The global machine builders market is undergoing rapid transformation, driven by increasing automation, advancements in Industry 4.0 technologies, and rising demand for precision manufacturing across sectors such as automotive, aerospace, and industrial equipment. According to Grand View Research, the global industrial machinery market size was valued at USD 1.2 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This sustained expansion is fueled by the integration of artificial intelligence, IoT-enabled systems, and smart manufacturing processes that enhance productivity and reduce operational downtime. As manufacturing hubs globally prioritize efficiency and scalability, machine builders are at the forefront of innovation, delivering customized, high-performance solutions. In this evolving landscape, nine key manufacturers have emerged as industry leaders, combining engineering excellence with data-driven automation to set new benchmarks in reliability, speed, and technological integration.

Top 9 Machine Builders Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Haas Automation Inc.

Domain Est. 1996

Website: haascnc.com

Key Highlights: Haas Automation is the largest machine tool builder in the western world, manufacturing a complete line of CNC vertical machining centers, ……

#2 STYLE CNC Machines

Domain Est. 2012

Website: stylecncmachines.com

Key Highlights: STYLE is the manufacturer of CNC milling machines specialised in single pieces and small series. Discover our CNC milling machines….

#3 to Mazak Corporation

Domain Est. 1998

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines, various ……

#4 Fadal

Domain Est. 1998 | Founded: 1973

Website: fadal.com

Key Highlights: Fadal is a CNC machine builder with dealers across the United States and Canada. Our clients have trusted us with their machining needs since 1973….

#5 MTB

Domain Est. 1999

Website: machinetoolbuilders.com

Key Highlights: As a world class machinery rebuilder MTB can build, rebuild, recontrol, retool and service your CNC machinery….

#6 Machine Concepts

Domain Est. 1999

Website: machineconcepts.com

Key Highlights: Machine Concepts specializes in engineering and building custom automation equipment, robotics, press room and coil processing equipment and other ……

#7 Machine Building

Domain Est. 2006

Website: machinebuilding.net

Key Highlights: KFT Food Machinery develops high-performance slicing equipment used in some of the food industry’s most demanding production environments. When ……

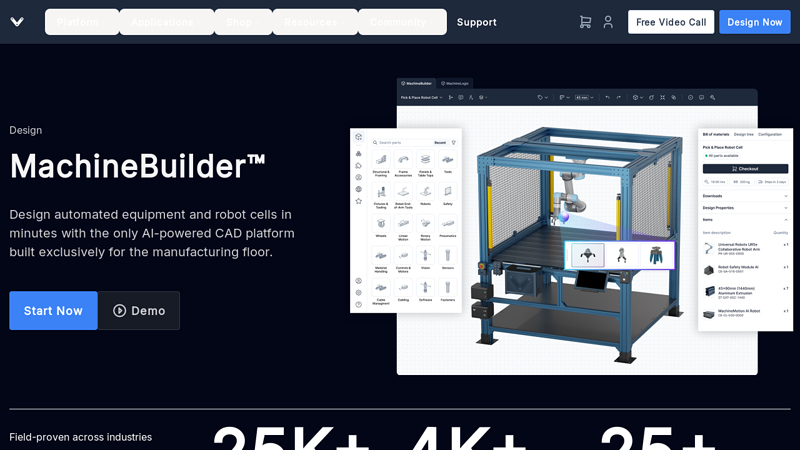

#8 MachineBuilder

Domain Est. 2016

Website: vention.io

Key Highlights: MachineBuilder™. Design automated equipment and robot cells in minutes with the only AI-powered CAD platform built exclusively for the manufacturing floor….

#9 Air Compressors

Domain Est. 2017

Website: machinebuildersusa.com

Key Highlights: Machine Builders USA is based in Spartanburg, SC and services the Carolinas and nation. We help businesses with their air compressor needs through quality ……

Expert Sourcing Insights for Machine Builders

H2 2026 Market Trends for Machine Builders

As the industrial landscape evolves rapidly, machine builders face a transformative environment in H2 2026 shaped by technological innovation, sustainability imperatives, and shifting customer demands. Here are the key trends expected to define the second half of 2026:

1. Accelerated Adoption of AI-Driven Predictive Maintenance & Optimization

Machine builders are increasingly embedding artificial intelligence and machine learning directly into equipment. In H2 2026, AI will move beyond proof-of-concept to mainstream deployment, enabling real-time predictive maintenance, adaptive process optimization, and autonomous quality control. Customers will demand machines that self-diagnose issues and suggest preemptive actions, reducing downtime and improving overall equipment effectiveness (OEE).

