The global market for inorganic salts such as magnesium chloride and calcium chloride has seen steady expansion, driven by rising demand across industrial, road safety, food processing, and pharmaceutical applications. According to Grand View Research, the global calcium chloride market was valued at USD 3.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. Similarly, the magnesium chloride market is witnessing robust growth, fueled by its use in dust control, de-icing, and as a precursor in magnesium metal production, with Mordor Intelligence projecting a significant CAGR over the forecast period amid increasing infrastructure and environmental management initiatives. As demand intensifies, key manufacturers are differentiating themselves through production efficiency, purity standards, sustainability practices, and application-specific formulations. In this competitive landscape, eight leading companies have emerged as dominant players, shaping the supply and innovation dynamics of both magnesium chloride and calcium chloride worldwide.

Top 8 Magnesium Chloride Vs Calcium Chloride Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TETRA Technologies, Inc.

Domain Est. 2023

Website: onetetra.com

Key Highlights: TETRA Technologies delivers leading solutions to the upstream energy industry for completions fluids, water management, and production testing….

#2 Calcium Chloride vs. Magnesium Chloride

Domain Est. 1995

Website: pollard.mnsi.net

Key Highlights: Calcium Chloride vs. Magnesium Chloride ; 2. Corrosiveness Top ; a. Claim, Magnesium chloride is less toxic and has less impact on vegetation and the environment….

#3 Magnesium Chloride USP/EP

Domain Est. 1998

Website: allanchem.com

Key Highlights: Magnesium Chloride USP/EP is rigorously tested for purity (98.0–101.0% as MgCl₂·6H₂O), solubility, and low heavy metal content (≤ 10 ppm), ……

#4 Calcium Chloride vs. Magnesium Chloride

Domain Est. 1999

Website: peterschemical.com

Key Highlights: Claim: Magnesium Chloride is a more effective ice melter. · FACT: Calcium chloride actually melts more ice between -18C and -1C (0 F and 30F). · FACT: Calcium ……

#5 Magnesium Chloride Ice Melt

Domain Est. 1999

Website: meltsnow.com

Key Highlights: Meltsnow.com offers all forms of magnesium chloride, including MAG® from Dead Sea Works in Flake and Pellet forms, as well as others for ice and snow removal ……

#6 The Benefits of Utilizing Magnesium Chloride or Calcium …

Domain Est. 1999

Website: hartru.com

Key Highlights: Two essential chemicals for clay court care are magnesium chloride and calcium chloride. They help with dust control, moisture retention, and maintaining the ……

#7 Calcium Chloride & Magnesium Chloride Supplier

Domain Est. 2020

Website: exelligent.ca

Key Highlights: Calcium Chloride (CaCl2) and Magnesium Chloride (MgCl2) are very useful as fertilizer for plants, because they provide important micronutrients that are vital ……

#8 Calcium Chloride vs Magnesium Chloride

Domain Est. 2015

Website: snowicesalt.com

Key Highlights: Compared to calcium chloride or rock salt, magnesium is more costly. In contrast to calcium chloride, which costs $20 for 50 pounds, and rock ……

Expert Sourcing Insights for Magnesium Chloride Vs Calcium Chloride

H2: Comparative Market Trends of Magnesium Chloride vs. Calcium Chloride (2026 Outlook)

As the global industrial and environmental sectors evolve, the demand for de-icing agents, dust suppressants, and chemical feedstocks continues to shape the market dynamics of chloride-based compounds—particularly magnesium chloride (MgCl₂) and calcium chloride (CaCl₂). By 2026, several key trends are expected to influence the relative performance, adoption, and pricing of these two compounds across major end-use industries.

