The global market for specialty inorganic chemicals has seen steady expansion, driven by increasing demand in water treatment, chemical synthesis, and industrial oxidation processes. Magnesium permanganate, while less common than other permanganate salts, is gaining traction due to its unique solubility profile and effectiveness in controlled-release oxidation applications. According to Grand View Research, the global permanganate market was valued at USD 786.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030, fueled by stringent environmental regulations and rising investments in wastewater management infrastructure. This growth trajectory underscores the importance of reliable manufacturing capacity and quality control in the supply chain. As demand for high-purity magnesium permanganate increases—particularly in niche pharmaceutical and environmental applications—identifying the leading manufacturers becomes critical for downstream users seeking consistency, scalability, and regulatory compliance. The following list highlights the top eight producers based on production capacity, geographic reach, product certification, and market presence.

Top 8 Magnesium Permanganate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

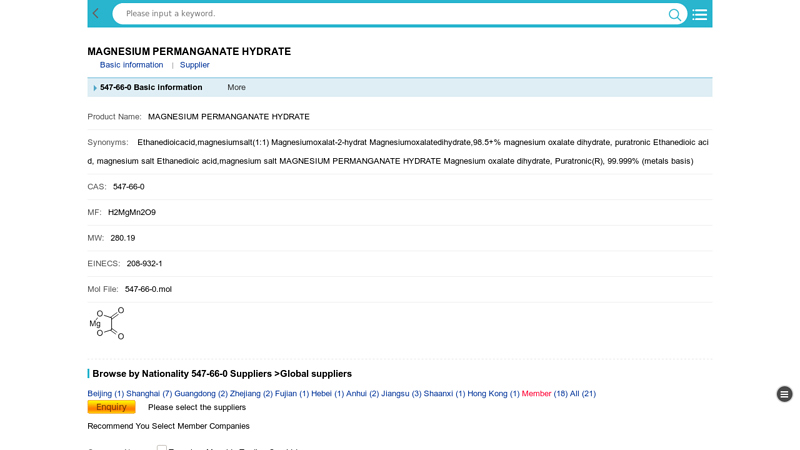

#1 MAGNESIUM PERMANGANATE HYDRATE suppliers …

Domain Est. 2006

Website: m.chemicalbook.com

Key Highlights: ChemicalBook provide 21 suppliers and manufacturers of MAGNESIUM PERMANGANATE HYDRATE in China.Welcome online inquiry and buy MAGNESIUM PERMANGANATE HYDRATE….

#2 Airedale Group

Domain Est. 2014 | Founded: 1973

Website: airedale-group.com

Key Highlights: Airedale Group is an award-winning UK supplier and manufacturer of speciality and commodity chemicals. Trusted by thousands of customers since 1973….

#3 Magnesium permanganate

Domain Est. 1997

Website: pubchem.ncbi.nlm.nih.gov

Key Highlights: Magnesium permanganate | MgMn2O8 | CID 11557984 – structure, chemical names, physical and chemical properties, classification, patents, literature, ……

#4 Magnesium Suppliers

Domain Est. 1998

Website: americanelements.com

Key Highlights: Magnesium qualified commercial & research quantity preferred supplier. Buy at competitive price & lead time. In-stock for immediate delivery….

#5 magnesium permanganate hydrate

Domain Est. 2008

Website: echemi.com

Key Highlights: LEAPChem is a specialized fine chemical supplier for research, development and production. LEAPChem provides nearly 200,000 rare and innovative chemical ……

#6 Magnesia chemicals

Domain Est. 2016

Website: magnesiachemicals.com

Key Highlights: At Magnesia Chemicals LLP, we specialize in the production of high-purity permanganate solutions, delivering quality, innovation, and sustainability at every ……

