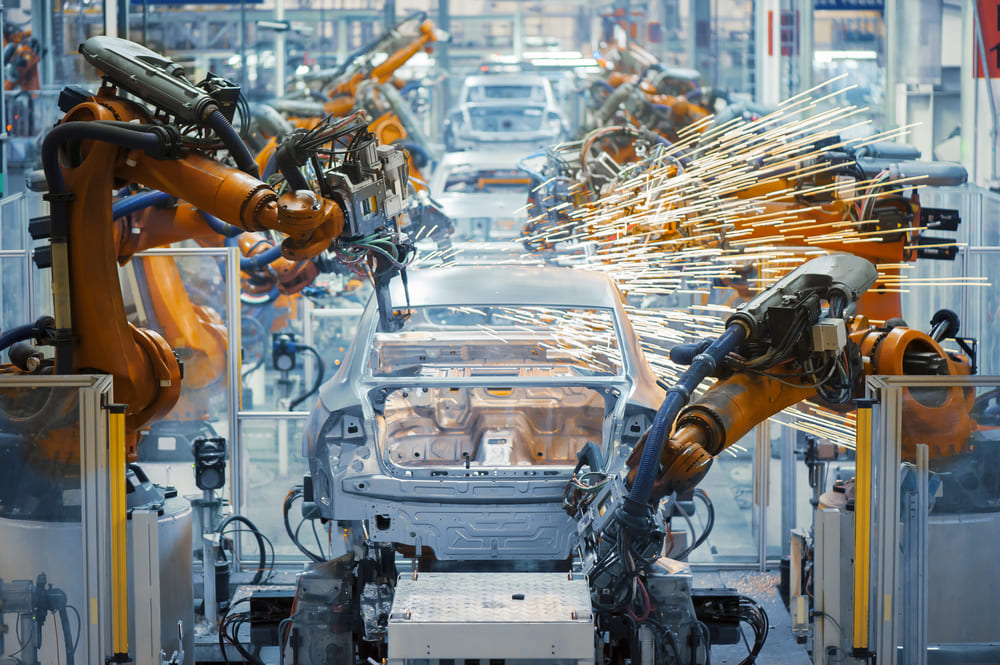

The global technology manufacturing industry continues to expand at a robust pace, driven by rising demand for consumer electronics, advancements in semiconductor technology, and increasing adoption of IoT and AI-enabled devices. According to a 2023 report by Mordor Intelligence, the global electronics manufacturing services (EMS) market was valued at USD 643.5 billion and is projected to grow at a CAGR of 6.8% from 2023 to 2028. Similarly, Grand View Research estimates that the global semiconductor market alone reached USD 574 billion in 2022 and is expected to grow at a CAGR of 11.5% over the forecast period through 2030. These trends underscore the critical role of technology manufacturers in shaping innovation and supply chain resilience across industries—from telecommunications and automotive to healthcare and smart infrastructure. As investment in advanced manufacturing and R&D intensifies, a select group of industry leaders continues to dominate market share, drive technological breakthroughs, and respond to evolving global demands.

Top 9 Technology Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TTM Technologies

Domain Est. 1995

Website: ttm.com

Key Highlights: TTM Technologies is an advanced Printed Circuit Board (PCB) manufacturer and a leading supplier in technology solutions….

#2 Micron Technology

Domain Est. 1994

Website: micron.com

Key Highlights: Explore Micron Technology, leading in semiconductors with a broad range of performance-enhancing memory and storage solutions….

