The global marine anodes market is experiencing steady growth, driven by rising maritime activities, increasing shipbuilding investments, and the critical need for corrosion protection in marine environments. According to a report by Mordor Intelligence, the marine coatings market—which includes sacrificial anodes such as zinc—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. Zinc anodes, in particular, remain a preferred choice for cathodic protection in saltwater due to their high efficiency, compatibility with various hull materials, and cost-effectiveness. With the International Maritime Organization (IMO) enforcing stricter maintenance and safety regulations, vessel operators are prioritizing durable anti-corrosion solutions. This demand has spurred innovation and competition among manufacturers, especially in key maritime hubs across Asia-Pacific, Europe, and North America. As the market expands, identifying the top marine zinc anode manufacturers becomes essential for buyers seeking reliability, performance, and compliance with international standards such as MIL-A-18001 and DNVGL. Below is a data-driven overview of the top 10 marine zinc anodes manufacturers shaping the industry.

Top 10 Marine Zinc Anodes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 About Marinezinc.com

Domain Est. 2016

Website: marinezinc.com

Key Highlights: We are one of the leading manufacturers of marine anodes and cathodic protection products in both zinc and aluminum….

#2 Camp Company

Domain Est. 1998

Website: campcompany.com

Key Highlights: Camp Company is a leading manufacturer of marine anodes. Our zinc and aluminum sacrificial anodes are manufactured in the US to ensure the highest quality ……

#3 Sacrificial anodes

Domain Est. 1998

Website: tecnoseal.it

Key Highlights: Tecnoseal is world’s leading manufacturer of sacrificial anodes for cathodic protection against galvanic currents in the leisure boat market, and for shipping, ……

#4 Anodes by Galvotec: Aluminum:Zinc:Magnesium

Domain Est. 1997 | Founded: 1984

Website: galvotec.com

Key Highlights: Manufacturing the highest quality Aluminum, Zinc, and Magnesium Sacrificial Anodes since 1984. Over 40 years of tried and true experience and thousands of ……

#5 Martyr Anodes

Domain Est. 1999

Website: martyranodes.com

Key Highlights: We offer zinc, aluminum, and magnesium anodes, with a focus on aluminum as a sustainable alternative, ensuring superior corrosion resistance while protecting ……

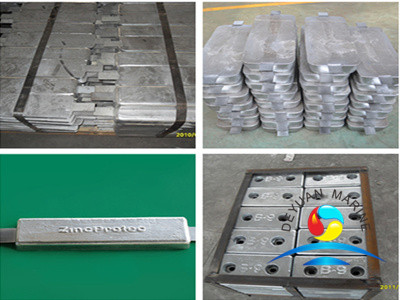

#6 B&S Marine Anodes

Domain Est. 2008

Website: bandszincs.com

Key Highlights: We have been making quality hand-poured zinc anodes for nearly 50 years. The original founders of Bossler & Sweezey poured zinc anodes back in the 1960s….

#7 Anodes for Boats and Yachts

Domain Est. 2009

Website: tecnoseal-usa.com

Key Highlights: With over 30 years of experience, we manufacture and supply Zinc, Aluminium and Magnesium anodes directly from our foundry in Grosseto (Tuscany) and today ……

#8 Boat Zinc Anodes

Domain Est. 2009

Website: thezincguy.com

Key Highlights: We specialize in zinc and aluminum anodes designed for pleasure crafts and commercial vessels. Whether you’re a boat owner, shipyard, or marine professional, we ……

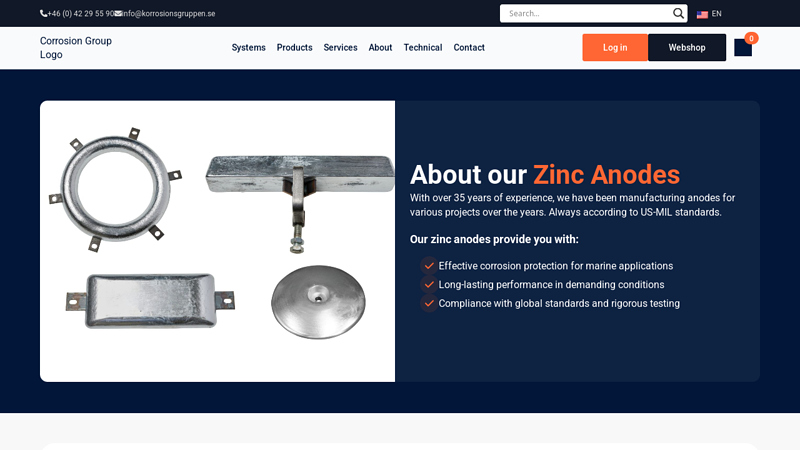

#9 Zinc anodes

Domain Est. 2022

Website: corrosion-group.com

Key Highlights: Our zinc anodes provide you with: · Effective corrosion protection for marine applications · Long-lasting performance in demanding conditions · Compliance with ……

#10 Sea Shield Marine

Domain Est. 2003

Website: seashieldmarine.com

Key Highlights: Sea Shield Marine is a leading manufacturer of zinc anodes & aluminum anodes servicing boats, ships, pleasure crafts, and cathodic protection professionals….

