The global manufacturing chairs market is experiencing robust growth, driven by rising demand across industrial, commercial, and institutional sectors. According to Grand View Research, the global industrial seating market size was valued at USD 6.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by increasing automation in manufacturing facilities, a heightened focus on workplace ergonomics, and expanding production capacities in emerging economies. Additionally, Mordor Intelligence forecasts sustained momentum in the industrial furniture sector, with growing investments in smart factories and employee well-being initiatives further boosting demand for durable, ergonomic seating solutions. As industries prioritize efficiency and operator comfort, leading manufacturers are innovating to meet evolving safety, customization, and sustainability requirements. In this competitive landscape, the following ten companies have emerged as top manufacturers of chairs specifically designed for manufacturing environments—recognized for their product quality, global reach, and technological advancements.

Top 10 Manufacturing Chairs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 1996 | Founded: 1950

Website: virco.com

Key Highlights: America’s leading manufacturer and supplier of classroom furniture and equipment. … Manufacturing quality products since 1950. Sage Series Rocking Chair….

#2 Lee Industries

Domain Est. 1997

Website: leeindustries.com

Key Highlights: Home Furnishings, Furniture Manufacturer, Lee Industries. … Products. SOFAS AND LOVESEATS SECTIONALS CHAIRS & CHAIR 1/2’S SWIVEL & GLIDER CHAIRS DESK CHAIRS ……

#3 Sherrill Furniture

Domain Est. 1997

Website: sherrillfurniture.com

Key Highlights: Sherrill Furniture manufactures handcrafting high-quality, customized furniture made in the USA. Learn more about our custom upholstery options….

#4 Keilhauer

Domain Est. 1998

Website: keilhauer.com

Key Highlights: Keilhauer manufactures seating and tables with a craftsmanship that is held to the highest environmental standards….

#5 Fairfield Chair

Domain Est. 1998

Website: fairfieldchair.com

Key Highlights: Fairfield is a major U.S. manufacturer of fine upholstered seating for the home, office, and hospitality industries….

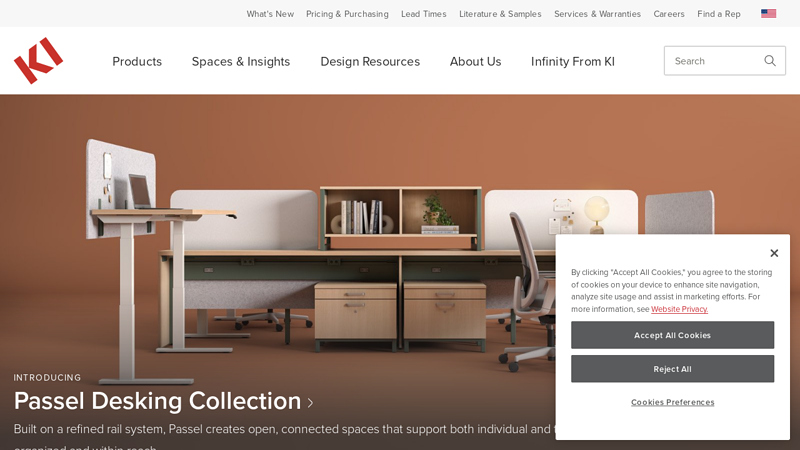

#6 KI: The Trusted Expert for Contract Furniture Solutions

Domain Est. 1991

Website: ki.com

Key Highlights: At KI, we help our customers make smart contract furniture decisions by offering expert advice, design options and personalized solutions….

#7 Knoll

Domain Est. 1995

Website: knoll.com

Key Highlights: Knoll uses modern design to connect people with their work, lives and world – browse & shop our entire furniture & textile collection for your home or ……

#8 Adams Manufacturing: Iconic American

Domain Est. 1996

Website: adamsmfg.com

Key Highlights: Adams Manufacturing is the leading made in USA supplier of high-quality residential and commercial resin furniture & accessories, as well as suction cups!…

#9 HON Office Furniture

Domain Est. 1997

Website: hon.com

Key Highlights: The HON Company designs and manufactures inspiring office furniture including office chairs, desks, tables, filing cabinets, workstations and workplace ……

#10 Emeco

Domain Est. 1999 | Founded: 1944

Website: emeco.net

Key Highlights: Shop chairs, stools, tables and sofas for in & out. Made in Pennsylvania since 1944. Tariff free. Built to last. Sustainable….