#3

Domain Est. 1994

Website: murata.com

Key Highlights: This is Murata Manufacturing’s products-related website. You can view electronic component information, product and event news, exhibition, campaign and ……

#4 GlobalFoundries

Domain Est. 1995

Website: gf.com

Key Highlights: GlobalFoundries (GF) is a leading manufacturer of essential semiconductors the world relies on to live, work and connect. We innovate and partner with customers ……

#5 AMT

Domain Est. 1999

Website: amtonline.org

Key Highlights: AMT – The Association For Manufacturing Technology represents and promotes U.S.-based manufacturing technology and its members—those who design, build, ……

#6 Manufacturing Technology Series

Domain Est. 2012

Website: mtseries.com

Key Highlights: The Manufacturing Technology Series connects decision-makers from diverse industries with leading suppliers of advanced manufacturing technology, equipment and ……

#7

Domain Est. 1998

Website: creationtech.com

Key Highlights: Creation’s manufacturing facilities around the world have the right mix of infrastructure and expertise. We are an Electronics Manufacturing Services provider….

#8 Lam Research

Domain Est. 2002

Website: lamresearch.com

Key Highlights: At Lam, we relentlessly pursue innovation that pushes the boundaries of technical limitations, creating solutions that enable chipmakers to power progress….

#9 Manufacturing.gov

Domain Est. 2003

Website: manufacturing.gov

Key Highlights: The manufacturing.gov website serves as the primary hub for information about federal manufacturing programs, funding opportunities, and other valuable ……

Expert Sourcing Insights for Technology

2026 Market Trends for Technology

Artificial Intelligence and Generative AI Integration

By 2026, artificial intelligence (AI) will be deeply embedded across industries, with generative AI driving transformative changes in content creation, customer service, software development, and decision-making. Enterprises will increasingly adopt AI-powered automation to streamline operations, reduce costs, and enhance productivity. Generative AI tools—capable of producing text, images, code, and even video—will become standard components in workflows, particularly in marketing, design, and R&D. Expect a shift from experimental AI projects to production-grade AI systems, supported by improved model transparency, regulation, and governance frameworks.

Expansion of Edge Computing

As latency-sensitive applications grow, edge computing will become a cornerstone of the technology landscape in 2026. With the proliferation of IoT devices, autonomous systems, and real-time analytics, processing data closer to the source—rather than in centralized cloud data centers—will reduce response times and bandwidth usage. Industries such as manufacturing, healthcare, and smart cities will leverage edge AI to enable faster decision-making. 5G and the emerging 6G testbeds will further accelerate edge adoption by providing ultra-reliable, low-latency connectivity.

Quantum Computing Advancements

While still in its early stages, quantum computing will see significant milestones by 2026. Major tech firms and research institutions will demonstrate quantum advantage in specific domains such as cryptography, materials science, and complex system optimization. Although widespread commercial use remains limited, early adopters in finance, pharmaceuticals, and logistics will begin piloting quantum algorithms for risk modeling and molecular simulation. Investment in quantum-safe encryption will also rise as concerns grow over quantum threats to current cybersecurity protocols.

Sustainable and Green Tech Innovation

Environmental, social, and governance (ESG) priorities will drive technology innovation in 2026. Companies will prioritize energy-efficient hardware, carbon-aware software design, and circular economy models for tech products. Data centers will increasingly rely on renewable energy and advanced cooling technologies. The demand for green semiconductors and low-power AI chips will surge, supported by government incentives and stricter environmental regulations. Sustainability will become a key differentiator in consumer and enterprise technology markets.

Cybersecurity in a Hyperconnected World

As digital infrastructure expands, cybersecurity will remain a critical concern in 2026. The rise of AI-powered cyberattacks will necessitate equally intelligent defense mechanisms, including AI-driven threat detection and automated response systems. Zero Trust Architecture (ZTA) will become the standard security model across organizations, particularly in cloud and hybrid environments. Regulatory frameworks like the EU’s Cyber Resilience Act will push manufacturers to build secure-by-design principles into software and hardware products.

Proliferation of Spatial Computing and the Metaverse

Spatial computing, combining augmented reality (AR), virtual reality (VR), and mixed reality (MR), will gain traction in 2026, particularly in enterprise and education. Apple’s Vision Pro and similar platforms will mature, enabling immersive collaboration, training simulations, and virtual workspaces. While consumer adoption of the metaverse may still be evolving, industries such as architecture, healthcare, and retail will deploy spatial solutions for design visualization, remote assistance, and personalized customer experiences.

