The global natural fiber market, driven by rising demand for sustainable and biodegradable materials, is projected to expand at a CAGR of 6.8% from 2023 to 2030, according to Grand View Research. Within this space, Manila fiber—derived from abaca (Musa textilis)—holds a distinct position due to its exceptional tensile strength, resistance to saltwater damage, and renewability, making it a preferred choice for marine cordage, specialty paper, and eco-friendly packaging. The Asia-Pacific region dominates production, with the Philippines accounting for over 85% of global abaca supply. As industries pivot toward green alternatives, the demand for high-quality Manila fiber continues to rise, fueling growth among local manufacturers. Mordor Intelligence reports increasing investment in agro-processing and value-added fiber products in the Philippines, positioning key players to capitalize on both domestic and international markets. Against this backdrop, the following seven manufacturers have emerged as leaders in innovation, output, and sustainability within the Manila fiber sector.

Top 7 Manila Fiber Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Manila Rope Manufacturers

Domain Est. 2005

Website: ropesuppliers.net

Key Highlights: Discover top Manila rope suppliers in the USA offering a wide range of ropes crafted from natural and synthetic materials….

#2 Manila Fiber Product

Domain Est. 1996

Website: frankwinne.com

Key Highlights: #1 Highest Grade available, fresh cut, bright color, consistently clean, long-length. Winmore fiber is made from Virgin Abaca Fiber, not seconds or rope waste ……

#3 Manila (Abaca) Fiber for World War II

Domain Est. 1996

Website: usni.org

Key Highlights: The Navy has regarded Manila as the best cordage fiber, and long before World War II initiated prior provision for a reserve supply in this country….

#4 Natural Manila Rope

Domain Est. 1996

Website: rope.com

Key Highlights: In stock Rating 4.8 (38) Product Description. Abaca Fiber is the strongest of all natural fibers. Native to the Philippines, it is known in the Western world as Manila or Hemp Ro…

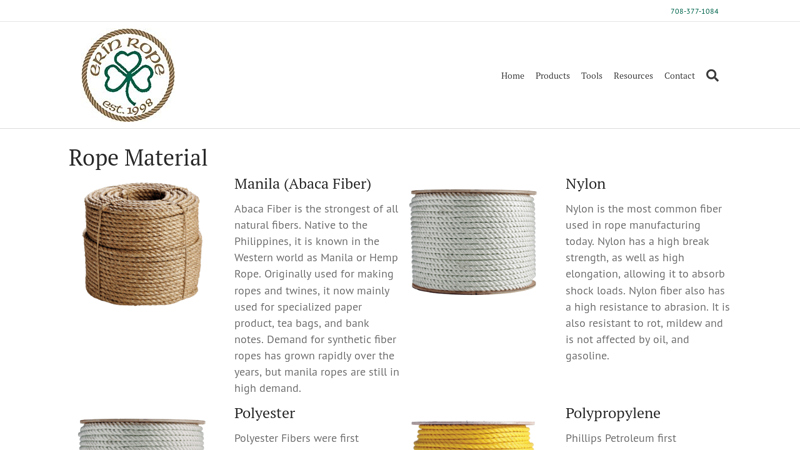

#5 Explore Our Rope Material Options

Domain Est. 2001

Website: erinrope.com

Key Highlights: Manila (Abaca Fiber) … Abaca Fiber is the strongest of all natural fibers. Native to the Philippines, it is known in the Western world as Manila or Hemp Rope….

#6 ORS Nasco

Domain Est. 2002

Website: orsnasco.com

Key Highlights: Twisted Manila Rope, 600 ft L, Manila, Natural, 1/2 in dia, 3 Strand. 811-330160-00600-60016 · Shop Now. Cover Lens, Scratch/Static Resistant, 4-1/4 in x 2 in ……

#7 Manila Cordage Company

Domain Est. 2014

Website: manilacordage.net

Key Highlights: Manila Cordage is the largest exporter for manila rope and cordage and other manila rope products….

Expert Sourcing Insights for Manila Fiber

2026 Market Trends for Manila Fiber (H2 Analysis)

Executive Summary

As of the second half of 2026 (H2 2026), the Manila fiber (also known as abaca) market is experiencing a transformation driven by sustainable demand, technological innovation in processing, and evolving global supply chain dynamics. The Philippines remains the dominant producer, contributing over 85% of global supply, but faces increasing competition from emerging cultivation in neighboring Southeast Asian countries. This analysis examines key market trends shaping the industry in H2 2026, including demand drivers, price movements, technological advancements, sustainability pressures, and trade dynamics.

