The global apparel manufacturing industry continues to experience robust expansion, driven by rising consumer demand, fast-fashion evolution, and increasing investment in sustainable production methods. According to a 2023 report by Grand View Research, the global clothing market size was valued at USD 1.5 trillion and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This sustained growth is fueled by shifting demographics, urbanization in emerging economies, and digital transformation across supply chains. Additionally, Mordor Intelligence forecasts similar momentum, citing Asia-Pacific as the dominant hub due to competitive labor costs, supportive government policies, and advanced textile infrastructure. As brands prioritize agility, scalability, and ethical sourcing, identifying the top clothing manufacturers has become critical for retailers and fashion labels aiming to maintain a competitive edge. The following list highlights the leading manufacturers shaping the future of apparel production, evaluated based on capacity, innovation, sustainability initiatives, and global reach.

Top 10 For Clothes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Apparel Production Inc.

Domain Est. 2006

Website: apparelproductionny.com

Key Highlights: Apparel Production is New York City’s leading fashion design house, clothing factory, and garment manufacturer for Men’s, Women’s, and Children’s clothing….

#2 Clothing Manufacturers

Domain Est. 2016

Website: createfashionbrand.com

Key Highlights: We are a Group of Clothing Manufacturers · Everything you need in one place for making Garments · Development From Scratch · Blanks Customization · Shop Blanks….

#3 Mega Apparel

Domain Est. 2012

Website: megaapparel.com

Key Highlights: Get your high-quality customized clothes from the best clothing manufacturer in the USA at reasonable prices. Give an idea and we will turn it into reality….

#4 ARGYLE Haus of Apparel

Domain Est. 2014

Website: argylehaus.com

Key Highlights: We an award-winning and premier clothing manufacturing company in Los Angeles. Our innovative approach to crafting high-quality apparel embodies the essence of ……

#5 Sewport

Domain Est. 2015

Website: sewport.com

Key Highlights: An digital platform to help you source high quality clothing manufacturers and suppliers. From sketch to production and everything in-between….

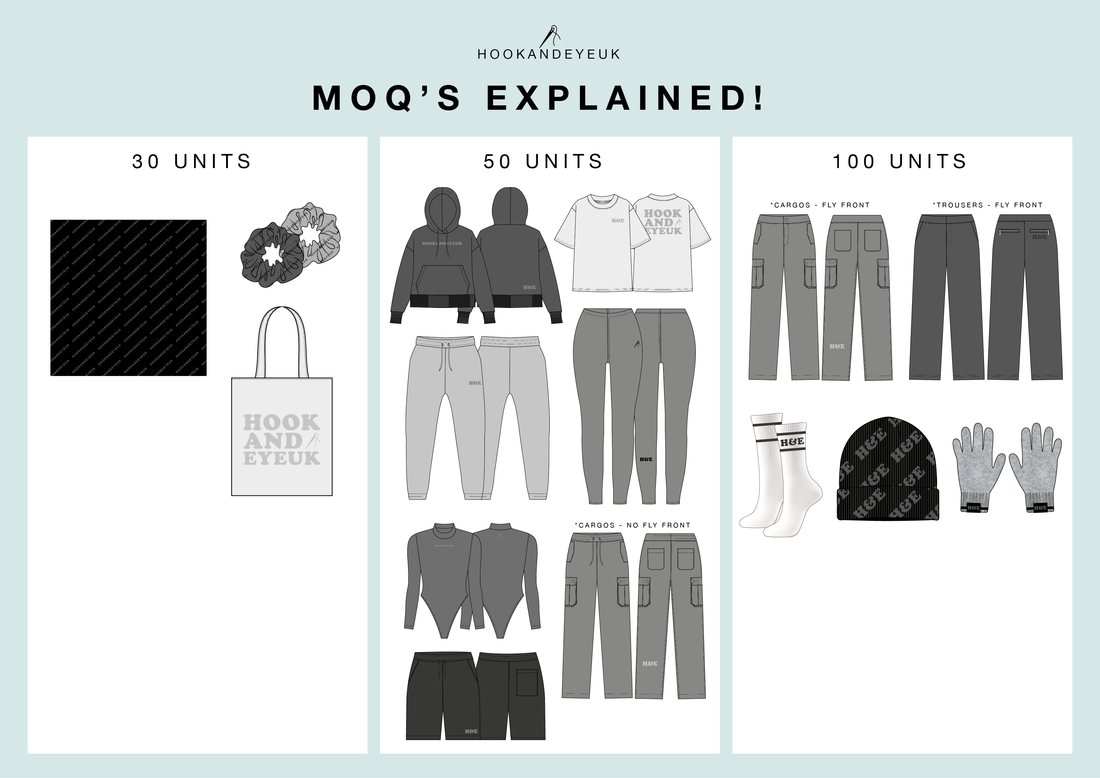

#6 Clothing Manufacturers UK – Low Order Quantity

Domain Est. 2015

Website: hawthornintl.com

Key Highlights: Hawthorn is one of the UK’s leading clothing manufacturers, producing custom garments for start up clothing brands at the lowest MOQ, from 50pcs….

