The global LED lighting market, which includes innovative product categories such as magnet lights, is experiencing robust expansion driven by rising energy efficiency standards, growing consumer demand for flexible lighting solutions, and rapid advancements in semiconductor technology. According to Grand View Research, the global LED lighting market size was valued at USD 85.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.3% from 2024 to 2030. This surge is further amplified by increasing adoption in residential, commercial, and industrial sectors, where magnetic LED lights—known for their easy installation, repositionability, and sleek design—have carved out a rapidly growing niche. As demand for modular and adaptable lighting grows, particularly in retrofit and smart lighting applications, manufacturers specializing in magnet lights are positioned at the forefront of innovation and market penetration. Based on industry performance, technological capability, and market reach, here are the top 10 magnet lights manufacturers leading this transformation.

Top 10 Magnet Lights Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 LED Magnetic Light Manufacturer

Domain Est. 2019

Website: mblamp.com

Key Highlights: Modular lighting solution for various spaces. Comprehensive customization options including color temperature. Deep discounts on volume orders….

#2 Philips Magnetic Sys

Domain Est. 1996

Website: signify.com

Key Highlights: Magnetic Sys offers excellent experience for the consumer, which includs eye comfort, reliable quality and outstanding performance….

#3 GOLIGHT

Domain Est. 1998

Website: golight.com

Key Highlights: The Golight GT builds on the original Golight/Radioray line. It features enhanced durability, more precise pan/tilt control, and an updated exterior design….

#4 Lithium Ion Magnetic Rechargeable Flex Light

Domain Est. 1999

Website: schumacherelectric.com

Key Highlights: 30-day returnsMAGNETIC BASE AND BEAM FOCUSING SYSTEM Cree® XPG high-performance LED Beam adjusts from spot light to wide area High and low settings 2200 mAh rechargeable ……

#5 Lumax Magnetic LED Light

Domain Est. 2004

Website: lumax.com

Key Highlights: The Magnetic LED Light can attach securely to most Hand Tools and is ideal for use on Grease Guns, Screwdrivers, Wrenches, Pliers, Ratchets, etc….

#6 ViviLux

Domain Est. 2008

Website: harbor-sales.com

Key Highlights: Free delivery over $99Illuminate, align, and magnify every project with ViviLux® LED lights, lasers, and magnifiers, all created by crafters for flawless sewing, quilting, and ……

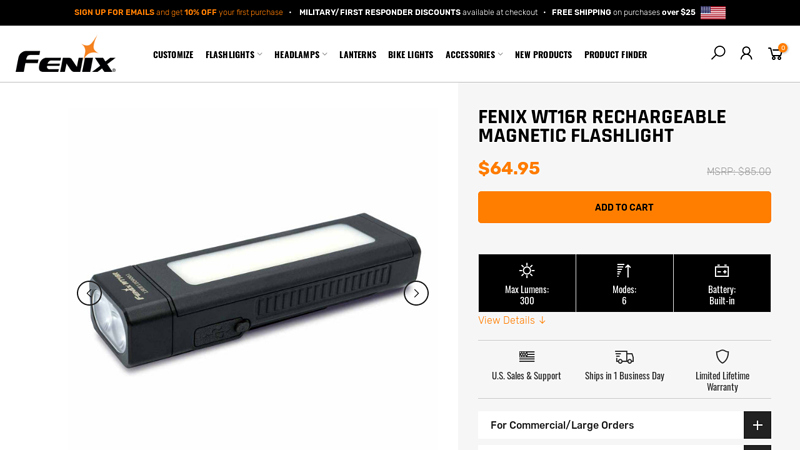

#7 Fenix WT16R Rechargeable Magnetic Flashlight

Domain Est. 2009

Website: fenixlighting.com

Key Highlights: In stock Rating 4.6 (34) The Fenix WT16R magnetic flashlight is a great all-purpose work light. Spotlight, floodlight & yellow flashing mode. USB type-C rechargeable….

#8 MAGNETIC LIGHT

Domain Est. 2012

Website: senna.hr

Key Highlights: Newly developed portable light with high-brightness LED breads. Compact and easy to carry but still very powerful RGBW light of 1900 LUX in 0,3m and CRI of 96+….

