The global laser manufacturing market has experienced robust growth, driven by rising demand across industrial, medical, telecommunications, and defense sectors. According to a 2023 report by Mordor Intelligence, the laser market was valued at USD 16.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2028, reaching an estimated USD 25.5 billion by the end of the forecast period. This expansion is fueled by advancements in fiber and semiconductor lasers, increased automation in manufacturing, and the growing adoption of laser-based solutions in precision applications such as micromachining and medical surgery. As innovation accelerates and industries seek higher efficiency and accuracy, the competitive landscape is shaped by a select group of leading manufacturers pushing the boundaries of laser technology. Based on market presence, technological innovation, and revenue performance, the following are the top 10 laser manufacturers leading this dynamic sector.

Top 10 Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Fiber Laser

Website: imra.com

Key Highlights: IMRA America, Inc. is dedicated to creative research and innovation leading to the development of essential technologies for industrial use….

#2 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#3 Amplitude

Website: amplitude-laser.com

Key Highlights: Amplitude is a leading manufacturer of femtosecond lasers. We are laying the foundations for advances in science, industry, and health care….

#4 Laser Technologies Inc

Website: lasertechnologiesinc.com

Key Highlights: Laser Technologies is a fully integrated turnkey manufacturer specializing in laser cutting and stamping laminations for the motor and generator industry as ……

#5 Laser Company for Industrial Laser Solutions

Website: laserline.com

Key Highlights: The leading laser company for integrated & customized diode laser manufacturing solutions for various industries & applications….

#6 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#7 to Sciton Medical & Aesthetic Laser Technologies

Website: sciton.com

Key Highlights: A leader in energy-based medical aesthetics. Sciton was founded to build exceptional lasers and light sources to improve people’s lives….

#8 Laser Tech

Website: lasertech.com

Key Highlights: Laser Tech is a global leader in innovative laser speed & distance measurement equipment bringing efficiency & improved safety to your industry….

#9 Coherent

Website: coherent.com

Key Highlights: Deliver laser solutions that drive innovations in display manufacturing and performance, especially for mobile devices….

#10 Nuburu Blue Laser Company

Website: nuburu.net

Key Highlights: NUBURU’s blue lasers uniquely deliver kW-class power with galvo scanner compatibility, enabling high speed welding with a large process window and micron-scale ……

Expert Sourcing Insights for Laser

H2: 2026 Market Trends for Lasers

The global laser market is poised for significant transformation by 2026, driven by technological advancements, expanding industrial applications, and growing demand across key sectors. In the second half of 2026 (H2), several converging trends are expected to shape the industry landscape, including increased adoption in manufacturing, healthcare, defense, and emerging applications in quantum technologies and photonic computing.