-

De-Icing and Road Safety Applications

-

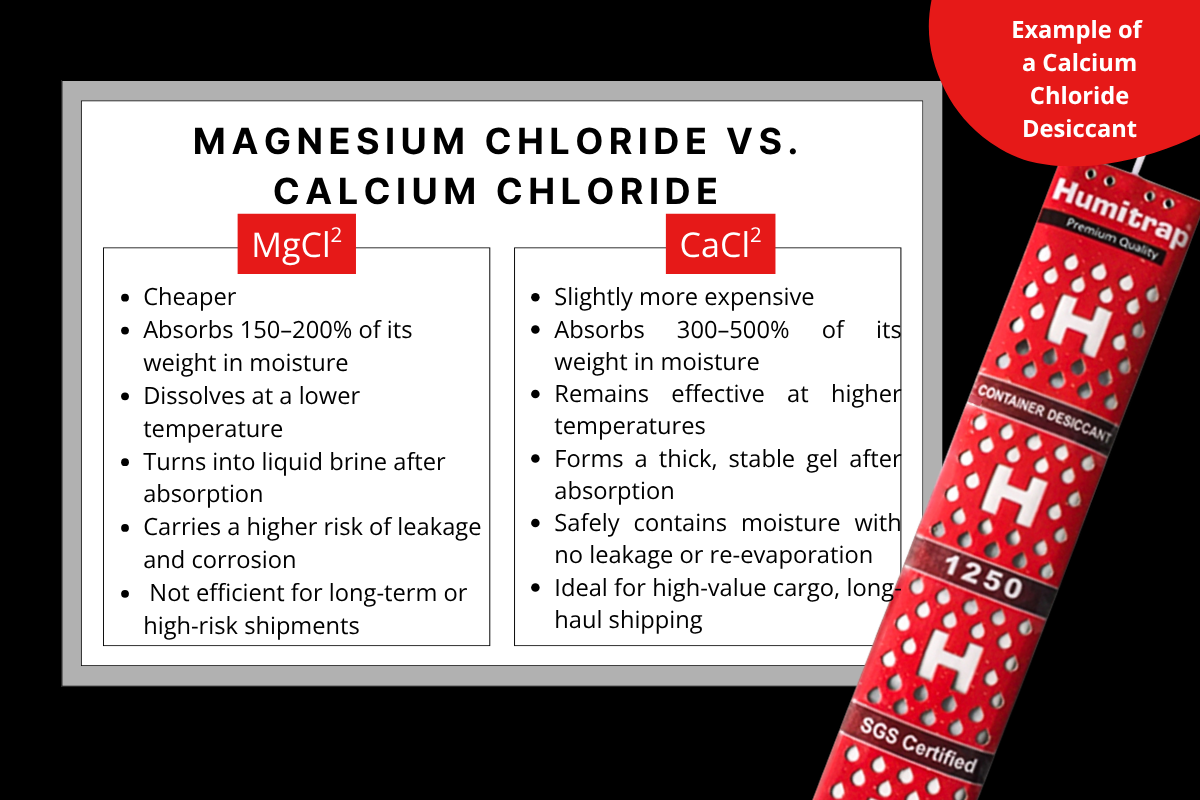

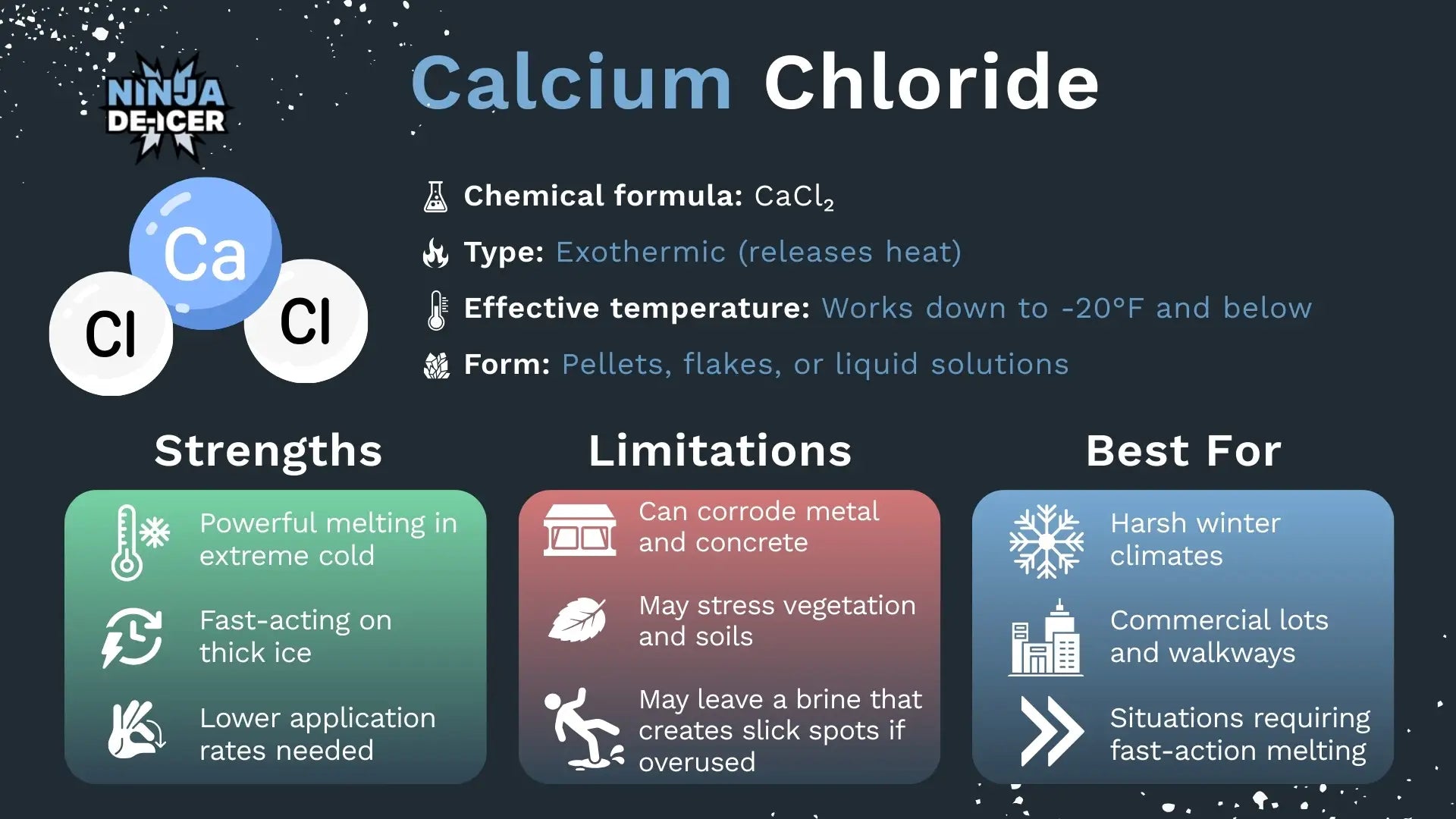

Calcium Chloride: Historically dominant in cold-climate de-icing due to its exothermic reaction and effectiveness at temperatures as low as -29°C (-20°F), CaCl₂ remains a preferred choice for municipalities and transportation departments. However, rising environmental concerns—especially regarding soil salinization and corrosion of infrastructure—are prompting regulatory scrutiny, potentially limiting its growth.

-

Magnesium Chloride: Gaining traction as a more environmentally friendly de-icer, MgCl₂ is effective down to about -15°C (5°F) and is less corrosive than CaCl₂. Its use as a pre-wetted agent or anti-icing treatment is expanding. In 2026, increased investment in sustainable winter road maintenance is projected to boost MgCl₂ demand, particularly in ecologically sensitive regions like the Pacific Northwest and Northern Europe.

Market Outlook 2026: MgCl₂ is expected to gain market share in the de-icing segment, driven by green procurement policies and municipal sustainability goals, although CaCl₂ will retain dominance in extreme cold applications.

-

Dust Control and Unpaved Road Stabilization

-

Magnesium Chloride: Widely used in mining, construction, and rural roads for dust suppression due to its hygroscopic nature and lower toxicity. The mining sector’s expansion in Latin America and Africa is driving demand. Additionally, stricter air quality regulations are accelerating adoption.

-

Calcium Chloride: Also effective for dust control, but its higher cost and greater corrosiveness reduce appeal. Its use is more common in industrial zones where performance is prioritized over environmental impact.

Market Outlook 2026: MgCl₂ is anticipated to maintain a stronger position in the dust control market, supported by cost-efficiency and environmental regulations. Demand is projected to grow at a CAGR of ~5.2% through 2026, outpacing CaCl₂ in this segment.

