The global air filter market is experiencing steady growth, driven by increasing demand for improved engine performance, stricter emission regulations, and rising vehicle production. According to Grand View Research, the global automotive air filter market size was valued at USD 7.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. As a leading supplier in the filtration space, Mahle GmbH holds a significant market position, known for its high-efficiency air filtration systems. With OEM partnerships and a strong aftermarket presence, Mahle sets a benchmark in quality and innovation. This performance has spurred competition and collaboration across the industry, giving rise to several key manufacturers that either produce under Mahle’s specifications, supply components for Mahle systems, or compete directly in the same performance tier. Below are the top four manufacturers associated with Mahle air filter technology or operating in the same competitive segment, selected based on production scale, global distribution, technological capabilities, and market influence.

Top 4 Mahle Air Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 1997

Website: us.mahle.com

Key Highlights: MAHLE is a leading international development partner and supplier to the automotive industry with customers in both passenger car and commercial vehicle sectors ……

#2 MAHLE Group

Domain Est. 1997

Website: mahle.com

Key Highlights: MAHLE is a leading international development partner and supplier to the automotive industry as well as a pioneer for the mobility of the future….

#3 MAHLE Service Solutions

Domain Est. 1997

Website: servicesolutions.mahle.com

Key Highlights: MAHLE Service Solutions manufactures A/C machines, fluid exchange machines, nitrogen tire fill machines, lift equipment, diagnostic and automotive service ……

#4 MAHLE air filters

Domain Est. 2000

Website: mahle-aftermarket.com

Key Highlights: With MAHLE air filters, up to 99.9 percent of dust, soot and tire wear particles are filtered out. At the same time, an optimal air/fuel mixture is assured….

Expert Sourcing Insights for Mahle Air Filter

H2: Market Trends Shaping the Mahle Air Filter Business in 2026

By 2026, the global automotive and industrial filtration market, including Mahle’s air filter segment, is expected to undergo significant transformation driven by technological innovation, regulatory shifts, and changing consumer behaviors. Below are the key market trends influencing Mahle Air Filter’s strategic positioning and growth trajectory in 2026:

-

Accelerated Electrification of Vehicles

The global push toward electric vehicles (EVs) continues to reshape automotive design. While EVs require less engine air filtration than internal combustion engine (ICE) vehicles, Mahle is adapting by focusing on cabin air quality systems and battery thermal management filtration. In 2026, Mahle’s air filters are increasingly integrated into EV climate control systems to remove particulates, allergens, and odors, supporting health and comfort in sealed cabin environments. -

Stricter Emissions and Air Quality Regulations

Governments worldwide are enforcing tighter air quality standards (e.g., Euro 7 in Europe, China 6b, and U.S. Tier 4). These regulations not only affect engine efficiency but also demand higher-performance filtration systems. Mahle is leveraging its R&D capabilities to produce high-efficiency particulate air (HEPA)-grade filters and advanced synthetic media that meet or exceed upcoming norms, giving it a competitive edge in both OEM and aftermarket channels. -

Growth in the Automotive Aftermarket

As the global vehicle fleet ages and maintenance intervals extend, the aftermarket for replacement air filters is expanding. Mahle’s strong distribution network and brand reputation for quality position it well in 2026 to capture market share, especially in emerging economies like India, Southeast Asia, and Latin America, where vehicle ownership is rising. -

Integration of Smart and Connected Filtration Systems

Mahle is advancing toward “smart” filtration solutions that use sensors to monitor filter life, air quality, and pressure drop in real time. In 2026, these connected air filters are increasingly adopted in commercial fleets and premium vehicles, enabling predictive maintenance and improving fuel efficiency. This digital integration enhances Mahle’s value proposition beyond traditional filtration. -

Sustainability and Circular Economy Initiatives

Environmental sustainability is a major trend shaping product development. Mahle is responding by introducing recyclable filter materials, reducing packaging waste, and exploring biodegradable filter media. In 2026, Mahle’s air filters are marketed with full lifecycle assessments, appealing to environmentally conscious OEMs and consumers alike. -

