The global machining manufacturing industry is experiencing robust growth, driven by rising demand for precision components across aerospace, automotive, medical, and industrial machinery sectors. According to Grand View Research, the global precision machining market was valued at USD 57.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This expansion is fueled by advancements in CNC technology, increasing automation, and the growing need for high-tolerance manufacturing processes. Additionally, Mordor Intelligence forecasts the machining services market to grow at a CAGR of over 6.5% during the forecast period 2023–2028, with Asia-Pacific emerging as a key hub due to rapid industrialization and manufacturing outsourcing trends. In this evolving landscape, a select group of machining manufacturing companies are leading innovation, scalability, and global reach—setting benchmarks in quality, efficiency, and technological integration.

Top 10 Machining Manufacturing Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Metalworking CNC Machine Tools Supplier & Equipment Distributor …

Domain Est. 1991

Website: productivity.com

Key Highlights: We are a single source machine tool distributor of metalworking machines, tooling and industrial supplies, robots and related manufacturing products and ……

#2 Alco Manufacturing

Domain Est. 1995

Website: alco.com

Key Highlights: Alco is a precision machine shop built on over 50 years of success. With seven locations, renowned customer service, and robust capabilities, we’re ready to ……

#3 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: Achieve superior results with Makino’s CNC machining. Makino machines and engineering services provide precision and reliability across applications….

#4 #1 Machining Parts Manufacturers in the US

Domain Est. 1998

Website: jrmachine.com

Key Highlights: We’re the machining parts manufacturers that deliver extraordinary value by streamlining contract machining through automation and process control….

#5 UNITED MACHINING

Domain Est. 1999

Website: gfms.com

Key Highlights: UNITED MACHINING delivers comprehensive, integrated solutions for manufacturers of precision parts, tools, and mold-making — helping them move seamlessly ……

#6 Imperial Machine & Tool Co.

Domain Est. 1997

Website: imperialmachine.com

Key Highlights: Imperial Machine & Tool Co. is a state-of-the-art machining, fabricating, and assembly facility specializing in Advanced Manufacturing techniques….

#7 to Mazak Corporation

Domain Est. 1998

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines, various ……

#8 Metal Fabrication Machinery

Domain Est. 1998

Website: mcmachinery.com

Key Highlights: MC Machinery Systems, a supplier of metal fabrication machines, provides EDM, milling, laser, press brake, finishing, and automation solutions….

#9 Cox Manufacturing Company

Domain Est. 2003

Website: coxmanufacturing.com

Key Highlights: Cox Manufacturing is an ISO Certified screw machine shop offering custom, high-volume Swiss machining, CNC milling & turning & more. Click to learn more!…

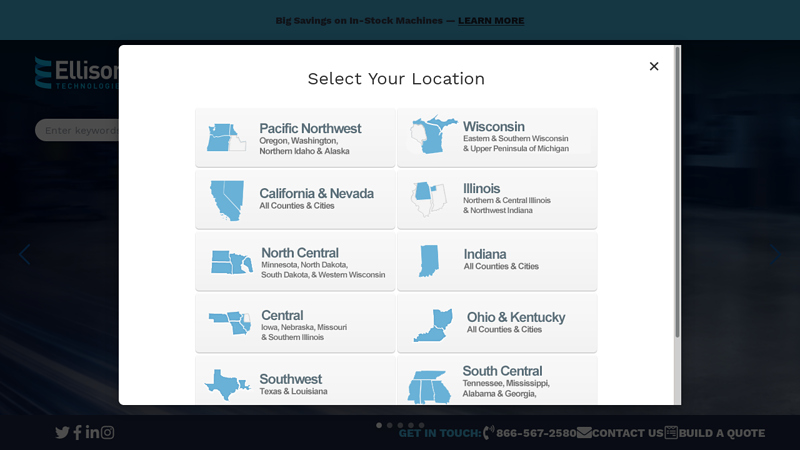

#10 Ellison Technologies: Advanced CNC Machining Solutions

Domain Est. 2005

Website: ellisontechnologies.com

Key Highlights: Discover advanced CNC machining solutions with Ellison Technologies—your trusted partner for metal-cutting innovations in North America.”…