1. Demand Growth Across Key Sectors

a. Specialty Paper and Tea Bags

Manila fiber continues to be in high demand for specialty paper applications due to its exceptional tensile strength and biodegradability. In H2 2026, premium tea and coffee bag manufacturers are increasingly replacing synthetic fibers with abaca, responding to consumer demand for compostable packaging. The global shift toward plastic-free packaging regulations—particularly in the EU and North America—is accelerating adoption.

Trend: Global demand for abaca in tea bag production has increased by 12% year-on-year (YoY) in 2026.

b. Textile and Nonwoven Fabrics

Innovations in abaca-based textiles, especially blended with organic cotton or hemp, are gaining traction in eco-friendly apparel and home goods. Fashion brands are leveraging abaca’s durability and low environmental impact to meet ESG (Environmental, Social, and Governance) goals.

Trend: The nonwoven segment, used in medical wipes and eco-disposable products, is projected to grow at a CAGR of 9.4% through 2026.

c. Industrial and Composite Materials

The automotive and construction industries are exploring abaca fiber as a natural reinforcement in biocomposites. In H2 2026, R&D partnerships between Philippine research institutions and Japanese/European manufacturers are producing prototypes for lightweight, sustainable composite panels.

Trend: Pilot projects in Japan and Germany are testing abaca-reinforced materials for interior car panels and acoustic insulation.

2. Price Volatility and Supply Constraints

a. Climatic Challenges

Typhoon activity in the Bicol Region and Eastern Visayas during the first half of 2026 disrupted planting and harvesting cycles, leading to tighter supply. Combined with prolonged dry spells in Q2, yields declined by approximately 8% compared to 2025.

Impact: Manila fiber prices rose to USD 2,850 per metric ton in H2 2026, up from USD 2,400 in H2 2025.

b. Labor and Land Constraints

Aging farmer demographics and rural-to-urban migration continue to affect labor availability. Land conversion for other crops or infrastructure projects limits abaca expansion.

Response: The Philippine Department of Agriculture (DA) and Fiber Industry Development Authority (FIDA) are promoting contract farming and youth engagement programs.

3. Technological Advancements and Processing Innovation

a. Mechanized Harvesting and Decortication

After years of pilot programs, small-scale mechanized decorticators are being adopted more widely in Catanduanes and Davao. This reduces processing time and improves fiber quality consistency.

Trend: Mechanization has increased farm-gate productivity by up to 30%, enhancing competitiveness.

b. Blockchain Traceability

Exporters are adopting blockchain platforms to verify the origin and sustainability of abaca fiber, responding to EU due diligence regulations (e.g., EU Deforestation Regulation – EUDR).

Case: A major Philippine exporter launched a QR-code traceability system in Q3 2026, allowing buyers to verify cultivation practices and carbon footprint.

4. Sustainability and Certification Trends

a. ESG Compliance

International buyers are requiring third-party certifications such as FSC (Forest Stewardship Council) and Rainforest Alliance for abaca sourcing. Certifications are becoming a non-negotiable for entry into premium markets.

Trend: Over 40% of exported abaca fiber in H2 2026 carried sustainability certification, up from 25% in 2024.

b. Carbon Sequestration Potential

Research indicates abaca plantations can sequester up to 10 tons of CO₂ per hectare annually. This is attracting interest from carbon credit programs.

Outlook: Pilot carbon credit projects with abaca farmers are underway, potentially unlocking new revenue streams by 2027.

5. Trade and Geopolitical Developments

a. Export Markets

The EU remains the largest export destination (38%), followed by Japan (25%) and the U.S. (18%). Demand from South Korea and India is rising due to green packaging mandates.

Opportunity: The Philippines is negotiating favorable tariff treatments under ASEAN-EU and RCEP frameworks to boost abaca exports.

b. Competition and Substitution

While no fiber fully replicates abaca’s strength and flexibility, synthetic alternatives (e.g., polypropylene) remain price-competitive. However, regulatory pressure on plastics is reducing their appeal.