Expansion in Industrial and Non-Automotive Applications

Beyond automotive, Mahle is diversifying into industrial, HVAC, and off-highway applications (e.g., construction, agriculture). With rising demand for clean air in factories and urban infrastructure, Mahle’s filtration technology is being adapted for use in stationary power generation, data centers, and public transportation systems. -

Supply Chain Resilience and Regionalization

Geopolitical uncertainties and past disruptions have prompted Mahle to localize production and sourcing. By 2026, the company operates regional manufacturing hubs in North America, Europe, and Asia, reducing lead times and import dependencies while improving responsiveness to local market demands.

Conclusion

In 2026, Mahle Air Filter is strategically positioned at the intersection of clean mobility, digitalization, and sustainability. While electrification presents a challenge to traditional engine air filtration, Mahle’s proactive innovation in cabin air quality, smart systems, and industrial applications ensures continued relevance and growth. The company’s ability to adapt to regulatory, environmental, and technological trends will be critical to maintaining its leadership in the global filtration market.

Common Pitfalls When Sourcing Mahle Air Filters (Quality & IP)

Sourcing genuine Mahle air filters requires vigilance to avoid counterfeit products and intellectual property (IP) violations. Falling into these common pitfalls can compromise engine performance, void warranties, and expose businesses to legal risks.

Inadequate Supplier Verification

One of the most frequent mistakes is failing to thoroughly vet suppliers. Many unauthorized vendors—especially on online marketplaces—claim to sell authentic Mahle filters but offer counterfeit or imitation products. These suppliers often lack proper authorization documentation or refuse to provide proof of a legitimate distribution agreement with Mahle. Relying on unverified sources increases the risk of receiving substandard filters that do not meet Mahle’s engineering specifications.

Ignoring IP Rights and Brand Authenticity

Mahle is a registered trademark, and unauthorized use of its branding, logos, or product designs constitutes intellectual property infringement. Sourcing from suppliers who sell “Mahle-style” or “compatible with Mahle” filters may still pose IP risks if the products mimic patented designs or use branding that creates consumer confusion. Businesses must ensure that suppliers respect Mahle’s IP and do not distribute replicas that violate trademark or design patents.

Compromising on Quality for Lower Costs

The allure of lower prices often leads buyers to choose cheaper alternatives that imitate Mahle filters. However, these knock-offs typically use inferior filtration media, subpar sealing materials, and inconsistent manufacturing processes. Poor-quality filters can lead to reduced engine efficiency, increased wear, and premature failure. The short-term savings are outweighed by long-term performance issues and potential damage to equipment or vehicles.

Lack of Traceability and Documentation

Authentic Mahle filters come with traceable batch numbers, certification marks, and packaging that includes holograms or security features. Sourcing without demanding proper documentation—such as certificates of authenticity, invoices from authorized distributors, or product traceability data—makes it difficult to verify legitimacy. Without traceability, businesses cannot prove compliance or defend against liability if faulty filters cause damage.

Overlooking Regional Distribution Rights

Mahle operates through a network of authorized distributors with specific regional rights. Sourcing filters from a supplier in a different region—especially if the part numbers or packaging differ—may indicate gray market goods. These products might not meet local regulatory standards or environmental requirements, and their sale could violate distribution agreements, exposing the buyer to contractual or legal consequences.

Failure to Audit Supply Chains

Even if a supplier appears legitimate, their own supply chain might include unauthorized sub-suppliers. Without conducting periodic audits or requiring transparency in sourcing practices, companies risk inadvertently introducing counterfeit or non-compliant Mahle filters into their operations. Proactive supply chain due diligence is essential to maintain quality and IP compliance.

Logistics & Compliance Guide for MAHLE Air Filters

This guide outlines the key logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence applicable to MAHLE air filters. Adherence to these guidelines ensures product integrity, safety, and compliance with international and local regulations.