Expert Sourcing Insights for Marine Zinc Anodes

H2: Marine Zinc Anodes Market Trends Forecast for 2026

The global marine zinc anode market is poised for continued, albeit measured, growth in 2026, driven by fundamental demand from the maritime sector and evolving industry dynamics. Key trends shaping the market include:

-

Steady Demand from Commercial & Recreational Fleets: The core driver remains the essential function of zinc anodes in cathodic protection. A large global fleet of commercial vessels (cargo, tankers, offshore support) and a significant recreational boating market (especially in North America, Europe, and parts of Asia-Pacific) will ensure consistent replacement demand. The need for regular anode replacement (typically every 1-2 years) provides market stability.

-

Growth in Offshore Energy & Infrastructure: Expansion in offshore wind farm construction and maintenance, as well as ongoing oil & gas platform operations, will boost demand for specialized, larger zinc anodes used on submerged structures, jackets, and subsea equipment. This segment offers higher-value opportunities.

-

Material Substitution Pressures & Aluminum Competition: Zinc anodes face significant competition from aluminum alloy anodes, which are lighter, last longer (higher capacity), perform better in brackish water, and are often more cost-effective over their lifespan. This trend, accelerating over the past decade, will continue to constrain zinc’s market share, particularly in new vessel construction and performance-critical applications. Zinc’s primary advantage remains its lower cost upfront and established use in purely saltwater environments.

-

Focus on Performance & Longevity: While aluminum dominates performance, manufacturers of zinc anodes will focus on improving alloy purity and consistency (meeting MIL-A-18001H or ASTM B418 standards) to maximize efficiency and service life within zinc’s inherent limitations. Marketing will emphasize reliability and proven track record.

-

Regional Variations:

- Established Markets (NA, EU): Mature markets with stable replacement demand. Preference may lean slightly more towards aluminum for performance, but zinc retains a strong foothold, especially in cost-sensitive segments and specific saltwater applications.

- Emerging Markets (Asia-Pacific, Latin America): Growth potential lies in expanding recreational boating, fishing fleets, and coastal infrastructure. Lower upfront cost makes zinc attractive here, though awareness of aluminum benefits is growing.

-

Sustainability & Recycling: Increased focus on environmental impact may marginally favor zinc due to established recycling streams for galvanic anodes. However, the overall environmental footprint difference between zinc and aluminum anodes is complex and not a primary purchase driver yet. Responsible disposal practices will gain importance.

-

Supply Chain & Cost Volatility: The market will be sensitive to fluctuations in zinc metal prices (influenced by global mining output, energy costs, and demand from other sectors like construction). Supply chain resilience remains a consideration, though less volatile than some other commodities.

Conclusion for 2026:

The marine zinc anode market in 2026 is expected to experience modest growth in revenue but likely stagnant or slightly declining volume share due to the persistent shift towards aluminum alloys. Growth will be primarily fueled by:

* Replacement cycles in the vast existing fleet.

* Expansion in offshore renewable energy infrastructure.

* Demand in cost-sensitive emerging markets and specific saltwater niches.

While zinc anodes remain a vital and widely used component, their long-term market trajectory is one of consolidation and specialization rather than expansion, as aluminum anodes capture an increasing share of new applications demanding higher performance and longevity. Success for zinc suppliers will depend on cost efficiency, reliability, and serving established customer bases and specific environmental conditions where zinc performs adequately.

Common Pitfalls in Sourcing Marine Zinc Anodes: Quality and Intellectual Property (IP) Risks

Sourcing marine zinc anodes is critical for protecting vessels and underwater structures from galvanic corrosion. However, procurement efforts often encounter significant challenges related to quality inconsistencies and potential intellectual property (IP) violations. Failing to address these pitfalls can lead to premature equipment failure, safety hazards, and legal complications.

