The virtual simulation (Vs) manufacturing sector has emerged as a pivotal segment within the broader industrial automation and digital twin landscape, driven by rapid advancements in AI, real-time data processing, and Industry 4.0 adoption. According to Grand View Research, the global digital twin market—closely tied to Vs manufacturing technologies—is projected to grow at a compound annual growth rate (CAGR) of 30.3% from 2023 to 2030, reaching an estimated value of USD 110.1 billion by the end of the forecast period. This surge is fueled by increasing demand for predictive maintenance, production optimization, and reduced downtime across automotive, aerospace, and heavy machinery industries. As companies seek to bridge physical and digital operations, virtual simulation tools have become essential for prototyping, testing, and scaling manufacturing processes with minimal real-world risk. In this evolving ecosystem, a select group of manufacturers are leading the charge in innovation, platform integration, and cross-industry application—setting the benchmark for performance, accuracy, and scalability in virtual simulation solutions.

Top 5 Vs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 3 Equal Manufacturers or Suppliers?

Domain Est. 1999

Website: discus.4specs.com

Key Highlights: Some of the so-called tile manufacturers are just suppliers, but they are the only source for the tile in the US. Do I list them as a manufacturer?…

#2 Supply

Domain Est. 2000

Website: fda.gov

Key Highlights: This guidance is intended for persons who participate in certain “co-manufacturing” agreements in the production of human or animal food….

#3 How To Find a Manufacturer or Supplier for a Product (2026)

Domain Est. 2005

Website: shopify.com

Key Highlights: This guide walks you through finding a manufacturer or supplier for your product ideas, with advice for evaluating manufacturers, deciding between domestic and ……

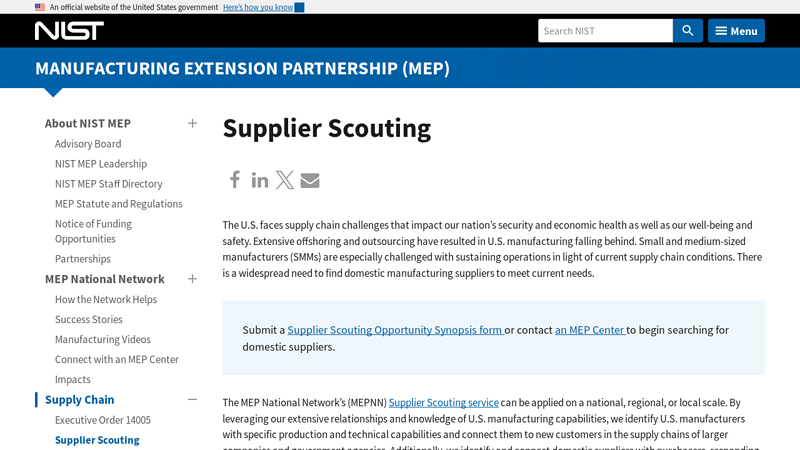

#4 Supplier Scouting

Domain Est. 1997

Website: nist.gov

Key Highlights: The MEPNN’s supplier scouting service provides a viable means by which domestic manufacturing suppliers can be catalyzed to produce needed items domestically….

#5 Supplier and Manufacturer Guide

Domain Est. 2014

Website: shipbob.com

Key Highlights: In this guide, we walk you through the process of finding suppliers and manufacturers for your business….

Expert Sourcing Insights for Vs

H2: 2026 Market Trends for VS (Assuming “VS” Refers to Visa Inc.)

As we look toward 2026, Visa Inc. (NYSE: V) is poised to continue its dominance in the global digital payments ecosystem, driven by macroeconomic shifts, technological innovation, and evolving consumer behaviors. The following analysis outlines key market trends expected to shape Visa’s trajectory through 2026.