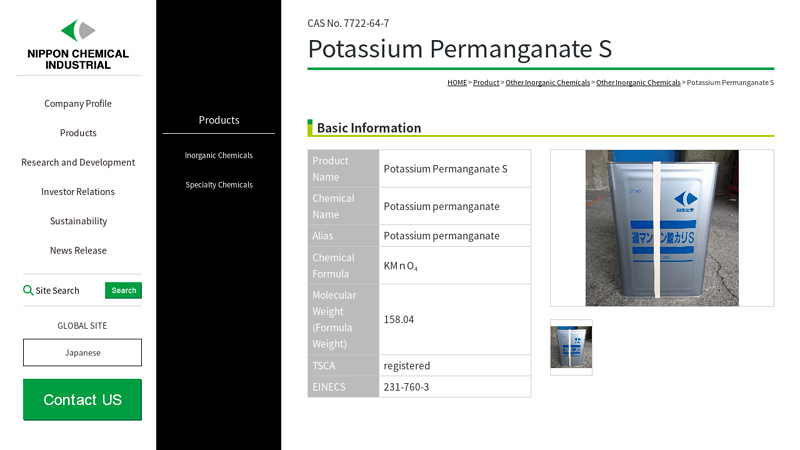

#7 Potassium Permanganate S

Website: nippon-chem.co.jp

Key Highlights: Description, Soluble in water. Decomposed in alcohol. Appearance, Dark purple, crystalline solid. Quality, KMnO4≧ 98.5% Water-insolubles ≦ 0.4% Cl ≦ 0.02%…

#8 Magnesium permanganate, CasNo.10377

Website: yisiteling.lookchem.com

Key Highlights: Quick Details. ProName: Magnesium permanganate; CasNo: 10377-62-5; Molecular Formula: HMnO4.1/2Mg; Appearance: solid or liquid; Application: Pharma;Industry ……

Expert Sourcing Insights for Magnesium Permanganate

H2: Market Trends for Magnesium Permanganate in 2026

As of 2026, the global market for magnesium permanganate (Mg(MnO₄)₂), though highly specialized and limited in commercial scale, is experiencing incremental growth driven by niche applications in advanced oxidation processes, environmental remediation, and specialized chemical synthesis. Despite its relatively low profile compared to more common oxidizing agents like potassium permanganate, magnesium permanganate is gaining attention due to its unique physicochemical properties—particularly its higher solubility in water and milder reactivity profile, which make it suitable for sensitive industrial and environmental applications.

Key Market Trends in 2026:

-

Growth in Environmental Remediation Technologies

A primary driver of demand for magnesium permanganate is its use in groundwater and soil decontamination. In 2026, regulatory tightening around environmental pollution—especially in North America and the European Union—has spurred the adoption of advanced in-situ chemical oxidation (ISCO) techniques. Magnesium permanganate is favored in these applications due to its reduced corrosivity and lower impact on soil pH compared to sodium or potassium permanganate, minimizing secondary ecological damage. -

Expansion in Wastewater Treatment Applications

The compound is increasingly being evaluated in municipal and industrial wastewater treatment facilities for the removal of emerging contaminants such as pharmaceuticals, endocrine disruptors, and trace organic pollutants. Pilot programs in Asia-Pacific and North America have demonstrated enhanced oxidation efficiency when magnesium permanganate is used in tandem with ultraviolet (UV) or ozone treatments, boosting its appeal in integrated water treatment systems. -

R&D Investment in Specialized Chemical Synthesis

Magnesium permanganate is being explored as a selective oxidizing agent in fine chemical and pharmaceutical manufacturing, where controlled reactivity is essential. In 2026, several research institutions and specialty chemical firms—particularly in Germany, Japan, and the United States—are conducting trials to leverage its properties in synthesizing high-purity organic intermediates. While still in early stages, this trend signals potential long-term market expansion if scalability and cost challenges are addressed. -

Supply Chain and Production Challenges

Despite growing interest, the market remains constrained by limited production capacity. Magnesium permanganate is not produced at scale due to its instability and complex synthesis, which requires precise conditions to avoid decomposition. As of 2026, only a few specialty chemical manufacturers (e.g., in China and the U.S.) offer the compound, often on a custom-order basis. This results in high pricing and supply volatility, which restricts widespread adoption. -