Quality-Related Pitfalls

-

Substandard Alloy Composition

One of the most prevalent issues is receiving anodes made from zinc that does not meet recognized standards such as MIL-A-18001H or ASTM B418. Unscrupulous suppliers may use recycled or contaminated zinc with excessive levels of impurities (e.g., iron, lead, cadmium). These impurities reduce electrochemical efficiency, cause passivation (formation of a non-conductive oxide layer), and shorten anode life—leaving protected metal structures vulnerable. -

Inadequate Performance Testing

Many suppliers, especially those in low-cost manufacturing regions, do not conduct or provide verifiable performance data such as actual current capacity (A·h/kg) or efficiency ratings. Buyers may assume compliance based on labeling alone, only to discover post-installation that the anodes fail to deliver sufficient protective current. -

Poor Physical Construction

Defects such as porosity, cracks, or weak core steel (used for mounting) compromise structural integrity. A poorly bonded steel core can detach underwater, rendering the anode useless. Inconsistent casting also leads to uneven consumption rates and unreliable protection. -

Mislabeling and Certification Fraud

Some suppliers falsely claim conformance to international standards without third-party certification. Certificates of Conformance (CoC) may be forged or based on outdated test data. Without independent verification—such as mill test reports or third-party lab analysis—buyers risk deploying non-compliant products.

Intellectual Property (IP) Pitfalls

-

Counterfeit Branded Products

Reputable anode manufacturers often face counterfeiting. Suppliers may replicate branded packaging and logos of well-known companies (e.g., Performance Metals, Farwest, or Weldspar) to deceive buyers into believing they are purchasing genuine, high-performance products. These counterfeit anodes typically use inferior materials and fail prematurely. -

Patent and Design Infringement

Certain anode designs—such as specialized shapes, core attachment methods, or alloy formulations—are protected by patents. Sourcing anodes from suppliers using such technologies without authorization exposes the buyer to potential IP infringement claims, especially in regulated markets like the U.S. or EU. -

Lack of Traceability and Transparency

Many offshore suppliers operate through intermediaries with opaque supply chains. This lack of transparency makes it difficult to verify the origin of the product, increasing the risk of inadvertently sourcing IP-infringing or counterfeit goods. Without clear documentation, buyers may be held liable under “willful blindness” doctrines. -

Unauthorized Use of Technical Specifications

Some suppliers copy technical drawings or performance data from original equipment manufacturers (OEMs) to market knock-off products. While the specifications may appear identical, the actual product performance often falls short, leading to functional and legal risks.

Mitigation Strategies

- Require certified test reports from accredited laboratories confirming alloy composition and electrochemical performance.

- Verify supplier credentials and conduct factory audits when sourcing in high-risk regions.

- Use independent third-party inspection services during production or pre-shipment.

- Protect procurement through contracts specifying compliance with standards and IP warranties.

- Work directly with authorized distributors or OEMs to avoid counterfeit products.

Ignoring these quality and IP pitfalls can result in costly vessel damage, regulatory non-compliance, and reputational harm. Diligent due diligence and supplier vetting are essential to ensure reliable corrosion protection and legal compliance.

Logistics & Compliance Guide for Marine Zinc Anodes

Overview

Marine zinc anodes are sacrificial components used in cathodic protection systems to prevent corrosion on submerged metal structures such as ship hulls, propellers, rudders, and ballast tanks. Proper logistics and compliance management are essential due to the materials involved, international shipping regulations, and environmental considerations.

Classification & Regulatory Framework

UN Number & Hazard Class

Zinc anodes are typically classified under:

– UN 3089 – Environmentally hazardous substances, solid, n.o.s. (zinc compounds may be present)

– Hazard Class: 9 – Miscellaneous hazardous substances and articles

– Packing Group: III (low danger)

While elemental zinc is not highly reactive, zinc compounds may leach in aquatic environments, triggering environmental hazard classification under international transport regulations.

IMO & IMDG Code Compliance

– Marine zinc anodes must comply with the International Maritime Dangerous Goods (IMDG) Code when transported by sea.

– Proper labeling, marking, and documentation are required, including a Dangerous Goods Declaration if classified under UN 3089.

– Packaging must be durable and prevent moisture ingress or physical damage during transit.

IATA & Air Transport

– Air transport is generally discouraged due to weight and cost, but if applicable, compliance with IATA Dangerous Goods Regulations (DGR) is mandatory.

– Confirmation of non-hazardous classification is recommended, as some forms of zinc may be restricted.

Packaging & Handling Requirements

Packaging Standards

– Use moisture-resistant packaging (e.g., plastic wrap, sealed polybags) to prevent oxidation or white rust formation.