-

Accelerated Shift to Digital and Contactless Payments

The global transition from cash to digital payments is accelerating, particularly in emerging markets. By 2026, contactless transactions—including NFC-based card taps, mobile wallets (Apple Pay, Google Pay), and wearable devices—are expected to account for over 60% of in-person transactions worldwide. Visa’s infrastructure and partnerships with banks and fintechs position it to capitalize on this shift, especially as urbanization and smartphone penetration grow across Asia, Africa, and Latin America. -

Expansion of Real-Time Payments and Instant Settlement

Central banks and financial institutions are increasingly investing in real-time payment rails (e.g., FedNow in the U.S., UPI in India). Visa’s push into instant settlement solutions—such as Visa Direct—will enable faster B2B and P2P transactions, enhancing liquidity and user satisfaction. By 2026, Visa is expected to integrate deeply with national payment systems, offering cross-border instant payments and improving settlement efficiency for merchants and consumers alike. -

Rise of Embedded Finance and B2B Payments

Embedded finance—where payment capabilities are integrated into non-financial platforms (e.g., e-commerce, SaaS, gig economy apps)—will be a major growth vector. Visa’s API-driven platforms and developer tools (Visa Developer Platform) allow third parties to embed payment solutions seamlessly. Additionally, the B2B payments market, historically inefficient and paper-based, is undergoing digital transformation. Visa’s B2B Connect and virtual card solutions are expected to capture significant market share by streamlining procurement, invoicing, and reconciliation. -

Increased Focus on Financial Inclusion and Emerging Markets

Visa continues to expand its footprint in underbanked regions through partnerships with local fintechs, mobile network operators, and digital banks. Initiatives like Visa’s Fastlane program for digital onboarding and low-cost card solutions aim to bring hundreds of millions of unbanked individuals into the formal financial system by 2026. This expansion not only drives volume but also strengthens Visa’s long-term network effects. -

Advancements in AI, Fraud Detection, and Data Monetization

Visa’s investment in artificial intelligence and machine learning will enhance real-time fraud detection, reducing losses and increasing consumer trust. Beyond security, AI will enable hyper-personalized offers, dynamic routing, and predictive analytics for merchants. Visa’s vast transaction dataset—when anonymized and aggregated—will become a valuable asset for trend analysis, economic forecasting, and targeted advertising, opening new revenue streams. -

Regulatory and Competitive Pressures

Despite its strengths, Visa faces rising regulatory scrutiny over interchange fees, network exclusivity, and data practices in regions like the EU, U.S., and India. Open banking mandates and the rise of alternative payment methods (e.g., central bank digital currencies, super-apps) could challenge Visa’s dominance. To remain competitive, Visa is likely to focus on compliance innovation, interoperability, and strategic acquisitions in the fintech space. -

Sustainability and ESG Integration

Environmental, Social, and Governance (ESG) considerations are becoming central to investor and consumer expectations. By 2026, Visa is expected to deepen its sustainability initiatives—such as carbon footprint tracking for transactions, green card programs, and partnerships with eco-conscious merchants—to align with global climate goals and attract ESG-focused stakeholders.

Conclusion

By 2026, Visa is expected to remain a pivotal player in the global payments landscape, leveraging technology, strategic partnerships, and regulatory agility to drive growth. While challenges around competition and regulation persist, Visa’s scalable network, brand strength, and innovation pipeline position it well for sustained profitability and market leadership in the digital economy.

Note: If “VS” refers to another entity (e.g., a tech startup, brand, or product), please clarify for a tailored analysis.

Common Pitfalls in Sourcing: Quality and Intellectual Property (IP) Risks

Sourcing products or components from third-party suppliers—especially internationally—offers cost and scalability advantages, but it also introduces significant risks related to quality and intellectual property (IP). Failing to address these can result in product failures, reputational damage, legal disputes, and financial loss. Below are common pitfalls in these two critical areas.

Quality-Related Pitfalls

1. Inadequate Supplier Vetting

A frequent mistake is selecting suppliers based solely on price or speed, without thoroughly assessing their manufacturing capabilities, quality control processes, or track record. This can lead to inconsistent product quality, defects, or non-compliance with industry standards.