#9 Magnetic tracklight systems

Domain Est. 2020

Website: italuxlighting.com

Key Highlights: 14-day returnsThe Italux store offers a full range of lamps including, but not limited to, pendant lamps, plafonds, wall sconces, desk lamps, floor lamps and much more. In ……

#10 Top 10 magnetic track lighting manufacturers(2025)

Domain Est. 2022

Website: kingornan.com

Key Highlights: Top 10 magnetic track lighting manufacturers(2025) · Philips Lighting · KingOrnan · WAC Lighting · Artemide Group · Juno Lighting Group · LED Lights ……

Expert Sourcing Insights for Magnet Lights

H2: Projected Market Trends for Magnet Lights in 2026

As we approach 2026, the market for magnet lights—compact, portable lighting solutions that utilize magnetic bases for secure attachment to metal surfaces—is poised for significant growth and transformation. Driven by advances in LED technology, increasing demand for flexible and energy-efficient lighting, and expanding applications across consumer, industrial, and automotive sectors, magnet lights are expected to experience strong momentum. Below are key trends shaping the 2026 market landscape for magnet lights:

-

Rising Demand in DIY and Home Improvement Markets

The surge in home renovation and do-it-yourself (DIY) projects continues to fuel consumer interest in versatile lighting tools. Magnet lights offer hands-free illumination in tight or hard-to-reach spaces, making them ideal for tasks like under-cabinet lighting, automotive repair, or basement work. With the growing popularity of smart homes, magnet lights with USB-C charging, dimmable settings, and motion sensors are becoming standard features, appealing to tech-savvy homeowners. -

Expansion in Industrial and Commercial Applications

Industrial sectors such as manufacturing, construction, and warehousing are increasingly adopting magnet lights for maintenance, inspection, and emergency lighting. Their durability, portability, and ability to attach securely to metal machinery or structures make them indispensable tools for field technicians. By 2026, integration with IoT-enabled systems—allowing remote control or status monitoring—is expected to become more common in commercial-grade magnet lights. -

Advancements in LED and Battery Technology

The evolution of energy-efficient LEDs and long-lasting lithium-ion batteries is enhancing the performance of magnet lights. In 2026, expect to see brighter outputs (up to 1,000 lumens or more), extended battery life (10+ hours on a single charge), and faster charging capabilities. Miniaturization trends will also lead to slimmer, more powerful designs without sacrificing magnetic strength. -

Sustainability and Eco-Friendly Design

Environmental concerns are influencing product development. Manufacturers are shifting toward recyclable materials, reduced packaging waste, and energy-efficient components. Rechargeable models are dominating over disposable battery versions, reducing e-waste and aligning with global sustainability goals. Some brands are introducing solar-charging options, especially for outdoor and emergency-use magnet lights. -

Growth in Automotive and Emergency Use Cases

The automotive aftermarket remains a key growth driver. Magnet lights are widely used for under-hood repairs, tire changes, and roadside emergencies. By 2026, integration with vehicle diagnostic tools or smartphone apps may emerge, offering enhanced functionality. Additionally, emergency preparedness kits increasingly include magnet lights due to their reliability during power outages or natural disasters. -

E-Commerce and Direct-to-Consumer Sales Surge

Online retail platforms continue to dominate magnet light distribution. Brands are leveraging social media, influencer marketing, and customer reviews to reach niche audiences. Subscription models for replacements or upgrades, along with bundled kits (e.g., multiple lights with magnetic bases and charging docks), are gaining traction. -

Increased Competition and Market Consolidation

As the magnet light market expands, new entrants and established players alike are innovating to capture market share. This competition is driving down prices while improving features. By 2026, we may see consolidation among smaller brands, with larger electronics or lighting companies acquiring niche magnet light manufacturers to expand their portfolios. -

Global Market Penetration and Regional Growth

While North America and Europe remain strong markets due to high DIY culture and industrial infrastructure, Asia-Pacific is expected to witness the fastest growth. Rising urbanization, infrastructure development, and increasing disposable incomes in countries like India and Southeast Asia are creating new opportunities for affordable, versatile lighting solutions.

In summary, the 2026 magnet light market is set to be defined by innovation, sustainability, and broader application reach. As consumer and industrial needs evolve, magnet lights will transition from simple utility tools to smart, connected devices that enhance productivity, safety, and convenience across multiple domains. Companies that prioritize design, functionality, and environmental responsibility will be best positioned to lead this dynamic market.