#7 Seam Apparel

Domain Est. 2021

Website: seamapparel.com

Key Highlights: We are a leading custom clothing manufacturers in the USA, offering high-quality, private label & wholesale apparel manufacturing for brands & startups….

#8 Quality Fashion Clothing for Your Brand

Domain Est. 2021

Website: bmc.fashion

Key Highlights: Discover premium fashion clothing from BMC Fashion, your trusted custom clothing manufacturers. Elevate your brand with our expert apparel manufacturing….

#9 Dignity Apparel Page

Domain Est. 2017

Website: dignityapparel.com

Key Highlights: We create high-quality and durable clothing that Americans love to wear, manufactured in the USA by a highly-skilled Union workforce….

#10 Zega Apparel

Domain Est. 2013

Website: zegaapparel.com

Key Highlights: Zega Apparel offers leading services including custom clothing manufacturers USA along with cut & sew clothing services to private labels across the globe….

Expert Sourcing Insights for For Clothes

2026 Market Trends for Clothes

Sustainable and Circular Fashion Gains Momentum

By 2026, sustainability will be a core driver in the global apparel market. Consumers are increasingly demanding transparency in sourcing, ethical labor practices, and eco-friendly materials. Brands are responding by investing in circular fashion models—emphasizing recycling, garment resale, rental services, and take-back programs. Innovations such as biodegradable textiles and low-impact dyes are becoming mainstream, supported by regulatory pressures in regions like the EU. The rise of blockchain technology is also enabling traceability, allowing customers to verify a garment’s lifecycle from raw material to finished product.

Technology Integration and Smart Clothing Expansion

Wearable technology is evolving beyond fitness trackers into functional fashion. By 2026, smart fabrics embedded with sensors for health monitoring, temperature regulation, and even UV protection are gaining popularity. Major brands are collaborating with tech firms to create garments that adapt to environmental conditions or enhance user experience through connectivity. Augmented reality (AR) and virtual try-ons are becoming standard in e-commerce, reducing return rates and improving customer satisfaction. AI-driven personalization is also optimizing inventory and design, enabling hyper-customized clothing recommendations.

Resurgence of Localized and On-Demand Manufacturing

Global disruptions have accelerated a shift toward localized production. In 2026, more fashion companies are adopting nearshoring and on-demand manufacturing to reduce lead times, minimize waste, and respond quickly to trends. 3D knitting and digital printing technologies enable small-batch production with high customization, appealing to consumers seeking unique, made-to-order apparel. This shift supports sustainability goals and strengthens brand authenticity by emphasizing craftsmanship and regional identity.

Inclusivity and Body-Positive Fashion as Standard

Diversity and inclusion are no longer niche concerns but central to brand identity. By 2026, leading clothing brands are offering extended size ranges, adaptive clothing for people with disabilities, and gender-neutral collections. Marketing campaigns are increasingly representative, featuring models of all ages, body types, and cultural backgrounds. This shift is driven by consumer demand for authenticity and social responsibility, with brands that fail to adapt facing reputational risks.

Growth of Secondhand and Rental Markets

The secondhand clothing market is projected to double by 2026, outpacing conventional retail growth. Platforms like ThredUp, Poshmark, and emerging rental services are normalizing pre-owned fashion. Younger consumers, particularly Gen Z, view thrifting and renting as both economical and environmentally responsible. High-end designer resale is also booming, with luxury brands launching certified pre-owned programs. This trend reflects a broader cultural shift from ownership to access, reshaping traditional retail models.

Conclusion

The clothing market in 2026 is defined by sustainability, technological innovation, inclusivity, and agility. Brands that embrace transparency, adapt to digital advancements, and prioritize social responsibility will lead the industry. As consumer values continue to evolve, the future of fashion lies in balancing style with purpose.

Common Pitfalls Sourcing Clothes: Quality and Intellectual Property

Sourcing clothing from manufacturers, especially overseas, can be highly cost-effective but comes with significant risks if not managed carefully. Two of the most critical areas where businesses encounter problems are quality control and intellectual property (IP) protection. Overlooking these aspects can lead to financial losses, damaged brand reputation, and legal complications.

Quality Control Challenges

One of the most frequent issues in clothing sourcing is inconsistent or subpar product quality. This can stem from unclear specifications, poor communication, or inadequate oversight.

- Inadequate Sampling: Skipping or rushing the sampling process often results in final products that differ from expectations. Pre-production, top-of-production, and pre-shipment samples should be reviewed carefully.

- Varying Fabric and Material Quality: Suppliers may substitute lower-grade fabrics, trims, or dyes to cut costs. Without precise technical specifications and third-party testing, these substitutions can go unnoticed until it’s too late.

- Poor Workmanship: Inconsistent stitching, misaligned patterns, improper labeling, or weak seams are common when factories prioritize speed over quality. Regular on-site or third-party inspections are essential.

- Lack of Quality Assurance Protocols: Relying solely on the supplier’s internal quality checks is risky. Implementing independent quality audits and defined acceptance criteria helps prevent defective goods from being shipped.

