The global magnesium market is experiencing steady expansion, driven by increasing demand across industries such as automotive, aerospace, electronics, and chemical synthesis. According to Grand View Research, the global magnesium market size was valued at USD 3.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. This growth is largely fueled by the metal’s lightweight properties and its critical role in alloy production and industrial chemical processes. Magnesium ribbon, a form used primarily in educational laboratories and certain metallurgical applications, represents a specialized segment within this broader market. As demand for high-purity magnesium forms increases, manufacturers are enhancing production capabilities and focusing on consistency, safety, and supply chain reliability. Based on global production capacity, export volume, and industry reputation, the following nine companies have emerged as key players in the magnesium ribbon manufacturing landscape.

Top 9 Magnesium Ribbon Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Magnesium (Metal) Ribbon

Domain Est. 2002

Website: cdhfinechemical.com

Key Highlights: CDH is an ISO certified Magnesium (Metal) Ribbon manufacturer in India, Magnesium (Metal) Ribbon (CAS-7439-95-4) supplier & exporter in India….

#2 Magnesium Metal Ribbon L/G 25G

Domain Est. 2018

Website: congeriem.com

Key Highlights: In stock Rating 4.8 (6,875) Chemical purchases under $50 requires an additional $10 handling fee. Manufacturer ID – IS22000 CAS#: 7439-95-4. Chemical Formula: Mg Molecular Weight…

#3 Magnesium Metal Ribbon

Domain Est. 1996

Website: viclabs.co.uk

Key Highlights: Magnesium Ribbon is a metal. A metal is a substance with high electrical conductivity and flexibility, which readily loses electrons to form positive ions….

#4 Magnesium Metal Ribbon, 25 g, Approx. 90 Feet

Domain Est. 1997

#5 Innovating Science®

Domain Est. 1997

Website: aldon-chem.com

Key Highlights: Magnesium Metal Ribbon, Lab Grade, 25g an Innovating Science® product from Aldon Corporation….

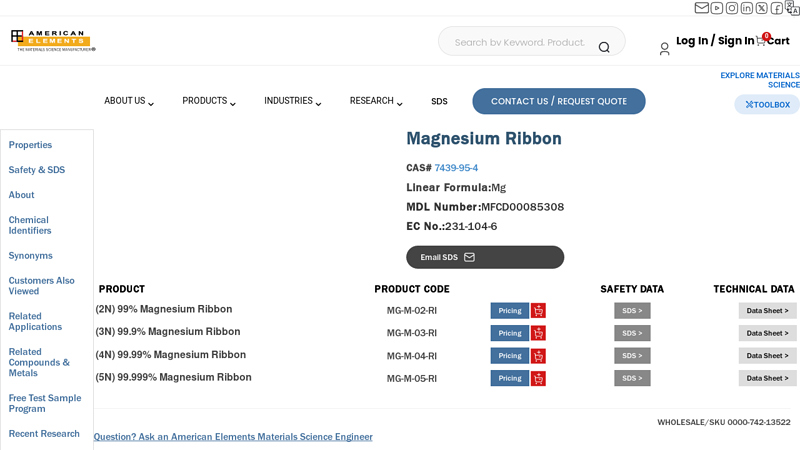

#6 Magnesium Ribbon

Domain Est. 1998

Website: americanelements.com

Key Highlights: American Elements specializes in producing Magnesium Ribbons in various thicknesses and sizes. Most ribbon is rolled for use in coating and thin film Chemical ……

#7 Magnesium

Domain Est. 2002

Website: dutscher.com

Key Highlights: Magnesium – ribbon – RPPE – For analysis – 100 g ; Made in Europe. Formula: Mg Molecular weight: 24,31. CASE: 7439-95-4 ; Specific terms. The sales prices ……

