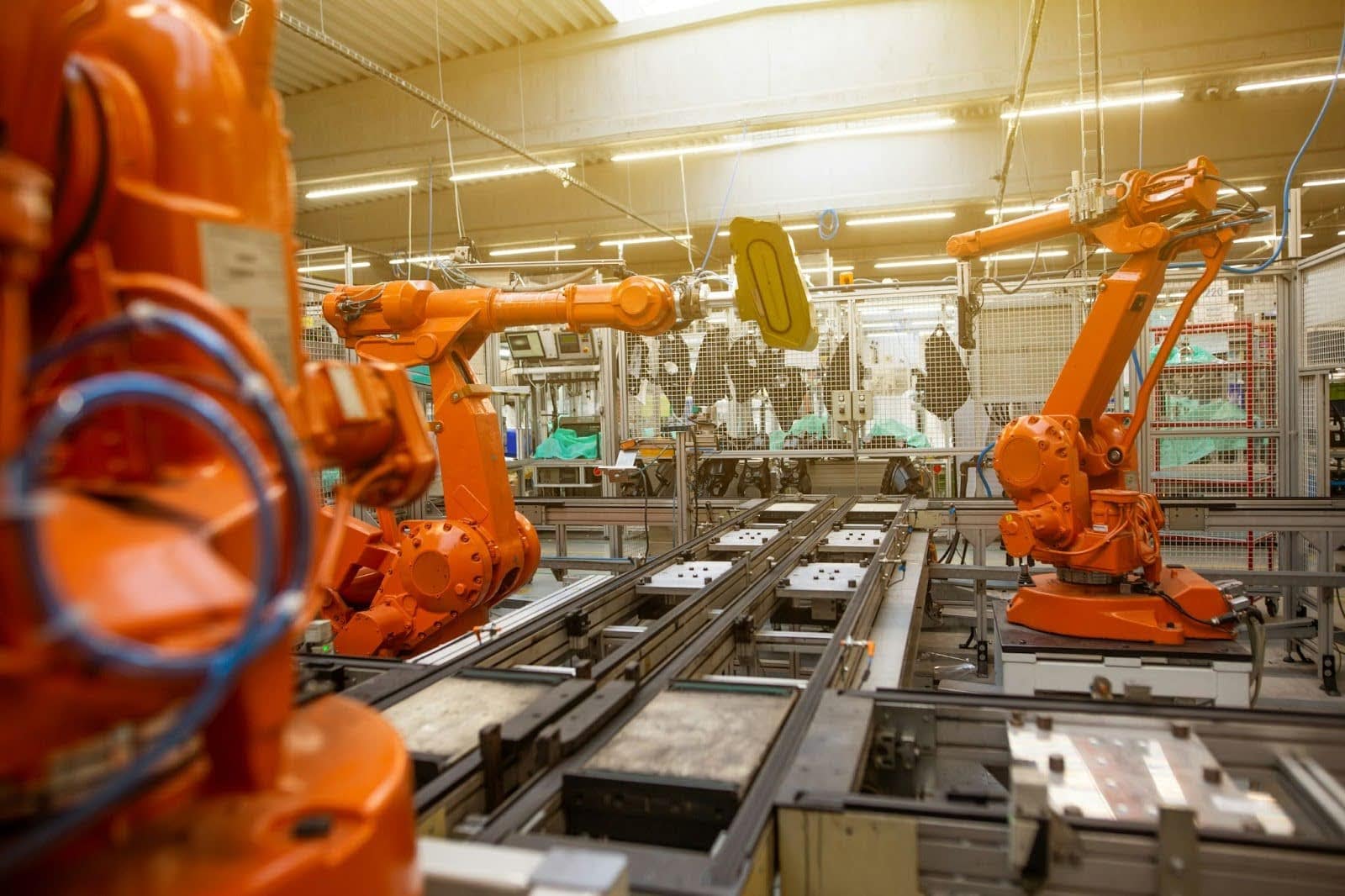

The global manufacturing sector continues to experience robust expansion, driven by rising industrialization, technological advancements, and increasing demand for automation and smart production systems. According to Grand View Research, the global manufacturing market was valued at USD 14.7 trillion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. This growth is further amplified by trends such as Industry 4.0 adoption, reshoring initiatives, and sustainable manufacturing practices. As competition intensifies, a select group of manufacturers have risen to the forefront through innovation, operational excellence, and strategic scalability. Based on market performance, revenue data, and industry influence, the following analysis highlights the top 10 manufacturing companies shaping the future of global production.

