The global marble market is witnessing steady expansion, driven by rising demand in construction, infrastructure, and luxury interior design. According to a report by Mordor Intelligence, the global marble market was valued at USD 34.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2029. This growth is underpinned by increasing urbanization, particularly in Asia-Pacific and the Middle East, alongside a resurgence in natural stone preference for high-end architectural applications. As demand for high-quality raw marble intensifies, the role of key manufacturers in ensuring consistent supply, geological expertise, and sustainable extraction practices becomes critical. The following list highlights the top 10 raw marble manufacturers worldwide, selected based on production capacity, global market reach, resource reserves, and industry reputation—companies that are shaping the future of this evolving market.

Top 10 Marble Raw Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Georgia Marble Company

Domain Est. 1997

Website: polycor.com

Key Highlights: It wouldn’t be until 1884 that the Georgia Marble Company was officially founded, gaining control of 7,000 acres on Samuel Tate’s land. The Georgia Marble ……

#2 Blanc Carrare, the marble manufacturer

Domain Est. 2001

Website: blanc-carrare.com

Key Highlights: Blanc Carrare has over the years established itself as the benchmark marble manufacturer for the architectural and interior design sectors….

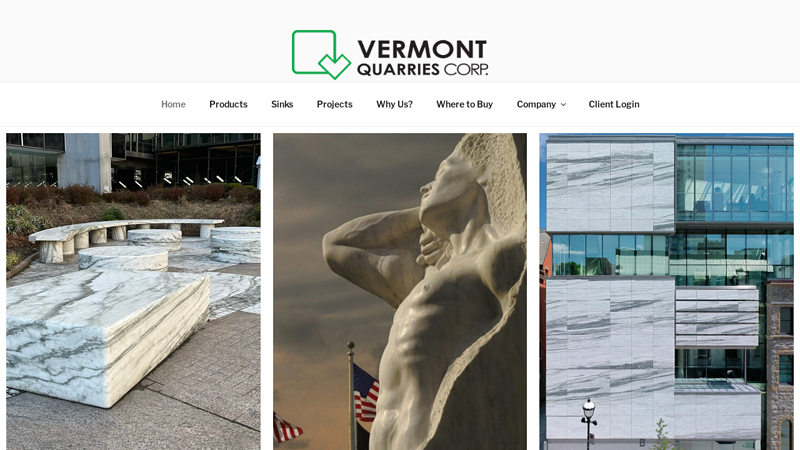

#3 Vermont Quarries Corp.

Domain Est. 2019

Website: vermontdanbymarble.com

Key Highlights: Vermont Quarries Corp. We Are The Largest Underground Marble Quarry in The World. There is no Substitute for Danby Marble!Missing: raw manufacturer…

#4 Tennessee Marble Company

Domain Est. 1998

Website: tnmarble.com

Key Highlights: Tennessee Marble Company is the exclusive quarrier of Tennessee marble. We deliver quality stone products, promote the integrity of the stone industry….

#5 Marmorplatten und Blöcke nach Maß kaufen

Domain Est. 2002

Website: lasamarmo.it

Key Highlights: High-quality Lasa marble raw blocks in various sizes and types can be selected on site in Laas (Lasa). You can also get expert advice at our branch in Verona….

#6 Cairns Marble & Granite — Australian natural stone

Domain Est. 2004

Website: cairnsmarble.com

Key Highlights: Cairns Marble Australia Pty Ltd manufactures and retails a complete range of marble products from raw marble blocks unpolished and polished slabs, marble tiles….

#7 Phenix Marble Company

Domain Est. 2008

Website: phenixmarble.com

Key Highlights: Phenix Marble Company is the steward and quarrier to our distinctive high density limestone. For over 135 years, our Napoleon Gray® and Fleuri cut stone has ……

#8 Marble Tile Source and Manufacturing

Domain Est. 2012

Website: msisurfaces.com

Key Highlights: Find out how marble tile is made: Famous marble tile quarry, Manufacturing process of marble tile from quarry to kitchen….

