The global manifold manufacturing market is experiencing robust growth, driven by increasing demand across industries such as oil & gas, automotive, industrial automation, and renewable energy. According to a 2023 report by Mordor Intelligence, the hydraulic manifold market alone is projected to grow at a CAGR of over 4.8% from 2023 to 2028, fueled by advancements in machinery efficiency and the expansion of industrial infrastructure in emerging economies. Additionally, Grand View Research estimates that the broader fluid power components market—encompassing manifolds—was valued at USD 48.5 billion in 2022 and is expected to expand at a CAGR of 5.2% through 2030, supported by rising automation and the integration of smart hydraulic systems. As demand for precision-engineered, application-specific manifolds intensifies, a select group of manufacturers has emerged as industry leaders, distinguished by innovation, scalability, and global reach. The following is a data-informed overview of the top 10 manifold manufacturers shaping this evolving landscape.

Top 10 Manifold Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Superior Products, LLC

Domain Est. 1996

Website: superiorprod.com

Key Highlights: A premier manufacturer of compressed gas fittings for the industrial, medical, and specialty gas industries. Flash arrestors, quick connects, and more….

#2 Full Tilt Performance

Domain Est. 2006 | Founded: 2004

Website: fulltiltperformance.com

Key Highlights: Free delivery over $7,500Full Tilt Performance is the premier manufacturer of American-made performance parts for the industry’s top truckers. Founded in 2004 by a trucking family….