#8 Magnesium Metal Ribbon, lab grade

Domain Est. 2008

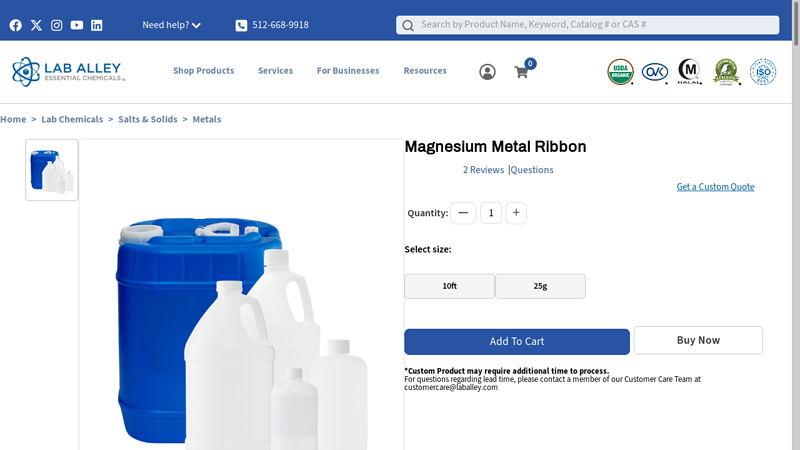

#9 Magnesium Metal Ribbon

Domain Est. 2011

Website: laballey.com

Key Highlights: In stock Rating 5.0 (2) Lab Alley is selling its high-quality Magnesium Metal Ribbon online at laballey.com. Due to its high purity, this Lab Alley product is highly recommended….

Expert Sourcing Insights for Magnesium Ribbon

H2: 2026 Market Trends for Magnesium Ribbon

The global magnesium ribbon market is poised for moderate but strategic growth by 2026, driven by its specialized applications in chemical synthesis, education, and niche industrial sectors. As a highly reactive form of magnesium metal, magnesium ribbon is primarily used in laboratory settings for demonstrations of redox reactions, combustion experiments, and as a reducing agent in organic chemistry. The 2026 outlook reflects evolving demand patterns, supply chain dynamics, and technological advancements.

1. Rising Demand in Educational and Research Sectors

By 2026, the demand for magnesium ribbon is expected to grow steadily in academic and research institutions, particularly in emerging economies. Increased investments in STEM (Science, Technology, Engineering, and Mathematics) education across Asia-Pacific, Latin America, and Africa are driving procurement of laboratory consumables, including magnesium ribbon. Governments and private institutions are modernizing science labs, which supports sustained consumption.

