The global cosmetic products market is experiencing robust expansion, driven by rising consumer awareness, increasing disposable incomes, and growing demand for natural and organic ingredients. According to Grand View Research, the global cosmetics market size was valued at USD 415.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 5.6% over the forecast period (2024–2029), fueled by innovations in skincare, clean beauty trends, and expanding e-commerce distribution channels. As competition intensifies, a select group of manufacturers are leading the way in product development, sustainability, and global reach. Here’s a data-informed look at the top 10 cosmetic product manufacturers shaping the industry’s future.

Top 10 Of Cosmetic Products Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Global Cosmetics

Domain Est. 2012

Website: global-cosmetics.com

Key Highlights: We manufacture trend-setting beauty products. From lipsticks to perfumes, we provide expert OEM and ODM manufacturing for beauty products….

#2 Columbia Cosmetics

Domain Est. 1998

Website: columbiacosmetics.com

Key Highlights: Explore top makeup & skin care manufacturers offering white label cosmetics & private label solutions. Discover beauty products & cosmetics development….

#3 Intercos Group

Domain Est. 1999

Website: intercos.com

Key Highlights: Intercos Group is a leading cosmetic contract manufacturer specialized in Development, Production and Packaging for major beauty labels….

#4 Top Makeup & Skincare Contract Manufacturer, USA

Domain Est. 2005

Website: newlookcosmetics.com

Key Highlights: At New Look Cosmetics, we offer formulation and contract manufacturing services for a full range of products for the face, eyes, lips, body and more….

#5 Arcade Beauty

Domain Est. 2015

Website: arcadebeauty.com

Key Highlights: Arcade Beauty is a leading global manufacturer for the beauty industry. Our century of industry expertise, expansive product portfolio, and 12 strategically ……

#6 Coty

Domain Est. 1998

Website: coty.com

Key Highlights: We are one of the world’s largest beauty companies with an iconic portfolio of brands across fragrance, color cosmetics, skin and body care….

#7 Beauty Manufacturing Solutions Corp

Domain Est. 2006

Website: beautymanufacture.com

Key Highlights: Unmatched expertise in developing new products in personal care, including skincare, haircare, color cosmetics, and fragrance products….

#8 e.l.f. Beauty

Domain Est. 2016

Website: elfbeauty.com

Key Highlights: e.l.f. Beauty is a bold disruptor with a kind heart. We stand with every eye, lip, face, paw and fin. We’re making the best of beauty accessible to ……

#9 SBLC Cosmetics

Domain Est. 2020

Website: sblcomp.com

Key Highlights: We are your one-stop-shop for bringing cosmetic products to market. From private label and formulation development to custom packaging, brand development, ……

#10 Cosmetic & Personal Care Product Manufacturing

Domain Est. 2021

Website: plzcorp.com

Key Highlights: we have a full range of services to help you design, manufacture, or deliver your product — or we can handle it all ……

Expert Sourcing Insights for Of Cosmetic Products

2026 Market Trends for Cosmetic Products

The global cosmetic products market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and increasing regulatory scrutiny. As sustainability, personalization, and digital engagement become central to brand strategies, companies must adapt to remain competitive. Below are key trends shaping the cosmetic industry in 2026.

Rise of Clean and Sustainable Beauty

Consumers are increasingly demanding transparency in ingredient sourcing and environmental impact. By 2026, clean beauty—defined by non-toxic, ethically sourced, and eco-friendly formulations—will dominate the market. Brands are prioritizing biodegradable packaging, carbon-neutral production, and refillable product models to meet sustainability goals. Certifications like COSMOS, Leaping Bunny, and EcoCert are becoming essential for consumer trust.

Personalization Through AI and Data Analytics

Advancements in artificial intelligence and machine learning have enabled hyper-personalized skincare and makeup experiences. By 2026, AI-powered skin analysis apps, virtual try-ons, and DNA-based skincare regimens are mainstream. Major brands and startups alike are leveraging consumer data to offer customized product recommendations, enhancing customer loyalty and reducing product waste.

Inclusivity and Diversity in Product Lines

Inclusivity has moved beyond marketing to become a core business strategy. By 2026, cosmetic brands are expanding shade ranges, developing products for diverse skin types and tones, and featuring underrepresented communities in advertising. Gender-neutral beauty lines are also gaining traction, reflecting broader societal shifts toward fluid identity expression.

Growth of the Men’s Grooming Segment

The male grooming market is experiencing robust growth, with increased demand for skincare, haircare, and cosmetic products tailored to men. By 2026, this segment is projected to expand at a compound annual growth rate (CAGR) of over 7%. Brands are investing in targeted formulations and marketing campaigns that resonate with younger, style-conscious male consumers.

E-commerce and Social Commerce Expansion

Online sales channels continue to dominate, with social commerce platforms like Instagram, TikTok, and WeChat driving discovery and purchase decisions. By 2026, live-streamed beauty events, influencer collaborations, and shoppable content are key drivers of revenue. Direct-to-consumer (DTC) models allow brands to build stronger relationships with their audiences and collect valuable data.