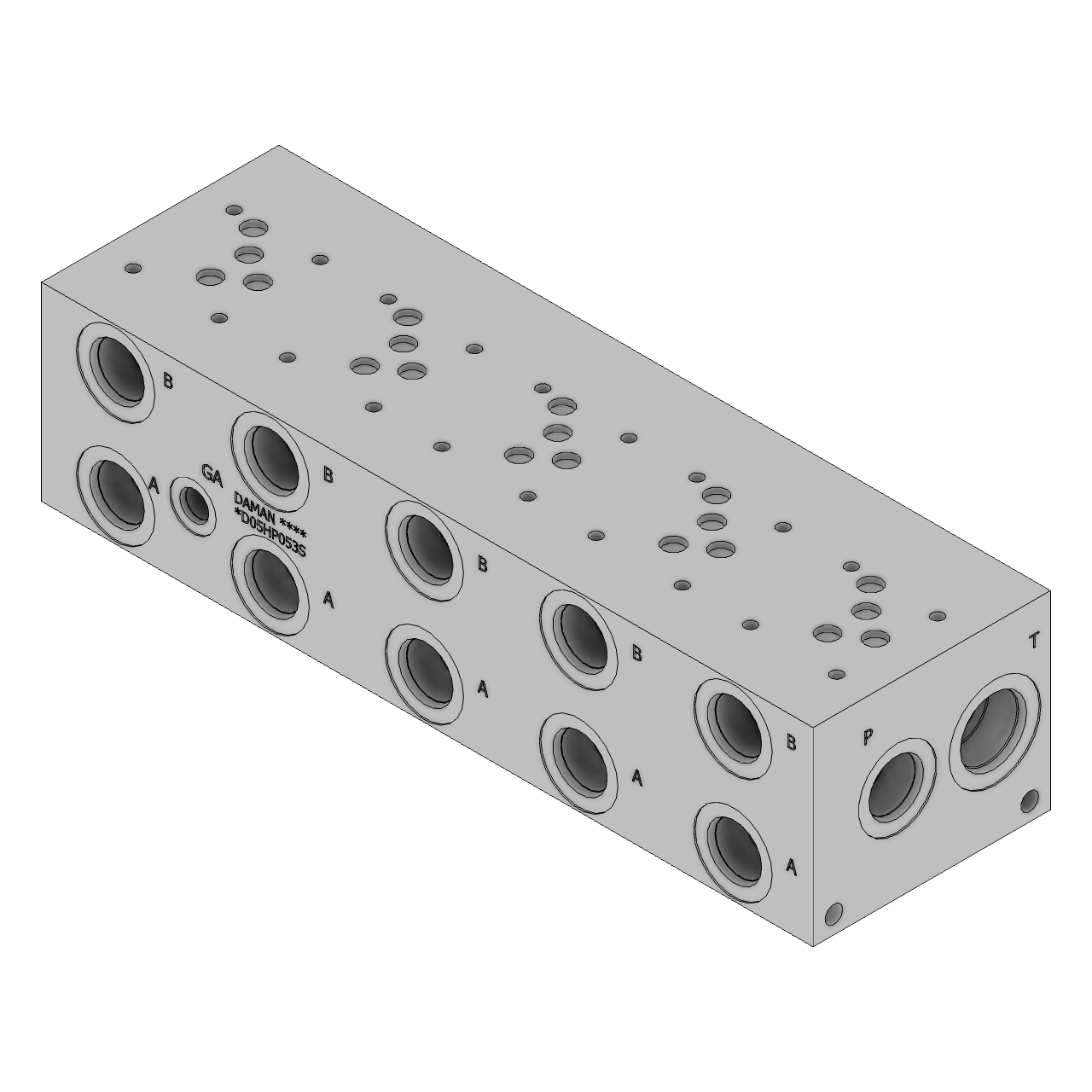

#3 Daman Products: Hydraulic Manifolds

Domain Est. 1996

Website: daman.com

Key Highlights: Daman Products, based in Mishawaka, Indiana, designs and manufactures hydraulic valve manifolds and related products for the fluid power industry….

#4 Aerospace: Modules/Manifolds

Domain Est. 1996

Website: ptitechnologies.com

Key Highlights: PTI’s custom designed filter manifolds integrate independent fluid system into one compact and efficient manifold providing greater reliability and improved ……

#5 Wilson Manifolds

Domain Est. 1997

Website: wilsonmanifolds.com

Key Highlights: Wilson Manifolds manufactures the highest performing and finest quality products possible to our customers in the automotive and racing industries….

#6 Custom Manifolds

Domain Est. 1997

Website: hpsx.com

Key Highlights: We can design and manufacture everything from proportionally controlled vacuum manifolds and electronic governor manifolds to actuator mounted manifolds….

#7 Lynch Fluid Controls

Domain Est. 2000

Website: lynch.ca

Key Highlights: Lynch Fluid Controls is dedicated to designing and manufacturing hydraulic motion control manifolds and integrated hydraulic systems….

#8 The Manifold Center

Domain Est. 2001

Website: manifoldcenter.com

Key Highlights: Custom blocks can be produced with all industry standard ports and valve cavities, and can be machined from any material….

#9 Controlled Fluidics

Domain Est. 2010

Website: controlledfluidics.com

Key Highlights: Controlled Fluidics specializes in precision plastic machining and bonded fluidic manifolds for aerospace, medical, life sciences, defense and research ……

#10 Hydraulic Manifolds USA

Domain Est. 2016

Website: hydraulicmanifoldsusa.com

Key Highlights: We have over 45 years of expertise in custom design and manufacturing services for hydraulic manifolds using a variety of materials. Standard Manifolds….

Expert Sourcing Insights for Manifold

H2: Market Trends for Manifold in 2026

As we approach 2026, the market landscape for Manifold—a platform focused on AI-powered data science and machine learning operations (MLOps)—is being shaped by several converging technological, economic, and industry-specific trends. The following analysis outlines key developments influencing Manifold’s position and growth potential in the second half of 2026 (H2 2026).

-

Accelerated Adoption of MLOps Platforms

By H2 2026, enterprises across finance, healthcare, and manufacturing are increasingly integrating MLOps into their core digital transformation strategies. Manifold’s platform, designed to streamline model deployment, monitoring, and governance, stands to benefit from this shift. The demand for scalable, reproducible, and auditable AI workflows has elevated the importance of platforms like Manifold, particularly in regulated industries where compliance and model transparency are paramount. -

Rise of Edge AI and Real-Time Inference

The proliferation of IoT devices and real-time analytics applications has driven demand for edge-compatible AI models. Manifold has responded by enhancing its platform to support edge deployment pipelines and lightweight model serving. In H2 2026, companies are leveraging Manifold’s tools to deploy and manage models directly on edge infrastructure, reducing latency and improving data privacy—a trend especially prominent in industrial automation and smart city projects. -

Consolidation in the AI/ML Tooling Space

The competitive AI tooling market is undergoing consolidation, with larger cloud providers acquiring niche MLOps startups. This trend pressures independent platforms like Manifold to differentiate through superior user experience, domain-specific customization, and open integration capabilities. In H2 2026, Manifold has strengthened partnerships with major cloud providers (AWS, GCP, Azure) while maintaining neutrality, allowing clients to avoid vendor lock-in—a key selling point. -

Regulatory Pressure and AI Governance

With the EU AI Act fully in effect and similar frameworks emerging in the U.S. and Asia, organizations face stricter requirements for AI model documentation, bias testing, and auditability. Manifold’s investment in automated model lineage tracking, explainability dashboards, and compliance reporting tools positions it favorably in H2 2026. Enterprises are increasingly selecting platforms with built-in governance features, giving Manifold a competitive edge in regulated sectors. -