Regulatory and Safety Considerations

Regulatory scrutiny around handling and transportation of strong oxidizers continues to influence market dynamics. However, magnesium permanganate’s lower hygroscopicity and reduced risk of spontaneous combustion compared to other permanganates have improved its safety profile, leading to more favorable handling regulations in certain jurisdictions. This has encouraged cautious adoption in industrial settings. -

Regional Market Dynamics

- North America: Leading in adoption due to stringent EPA regulations and active remediation projects.

- Europe: Moderate growth, with emphasis on green chemistry and sustainable remediation methods.

- Asia-Pacific: Emerging interest, particularly in China and India, where rapid industrialization has created demand for advanced pollution control solutions.

Conclusion:

While magnesium permanganate remains a niche chemical in 2026, its market is on an upward trajectory, supported by environmental regulations, technological advancements, and targeted R&D. However, scalability, cost, and stability issues continue to limit broad commercialization. Future growth will depend on innovation in stabilization techniques, production efficiency, and demonstration of cost-effective applications across water treatment and specialty chemistry sectors.

H2: Common Pitfalls in Sourcing Magnesium Permanganate (Quality and Intellectual Property)

Sourcing magnesium permanganate—whether for research, industrial applications, or specialty chemical synthesis—can present several challenges, particularly concerning product quality and intellectual property (IP) considerations. Below are key pitfalls to avoid:

1. Quality Assurance and Purity Issues

-

Inconsistent Purity Levels: Magnesium permanganate is not as commonly produced or standardized as other permanganates (e.g., potassium permanganate). Suppliers may offer varying purity grades (e.g., 70% vs. 95%), often without rigorous certification. Always request a Certificate of Analysis (CoA) detailing assay, heavy metals, moisture content, and insoluble residues.

-

Stability and Decomposition: Magnesium permanganate is relatively unstable compared to alkali metal permanganates. It may degrade during storage or transit, especially under heat, light, or humidity. Ensure suppliers provide stability data and proper packaging (e.g., light-resistant, sealed containers with desiccants).

-

Impurity Profile: Contaminants such as chloride, sulfate, or residual solvents can interfere with sensitive applications (e.g., organic synthesis or catalysis). Confirm the supplier conducts full impurity profiling and adheres to relevant quality standards (e.g., ASTM, ISO, or internal QC protocols).

-

Mislabeling or Substitution: Rare compounds like magnesium permanganate are sometimes misrepresented. Unscrupulous suppliers may substitute with mixtures or lower-cost analogs. Third-party testing (e.g., via ICP-MS, UV-Vis, or titration) upon receipt is strongly advised.

2. Intellectual Property (IP) Risks

-

Patented Synthesis Methods: The preparation of magnesium permanganate may be covered under process patents, especially if produced via a novel route (e.g., ion exchange, electrochemical methods). Sourcing from a manufacturer using an infringing process could expose your organization to indirect liability, particularly in regulated industries.

-

Application-Specific IP: Certain uses of magnesium permanganate (e.g., in water treatment, battery materials, or pharmaceutical intermediates) may be protected by method-of-use patents. Verify freedom-to-operate (FTO) before commercial deployment.

-

Trade Secrets and Proprietary Formulations: Some suppliers may offer “enhanced” or stabilized forms of magnesium permanganate that incorporate proprietary additives. Ensure any such formulations do not impose IP restrictions on your downstream use or resale.

3. Supply Chain Transparency and Reliability

-

Limited Suppliers and Opaque Sources: Due to low demand, there are few established manufacturers. Some vendors may act as intermediaries without direct production capabilities, leading to inconsistent supply or lack of technical support. Prefer suppliers with verifiable production facilities and technical expertise.

