards for warehouse and field operations, and Department of Transportation (DOT) rules for transporting hazardous materials. Maintain up-to-date certifications for technicians and ensure all required permits are obtained for operations and installations.

Environmental and Sustainability Practices

Follow proper disposal protocols for refrigerants, packaging materials, and electronic components. Recycle scrap metal, insulation, and packaging whenever possible. Explore energy-efficient transportation options and sustainable packaging solutions to reduce the company’s environmental footprint.

Documentation and Recordkeeping

Maintain comprehensive records for shipments, inventory, compliance certifications, safety training, and equipment maintenance. Use digital systems to ensure easy access and audit readiness. Ensure all delivery and service documentation includes proper signatures, dates, and product details.

Risk Management and Contingency Planning

Identify potential supply chain disruptions (e.g., material shortages, weather events) and develop response plans. Maintain safety stock for critical items and identify alternate suppliers. Train staff on emergency procedures and ensure insurance coverage includes cargo, liability, and business interruption.

Conclusion for Sourcing Mastic HVAC:

Sourcing high-quality mastic sealant for HVAC applications is a critical step in ensuring energy efficiency, system longevity, and indoor air quality. Proper selection and procurement of mastic involve evaluating product specifications—such as UL 181 compliance, vapor permeability, durability, and ease of application—as well as considering supplier reliability, cost-effectiveness, and availability. By prioritizing certified, code-compliant mastics from reputable manufacturers and distributors, contractors and facility managers can achieve superior sealing performance on ductwork, minimize air leakage, and meet energy code requirements. Ultimately, investing in the right mastic product through a strategic sourcing process leads to improved HVAC system efficiency, reduced operational costs, and long-term building performance.