Growth in Vertical-Specific AI Solutions

Manifold has expanded its offerings with industry-specific templates and pre-built pipelines for healthcare diagnostics, financial risk modeling, and supply chain forecasting. By H2 2026, this verticalization strategy is driving customer acquisition, as businesses seek faster time-to-value without extensive customization. Strategic collaborations with domain experts and data providers have further solidified Manifold’s relevance in these niches. -

Talent Shortage Driving Demand for Low-Code Tools

Despite growth in data science programs, the global shortage of skilled ML engineers persists. Manifold’s low-code interface and automated pipeline generation are increasingly adopted by citizen data scientists and domain experts. In H2 2026, this democratization of AI tools contributes to broader platform adoption across mid-sized enterprises that lack large AI teams. -

Sustainability and Energy-Efficient AI

Environmental concerns are influencing AI deployment strategies. Manifold has introduced features to optimize model training efficiency and monitor carbon footprint per inference cycle. In H2 2026, sustainability metrics are becoming part of procurement criteria, particularly among ESG-focused organizations, enhancing Manifold’s appeal.

Conclusion

By H2 2026, Manifold is well-positioned to capitalize on the growing demand for reliable, compliant, and scalable MLOps solutions. Its focus on interoperability, governance, and vertical-specific innovation enables it to compete effectively in a maturing AI market. Continued investment in automation, edge computing, and sustainability will be critical to maintaining momentum and expanding market share in the years ahead.

Common Pitfalls in Sourcing Manifolds: Quality and Intellectual Property (IP) Risks

When sourcing manifolds—especially for critical applications in industries like aerospace, medical devices, or energy—organizations often face significant challenges related to both product quality and intellectual property (IP) protection. Overlooking these aspects can result in performance failures, regulatory non-compliance, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Material Specifications

Sourcing manifolds without clearly defined material requirements (e.g., ASTM/ASME standards, corrosion resistance, pressure ratings) can lead to premature failure. Substandard alloys or improper heat treatments may compromise structural integrity and system safety.

2. Poor Manufacturing Tolerances and Surface Finish

Manifolds require precise dimensional accuracy and internal surface finishes to ensure proper flow dynamics and sealing. Suppliers using outdated or inconsistent manufacturing processes (e.g., subpar CNC machining or welding) can introduce flow restrictions, leaks, or contamination risks.

3. Inconsistent Quality Control Processes

Relying on suppliers without robust quality management systems (e.g., ISO 9001-certified) increases the risk of non-conforming parts. Lack of proper inspection documentation, pressure testing, or non-destructive testing (NDT) can allow defective units to reach end users.

4. Insufficient Testing and Validation

Some suppliers may skip or falsify performance tests such as burst pressure, leak testing, or cycle endurance. Without third-party validation or in-house verification, sourced manifolds may not meet operational demands under real-world conditions.

5. Supply Chain Transparency Issues

Using subcontractors or secondary sources without oversight can introduce untraceable materials or processes. This lack of traceability undermines quality assurance and complicates root cause analysis during failures.

Intellectual Property (IP)-Related Pitfalls

1. Lack of IP Ownership Clarity

Failing to define IP ownership in the sourcing agreement may result in the supplier claiming rights to custom designs, tooling, or proprietary configurations. This can limit your ability to switch suppliers or modify the design later.

2. Risk of Design Theft or Reverse Engineering

Sharing detailed CAD models or specifications with unvetted suppliers—especially in regions with weaker IP enforcement—increases the risk of unauthorized replication or sale of your design to competitors.

3. Inadequate Protection in Contracts

Sourcing agreements that omit strong IP clauses, non-disclosure agreements (NDAs), or restrictions on secondary use leave your innovations vulnerable. Without legal safeguards, enforcing IP rights becomes difficult and costly.

4. Use of Infringing Components or Designs

Suppliers may incorporate third-party patented technologies (e.g., valve integration, port configurations) without licensing, exposing your organization to infringement claims even if unintentional.

5. Over-Reliance on Standard Catalog Parts with Hidden IP

Even when using “off-the-shelf” manifold solutions, embedded design elements may be protected by patents or trade secrets. Failure to conduct IP due diligence can lead to legal exposure upon integration into your products.

Mitigation Strategies

- Require full material traceability and certifications

- Audit supplier quality systems and production facilities

- Conduct independent validation testing

- Include explicit IP ownership terms in contracts

- Use NDAs and limit design data access to need-to-know

- Perform IP landscape reviews before sourcing

- Engage legal counsel to draft and review supply agreements

By proactively addressing these quality and IP pitfalls, organizations can ensure reliable performance, maintain competitive advantage, and reduce long-term liabilities in their manifold sourcing efforts.