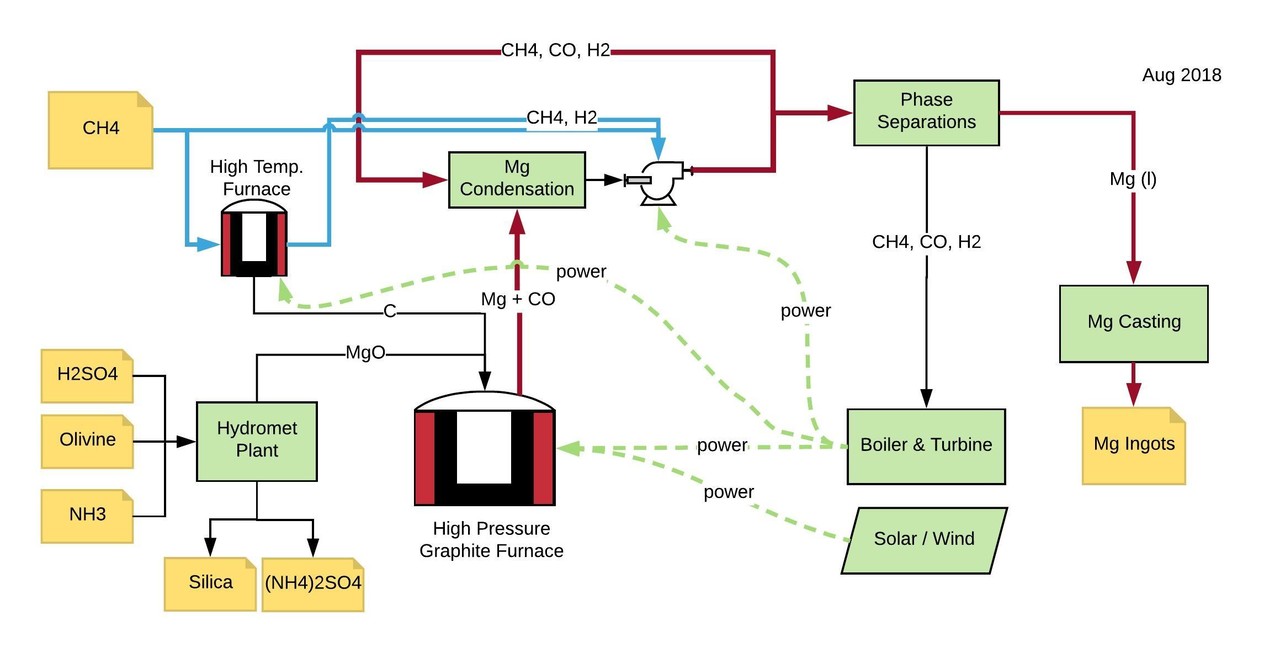

2. Supply Chain and Raw Material Constraints

Magnesium ribbon production is dependent on primary magnesium metal, predominantly sourced from China, which accounts for over 80% of global supply. Ongoing geopolitical tensions, environmental regulations, and energy costs in China could impact the availability and pricing of magnesium ingots—the raw material for ribbon production. By 2026, manufacturers may diversify sourcing or invest in secondary (recycled) magnesium to mitigate supply risks, though recycling of magnesium ribbon itself remains limited due to its single-use nature in most applications.

3. Environmental and Safety Regulations

Environmental, health, and safety (EHS) regulations are becoming more stringent, particularly in North America and Europe. Magnesium ribbon is flammable and requires careful handling and storage. Regulatory scrutiny may increase compliance costs for producers and distributors. However, these regulations also drive innovation in safer packaging, labeling, and handling protocols, improving market standards.

4. Technological and Application-Specific Innovations

While magnesium ribbon remains a commodity product, niche applications in materials science and pyrotechnics are emerging. Research into magnesium-based lightweight alloys and hydrogen storage materials may indirectly boost interest in high-purity magnesium forms, including ribbon, for experimental use. Additionally, advancements in automated lab systems could lead to standardized ribbon formats for integration into educational robotics or AI-driven chemistry platforms.

5. Price Volatility and Market Competition

Magnesium prices have historically been volatile due to energy-intensive production processes. In 2026, energy transition policies and carbon pricing may further influence production costs, particularly in regions reliant on coal-based power for magnesium smelting. This could lead to price fluctuations in magnesium ribbon, affecting procurement strategies among end users. Market competition remains fragmented, with numerous regional suppliers competing on purity, consistency, and delivery speed.

6. Regional Market Dynamics

– Asia-Pacific: Expected to be the fastest-growing region due to expanding education infrastructure and government support for scientific research.

– North America and Europe: Mature markets with stable demand, primarily driven by university labs and chemical research facilities.

– Middle East and Africa: Gradual market expansion supported by investments in education and industrial development.

Conclusion

By 2026, the magnesium ribbon market will remain a niche but essential segment within the broader specialty metals and laboratory supplies industry. Growth will be underpinned by educational expansion, quality standardization, and supply chain adaptation. While large-scale industrial shifts are unlikely, strategic developments in sustainability, safety, and regional manufacturing could shape the competitive landscape. Stakeholders should monitor raw material trends, regulatory changes, and educational funding policies to capitalize on emerging opportunities.

When sourcing magnesium ribbon, especially for applications involving hydrogen gas (H₂) generation—such as in educational labs or small-scale chemical synthesis—several common pitfalls can compromise both quality and safety. Here’s a breakdown of key issues related to quality and intellectual property (IP), with emphasis on safe and effective use in H₂ production:

🔹 Common Quality Pitfalls

- Surface Oxidation and Passivation

- Issue: Magnesium readily forms a surface layer of magnesium oxide (MgO) when exposed to air. This passivation layer reduces reactivity, especially in acid-based H₂ generation (e.g., with HCl: Mg + 2HCl → MgCl₂ + H₂↑).

- Impact: Slower or incomplete hydrogen production, inconsistent reaction rates.

-

Mitigation:

- Source ribbon with protective coating (e.g., wax or oil) and store in airtight containers.

- Use freshly abraded (sanded) magnesium before use to expose clean metal surface.

