The manufacturing sector in Nevada has experienced steady momentum in recent years, supported by strategic geographic positioning, business-friendly policies, and growing investment in advanced industries. According to Mordor Intelligence, the U.S. manufacturing market is projected to grow at a CAGR of approximately 3.8% from 2023 to 2028, with states like Nevada benefiting from expanding activity in electronics, aerospace, and clean technology production. Moreover, Grand View Research reports rising domestic reshoring efforts and federal incentives under the CHIPS and Science Act are further catalyzing regional manufacturing growth. Nevada, home to key industrial hubs in Reno, Henderson, and North Las Vegas, has attracted major players in battery production, semiconductors, and sustainable materials. As the state continues to diversify its economy beyond tourism and gaming, its manufacturing output has seen a notable uptick—up 5.2% between 2021 and 2023, per U.S. Census data. This growth trajectory underscores Nevada’s emerging role in the national supply chain, making it one of the fastest-growing manufacturing environments in the Western U.S. The following list highlights the top eight manufacturers shaping this industrial evolution.

Top 8 In Nevada Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Manufacture Nevada

Domain Est. 1997

Website: nist.gov

Key Highlights: Manufacture Nevada works side-by-side with Nevada manufacturers, connecting them to a comprehensive network of resources, experts, and solutions….

#2 Nevada Manufacturers Association

Domain Est. 2012

Website: nvmanufacturers.com

Key Highlights: The Nevada Manufacturer’s Association is a powerful force at the state legislature, advocating for members of all sizes – from mom-and-pop to global….

#3 Manufacture Nevada

Domain Est. 2022

Website: manufacturenevada.com

Key Highlights: We work side-by-side with Nevada manufacturers, connecting them to a comprehensive network of resources, experts, and solutions that help their businesses ……

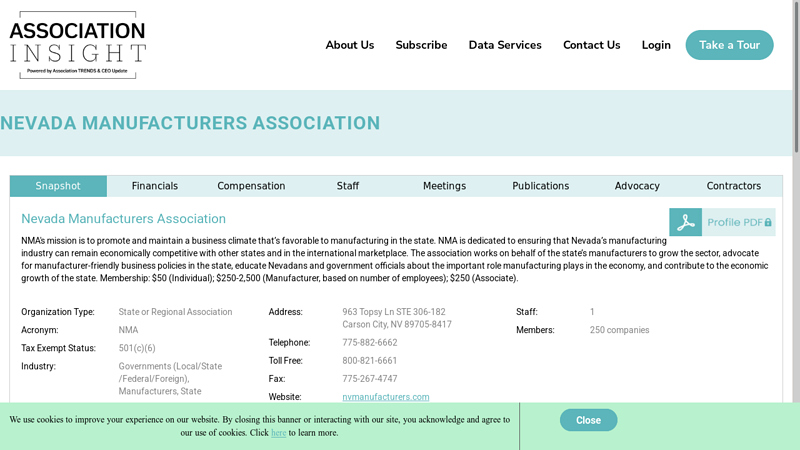

#4 Nevada Manufacturers Association

Domain Est. 2023

Website: association-insight.com

Key Highlights: NMA is dedicated to ensuring that Nevada’s manufacturing industry can remain economically competitive with other states and in the international marketplace….

#5 Nevada Test Site Sub

Domain Est. 1997

Website: btcomp.dol.gov

Key Highlights: BTComp is a general information resource tool. It is not intended to nor does it contain all information that relates to DOE subcontractors….

#6 Manufactured Food and Supplement Production

Domain Est. 2002

Website: dpbh.nv.gov

Key Highlights: The information on this page provides a brief overview of the regulatory requirements that relate to staring a wholesale food business. In addition to the State ……

#7 About

Domain Est. 2013

Website: nevada-showcase.webflow.io

Key Highlights: Manufacture Nevada is dedicated to fostering a strong manufacturing community throughout the state of Nevada and solving today’s toughest business ……

#8 Nevada Manufacturers Directory

Domain Est. 2003

Website: industrynet.com

Key Highlights: The official Nevada Manufacturers Directory®, powered by IndustryNet, connects you with 2,016 verified and reliable manufacturers, suppliers, and industrial ……

Expert Sourcing Insights for In Nevada

H2: Projected 2026 Market Trends in Nevada

As Nevada approaches 2026, several key market trends are expected to shape its economic landscape, driven by population growth, technological innovation, and shifting consumer behaviors. These trends span multiple sectors including real estate, tourism, technology, and renewable energy.