#9 Page – Marble Systems

Website: marblesystemstureks.com.tr

Key Highlights: Marble Systems Tureks, one of Türkiye’s long-established natural stone companies, has once again demonstrated the importance it places on sports and athletes ……

#10 Stone Group International

Website: stonegroup.gr

Key Highlights: Stone Group is a leading marble supplier, providing high quality natural stone and marble tiles, slabs and mosaics. Contact us and plan your visit today!…

Expert Sourcing Insights for Marble Raw

H2 2026 Market Trends Outlook for Marble Raw

The global raw marble market in the second half of 2026 is expected to reflect a complex interplay of persistent demand drivers, evolving sustainability pressures, and geopolitical influences. While precise forecasting remains challenging, current trajectories point toward several key trends shaping the sector:

-

Continued Demand Growth (Modest & Selective):

- Resilient Luxury & High-End Construction: Demand for premium, rare, and high-quality marble (e.g., Calacatta, Statuario, specific regional varieties) will remain robust, driven by luxury residential projects, high-end hospitality (hotels, resorts), and commercial developments in affluent markets (North America, Western Europe, Middle East, select Asian hubs).

- Infrastructure & Urbanization: Ongoing urbanization, particularly in emerging economies (India, Southeast Asia, parts of Africa), will sustain baseline demand for standard-grade marble in public buildings, government projects, and mid-tier commercial developments.

- Replacement & Renovation: The renovation and remodeling market in developed economies (US, EU) will provide steady demand for both standard and premium marble, especially in kitchens, bathrooms, and flooring upgrades.

-

Sustainability & Environmental Pressures Intensifying:

- Carbon Footprint Scrutiny: Marble extraction and transportation are energy-intensive. By H2 2026, Environmental, Social, and Governance (ESG) criteria will be significantly more critical for large buyers (developers, architects, governments). Traceability and verifiable low-carbon extraction/processing will become key differentiators.

- Regulatory Pressure: Expect stricter environmental regulations in major producing (e.g., Italy, Turkey, Greece, India) and consuming regions regarding quarry rehabilitation, water usage, dust control, and emissions. Compliance costs will rise, potentially impacting smaller, less-regulated producers.

- Circular Economy Focus: Increased interest in recycled marble aggregates and reclaimed stone will grow, though its impact on raw marble demand will be indirect, potentially influencing design choices and reducing waste perception.

-

Geopolitical & Supply Chain Dynamics:

- Trade Flows & Tariffs: Ongoing geopolitical tensions (e.g., Russia-Ukraine, Middle East) could disrupt logistics and energy prices, impacting quarrying and processing costs. Trade policies, particularly US-China relations and EU regulations, will influence sourcing strategies. Diversification of supply chains will remain a priority.

- Energy Costs: Fluctuations in global energy prices will directly affect the cost of quarrying (heavy machinery, explosives), processing (cutting, polishing), and transportation. Producers in regions with stable or lower energy costs may gain a competitive edge.

- Logistics: While likely normalized compared to pandemic peaks, global logistics (shipping, trucking) will remain a factor influencing delivery times and costs, especially for long-distance trade.

-

Technology & Efficiency Gains:

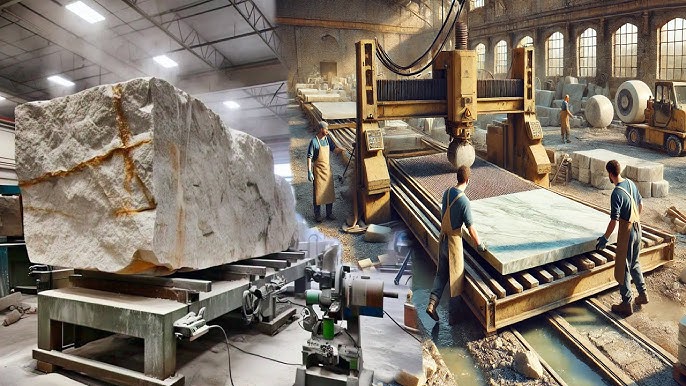

- Automation & AI: Adoption of advanced quarrying techniques (precision drilling, automated block extraction), AI-driven vein mapping, and automated processing (sawing, polishing) will increase among larger producers to improve yield, reduce waste, enhance safety, and lower operational costs.