Expert Sourcing Insights for Machining Manufacturing Companies

H2: 2026 Market Trends for Machining Manufacturing Companies

As the global manufacturing landscape evolves, machining manufacturing companies are poised to experience transformative shifts by 2026. Driven by technological innovation, sustainability imperatives, and dynamic supply chain realignments, the industry is entering a phase of strategic recalibration. The following key trends are expected to define the market environment for machining manufacturers in 2026:

1. Accelerated Adoption of Smart Machining and Industry 4.0 Integration

By 2026, machining companies will increasingly rely on smart manufacturing technologies. The integration of Industrial Internet of Things (IIoT), AI-driven predictive maintenance, and real-time data analytics is expected to become standard practice. CNC machines equipped with sensors and connected to centralized digital platforms will enable greater operational efficiency, reduced downtime, and improved quality control. Cloud-based manufacturing execution systems (MES) will allow for remote monitoring and adaptive production scheduling, enhancing responsiveness to market demand.

2. Growth in Demand for High-Precision and Customized Components

Industries such as aerospace, electric vehicles (EVs), medical devices, and renewable energy systems are driving demand for complex, high-precision machined parts. Machining manufacturers are adapting by investing in multi-axis CNC machines and advanced metrology tools to meet tight tolerances and stringent quality standards. Customization and low-volume, high-mix production runs are becoming more common, supported by flexible manufacturing systems (FMS) and digital twin simulations.

3. Sustainability and Green Manufacturing Initiatives

Environmental regulations and customer expectations are pushing machining firms toward sustainable practices. By 2026, companies will emphasize energy-efficient machine tools, recyclable cutting fluids, and closed-loop coolant systems. Carbon footprint tracking and lifecycle assessments will become part of compliance and marketing strategies. Additionally, remanufacturing and precision re-machining of used components will gain traction as part of circular economy models.

4. Workforce Transformation and Skills Gap Mitigation

The growing complexity of modern machining systems necessitates a digitally skilled workforce. By 2026, manufacturers will continue to face a shortage of workers proficient in programming, robotics, and data analysis. To address this, companies are expected to expand partnerships with technical schools, implement augmented reality (AR)-assisted training, and adopt collaborative robots (cobots) that reduce the skill burden on operators.

5. Supply Chain Resilience and Regionalization

Geopolitical uncertainties and past disruptions have prompted a shift toward nearshoring and regional supply chains. Machining companies are increasingly positioning themselves as localized, agile suppliers to automotive, defense, and industrial equipment OEMs. Digital supply chain platforms will enable better inventory management, supplier collaboration, and rapid response to demand fluctuations.

6. Expansion in Additive-Hybrid Machining

Hybrid manufacturing—combining additive manufacturing (3D printing) with subtractive CNC machining—is expected to gain momentum by 2026. This approach allows for the creation of complex geometries with internal features that are later precision-machined to final specifications. Aerospace and energy sectors will be early adopters, leveraging hybrid systems to reduce material waste and lead times.

7. Increased Investment in Automation and Lights-Out Manufacturing

To combat labor shortages and improve cost competitiveness, machining manufacturers are investing in automation for 24/7 operations. Automated pallet changers, robotic part handling, and integrated quality inspection systems will enable “lights-out” manufacturing, where facilities operate overnight with minimal human intervention. This trend will be particularly evident among mid-sized contract manufacturers serving high-volume industries.

8. Rising Importance of Cybersecurity

As machining operations become more connected, cybersecurity risks grow. By 2026, companies will need robust cybersecurity frameworks to protect intellectual property, production data, and control systems from cyber threats. Investment in secure network architecture, employee training, and compliance with standards like NIST or ISO 27001 will be critical.