-

Real Estate and Housing Market Expansion

Nevada, particularly Las Vegas and Reno, is projected to see continued demand in both residential and commercial real estate. The influx of new residents—fueled by lower taxes and a favorable cost of living compared to neighboring states like California—is expected to sustain housing demand. By 2026, home prices may stabilize after recent volatility, with increased construction of affordable and mixed-use developments. Commercial real estate will likely benefit from corporate relocations and expansions, especially in tech and logistics. -

Growth in Technology and Data Centers

Northern Nevada, anchored by Reno and Sparks, is emerging as a tech and data center hub. Proximity to California, access to fiber-optic networks, and business-friendly regulations are attracting major tech companies and hyperscale data center investments. By 2026, this corridor is expected to solidify its reputation as a “data haven,” creating high-paying jobs and stimulating ancillary services. -

Tourism and Hospitality Evolution

Las Vegas remains the epicenter of Nevada’s tourism industry, and by 2026, the sector is expected to embrace more experiential and integrated offerings. Demand for luxury entertainment, wellness tourism, and convention-based travel will rise. Additionally, operators will increasingly adopt AI and automation to personalize guest experiences and optimize operations. Sports betting and iGaming are also anticipated to grow, supported by expanding digital infrastructure. -

Renewable Energy and Sustainability Initiatives

Nevada’s abundant solar and geothermal resources position it as a leader in clean energy. By 2026, the state is expected to significantly increase its renewable energy capacity, driven by both public policy (such as the Renewable Portfolio Standard) and private investment. Large-scale solar farms and battery storage projects will support not only local needs but also regional energy exports, creating green jobs and attracting environmentally focused industries. -

Workforce Development and Education Alignment

To support growing industries, Nevada is investing in workforce training and higher education programs aligned with tech, healthcare, and advanced manufacturing needs. Community colleges and trade schools are expanding partnerships with employers to close skills gaps. By 2026, this focus on talent development is expected to improve labor market outcomes and reduce dependency on out-of-state hires. -

Transportation and Infrastructure Upgrades

With population growth and increased economic activity, infrastructure investment—especially in transportation—will be critical. Projects such as the proposed high-speed rail between Las Vegas and Southern California could gain momentum by 2026, enhancing regional connectivity. Meanwhile, smart city initiatives in urban centers aim to improve traffic management and public transit efficiency.

Conclusion

By 2026, Nevada is poised to transition from a tourism-centric economy to a more diversified and innovation-driven market. Strategic investments in technology, sustainability, and human capital will be key drivers of this transformation, positioning the state as a competitive player in the Western U.S. economy. Policymakers and businesses that anticipate these trends will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing in Nevada (Quality, IP)

Sourcing goods or services in Nevada—whether from manufacturers, contractors, or technology providers—can present unique challenges related to quality control and intellectual property (IP) protection. Being aware of these pitfalls helps mitigate risks and ensure successful outcomes.

Quality Control Challenges

One frequent issue when sourcing in Nevada is inconsistent product or service quality, particularly with smaller or regional suppliers who may lack standardized processes. Nevada’s diverse industrial base—spanning mining, construction, and emerging tech—means quality expectations and capabilities can vary significantly. For example, custom fabrication shops in rural areas may not adhere to the same quality assurance protocols as larger, urban-based vendors. Without clear specifications, regular inspections, or third-party audits, buyers risk receiving substandard materials or workmanship. Additionally, Nevada’s remote geography can complicate logistics and delay corrective actions, amplifying quality-related disruptions.

Intellectual Property Vulnerabilities

Protecting intellectual property when sourcing in Nevada requires proactive legal safeguards. A common pitfall arises when businesses collaborate with local designers, engineers, or developers without properly defined IP ownership in contracts. Under default U.S. law, work created by independent contractors may not automatically belong to the hiring party unless a “work made for hire” agreement or IP assignment clause is in place. This gap can lead to disputes over proprietary designs, software, or processes—especially in sectors like gaming technology or renewable energy innovation, where Nevada has a growing presence. Furthermore, verbal agreements or informal partnerships, sometimes seen in tight-knit local industries, increase the risk of IP leakage or unauthorized use. Ensuring comprehensive NDAs and written contracts is essential to safeguarding sensitive information.

Logistics & Compliance Guide for Nevada

Navigating logistics and regulatory requirements in Nevada requires understanding state-specific rules related to transportation, vehicle regulations, permits, and business compliance. This guide outlines key considerations for companies operating or transporting goods within the Silver State.

Transportation Infrastructure and Routes

Nevada’s strategic location between major West Coast markets and the central U.S. makes it a crucial logistics corridor. Key interstates include I-80 (east-west across northern Nevada) and I-15 (north-south linking Las Vegas to Salt Lake City and Los Angeles). The state maintains a robust network of highways, but remote desert areas may present challenges due to extreme weather and limited services.

Companies should plan routes carefully, considering seasonal closures, weight restrictions on mountain passes, and access to rest areas. The Nevada Department of Transportation (NDOT) provides real-time traffic and road condition updates through its 511 system.