Top 10 In Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DuPont

Domain Est. 1987

Website: dupont.com

Key Highlights: DuPont is a leading solutions provider for healthcare, water, and a broad range of industrial segments, powered by high-performance engineered products, ……

#2 manufacturers website

Domain Est. 1991

Website: learn.microsoft.com

Key Highlights: Hi. I was just wondering, how do I find the manufacturers website for my laptop?? is there anyway I can find it in the computer?…

#3 Materials Science & Chemical Manufacturing

Domain Est. 1992

Website: dow.com

Key Highlights: Dow is a materials science company that offers a wide range of products and services, including agricultural films, construction materials, ……

#4 Murata Manufacturing Co., Ltd.

Domain Est. 1994

Website: murata.com

Key Highlights: This is Murata Manufacturing’s products-related website. You can view electronic component information, product and event news, exhibition, campaign and ……

#5 Taiwan Semiconductor Manufacturing Company Limited

Domain Est. 1993 | Founded: 1987

Website: tsmc.com

Key Highlights: TSMC has been the world’s dedicated semiconductor foundry since 1987, and we support a thriving ecosystem of global customers and partners with the ……

#6 Jabil

Domain Est. 1993

Website: jabil.com

Key Highlights: We are an engineering-led, supply chain-enabled manufacturing company. Our global team designs, builds, and delivers products that enable the future today….

#7 Rheem Manufacturing Company

Domain Est. 1995

Website: rheem.com

Key Highlights: Learn about Rheem’s innovative and efficient heating, cooling, and water heating solutions for homes and businesses….

#8 BASF

Domain Est. 1995

Website: basf.com

Key Highlights: At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility….

#9 Evonik

Domain Est. 2006

Website: evonik.com

Key Highlights: Additive Manufacturing. Discover Evonik’s Advanced Solutions for Additive Manufacturing ; Adhesives & Sealants. Advanced chemical solutions for enhanced adhesion ……

#10 Manufacturing Day

Domain Est. 2012

Website: mfgday.com

Key Highlights: MFG Day is manufacturing’s biggest annual opportunity to inspire the next generation to explore careers in modern manufacturing through a series of focused ……

Expert Sourcing Insights for In

H2: 2026 Market Trends for India – Strategic Outlook

As India moves into 2026, the country’s economy and market landscape are undergoing a transformative shift, driven by digital innovation, demographic momentum, policy reforms, and global positioning. This analysis explores key market trends shaping India’s trajectory in 2026 across major sectors, including technology, manufacturing, consumer behavior, sustainability, and finance.

- Digital Transformation and Tech-Led Growth

By 2026, India solidifies its status as a global digital powerhouse. The digital economy is projected to surpass $1 trillion, fueled by: - Rapid expansion of 5G and fiber-optic networks enabling high-speed connectivity in urban and rural areas.

- Growth of artificial intelligence (AI), with Indian startups and enterprises deploying AI in healthcare, agriculture, and financial services.

- Expansion of India Stack (UPI, Aadhaar, DigiLocker), which continues to drive financial inclusion and digital governance.

The government’s push for “Digital Bharat” and increased startup funding (over 120 unicorns as of 2025) position India as a top destination for tech innovation.

- Manufacturing and Atmanirbhar Bharat Momentum

India’s “Make in India” and “Atmanirbhar Bharat” (Self-Reliant India) initiatives gain stronger traction by 2026: - Electronics and semiconductor manufacturing rise due to PLI (Production-Linked Incentive) schemes, attracting global players like Apple, Samsung, and Foxconn to expand local production.

- India emerges as a key alternative to China in global supply chains, especially in electronics, pharmaceuticals, and textiles.

-

Green manufacturing and industrial automation gain momentum, supported by government and private sector investments.

-

Consumer Evolution and Rising Middle Class

With a median age of 29 and a growing middle class, India’s consumer market sees a surge in demand for: - Premium and personalized products in e-commerce, FMCG, and lifestyle sectors.

- Digital-first experiences, including social commerce and vernacular content platforms.

- Health and wellness products, driven by increased health awareness post-pandemic.

Rural consumption grows significantly, supported by improved digital access and income from government schemes and agri-tech innovations.

- Sustainability and Green Transition

Environmental, social, and governance (ESG) considerations become central to business strategy: - Renewable energy capacity targets reach 500 GW by 2030, with solar and wind investments accelerating.

- Electric vehicles (EVs) penetrate deeper into two-wheeler, three-wheeler, and public transport markets, supported by charging infrastructure and battery swapping policies.

-

Green hydrogen and sustainable agriculture attract venture capital and public-private partnerships.

-

Financial Sector Innovation and Inclusion

India’s financial ecosystem evolves with: - UPI processing over 20 billion transactions monthly, expanding into cross-border payments and merchant lending.

- Rise of neo-banking, wealth tech, and insurtech platforms targeting younger, digitally native users.

-

Regulatory sandbox frameworks enabling fintech experimentation and RBI’s digital currency (e-Rupee) gaining traction in retail and wholesale markets.

-

Geopolitical and Investment Landscape

India’s strategic global positioning enhances its appeal: - Strong FDI inflows continue, particularly in renewables, tech, and infrastructure.