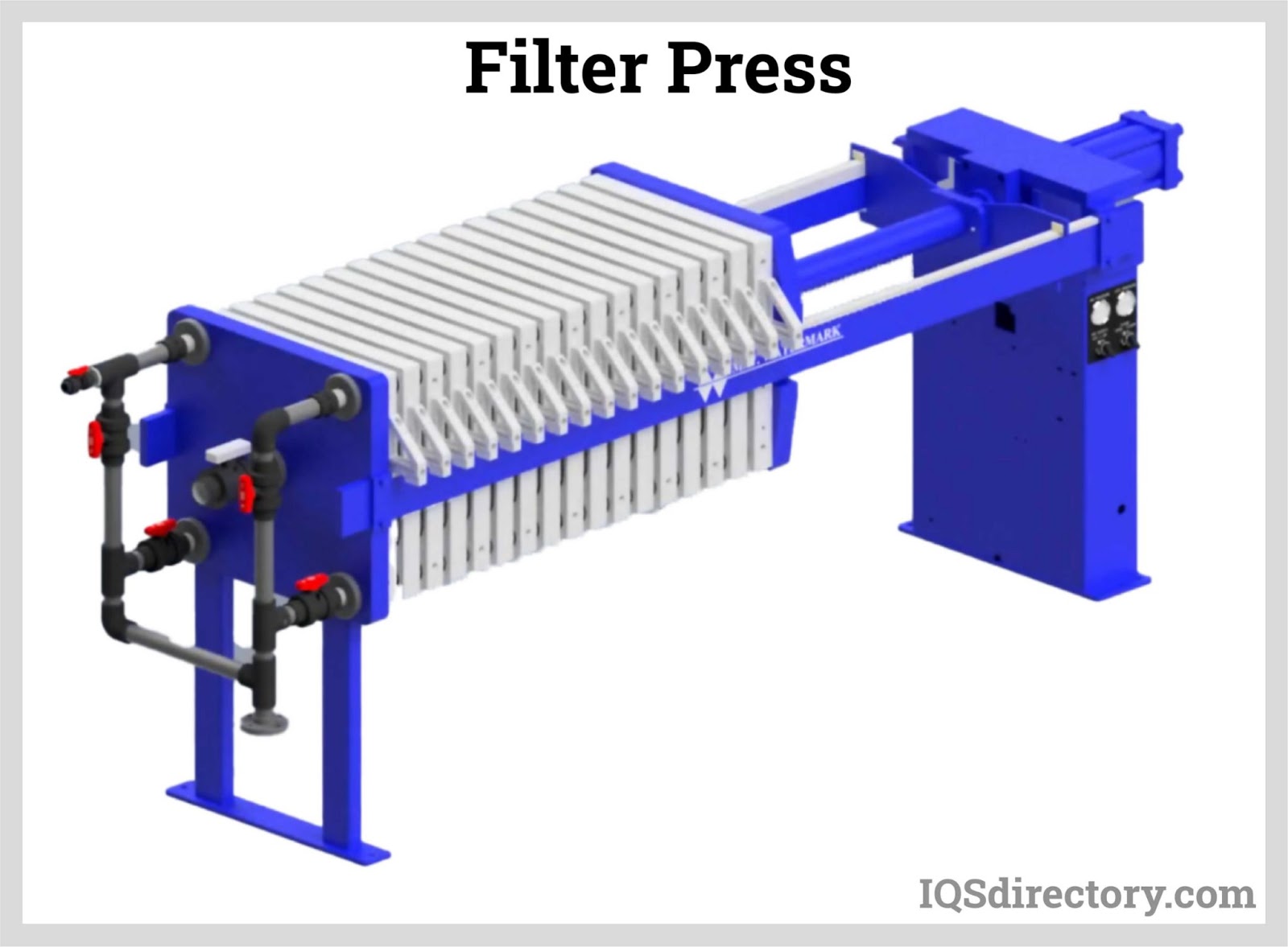

Packaging and Handling Requirements

MAHLE air filters must be packaged in accordance with MAHLE’s approved packaging standards to prevent damage during transit. Use only original or MAHLE-approved packaging materials. Filters should be stored in sealed containers to avoid exposure to dust, moisture, and contaminants. During handling, avoid dropping or applying pressure to the filter media. Use appropriate lifting equipment for palletized loads, and ensure stacks do not exceed maximum height limits specified on packaging labels.