Intellectual Property Risks

Protecting your designs and brand identity is crucial when sourcing apparel, particularly in regions where IP enforcement may be weak.

- Design Copying and Counterfeiting: Suppliers may replicate your designs and sell them to competitors or produce unauthorized copies for the grey market. This undermines your brand’s exclusivity and profitability.

- Weak Contractual Protections: Failing to include strong IP clauses in supplier agreements—such as ownership of designs, confidentiality, and non-compete terms—leaves you vulnerable to misuse.

- Lack of IP Registration: Not registering trademarks, designs, or patents in key markets (including the manufacturing country) limits your legal recourse if infringement occurs.

- Unsecured Digital Files: Sharing design files (e.g., tech packs, CADs) without watermarks, NDAs, or digital rights management increases the risk of theft or unauthorized use.

To mitigate these pitfalls, establish clear quality standards, conduct regular audits, protect IP through legal means, and build trusted relationships with vetted suppliers. Proactive management in these areas is essential for successful and sustainable clothing sourcing.

Logistics & Compliance Guide for Clothing

Product Classification and Documentation

Ensure all clothing items are accurately classified under the correct Harmonized System (HS) codes, typically falling within Chapter 61 (knitted or crocheted apparel) or Chapter 62 (non-knitted apparel). Maintain detailed product descriptions, including fabric composition, country of origin, and intended use. Required documentation includes commercial invoices, packing lists, and bills of lading or air waybills. Accurate labeling of garments with fiber content, care instructions, and country of origin is mandatory in most markets.

Import/Export Regulations

Comply with import regulations in the destination country, including customs duties, quotas, and trade agreements. Some countries impose restrictions or tariffs on clothing from specific regions. Verify eligibility for preferential treatment under free trade agreements (e.g., USMCA, RCEP, or EU GSP). Monitor changes in trade policies and sanctions that may affect sourcing or shipping routes. Pre-shipment inspections may be required in certain markets.

Labeling and Consumer Safety Requirements

Adhere to labeling laws such as the U.S. Textile Fiber Products Identification Act and EU Textile Regulation (EU No 1007/2011), which require fiber content, care symbols, and country of origin to be clearly marked on garments. In the U.S., the FTC Care Labeling Rule mandates permanent care instructions. Comply with safety standards like CPSIA (U.S.) for lead and phthalates, and REACH and OEKO-TEX® (EU) for restricted substances in textiles. Children’s clothing must meet additional safety requirements.

Packaging and Sustainability Compliance

Use packaging that meets destination market regulations, including recyclability and labeling requirements (e.g., France’s Triman logo or Germany’s Green Dot). Minimize single-use plastics and ensure compliance with Extended Producer Responsibility (EPR) schemes in countries like France, Germany, and Canada. Provide environmental disclosures if making sustainability claims (e.g., “organic cotton”) to avoid greenwashing accusations under FTC or EU Green Claims Directive guidelines.

Customs Clearance and Duties

Prepare for customs clearance by ensuring all documentation is complete and consistent. Use a licensed customs broker if necessary, especially for complex shipments. Calculate landed costs including duties, VAT/GST, and handling fees. Utilize Authorized Economic Operator (AEO) programs where available to expedite clearance. Retain records for a minimum of five years for audit purposes.

Transportation and Warehousing

Choose shipping methods (air, sea, or ground) based on cost, speed, and seasonality. Use moisture-resistant packaging to prevent mildew during ocean transport. Store inventory in warehouses compliant with fire safety and labor standards. Implement inventory tracking systems to manage stock levels and support customs audits. Consider bonded warehousing for deferred duty payment in some jurisdictions.

Ethical Sourcing and Labor Compliance

Ensure supply chains comply with local labor laws and international standards such as the ILO Core Conventions. Conduct regular supplier audits to prevent forced labor, child labor, and unsafe working conditions. Align with initiatives like the Ethical Trading Initiative (ETI) or Fair Wear Foundation. Be prepared to provide supply chain transparency under laws such as the U.S. Uyghur Forced Labor Prevention Act (UFLPA) or the German Supply Chain Act (LkSG).

Returns and Reverse Logistics

Establish clear return policies in compliance with consumer protection laws (e.g., 14-day right of withdrawal in the EU). Manage returned goods efficiently through restocking, recycling, or disposal, adhering to environmental regulations. Track return reasons to improve product quality and reduce waste.

In conclusion, sourcing manufacturers for clothing requires careful research, due diligence, and strategic decision-making to ensure quality, reliability, and cost-effectiveness. Whether sourcing locally or internationally, it’s essential to evaluate factors such as production capabilities, minimum order quantities, lead times, ethical practices, and communication efficiency. Building strong relationships with manufacturers, conducting factory audits, and requesting samples can significantly reduce risks and improve outcomes. Ultimately, choosing the right manufacturing partner aligns your brand with a reliable supply chain, supports consistent product quality, and contributes to the long-term success and scalability of your clothing business.