-

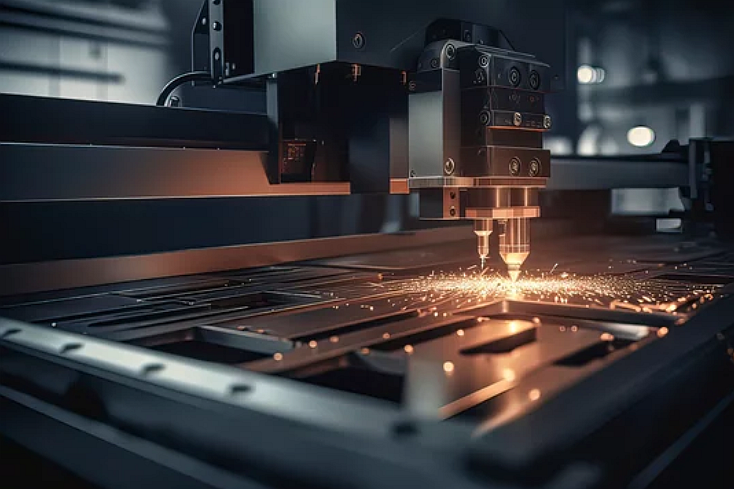

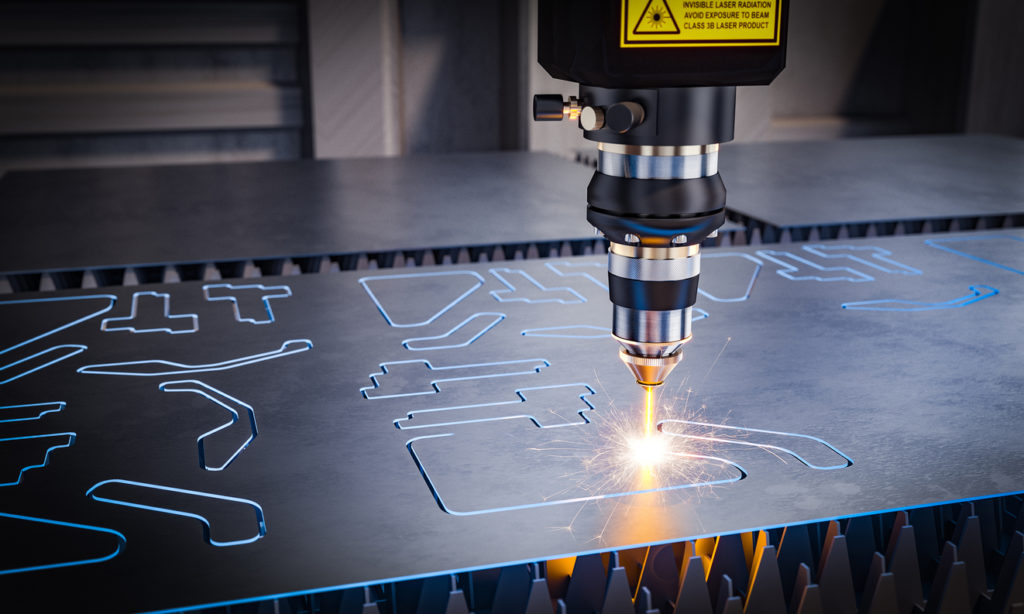

Industrial Manufacturing and Materials Processing

In H2 2026, high-power fiber and ultrafast lasers will continue to dominate industrial applications such as precision cutting, welding, and additive manufacturing (3D printing). The push for automation and smart factories—particularly in automotive and aerospace—will fuel demand for reliable, high-efficiency laser systems. Green and ultraviolet lasers will gain traction in microfabrication due to their precision in processing sensitive materials like semiconductors and flexible electronics. -

Healthcare and Medical Applications

The medical laser market will see accelerated growth in H2 2026, especially in minimally invasive surgeries, dermatology, ophthalmology, and dental procedures. Advances in diode and solid-state lasers will improve treatment efficacy and reduce recovery times. Regulatory approvals for new laser-based therapies, particularly in oncology and neurology, are expected to expand market access in North America and Europe. -

Consumer Electronics and Displays

Lasers will play a crucial role in next-generation display technologies such as laser projectors and micro-LED fabrication. The integration of laser annealing in semiconductor production, especially for OLED and foldable screens, will boost demand from Asia-Pacific electronics manufacturers. Apple, Samsung, and other OEMs are likely to increase laser system procurement to meet production timelines. -

Defense and Aerospace

Directed-energy weapons (DEWs) and laser-based defense systems will move from testing to deployment phases by H2 2026. Countries including the U.S., China, and members of NATO will invest heavily in laser counter-drone and missile defense technologies. This shift will open new revenue streams for defense contractors and laser component suppliers. -

Photonic Integration and Quantum Technologies

A nascent but high-potential trend in H2 2026 is the use of semiconductor lasers in quantum computing and secure communications (quantum key distribution). Silicon photonics platforms incorporating on-chip lasers are expected to mature, enabling faster data transmission in data centers and supporting the rollout of 6G infrastructure. -

Sustainability and Energy Efficiency

As global ESG standards tighten, laser manufacturers will focus on developing energy-efficient systems with longer lifespans and reduced environmental impact. Recycling of rare-earth elements used in solid-state lasers and improved thermal management designs will become competitive differentiators. -

Regional Market Dynamics

Asia-Pacific will remain the largest market due to robust industrialization in China, India, and South Korea. Europe will lead in precision engineering and medical laser innovation, while North America will dominate in defense and R&D-driven applications.