Common Pitfalls When Sourcing Magnet Lights: Quality and Intellectual Property Risks

Sourcing magnet lights—compact, portable LED lights with magnetic bases—can present several challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these pitfalls can result in poor performance, customer dissatisfaction, legal complications, and reputational damage. Here are key risks to avoid:

Quality Inconsistencies and Substandard Components

One of the most prevalent issues when sourcing magnet lights is inconsistent product quality, especially when dealing with low-cost suppliers. Many manufacturers cut corners by using inferior materials such as weak magnets, low-lumen LEDs, or thin housings that crack easily. Batteries may have shorter lifespans or overheat, posing safety hazards. Without rigorous quality control and third-party testing, buyers risk receiving products that fail prematurely or underperform compared to specifications.

Best Practice: Request product samples, conduct independent testing (e.g., IP rating verification, drop tests, battery cycle checks), and audit supplier facilities. Ensure compliance with safety standards such as CE, RoHS, or UL where applicable.

Misrepresentation of IP Protection and Design Infringement

Many magnet light designs, particularly popular configurations like folding arms, multi-directional joints, or patented magnetic mounting systems, are protected by intellectual property rights. A common pitfall is sourcing “look-alike” products from suppliers who falsely claim the design is original or freely usable. In reality, these may infringe on existing utility or design patents, exposing the buyer to legal action, customs seizures, or forced product recalls.

Best Practice: Conduct thorough IP due diligence before placing orders. Work with legal counsel to perform patent searches and ensure freedom to operate. Require suppliers to provide IP indemnification clauses in contracts and verify that designs are either licensed or in the public domain.

Overstated IP Ratings and Environmental Resistance

Magnet lights are often marketed with high Ingress Protection (IP) ratings (e.g., IP65, IP67), suggesting dust and water resistance. However, many sourced products fail to meet these claims due to poor sealing, low-quality gaskets, or inadequate manufacturing tolerances. This misrepresentation can lead to product failures in wet or dusty environments, damaging brand credibility.

Best Practice: Demand test reports from accredited labs verifying the stated IP rating. Avoid relying solely on supplier claims. Perform your own environmental testing, especially if the lights will be used in demanding conditions.

Lack of Traceability and Supplier Transparency

Some suppliers, particularly those found on open marketplaces, may act as intermediaries without direct oversight of manufacturing. This lack of transparency makes it difficult to trace component origins, verify quality control procedures, or hold anyone accountable for defects or IP violations.

Best Practice: Source directly from verified manufacturers when possible. Request detailed information about production processes, component suppliers, and quality assurance protocols. Build long-term relationships with suppliers who prioritize transparency and compliance.

By proactively addressing these pitfalls—focusing on rigorous quality validation and diligent IP verification—buyers can mitigate risks and ensure they source reliable, legally compliant magnet lights that meet market expectations.

Logistics & Compliance Guide for Magnet Lights

Proper logistics and compliance management are essential for the safe, efficient, and legal distribution of Magnet Lights. This guide outlines key best practices and regulatory considerations for handling, shipping, storing, and documenting these products.

Product Classification & Identification

Magnet Lights—compact, portable lighting solutions with magnetic bases—typically fall under electrical lighting equipment. Accurate classification ensures correct handling and compliance. Key identification details include:

- HS Code (Harmonized System Code): Commonly 9405.40 (Electric lamps with a self-contained power source), but may vary by country and specific product features.

- UN Number: If containing lithium batteries, UN3480 (for standalone lithium-ion batteries) or UN3481 (for equipment containing lithium batteries) may apply.

- Product Specifications: Voltage, wattage, battery type (e.g., Li-ion, Li-Po), and certifications (e.g., CE, FCC, RoHS).

Ensure product labels include safety warnings, technical data, and compliance marks.

Battery Regulations & Safety

Most Magnet Lights use rechargeable lithium batteries, which are subject to strict transport regulations due to fire risks.

- IATA/ICAO (Air Transport): Lithium batteries must comply with Packing Instruction 965 (for batteries alone) or PI 966/967 (for batteries packed with or contained in equipment). Batteries must be at ≤30% state of charge and protected from short circuits.