Risk: Vietnam and Indonesia are scaling up abaca trials, potentially increasing supply competition beyond 2027.

6. Outlook for 2027 and Beyond

- Positive Drivers: Strong demand from sustainability-focused industries, innovation in value-added products, and policy support from the Philippine government.

- Challenges: Climate vulnerability, limited processing infrastructure, and the need for farmer income stabilization.

- Forecast: The global abaca market is expected to reach USD 320 million by end-2026, with continued growth anticipated through 2030.

Conclusion

H2 2026 marks a pivotal period for Manila fiber as it transitions from a traditional agricultural commodity to a high-value, sustainable material in global green supply chains. Success will depend on sustained investment in R&D, farmer resilience, and adherence to international environmental standards. Stakeholders who align with ESG principles and leverage digital traceability will gain competitive advantage in the evolving market landscape.

Sources: FAO, Philippine Fiber Industry Development Authority (FIDA), ASEAN Secretariat, EU Market Watch, Global Abaca Trade Reports (H2 2026).

Common Pitfalls Sourcing Manila Fiber (Quality, IP)

Sourcing Manila fiber, also known as abaca fiber, presents several challenges, particularly concerning quality consistency and intellectual property (IP) issues. Being aware of these pitfalls is essential for businesses relying on this natural fiber for products such as specialty paper, tea bags, ropes, and eco-friendly textiles.

Inconsistent Fiber Quality

One of the most significant challenges in sourcing Manila fiber is variability in quality. Factors such as growing conditions, harvesting methods, and post-harvest processing greatly influence fiber characteristics. Poorly processed fiber may contain high levels of lignin, impurities, or residual non-fibrous matter, leading to reduced tensile strength and durability. Buyers often face inconsistencies between batches, which can disrupt manufacturing processes and compromise final product performance.

Lack of Standardized Grading Systems

The absence of universally accepted grading standards for Manila fiber complicates procurement. Different suppliers may use proprietary or regional classifications, making it difficult to compare quality across sources. Without clear benchmarks for length, color, cleanliness, and strength, buyers risk receiving substandard material or overpaying for lower-grade fiber.

Supply Chain Opacity and Traceability Issues

Manila fiber is primarily produced in the Philippines, often through smallholder farming systems with fragmented supply chains. Limited transparency makes it difficult to trace fiber origins, verify sustainable farming practices, or ensure fair labor conditions. This opacity increases the risk of contamination, adulteration, or mixing with inferior fibers, undermining quality assurance efforts.

Intellectual Property and Geographical Indication Concerns

Manila fiber is closely associated with the Philippines, where it is a protected geographical indication (GI) product. Unauthorized use of terms like “Manila hemp” or “abaca” for non-Philippine-sourced fibers may lead to legal disputes or reputational damage. Furthermore, innovations in processing or product development using abaca may involve patented technologies; sourcing without due diligence can expose companies to IP infringement risks, especially when importing processed fiber or derivatives.

Counterfeit and Substituted Materials

Due to its premium status and limited supply, Manila fiber is sometimes substituted with cheaper alternatives like sisal, jute, or synthetic fibers. Unscrupulous suppliers may misrepresent blends or lower-grade fibers as pure abaca. Without third-party testing or reliable certification, buyers may inadvertently purchase counterfeit or adulterated materials, affecting both product integrity and compliance.

Insufficient Supplier Verification

Relying on unverified or unqualified suppliers increases exposure to the above risks. Many intermediaries lack technical expertise in fiber quality assessment or fail to implement quality control protocols. Conducting thorough due diligence—including site audits, sample testing, and certification verification—is critical but often overlooked in cost-driven procurement strategies.

Conclusion

To mitigate these pitfalls, buyers should establish clear quality specifications, partner with certified and reputable suppliers, invest in independent testing, and stay informed about IP and regulatory frameworks related to Manila fiber. Proactive risk management ensures both product quality and legal compliance in the global marketplace.

Logistics & Compliance Guide for Manila Fiber

Manila fiber, also known as abacá, is a strong, durable natural fiber derived from the leaf sheaths of the abacá plant (Musa textilis), primarily grown in the Philippines. Efficient logistics and strict compliance with international regulations are essential for successful export and import operations. This guide outlines key considerations for handling, transporting, and ensuring regulatory compliance when trading Manila fiber.