2. Poorly Defined Specifications

Vague or incomplete technical specifications increase the risk of misinterpretation. Without clear documentation (e.g., materials, tolerances, testing protocols), suppliers may deliver substandard products that do not meet functional or safety requirements.

3. Insufficient Quality Control Oversight

Relying solely on a supplier’s internal quality checks—without independent inspections or audits—can result in undetected defects reaching the final product. Skipping pre-shipment inspections or failing to implement a robust quality assurance program exacerbates this risk.

4. Lack of Process Standardization

Suppliers may change manufacturing processes or subcontract to unapproved vendors without notifying the buyer. This lack of transparency can compromise consistency and traceability, especially in regulated industries.

5. Inconsistent Communication and Feedback Loops

Miscommunication due to language barriers, time zone differences, or unclear feedback mechanisms can delay issue resolution and erode quality over time.

Intellectual Property (IP)-Related Pitfalls

1. Inadequate Legal Protection in Contracts

Many sourcing agreements fail to clearly define IP ownership, usage rights, or confidentiality obligations. Without strong contractual safeguards, suppliers may claim partial ownership or misuse proprietary designs, software, or processes.

2. Weak Enforcement in IP-Prone Jurisdictions

In some countries, IP laws are either underdeveloped or poorly enforced. Suppliers may reverse-engineer products, produce counterfeit versions, or sell proprietary information to competitors with minimal legal consequences.

3. Overexposure of Sensitive Information

Sharing blueprints, source code, or trade secrets without proper need-to-know restrictions or non-disclosure agreements (NDAs) increases the risk of IP theft. Even with NDAs, enforcement can be challenging across borders.

4. Supplier Becomes a Competitor

A serious long-term risk is when a supplier uses acquired knowledge or designs to develop and market competing products—sometimes even targeting the original buyer’s customer base.

5. Lack of IP Monitoring and Auditing

Failing to monitor how a supplier uses IP or conduct periodic audits enables misuse to go unnoticed. Without proactive oversight, infringement or unauthorized replication may only be discovered after significant damage has occurred.

Mitigation Strategies

To avoid these pitfalls, businesses should:

– Conduct rigorous due diligence on suppliers.

– Define clear technical and quality requirements in writing.

– Implement third-party quality inspections and audits.

– Use strong, jurisdiction-specific contracts that protect IP rights.

– Limit access to sensitive information and use phased disclosure.

– Monitor supplier activities and retain legal counsel familiar with international IP law.

Proactively addressing quality and IP concerns during sourcing can prevent costly disruptions and safeguard long-term competitive advantage.

Logistics & Compliance Guide for VS

Overview of VS Logistics Framework

The logistics and compliance framework for VS (Virtual Systems or Vendor Solutions, depending on context) involves the strategic coordination of supply chain operations, transportation, warehousing, and regulatory adherence. This guide outlines best practices, compliance requirements, and logistical considerations to ensure efficient and lawful operations.

Regulatory Compliance Requirements

VS must adhere to international, federal, and regional regulations including customs documentation, import/export controls, and product-specific standards (e.g., FDA, CE marking). Ensure all shipments include accurate Harmonized System (HS) codes, commercial invoices, and certificates of origin. Maintain records for a minimum of five years to satisfy audit requirements.

Transportation & Carrier Management

Select carriers with proven reliability and compliance certifications (e.g., ISO 9001, CTPAT). Utilize real-time tracking systems for shipment visibility. Define service level agreements (SLAs) for delivery timelines, damage rates, and claims processing. Optimize routing to reduce costs and environmental impact.

Warehouse & Inventory Controls

Implement warehouse management systems (WMS) to track inventory in real time. Conduct regular cycle counts and annual audits to ensure accuracy. Store goods according to safety and regulatory guidelines (e.g., hazardous materials, temperature-sensitive items). Enforce strict access controls and security protocols.