Expert Sourcing Insights for Manufacturing Chairs

H2: 2026 Market Trends for Manufacturing Chairs

The global manufacturing chairs market is poised for significant transformation by 2026, driven by technological innovation, shifting consumer preferences, sustainability imperatives, and evolving workplace dynamics. Several key trends are expected to shape the industry landscape:

-

Increased Adoption of Automation and Smart Manufacturing

By 2026, manufacturers are expected to widely adopt Industry 4.0 technologies such as robotics, AI-driven quality control, and IoT-enabled production lines. These advancements will enhance precision, reduce labor costs, and improve scalability. Automated assembly lines will allow faster customization and on-demand production, meeting rising demand for personalized office and ergonomic chairs. -

Sustainability and Circular Economy Practices

Environmental concerns will continue to influence material selection and manufacturing processes. By 2026, a majority of leading chair manufacturers are expected to utilize recycled plastics, bio-based foams, and sustainably sourced wood or metal. Closed-loop recycling systems and modular designs that allow easy disassembly and repair will gain traction, aligning with global ESG (Environmental, Social, and Governance) standards and consumer demand for eco-friendly products. -

Growth in Ergonomic and Hybrid Work Solutions

With remote and hybrid work models becoming permanent fixtures post-pandemic, demand for ergonomic home office chairs will remain strong. Manufacturers will focus on producing chairs that support long-duration sitting, featuring adjustable lumbar support, breathable fabrics, and smart sensors to monitor posture. The integration of wellness-focused design will differentiate premium brands in competitive markets. -

Rise of Customization and Direct-to-Consumer (DTC) Models

Digital platforms will enable greater personalization, allowing customers to choose frame materials, colors, and ergonomics online. DTC sales will bypass traditional retail channels, reducing costs and improving margins. Brands will leverage 3D modeling and augmented reality (AR) tools to enhance the virtual shopping experience, driving higher conversion rates. -

Expansion in Emerging Markets

Rapid urbanization and growing corporate infrastructure in regions like Southeast Asia, India, and Latin America will fuel demand for commercial seating. Localized manufacturing hubs will emerge to reduce logistics costs and tariffs, while catering to regional aesthetic and functional preferences. -

Supply Chain Resilience and Nearshoring

In response to past disruptions, manufacturers will increasingly adopt nearshoring and dual-sourcing strategies. Regional production facilities in North America, Europe, and East Asia will help mitigate risks related to geopolitical tensions and logistics bottlenecks, ensuring more reliable delivery timelines. -

Material Innovation and Lightweight Design

Research into advanced composites, bioplastics, and aluminum alloys will lead to lighter, stronger, and more durable chair frames. These materials will improve product longevity while reducing environmental impact and shipping costs—critical factors in a carbon-conscious market.

In summary, the 2026 manufacturing chairs market will be defined by smart production, sustainability, ergonomic innovation, and agile supply chains. Companies that invest in digital transformation, circular design, and customer-centric models are likely to gain a competitive edge in this evolving sector.

Common Pitfalls Sourcing Manufacturing Chairs: Quality and Intellectual Property Risks

Sourcing manufacturing chairs—whether for office, industrial, or specialized production environments—can present significant challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these critical areas can lead to operational inefficiencies, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality Inconsistencies and Lack of Oversight

One of the most frequent issues when sourcing chairs from manufacturers, especially overseas, is inconsistent product quality. Suppliers may deliver excellent samples but fail to maintain those standards during mass production. Variations in materials (e.g., substandard foam, weak frame metals), poor craftsmanship, or deviations from design specifications can result in premature wear, safety hazards, and increased warranty claims. Without a robust quality assurance process—such as on-site inspections, third-party testing, or clear acceptance criteria—buyers risk receiving products that do not meet functional or regulatory requirements.

Inadequate Quality Control Processes

Many manufacturers, particularly smaller or less experienced ones, may lack formal quality management systems (e.g., ISO 9001 certification). This increases the risk of defects going undetected until after delivery. Buyers often assume that initial prototypes reflect ongoing production quality, but without regular audits and defined inspection checkpoints (pre-production, during production, and pre-shipment), defects can proliferate unnoticed.

Intellectual Property (IP) Theft and Design Copying

When sharing detailed chair designs, CAD files, or proprietary materials with manufacturers, there is a significant risk of IP theft—especially in regions with weaker IP enforcement. Unscrupulous suppliers may duplicate and sell the designs to competitors, manufacture knock-offs independently, or even register the design as their own. This not only undermines competitive advantage but can also flood the market with inferior copies that harm brand reputation.

Weak or Absent Legal Protections

Many sourcing agreements fail to include comprehensive IP clauses, non-disclosure agreements (NDAs), or clear ownership rights over designs and tooling. Without these legal safeguards, enforcing IP rights becomes difficult and costly. Even with agreements in place, jurisdictional challenges can hinder enforcement, particularly when the manufacturer is located in a country with different legal standards.

Supply Chain Transparency Gaps

Limited visibility into the manufacturer’s supply chain can conceal the use of unauthorized subcontractors or unapproved materials—both of which compromise quality and increase IP exposure. Without contractual restrictions and audit rights, suppliers may outsource parts of production without buyer knowledge, introducing uncontrolled variables into the manufacturing process.