-

Industrial and Chemical Feedstock Use

-

Calcium Chloride: Critical in oil & gas (as a completion fluid), food processing (firming agent), and refrigeration. Its role in concrete acceleration remains significant in construction. Supply chain resilience and consistent purity are key market drivers.

-

Magnesium Chloride: Used in flame retardants, textiles, and as a precursor for magnesium metal production. Growth in the electric vehicle (EV) sector may increase demand for magnesium alloys, indirectly boosting MgCl₂. However, its industrial applications are more niche compared to CaCl₂.

Market Outlook 2026: CaCl₂ will likely continue leading in industrial chemical applications due to broader utility and established supply chains. However, emerging demand for magnesium in lightweight materials could elevate MgCl₂’s strategic importance.

-

Environmental and Regulatory Pressures

-

Both compounds face increasing regulation due to chloride runoff impacting freshwater ecosystems. However, MgCl₂ is generally perceived as less harmful, influencing procurement decisions.

-

The U.S. Environmental Protection Agency (EPA) and EU REACH regulations are expected to tighten chloride discharge limits by 2026, favoring less toxic alternatives. This regulatory tilt supports MgCl₂ adoption in environmentally sensitive areas.

-

Supply Chain and Production Trends

-

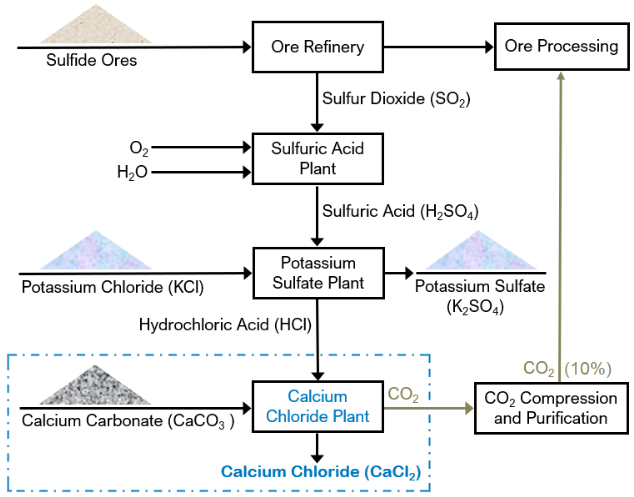

Calcium Chloride: Primarily a byproduct of the Solvay process; supply is tied to soda ash production. Fluctuations in soda ash demand can affect availability and pricing.

-

Magnesium Chloride: Extracted from seawater, brine lakes (e.g., Great Salt Lake), and mineral deposits. Geopolitical concerns over water resource use in the U.S. West could constrain supply, potentially increasing prices.

Market Outlook 2026: Supply constraints for MgCl₂ may emerge, while CaCl₂ benefits from stable, though less flexible, production pathways. Price volatility for MgCl₂ could moderate growth despite strong demand.

-

Regional Market Dynamics

-

North America: Strong growth in MgCl₂ due to environmental policies; CaCl₂ remains entrenched in industrial hubs.

- Europe: Preference for lower-impact solutions favors MgCl₂; REACH compliance is a key factor.

- Asia-Pacific: Rapid infrastructure development drives demand for both, but CaCl₂ dominates due to lower cost and availability.

Conclusion (H2 Summary):

By 2026, magnesium chloride is projected to outpace calcium chloride in growth rate, particularly in environmentally sensitive applications like dust control and eco-friendly de-icing. However, calcium chloride will maintain a larger overall market share due to its superior performance in extreme conditions and broader industrial utility. The evolving regulatory landscape, sustainability imperatives, and advances in magnesium-based materials will be critical differentiators. Companies investing in cleaner production and sustainable sourcing for MgCl₂ are likely to gain competitive advantage, while CaCl₂ suppliers must innovate around corrosion inhibition and recycling to remain viable.

Common Pitfalls in Sourcing Magnesium Chloride vs Calcium Chloride (Quality & Intellectual Property)

H2: Quality and Purity Concerns

Impurity Profiles

- Magnesium Chloride (MgCl₂): Often derived from seawater, brine, or mineral sources like bischofite. Common impurities include sulfates, sodium, potassium, and bromides. Low-grade technical MgCl₂ may contain high moisture, leading to clumping and handling issues.