Conclusion

By H2 2026, the laser market will reflect a convergence of industrial maturity and disruptive innovation. Companies that invest in miniaturization,智能化 (smart automation), and cross-sector applications will be best positioned to capture growth. Total market value is projected to exceed $25 billion by year-end, with double-digit growth in ultrafast and semiconductor laser segments.

Common Pitfalls Sourcing Lasers: Quality and Intellectual Property Risks

Sourcing lasers—especially for industrial, medical, or high-tech applications—comes with significant risks if due diligence is not rigorously applied. Two of the most critical areas where companies often encounter problems are laser quality inconsistencies and intellectual property (IP) infringement. Failing to address these pitfalls can result in product failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

One of the most frequent challenges when sourcing lasers is ensuring consistent, reliable performance. Many suppliers—particularly from regions with less stringent manufacturing oversight—may deliver products that do not meet specified technical standards.

-

Inconsistent Output Power and Beam Quality: Lasers may claim certain power outputs or beam characteristics (e.g., M² factor, divergence), but actual performance can vary significantly between units or over time. This inconsistency can disrupt manufacturing processes or compromise medical treatments.

-

Poor Thermal Management and Reliability: Lower-tier manufacturers may use inadequate cooling systems or substandard materials, leading to premature failure, wavelength drift, or reduced operational lifespan.

-

Lack of Traceability and Testing Documentation: Reputable suppliers provide comprehensive test reports (e.g., L-I-V curves, spectral analysis). Sourcing from vendors who do not offer full traceability increases the risk of receiving non-compliant or counterfeit components.

-

Insufficient Environmental and Safety Certifications: Lasers used in regulated industries must comply with standards like IEC 60825 (laser safety) or FDA regulations. Sourcing without verifying certifications can lead to compliance failures and legal liability.

Intellectual Property (IP) Risks

Another major pitfall involves unintentionally sourcing lasers that infringe on third-party patents or incorporate stolen technology.

-

Counterfeit or Cloned Designs: Some suppliers, particularly in less regulated markets, offer lasers that closely mimic branded products but are reverse-engineered without proper licensing. Using such components exposes the buyer to IP litigation.

-

Unclear IP Ownership in OEM/ODM Arrangements: When working with original equipment manufacturers (OEMs) or original design manufacturers (ODMs), contracts may not clearly assign IP rights to custom-developed laser modules. This can lead to disputes over ownership or restrict future product development.

-

Use of Licensed Technology Without Authorization: Certain laser diodes or control systems incorporate patented technology (e.g., from companies like Coherent, IPG Photonics, or II-VI Incorporated). If the supplier lacks proper sublicensing, the end user may be held liable for infringement.

-

Inadequate IP Due Diligence: Buyers often focus on price and delivery timelines while neglecting to investigate the supplier’s IP portfolio, patent licenses, or freedom-to-operate (FTO) status. This oversight can result in costly legal challenges after integration into final products.

Mitigation Strategies

To avoid these pitfalls, companies should:

– Conduct technical audits and request sample testing from independent labs.

– Verify compliance with international standards and request full certification documentation.

– Perform IP due diligence, including patent landscape reviews and supplier licensing checks.

– Include IP indemnification clauses in procurement contracts.

– Prioritize suppliers with transparent manufacturing processes and established reputations.

By proactively addressing quality and IP concerns, organizations can reduce risk and ensure the reliability and legality of their laser-based systems.

Logistics & Compliance Guide for Laser Equipment

Proper handling, transportation, and regulatory compliance are essential when shipping laser equipment. This guide outlines key considerations to ensure safe, legal, and efficient logistics operations.

Regulatory Classification and Documentation

Laser devices are subject to international and national regulations due to their potential hazards. Accurate classification and documentation are critical for compliance.

- Laser Safety Standards: Ensure equipment complies with the IEC 60825-1 standard for laser product safety. Labeling must include the laser class (e.g., Class 1, Class 4), wavelength, output power, and appropriate warning symbols.

- FDA/CDRH Regulations (U.S.): For U.S. shipments, manufacturers and importers must comply with U.S. Food and Drug Administration (FDA) Center for Devices and Radiological Health (CDRH) requirements. This includes product reporting, certification, and submission of an Accession Number.