-

Impurity Content

- Issue: Low-grade magnesium may contain impurities like iron, nickel, or copper, which can act as catalysts for side reactions or reduce H₂ yield.

- Impact: Unpredictable reaction behavior, potential contamination of gas, or increased risk of ignition (due to catalytic decomposition of H₂).

-

Mitigation:

- Specify high purity (99.9% or higher, often labeled “lab grade” or “reagent grade”).

- Request a Certificate of Analysis (CoA) from the supplier.

-

Inconsistent Dimensions and Thickness

- Issue: Variability in width, thickness, or length affects surface area and thus reaction kinetics in H₂ generation.

- Impact: Poor reproducibility in experiments or processes.

-

Mitigation:

- Source from reputable chemical suppliers (e.g., Sigma-Aldrich, Fisher Scientific) who ensure dimensional consistency.

- Define precise specs in procurement (e.g., 6 mm × 10 m × 0.1 mm).

-

Use of Magnesium Alloys Instead of Pure Mg

- Issue: Some suppliers may offer magnesium alloys (e.g., AZ31) under misleading names.

- Impact: Alloys may react differently, produce less H₂, or generate unwanted byproducts.

- Mitigation:

- Confirm the material is pure magnesium (Mg), not an alloy.

- Verify with material safety data sheet (MSDS/SDS) and supplier specifications.

🔹 Intellectual Property (IP) Pitfalls

- Unlicensed Use in Patented Processes

- Issue: While magnesium ribbon itself is a commodity, its application in specific H₂ generation systems (e.g., portable hydrogen generators, fuel cells, or controlled-release reactors) may be protected by patents.

- Example: A startup designing a compact H₂ generator using Mg + H₂O (with a catalyst) might unknowingly infringe on existing IP covering such reaction chambers or activation methods.

-

Mitigation:

- Conduct a patent landscape search (e.g., using USPTO, Google Patents) before commercializing a process.

- Focus on non-patented reaction conditions (e.g., low-temperature acid hydrolysis) if developing proprietary systems.

-

Reverse Engineering Risks

- Issue: Copying a competitor’s magnesium-based H₂ device (e.g., shape, coating, activation method) could violate design or utility patents.

-

Mitigation:

- Avoid replicating proprietary geometries or treatment processes without licensing.

- Innovate on reaction control (e.g., pulsed acid delivery) rather than copying existing hardware.

-

Trade Secrets in Surface Treatment

- Issue: Some suppliers apply proprietary coatings or activation treatments to enhance reactivity with water (for direct H₂O + Mg → Mg(OH)₂ + H₂).

- Risk: Attempting to replicate such treated ribbon without permission may breach trade secret laws.

- Mitigation:

- Source treated magnesium only under appropriate agreements.

- Develop in-house surface modification methods (e.g., indium chloride activation) that are novel and patentable.

✅ Best Practices for Sourcing Magnesium Ribbon (for H₂ use)

| Aspect | Recommendation |

|——-|—————-|

| Purity | ≥99.9% Mg, with CoA |

| Form | Clean, unoxidized ribbon; wax-coated and vacuum-sealed |

| Supplier | Reputable chemical or lab supply vendor |

| Storage | Keep dry, sealed, away from moisture and acids |

| IP Check | Search patents before commercializing H₂ generation systems |

| Testing | Validate H₂ output and reaction rate upon receipt |

🔬 Example Reaction (H₂ Generation):

[\text{Mg (s)} + 2\text{HCl (aq)} \rightarrow \text{MgCl}_2 \text{(aq)} + \text{H}_2 \text{(g)} \uparrow

]

Ensure ribbon is reactive by testing a small piece with dilute HCl—vigorous bubbling indicates good quality.

Summary

Sourcing magnesium ribbon for H₂ production demands attention to material purity, reactivity, and consistency. While the metal itself is not IP-protected, its application in engineered systems may be. Always verify specifications, test performance, and conduct IP due diligence when developing or commercializing hydrogen-generating technologies.