- Calcium Chloride (CaCl₂): Typically sourced from the Solvay process or natural brines. Key impurities include magnesium, sodium, and sulfates. Hygroscopic nature can result in deliquescence if not properly stored or stabilized.

Hydration States

- Both compounds are available in various hydration states (anhydrous, dihydrate, hexahydrate). Incorrect specification can lead to performance issues—e.g., using hydrated CaCl₂ in de-icing applications may reduce effectiveness due to lower active chloride content.

Physical Form and Consistency

- Inconsistent particle size or caking tendencies can impact solubility and dosing accuracy. Suppliers may vary significantly in their processing methods, affecting flowability and handling.

Testing and Certification

- Lack of standardized quality testing (e.g., ICP-MS for trace metals, Karl Fischer for moisture) can result in variable batch performance. Buyers should require CoAs (Certificates of Analysis) with verified test methods.

H2: Intellectual Property and Supply Chain Risks

Proprietary Production Processes

- Some high-purity or specialty-grade chloride salts (e.g., food or pharma grade) are produced using patented purification technologies. Unauthorized sourcing or replication may infringe on process patents.

- Example: A supplier using a proprietary membrane separation or crystallization method to produce ultra-pure MgCl₂ may hold IP rights restricting reverse engineering.

Source Material IP and Licensing

- Brine sources (e.g., the Dead Sea, Zechstein deposits) are often controlled by regional governments or consortia with licensing agreements. Unauthorized access or misrepresentation of origin can lead to legal disputes.

- “Dead Sea” labeled MgCl₂, for instance, may carry geographic indication protections.

Formulation and Application Patents

- End-use formulations (e.g., de-icers, dust suppressants, nutritional supplements) may be protected by IP. Sourcing raw materials for such formulations requires diligence to avoid contributory infringement.

- Example: A patented dust control blend using CaCl₂ with specific additives could restrict how the raw material is used commercially.

Supplier Transparency and Traceability

- Lack of supply chain transparency increases risk of inadvertently sourcing materials produced via patented methods or from restricted sources. Auditing supplier practices and requesting chain-of-custody documentation is essential.

Conclusion: When sourcing magnesium chloride versus calcium chloride, procurement teams must evaluate not only chemical purity and physical properties but also navigate potential IP constraints related to production methods, source origin, and end-use applications. Due diligence in supplier qualification and contractual IP safeguards is critical.

H2: Logistics & Compliance Guide: Magnesium Chloride vs. Calcium Chloride

Choosing between magnesium chloride (MgCl₂) and calcium chloride (CaCl₂) involves critical considerations beyond performance. This guide outlines key logistics and compliance factors to inform your decision-making process.

H2: Physical Form & Handling

-

Magnesium Chloride (MgCl₂):

- Common Forms: Typically supplied as a liquid (aqueous solution, 20-35% concentration) or hygroscopic flakes/pellets. Liquid form is dominant for dust control and de-icing.

- Handling: Liquid requires specialized storage tanks (plastic, fiberglass, lined steel) resistant to corrosion. Flakes/pellets are dusty and highly hygroscopic (absorbs moisture rapidly from air), requiring dry storage in sealed containers to prevent caking and degradation. Handling requires PPE (gloves, eye protection) due to corrosivity and potential dust irritation.

- Logistics: Liquid transport via tank trucks or railcars; bulk solids via covered hoppers. High water content in liquid form increases transport weight/cost. Flakes require dry, covered transport.

-

Calcium Chloride (CaCl₂):

- Common Forms: Available as liquid (aqueous solution, often 30-45%), high-purity flakes, pellets, prills, or dihydrate powder. More variety in solid forms than MgCl₂.

- Handling: Liquid requires corrosion-resistant tanks (similar materials to MgCl₂). Solids are extremely hygroscopic and deliquescent (absorbs enough moisture to dissolve into a solution), demanding rigorous dry storage in sealed, moisture-proof packaging (e.g., multi-wall paper bags with plastic liners). Generates significant heat upon dissolution or contact with moisture. Requires robust PPE (chemical gloves, goggles, face shield, protective clothing) due to high corrosivity and exothermic reaction risk.