-

Lack of Regulatory Compliance Documentation: Depending on jurisdiction, magnesium permanganate may be subject to chemical control regulations (e.g., REACH, TSCA). Ensure the supplier provides necessary compliance documentation to avoid import/export delays or legal issues.

4. Handling and Safety Data Gaps

- Inadequate SDS (Safety Data Sheets): Some suppliers provide incomplete or generic SDS, especially for less common chemicals. Confirm that hazard classifications (oxidizer, environmental toxicity) are accurate and aligned with GHS standards.

Recommendations:

- Conduct due diligence: Audit suppliers for quality systems (e.g., ISO 9001), production capabilities, and regulatory compliance.

- Require batch-specific analytical data and retain samples for verification.

- Consult IP counsel when sourcing for commercial applications, especially if scaling up or integrating into patented processes.

- Consider custom synthesis agreements with clear IP ownership terms if off-the-shelf sourcing poses risks.

By addressing both quality and IP concerns proactively, organizations can mitigate risks and ensure reliable, compliant access to magnesium permanganate.

H2. Logistics & Compliance Guide for Magnesium Permanganate

Note: Magnesium permanganate (Mg(MnO₄)₂) is a strong oxidizing agent and must be handled with extreme care. While it is less commonly used than potassium or sodium permanganate, its reactivity and hazards require strict adherence to safety, logistics, and regulatory guidelines.

H2.1 Chemical Identification

- Chemical Name: Magnesium Permanganate

- CAS Number: 10101-50-5 (estimated; verify with supplier)

- Molecular Formula: Mg(MnO₄)₂

- UN Number: UN 1490 (Permanganates, inorganic, n.o.s.)

- Class: 5.1 Oxidizing Substances (Dangerous Goods)

- Packing Group: II (Medium Danger) – may vary based on concentration and form

H2.2 Hazard Classification (GHS)

- GHS Classification:

- Ox. Sol. 2 (Oxidizing Solid, Category 2) – H272: May intensify fire; oxidizer

- Acute Tox. 4 (Oral, Category 4) – H302: Harmful if swallowed

- Skin Irrit. 2 – H315: Causes skin irritation

- Eye Dam. 2A – H319: Causes serious eye irritation

- STOT SE 3 – H335: May cause respiratory irritation

H2.3 Storage Requirements

- Storage Conditions:

- Store in a cool, dry, well-ventilated area.

- Keep away from heat, sparks, and open flames.

- Store separately from flammable materials, reducing agents, organic compounds, and combustibles.

- Use non-combustible flooring and storage shelving.

-

Keep containers tightly closed.

-

Compatibility:

❌ Incompatible with: Acids, alcohols, glycerol, sulfur, phosphorus, amines, and other organic materials.

✅ Compatible with: Inert materials such as glass or certain plastics (verify chemical resistance).

H2.4 Transportation (DOT, IATA, IMDG)

- Transport Classification:

- UN Number: UN 1490

- Proper Shipping Name: PERMANGANATES, INORGANIC, N.O.S. (Magnesium Permanganate)

- Class: 5.1 (Oxidizing Substances)

- Packing Group: II

- Labels Required: Oxidizer (5.1) label on package

-

Segregation: Keep away from flammables, combustibles, and reducing agents during transport

-

Packaging Requirements:

- Must use packaging tested and certified for Packing Group II.

- Inner containers must prevent leakage; outer packaging must pass drop and stacking tests.

-

Use non-combustible absorbent material if necessary.

-

Documentation:

- Safety Data Sheet (SDS) required

- Shipper’s Declaration for Dangerous Goods (for air and sea)

-

Transport emergency card (e.g., TREMCARD) recommended

-

Air (IATA): Permitted with restrictions; check IATA DGR Section 4.2 and Special Provision A20

- Sea (IMDG): Must comply with IMDG Code, Chapter 3.3, Packing Instruction 505

- Ground (DOT 49 CFR): Follow Hazardous Materials Regulations (HMR); placard vehicles if > 1,001 lbs aggregate gross weight of Class 5.1 materials

H2.5 Handling & Personal Protective Equipment (PPE)

- Engineering Controls:

- Use local exhaust ventilation.