- Digital Platforms: Online marketplaces and B2B platforms for sourcing raw marble blocks and slabs will become more sophisticated, improving transparency, price discovery, and access to global suppliers, particularly benefiting smaller buyers.

-

Pricing & Market Structure:

- Premiumization: Prices for high-quality, unique, or sustainably sourced marble are expected to hold firm or increase slightly due to sustained demand and rising compliance/certification costs.

- Competition in Standard Grades: The market for common, standard-grade marble will remain highly competitive, with pricing pressure from large producers (especially in Turkey, China, India) and alternative materials. Profit margins may be squeezed.

- Consolidation: Potential for further consolidation among mid-tier producers seeking economies of scale, technological investment, and stronger market access.

In Summary for H2 2026:

The raw marble market will be characterized by a dual-track dynamic:

* A premium segment driven by luxury demand, where quality, uniqueness, provenance, and sustainability credentials command higher prices and face less direct competition from alternatives.

* A commoditized segment focused on standard grades, facing intense price competition, pressure from engineered stone and ceramics, and higher sensitivity to energy and logistics costs.

Key Success Factors: Producers and traders who invest in sustainability (certifications, low-impact operations), technology (efficiency, traceability), supply chain resilience, and high-quality, differentiated products will be best positioned to navigate the challenges and capitalize on opportunities in the H2 2026 market. Buyers will increasingly prioritize transparency and environmental performance alongside cost and aesthetics.

Common Pitfalls Sourcing Marble Raw (Quality, IP)

Sourcing raw marble presents several challenges, particularly when it comes to ensuring consistent quality and protecting intellectual property (IP). Being aware of these pitfalls can help buyers, designers, and manufacturers make informed decisions and avoid costly mistakes.

Inconsistent Quality and Hidden Defects

One of the most frequent issues in marble sourcing is variability in stone quality. Natural marble inherently contains variations, but poor sourcing can exaggerate problems such as fissures, inconsistent veining, color shifts, and soft spots. Buyers may receive slabs or blocks that differ significantly from samples due to:

– Lack of standardized grading across quarries

– Inadequate inspection protocols before shipment

– Poor block selection at the quarry level

This inconsistency can lead to project delays, increased waste during fabrication, and dissatisfied clients.

Misrepresentation of Origin and Grade

Marble is often marketed under misleading names or attributed to prestigious regions (e.g., “Italian-style” or “Carrara-grade”) without actual origin verification. Unethical suppliers may:

– Label lower-quality marble from one region as premium marble from another

– Use generic names that imply higher value

– Provide falsified certificates of authenticity

This misrepresentation undermines quality expectations and can damage brand reputation.

Lack of Traceability and Sustainability Concerns

Transparent sourcing is increasingly important, yet many suppliers fail to provide clear quarry-to-customer traceability. This lack of transparency can lead to:

– Involvement with quarries that employ unethical labor practices

– Environmental violations such as unregulated extraction or habitat destruction

– Inability to verify compliance with sustainability standards

Without proper documentation, buyers risk reputational damage and non-compliance with green building certifications.

Intellectual Property (IP) Risks in Design and Patterns

When sourcing unique or custom marble patterns for architectural or design applications, IP issues can arise:

– Exclusive vein patterns or rare color combinations may be protected or claimed by other designers or quarries

– Using a distinctive slab in a high-profile project could lead to disputes over design ownership

– Digital renderings or physical samples shared during sourcing may be copied or reused without permission

Designers and architects may unknowingly infringe on existing design rights or fail to secure rights to proprietary marble features.