- EU Compliance: Within the European Union, lasers must meet the requirements of the Low Voltage Directive (LVD), Electromagnetic Compatibility (EMC) Directive, and the Radio Equipment Directive (if applicable), along with CE marking.

- Export Controls: High-powered lasers may be subject to export control regulations such as the International Traffic in Arms Regulations (ITAR) or the Export Administration Regulations (EAR). Verify if your product requires an export license.

Packaging and Handling Requirements

Lasers are precision instruments that require specialized packaging to prevent damage and ensure safety during transit.

- Shock and Vibration Protection: Use custom-fitted foam, cushioning materials, and rigid outer packaging to protect sensitive optical and electronic components.

- Environmental Protection: Seal packaging to prevent moisture, dust, or temperature extremes from affecting performance. Include desiccants if necessary.

- Orientation Labels: Mark packages with “This Side Up” and “Fragile” indicators to guide proper handling.

- Laser Safety Precautions: Ensure lasers are powered off and secured to prevent accidental activation. Remove batteries if applicable. Cover apertures with protective caps.

Transportation and Shipping

Select appropriate carriers and shipping methods based on laser class, destination, and regulatory requirements.

- Classified Shipments: Class 3B and Class 4 lasers are considered hazardous goods in some contexts. Check with carriers (e.g., IATA, IMDG) for requirements on air or sea freight.

- Labeling and Marking: Packages must display proper hazard labels, laser warning labels, handling instructions, and compliance marks (e.g., CE, FCC).

- Carrier Compliance: Notify carriers in advance if shipping high-powered lasers. Some carriers require special handling forms or declarations.

- Temperature Control: For temperature-sensitive lasers, use climate-controlled transport to avoid performance degradation.

Import and Customs Clearance

Smooth customs processing requires accurate declarations and supporting documentation.

- Harmonized System (HS) Code: Use the correct HS code for laser equipment (e.g., 9013.20 for laser diodes or 8543.70 for other optoelectronic devices) to determine duties and restrictions.

- Commercial Invoice and Packing List: Include detailed descriptions, quantities, values, country of origin, and end-use information.

- Certificates of Conformity: Provide test reports, CE certificates, FCC declarations of conformity, or other required certifications upon request.

- Import Licenses: Some countries require special permits for laser imports, particularly for industrial or medical lasers.

End-User Compliance and Training

Ensure recipients are prepared to use the laser safely and legally.

- Safety Manuals and Documentation: Include user manuals, safety instructions, and compliance certificates with each shipment.

- Installation and Training: Offer remote or on-site training for high-power or industrial laser systems to ensure regulatory and operational compliance.

- Local Regulations: Advise end users to verify compliance with local occupational safety, radiation protection, and laser use laws (e.g., OSHA in the U.S., HSE in the UK).

Recordkeeping and Audit Preparedness

Maintain detailed records to support compliance and streamline audits.

- Shipping Logs: Document shipment dates, destinations, equipment specs, compliance certifications, and carrier details.

- Regulatory Filings: Retain copies of FDA submissions, export licenses, CE technical files, and conformity assessments for at least five years.

- Incident Reporting: Establish procedures for reporting and investigating any safety incidents related to laser use or transport.

By adhering to this logistics and compliance guide, businesses can mitigate risks, avoid delays, and ensure the safe and lawful distribution of laser equipment worldwide.

Conclusion for Sourcing a Laser Manufacturer:

Sourcing a reliable laser manufacturer is a critical decision that directly impacts product quality, performance, compliance, and long-term business success. After thorough evaluation of potential suppliers, key factors such as technical expertise, production capabilities, quality certifications (e.g., ISO, FDA, CE), R&D investment, customer support, and cost-efficiency must align with your project requirements.

It is recommended to partner with a manufacturer that offers proven experience in your specific laser application (e.g., industrial cutting, medical devices, or telecommunications), demonstrates consistent quality control, and provides scalability for future needs. Conducting on-site audits, requesting samples, and reviewing client testimonials can further validate a manufacturer’s reliability.

Ultimately, selecting the right laser manufacturing partner is not solely about cost, but about building a sustainable, collaborative relationship that ensures innovation, precision, and compliance in every laser solution delivered.