H2: Logistics & Compliance Guide for Magnesium Ribbon

Magnesium ribbon is a flammable solid classified under hazardous materials regulations due to its reactivity, particularly with water and moisture, which can produce flammable hydrogen gas. Proper handling, packaging, transportation, and storage are essential to ensure safety and regulatory compliance.

- Hazard Classification

- UN Number: UN1504

- Proper Shipping Name: Magnesium, in solid form, including scrap and swarf

- Hazard Class: 4.3 (Dangerous when wet – emits flammable gas on contact with water)

- Packing Group: II (Medium danger)

- GHS Classification:

- Flammable Solid (Category 1)

- Hazardous in Contact with Water, Emitting Flammable Gases (Category 1)

-

Specific Target Organ Toxicity (Single Exposure) – Respiratory Irritation (Category 3)

-

Packaging Requirements

- Use tightly sealed, moisture-resistant containers (e.g., sealed plastic bags inside metal or rigid plastic drums).

- Inner packaging must prevent contact with water or moisture; desiccants may be used.

- Outer packaging must be UN-certified for Packing Group II, 4.3 hazards.

-

Avoid packaging with materials that may react (e.g., strong acids, oxidizers).

-

Labeling and Marking

- Diamond-shaped hazard label: Class 4.3 (Dangerous When Wet)

- “Keep Dry” and “Flammable Solid” markings

- UN1504 and proper shipping name on package

-

GHS pictograms: Flame, Exclamation Mark

-

Transport Regulations

- Road (ADR): Requires orange placards with “43” and “1504” on both sides and rear of vehicle. Driver must have ADR training.

- Air (IATA): Restricted; generally prohibited on passenger aircraft. May be permitted on cargo aircraft with special provisions (consult IATA DGR Section 4.2).

- Sea (IMDG Code): Allowed in closed or open freight containers with proper segregation (keep away from Class 8: Corrosives, especially acids and water sources).

-

Domestic (e.g., 49 CFR in USA): Requires hazardous materials shipping papers, placarding for bulk transport, and employee training.

-

Storage Guidelines

- Store in a cool, dry, well-ventilated area away from water sources, moisture, and incompatible materials (acids, oxidizers, halogens).

- Use non-combustible flooring and spill containment.

-

Storage containers should remain sealed when not in use.

-

Handling Precautions

- Use non-sparking tools and grounding equipment to prevent static discharge.

- Avoid creating dust or fines; use local exhaust ventilation.

-

Personnel should wear appropriate PPE: chemical-resistant gloves, safety goggles, flame-resistant lab coat, and respiratory protection if dust is generated.

-

Emergency Response

- Fire: Use Class D fire extinguishers (e.g., dry sand, graphite powder, or special metal fire extinguishers). Never use water, CO₂, or halogenated agents.

- Spill: Avoid water contact. Collect dry material using non-sparking tools and place in a dry, approved container.

-

Exposure: In case of inhalation, move to fresh air. For skin/eye contact, rinse thoroughly with water (only if dry; if wet, treat as reactive incident).

-

Regulatory Documentation

- Safety Data Sheet (SDS) – Ensure up-to-date, compliant with GHS.

- Shipper’s Declaration for Dangerous Goods (air/sea).

-

Hazardous Waste Manifest (if discarded as waste; check local regulations).

-

Training & Compliance

- Personnel involved in handling, shipping, or storing must receive hazmat training per OSHA (HCS), DOT (49 CFR), or equivalent international standards.

- Regular audits and inspections recommended to maintain compliance.

Note: Always consult the latest edition of applicable regulations (e.g., IATA DGR, IMDG Code, ADR, 49 CFR) and local authority requirements before shipping or storing magnesium ribbon.

In conclusion, sourcing magnesium ribbon requires careful consideration of purity, supplier reliability, cost-effectiveness, and compliance with safety and environmental standards. It is essential to select suppliers who provide high-quality, consistent products suitable for intended applications—whether for educational demonstrations, industrial processes, or research purposes. Verifying certifications, conducting supplier audits, and evaluating lead times and shipping conditions can ensure a dependable supply chain. Additionally, proper storage and handling guidelines must be communicated to maintain the integrity and safety of the magnesium ribbon upon receipt. A well-structured sourcing strategy will ultimately support operational efficiency, safety, and cost management.