Sourcing and Harvesting Compliance

Manila fiber must be sourced from registered and sustainable plantations, particularly within the Philippines where over 85% of global production occurs. Exporters must comply with the Philippine Fiber Industry Development Authority (FIDA) regulations. Ensure all harvesting practices follow environmental guidelines and labor standards as required by Philippine law. Documentation such as a Certificate of Origin and FIDA clearance may be required for export.

Classification and Customs Documentation

Correct commodity classification is crucial for customs clearance. Manila fiber is typically classified under HS Code 5305.00.00 (Coir and other vegetable textile fibers, not elsewhere specified). Accurate documentation—including commercial invoices, packing lists, bill of lading/air waybill, phytosanitary certificate, and certificate of origin—must accompany shipments. Misclassification can lead to delays, fines, or seizure.

Phytosanitary and Agricultural Regulations

Due to its plant origin, Manila fiber is subject to phytosanitary regulations in importing countries. A phytosanitary certificate issued by the Bureau of Plant Industry (BPI) in the Philippines is often mandatory. This certifies that the fiber is free from pests and diseases. Importing countries such as the United States (USDA-APHIS), the European Union (via EFSA), and Australia (DAFF) enforce strict biosecurity measures. Pre-shipment inspections may be required.

Packaging and Handling Standards

Manila fiber is typically exported in bales, bundles, or spools, depending on the end-use (e.g., specialty paper, tea bags, marine ropes). Proper packaging must prevent moisture absorption, contamination, and physical damage. Use moisture-resistant wrapping and store in dry, ventilated areas. Handling should minimize fiber breakage and maintain quality throughout the supply chain.

Transportation and Storage

Maritime shipping is the most common method for bulk transport of Manila fiber. Ensure containers are clean, dry, and free from contaminants. Ventilated containers are preferred to prevent mold growth. During storage—both pre-shipment and upon arrival—maintain a controlled environment with low humidity. Avoid ground-level storage to prevent water damage. Monitor for pests and rodents, especially in tropical climates.

Import Regulations by Key Markets

Different countries have specific requirements for importing natural fibers. For example:

– United States: Requires a USDA permit for certain plant materials; fiber must undergo inspection upon arrival.

– European Union: Subject to the EU Timber Regulation (EUTR) and may require a due diligence statement, especially if used in composite products.

– Japan and South Korea: Demand high-quality documentation and may require additional inspection or fumigation certificates.

Sustainability and Certification Requirements

Growing demand for sustainable sourcing means buyers may require proof of responsible production. Consider obtaining certifications such as:

– FSC (Forest Stewardship Council) – if integrated with forest-based supply chains.

– Organic certification – if grown without synthetic inputs.

– Fair Trade – to demonstrate ethical labor practices.

These certifications can enhance market access and command premium pricing.

Labeling and Traceability

Ensure all shipments are clearly labeled with fiber type, weight, lot number, origin, and handling instructions. Maintain traceability from farm to port to meet compliance standards and facilitate recalls if necessary. Digital tracking systems can improve transparency and efficiency.

Risk Management and Insurance

Given the susceptibility of natural fibers to environmental damage (e.g., moisture, mold), secure comprehensive marine cargo insurance covering all risks during transit. Include clauses for delay, contamination, and quality degradation. Conduct regular audits of logistics partners to ensure adherence to best practices.

Conclusion

Successful logistics and compliance for Manila fiber require attention to detail across sourcing, documentation, regulatory standards, and transport. By adhering to national and international requirements and investing in sustainable practices, exporters and importers can ensure smooth operations and maintain the high reputation of Manila fiber in global markets.

In conclusion, sourcing manila fiber—primarily derived from the leaves of the abacá plant (Musa textilis)—requires a strategic and sustainable approach due to its limited geographic production and growing global demand. The Philippines remains the dominant supplier, making supplier relationships, ethical sourcing practices, and supply chain transparency critical. Buyers should prioritize working with certified and environmentally responsible producers to ensure long-term availability and compliance with sustainability standards. Additionally, considering the vulnerability of supply to climate and market fluctuations, diversification and investment in local processing infrastructure can enhance supply security. Overall, successful sourcing of manila fiber hinges on balancing economic efficiency with environmental stewardship and socio-economic responsibility in producing regions.