- IMDG Code (Sea Freight): Follow applicable sections for Class 9 hazardous materials; proper packaging, marking, and documentation required.

- 49 CFR (U.S. Ground Transport): Comply with hazardous materials regulations when shipping via truck; exceptions may apply for small quantities under “de minimis” rules.

- Packaging: Use sturdy, non-conductive inner packaging to prevent terminal contact. Outer packaging must pass drop and vibration tests.

Packaging & Labeling Standards

Effective packaging protects product integrity and ensures regulatory compliance.

- Inner Packaging: Secure lights and accessories to prevent movement. Isolate battery terminals with insulating caps or tape.

- Outer Packaging: Use double-walled corrugated boxes with sufficient cushioning (e.g., foam inserts, bubble wrap).

- Labels & Markings:

- “Lithium Battery” handling labels (when applicable)

- Orientation arrows (if required)

- Proper shipping name and UN number

- Recyclable materials symbol (if applicable)

- Compliance marks (CE, FCC, UKCA, etc.)

Import/Export Compliance

Cross-border shipments require adherence to destination country regulations.

- CE Marking (EU): Required for safety, electromagnetic compatibility (EMC), and RoHS (Restriction of Hazardous Substances). Technical documentation must be available.

- FCC Certification (USA): Ensures electromagnetic interference compliance under Part 15 rules.

- UKCA Marking (UK): Required post-Brexit; similar to CE but for UK market.

- Energy Efficiency Regulations: Some regions (e.g., EU Ecodesign Directive) may impose energy consumption standards.

- Customs Documentation: Include commercial invoice, packing list, certificate of origin, and any required test reports or declarations of conformity.

Storage & Inventory Management

Proper storage preserves product quality and safety.

- Environment: Store in a cool, dry place away from direct sunlight and extreme temperatures (ideally 10°C–25°C / 50°F–77°F).

- Fire Safety: Avoid storing large quantities of battery-powered devices in confined spaces. Use non-combustible shelving and have fire suppression systems in place.

- Stock Rotation: Implement FIFO (First In, First Out) to prevent battery degradation over time.

- Segregation: Store batteries and devices separately if required by local fire code or insurance policies.

Reverse Logistics & End-of-Life

Plan for returns, repairs, and recycling.

- Warranty Returns: Clearly define return policies and test returned units for battery condition before resale or refurbishment.

- Battery Disposal: Comply with local WEEE (Waste Electrical and Electronic Equipment) regulations. Partner with certified e-waste recyclers.

- Recycling Labels: Include disposal instructions on packaging (e.g., “Do not dispose of as unsorted waste”).

Documentation & Recordkeeping

Maintain comprehensive records to support compliance audits and traceability.

- Test Reports: Keep copies of safety, EMC, and battery safety certifications (e.g., UL, TÜV).

- SDS (Safety Data Sheet): Required for lithium batteries under GHS regulations.

- Certificates of Conformity: For each major market (EU, US, UK, etc.).

- Shipping Records: Retain bills of lading, air waybills, and hazardous materials declarations for at least two years.

By adhering to this guide, businesses can ensure the reliable, compliant, and safe global distribution of Magnet Lights while minimizing risks and delays. Regularly review regulatory updates and consult with logistics partners specializing in battery-powered goods.

Conclusion for Sourcing Magnetic Lights:

In conclusion, sourcing magnetic lights requires a careful evaluation of quality, functionality, supply chain reliability, and cost-effectiveness. These versatile lighting solutions offer significant advantages in terms of ease of installation, repositioning, and space efficiency, making them ideal for a wide range of applications—from industrial and commercial settings to residential and retail environments.

When selecting suppliers, it is essential to prioritize vendors that demonstrate consistent product quality, compliance with safety and regulatory standards (such as CE, RoHS, or UL), and strong manufacturing capabilities. Additionally, factors such as magnetic strength, brightness (lumens), color temperature, battery life (for portable models), and durability should align with the intended use case.

Establishing partnerships with reputable manufacturers, particularly those offering customization options and scalable production, can provide long-term value and operational flexibility. Conducting sample testing, assessing lead times, and negotiating favorable pricing and payment terms further ensure a successful sourcing strategy.

Ultimately, a well-executed procurement plan for magnetic lights not only enhances lighting performance and adaptability but also contributes to operational efficiency and cost savings across projects.