Documentation & Recordkeeping

Maintain comprehensive digital records of all logistics transactions, including bills of lading, packing lists, customs filings, and compliance certifications. Automate document generation where possible to reduce errors. Ensure data is backed up securely and accessible during inspections.

Risk Management & Contingency Planning

Identify potential supply chain disruptions (e.g., geopolitical events, natural disasters) and develop contingency plans. Diversify suppliers and transportation routes. Carry appropriate cargo insurance and verify carrier liability coverage.

Sustainability & Ethical Sourcing

Align logistics operations with corporate sustainability goals. Partner with vendors and carriers committed to carbon reduction and ethical labor practices. Monitor and report on key environmental metrics such as fuel consumption and emissions.

Audit & Continuous Improvement

Conduct regular internal and third-party audits of logistics and compliance processes. Use findings to refine procedures, train staff, and upgrade systems. Stay informed on regulatory changes and industry best practices to maintain ongoing compliance and operational excellence.

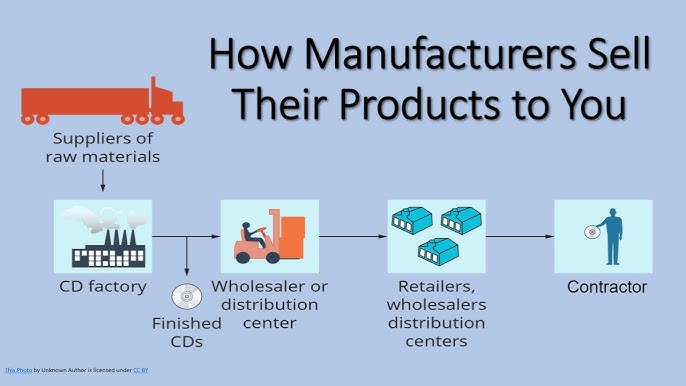

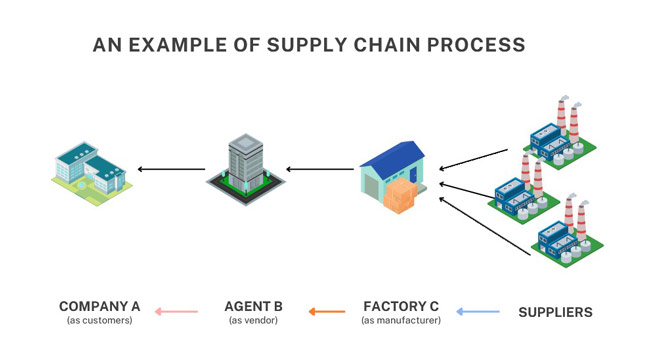

Conclusion: Sourcing from Manufacturer vs. Supplier

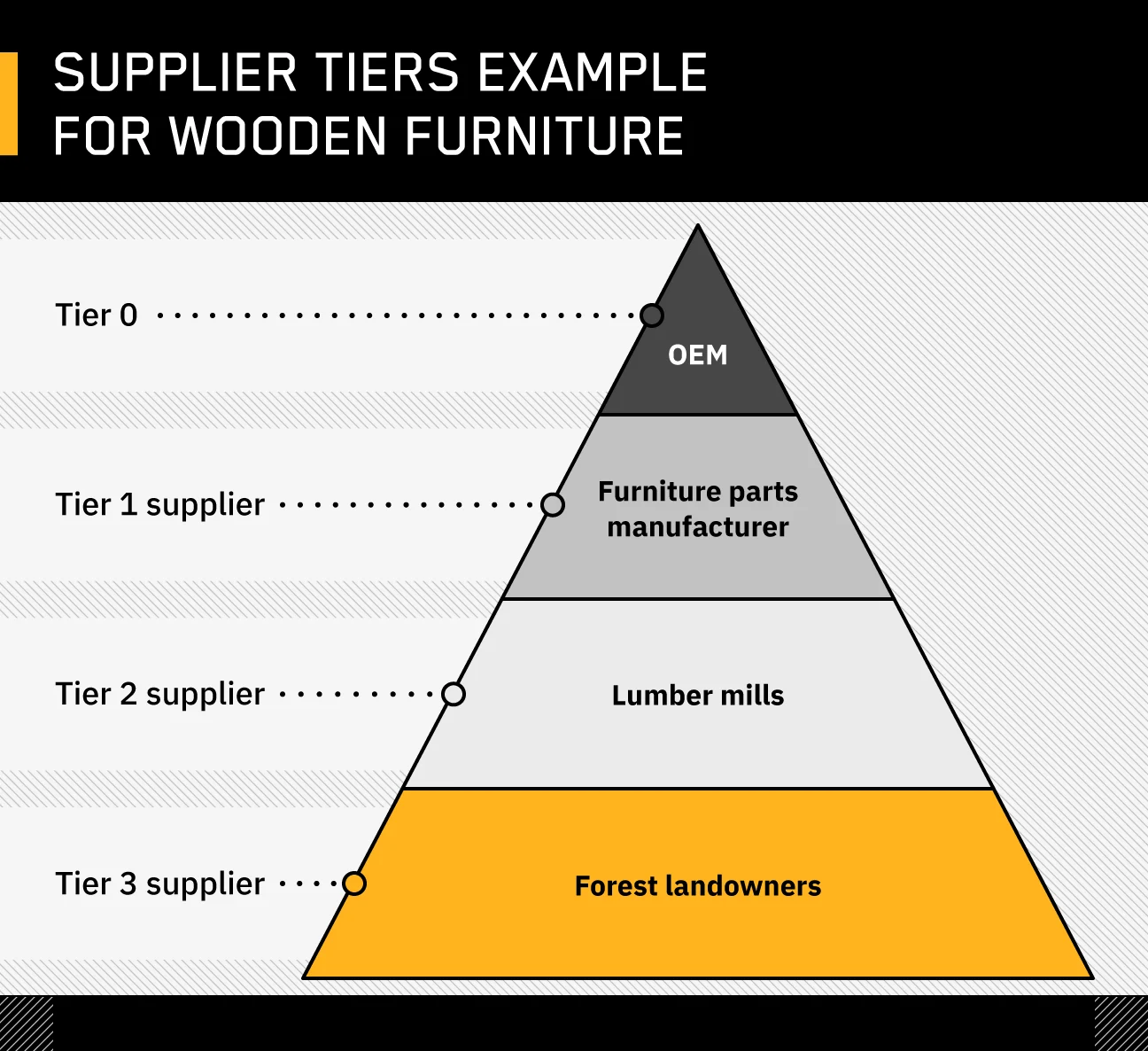

Deciding between sourcing directly from a manufacturer or through a supplier depends on several key factors including cost, control, scale, expertise, and supply chain complexity.

Sourcing from a manufacturer typically offers lower unit costs, greater customization options, and increased control over quality and production timelines—ideal for businesses with higher order volumes and in-house supply chain management capabilities. However, it often requires larger minimum order quantities (MOQs), longer lead times, and more direct oversight.

On the other hand, sourcing through a supplier (such as a distributor or trading company) provides greater flexibility, faster turnaround, lower MOQs, and valuable logistical support—making it ideal for startups, small businesses, or brands testing new markets. Suppliers can simplify procurement and reduce operational burden, though often at a higher per-unit cost and with less transparency in the production process.

Ultimately, the choice should align with your business size, product strategy, budget, and long-term goals. For scalability and cost-efficiency, manufacturers may be preferable in the long run; for speed, convenience, and flexibility, suppliers offer significant advantages. A hybrid approach—leveraging manufacturers for core products and suppliers for niche or seasonal items—can also optimize overall sourcing effectiveness. Careful evaluation of risks, reliability, and relationship management is essential in either scenario to ensure sustainable success.