Transportation Guidelines

Transport MAHLE air filters in dry, enclosed, and temperature-controlled vehicles whenever possible. Avoid exposure to extreme temperatures (below -20°C or above 60°C) and high humidity. Secure loads to prevent shifting during transit. For international shipments, comply with IATA, IMDG, or ADR regulations as applicable, although air filters generally do not classify as hazardous goods. However, packaging materials (e.g., plastic wraps, pallets) must meet ISPM 15 standards for wood packaging in international trade.

Storage Conditions

Store air filters in a clean, dry, and well-ventilated area with temperatures between 10°C and 35°C and relative humidity below 70%. Keep filters off the floor (minimum 10 cm) using pallets or shelving to prevent moisture absorption and contamination. Implement a first-in, first-out (FIFO) inventory system to ensure older stock is used first. Avoid storing near chemicals, oils, or strong odors that could affect filter performance.

Regulatory Compliance

Ensure compliance with all relevant regional and international regulations. In the European Union, follow REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives. In the United States, comply with EPA guidelines related to emissions and filtration standards. Product labeling must include MAHLE part numbers, batch/lot numbers, manufacturing dates, and CE or other required conformity marks. Safety Data Sheets (SDS) are available upon request for non-hazardous components.

Import/Export Documentation

For cross-border shipments, provide accurate commercial invoices, packing lists, and certificates of origin. Verify Harmonized System (HS) codes for MAHLE air filters (typically 8421.39 under filtration equipment) to ensure correct tariff classification. Confirm import requirements for destination countries, including conformity assessments or local certifications (e.g., INMETRO in Brazil, KC in South Korea). Retain documentation for a minimum of five years for audit and traceability purposes.

Traceability and Quality Assurance

Each batch of MAHLE air filters is traceable through unique batch/lot numbers recorded in MAHLE’s quality management system. Maintain documentation of receiving, storage, and dispatch activities. Report any damaged or non-conforming products immediately to MAHLE Customer Service. Regular audits of storage and handling practices are recommended to ensure continued compliance with MAHLE standards and ISO 9001/14001 requirements.

Environmental and Sustainability Considerations

Dispose of packaging materials in accordance with local recycling regulations. MAHLE promotes sustainable logistics practices, including returnable packaging where available. Used air filters are generally classified as non-hazardous waste but should be disposed of per local environmental regulations. Partner with certified waste management providers for end-of-life disposal.

Conclusion for Sourcing MAHLE Air Filters:

Sourcing MAHLE air filters presents a strategic advantage for ensuring high-quality, reliable, and efficient filtration solutions. MAHLE, as a globally recognized leader in automotive and industrial filtration technology, offers products that meet stringent international standards, providing excellent particulate capture, extended service life, and optimal engine protection. Their extensive product range ensures compatibility across a wide variety of applications and equipment types.

Procuring MAHLE air filters supports improved operational performance, reduced maintenance costs, and enhanced engine longevity. Additionally, sourcing from an established OEM like MAHLE ensures authenticity, traceability, and access to technical support. While the initial cost may be higher compared to generic alternatives, the long-term benefits in terms of performance, durability, and total cost of ownership make MAHLE a preferred and justified choice.

In conclusion, sourcing MAHLE air filters aligns with a commitment to quality, reliability, and efficiency, making it a sound decision for maintaining peak performance across vehicle and machinery fleets.