Logistics & Compliance Guide for Manifold

This guide outlines the essential logistics and compliance considerations for operating within the Manifold ecosystem. Adhering to these practices ensures smooth operations, regulatory adherence, and customer satisfaction.

Overview

Manifold enables developers to deploy and manage cloud infrastructure through intuitive tools and automation. While Manifold simplifies provisioning, organizations remain responsible for logistics such as deployment tracking, access management, and compliance with data protection and industry regulations.

Infrastructure Provisioning & Management

All infrastructure deployed via Manifold—such as databases, storage, and compute services—is provisioned through integrated cloud providers (e.g., AWS, GCP, Azure). Users must:

- Track resource creation and ownership using Manifold’s tagging and labeling features.

- Review provisioning logs regularly to audit infrastructure changes.

- Use environment-specific configurations (e.g., staging vs. production) to minimize misconfigurations.

Data Security & Privacy

Organizations must ensure that data processed or stored via Manifold-managed resources complies with applicable regulations, including but not limited to GDPR, CCPA, and HIPAA.

Key actions include:

- Encrypting data at rest and in transit using provider-native tools or third-party solutions.

- Limiting data access using role-based access control (RBAC) and least-privilege principles.

- Conducting regular vulnerability assessments and penetration tests on deployed services.

Access Control & Authentication

Manifold supports SSO and integration with identity providers (e.g., Okta, Azure AD). To maintain compliance:

- Enforce multi-factor authentication (MFA) for all administrative users.

- Regularly audit user permissions and remove access for inactive or offboarded team members.

- Use service accounts with scoped permissions for automation and CI/CD pipelines.

Logging, Monitoring & Audit Trails

Maintain comprehensive logs for compliance and troubleshooting:

- Enable logging for all provisioned resources (e.g., database query logs, API access logs).

- Integrate with centralized monitoring tools (e.g., Datadog, Splunk) via Manifold webhooks or provider APIs.

- Retain logs for a minimum of 90 days (or longer based on regulatory requirements).

Regulatory Compliance

Depending on your industry, you may need to comply with standards such as:

- SOC 2: Implement controls around security, availability, processing integrity, confidentiality, and privacy.

- ISO 27001: Establish an information security management system (ISMS).

- PCI DSS: If handling payment data, ensure all Manifold-managed systems meet PCI requirements.

Manifold assists by enabling secure configurations, but ultimate compliance responsibility lies with the customer.

Incident Response & Disaster Recovery

Develop and maintain response plans for potential security incidents or service disruptions:

- Define escalation paths and response procedures for infrastructure outages or breaches.

- Use Manifold’s backup and failover integrations to maintain high availability.

- Test disaster recovery plans quarterly and update documentation accordingly.

Third-Party Vendor Management

When using external services through Manifold (e.g., Redis, PostgreSQL), evaluate vendor compliance certifications:

- Confirm that providers meet relevant standards (e.g., AWS SOC reports).

- Review data processing agreements (DPAs) and terms of service.

- Limit third-party access to only what is operationally necessary.

Documentation & Policy Maintenance

Maintain up-to-date internal policies covering:

- Infrastructure as Code (IaC) practices using Manifold CLI or Terraform.

- Change management procedures for production environments.

- Employee training on security best practices and compliance obligations.

Regularly review and update these documents to reflect changes in regulations or infrastructure usage.

Conclusion

While Manifold streamlines cloud infrastructure deployment, organizations must proactively manage logistics and compliance. By implementing robust access controls, monitoring, and regulatory practices, you can leverage Manifold effectively while maintaining security and compliance across your operations.

Conclusion:

After a thorough evaluation of potential manifold manufacturers, it is evident that selecting the right supplier requires a balanced assessment of technical capabilities, production capacity, quality assurance systems, regulatory compliance, and cost-efficiency. Key factors such as material expertise, precision engineering, customization flexibility, and delivery reliability play a critical role in ensuring long-term performance and integration success within the intended application.

Among the evaluated suppliers, several stand out based on ISO certifications, advanced CNC and welding technologies, experience in industries such as automotive, aerospace, or industrial machinery, and a proven track record of on-time delivery. Additionally, manufacturers with in-house design support and robust testing protocols offer added value by reducing lead times and improving product reliability.

Ultimately, the recommended approach is to establish partnerships with a shortlisted group of manufacturers that not only meet current project specifications but also demonstrate scalability and innovation potential for future needs. Ongoing supplier performance monitoring and continuous improvement collaboration will ensure sustained quality and operational efficiency in the supply chain.

In conclusion, strategic sourcing of manifold manufacturers should prioritize capability, consistency, and collaboration to achieve optimal performance, cost savings, and supply chain resilience.