In summary, the 2026 outlook for machining manufacturing companies is defined by digital transformation, sustainability, and strategic agility. Firms that proactively embrace automation, upskill their workforce, and align with emerging industry demands will be best positioned to thrive in a competitive and rapidly evolving market.

Common Pitfalls When Sourcing Machining Manufacturing Companies (Quality, IP)

Sourcing machining manufacturing partners is critical for product success, but it comes with significant risks—particularly around quality consistency and intellectual property (IP) protection. Overlooking these areas can lead to costly delays, product failures, and legal disputes. Below are key pitfalls to avoid:

Inadequate Quality Assurance Processes

Many suppliers claim to meet international standards, but verification is often lacking. Relying solely on certifications like ISO 9001 without auditing actual shop-floor practices can result in inconsistent part quality, dimensional inaccuracies, and material non-conformance. Hidden issues such as poor process control, outdated equipment, or insufficient inspection protocols may only surface after production has begun.

Lack of IP Protection Agreements

Sharing design files, CAD models, and technical specifications with manufacturers exposes sensitive intellectual property. A common mistake is failing to establish legally binding Non-Disclosure Agreements (NDAs) and IP ownership clauses before engagement. Without clear contracts, manufacturers may duplicate designs, sell them to competitors, or claim partial ownership—especially in jurisdictions with weak IP enforcement.

Insufficient Supplier Vetting and Audits

Companies often rush sourcing decisions based on cost or speed, skipping comprehensive due diligence. This includes not visiting facilities, skipping sample evaluations, or neglecting background checks on subcontracting practices. Without on-site audits, it’s difficult to assess real capabilities, workforce training, or quality culture—increasing the risk of defects and non-compliance.

Poor Communication and Documentation

Miscommunication about tolerances, surface finishes, or material grades can lead to rejected batches and rework. Verbal agreements or vague purchase orders are insufficient. Lack of detailed engineering drawings, quality inspection plans (QIPs), and change management procedures often results in misunderstandings and compromised product integrity.

Overlooking Sub-Tier Supply Chain Risks

Some machining companies outsource critical operations (e.g., heat treatment, plating) without transparency. If sub-suppliers lack quality controls or proper certifications, it undermines the final product—even if the primary vendor appears reliable. Failing to map and audit the full supply chain exposes buyers to hidden quality and compliance risks.

Jurisdictional IP Enforcement Challenges

Sourcing from regions with limited IP legal frameworks increases exposure. Even with an NDA, enforcing IP rights abroad can be costly and impractical. Companies may find their designs replicated locally or sold into competing markets without recourse, eroding competitive advantage and brand value.

Failure to Implement Ongoing Quality Monitoring

Once production begins, many buyers reduce oversight, assuming initial approval guarantees consistency. However, process drift, staff turnover, or equipment wear can degrade quality over time. Lack of regular audits, statistical process control (SPC) data review, or incoming inspection protocols leaves room for undetected defects.

Avoiding these pitfalls requires a structured sourcing strategy: thorough due diligence, strong legal protections, clear technical documentation, and continuous quality monitoring. Prioritizing both quality systems and IP safeguards ensures reliable manufacturing partnerships and protects long-term business interests.

Logistics & Compliance Guide for Machining Manufacturing Companies

Supply Chain Management and Material Procurement

Effective logistics in machining manufacturing begins with a reliable supply chain. Establish strong relationships with certified suppliers of raw materials such as steel, aluminum, and specialty alloys. Ensure suppliers comply with industry standards (e.g., ISO, ASTM, ASME) and provide traceable material certifications (e.g., Material Test Reports). Implement just-in-time (JIT) or vendor-managed inventory (VMI) systems to optimize inventory turnover and reduce carrying costs while maintaining production continuity.

Inventory Control and Warehousing

Maintain accurate inventory records using an integrated ERP or MRP system to track raw materials, work-in-progress (WIP), and finished components. Use barcode or RFID systems for real-time tracking. Store materials in a controlled environment to prevent corrosion or damage, especially for high-precision or sensitive alloys. Segregate non-conforming materials and maintain clear labeling based on specifications, heat numbers, and revision levels.