- Logistics: Liquid transport via tank trucks/railcars. Solids require covered, dry transport (box trucks, covered hoppers). Deliquescence risk means solids are more sensitive to humidity during transit/storage than MgCl₂ flakes.

H2: Storage Requirements

-

Magnesium Chloride (MgCl₂):

- Liquids: Store in corrosion-resistant tanks (HDPE, fiberglass-reinforced plastic, rubber-lined steel) with secondary containment. Protect from freezing (solutions freeze around -10°C to -15°C depending on concentration). Ventilation recommended.

- Solids: Store in a cool, dry, well-ventilated area. Keep containers tightly sealed. Use pallets to avoid floor moisture. Protect from rain and humidity. Segregate from incompatible materials (strong bases, metals).

- Key Concern: Caking of solids due to moisture absorption.

-

Calcium Chloride (CaCl₂):

- Liquids: Store in corrosion-resistant tanks (HDPE, fiberglass, rubber-lined steel, specific stainless steels). Secondary containment mandatory. Protect from freezing (solutions freeze lower than MgCl₂, e.g., ~-50°C for 45% solution). Ventilation critical.

- Solids: Extreme emphasis on dry storage. Use airtight, moisture-proof packaging. Store in a cool, dry, well-ventilated area away from any moisture sources. Palletize. Even brief exposure to humid air can cause caking or solution formation. Segregate from incompatible materials (strong bases, metals, organic materials).

- Key Concern: Deliquescence (turning into liquid) and caking are major risks for solids. Exothermic dissolution if wet.

H2: Transportation & Shipping Regulations

-

Both Compounds:

- Classified as Corrosive Substances (Class 8) under international (UN Model Regulations, IMDG Code for sea, IATA DGR for air) and national (e.g., DOT 49 CFR in US, ADR in Europe) transport regulations.

- UN Numbers: Typically UN 1842 (Anhydrous Calcium Chloride), UN 1445 (Calcium Chloride Solution), UN 1447 (Magnesium Chloride Solution). Always verify the specific UN number and packing group (usually PG II or III) for the exact concentration and form.

- Packing Group: Usually Packing Group II (Medium Hazard) or III (Low Hazard) depending on concentration and form. Liquids often PG II, solids often PG III.

- Requirements: Corrosive labels (Class 8 diamond), proper shipping name (e.g., “CALCIUM CHLORIDE, SOLUTION”, “MAGNESIUM CHLORIDE, SOLUTION”), correct packaging (leak-proof, pressure-relief for liquids, moisture-proof for solids), placarding for bulk quantities, and trained personnel.

- Documentation: Safety Data Sheet (SDS) required. Shipper must provide accurate declaration.

-

Key Differences:

- Solids Sensitivity: CaCl₂ solids require significantly more stringent moisture protection during transport than MgCl₂ solids due to deliquescence.

- Freezing Points: CaCl₂ solutions generally have much lower freezing points, potentially reducing freeze protection needs in very cold climates.

H2: Environmental & Regulatory Compliance

-

Environmental Impact:

- Both: High chloride content is the primary environmental concern. Runoff can:

- Increase soil and water salinity, harming vegetation and aquatic life.

- Corrode infrastructure (bridges, vehicles, rebar in concrete).

- Contaminate groundwater and surface water.

- Magnesium Chloride (MgCl₂): Generally considered slightly less damaging to vegetation than CaCl₂ at equivalent chloride levels, but still significant. Can contribute to nutrient imbalances (Mg vs K/Ca).

- Calcium Chloride (CaCl₂): High chloride load. The calcium can potentially bind with soil particles, but excessive use can still disrupt soil structure and chemistry. Can be more phytotoxic (plant-damaging) than MgCl₂ in some contexts.

- Regulatory Focus: Regulations (e.g., EPA Clean Water Act, state/local stormwater permits – often under MS4 programs) primarily target chloride loading and runoff management. BMPs (Best Management Practices) are crucial: precise application rates, avoiding application near sensitive areas (wetlands, streams, drinking water sources), use of application equipment with controls, containment of storage areas (secondary containment), and potential requirements for monitoring.