– Secure in wooden crates or pallets to prevent movement during shipping.

– Include desiccants if long-term storage or humid environments are expected.

Labeling & Marking

– Clearly mark packages with:

– Product name: “Marine Zinc Anodes”

– Net weight and quantity

– UN number (if applicable: UN 3089)

– Proper shipping name: “Environmentally hazardous substance, solid, n.o.s.”

– Hazard Class 9 label (if required)

– Handling instructions: “Fragile,” “Keep Dry,” “This Side Up”

Handling Precautions

– Use appropriate PPE (gloves, safety glasses) to avoid skin irritation from zinc dust.

– Store in dry, well-ventilated areas away from acids and oxidizing agents.

– Avoid prolonged skin contact with zinc residues.

Storage & Shelf Life

Storage Conditions

– Store indoors on pallets to avoid ground moisture.

– Keep away from saltwater spray, rain, and high humidity.

– Separate from incompatible materials (e.g., strong acids, copper alloys).

Shelf Life

– Zinc anodes have an indefinite shelf life if stored properly.

– Inspect periodically for excessive oxidation (white powder formation); light oxidation does not impair performance.

Environmental & Regulatory Compliance

REACH & RoHS Compliance (EU)

– Ensure zinc anodes comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives.

– Confirm absence of restricted substances (e.g., cadmium, lead >0.01%).

EPA & US Regulations

– In the United States, zinc anodes are generally exempt from EPA hazardous waste classification when intact.

– Spent anodes may be considered hazardous waste if contaminated with heavy metals; dispose of according to RCRA guidelines.

MARPOL Annex III

– Under MARPOL, packaged harmful substances (including some zinc compounds) must be labeled and documented to prevent marine pollution.

– Ensure proper marking to comply with Annex III requirements when shipped internationally.

Documentation Requirements

Essential Shipping Documents

– Commercial Invoice (with declared value and product description)

– Packing List (itemizing weights, dimensions, and quantities)

– Bill of Lading or Air Waybill

– Dangerous Goods Declaration (if classified as hazardous)

– Certificate of Compliance (REACH, RoHS, or ISO standards, if applicable)

– Material Safety Data Sheet (MSDS/SDS) – Required for all shipments

Import & Customs Considerations

HS Code

– Typical HS Code: 8112.52.00 – Zinc waste and scrap; other unwrought zinc; zinc powders and flakes

– May vary by country; confirm local tariff classification.

Customs Clearance

– Provide accurate product description (e.g., “Marine-grade sacrificial zinc anodes for cathodic protection”)

– Some countries may require import permits or environmental assessments for bulk shipments.

Duty & Tariff Exemptions

– Check for free trade agreements (e.g., USMCA, EU-Canada) that may reduce or eliminate tariffs on metal components.

End-of-Life & Recycling

Recycling Guidelines

– Spent zinc anodes should be recycled through licensed metal recyclers.

– Zinc is 100% recyclable; recycling reduces environmental impact and conserves resources.

– Follow local regulations for disposal of used anodes (e.g., classification as non-hazardous industrial scrap).

Environmental Responsibility

– Encourage customers to return used anodes for responsible recycling.

– Partner with recycling programs compliant with ISO 14001 or equivalent environmental standards.

Best Practices Summary

- Verify hazard classification before shipment.

- Use weather-resistant packaging and proper labeling.

- Maintain up-to-date SDS and compliance documentation.

- Train logistics staff on handling and reporting procedures.

- Monitor regulatory changes in target markets (EU, USA, Asia, etc.).

By adhering to this guide, businesses can ensure safe, compliant, and efficient logistics for marine zinc anodes across global supply chains.

Conclusion for Sourcing Marine Zinc Anodes

In conclusion, sourcing high-quality marine zinc anodes is a critical step in ensuring the long-term protection and performance of marine vessels and underwater metal structures against galvanic corrosion. Choosing the right supplier involves evaluating factors such as anode composition (meeting MIL-A-18001H or ASTM B418 standards), manufacturing reliability, cost-effectiveness, and availability of custom solutions to fit specific vessel or application requirements.

It is essential to partner with reputable suppliers who provide certified materials, consistent quality control, and technical support to ensure proper installation and optimal performance. Additionally, considering environmental regulations and shifting industry trends—such as the potential move toward alternative alloys in brackish or polluted waters—can future-proof maintenance strategies.

Ultimately, investing in properly sourced, high-grade zinc anodes not only enhances the durability and safety of marine assets but also reduces long-term maintenance costs, making it a prudent decision for shipowners, shipbuilders, and marine operators alike.