Overlooking Compliance and Certification Requirements

Manufacturing chairs often must meet safety, ergonomic, and environmental standards (e.g., ANSI/BIFMA, EN 1335, Greenguard). Sourcing from manufacturers unfamiliar with or indifferent to these certifications can result in non-compliant products that cannot be legally sold or used in certain markets. Assuming compliance without verification is a common but costly oversight.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier due diligence, including site audits and reference checks.

– Implement stringent quality control protocols with defined inspection stages.

– Secure IP rights through legally binding contracts, NDAs, and design registrations.

– Retain ownership of molds, tooling, and technical documentation.

– Work with legal counsel experienced in international manufacturing law.

– Prioritize suppliers with recognized quality certifications and transparent supply chains.

By proactively addressing quality and IP risks, companies can ensure reliable, compliant, and protected sourcing of manufacturing chairs.

Logistics & Compliance Guide for Manufacturing Chairs

Supply Chain Management

Establish a reliable network of suppliers for raw materials such as wood, metal, foam, fabric, and hardware. Implement vendor qualification processes to ensure material quality and consistency. Use just-in-time (JIT) or lean inventory practices to minimize storage costs while maintaining production continuity. Maintain safety stock for critical components to mitigate supply disruptions.

Material Sourcing & Sustainability Compliance

Source materials in compliance with environmental regulations and sustainability standards (e.g., FSC-certified wood, Greenguard-certified foam). Document material origins and ensure adherence to local and international laws such as the Lacey Act (U.S.) or EU Timber Regulation. Prioritize suppliers with ethical labor practices and low environmental impact.

Manufacturing & Quality Control

Follow standardized production procedures to ensure product consistency and durability. Implement quality control checkpoints at key stages: raw material inspection, frame assembly, upholstery, and final product testing. Conduct routine stress, load, and safety tests in accordance with industry standards (e.g., BIFMA X5.1 for office chairs).

Regulatory Compliance

Ensure chairs meet safety, labeling, and performance standards required in target markets:

– United States: ANSI/BIFMA X5 series (office furniture), California Proposition 65 (chemical labeling)

– European Union: EN 1335 (office chairs), REACH (chemical restrictions), CE marking

– Canada: CSA Z546 (office furniture)

– Global: CARB Phase 2 (formaldehyde emissions for composite wood)

Maintain technical documentation and certification records for audits.

Packaging & Labeling Requirements

Use sustainable, damage-resistant packaging suitable for domestic and international transport. Include required labels: product specifications, country of origin, care instructions, compliance marks (e.g., CE, BIFMA), and safety warnings. Ensure multilingual labeling for export markets.

Domestic & International Shipping

Choose appropriate freight modes (road, rail, sea, air) based on cost, speed, and destination. Partner with certified logistics providers experienced in furniture transport. Prepare accurate shipping documentation including commercial invoices, packing lists, and bills of lading. Comply with Incoterms (e.g., FOB, EXW) agreed with buyers.

Import/Export Regulations

Understand and comply with customs requirements in destination countries. Classify products correctly using Harmonized System (HS) codes (e.g., 9401.61 for office chairs with metal frames). Pay applicable tariffs, duties, and taxes. Obtain export licenses if required, and ensure adherence to trade sanctions and embargoes.

Product Safety & Recalls

Implement a product traceability system (e.g., batch numbering) to support recalls if necessary. Monitor consumer feedback and regulatory alerts. Establish a recall response plan aligned with authorities such as the U.S. Consumer Product Safety Commission (CPSC) or EU RAPEX system.

Environmental & Labor Compliance

Comply with local environmental regulations for waste disposal, emissions, and energy use. Adhere to labor laws regarding working conditions, wages, and safety in manufacturing facilities. Follow guidelines from OSHA (U.S.) or equivalent bodies abroad. Consider third-party audits (e.g., SMETA, BSCI) for social compliance.

Recordkeeping & Audits

Maintain comprehensive records for at least seven years, including: supplier agreements, material certifications, test reports, shipping documents, and compliance certificates. Conduct regular internal audits to ensure ongoing adherence to logistics and regulatory standards.

In conclusion, sourcing the manufacturing of chairs requires a strategic approach that balances cost-efficiency, quality, lead times, and sustainability. Careful evaluation of potential manufacturers—considering factors such as production capabilities, quality control processes, compliance with international standards, and logistical reliability—is essential to ensure a successful partnership. Additionally, building strong supplier relationships, conducting regular audits, and maintaining clear communication can mitigate risks and support long-term scalability. Whether manufacturing locally or overseas, a well-structured sourcing strategy will ultimately enhance product consistency, reduce costs, and strengthen competitive advantage in the market.