Semiconductor and Supply Chain Resilience

Global investments in semiconductor manufacturing will yield results by 2026, reducing dependency on a few geographic regions. The U.S. CHIPS Act, EU’s semiconductor initiatives, and Asian expansions will lead to more resilient and diversified supply chains. Advances in chiplet design, 3D packaging, and next-generation materials (like GaN and SiC) will enable higher performance and efficiency in computing devices. Domestic production and strategic stockpiling will mitigate future supply disruptions.

Conclusion

The technology landscape in 2026 will be defined by integration, intelligence, and sustainability. Organizations that embrace AI, edge computing, and secure-by-design principles while aligning with environmental and regulatory demands will lead the next wave of digital transformation. Continuous innovation, coupled with ethical considerations and global collaboration, will shape a more connected, efficient, and resilient technological future.

Common Pitfalls in Sourcing Technology: Quality and Intellectual Property Risks

Sourcing technology—whether through partnerships, licensing, outsourcing, or acquisition—introduces significant risks related to quality and intellectual property (IP). Failing to address these can lead to legal disputes, compromised product integrity, and long-term strategic setbacks.

Quality-Related Pitfalls

Inadequate Due Diligence on Technical Capabilities

Organizations often assume the technology functions as advertised without rigorous testing or validation. This can result in integration challenges, performance shortfalls, or scalability issues post-deployment.

Lack of Clear Quality Standards and SLAs

Without well-defined service-level agreements (SLAs) or performance benchmarks, vendors may deliver subpar solutions. Ambiguities in specifications can lead to disputes over what constitutes acceptable quality.

Insufficient Testing and Validation Processes

Relying solely on vendor-provided demonstrations or documentation without independent verification (e.g., penetration testing, code reviews) increases the risk of undetected flaws, security vulnerabilities, or compliance gaps.

Dependency on Obsolete or Unsupported Technology

Sourcing technology built on deprecated frameworks or unsupported platforms can lead to maintenance challenges, security risks, and high technical debt in the long run.

Intellectual Property-Related Pitfalls

Unclear Ownership and Licensing Rights

Failing to explicitly define IP ownership in contracts may result in shared rights, restricted usage, or unexpected royalty obligations. This is particularly critical when custom development is involved.

Use of Third-Party or Open-Source Components Without Verification

Many technology solutions incorporate third-party libraries or open-source code. Without proper audit, organizations risk violating licenses (e.g., GPL), exposing themselves to litigation, or inheriting security flaws.

Inadequate IP Protection in Contracts

Poorly drafted agreements may omit confidentiality clauses, non-disclosure terms, or fail to secure warranties from the vendor regarding infringement. This leaves the buyer exposed to IP disputes initiated by third parties.

Reverse Engineering or IP Leakage Risk

When working with external vendors—especially in offshore development—there’s a risk of IP being reverse-engineered, copied, or improperly shared. Insufficient security protocols and access controls can exacerbate this.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct thorough technical and legal due diligence.

– Define clear quality metrics and acceptance criteria in contracts.

– Perform independent code and security audits.

– Ensure IP ownership, usage rights, and license compliance are explicitly documented.

– Include audit rights and indemnification clauses in sourcing agreements.

Proactive management of quality and IP issues during technology sourcing is essential to protect innovation, ensure compliance, and maintain competitive advantage.

Logistics & Compliance Guide for Technology

Technology companies face unique challenges in logistics and compliance due to the sensitive nature of their products, global supply chains, and rapidly evolving regulations. This guide outlines key considerations and best practices to ensure efficient operations and adherence to legal requirements.

Supply Chain Management

Effective supply chain management is critical for technology firms dealing with high-value, time-sensitive, and often globally sourced components. Establish strong relationships with suppliers, implement real-time inventory tracking systems, and use demand forecasting tools to mitigate risks such as component shortages or obsolescence. Consider dual sourcing for critical components and leverage vendor-managed inventory (VMI) where appropriate to reduce lead times and improve responsiveness.