Regulatory and Ingredient Transparency

Regulatory bodies worldwide are tightening restrictions on harmful ingredients and greenwashing. By 2026, compliance with regulations such as the EU’s Chemicals Strategy for Sustainability and the U.S. Modernization of Cosmetics Regulation Act (MoCRA) is critical. Brands are investing in clear labeling, ingredient traceability, and third-party verification to maintain credibility.

Innovation in Biotechnology and Green Chemistry

Biotech-derived ingredients—such as lab-grown collagen, plant stem cells, and fermented actives—are gaining popularity for their efficacy and low environmental impact. Green chemistry principles are being adopted to replace synthetic compounds with bio-based alternatives. This shift supports both performance and sustainability, attracting eco-conscious consumers.

Conclusion

The cosmetic products market in 2026 is defined by innovation, responsibility, and customer-centricity. Companies that embrace clean formulations, digital personalization, inclusivity, and sustainable practices will lead the industry. As consumer expectations evolve, agility and authenticity will be the hallmarks of successful cosmetic brands.

Common Pitfalls in Sourcing Cosmetic Products (Quality, IP)

Sourcing cosmetic products, especially from third-party manufacturers or overseas suppliers, can be a cost-effective strategy for brands. However, it comes with significant risks, particularly concerning product quality and intellectual property (IP) protection. Being aware of these common pitfalls is essential for maintaining brand integrity, ensuring consumer safety, and avoiding legal complications.

Quality Control Challenges

One of the most critical concerns in cosmetic sourcing is maintaining consistent product quality. Poor quality control can lead to customer dissatisfaction, product recalls, and damage to brand reputation.

Inconsistent Formulations

Suppliers may alter formulations without notice due to raw material availability or cost-cutting measures. These changes can affect product performance, scent, texture, or stability, leading to inconsistencies across batches.

Substandard Raw Materials

Some manufacturers may use low-grade or unverified ingredients to reduce costs. This compromises product efficacy and may introduce allergens or contaminants, increasing the risk of adverse reactions.

Lack of Certifications and Compliance

Suppliers operating without proper certifications (e.g., GMP, ISO 22716, or FDA compliance) may not adhere to international safety and hygiene standards. This increases the risk of microbiological contamination and non-compliance with regional regulations.

Inadequate Testing and Validation

Reliable suppliers conduct stability, compatibility, and microbial testing. Sourcing from manufacturers that skip these steps exposes brands to shelf-life issues and safety hazards.

Intellectual Property Risks

Protecting intellectual property is often overlooked in cosmetic sourcing but is crucial to maintaining brand uniqueness and preventing unauthorized replication.

Formula Theft and Replication

Sharing proprietary formulations with manufacturers without legal safeguards can result in the supplier replicating or selling your formula to competitors. This is especially prevalent in regions with weak IP enforcement.

Lack of Confidentiality Agreements

Failing to sign a robust Non-Disclosure Agreement (NDA) before disclosing formulations, packaging designs, or branding elements leaves your IP vulnerable to misuse.

Unauthorized Use of Brand Assets

Suppliers may use your brand name, logo, or product designs for their marketing or portfolio without permission, potentially misleading customers or creating counterfeit products.

Weak Contractual Protections

Sourcing contracts that don’t clearly define IP ownership, usage rights, and post-contract obligations can result in legal disputes. Ensure that all IP developed during production (e.g., custom molds, unique packaging) is explicitly assigned to your brand.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough due diligence on potential suppliers, including site audits and sample testing.

– Require certifications and proof of compliance with relevant cosmetic regulations (e.g., EU Annex compliance, FDA).

– Use legally binding agreements covering NDAs, IP ownership, and quality standards.

– Retain rights to all formulations and physical assets (e.g., molds, packaging).

– Perform regular quality audits and third-party lab testing of finished products.

By proactively addressing quality and IP risks, brands can build secure, reliable sourcing relationships that support long-term success.

Logistics & Compliance Guide for Cosmetic Products

Regulatory Framework and Market Authorization

Cosmetic products must comply with the regulatory requirements of the target market. In the European Union, Regulation (EC) No 1223/2009 governs cosmetics, requiring a Responsible Person (RP) to ensure product safety and compliance. In the United States, the FDA oversees cosmetics under the Federal Food, Drug, and Cosmetic Act (FD&C Act), though pre-market approval is not required. Always verify local regulations in countries such as Canada, Australia, Japan, and others, as compliance standards may vary.

Product Safety and Cosmetic Product Safety Report (CPSR)

Before placing a cosmetic product on the market, a Cosmetic Product Safety Report (CPSR) must be prepared by a qualified safety assessor. The CPSR evaluates the safety of the formulation, including ingredient concentrations, exposure, and potential risks. This report is mandatory in the EU and should be maintained in the Product Information File (PIF).