2. Strong Push Toward Sustainability and Energy-Efficient Machinery

Regulatory pressures and corporate ESG goals are driving demand for sustainable machine design. Machine builders will prioritize energy-efficient components, modular designs for easier repair and upgrades, and use of recyclable or lower-carbon materials. Machines equipped with energy monitoring and carbon footprint tracking capabilities will become standard offerings, especially in Europe and North America.

3. Growth of Modular and Reconfigurable Machine Platforms

To meet the need for flexibility in high-mix, low-volume production environments, machine builders are shifting toward modular architectures. In H2 2026, this trend will accelerate, with standardized interfaces (mechanical, electrical, software) enabling faster reconfiguration for different product lines. This approach reduces time-to-market and total cost of ownership for end users.

4. Expansion of Industrial IoT (IIoT) and Digital Twin Integration

Digital twins—virtual replicas of physical machines—are becoming essential tools for simulation, commissioning, and lifecycle management. Machine builders will increasingly offer comprehensive digital twin solutions that allow customers to test configurations, optimize performance, and train operators before deployment. Seamless IIoT connectivity will be a baseline expectation.

5. Rise of Servitization and Outcome-Based Business Models

More machine builders are transitioning from selling hardware to offering “machines-as-a-service” or performance-based contracts. In H2 2026, this servitization trend will gain momentum, with builders retaining ownership of equipment and charging based on uptime, output, or efficiency gains. This model aligns incentives and fosters long-term customer relationships.

6. Increased Cybersecurity Integration in Machine Design

As machines become more connected, cybersecurity is a growing concern. Machine builders will incorporate robust security protocols (e.g., secure boot, data encryption, role-based access) directly into their control systems. Compliance with international standards like IEC 62443 will be critical to winning contracts, particularly in regulated industries.

7. Supply Chain Resilience and Localization Pressures

Ongoing geopolitical tensions and supply chain disruptions are pushing machine builders to diversify suppliers and localize components where feasible. In H2 2026, expect increased investment in nearshoring, dual sourcing, and digital supply chain visibility tools to mitigate risks and improve delivery reliability.

Conclusion

H2 2026 will be a pivotal period for machine builders, defined by digital integration, sustainability, and customer-centric innovation. Success will depend on the ability to deliver intelligent, flexible, and future-proof machines while adapting business models to a service-driven economy. Builders who embrace these trends will gain a competitive edge in an increasingly dynamic global market.

Common Pitfalls When Sourcing Machine Builders: Quality and Intellectual Property Risks

Inadequate Quality Assurance Processes

Many machine builders, especially smaller or offshore suppliers, may lack robust quality management systems. This can result in inconsistent build quality, substandard components, and machines that fail to meet performance or safety standards. Without clear quality benchmarks, documented inspection procedures, and third-party certifications (e.g., ISO 9001), buyers risk receiving equipment that requires costly rework or causes production downtime.

Lack of Transparency in Manufacturing Practices

Some machine builders outsource critical components or assembly steps without disclosure, leading to variability in quality and reliability. Hidden subcontractors may not adhere to the same standards, increasing the risk of defects. Buyers often discover these issues only after delivery, complicating troubleshooting and accountability.

Insufficient Testing and Validation

Machine builders might perform minimal or incomplete testing before shipment. Without comprehensive factory acceptance tests (FATs) or performance validations under real-world conditions, undetected flaws can surface during installation or operation, leading to delays and increased costs.

Weak or Ambiguous Intellectual Property (IP) Agreements

A major risk in sourcing custom machinery is unclear ownership of designs, software, and process innovations. If contracts fail to specify that IP developed for the buyer remains the buyer’s property, the machine builder may retain rights or reuse designs for competitors. This compromises competitive advantage and can lead to legal disputes.

Use of Proprietary or Closed-Source Software

Some builders embed proprietary control software or lock out access to machine logic and parameters. This limits the buyer’s ability to maintain, modify, or integrate the machine with existing systems. Dependency on the builder for updates or repairs increases long-term costs and reduces operational flexibility.

Inadequate Documentation and Knowledge Transfer

Poorly documented designs, wiring diagrams, or software code hinder troubleshooting, training, and future modifications. Without complete documentation, buyers become dependent on the original builder for support, creating a single point of failure.