- India becomes a pivotal member of global trade blocs (e.g., Indo-Pacific Economic Framework), reducing dependency on single markets.

- Startups and SMEs increasingly export digital services, software, and niche manufacturing products.

Conclusion

By 2026, India’s market reflects a dynamic convergence of demographic advantage, policy foresight, and technological adoption. Businesses that align with digital inclusion, sustainable growth, and consumer-centric innovation are poised to thrive. Challenges remain—such as upskilling the workforce and bridging regional disparities—but the overall momentum points to India emerging as one of the world’s most influential growth markets.

Common Pitfalls in Sourcing Indium (In): Quality and Intellectual Property Risks

Sourcing indium, a critical metal used in electronics, photovoltaics, and specialty alloys, presents unique challenges related to both material quality and intellectual property (IP) protection. Overlooking these aspects can lead to supply chain disruptions, product failures, and legal exposure. Below are key pitfalls to avoid.

Poor Quality Assurance and Purity Issues

Indium’s performance in high-tech applications—such as indium tin oxide (ITO) for touchscreens—depends on extremely high purity levels (often 99.99% or higher). A common pitfall is sourcing from suppliers without rigorous quality control processes, leading to:

- Contaminated or inconsistent material that affects deposition uniformity and electrical conductivity.

- Lack of traceability, making it difficult to diagnose failures in end products.

- Inadequate certification, such as missing mill test reports or ISO compliance, increasing the risk of nonconforming shipments.

Mitigation requires vetting suppliers with proven quality management systems, demanding third-party assay reports, and establishing clear specifications in procurement contracts.

Supply Chain Opacity and Ethical Sourcing Risks

Indium is primarily a byproduct of zinc mining, and its supply chain can be complex and opaque. This creates risks related to:

- Unverified origin, potentially implicating companies in unethical mining practices or conflict minerals.

- Lack of due diligence, exposing organizations to reputational damage and regulatory noncompliance (e.g., under the U.S. Dodd-Frank Act or EU conflict minerals regulations).

Procurement teams must require full chain-of-custody documentation and favor suppliers who participate in responsible sourcing initiatives.

Intellectual Property Exposure in Material Formulations

Indium is often used in proprietary alloys or thin-film coatings where the exact composition and processing methods are trade secrets. Risks arise when:

- Suppliers reverse-engineer formulations from supplied samples or shared specs, potentially infringing or replicating proprietary technologies.

- Joint development agreements lack clear IP clauses, leading to ownership disputes over improvements or derivative materials.

- NDAs are weak or unenforced, allowing leakage of sensitive technical data during sourcing negotiations.

To protect IP, companies should implement robust confidentiality agreements, limit technical disclosure to what is essential, and define IP ownership upfront in development or supply contracts.

Overreliance on Single or Geopolitically Concentrated Suppliers

A significant portion of indium production and refining is concentrated in a few countries, notably China. Overdependence on such sources leads to:

- Supply vulnerability due to export controls, trade disputes, or policy changes.

- Price volatility influenced by geopolitical factors rather than market fundamentals.

Diversifying supplier bases, investing in recycling partnerships, and exploring alternative materials can reduce strategic risk.

Inadequate Contractual Protections for Quality and IP

Many sourcing agreements fail to address indium-specific risks adequately. Pitfalls include:

- Vague quality specifications that allow marginal product acceptance.

- Absence of IP indemnification clauses, leaving the buyer liable if the supplied material infringes third-party rights.

- No audit rights to verify supplier compliance with quality or ethical sourcing standards.

Contracts should include precise technical specs, audit provisions, IP warranties, and clauses allowing for recalls or penalties in case of noncompliance.

By recognizing and addressing these common pitfalls, organizations can secure reliable, high-quality indium supplies while safeguarding their intellectual property and maintaining ethical and legal compliance.

Logistics & Compliance Guide for India

Overview of Indian Logistics Landscape

India’s logistics sector plays a crucial role in supporting the country’s growing economy. With a vast geographic expanse and diverse infrastructure, understanding the logistics and compliance environment is essential for businesses operating domestically or internationally.

Key Regulatory Authorities

Ministry of Road Transport and Highways (MoRTH)

Oversees national highways, road safety, vehicle regulations, and transport policies. The introduction of the Bharatmala Pariyojana aims to enhance road connectivity across India.

Ministry of Shipping and Ministry of Ports, Shipping and Waterways

Regulates ports, shipping operations, and maritime logistics. Major ports like JNPT (Mumbai), Chennai Port, and Kolkata Port are critical gateways for international trade.

Directorate General of Foreign Trade (DGFT)

Administers foreign trade policy and issues licenses for import and export through the IEC (Import Export Code). The DGFT promotes export-oriented businesses via schemes like the Foreign Trade Policy (FTP) and Export Promotion Capital Goods (EPCG) Scheme.