- Both: High chloride content is the primary environmental concern. Runoff can:

-

Workplace Safety (OSHA/GHS):

- Both: Classified as Skin Corrosion/Irritation (Category 1B), Serious Eye Damage/Eye Irritation (Category 1), and Specific Target Organ Toxicity (Single Exposure – Respiratory Tract Irritation, Category 3) under GHS. SDS Sections 8 (Exposure Controls/PPE) and 11 (Toxicological Information) are critical.

- PPE: Chemical-resistant gloves (nitrile, neoprene), chemical splash goggles, face shield (especially for solids/dust), protective clothing (aprons, coveralls), and respiratory protection (dust mask for solids, potentially more for high dust levels or confined spaces) are mandatory.

- CaCl₂ Specific: Higher risk of exothermic burns if solid contacts wet skin or dissolves rapidly in confined space. Requires specific handling procedures to prevent this.

-

Other Regulations: Check for local restrictions on chloride-based deicers, reporting requirements for storage quantities (e.g., Tier II in US), and potential restrictions near sensitive ecological zones.

Summary Table: Key Logistics & Compliance Differences

| Feature | Magnesium Chloride (MgCl₂) | Calcium Chloride (CaCl₂) |

| :———————- | :——————————————— | :————————————————— |

| Dominant Liquid Form | Yes (20-35%) | Yes (30-45%), often higher concentration possible |

| Solid Form Key Risk | Hygroscopic (Caking) | Extremely Hygroscopic & Deliquescent (Liquefies) |

| Solid Storage | Dry, sealed containers | Rigorous dry, moisture-proof sealed packaging |

| Transport Solids | Dry, covered transport; moisture sensitive | Highly sensitive to humidity; moisture-proof packaging critical |

| Freezing Point (Liq)| Higher (e.g., ~ -15°C for 30%) | Lower (e.g., ~ -50°C for 45%) |

| Exothermic Reaction | Moderate (dissolution) | Significant (dissolution, contact with moisture) |

| Environmental Focus | Chloride load, soil/water salinity | Chloride load, soil/water salinity, potential for higher phytotoxicity |

| PPE Emphasis | Corrosion protection, dust control | Corrosion protection, exothermic burn prevention, dust control |

Critical Recommendation: Always consult the Safety Data Sheet (SDS) for the specific product you are handling. Regulations, hazards, and handling procedures can vary based on purity, concentration, and additives. Implement comprehensive training, proper engineering controls (ventilation, containment), and strict adherence to regulatory requirements for storage, handling, transport, and environmental management.

Conclusion: Sourcing Magnesium Chloride vs Calcium Chloride

When deciding between sourcing magnesium chloride and calcium chloride, the optimal choice depends on the specific application, environmental conditions, cost considerations, and performance requirements.

Magnesium chloride offers advantages in dust control, low-temperature deicing (effective down to approximately −15°C or 5°F), and is less corrosive than many alternatives, making it suitable for sensitive environments. It is also hygroscopic, helping to retain moisture and suppress dust over extended periods. However, it can be more expensive than calcium chloride and may attract moisture excessively in humid conditions, leading to potential slipperiness or tracking.

Calcium chloride, on the other hand, is highly effective at lower temperatures (down to −29°C or −20°F), releases heat upon dissolution (exothermic reaction), and provides rapid ice-melting action. It is often preferred for winter road maintenance in extreme cold. Though generally more corrosive than magnesium chloride, its high efficiency and performance in severe conditions make it a reliable choice. It is also available in various forms (flakes, pellets, liquid), offering flexibility in application.

From a sourcing perspective, availability may vary regionally—magnesium chloride is often derived from brine or seawater (e.g., the Great Salt Lake or Dead Sea), while calcium chloride is typically a byproduct of the Solvay process or mined from natural deposits.

Final Recommendation:

Choose magnesium chloride for moderate climates, dust control, and applications where lower corrosivity and environmental impact are priorities. Opt for calcium chloride in extreme cold conditions where rapid and reliable deicing performance is critical, accepting higher corrosivity and handling considerations. Cost, local supply chains, environmental regulations, and long-term performance should all factor into the final sourcing decision.