International Shipping & Customs Compliance

Technology products frequently cross international borders, making customs compliance essential. Ensure accurate classification of goods using Harmonized System (HS) codes, maintain proper documentation (commercial invoices, packing lists, certificates of origin), and comply with export control regulations such as the U.S. Export Administration Regulations (EAR) or the EU Dual-Use Regulation. Utilize automated customs platforms and partner with experienced freight forwarders to streamline clearance and avoid delays or penalties.

Export Control & Sanctions

Technology companies must comply with export control laws that restrict the transfer of certain goods, software, and technologies to specific countries, entities, or individuals. Conduct regular screening of customers and partners against government sanction lists (e.g., OFAC, EU Consolidated List). Implement internal compliance programs, including classification of products under control regimes (e.g., EAR99, ECCN), and obtain necessary licenses before shipping controlled items.

Product Safety & Regulatory Standards

Ensure all technology products meet relevant safety and performance standards in target markets. In the U.S., this may include FCC (radiofrequency devices), UL (safety), and ENERGY STAR (efficiency) certifications. In the EU, compliance with CE marking directives such as RoHS (restriction of hazardous substances), REACH (chemicals), and the Radio Equipment Directive (RED) is mandatory. Maintain technical documentation and conduct periodic audits to verify ongoing conformity.

Data Privacy & Cybersecurity in Logistics

Logistics operations involve handling sensitive data, including customer information, shipment details, and tracking data. Comply with data protection regulations such as the GDPR (EU), CCPA (California), and other local privacy laws. Implement cybersecurity measures across logistics platforms—encrypt data in transit and at rest, enforce access controls, and conduct regular security assessments of third-party logistics providers (3PLs).

Reverse Logistics & E-Waste Compliance

Technology products have short lifecycles, leading to significant returns and end-of-life equipment. Establish efficient reverse logistics processes for repairs, refurbishment, and recycling. Comply with e-waste regulations such as the EU WEEE Directive, which mandates producer responsibility for collecting and recycling electronic waste. Partner with certified e-waste recyclers and maintain traceability throughout the reverse supply chain.

Trade Agreements & Tariff Optimization

Leverage free trade agreements (FTAs) such as the USMCA, CETA, or RCEP to reduce or eliminate tariffs on technology products. Maintain detailed records to prove origin eligibility and use customs rulings or binding tariff information (BTI) to secure advance classification determinations. Regularly review global sourcing strategies to optimize duty savings and mitigate trade policy risks.

Recordkeeping & Audit Preparedness

Maintain comprehensive records related to shipments, compliance certifications, export licenses, and due diligence activities. Retention periods vary by jurisdiction but typically range from 3 to 5 years. Conduct regular internal audits and readiness assessments to ensure compliance with all applicable regulations and to prepare for potential government inquiries or inspections.

By proactively addressing these logistics and compliance areas, technology companies can enhance operational efficiency, reduce legal risks, and maintain a strong reputation in global markets.

Conclusion on Sourcing Manufacturers and Technology

Sourcing manufacturers and integrating advanced technology is a strategic imperative for businesses aiming to remain competitive, efficient, and innovative in today’s global market. The successful alignment of reliable manufacturing partners with cutting-edge technologies—such as automation, IoT, AI-driven analytics, and sustainable production methods—enables companies to enhance product quality, reduce time-to-market, and improve supply chain resilience.

Effective sourcing requires thorough due diligence, including evaluating a manufacturer’s technological capabilities, compliance standards, scalability, and commitment to innovation. Leveraging digital platforms and data analytics further streamlines vendor selection, performance monitoring, and risk management. Moreover, building strong collaborative relationships with manufacturers fosters transparency, drives continuous improvement, and supports long-term growth.

Ultimately, the integration of strategic sourcing with advanced manufacturing technologies not only optimizes operational performance but also positions organizations to adapt quickly to market changes, meet evolving customer demands, and achieve sustainable success in an increasingly interconnected and technology-driven industrial landscape.