-

Avoid dust formation.

-

PPE Requirements:

- Gloves: Nitrile or neoprene (check chemical resistance)

- Eye Protection: Chemical splash goggles or face shield

- Respiratory Protection: NIOSH-approved N95 respirator if dust is generated; for higher exposure, use a half-face or full-face respirator with P100 filter

- Protective Clothing: Lab coat or chemical-resistant apron; avoid synthetic fabrics that may ignite

H2.6 Emergency Procedures

- Spill Response:

- Evacuate non-essential personnel.

- Do not use combustible materials (e.g., sawdust) for cleanup.

- Dampen spill with water and carefully collect using non-combustible tools.

- Place in approved container for disposal.

-

Ventilate area.

-

Fire Response:

- Fire Hazard: Strong oxidizer; may cause or intensify fire.

- Extinguishing Media: Use water spray, dry chemical, CO₂, or foam.

- Evacuate area; do not fight fire alone.

- Cool containers with water from a safe distance.

-

Do not use combustible extinguishing agents (e.g., halons in some cases may react).

-

First Aid:

- Inhalation: Move to fresh air; seek medical attention if respiratory irritation occurs.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Flush with water for at least 15 minutes; seek medical help.

- Ingestion: Rinse mouth; do not induce vomiting; seek immediate medical attention.

H2.7 Regulatory Compliance

- OSHA (USA):

- Comply with 29 CFR 1910.1200 (Hazard Communication Standard)

-

Maintain SDS and train employees on hazards and procedures

-

EPA (USA):

- Reportable quantities (RQ): 100 lbs for permanganate compounds (verify for magnesium permanganate) under CERCLA

-

RCRA: Not typically listed as hazardous waste unless mixed with contaminants

-

REACH/CLP (EU):

- Registered under REACH if produced/imported > 1 ton/year

-

Labeling per CLP Regulation (EC) No 1272/2008

-

Globally Harmonized System (GHS):

- All labels and SDS must conform to GHS standards

H2.8 Disposal

- Waste Classification: Oxidizing waste; may be hazardous depending on local regulations

- Disposal Method:

- Do not dispose of in sewer or environment.

- Neutralize under controlled conditions if possible (consult specialist).

- Dispose through licensed hazardous waste contractor

- Regulatory Compliance: Follow RCRA (USA), Waste Framework Directive (EU), or local hazardous waste regulations

H2.9 Training & Documentation

- All personnel involved in handling, storage, or transport must be trained in:

- Hazards of oxidizing materials

- Emergency response procedures

- Use of PPE

- Regulatory requirements (DOT, OSHA, etc.)

- Maintain records of training, SDS access, and incident reports

Disclaimer: Specific properties and regulatory details for magnesium permanganate may vary by formulation and concentration. Always consult the manufacturer’s SDS and regulatory authorities before handling, transporting, or storing this material.

Document Control:

Prepared by: [Your Safety Officer]

Version: 1.0

Date: [Current Date]

Review Period: Annual or after regulatory change

In conclusion, sourcing magnesium permanganate requires careful consideration of supplier reliability, product purity, regulatory compliance, and safety documentation. Due to its specialized applications—primarily in research, chemical synthesis, and water treatment—magnesium permanganate is not as widely available as other permanganates like potassium permanganate. Potential buyers should prioritize suppliers with proven experience in handling oxidizing chemicals, proper storage and shipping protocols, and certifications ensuring quality control. Additionally, evaluating cost-effectiveness, minimum order quantities, and lead times will help in establishing a sustainable supply chain. Given its sensitivity and reactivity, proper handling, storage, and safety precautions must be emphasized throughout the sourcing process. Overall, a thorough due diligence approach will ensure the acquisition of high-quality magnesium permanganate suitable for intended applications.