Geographic and Cultural Communication Barriers

When sourcing internationally, differences in language, time zones, and engineering standards can lead to misunderstandings, misaligned expectations, and quality issues. These barriers often delay problem resolution and complicate oversight during the build process.

Failure to Verify Builder Credentials and References

Skipping due diligence on a machine builder’s track record, client references, or past projects increases the risk of engaging an unproven or unreliable partner. Verified case studies and site visits are essential to assess capability and reliability firsthand.

Mitigating these pitfalls requires thorough vetting, well-drafted contracts with clear IP terms, defined quality metrics, and active project management throughout the sourcing and build process.

Logistics & Compliance Guide for Machine Builders

Understanding Regulatory Requirements

Machine builders must comply with a range of international, national, and regional regulations. Key standards include the EU’s Machinery Directive (2006/42/EC), the U.S. OSHA regulations, and global standards such as ISO 12100 (safety of machinery). Ensure all machines meet essential health and safety requirements before entering any market. Maintain a Technical File for each machine, including risk assessments, design drawings, and conformity declarations.

CE Marking and Product Certification

For machines sold in the European Economic Area (EEA), CE marking is mandatory. This involves conducting a conformity assessment, preparing technical documentation, and issuing an EU Declaration of Conformity. Use accredited third-party notified bodies when required, especially for higher-risk machinery. Keep certification records accessible for audits and market surveillance.

Export Controls and International Trade Compliance

Verify export classification (e.g., ECCN under the U.S. Commerce Control List or dual-use regulations in the EU) for machines with potential military or strategic applications. Obtain necessary export licenses when shipping controlled technology. Comply with sanctions and embargoes by screening end-users and destinations using automated compliance tools.

Packaging and Transport Preparation

Design packaging to protect machinery during transit, accounting for vibration, moisture, and impact. Use environmentally compliant materials where possible. Clearly label packages with handling instructions, weight, dimensions, and hazard symbols if applicable. Include customs documentation inside a weatherproof pouch on the exterior.

Supply Chain and Vendor Compliance

Ensure suppliers adhere to your quality and compliance standards. Require material declarations (e.g., RoHS, REACH) for components. Audit critical vendors regularly and maintain traceability of parts for recalls or compliance verification. Include compliance clauses in procurement contracts.

Documentation for Global Shipments

Prepare a complete shipping package: commercial invoice, packing list, bill of lading/airway bill, certificate of origin, and conformity certificates (e.g., CE, UL). For U.S. imports, ensure compliance with Customs-Trade Partnership Against Terrorism (C-TPAT) guidelines. For Canada, adhere to Customs Self Assessment (CSA) program requirements if applicable.

Installation, Commissioning, and On-Site Compliance

Plan logistics for machine delivery, including site access, crane availability, and installation team travel. Ensure on-site activities comply with local labor, safety, and environmental regulations. Provide multilingual operation and safety manuals. Train local personnel according to regional requirements.

After-Sales Service and Spare Parts Logistics

Establish a responsive spare parts supply chain with regional warehouses or distribution partners. Track parts for traceability and compliance with environmental regulations (e.g., WEEE for electrical waste). Offer remote diagnostics to reduce service travel and downtime.

Environmental and Sustainability Compliance

Adhere to environmental directives such as WEEE (Waste Electrical and Electronic Equipment), RoHS (Restriction of Hazardous Substances), and energy efficiency standards (e.g., EU Ecodesign Directive). Design machines for recyclability and provide end-of-life disposal guidance.

Recordkeeping and Audit Readiness

Maintain comprehensive records for at least 10 years (or as required by jurisdiction), including design documents, test reports, certifications, shipping logs, and customer communications. Conduct regular internal audits to verify compliance across logistics and production processes.

Conclusion for Sourcing Machine Builders

Sourcing the right machine builder is a critical strategic decision that directly impacts operational efficiency, product quality, and long-term competitiveness. A thorough evaluation process—considering technical expertise, industry experience, financial stability, project management capabilities, and after-sales support—is essential to ensure alignment with your specific production needs and business goals. Prioritizing transparency, communication, and proven track records helps mitigate risks and supports successful project execution.

Furthermore, building strong, collaborative relationships with reliable machine builders fosters innovation, enables customization, and supports scalability. As automation and Industry 4.0 technologies continue to evolve, choosing partners who embrace technological advancements and sustainable practices will position your operations for future growth and resilience.

In summary, effective sourcing of machine builders combines diligent due diligence with strategic partnership development, ultimately contributing to enhanced productivity, reduced downtime, and a stronger competitive advantage in the marketplace.