Ingredient Compliance and Labeling

Ensure all ingredients comply with permitted substances lists, concentration limits, and banned or restricted substances defined by regional regulations. Labels must include:

– Product name

– Name and address of the Responsible Person

– Net quantity

– Date of minimum durability or period after opening

– Precautions for use

– Batch number

– List of ingredients (INCI names) in descending order of weight

In the U.S., labels must follow FDA guidelines, including the ingredient list in descending order of predominance.

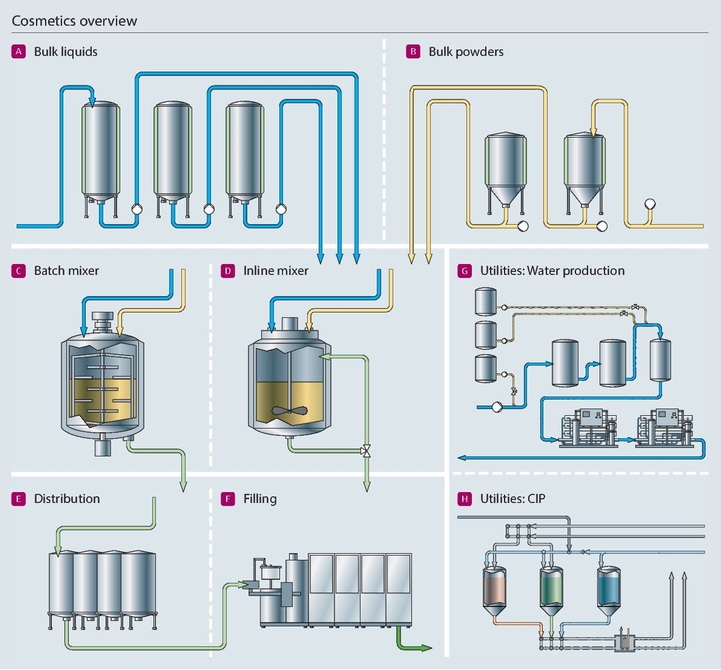

Good Manufacturing Practices (GMP)

Manufacturers must follow ISO 22716 or equivalent Good Manufacturing Practices to ensure product quality and safety. GMP compliance covers hygiene, equipment maintenance, personnel training, documentation, and quality control procedures. Regular audits and certifications are recommended to demonstrate adherence.

Import and Export Regulations

International shipping requires compliance with customs, import duties, and documentation. Key documents include commercial invoices, packing lists, certificates of origin, and, if applicable, a free sale certificate or Certificate of Free Sale (CFS). Some countries may require product registration or notification prior to import.

Customs Classification and Tariffs

Cosmetic products are classified under the Harmonized System (HS Code). Typical HS codes for cosmetics range from 3304 (beauty or makeup preparations) to 3305 (preparations for perfuming or deodorizing rooms). Accurate classification ensures correct duty assessment and smooth customs clearance.

Transportation and Storage

Cosmetics must be transported and stored under appropriate conditions to prevent degradation. Consider temperature sensitivity, light exposure, and shelf life. Use validated cold chain logistics if required. Ensure packaging is secure to prevent leakage or contamination during transit.

Environmental and Sustainability Compliance

Increasingly, regulations and consumer demand emphasize sustainable practices. Comply with packaging waste directives (e.g., EU Packaging and Packaging Waste Directive), ensure recyclability, and minimize hazardous substances. Some regions require take-back schemes or environmental labeling.

Post-Market Surveillance and Incident Reporting

After product launch, monitor adverse reactions and consumer complaints. In the EU, serious undesirable effects must be reported to the competent authority within 15 days. Maintain a system for tracking, investigating, and documenting incidents. Update the PIF as necessary.

Record Keeping and Documentation

Retain all compliance documents for at least 10 years after the last batch is manufactured. This includes the CPSR, PIF, GMP certificates, labeling records, and supplier documentation. Digital record management systems are recommended for traceability and audit readiness.

Updates and Regulatory Monitoring

Regulations evolve frequently. Subscribe to regulatory updates from agencies such as the EU Commission, FDA, Health Canada, and other relevant bodies. Regularly review formulations and compliance status to ensure continued market authorization.

Conclusion: Sourcing a Manufacturer for Cosmetic Products

Sourcing the right manufacturer for cosmetic products is a critical step that directly impacts product quality, regulatory compliance, brand reputation, and long-term success. After evaluating potential manufacturers based on criteria such as certifications (e.g., GMP, ISO, FDA compliance), production capabilities, ingredient sourcing, minimum order quantities, pricing, lead times, and track record, it becomes evident that a strategic and thorough selection process is essential.

A reliable manufacturing partner should not only meet technical and regulatory standards but also align with your brand’s values—such as sustainability, innovation, and customer safety. Clear communication, transparency, and the ability to scale production as your brand grows are equally important considerations. Additionally, conducting site visits, requesting samples, and reviewing client testimonials can provide valuable insights into a manufacturer’s reliability and quality control practices.

In conclusion, investing time and resources into selecting the right cosmetic manufacturer lays the foundation for a successful product launch and brand growth. By prioritizing quality, compliance, and partnership, brands can ensure consistency, build consumer trust, and remain competitive in the dynamic cosmetics industry.