Inadequate Contracts and Legal Protections

Many marble supply agreements lack specificity regarding:

– Exact quality standards and acceptable tolerances

– Rights to exclusive access to a particular block or vein

– Ownership of design elements derived from unique marble characteristics

– Remedies for non-compliance or substitution

Without robust contracts, buyers have limited recourse in case of disputes over quality or IP.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough due diligence, work with reputable suppliers who provide certifications and traceability, invest in quality inspections, and include clear IP and quality clauses in contracts. Engaging legal and material experts early in the sourcing process can safeguard both quality expectations and intellectual property rights.

Logistics & Compliance Guide for Marble Raw

This guide outlines the essential logistics and compliance considerations for sourcing, transporting, storing, and handling raw marble. Adhering to these standards ensures operational efficiency, regulatory compliance, and product integrity throughout the supply chain.

Sourcing and Procurement Compliance

Ensure all raw marble is sourced from quarries compliant with local and international environmental, labor, and safety regulations. Obtain documentation verifying legal extraction permits, environmental impact assessments, and adherence to fair labor practices. Prioritize suppliers certified under recognized sustainability standards (e.g., ISO 14001, LEED-compliant sourcing).

Transportation Logistics

Transport raw marble blocks using heavy-duty flatbed or lowboy trailers with secure cradling and weather-resistant covering. Plan shipping routes to minimize transit time and exposure to extreme conditions. Coordinate with carriers experienced in handling oversized and high-weight cargo. Comply with road weight limits and obtain special permits when required for oversized loads.

Import/Export Documentation

Prepare and maintain accurate documentation for cross-border shipments, including commercial invoices, packing lists, certificates of origin, and bill of lading. Ensure compliance with customs regulations in both origin and destination countries. Classify marble under the correct HS Code (typically 2515.11 or 2515.12) and comply with import duties, taxes, and trade restrictions.

Regulatory Compliance

Adhere to health, safety, and environmental regulations such as OSHA (Occupational Safety and Health Administration) standards for workplace handling and the EPA guidelines for dust control during cutting or processing. Follow REACH and CLP regulations in the EU if applicable. Monitor changes in international trade policies that may affect marble imports/exports.

Storage and Handling

Store raw marble blocks on level, well-drained surfaces to prevent moisture damage and cracking. Use appropriate lifting equipment (e.g., forklifts with stone clamps or overhead cranes) to avoid breakage. Implement clear labeling and inventory tracking systems. Protect material from prolonged exposure to rain, freeze-thaw cycles, and direct sunlight.

Quality Control and Traceability

Establish a quality control protocol to inspect raw blocks for structural integrity, color consistency, and absence of major fissures. Maintain a traceability system linking each block to its quarry of origin, extraction date, and shipment details. This supports compliance audits and customer inquiries.

Sustainability and Environmental Responsibility

Minimize waste through efficient block utilization and recycling of stone offcuts. Implement dust and water management systems in processing areas. Report sustainability practices transparently and seek third-party verification where possible to enhance market credibility.

Emergency Preparedness and Risk Management

Develop contingency plans for transport delays, natural disasters, or supply disruptions. Insure shipments against damage, loss, or theft. Train personnel in emergency response procedures for accidents involving heavy materials or hazardous conditions.

By following this guide, Marble Raw can ensure a compliant, efficient, and sustainable logistics operation that supports business growth and regulatory integrity.

In conclusion, sourcing marble raw materials requires a strategic and well-informed approach that balances quality, cost, sustainability, and reliability. Identifying reputable quarries, conducting thorough material testing, and establishing strong relationships with suppliers are essential steps in ensuring a consistent supply of high-grade marble. Additionally, compliance with environmental regulations and ethical sourcing practices enhances long-term sustainability and corporate responsibility. By carefully evaluating geographic origins, logistical considerations, and market fluctuations, businesses can optimize their procurement process, reduce risks, and maintain a competitive edge in industries ranging from construction to luxury design. Ultimately, a disciplined and transparent sourcing strategy is key to securing premium marble raw materials that meet both aesthetic and performance standards.