Central Board of Indirect Taxes and Customs (CBIC)

Manages customs clearance, enforces import/export regulations, and collects duties. The ICEGATE portal facilitates electronic clearance and documentation.

Goods and Services Tax Network (GSTN)

Handles GST compliance, including inter-state movement of goods (IGST), e-way bill generation, and input tax credit claims.

Transportation Infrastructure

Road Transport

- Accounts for ~60% of freight movement in India.

- National Highways (NH) span over 140,000 km and connect major industrial and commercial hubs.

- E-way bills are mandatory for inter-state and intra-state movement of goods valued over ₹50,000.

Rail Transport

- Indian Railways operates one of the largest rail networks globally.

- Dedicated Freight Corridors (DFCs) are being developed to improve cargo speed and efficiency (Eastern and Western DFCs).

- Container Corporation of India (CONCOR) manages rail container movement.

Air Freight

- Major international airports include Delhi (IGI), Mumbai (CSMIA), and Bengaluru (KIA).

- Air cargo is used for high-value, perishable, or time-sensitive goods.

- Airports are integrated with Multi-Modal Logistics Parks (MMLPs) for seamless connectivity.

Sea Freight

- 13 major and over 200 minor/intermediate ports.

- Key gateways: JNPT, Mundra Port (largest private port), Chennai, and Kolkata.

- Coastal shipping and Sagarmala Programme aim to decongest roads and reduce logistics costs.

Compliance Requirements

Import Regulations

- Importers must have a valid IEC code from DGFT.

- Prohibited, restricted, and freely importable items are listed in the ITC (HS) classification.

- Mandatory documents: Bill of Entry, Commercial Invoice, Packing List, Bill of Lading/Airway Bill, Certificate of Origin (if claiming FTA benefits).

- Customs valuation based on transaction value; anti-dumping and safeguard duties may apply.

Export Regulations

- Exports require IEC and adherence to FTP guidelines.

- Simplified procedures under the GST regime; zero-rated supplies allowed.

- Duty Drawback, RoDTEP (Remission of Duties and Taxes on Exported Products), and RoSCTL schemes provide export incentives.

GST and E-way Bill Compliance

- GST registration required for inter-state suppliers.

- E-way bill mandatory for movement of goods:

- Over ₹50,000 value.

- Generated via the GSTN portal or SMS.

- Validity based on distance (1 day for every 200 km).

- Transporters must carry e-way bill or its number and transport document.

Packaging and Labeling

- Pre-packaged commodities must comply with Legal Metrology Act, 2009.

- Mandatory labeling: MRP, manufacturer details, net quantity, batch/lot number.

- Environment regulations require eco-friendly packaging where applicable.

Special Economic Zones (SEZs) and Export-Oriented Units (EOUs)

- SEZs offer tax incentives, duty-free imports, and simplified compliance.

- Units in SEZs treated as outside India for customs purposes.

- EOUs benefit from duty exemptions on raw materials used in export production.

Digital Platforms and Automation

ICEGATE (Indian Customs EDI Gateway)

- Electronic filing of shipping bills and bills of entry.

- Integration with GSTN, DGFT, and banking systems.

- Use of RFID tags and scanning at major ports for faster clearance.

e-Sanchit

- Document upload system for customs; eliminates physical submission.

Parivesh

- Online portal for environmental, forest, and wildlife clearances.

Challenges and Best Practices

Common Challenges

- Infrastructure bottlenecks in rural and semi-urban areas.

- Multi-layered state and central regulations.

- Delays at ports due to documentation errors or inspections.

Best Practices

- Partner with authorized logistics service providers (3PL/4PL).

- Use integrated ERP systems for real-time tracking and compliance.

- Conduct regular audits of GST, customs, and transport documentation.

- Stay updated on policy changes via DGFT, CBIC, and GSTN notifications.

Conclusion

Navigating logistics and compliance in India requires a strategic understanding of regulatory frameworks, infrastructure capabilities, and digital systems. By leveraging available incentives, adopting technology, and ensuring strict adherence to compliance norms, businesses can optimize supply chain efficiency and reduce operational risks in the Indian market.

Certainly! Here’s a strong conclusion for sourcing a manufacturer:

Conclusion:

Sourcing the right manufacturer is a critical step that significantly impacts product quality, cost-efficiency, scalability, and time-to-market. A thorough evaluation process—encompassing due diligence on production capabilities, quality control standards, compliance certifications, communication practices, and financial stability—is essential to forming a reliable and long-term partnership. By clearly defining your requirements, visiting facilities when possible, and fostering transparent communication, you can mitigate risks and build a strong supply chain foundation. Ultimately, the right manufacturing partner is not just a vendor, but a strategic ally in bringing your product vision to life successfully and sustainably.