Commercial Vehicle Regulations

All commercial motor vehicles (CMVs) operating in Nevada must comply with both federal FMCSA regulations and additional state requirements. Key regulations include:

- Vehicle Registration: CMVs must be registered with the Nevada Department of Motor Vehicles (DMV). Heavy vehicles (over 26,000 lbs GVWR) may require apportioned registration through the International Registration Plan (IRP).

- Weight Limits: Standard gross vehicle weight limit is 80,000 lbs. Exceeding this requires a special overweight permit.

- Hours of Service (HOS): Drivers must follow federal HOS rules; electronic logging devices (ELDs) are mandatory for most fleets.

Permits and Special Authorizations

Nevada requires several permits for commercial operations:

- Overweight/Overdimensional Permits: Issued by the NDOT for loads exceeding standard size or weight limits. Applications must be submitted in advance with detailed routing.

- Trip Permits: Available for non-resident carriers making short-term deliveries without full registration.

- Hazardous Materials (HazMat): Transporters must follow federal HazMat regulations and ensure proper placarding, training, and routing. Certain routes may be restricted for HazMat carriers.

Fuel Tax Compliance

Nevada participates in the International Fuel Tax Agreement (IFTA). Qualified motor carriers must:

- Obtain an IFTA license from the Nevada DMV.

- File quarterly fuel tax reports based on miles traveled and fuel consumed in member jurisdictions.

- Maintain detailed records of fuel purchases and trip logs.

Carriers not qualifying for IFTA must obtain non-IFTA fuel permits for temporary operations.

Nevada Business Licensing and Tax Obligations

Companies conducting logistics operations in Nevada must meet state business compliance requirements:

- Business License: All businesses operating in Nevada must obtain a State Business License from the Secretary of State, renewed annually.

- Sales Tax: Nevada has no state income tax but imposes a 6.85% state sales tax, with additional local taxes in counties and cities (e.g., Clark County adds up to 1.53%). Freight and delivery charges may be taxable depending on circumstances.

- Use Tax: Applies to taxable goods purchased out-of-state for use in Nevada if sales tax was not paid at purchase.

Environmental and Safety Regulations

- Idling Restrictions: While Nevada does not have a statewide anti-idling law, local ordinances in areas like Washoe and Clark Counties may limit engine idling to reduce emissions.

- Spill Prevention: Operators transporting hazardous materials must comply with Nevada Division of Environmental Protection (NDEP) regulations for spill reporting and containment.

- Safety Inspections: Nevada participates in the Commercial Vehicle Safety Alliance (CVSA). Vehicles are subject to roadside inspections for compliance with safety standards.

Driver Requirements

- CDL Licensing: Drivers operating CMVs must hold a valid Commercial Driver’s License (CDL) issued by Nevada or another state, in accordance with federal standards.

- Background Checks: Required for HazMat endorsement applicants through the TSA.

- Drug and Alcohol Testing: Must comply with FMCSA-mandated testing programs.

Local Considerations in Major Markets

- Las Vegas (Clark County): High volume of last-mile deliveries and tourism-related logistics. Curbside delivery restrictions may apply in downtown and resort zones.

- Reno (Washoe County): A growing logistics hub with proximity to California. Cold storage and distribution facilities are expanding due to e-commerce growth.

- Carson City: State capital with government-related shipping needs and regulatory oversight presence.

Resources and Contacts

- Nevada Department of Motor Vehicles (DMV): dmv.nv.gov – Registration, permits, CDL services.

- Nevada Department of Transportation (NDOT): ndot.nv.gov – Road conditions, permits, freight planning.

- Nevada Secretary of State: nvsos.gov – Business licensing.

- Nevada Division of Environmental Protection (NDEP): ndep.nv.gov – Environmental compliance.

Staying compliant in Nevada’s logistics environment requires proactive planning, adherence to both state and federal regulations, and ongoing monitoring of local and seasonal requirements. Regular consultation with regulatory agencies and legal counsel is recommended for complex operations.

In conclusion, sourcing manufacturers in Nevada offers a strategic advantage for businesses seeking reliable, locally-based production with access to growing industrial infrastructure and logistical networks. While Nevada may not have the dense manufacturing hubs of other states, its business-friendly environment—characterized by no corporate or personal income tax, streamlined regulations, and strong supply chain connections—makes it an attractive option for certain industries, particularly in advanced manufacturing, clean technology, and aerospace. Additionally, proximity to major Western markets and transportation corridors enhances distribution efficiency.

However, companies must carefully evaluate the limited pool of manufacturers and potential niche specialization within the state. Conducting thorough due diligence, building strong local partnerships, and leveraging state resources such as the Nevada Industry Excellence and Governor’s Office of Economic Development can help mitigate challenges. Ultimately, while Nevada may not be the top choice for all manufacturing needs, it presents a promising sourcing option for businesses aligned with its emerging sectors and value propositions of operational efficiency and strategic geographic location.