Inbound and Outbound Logistics

Coordinate inbound logistics to ensure raw materials and tooling arrive on schedule and meet quality requirements. Inspect all incoming shipments for compliance with purchase orders and specifications. For outbound logistics, package machined parts appropriately (using anti-corrosion wrapping, cushioning, and secure crating) to prevent damage during transit. Use reliable freight partners and track shipments in real time. Offer multiple shipping options (e.g., LTL, FTL, air freight) to meet customer delivery expectations.

Regulatory Compliance and Export Controls

Adhere to domestic and international regulations, especially when exporting machined components. Comply with ITAR (International Traffic in Arms Regulations) if manufacturing defense-related parts, and EAR (Export Administration Regulations) for dual-use items. Obtain required licenses and maintain accurate export documentation, including commercial invoices, packing lists, and certificates of origin. Classify products using correct HS and ECCN codes.

Quality Assurance and Documentation

Follow ISO 9001 and, where applicable, ISO 13485 (medical) or AS9100 (aerospace) standards. Maintain comprehensive quality records, including inspection reports, first-article inspections (FAI), and process capability studies (Cp/Cpk). Provide customers with required documentation such as COC (Certificate of Conformance), PPAP (Production Part Approval Process), and dimensional reports. Implement corrective and preventive actions (CAPA) for non-conformances.

Environmental, Health, and Safety (EHS) Compliance

Comply with OSHA standards for workplace safety, including machine guarding, lockout/tagout (LOTO), and proper handling of cutting fluids and metal dust. Manage hazardous waste (e.g., used oils, sludge, solvents) in accordance with EPA regulations and ensure proper disposal through licensed vendors. Monitor air quality and noise levels, and provide required PPE (Personal Protective Equipment) to employees. Maintain SDS (Safety Data Sheets) for all chemicals used.

Traceability and Serialization

Ensure full traceability of machined parts from raw material to final delivery. Record lot numbers, heat numbers, machine IDs, operators, and inspection data. Use serialization for high-reliability industries (aerospace, medical, automotive) to support recalls, audits, and warranty tracking. Integrate traceability systems with your quality management software.

Customs and International Trade Compliance

When shipping internationally, ensure accurate customs declarations and compliance with destination country regulations. Partner with experienced customs brokers to avoid delays or penalties. Stay informed about trade agreements, tariffs, and sanctions lists (e.g., OFAC). Conduct regular internal audits of export activities to maintain compliance.

Risk Management and Business Continuity

Identify logistics and compliance risks such as supplier failure, transportation delays, or regulatory changes. Develop contingency plans, including alternate suppliers and logistics routes. Conduct regular training for staff on compliance responsibilities and emergency procedures. Maintain cyber resilience for digital logistics and compliance systems.

Continuous Improvement and Audits

Perform regular internal audits of logistics and compliance processes. Use key performance indicators (KPIs) such as on-time delivery rate, inventory accuracy, and compliance incident rate to assess performance. Engage in continuous improvement initiatives like Lean Manufacturing and Six Sigma to enhance efficiency and reduce compliance risks. Prepare for and respond effectively to customer and third-party audits.

In conclusion, sourcing machining and manufacturing companies requires a strategic approach that balances cost, quality, capacity, and reliability. It is essential to conduct thorough research, evaluate potential partners based on technical capabilities, certifications, production capacity, and past performance, and establish clear communication to align expectations. Factors such as geographic location, lead times, scalability, and supply chain resilience should also be carefully considered. Building strong, long-term relationships with trusted manufacturers not only ensures consistent product quality and on-time delivery but also supports innovation and operational efficiency. Ultimately, a well-executed sourcing strategy in the machining and manufacturing sector can provide a significant competitive advantage, driving growth and sustainability in today’s global market.